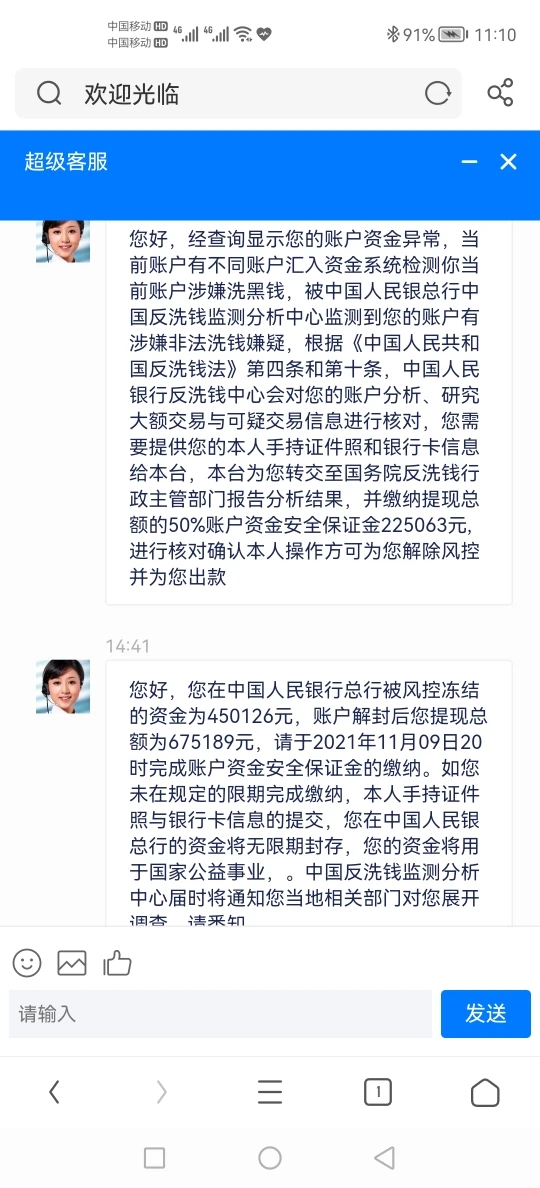

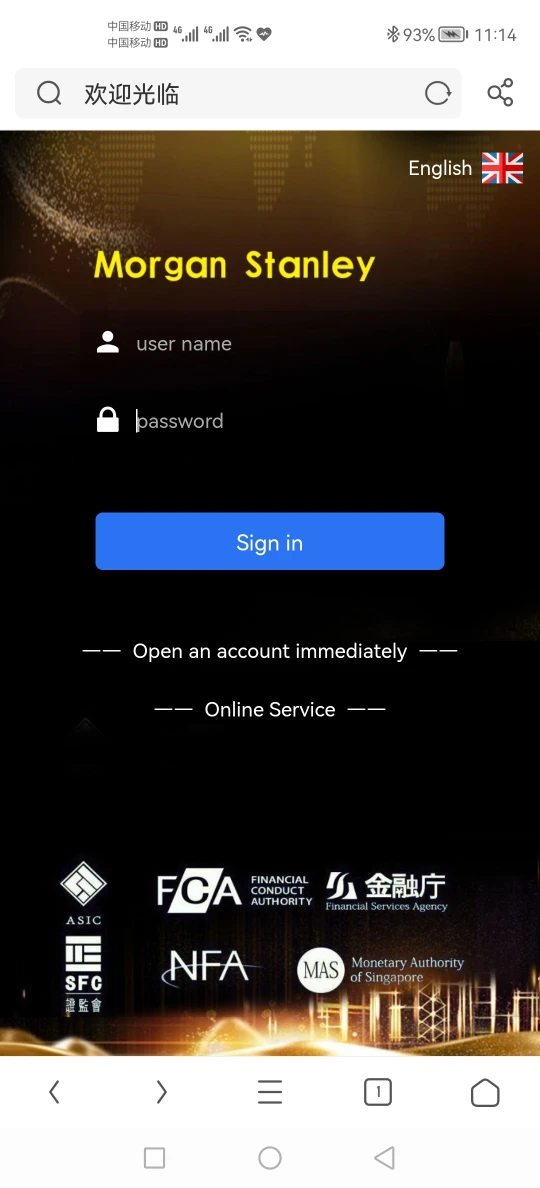

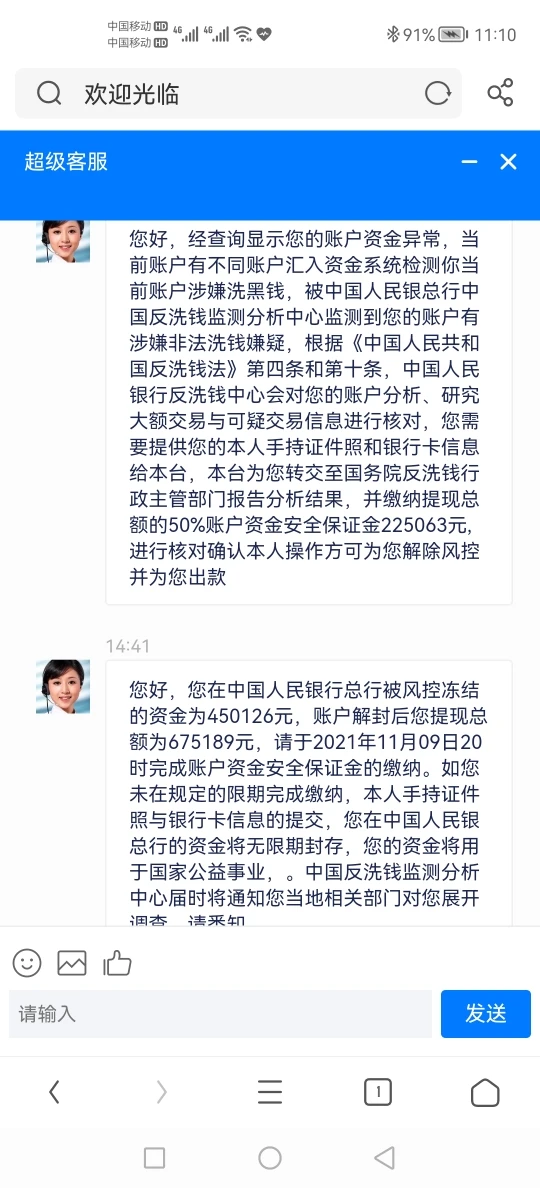

公司簡介

| Morgan Stanley評論摘要 | |

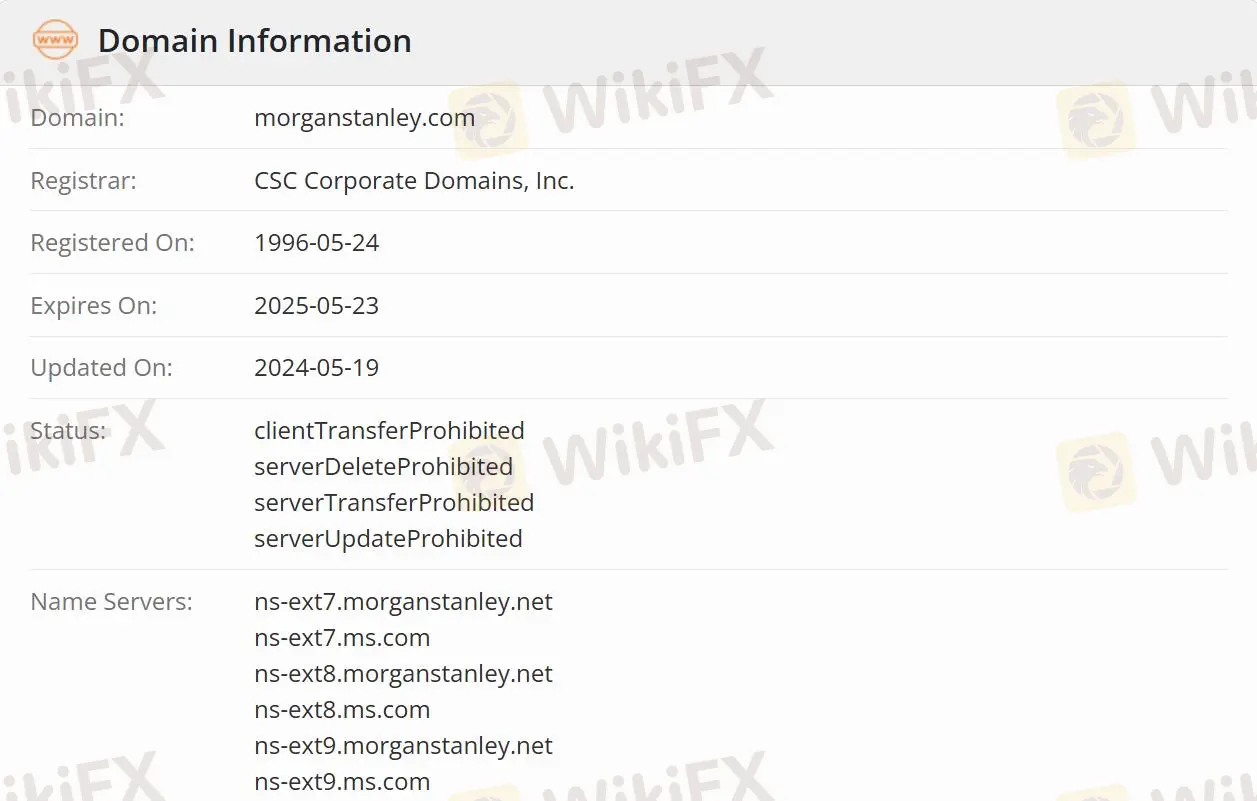

| 成立日期 | 1996-05-24 |

| 註冊國家/地區 | 美國 |

| 監管 | 受監管 |

| 服務 | 財富管理、投資銀行與資本市場、銷售與交易、研究、投資管理、Morgan Stanley在職場、可持續投資和包容性創業集團 |

| 客戶支援 | 社交媒體:LinkedIn、Instagram、Twitter、Facebook、YouTube |

Morgan Stanley資訊

Morgan Stanley是一家經紀商,幫助個人、家庭、機構和政府籌集、管理和分配資本。

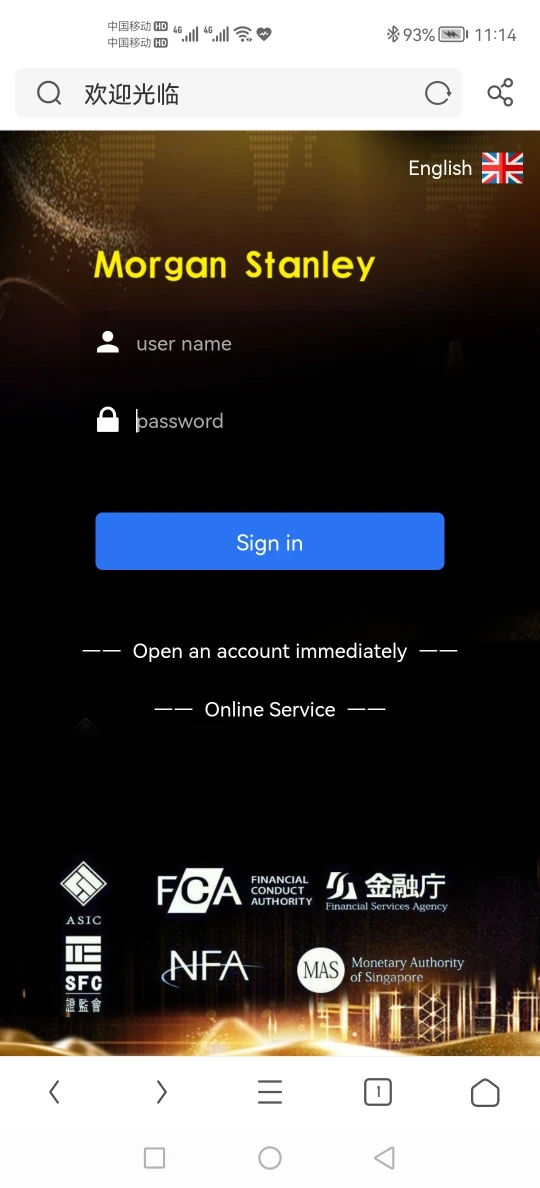

Morgan Stanley是否合法?

Morgan Stanley獲得加拿大投資監管機構(CIRO)的授權和監管,比受監管的經紀商更安全。但風險無法完全避免。

Morgan Stanley做什麼?

該公司的工作涉及8個主要方面,包括財富管理、投資銀行與資本市場、銷售與交易、研究、投資管理、Morgan Stanley在職場、可持續投資和包容性創業集團。

財富管理:幫助人們、企業和機構建立、保護和管理財富。

投資銀行與資本市場:在市場分析、咨詢和為企業、機構和政府提供籌資服務方面具有專業知識。

銷售與交易:提供銷售、交易和市場做市服務。

研究:提供對公司、行業、市場和經濟的分析,幫助客戶做出決策。

投資管理:在公共和私人市場上提供各種資產類別的投資策略。

Morgan Stanley在職場:為組織及其員工提供職場金融解決方案,結合建議。

可持續投資:提供可持續投資產品,促進創新解決方案,並提供有關可持續性問題的可行性見解。

客戶支援選項

交易者可以在各種社交媒體上關注Morgan Stanley,包括LinkedIn、Instagram、Twitter、Facebook和YouTube。

| 聯繫選項 | 詳細資訊 |

| 社交媒體 | LinkedIn、Instagram、Twitter、Facebook、YouTube |

| 支援語言 | 英語 |

| 網站語言 | 英語 |

| 實體地址 | Morgan Stanley 1585 Broadway New York, NY 10036 |