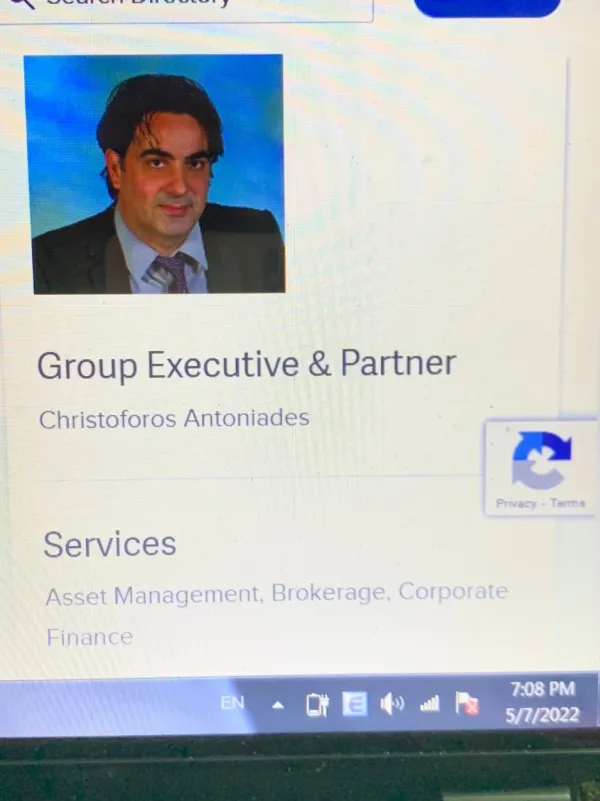

公司簡介

| ARGUS 評論摘要 | |

| 成立年份 | 2000 |

| 註冊國家/地區 | 塞浦路斯 |

| 監管 | 由CYSEC監管 |

| 服務 | 資產管理、全球經紀、投資建議、企業金融與諮詢 |

| 交易平台 | ARGUS Trader、Argus Global |

| 客戶支援 | 電話:+357 22 717000 |

| 傳真:+357 22 717070 | |

| 電郵:argus@argus.com.cy | |

| 地址:25 Demosthenis Severis Ave., 1st & 2nd Floor, 1080 Nicosia, Cyprus; P.O. Box 24863, 1304 Nicosia, Cyprus。 | |

ARGUS 資訊

成立於2000年,ARGUS提供包括資產管理、全球經紀、投資建議、企業金融和諮詢在內的金融服務。

好處在於該公司受CYSEC監管嚴格,這意味著其金融活動受到監管機構的嚴格監督,在一定程度上保證了客戶的某種程度的保護。

優缺點

| 優點 | 缺點 |

| 行業多年經驗 | / |

| CYSEC監管 | |

| 提供多樣化的金融服務 | |

| 多種聯絡渠道 |

ARGUS 是否合法?

ARGUS目前受到CYSEC(塞浦路斯證券交易委員會)監管,牌照號碼為010/03。該監管機構在其他17個國家授權,這擴大了您與該公司交易的保障。

| 監管國家 | 監管機構 | 當前狀態 | 受監管實體 | 牌照類型 | 牌照號碼 |

| CYSEC | 受監管 | Argus Stockbrokers Ltd | 直通處理(STP) | 010/03 |

ARGUS 服務

Argus提供全面的金融服務,包括獨立的資產管理、通過ARGUS Global Trader平台進行全球交易經紀、在塞浦路斯和雅典證券交易所獲得牌照的經紀業務、為IPO和併購提供企業融資解決方案、自主基金管理以及針對各種資產類別(如股票、債券和替代投資)的度身定制的投資諮詢。

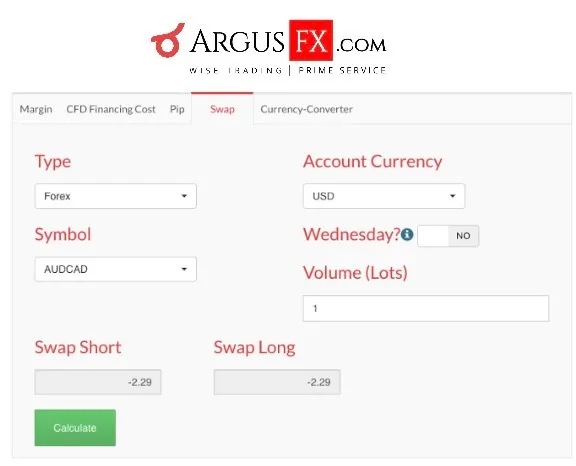

交易平台

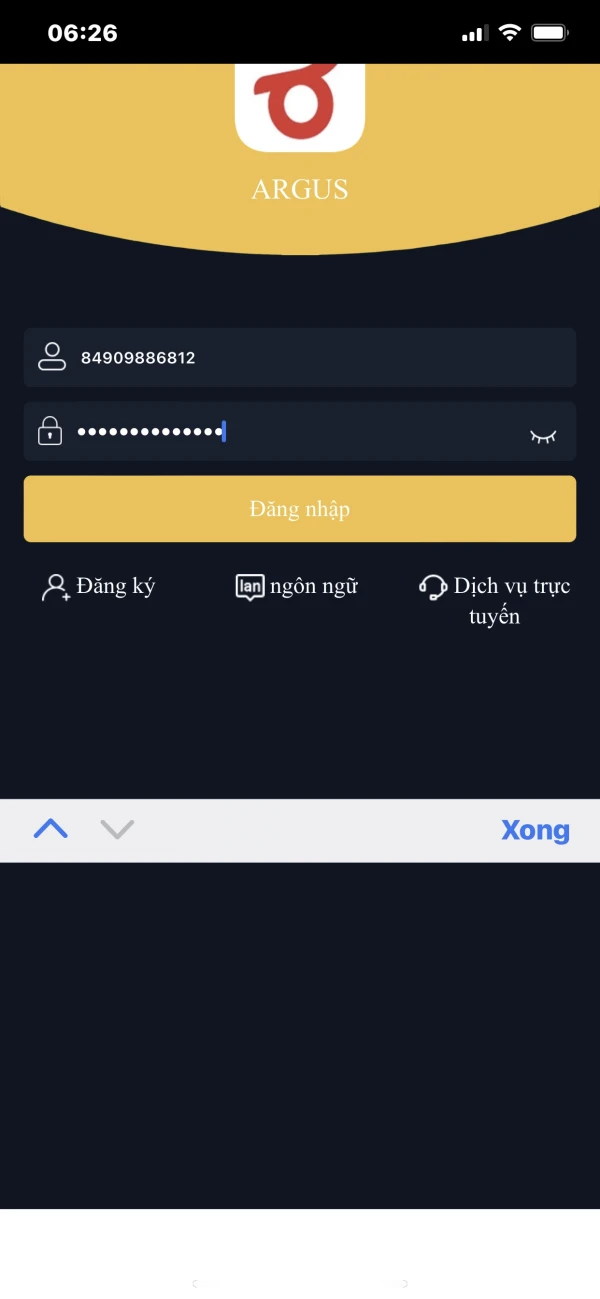

Argus Stockbrokers Ltd 提供兩個交易平台:

- ARGUS Trader:可在塞浦路斯和雅典證券交易所(CSE&ASE)進行交易,並具有完整的電子訂單執行功能。投資者可以在線交易或致電+357 22 717000。

- Argus Global Trader:由Saxo提供支持,此平台可訪問全球市場,包括外匯、股票和商品。可在線和通過桌面使用,並提供試用帳戶選項。

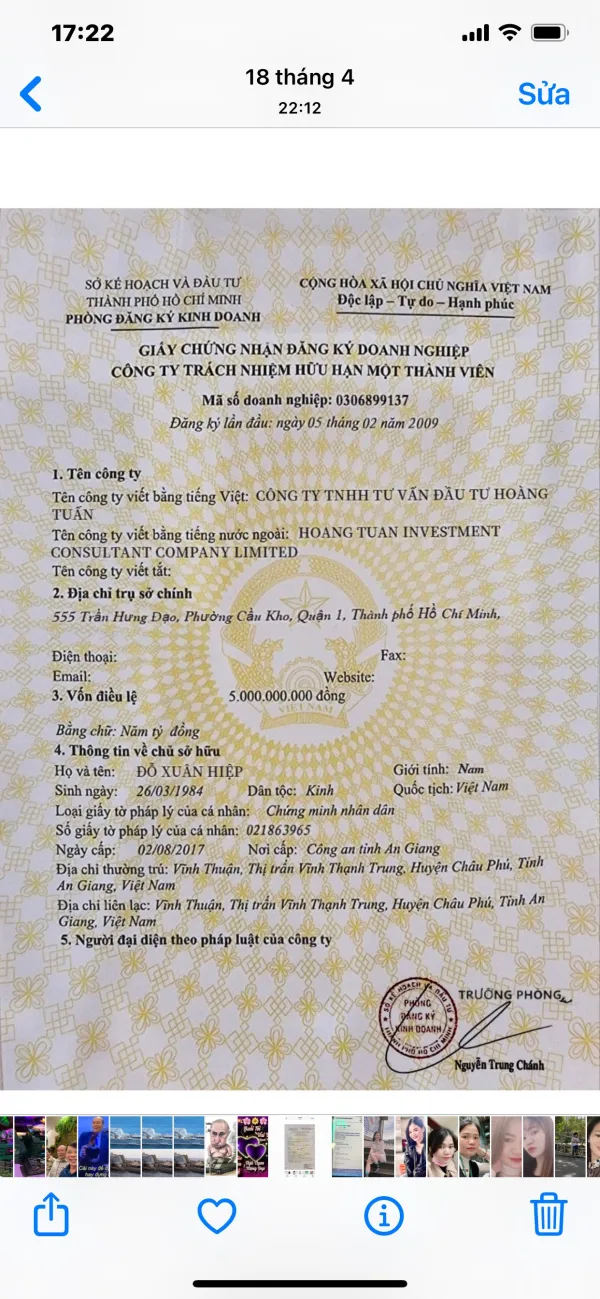

FX2392855517

越南

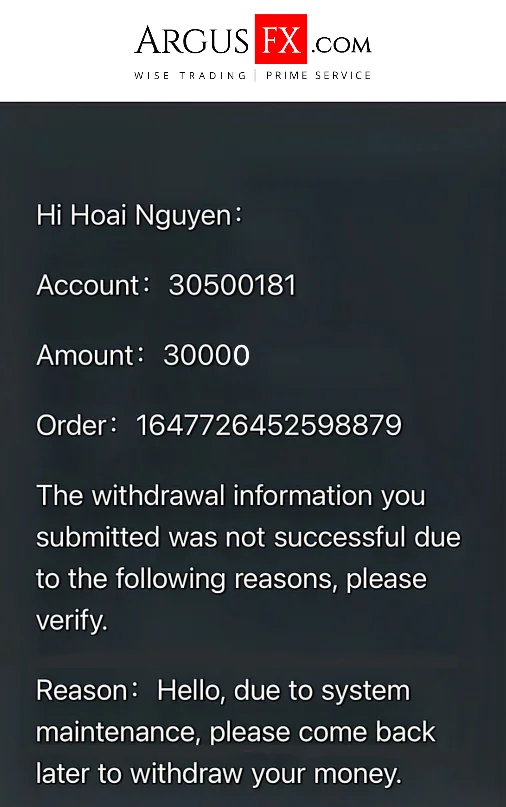

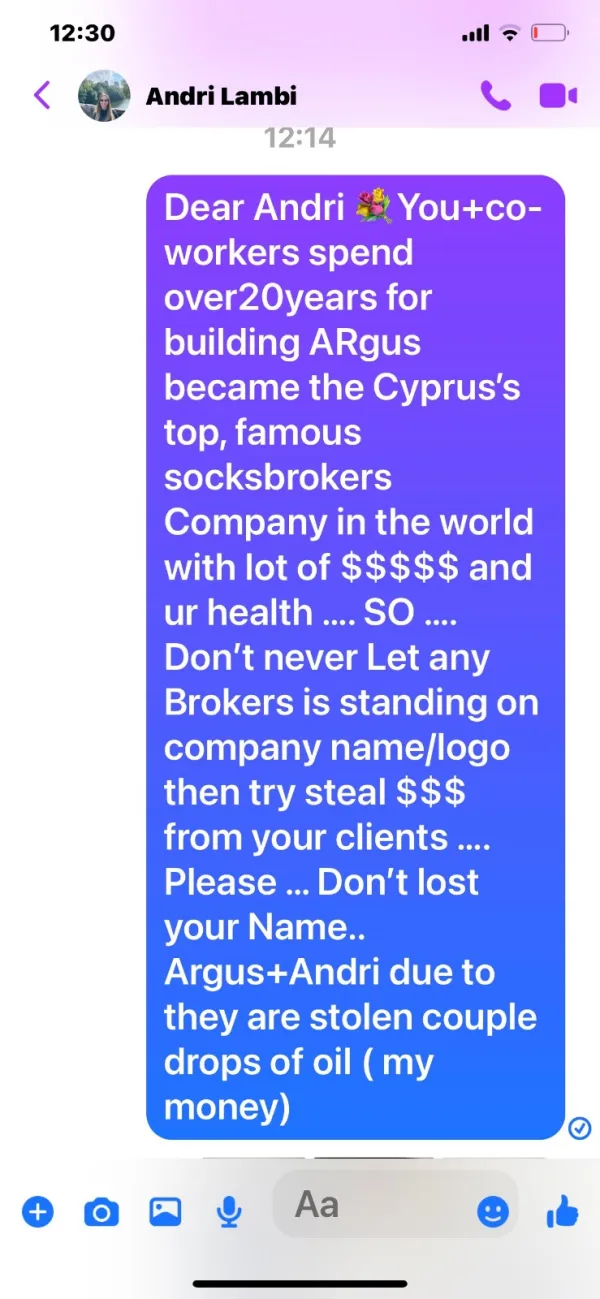

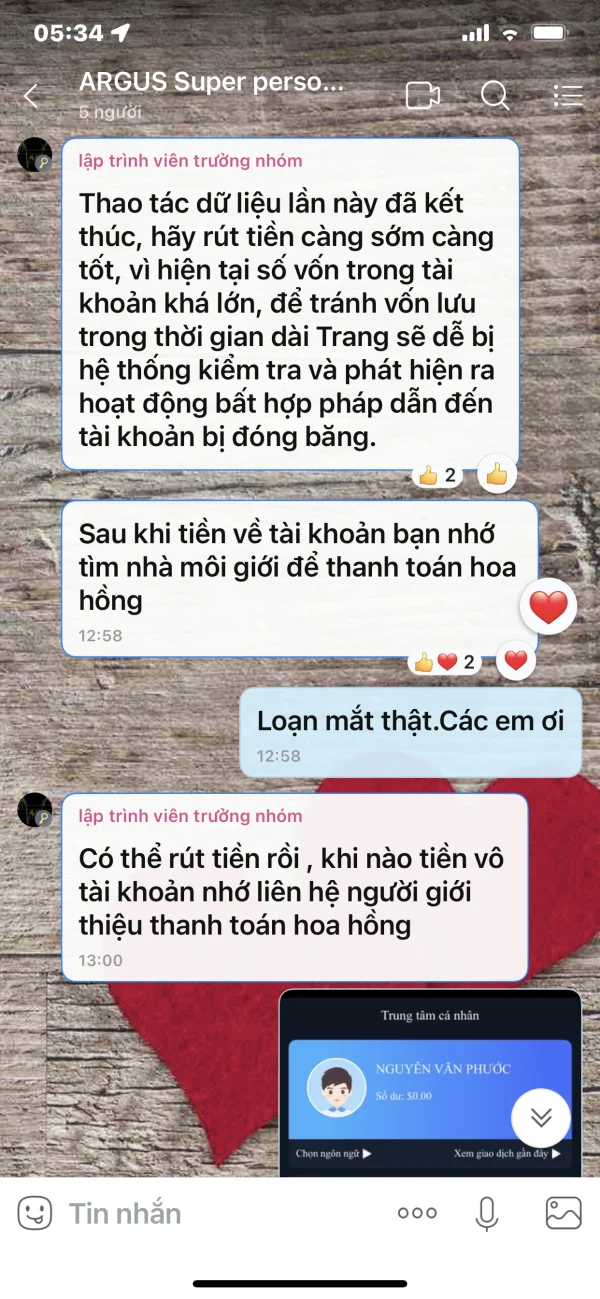

今天是 2022 年 5 月 27 日……董事會不是瞎子,也不是聾子……[再過兩周 5 月 19 日****又一個月]等待我的錢回來,傷心……2022 年 5 月 5 日戰爭最糟糕的。我不逼你..親愛的 ARGUS公司 ..今天是 2022 年 4 月 4 日 .. 戰爭可能讓你真的很忙 .. 但我必須提醒你盡量盡快償還我所有的錢,就像你推我押金一樣,謝謝............祝你好運 ARGUS股票交易商(andri tringidou 和 christos akkelides)和bd dạ thảo phương .. 為塞浦路斯人民感到驕傲 .. 變得更強大 ..april20.2022 今天是 april21st-2022 .... (christoforos antoniades -executor 在哪里)?? ??誰來回答我所有的這些問題...... ARGUS股票經紀人有限公司帳戶...請不要讓我的提問消失...我在等待ARGUS董事會的回答…… ARGUS詐騙后仍然沒有回到……所以我認為他們試圖搶劫/偷走我所有的錢

爆料

FX3071480497

美國

我是該詐騙的受害者之一,被引誘投資于ARGUS,被一個臺灣女人欺騙了,并指導我完成了交易和投資的過程。正是在此期間,我發現了fintrack.org并提出了投訴,因為ARGUS不允許提款,他們在幾周內恢復了我的提款權限

爆料

Misshomeland22

越南

ARGUS不在網站上回復/回答我所有的報告和索賠 ARGUS股票經紀公司

爆料

FX1465373339

越南

要求公司退款

爆料

FX2392855517

越南

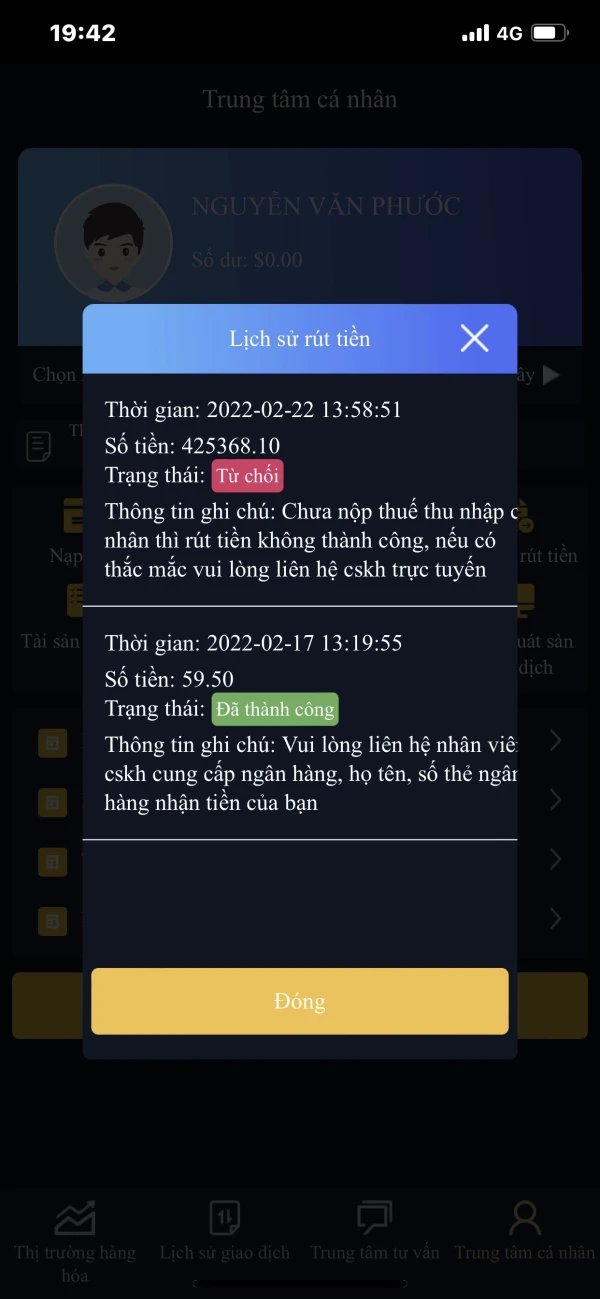

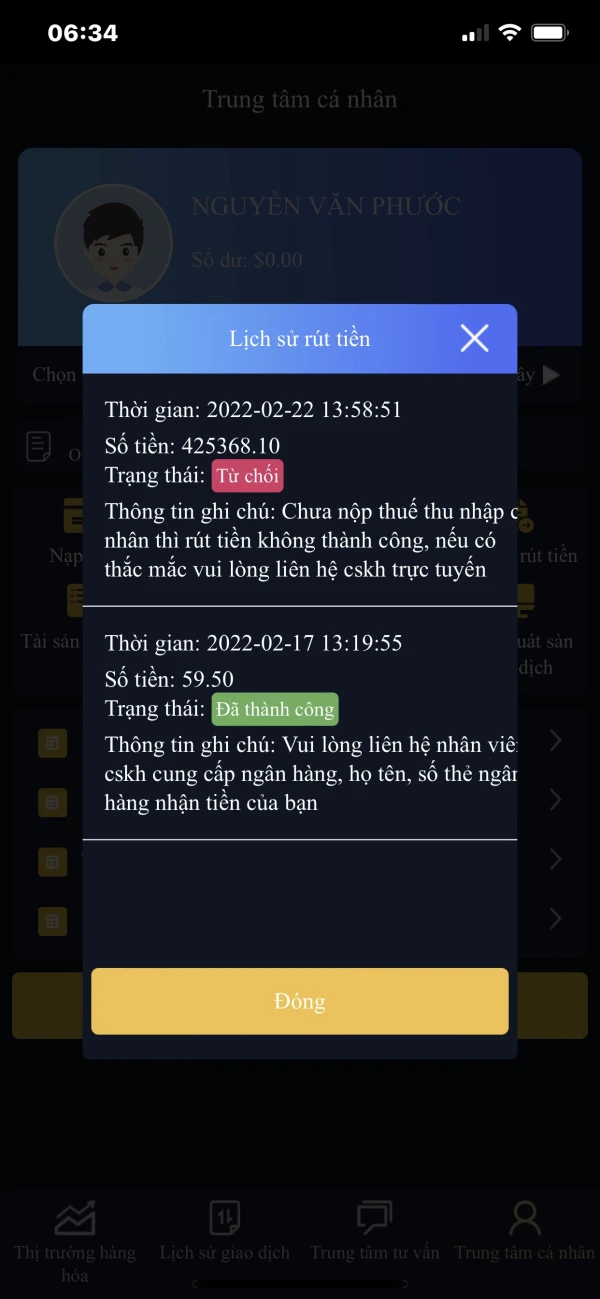

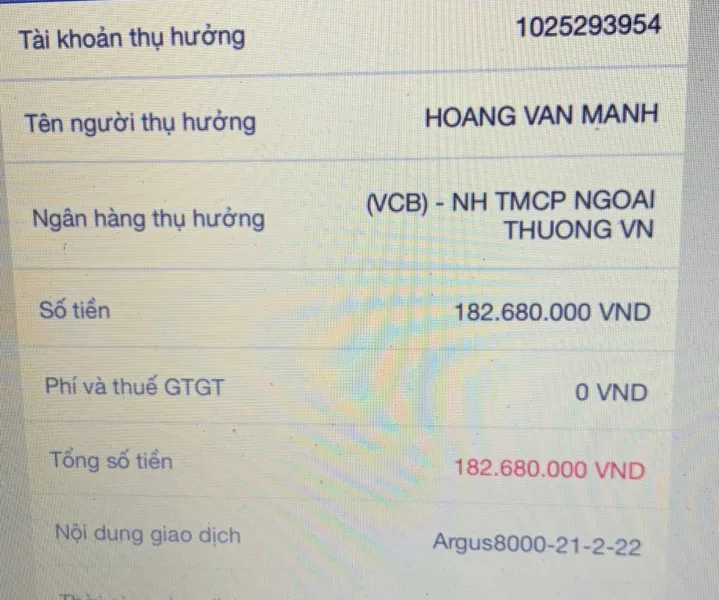

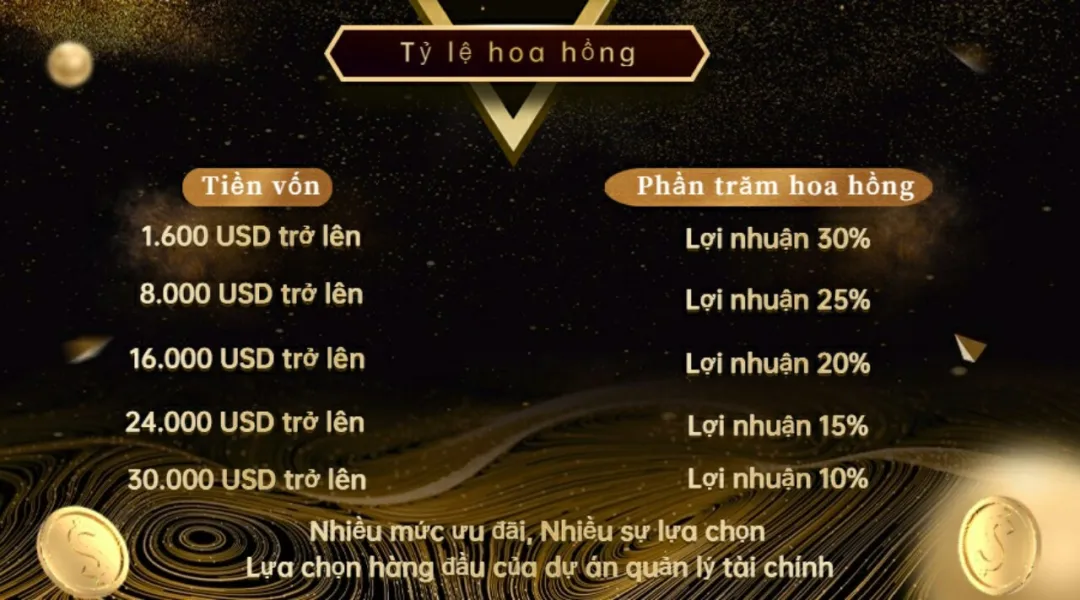

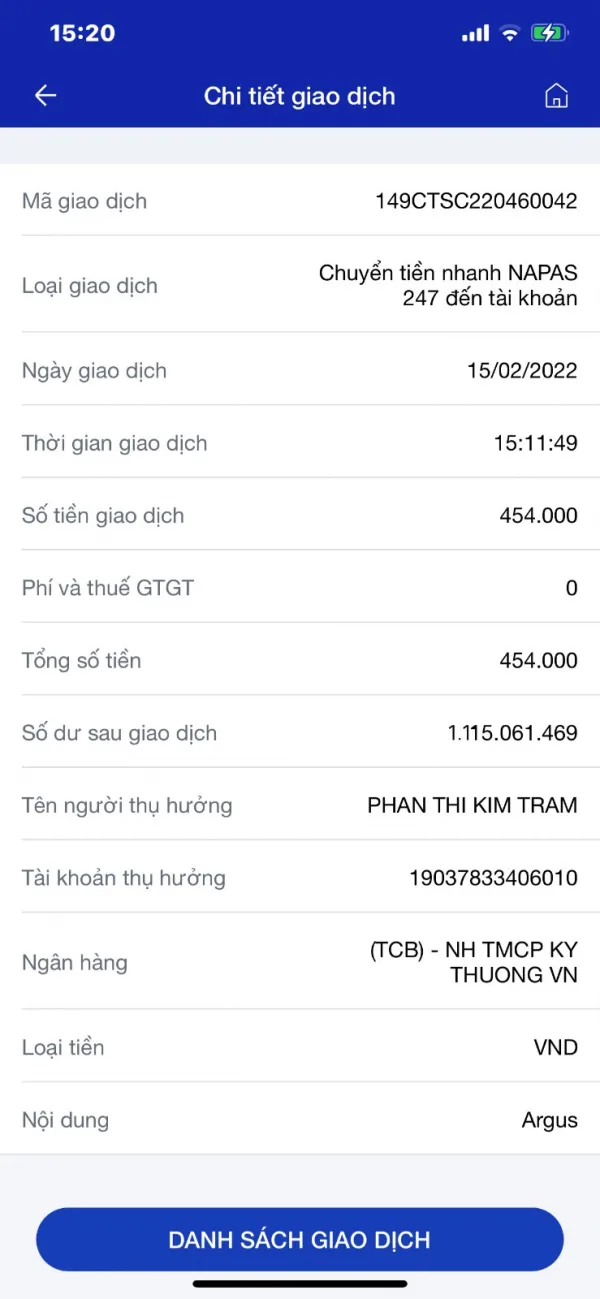

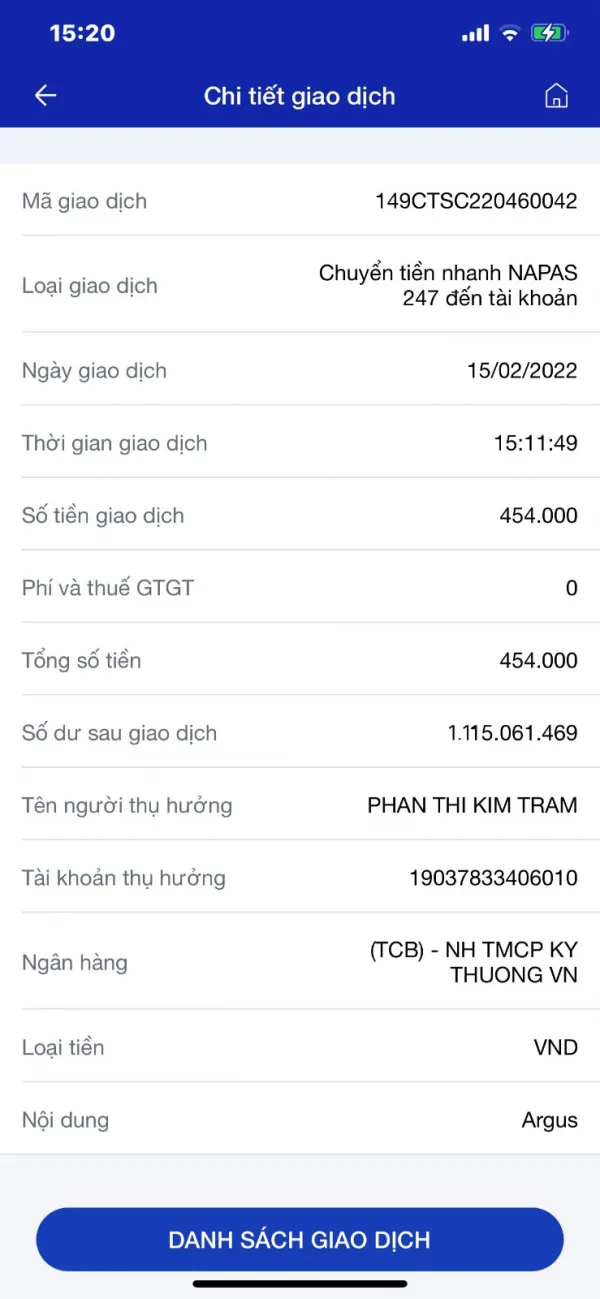

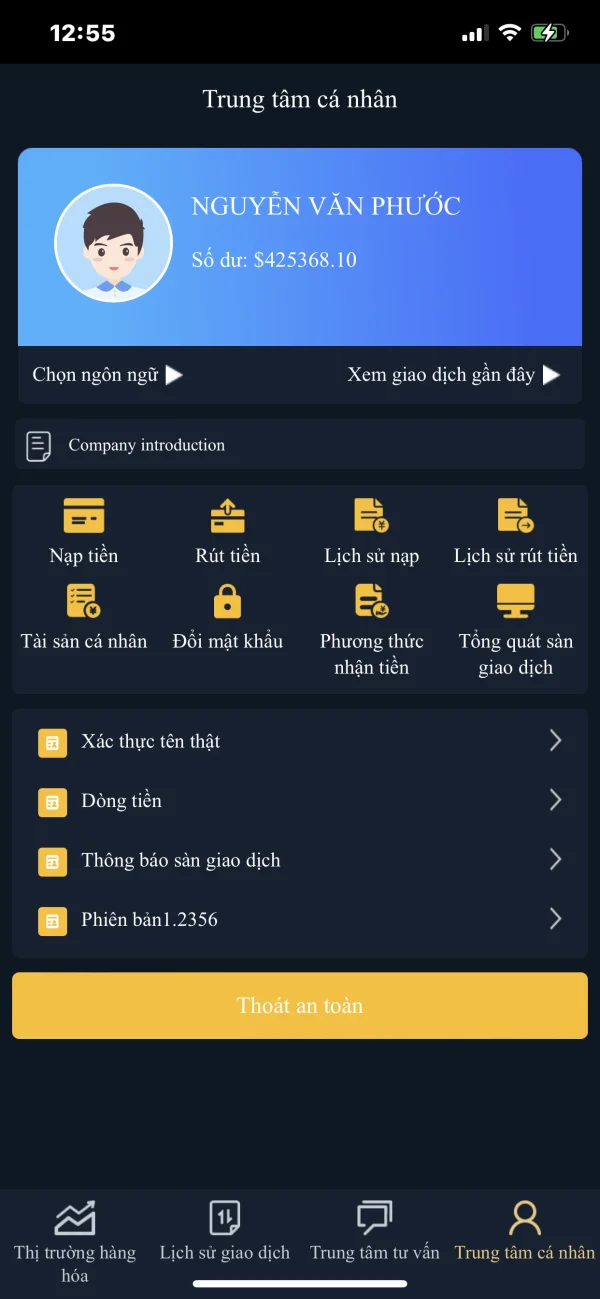

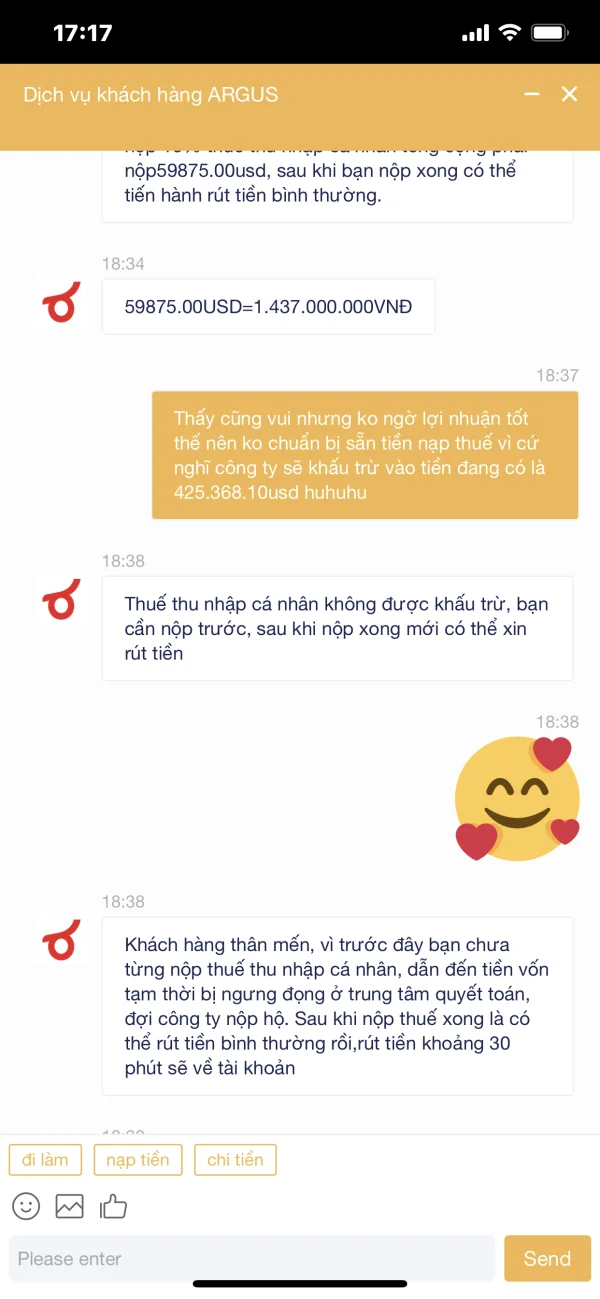

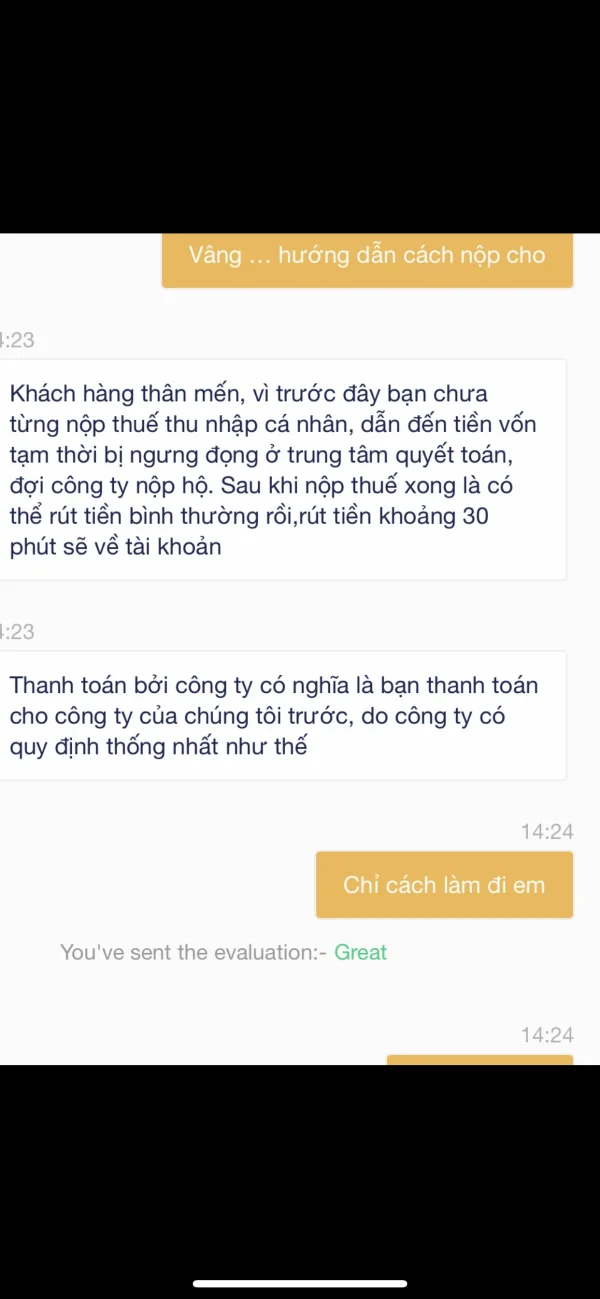

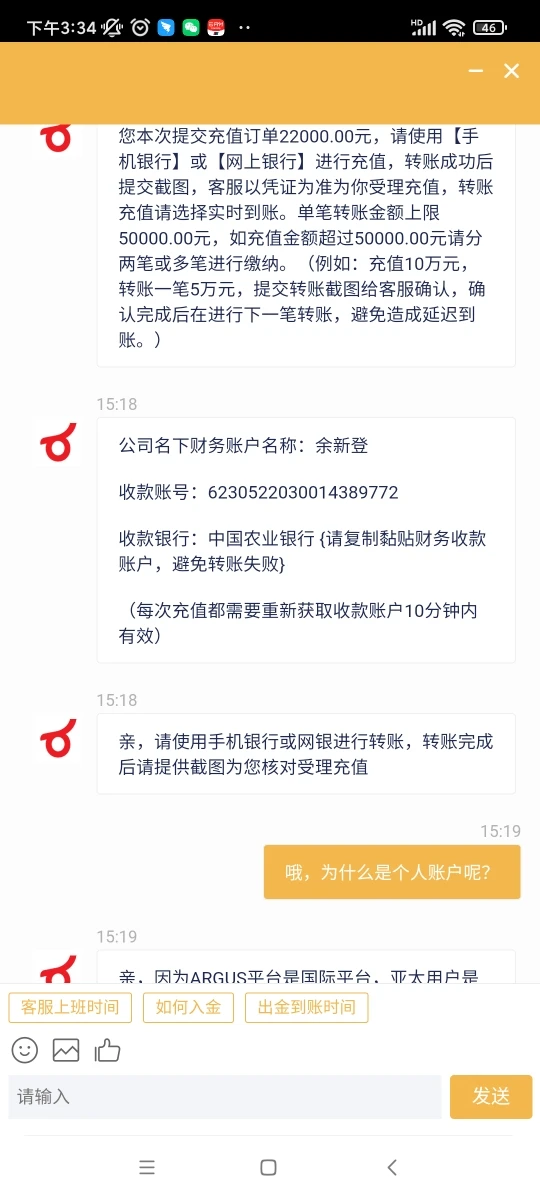

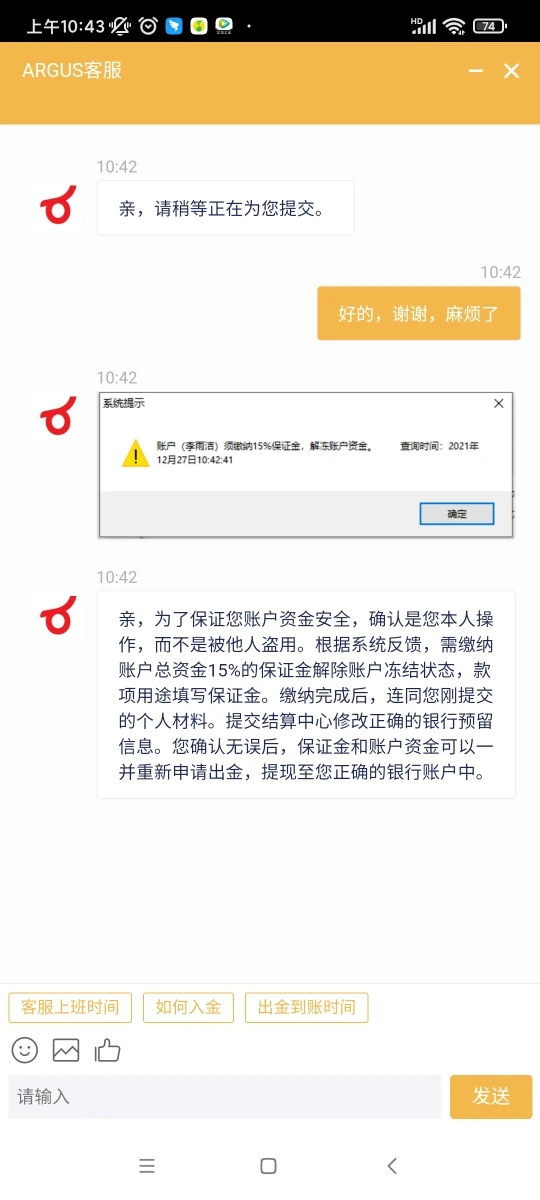

應經紀人的邀請 ARGUS公司我借了 32,000 美元來投資交易所 ARGUS.. 幸運的是,我有 399.168.10 美元的利潤加上資本是 425,368.10 美元的錯誤,並且在遵循提款指令後將凍結帳戶(??),htnt 報告拒絕,因為 15% 的個人所得稅尚未支付(???? ) 經紀系統 nt 將 15% 稅金 59,875.00 美元等值 10 億 437,000,000 美元存入經紀商的個人賬戶或私人公司賬戶之前奇怪... ARGUS著名的股票公司不這樣做...現在我抱怨..請求 ARGUS公司干預或直接退還我賬戶裡的所有錢

爆料

上善若水86692

香港

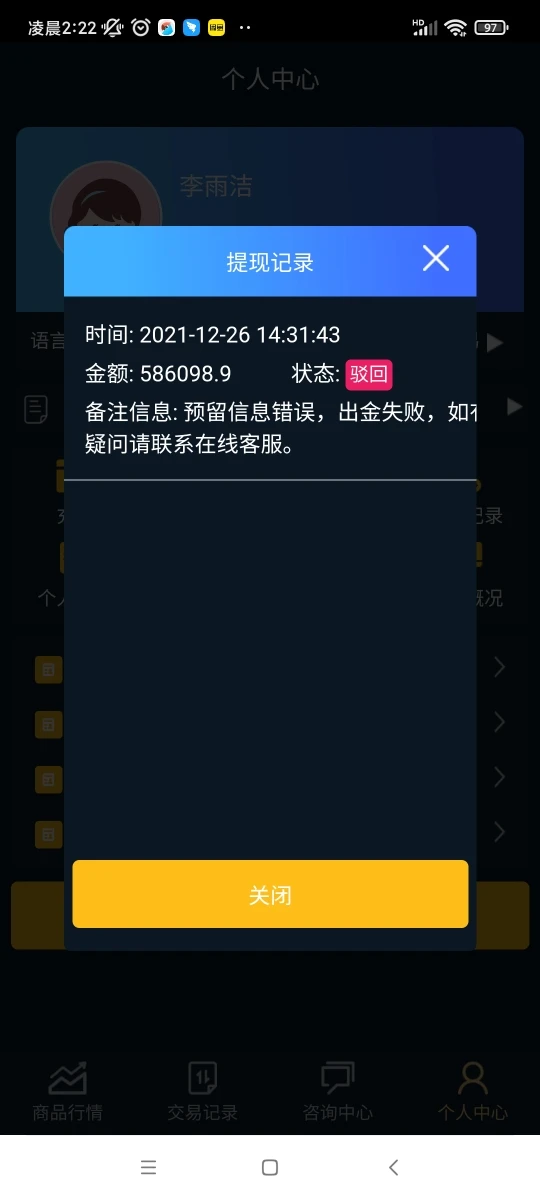

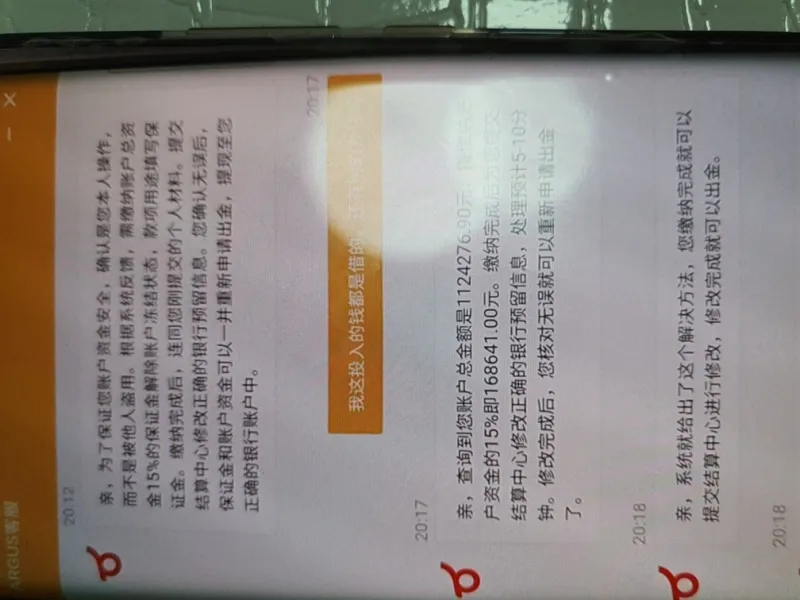

黑平台,杀猪盘,篡改客户信息,改变提现卡号,核对三遍没问题的卡号,提现时更改,然后继续让你交保证金,冻结资金,不让出金,圈套

爆料

FX2268019297

香港

卡号错了要15%保证金,要不给出金,还锁定了帐户

爆料

FX2268019297

香港

因银行卡号错了不予出金,让交15%保证金

爆料