公司簡介

| Bull Market 評論摘要 | |

| 成立年份 | 2000 |

| 註冊國家/地區 | 阿根廷 |

| 監管 | 無監管 |

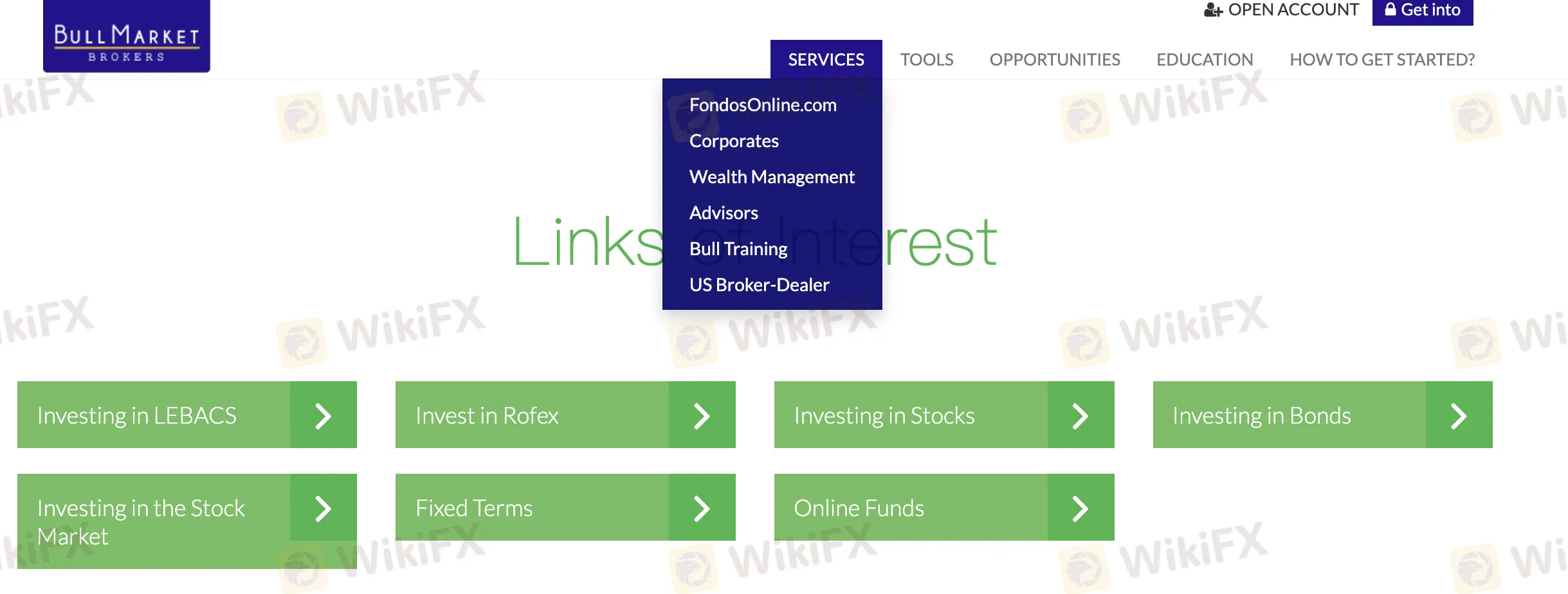

| 產品與服務 | 共同基金、企業解決方案、財富管理、諮詢服務 |

| 模擬帳戶 | ❌ |

| 交易平台 | Bull Market 在線平台 |

| 最低存款 | $10,000 ARS(FondosOnline 最低) |

| 客戶支援 | 在線聊天 |

Bull Market 資訊

Bull Market 是一家成立於2000年的阿根廷券商。它提供廣泛的投資產品,可提供本地和國際市場的進入。該公司非常注重技術和諮詢服務。它收取合理的費用,並擁有像是AI驅動平台等技術,但不必遵守阿根廷的CNV或主要國際機構設定的任何規則。

優缺點

| 優點 | 缺點 |

| 廣泛的阿根廷和美國投資產品 | 無監管 |

| 低費用(無帳戶維護費,免費本地轉帳) | 有限的國際產品訪問(例如,無外匯、加密貨幣) |

| 為投資者提供AI驅動的在線平台 | 無模擬帳戶 |

Bull Market 是否合法?

券商 Bull Market 沒有受到監管。儘管在阿根廷註冊,但它並未獲得阿根廷的Comisión Nacional de Valores(CNV)或任何主要國際金融機構如英國的FCA、澳大利亞的ASIC或塞浦路斯的CySEC的許可或監管。

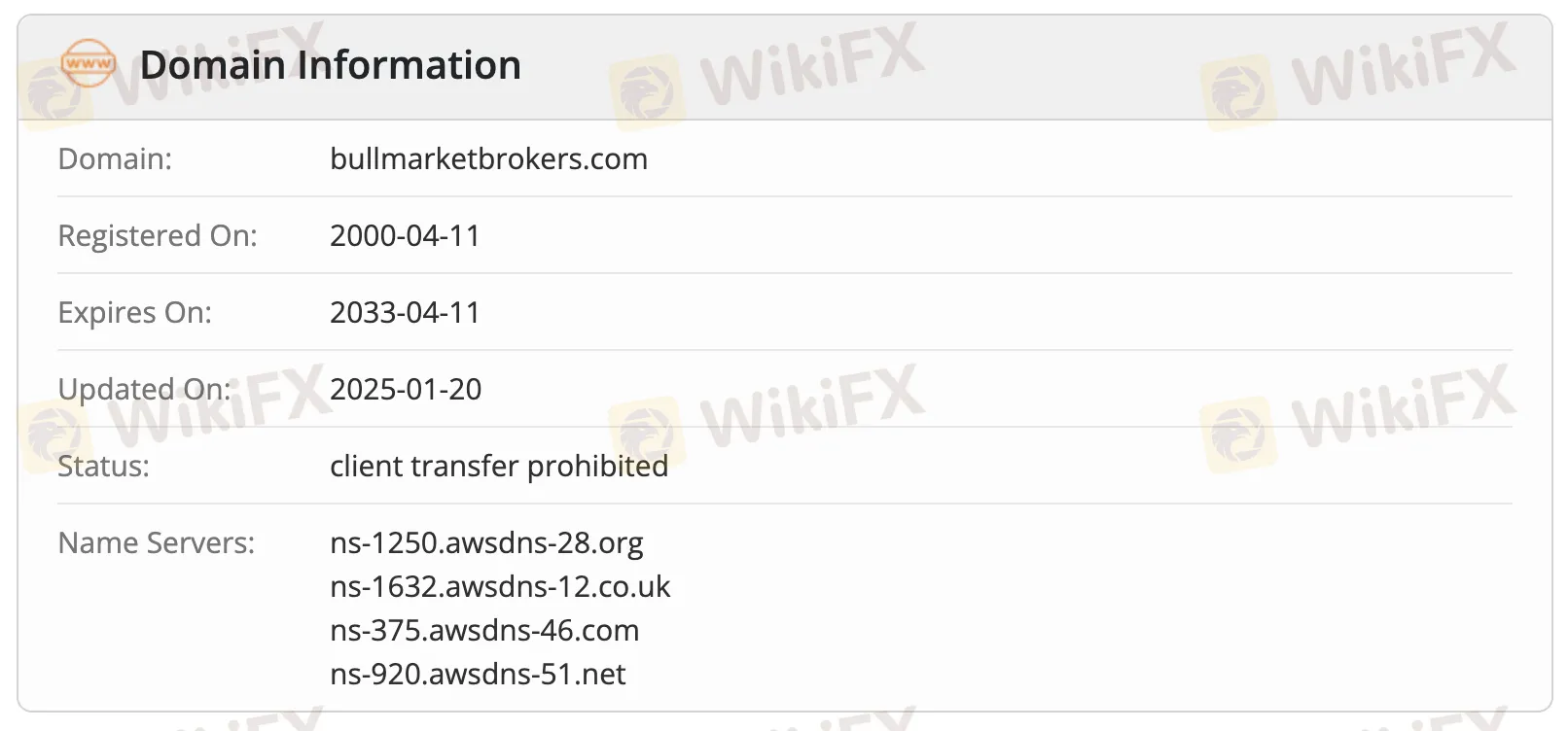

WHOIS 域名數據顯示 bullmarketbrokers.com 於2000年4月11日註冊,將於2033年4月11日到期。最後更新日期為2025年1月20日,並具有“客戶轉移禁止”狀態。

產品與服務

Bull Market 提供廣泛的投資和金融服務,涵蓋共同基金、企業解決方案、財富管理、諮詢服務和投資者教育。

| 類別 | 主要產品/服務 |

| FondosOnline.com | 100+ 共同基金,輕鬆線上訪問 |

| 企業 | MEP 美元交易,融資,對沖 |

| 財富管理 | 個性化諮詢,獨家報告 |

| 顧問 | 認證顧問,投資組合管理 |

| Bull 培訓 | 免費金融教育 |

| 美國經紀商 | 美國股票、債券、期權、ETF、ADR |

Bull Market 費用

Bull Market的費用相對於行業標準來說相對較低,特別是因為他們提供免費銀行轉帳並且不收取任何帳戶維護費。

| 費用類型 | 金額 |

| 銀行轉帳費 | 0 |

| 帳戶維護費 | 0 |

| 交易佣金 | 未提及 |

交易平台

| 交易平台 | 支援 | 可用設備 |

| Bull Market 在線平台(附帶AI工具) | ✔ | 網頁、桌面、手機 |

存款和提款

Bull Market不收取存款或提款費用。最低存款金額為$10,000 ARS(尤其適用於FondosOnline帳戶)。

| 付款選項 | 最低金額 | 費用 |

| 銀行轉帳(阿根廷) | $10,000 ARS | 0 |

| 平台上的線上轉帳 |

Nico Nava

阿根廷

它一直是一個便宜的經紀人,今天它是最便宜的經紀人之一。平台掉線,不時出現問題。他們時不時地發些狗屎,問題是在他們接手並為你修復之前,有一段時間商業注意力消失了,沒有電話,沒有電子郵件,只有他們的平台和響應可能性類似於那些你擁有的鵝卵石。如果他們發送狗屎,則沒有解決的最後期限。今天不可能推薦它,太可怕了。

爆料

Nimbus

阿根廷

很久以前我就和他們交易了。我從來沒有遇到過嚴重的問題。只是偶爾會有一些短暫的Byma系統故障。

中評

-小敏

尼日利亞

Bull Market 是一家非常棒的貿易公司!它們為技術分析、基礎分析和債券分析提供了很棒的工具。此外,他們的交易平台非常易於使用且運行良好。如果您是一位尋求可靠和優質服務的交易者,Bull Market 絕對值得一試。

好評

岁月你慢点

英國

太糟糕了,這家公司只有一個西班牙語網站。如果可以,希望這家公司能提供英文服務。

中評

佚柘

西班牙

雖然在我看來你們在拉美國家註冊的外匯經紀商不錯,但我更關心安全。

中評

FX1185154381

阿根廷

這家公司網站顯示的信息太籠統了,我沒興趣跟它做生意……我不想問客服,好像是浪費時間。

中評

张恭硕1413

哥倫比亞

Bull Market公司建議存款25,000美元,同時說開戶沒有最低投資額。。。搞不懂。如果這是最低金額,我會放棄,它太貴了。

中評