Company Summary

| Purple Trading Review Summary | |

| Founded | 2016 |

| Registered Country/Area | Cyprus |

| Regulation | CYSEC |

| Tradable Assets | Forex, indices, commodities, stocks, futures |

| Demo Account | ✅ |

| Islamic Account | ❌ |

| Account Types | STP, ECN, PRO |

| Maximum Leverage | 1:30 (retail)/1:500 (professional) |

| EUR/USD Spread | From 0.3 pips |

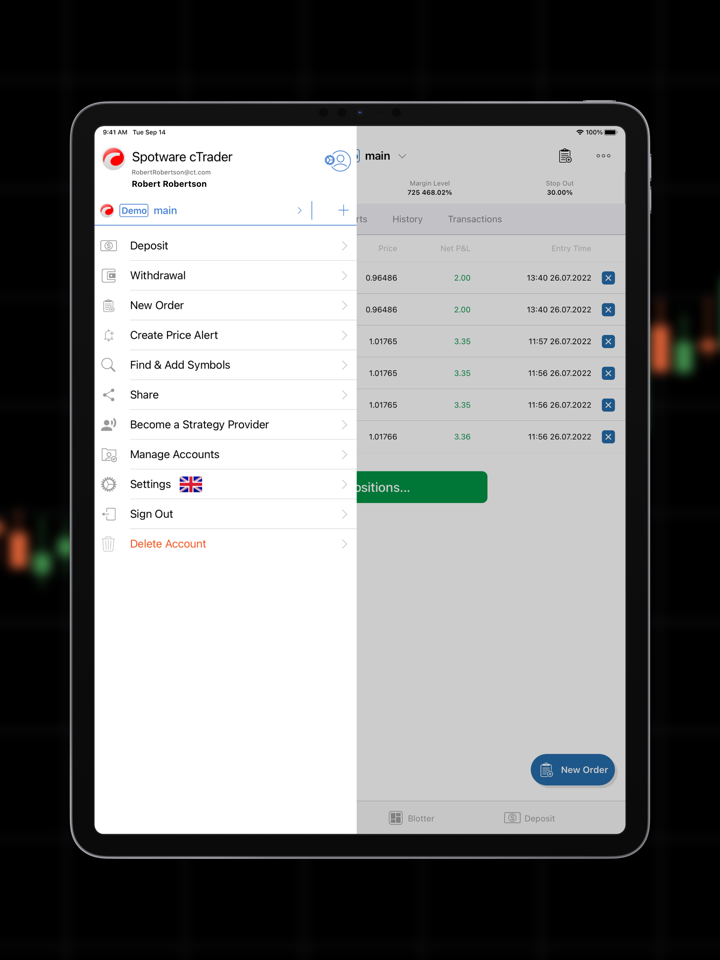

| Trading Platforms | MT4/5, cTrader |

| Payment Methods | Visa, MasterCard |

| Deposit & Withdrawal Fee | ❌ |

| Customer Support | Mon - Fri, 8-16 h (CET) |

| Live chat | |

| Tel: +420 228 884 711 | |

| Email: support@purple-trading.com (for current clients) | |

| info@purple-trading.com (for new clients) | |

| Regional Restrictions | Not accept clients from outside the European Economic Area and from Belgium, Switzerland and USA |

Purple Trading Information

Purple Trading, headquartered in Cyprus, operates under the regulatory oversight of the Cyprus Securities and Exchange Commission (CYSEC). It offers a maximum leverage of up to 1:30 for retail clients and up to 1:500 for professional clients, varying by instrument. Spreads start from 1.3 pips for STP accounts and 0.3 pips for ECN accounts. Clients can trade a diverse range of assets including Forex, Indices, Commodities, Stocks, and Futures. Purple Trading provides multiple account types such as ECN, STP, and PRO, each with its own fee structures and benefits. It also offers a free demo account for users to practice trading strategies.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

| |

| |

| |

|

Is Purple Trading Legit?

Purple Trading is regulated by the Cyprus Securities and Exchange Commission (CYSEC) with license no. 271/15, ensuring compliance with strict financial standards and protocols. This regulatory oversight instills confidence in clients, as it indicates that Purple Trading operates within a regulated framework, offering greater transparency and protection for investors. CYSEC's supervision ensures Purple Trading's adherence to legal and ethical practices in the financial industry.

Market Instruments

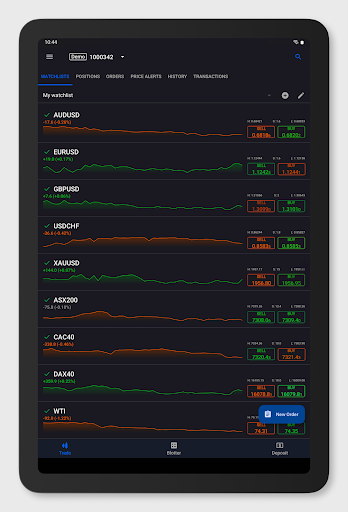

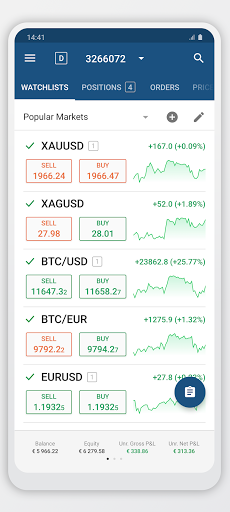

Purple Trading offers a comprehensive array of market instruments across various categories: forex, indices, commodities, stocks, and futures.

| Tradable Assets | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Futures | ✔ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Types/Fees

Purple Trading offers free demo accounts with a minimum initial virtual deposit of 1,000 (EUR, GBP, USD, CZK, or PLN).

It also offers three real account types, including STP, ECN, and PRO, with minimum deposit requirement of $100. You can find similarities and differences between different account types in the table below:

| STP | ECN | PRO | |

| Suitable for | Position/swing traders | Intraday/scalping traders | Professional traders |

| Trading Platforms | MT4 / MT5 / cTrader | ||

| Account Opening Fee | ❌ | ||

| Minimum Deposit | $100 | ||

| Accepted Currencies | EUR / GBP / USD / CZK / PLN | ||

| Spread | From 1.3 pips | From 0.3 pips | - |

| Commission | ❌ | 5-10 USD/lot | - |

Additionally, Purple Trading also offers a managed account, which serves as your link to the wide range of investment products that Purple Trading offers to their clients, including passive ETF portfolios, dynamic investment strategies created by professional traders, as well as their “mini” version which is more suitable for smaller investments because they can invest as little as 100 EUR.

Leverage

Purple Trading offers varying levels of leverage depending on the instrument being traded and the classification of the client:

- For retail clients, the maximum trading leverage is up to 1:30 across all instruments, including Forex, Indices, Commodities, Stocks, and Futures.

- For clients meeting the requirements for classification as a professional client, the maximum leverage is up to 1:500 for certain instruments.

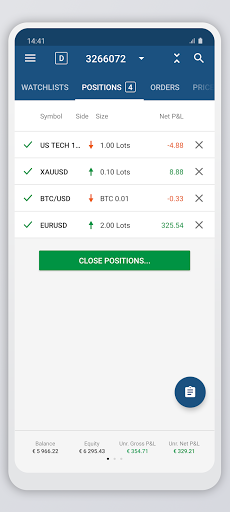

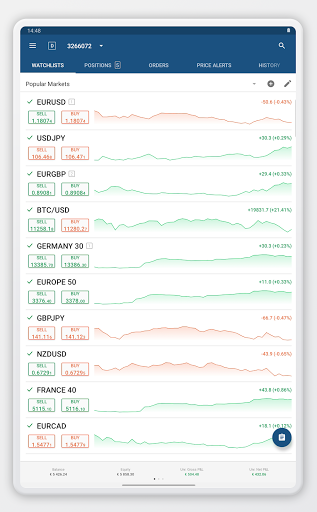

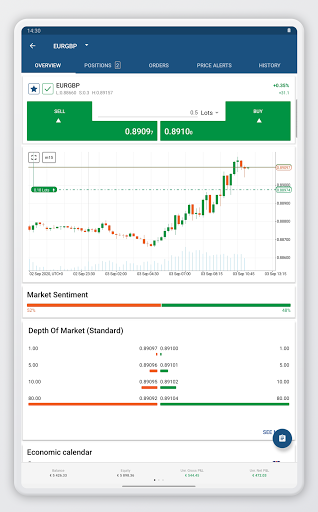

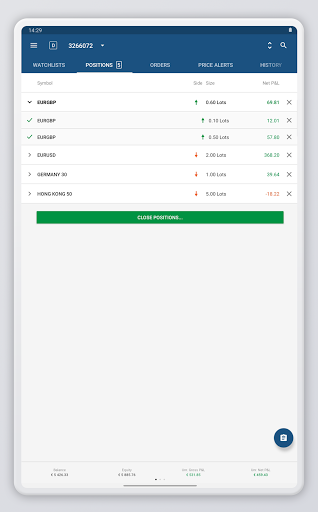

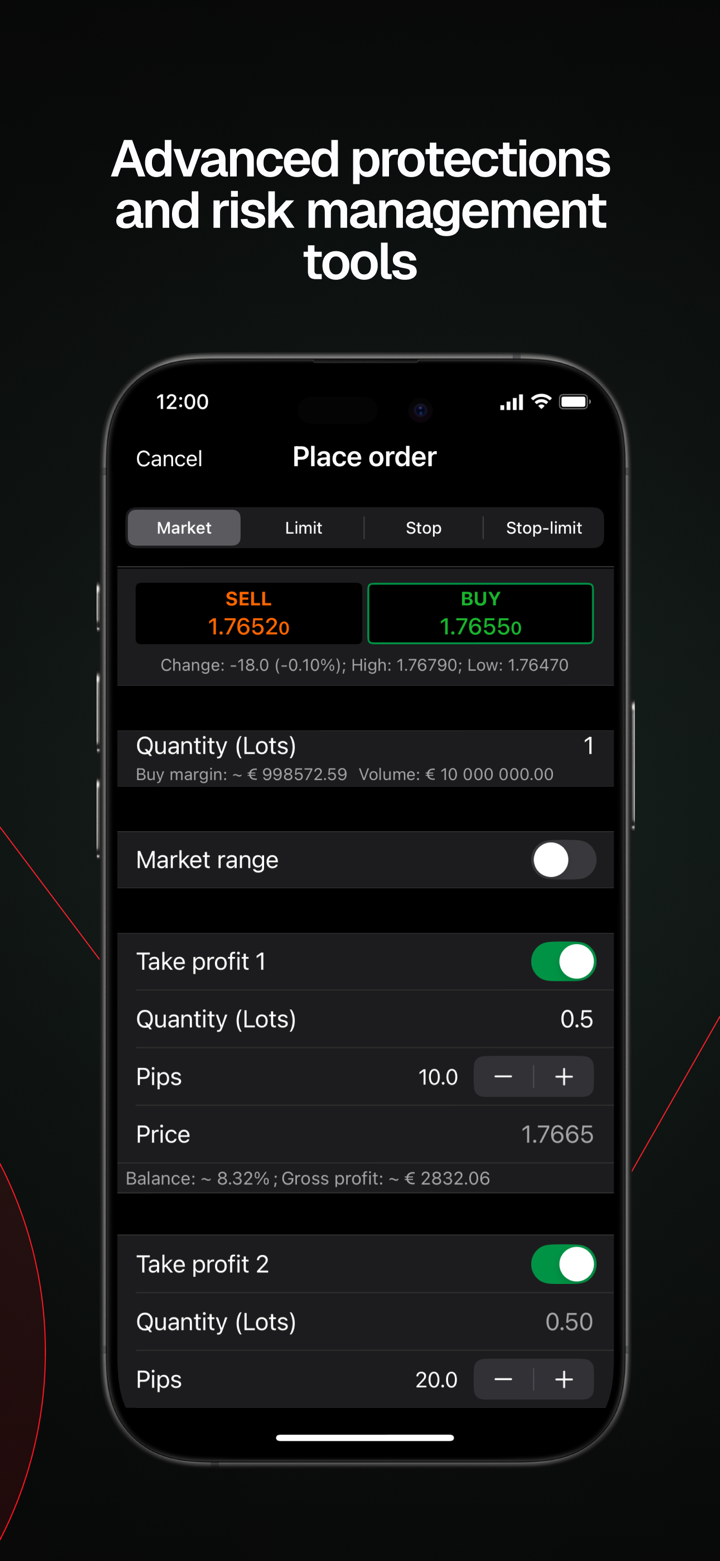

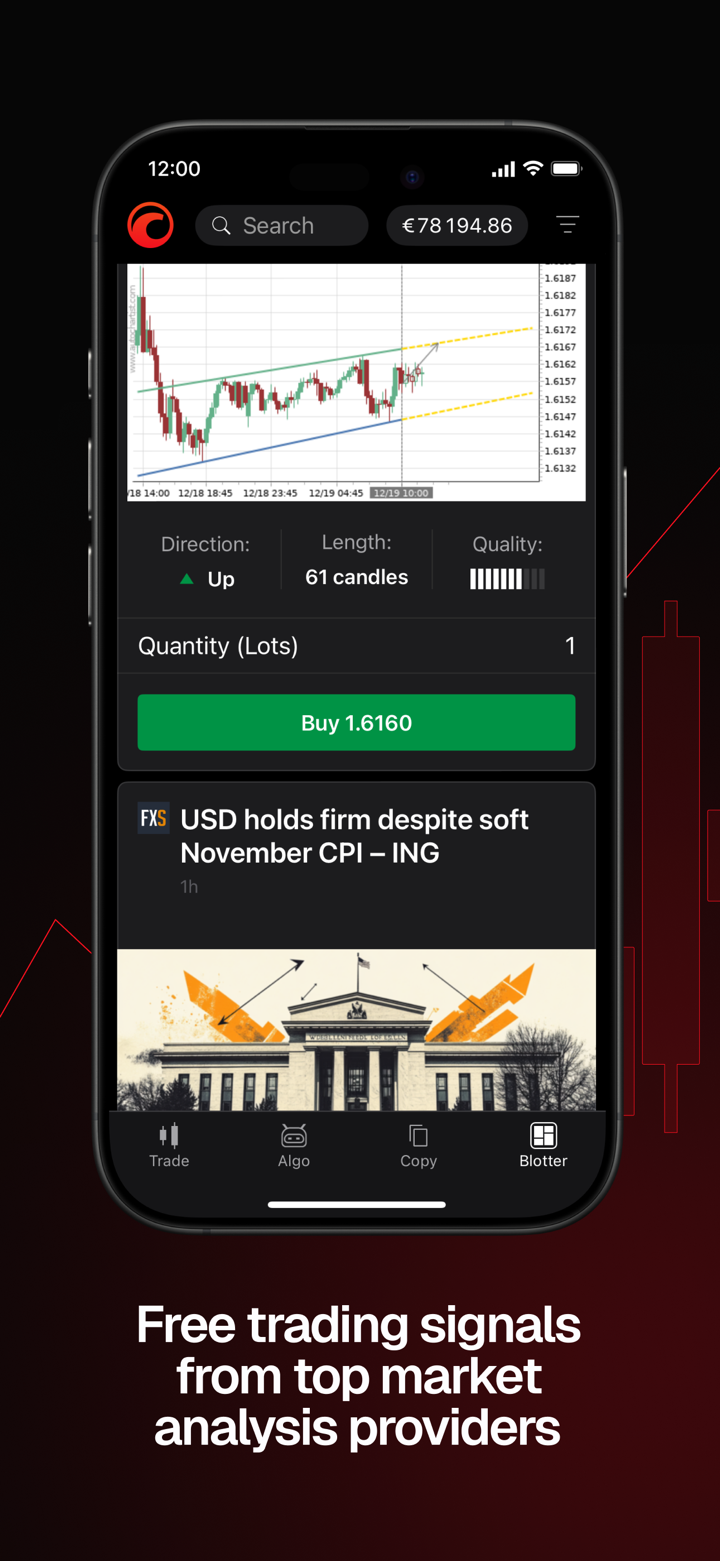

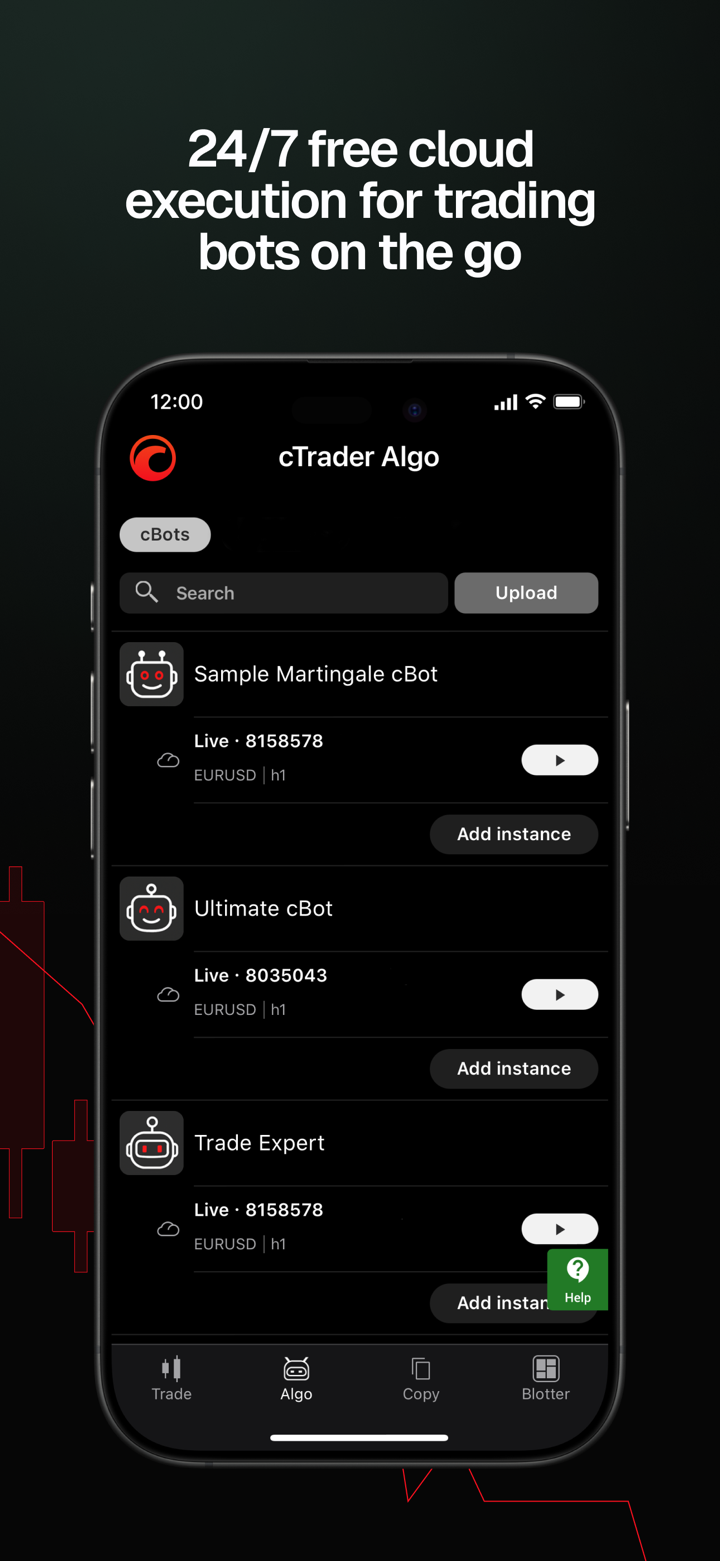

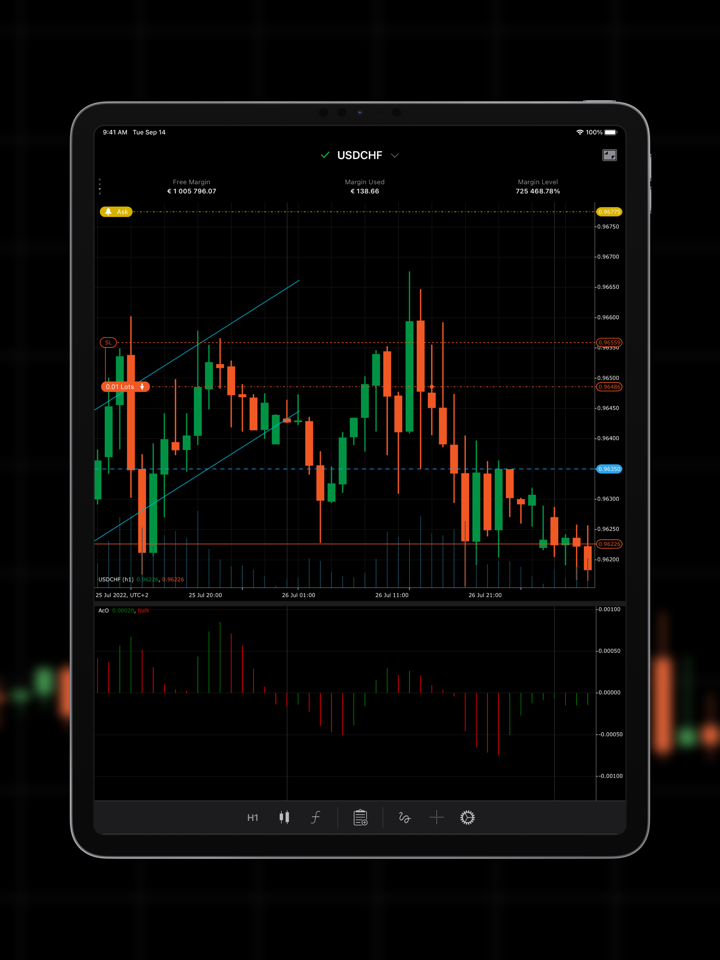

Trading Platforms

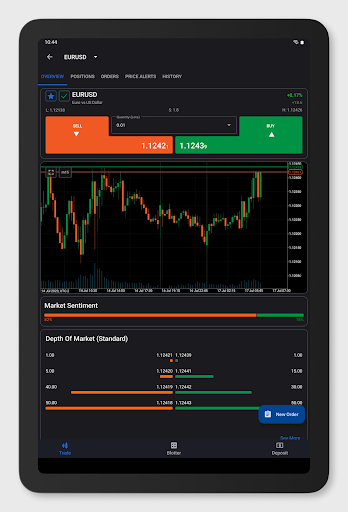

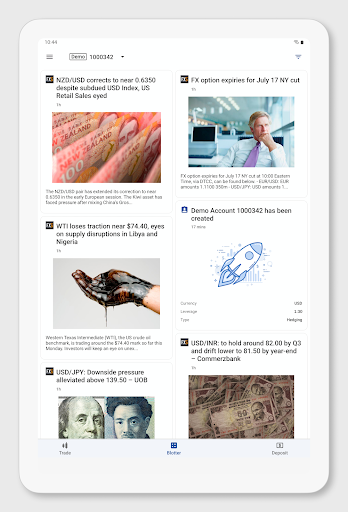

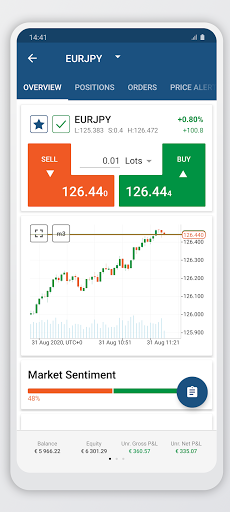

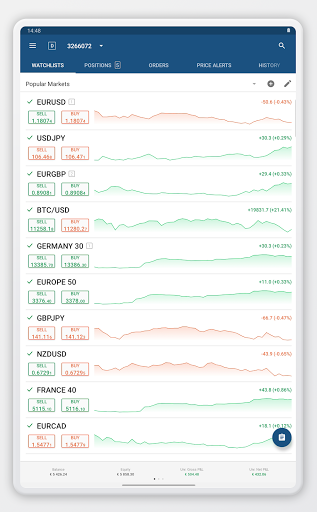

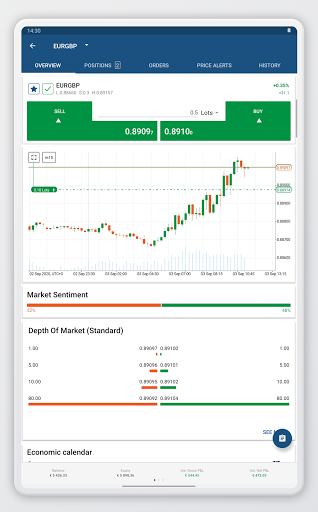

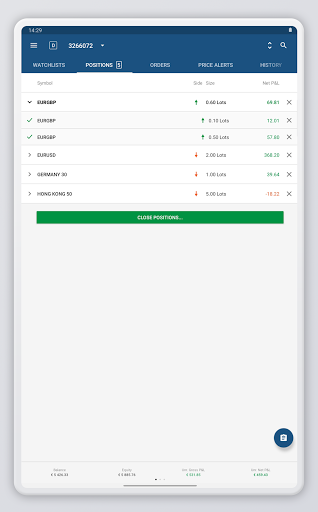

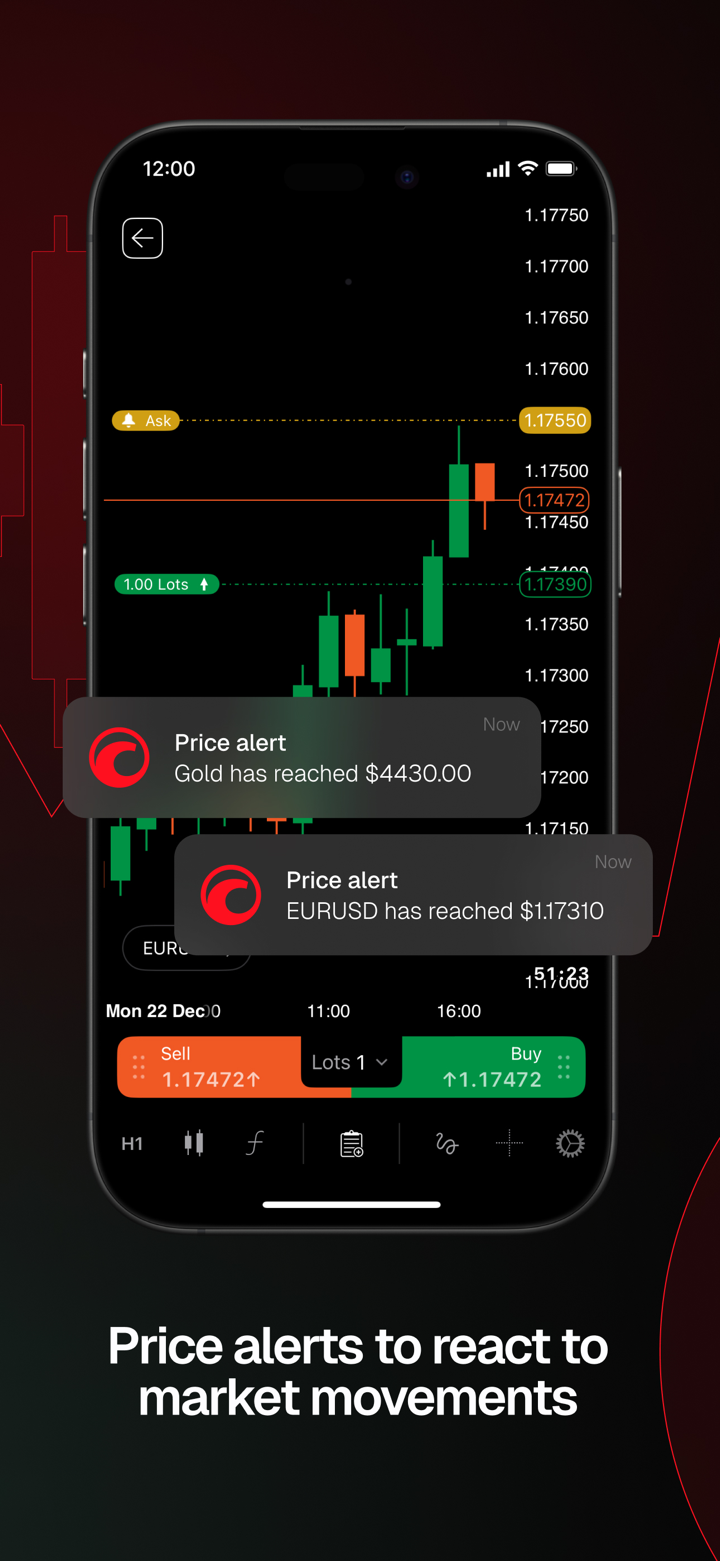

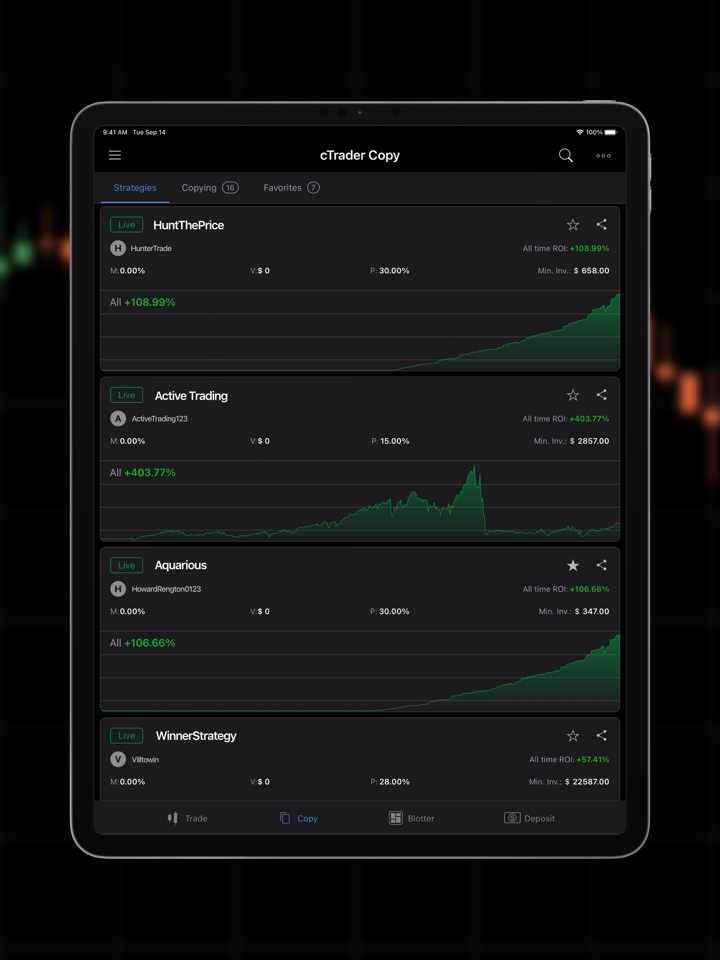

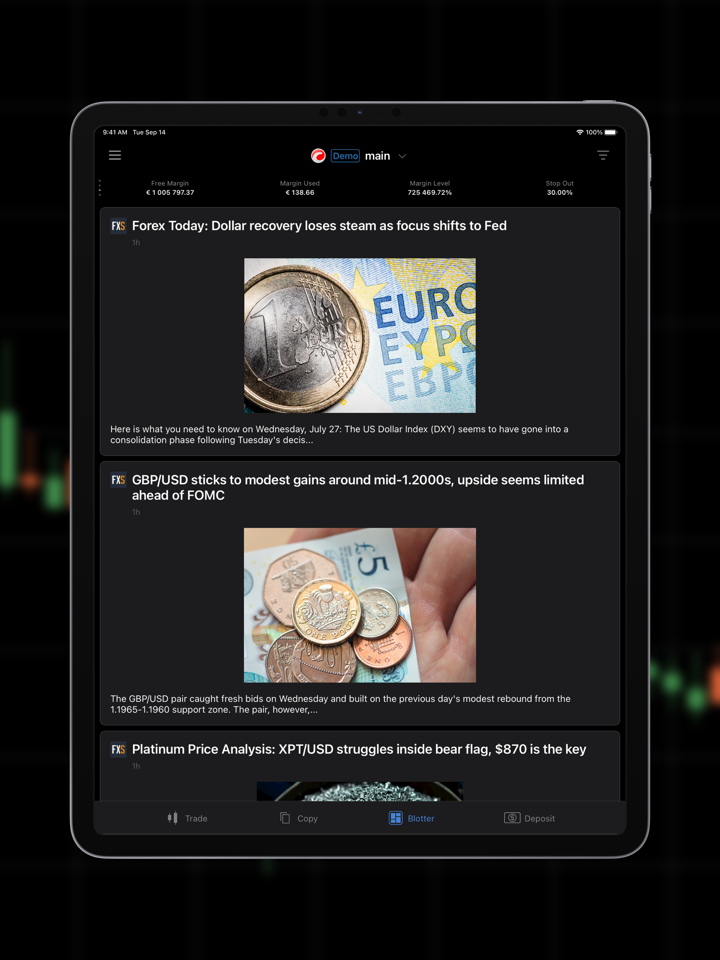

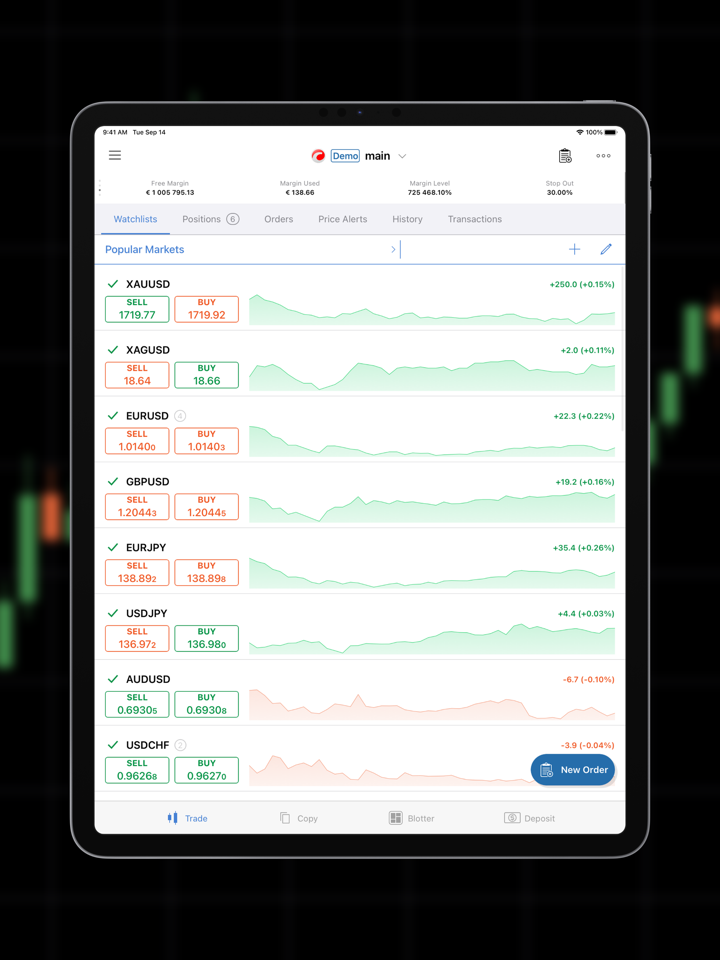

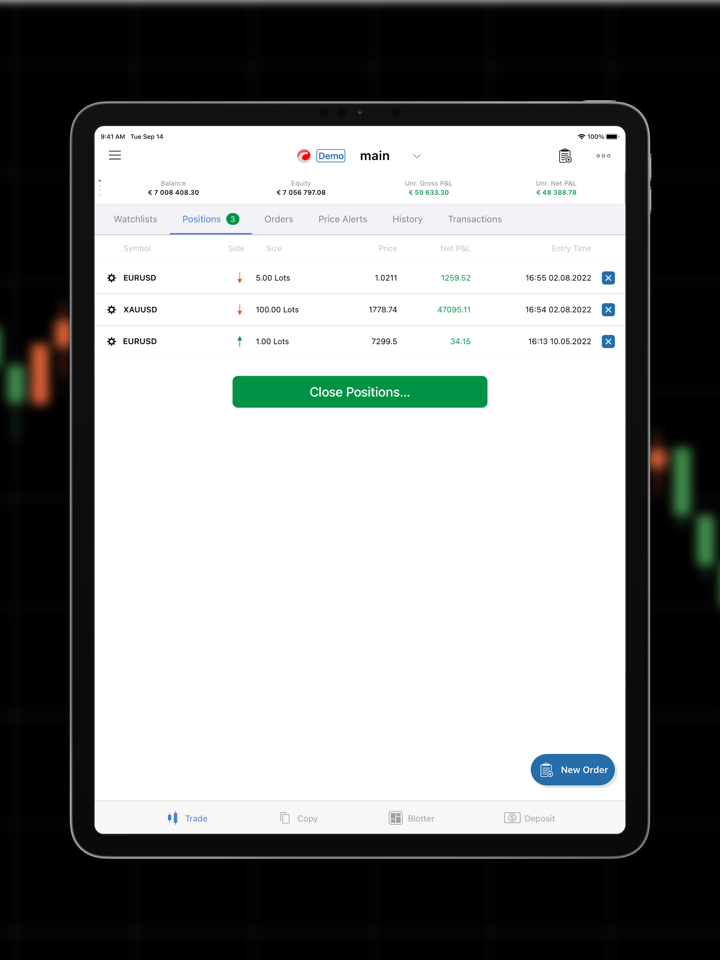

Purple Trading provides access to three leading trading platforms, MetaTrader 4/5 (MT4/5) and cTrader, offering clients a comprehensive suite of tools and features for effective trading.

MetaTrader 4/5, a widely acclaimed platform in the industry, offers advanced charting capabilities, customizable indicators, and automated trading through Expert Advisors (EAs), empowering traders with robust technical analysis tools.

On the other hand, cTrader stands out with its intuitive interface, lightning-fast execution, and Level II pricing transparency, catering to traders who prioritize speed, precision, and depth of market insights.

Deposit & Withdrawal

| Payment Methods | Deposit/Withdrawal Fee | Max. Deposit/Withdrawal | Deposit Time | Withdrawal Time |

| MasterCard/Visa | ❌ | EUR 60,000 | Instantly | 1 business day |

| Domestic payment in CZK and PLN; SEPA payment in EUR | ❌ | - | 1 business day | |

| International payment in other currencies | 0.5% (min. 5 EUR, max. 100 EUR) | - | 1 business day | |

Note that deposits and withdrawals made in a currency different from your account's currency will be automatically converted and the final amount credited may vary due to exchange and conversion rates.

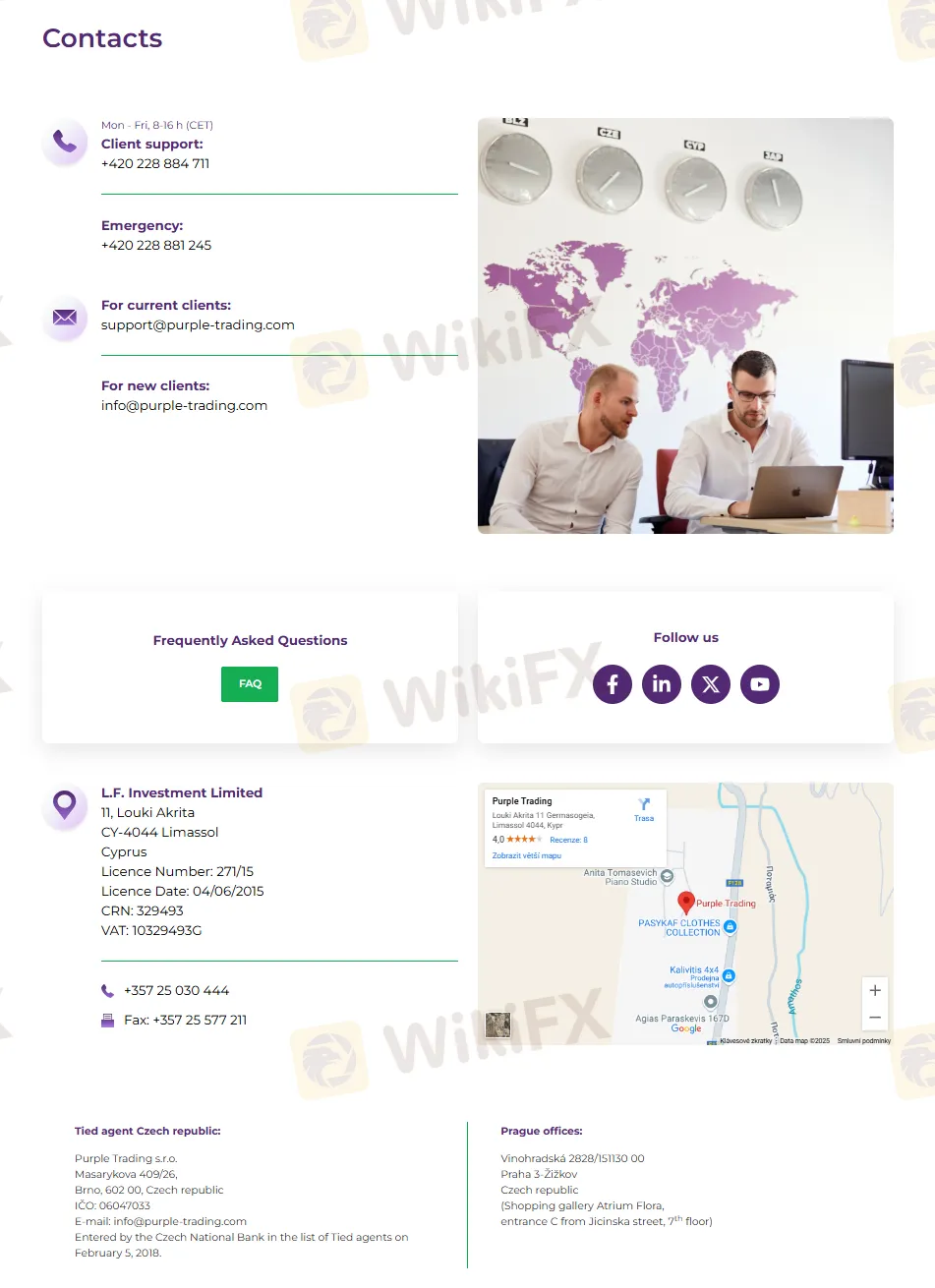

Customer Support

Purple Trading offers comprehensive customer support through various channels:

- Phone Support:

- In case of emergencies, clients can reach out to Purple Trading at +420 228 881 245.

- General client support is available Monday to Friday from 8:00 to 16:00 (CET) via phone at +44 14 46 506 711.

- Email Support:

- New clients can reach out to info@purple-trading.com for inquiries.

- Existing clients can contact support@purple-trading.com for assistance.

- Online Resources:

- Clients can visit the Frequently Asked Questions (FAQs) section on the Purple Trading website for quick answers to common queries.

- Physical Address:

- Clients can contact the company by phone at +357 25 030 444 or via fax at +357 25 577 211.

- Purple Trading's headquarters is located at 11, Louki Akrita, CY-4044 Limassol, Cyprus.