公司簡介

| 方面 | 信息 |

| 公司名称 | 創僑資本证券有限公司 |

| 注册国家/地区 | 香港 |

| 成立年份 | 2011 |

| 监管 | 受香港证券及期货事务监察委员会监管 |

| 点差 | 未提供信息 |

| 交易平台 | 創僑資本全球移动版、PC版、Web版 |

| 产品和服务 | 投资管理、投资服务和企业管理 |

| 客户支持 | 全球交易热线:(852) 3153 1128,电子邮件:cs@clchk.com |

| 教育资源 | 视频 |

創僑資本概述

成立于2011年,創僑資本是一家总部位于香港的投资公司,管理多个全球投资策略。他们通过遵循纪律性的方法、利用独特的见解和进行彻底的研究来产生有吸引力的投资回报。他们独特的企业文化吸引了高素质的个人,他们与公司的愿景相符,并致力于共同成长。这反过来使他们能够不断改进他们为投资伙伴提供的解决方案。

創僑資本通過在每個解決方案中投資自己的資本,展示了他們的承諾,確保他們的利益與投資者的利益密切相關。此外,他們的投資和客戶受益於他們的投資服務部門提供的廣泛金融和運營專業知識。

創僑資本集團的公司在證券及期貨事務監察委員會(SFC)的監管下運營,使他們能夠提供證券及期貨合約交易和諮詢,以及資產管理等服務。他們的投資服務部門致力於為客戶和自身提供具有成本效益和高效執行的服務。

監管狀態

創僑資本受香港证券及期货事务监察委员会监管。他们目前的监管状态是“受监管”,并持有“期货合约交易”的许可证。监管监督由香港的监管机构提供,他们的特定许可证号码是AQF520。

這些監管信息確保創僑資本在香港遵守適用的金融法規,並保持進行期貨合約交易所需的必要授權。

優點和缺點

| 優點 | 缺點 |

| 有潛力的高質量投資公司 | 帳戶類型的信息有限 |

| 紀律性的方法和深入研究 | 存款和提款方式的信息有限 |

| 獨特的見解和有吸引力的回報 | 教育資源細節缺乏 |

| 多樣化的策略和投資選擇 | |

| 以客戶為中心的方法 | |

| 香港證監會的監管監督 | |

| 強大的客戶支持渠道 | |

| 包括移動、PC和Web平台 |

產品和服務

投資管理

我们为投资合作伙伴和自有资金投资于自主宏观和系统性策略。我们的团队不断学习和提升我们的知识、理解和方法论,怀着强烈的好奇心和奉献精神。

投资服务

我们专注于与客户建立长期合作伙伴关系,为他们提供全面有效的融资和投资解决方案,帮助客户发展业务和财富。我们的团队是经验丰富的行业专家和积极进取的个人,致力于开发广泛的知识和资源,解决复杂和具有挑战性的任务。

企业管理

我們的企業管理部門負責管理企業事務並支持公司的成長。該部門包括人力資本管理、法律與合規、會計與財務以及企業策略等職能。

我们管理内部和外包服务,研究和部署企业战略,培养企业文化,并自动化和执行例行程序。

創僑資本 全球交易平台

創僑資本證券有限公司提供一個多功能的交易平台,可在移動設備、個人電腦和網頁版本上使用。該平台設計了用戶友好的界面,最大程度地減少了登錄、下單、訪問市場新聞和查看報表等任務所需的努力。這種設計確保了用戶無縫高效的交易體驗,同時他們的客戶服務團隊隨時可用以解答問題並支持投資需求。該平台還提供中國大陸移動安卓版本的訪問。

如何開設帳戶?

您可以选择两种方式来开设創僑資本证券有限公司的账户:在线开户或面对面开户。

線上開戶的5個步驟:

在网页上填写您的个人信息。

上傳您的個人身份證明文件。

請在您的電子郵件中簽署將要發送的文件。

請通過郵寄一張價值2,000美元(或等值貨幣)的支票給我們公司*,或者親自前往律師、會計師或銀行分行經理處進行身份證明。

請將簽署的文件、您的認證身份證明文件以及2,000美元的支票(如適用)郵寄給我們公司。

面對面開戶的五個步驟:

在网页上填写您的个人信息。

上傳您的個人身份證明文件。

安排面对面的预约。

請將您的個人資料文件帶到我們的辦公室。

我们的授权代表将验证您的身份和签名。

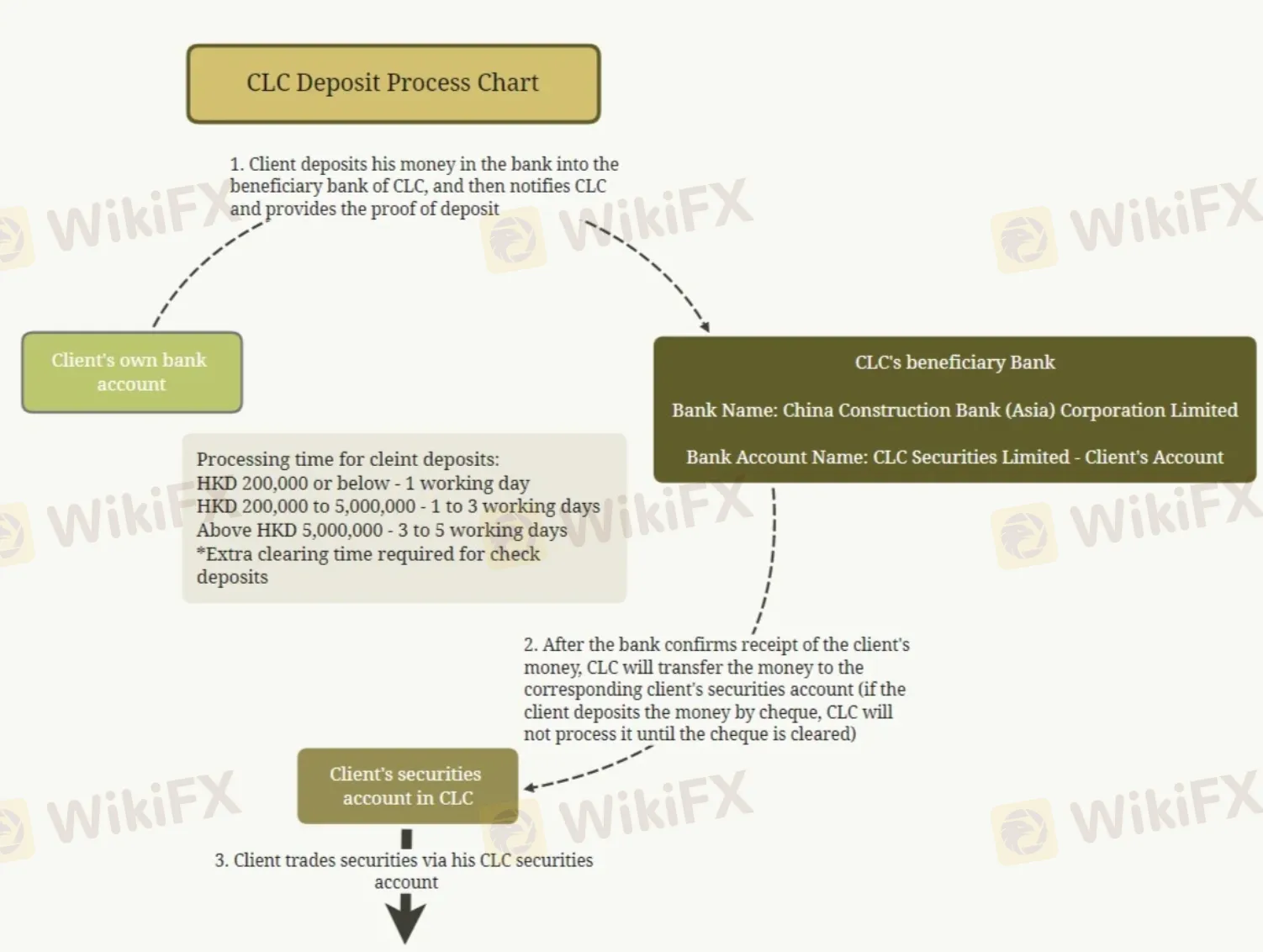

存款流程

客戶通過將資金存入創僑資本的受益銀行來啟動存款流程。存款後,客戶通知創僑資本存款並提供交易的支持證明。創僑資本的受益銀行是中國建設銀行(亞洲)有限公司。

- 客戶存款處理時間:

- 對於港幣200,000元或以下的存款:1個工作日

- 對於存款範圍在港幣200,000至5,000,000之間的:1至3個工作日

- 存款超过HKD 5,000,000:3至5个工作日

- 注意:支票存款需要额外的结算时间。

一旦银行确认客户资金的收到,創僑資本将继续将存款转入相应客户的证券账户。需要注意的是,在支票存款的情况下,創僑資本只会在支票结算后处理存款。

客戶隨後可以使用他們的創僑資本證券帳戶進行證券交易。

教育資源

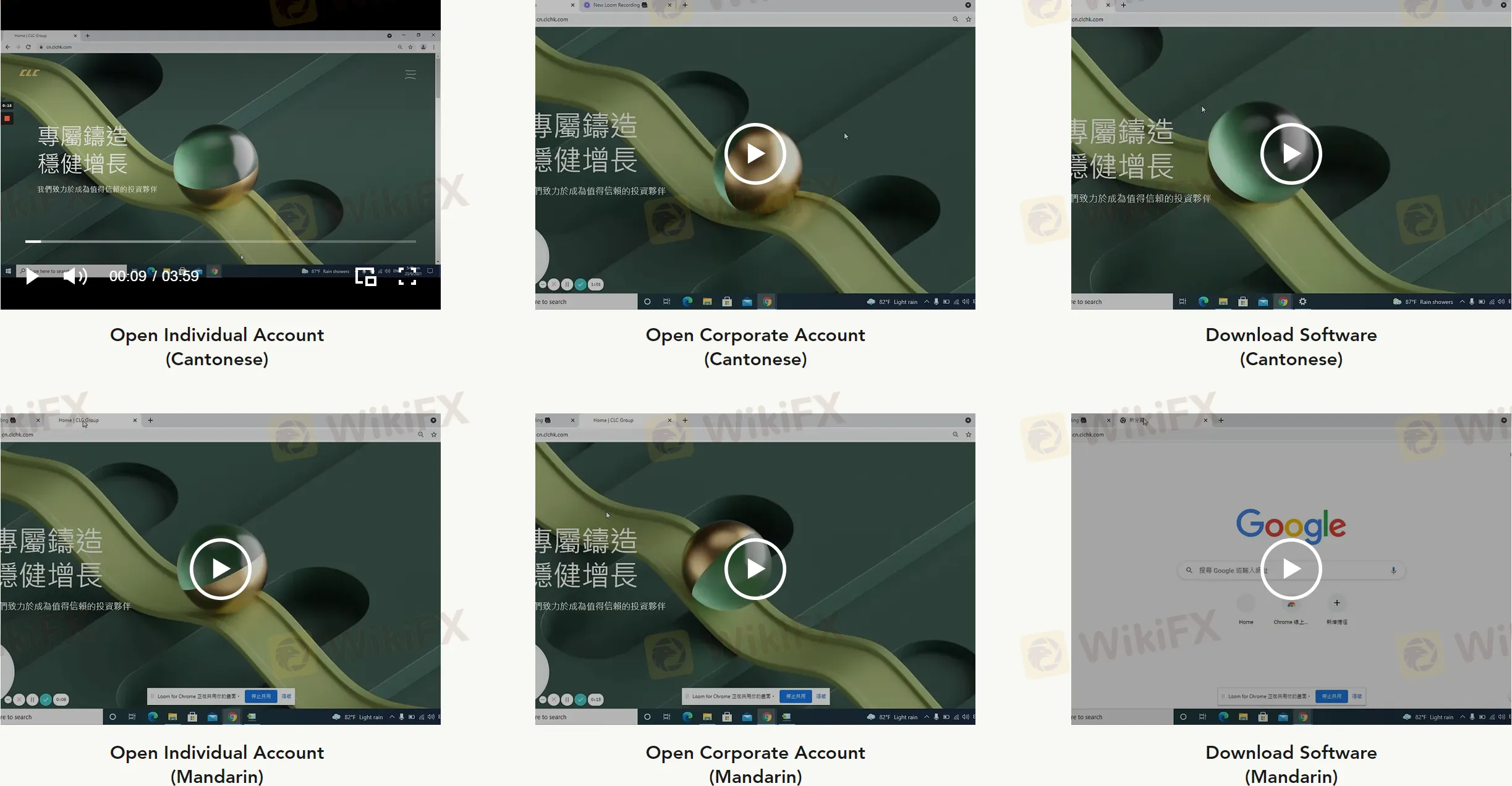

創僑資本提供了许多视频教程,包括普通话和粤语,教授如何开设账户、下载软件、在交易平台下订单等等,供新手交易者熟悉并入门。

客户支持

創僑資本证券有限公司通过其全球交易热线提供全面的客户支持。您可以通过电话联系他们的客户服务团队,电话号码为(852) 3153 1128。此外,他们还提供电子邮件支持,邮箱为cs@clchk.com。这些联系方式使客户能够获得帮助,查询服务或寻求有关交易的任何问题的帮助。

結論

總結來說,創僑資本證券有限公司通過其紀律嚴謹的方法、深入研究和多樣化的策略,為投資者提供了高質量的投資機會。該公司以客戶為中心的方法、香港證監會的監管監督以及強大的客戶支援渠道都是明顯的優勢。

然而,缺乏有关最低存款、最大杠杆、点差、可交易资产、账户类型、模拟账户、存款和提款方式以及教育资源等关键方面的具体信息可能被视为劣势,因为这可能会阻碍潜在客户做出明智的投资决策。

常见问题

問:如何申購首次公開募股(IPO)股票?

A: 創僑資本证券有限公司为符合条件的客户提供通过香港股票发行(“e-IPO”)和国际股票发行(“私募”)参与首次公开发行(“IPO”)的能力。

您可以通过指定的账户执行人或访问我们的办公室来认购首次公开发行(IPO)股票。分配的IPO持股将直接存入您的交易账户,分配日您可以在首个上市日交易您的股票。

問:創僑資本證券有限公司採用哪些投資策略?

A: 創僑資本证券有限公司采用多种投资策略,根据不同的财务目标和风险承受能力进行量身定制。

問:與創僑資本證券有開始交易的最低存款要求嗎?

A:根據您希望開設的帳戶類型,最低存款要求可能會有所不同。

問:創僑資本證券有限公司提供什麼樣的客戶支援服務?

A: 創僑資本證券有限公司通過多種渠道提供強大的客戶支援,包括全球交易熱線和電子郵件支援,以解答客戶的查詢和問題。

問:創僑資本證券有限公司的監管機構是什麼?

A: 創僑資本证券有限公司受香港证券及期货事务监察委员会(SFC)监管,确保遵守金融法规。

問:創僑資本證券有提供哪些交易平台?

A: 創僑資本證券有限公司提供移動、PC和網絡交易平台,讓您在執行交易時更具靈活性。

零度寂寞

香港

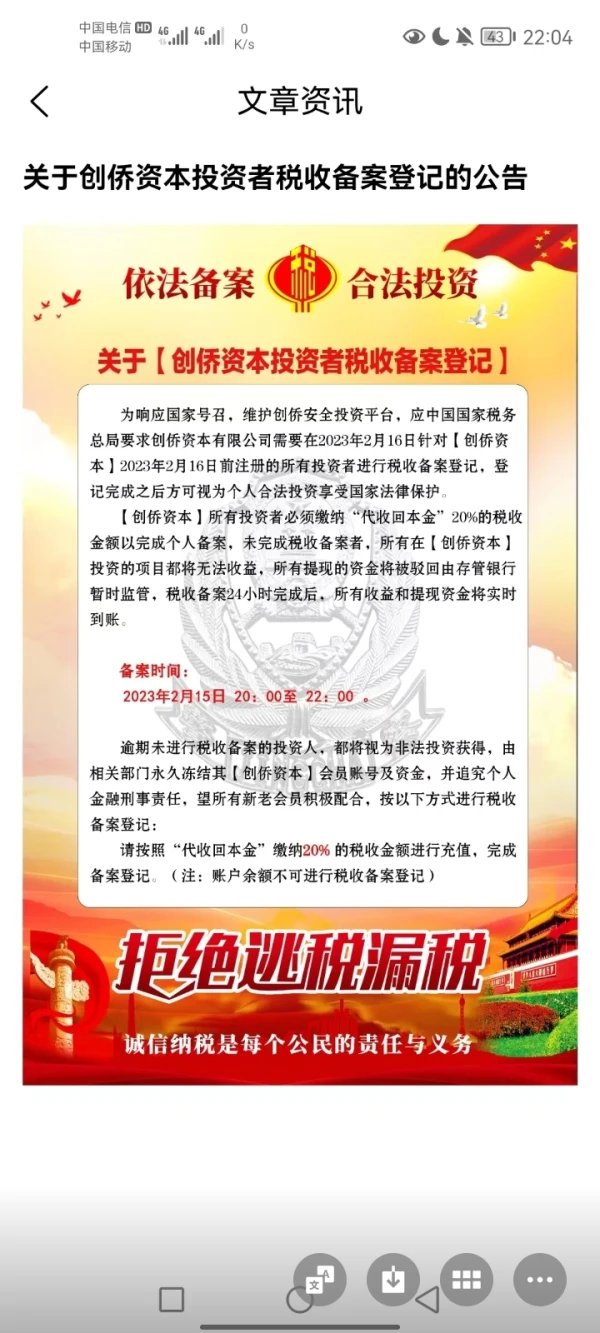

诈骗平台,就算跑路了还要最后再收割一次,真是无耻之徒,现在APP已经登录不进去了,望平台给于解决,还我血汗钱。

爆料

小白2933

香港

无法出金 还让交税 公安已介入调查,看到的不要在做啦

爆料

风沙610

香港

资金盘,资金盘,如果再做,请远离,远离,如果你钱多的话,可以多玩一玩,送钱给骗子。

爆料

FX1391372709

香港

CLC 是一家受監管的投資公司,提供各種金融服務,包括證券交易、保證金融資和 IPO 認購服務。不過最近差評太多,暴露出無法撤回。與任何金融機構一樣,在投資或與他們合作之前進行徹底的研究和盡職調查非常重要。

中評