公司簡介

| OTTMarkets評論摘要 | |

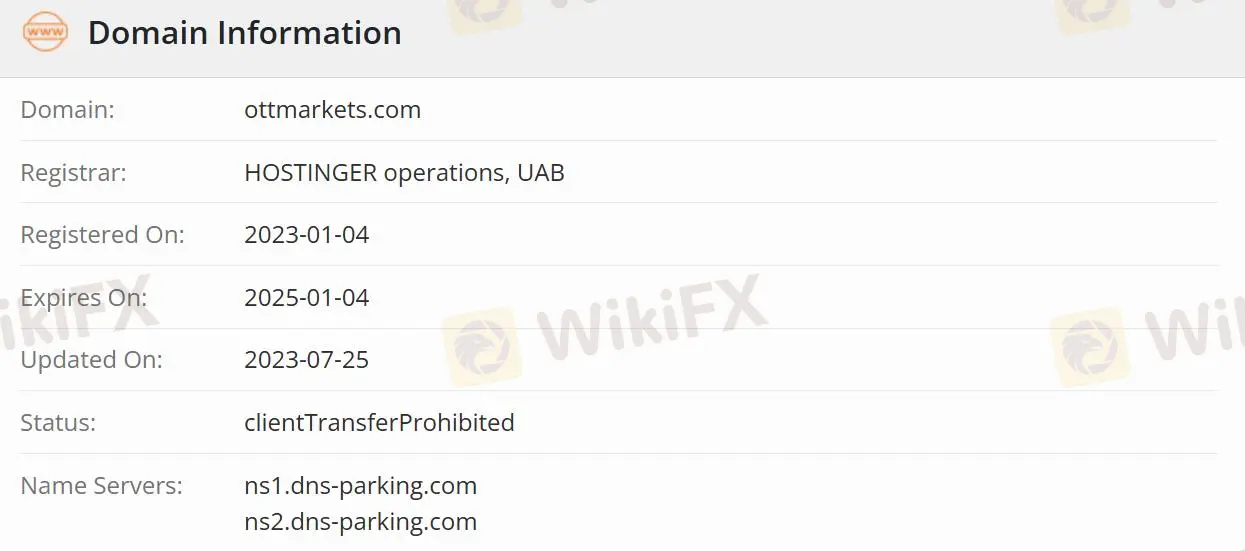

| 成立日期 | 2023-01-04 |

| 註冊國家/地區 | 中國 |

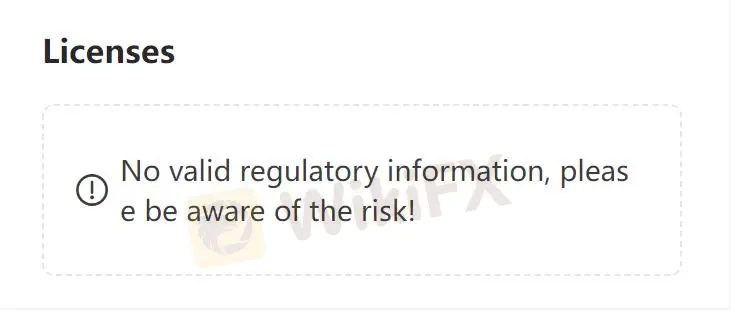

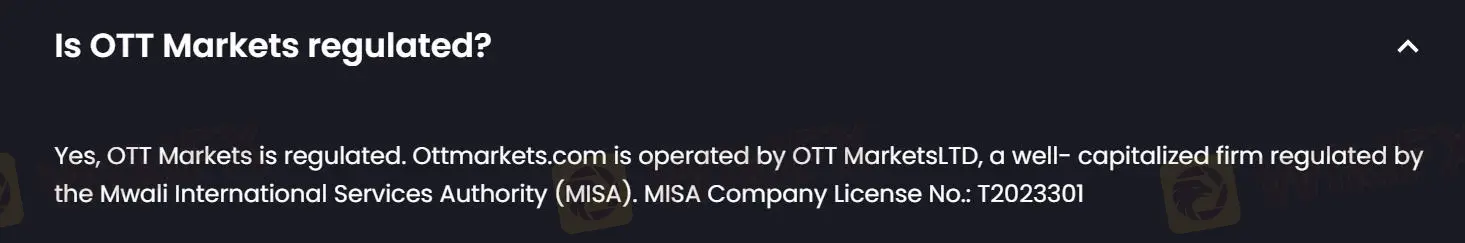

| 監管 | 未受監管 |

| 市場工具 | 外匯/指數/ETF/現貨金屬/能源/股票/加密貨幣 |

| 模擬帳戶 | ✅ |

| 槓桿 | 最高1:100 |

| 點差 | 從0開始 |

| 交易平台 | OTT Markets cTrader(手機/桌面/網頁) |

| 最低存款 | $100 |

| 客戶支援 | 未提及 |

OTTMarkets 資訊

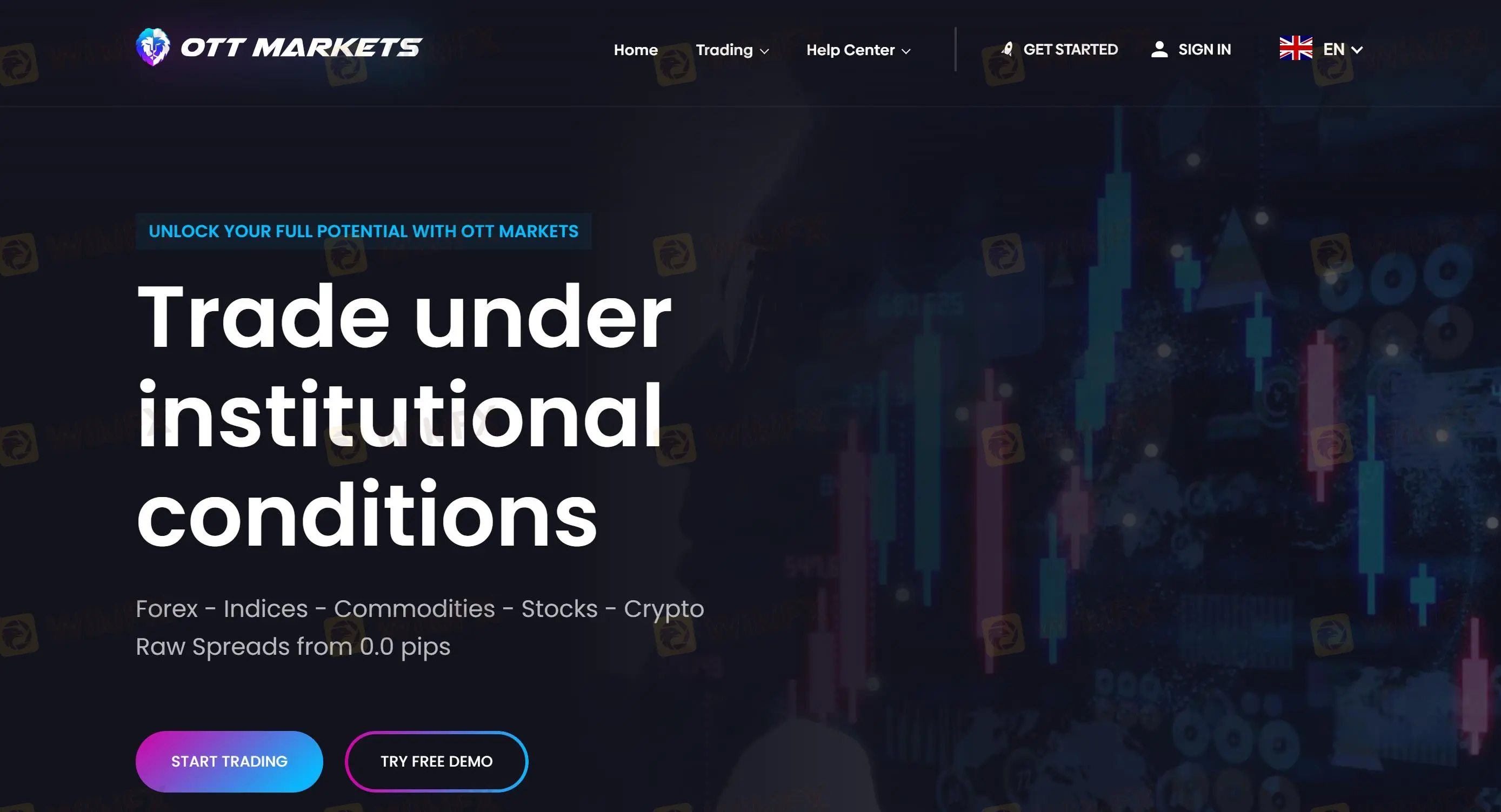

OTTMarkets 是一家經紀商,提供三種帳戶類型,最高槓桿為1:100。可交易的工具包括外匯、指數、ETF、現貨金屬、能源、股票和加密貨幣。最低點差為0點,最低存款為$100。由於OTTMarkets的監管狀態未明、高槓桿以及有關聯絡方式、付款方式等資訊不完整,仍然存在風險。

優點與缺點

| 優點 | 缺點 |

| 最高槓桿達1:100 | 未受監管 |

| 點差最低為0點 | 聯絡方式缺失 |

| 提供模擬帳戶 | 無付款方式 |

| 提供教育資源 |

OTTMarkets 是否合法?

OTTMarkets 未受監管,相比受監管的經紀商,風險較高。

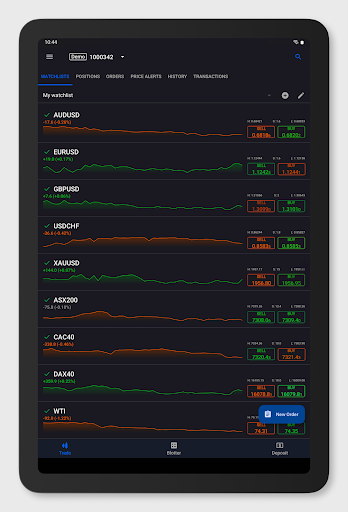

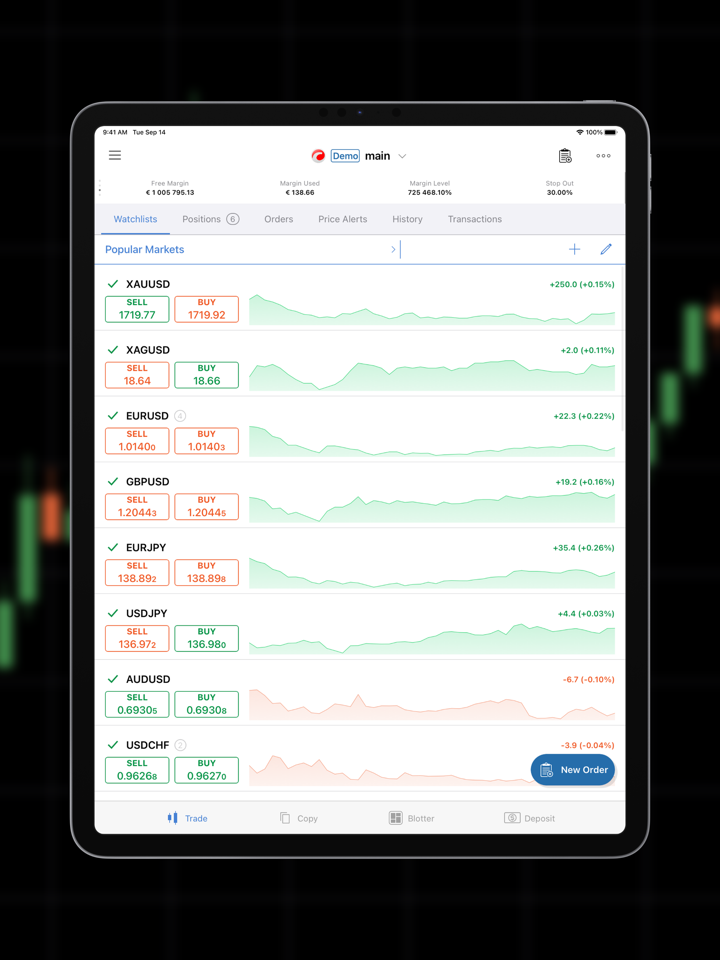

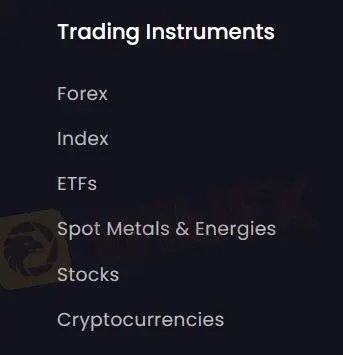

我可以在OTTMarkets上交易什麼?

交易者可以選擇不同的投資方向,因為該經紀商提供外匯、指數、ETF、現貨金屬、能源、股票和加密貨幣。

| 可交易工具 | 支援 |

| 外匯 | ✔ |

| 指數 | ✔ |

| ETF | ✔ |

| 現貨金屬 | ✔ |

| 貴金屬 | ✔ |

| 能源 | ✔ |

| 股票 | ✔ |

| 加密貨幣 | ✔ |

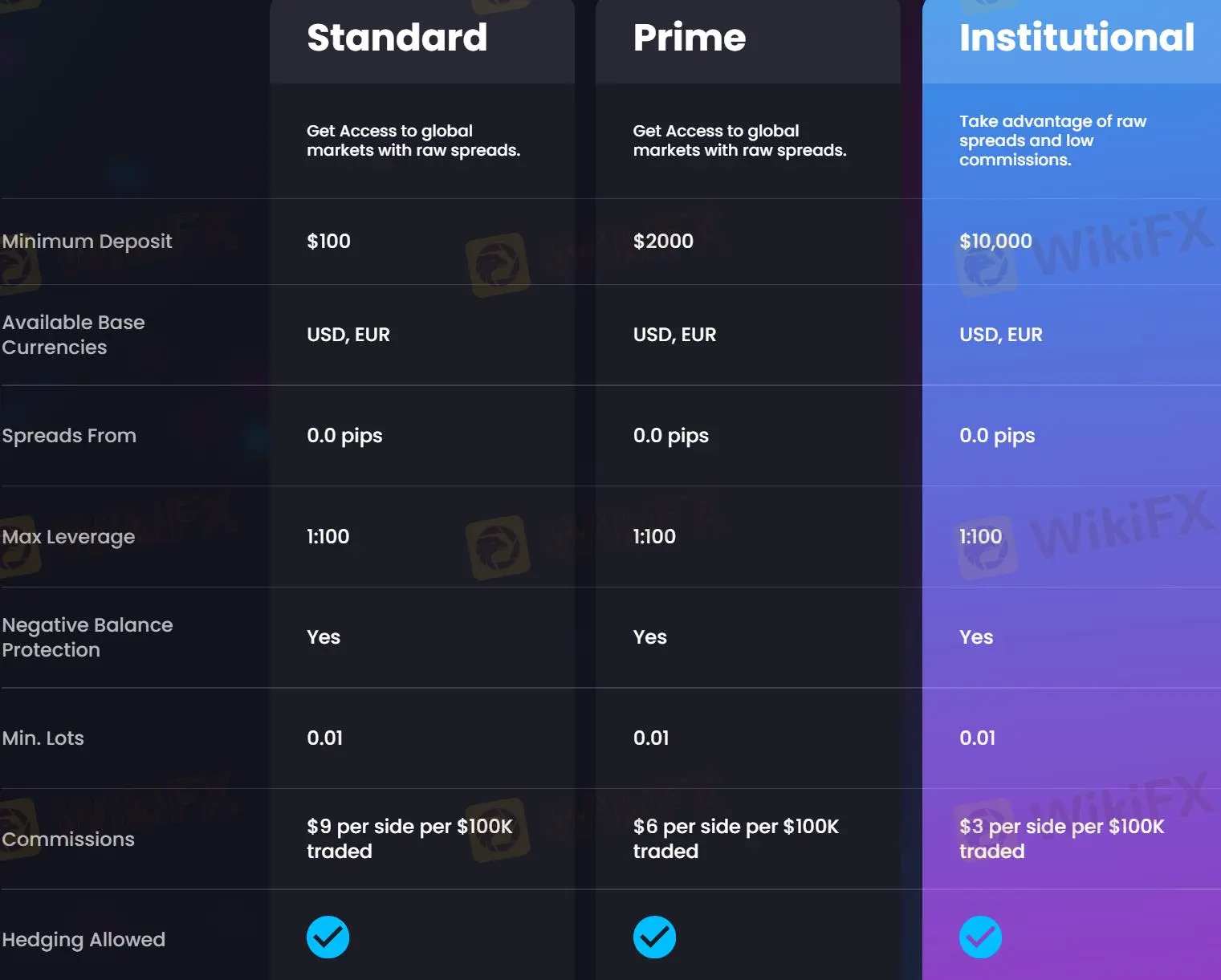

帳戶類型

OTTMarkets有三種帳戶類型:標準、Prime和機構。想要低佣金的交易者可以選擇機構帳戶,而偏好低存款的交易者可以開設標準帳戶。

| 帳戶類型 | 標準 | Prime | 機構 |

| 最低存款 | $100 | $2000 | $10000 |

| 可用基本貨幣 | USD、EUR | USD、EUR | USD、EUR |

| 點差起始值 | 0.0點 | 0.0點 | 0.0點 |

| 最大槓桿 | 1:100 | 1:100 | 1:100 |

| 負債平衡保護 | 是 | 是 | 是 |

| 最小交易手數 | 0.01 | 0.01 | 0.01 |

| 佣金 | 每100K交易的每邊收取$9 | 每100K交易的每邊收取$6 | 每100K交易的每邊收取$3 |

| 允許對沖 | 是 | 是 | 是 |

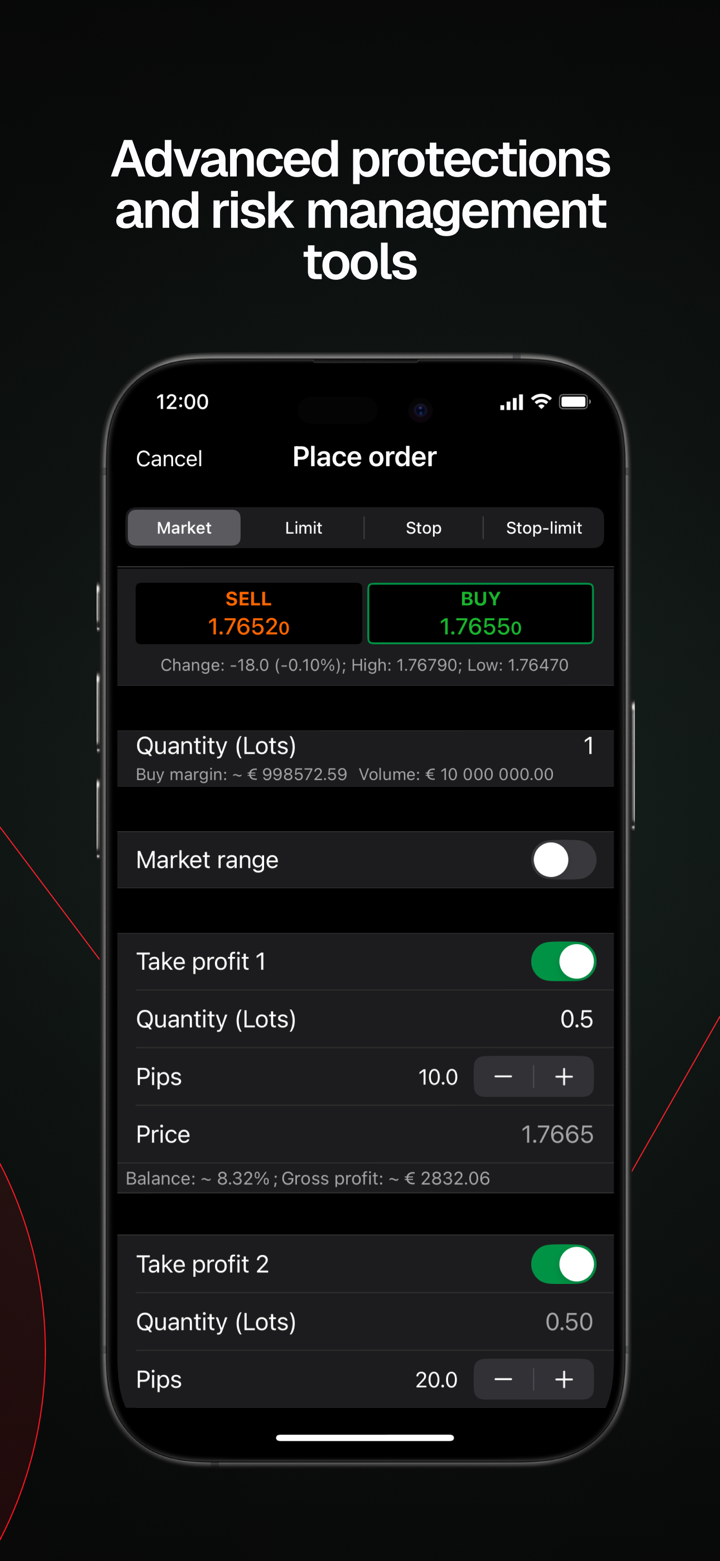

OTTMarkets費用

點差低至0點,佣金從$3起。

槓桿

最大槓桿為1:100,意味著利潤和損失放大100倍。

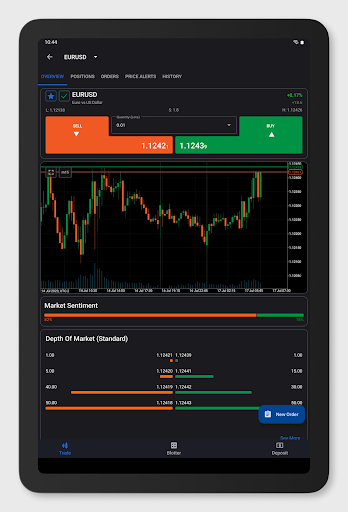

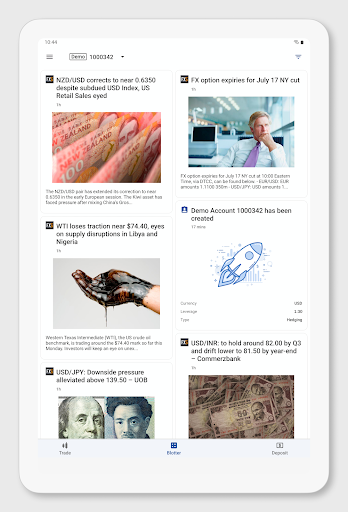

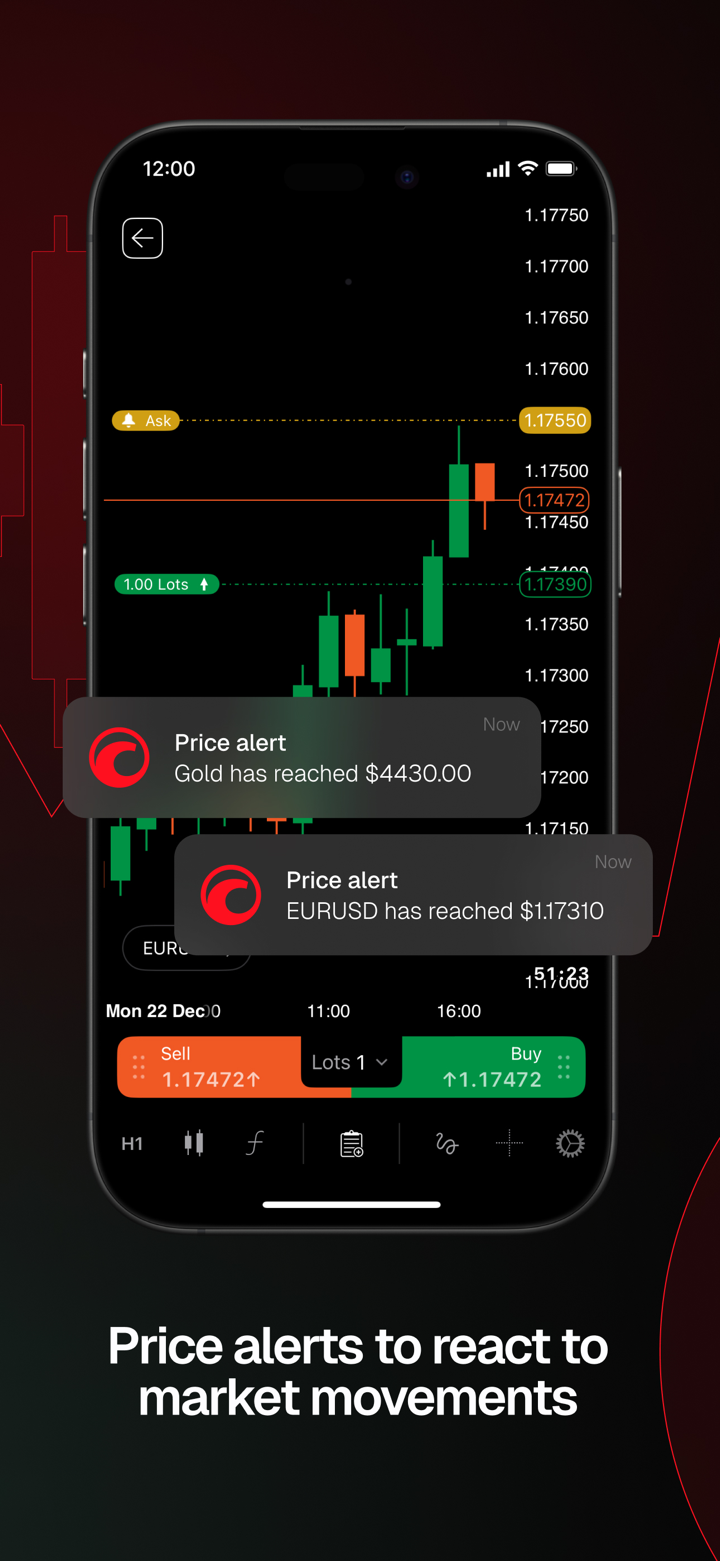

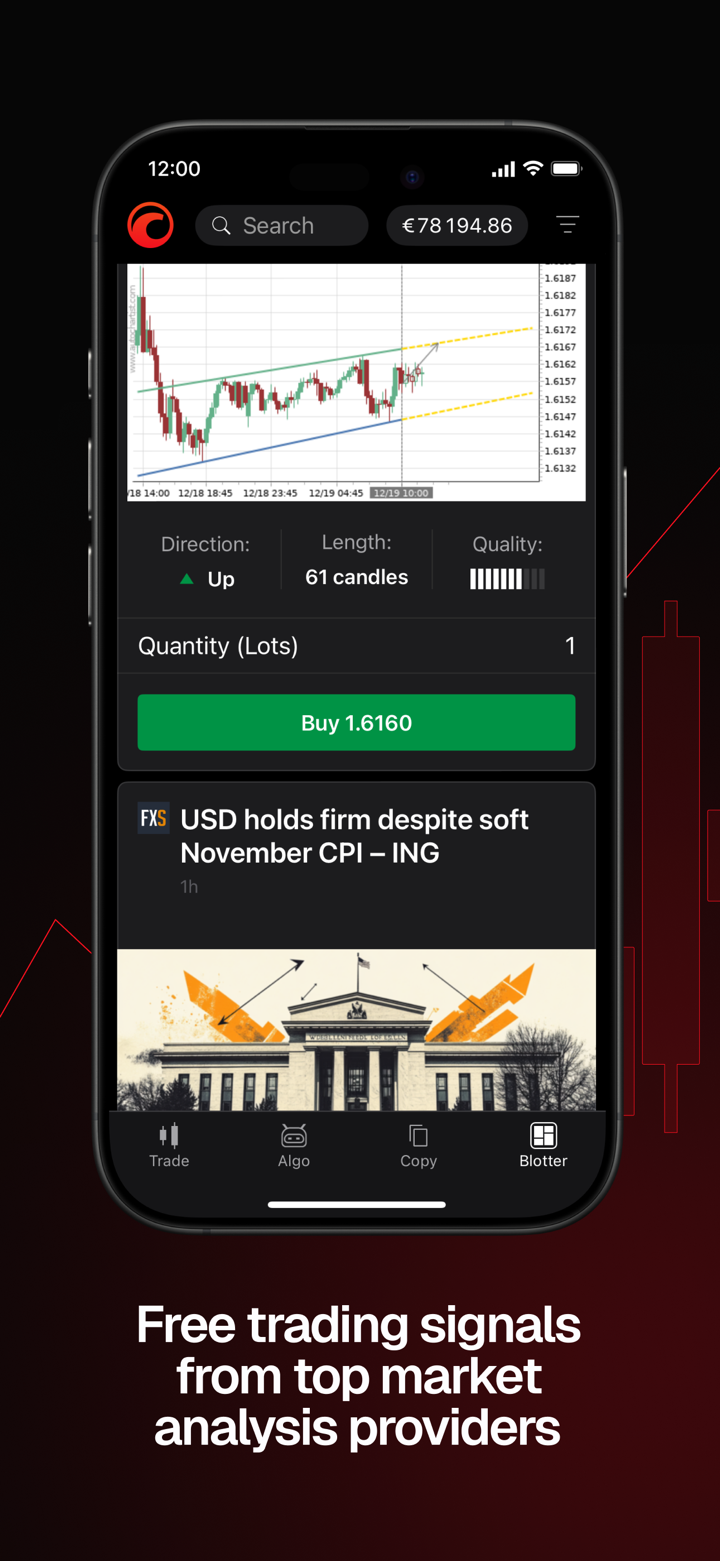

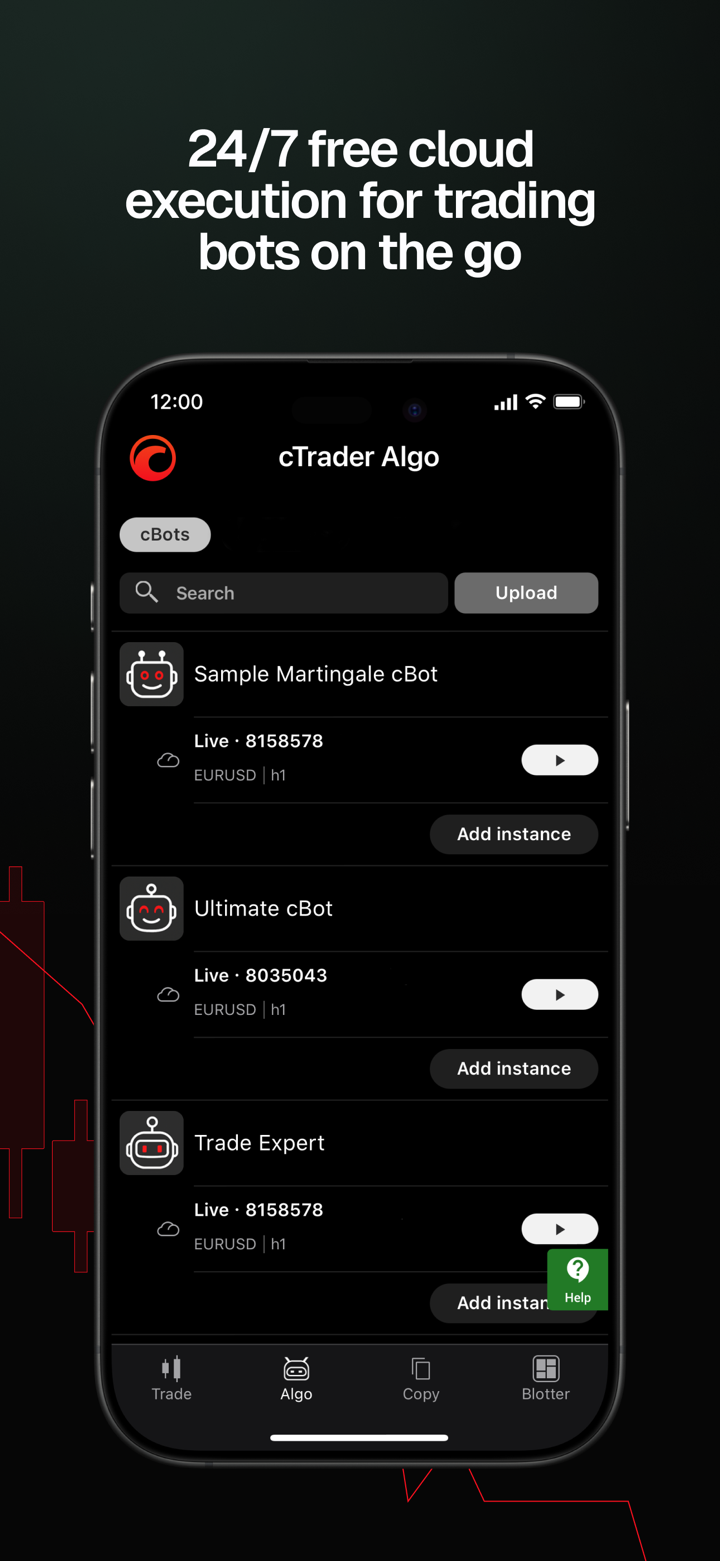

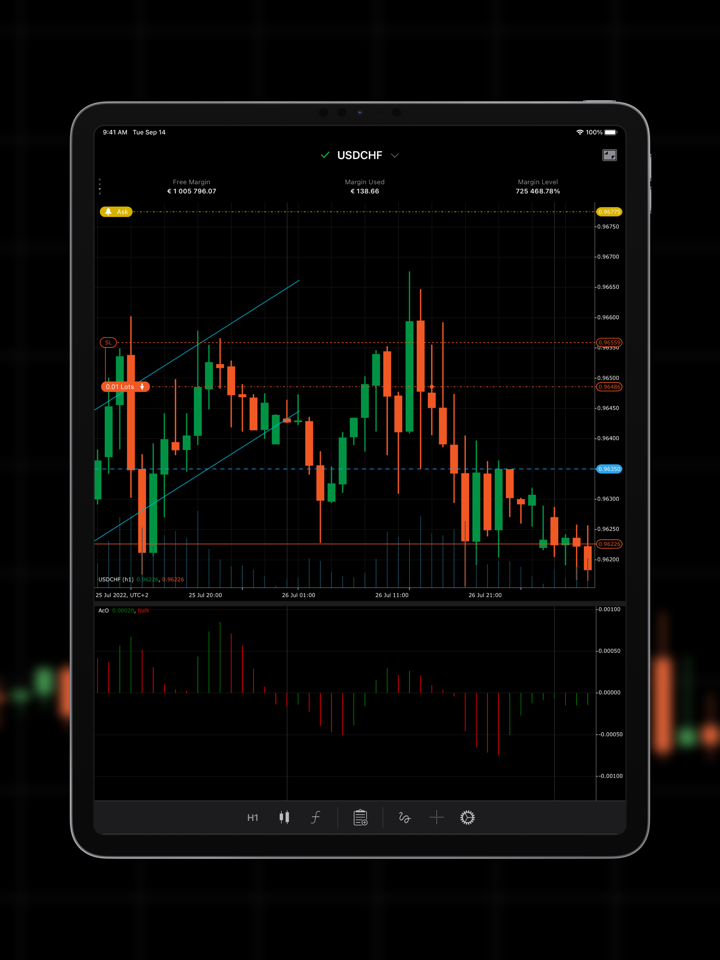

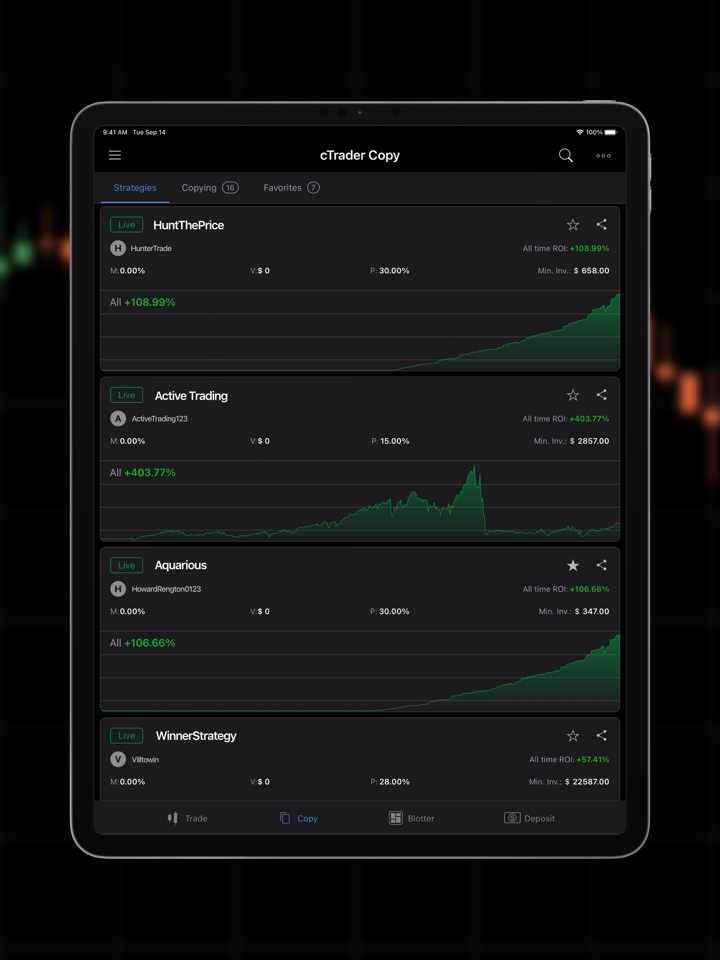

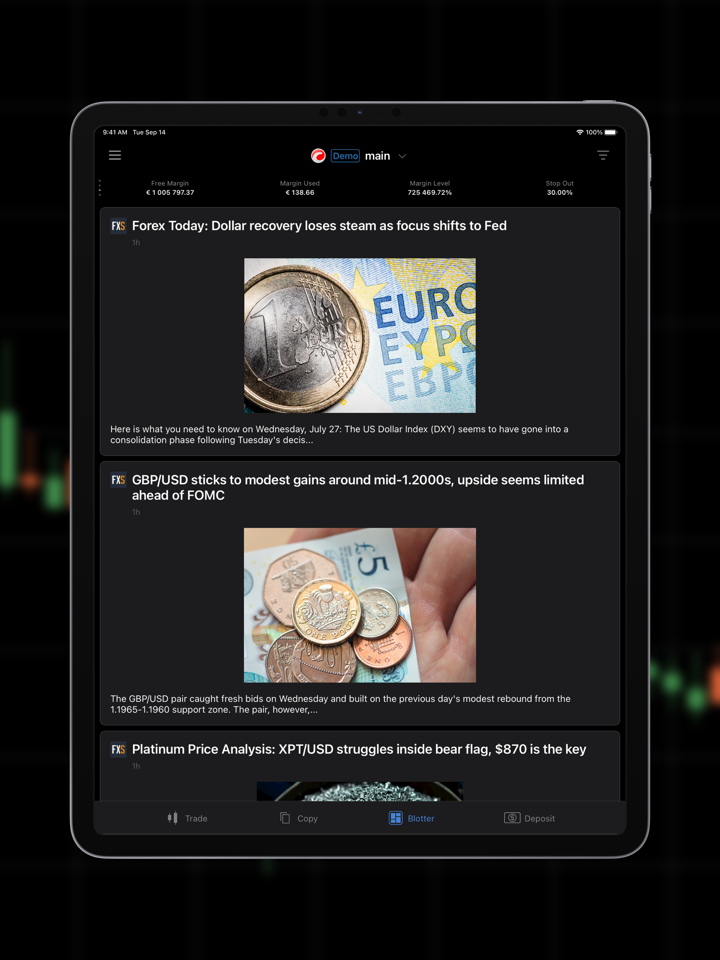

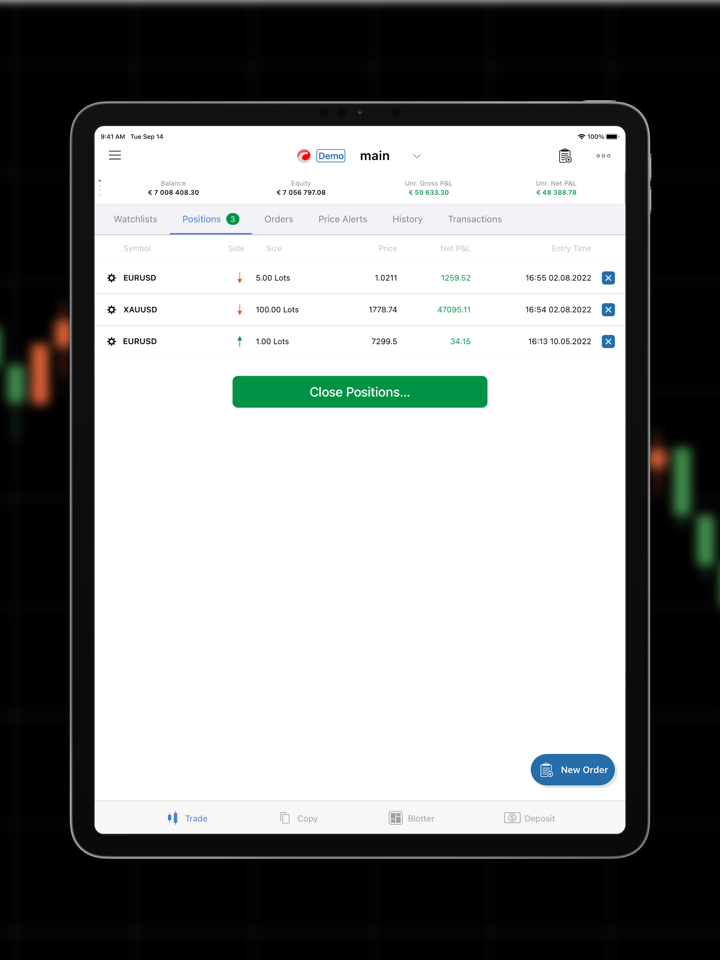

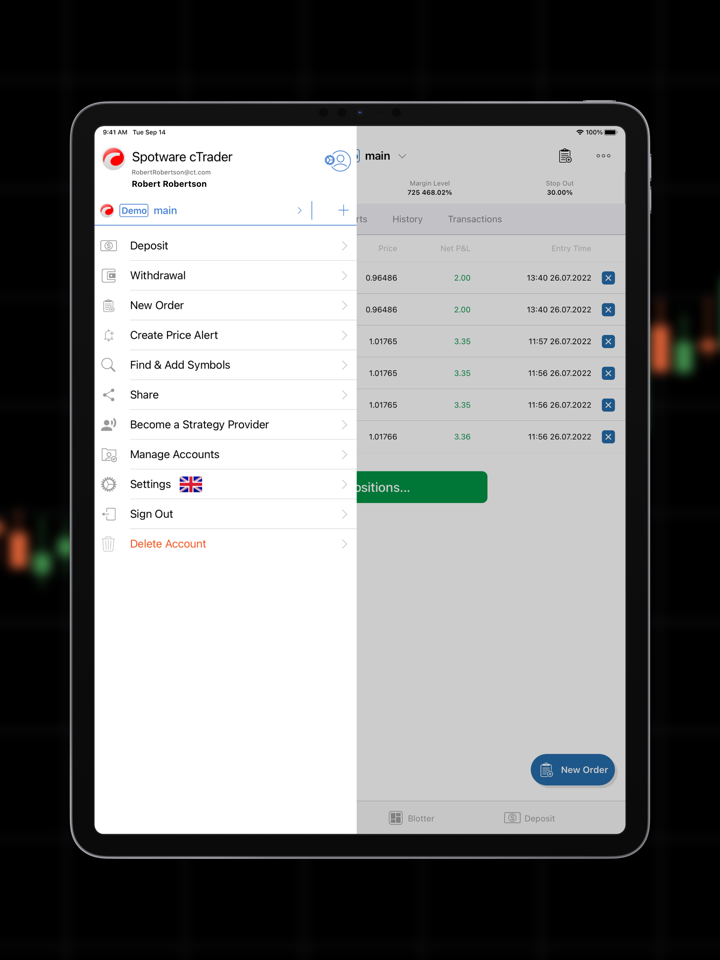

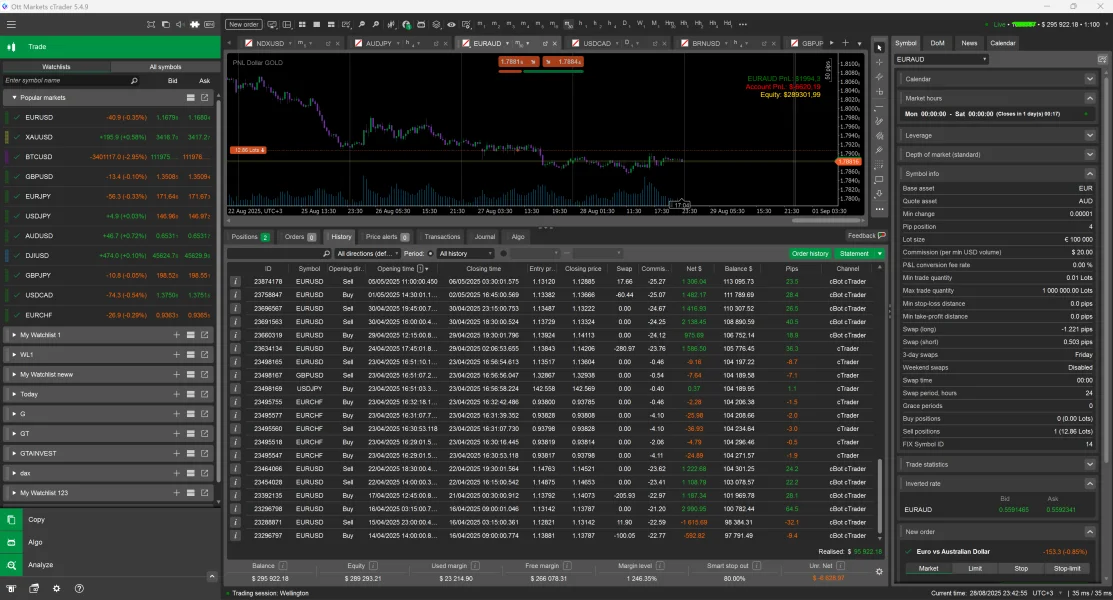

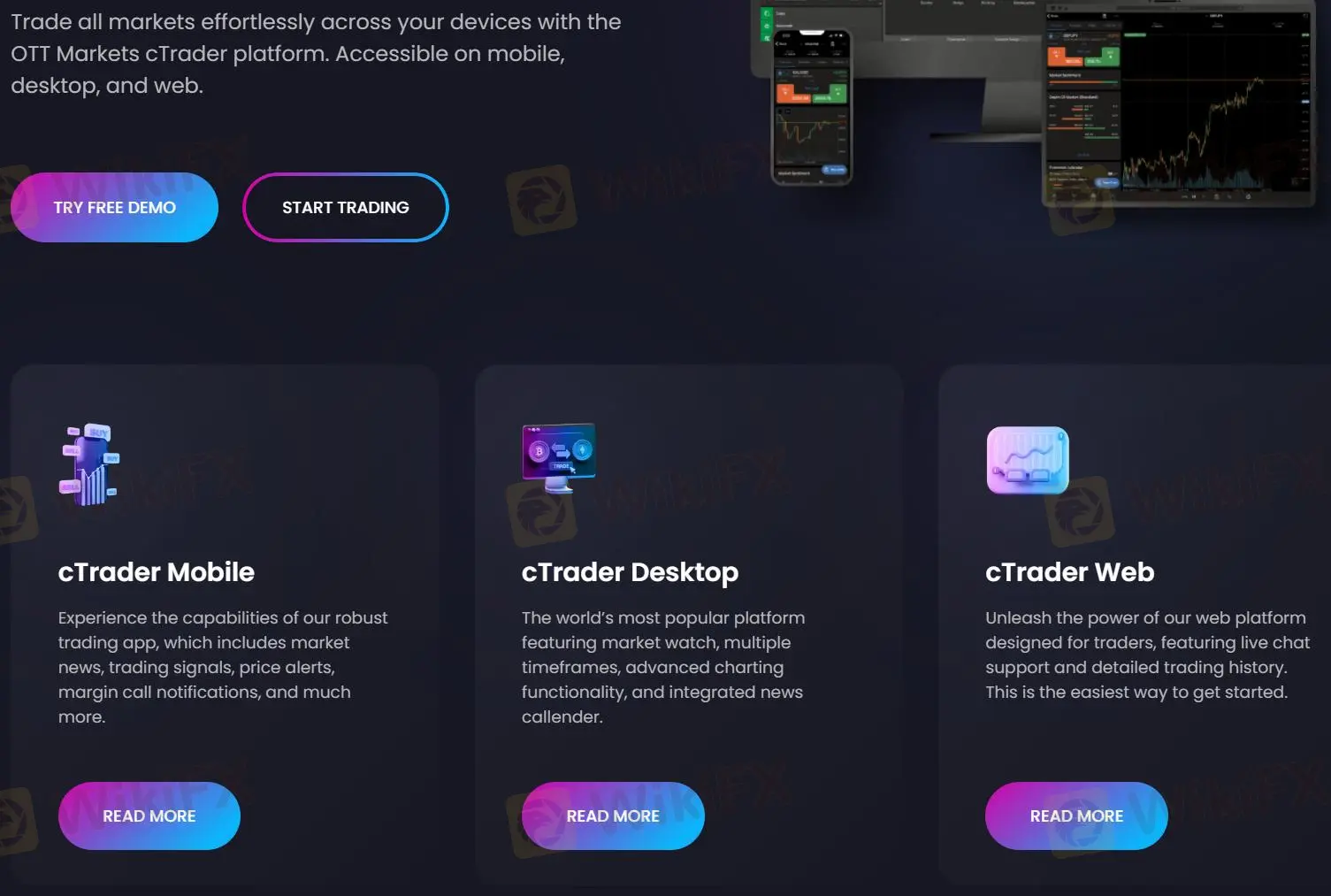

交易平台

OTTMarkets 提供了一個專有平台 - OTT Markets cTrader,可在移動設備、桌面和網頁上使用。

| 交易平台 | 支援 | 可用設備 |

| OTT Markets cTrader | ✔ | 移動設備/桌面/網頁 |

存款和提款

最低存款金額為$100。

客戶支援選項

OTTMarkets 提供24/7客戶支援。然而,交易者不知道如何聯繫這家經紀商。

| 聯繫選項 | 詳細資料 |

| 支援語言 | 英文 |

| 網站語言 | 英文 |

| 實體地址 | 未提及 |