مقدمة عن الشركة

| Ata Yatırım ملخص المراجعة | |

| تأسست | 1990 |

| البلد/المنطقة المسجلة | تركيا |

| التنظيم | لا يوجد تنظيم |

| المنتجات والخدمات | الأسهم، العقود الآجلة، الخيارات، السندات، صناديق الاستثمار، خدمات الوساطة، التمويل الشركوي، استشارات الاستثمار، إدارة المحافظ، والبحث |

| حساب تجريبي | / |

| الرافعة المالية | / |

| الانتشار | / |

| منصة التداول | تطبيق الجوال |

| الحد الأدنى للإيداع | / |

| دعم العملاء | نموذج الاتصال |

| البريد الإلكتروني: iletisim@atayatirim.com.tr | |

| هاتف: 0 (212) 310 60 60 | |

| وسائل التواصل الاجتماعي: X، يوتيوب، فيسبوك، إنستغرام، لينكدإن، سبوتيفاي، مدونة | |

| العنوان: رقم: 109 ك: 12 أتاكول، بشكطاش، اسطنبول، 34349، تركيا | |

معلومات Ata Yatırım

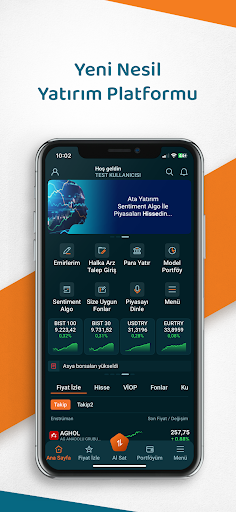

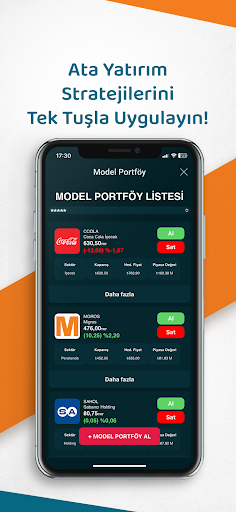

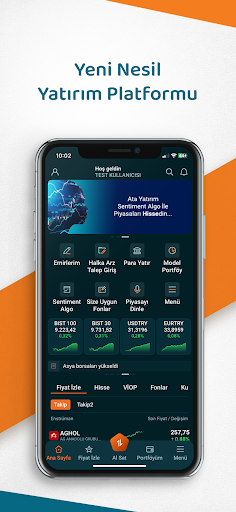

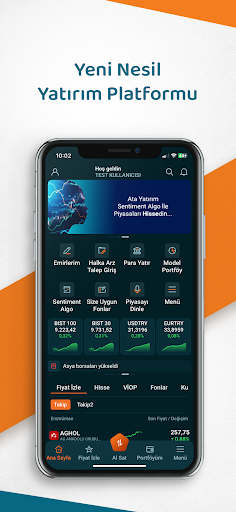

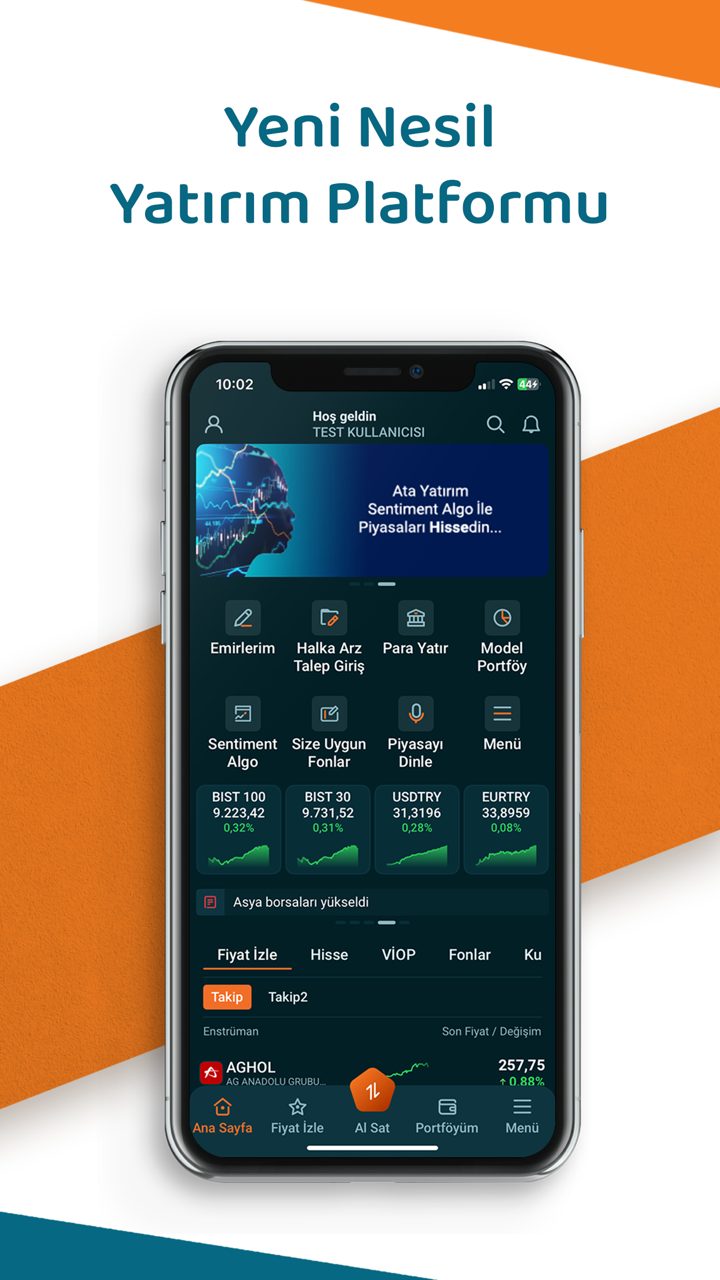

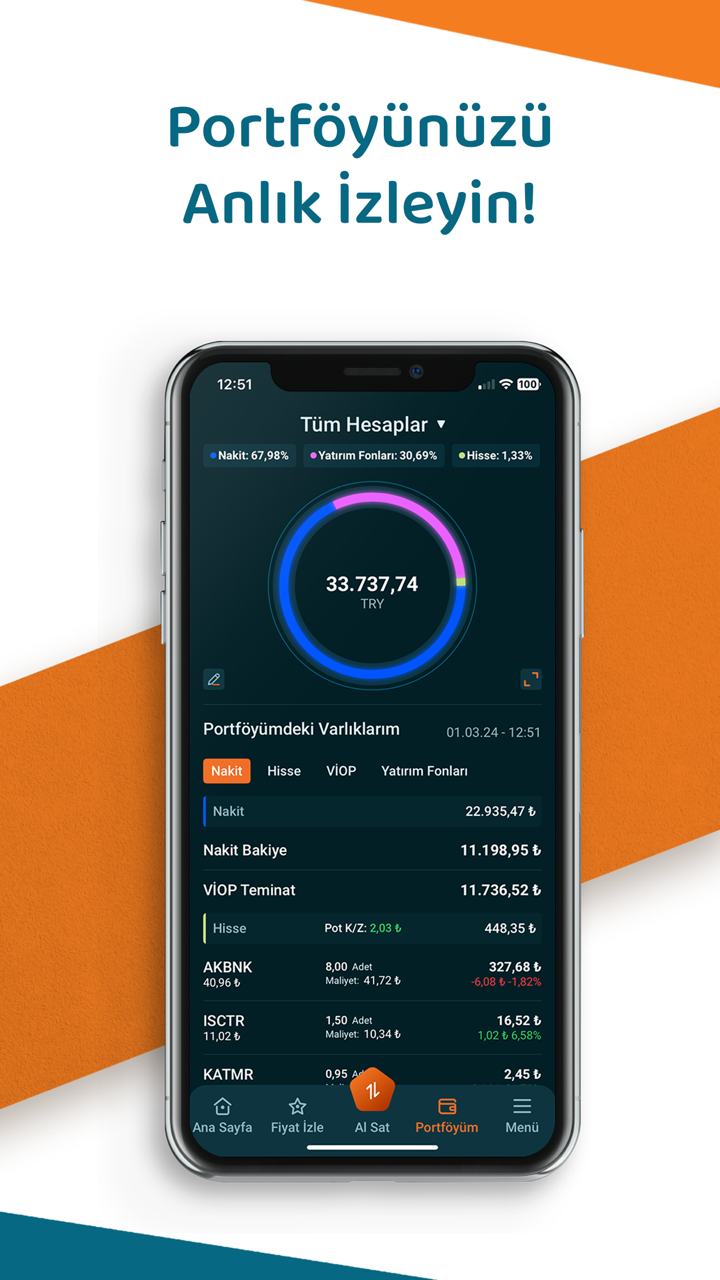

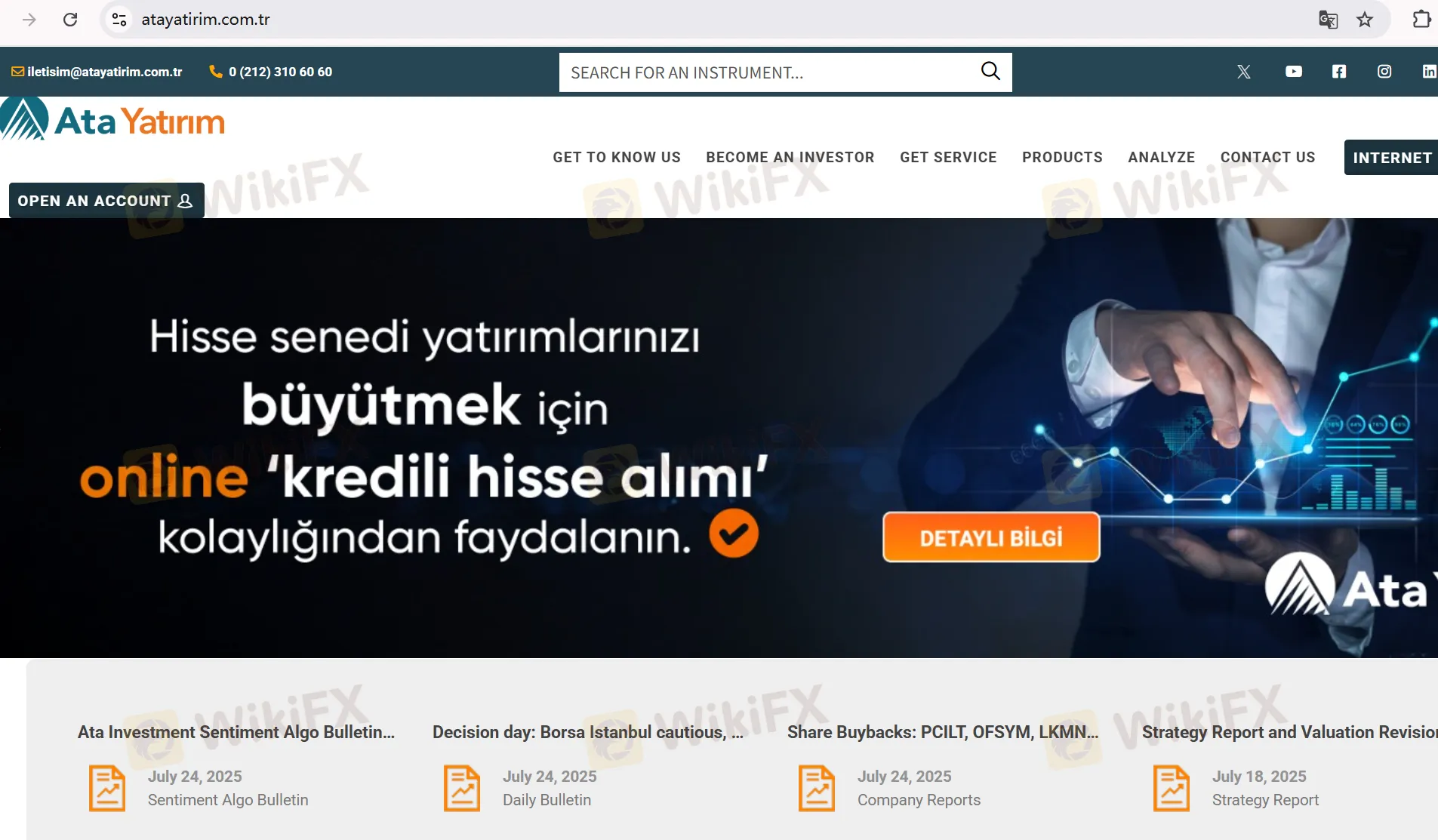

Ata Yatırım، التي تأسست في عام 1990 ومقرها في تركيا، هي منصة غير منظمة تقدم مجموعة شاملة من الخدمات المالية، بما في ذلك منصات الاستثمار مثل AtaOnline للتداول عبر الهاتف المحمول، بالإضافة إلى منتجات متنوعة مثل الأسهم، العقود الآجلة، الصناديق، والسندات.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| خدمات شاملة | نقص في التنظيم |

| قنوات اتصال متنوعة | معلومات محدودة حول الرسوم |

| تاريخ عمل طويل |

هل Ata Yatırım شرعية؟

Ata Yatırım هي منصة غير منظمة. تم تسجيل نطاق atayatirim.com.tr في WHOIS في 26 سبتمبر 1997، وينتهي في 25 سبتمبر 2027.

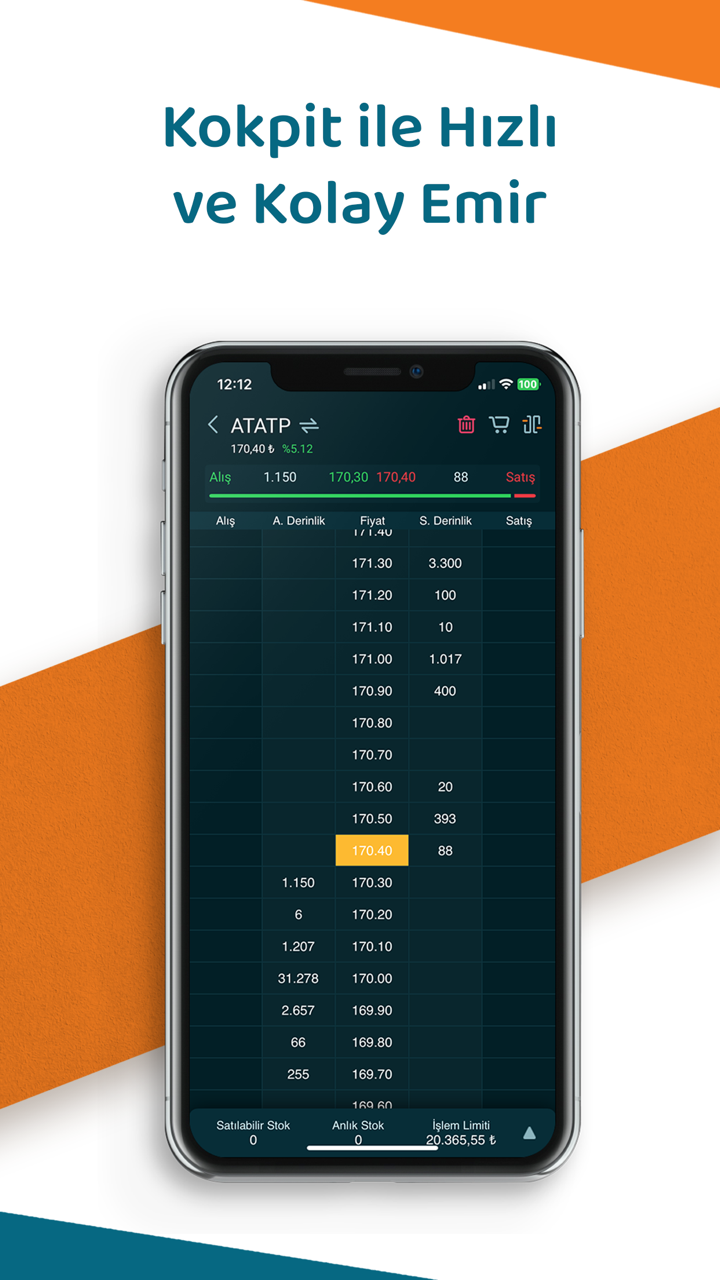

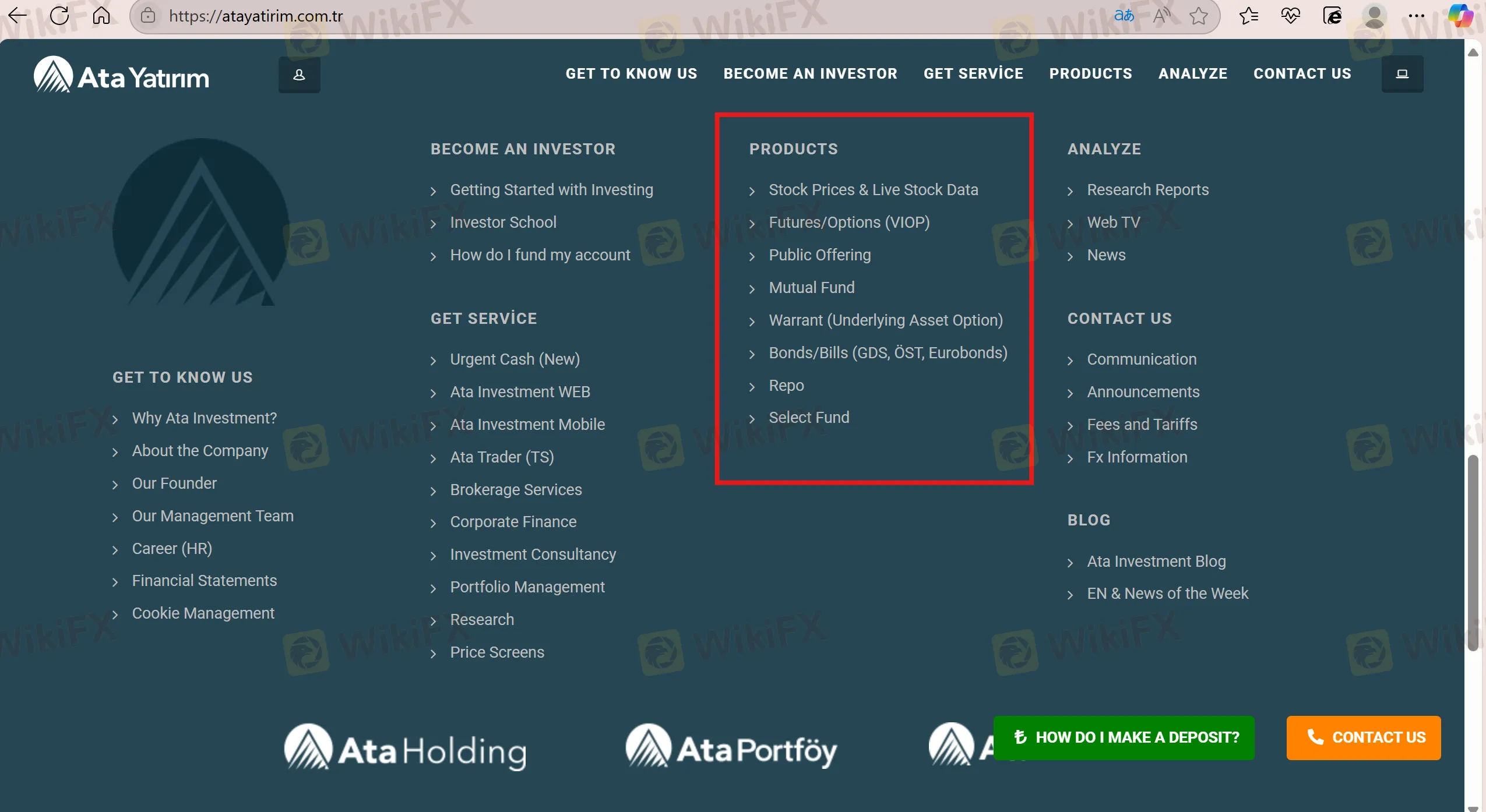

ما الذي يمكنني تداوله على Ata Yatırım؟

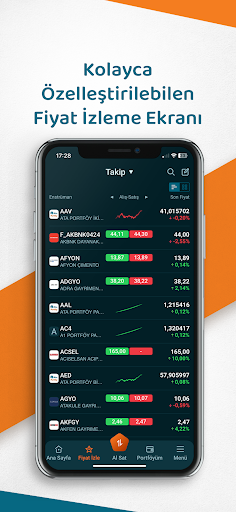

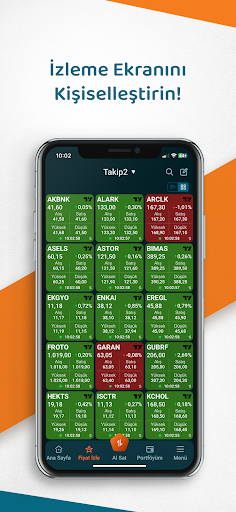

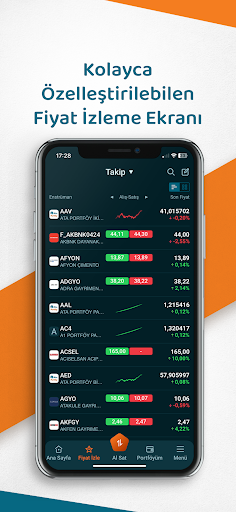

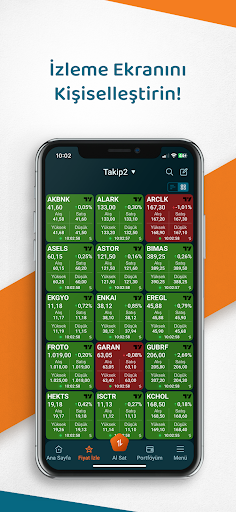

Ata Yatırım تقدم مجموعة متنوعة من المنتجات الاستثمارية بما في ذلك أسعار الأسهم والبيانات الحية، العقود الآجلة/الخيارات (VIOP)، الطروحات العامة، صناديق الاستثمار، الشهادات، السندات/الفواتير، الريبو، وصناديق الاختيار.

| الأدوات التجارية | مدعوم |

| العقود الآجلة | ✔ |

| الخيارات | ✔ |

| الأسهم | ✔ |

| السندات | ✔ |

| صناديق الاستثمار | ✔ |

| الفوركس | ❌ |

| السلع | ❌ |

| العملات الرقمية | ❌ |

الخدمات

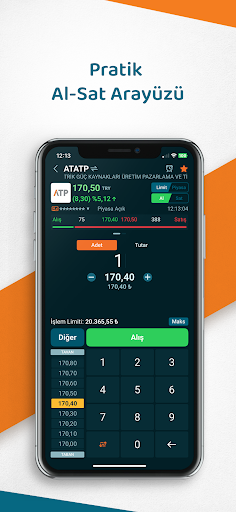

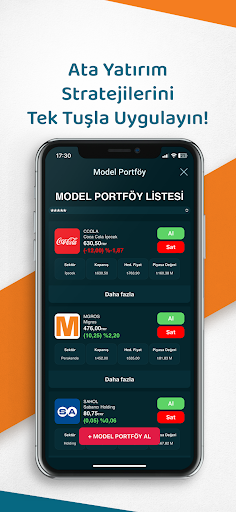

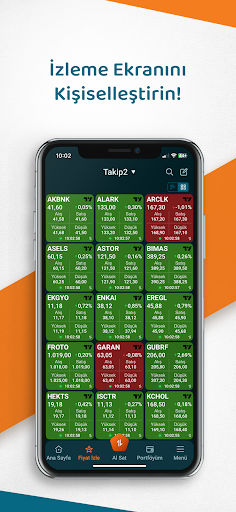

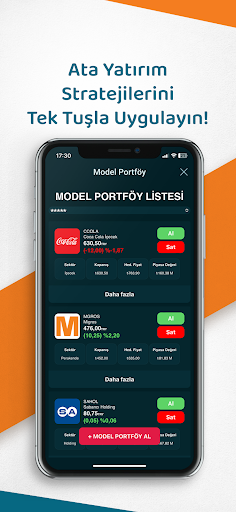

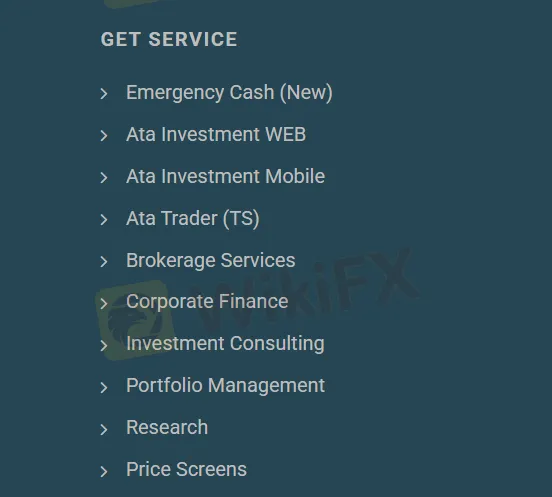

Ata Yatırım يوفر مجموعة من الخدمات المالية، بما في ذلك منصات الاستثمار (WEB، Mobile، Trader TS)، خدمات الوساطة، التمويل الشركاتي، استشارات الاستثمار، إدارة المحافظ، والبحث، بالإضافة إلى خدمة نقدية طارئة جديدة وشاشات الأسعار.

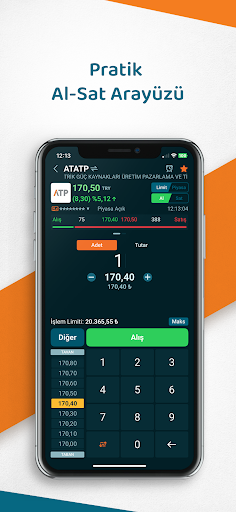

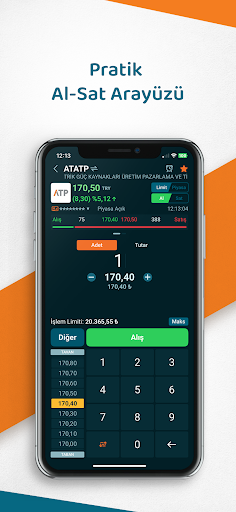

منصة التداول

| منصة التداول | مدعومة | الأجهزة المتاحة | مناسبة لـ |

| تطبيق الجوال | ✔ | IOS و Android | / |