公司简介

| 注册国家/地区 | 英国 |

| 规定 | 菲亚特汽车公司 |

| 成立时间 | 2005年 |

| 产品与服务 | 商品、金融期货、期权和外汇、做市商、执行和清算、对冲和投资解决方案、价格发现和数据与咨询方面的高附加值服务。 |

| 交易平台 | 桌面和移动应用程序 |

| 最低存款 | 不适用 |

| 点差 | 不适用 |

| 支付方式 | 不适用 |

| 客户支持 | 电话和电子邮件支持 |

一般的 信息与监管

Marex Financial 成立于 2005 年,是一家独立的衍生品和外汇经纪商,提供商品、金融期货、期权和外汇交易,由 Marathon Special Opportunity Master Fund Limited 成立,该基金在其前母公司 REFCo 于 2005 年倒闭后由 Marathon Asset Management 管理。 2010 年 2 月,对冲基金 JRJ Group 获得了 74% 的股权和执行控制权,任命多名前雷曼兄弟银行家加入其广泛的业务,以帮助扩大业务。

2021 年 5 月,marex financial 在公司更名时完成了对 spectron 集团的收购,该公司是一家批发能源和其他商品产品的经纪商 Marex Spectron国际有限公司。 2021年4月1日,公司更名为marex。

监管方面,Marex Financia由英国金融市场行为监管局(FCA)授权和监管,监管牌照号为442767。

Marex 总部位于伦敦,在悉尼、香港、迪拜、新加坡、都柏林、法兰克福、巴黎、凡尔赛、奥斯陆、鹿特丹和北美、芝加哥、伊利诺伊州绍姆贝格、纽约、斯坦福德、新泽西州克拉克、休斯顿、得梅因设有办事处、旧金山、明尼阿波利斯、蒙特利尔和卡尔加里。

产品与服务

Marex 将客户与全球能源、金属、农业和金融市场联系起来。在其业务中,Marex 在做市、执行和清算、对冲和投资解决方案、价格发现以及数据和咨询方面提供高附加值服务。

Marex Financial 提供商品、金融期货、期权和外汇交易服务。

Marex可用的交易平台

除了电话交易服务外,Marex 还为用户提供桌面和移动应用程序,用于外汇和贵金属现货交易以及市场监控。通过该平台,跨现货、远期和期货、NDF、期权以及场外交易和交易所交易交易的外汇价格对冲提供外汇执行服务。通过对现货和期货的直接市场访问以及高级 API 连接,客户可以从多家银行和外汇流动性提供商的汇总流动性中受益。该服务专为金融机构、商业用户、对冲基金、CTA 和自营交易公司而设计。

客户支持

有任何疑问或交易相关问题的客户可以通过以下联系渠道与Marex取得联系:

电话 +44 (0)20 7655 6000

邮箱:acrabbe@marexspectron.com, enquiries@marexspectron.com

或者您可以在一些社交媒体平台上关注该经纪人,例如 Twitter、Linkedin 和 Youtube

优点缺点

| 优点 | 缺点 |

| 受 FCA 监管 | 现在无法打开网站 |

| 多样化的产品和服务 | 没有明确的最低存款信息 |

| 平均客户支持 | |

经常问的问题

Marex什么时候成立的?

Marex 成立于 2005 年。

与 Marex 交易所需的最低入金金额是多少?

未披露与 Marex 交易的最低存款额。

Marex提供哪些产品和服务?

Marex 提供进入一系列金融市场的途径,例如外汇、商品、期货、期权,以及做市商、执行和清算、对冲和投资解决方案、价格发现等方面的高附加值服务。

孙永秋

法国

从一个以前我出金申请2笔成功 一直是显示待审核 问客服一直不理人 无法出金 还有最近我买的都是离岸人民币 前面买的都是1个点一美金的 就在昨天刚买进去也是1个1美金 后来在我持仓当中做了手脚他们私自改成1个点60美金 把我帐号里2万4千美金一下子输光

曝光

孙永秋

法国

恶意爆仓 损失大量资金 出金不理

曝光

芳芳

香港

孟秋晨女,大概30出头,以老师的身份推荐买外汇,自称有团队操盘,当天入金后便不能出金。现在平台已经打不开。已经报警,希望能把这些可恶的骗子全部绳之以法!原网站www.marexforex.com,现在打开已经不是同一个平台了。

曝光

Fighting for life

香港

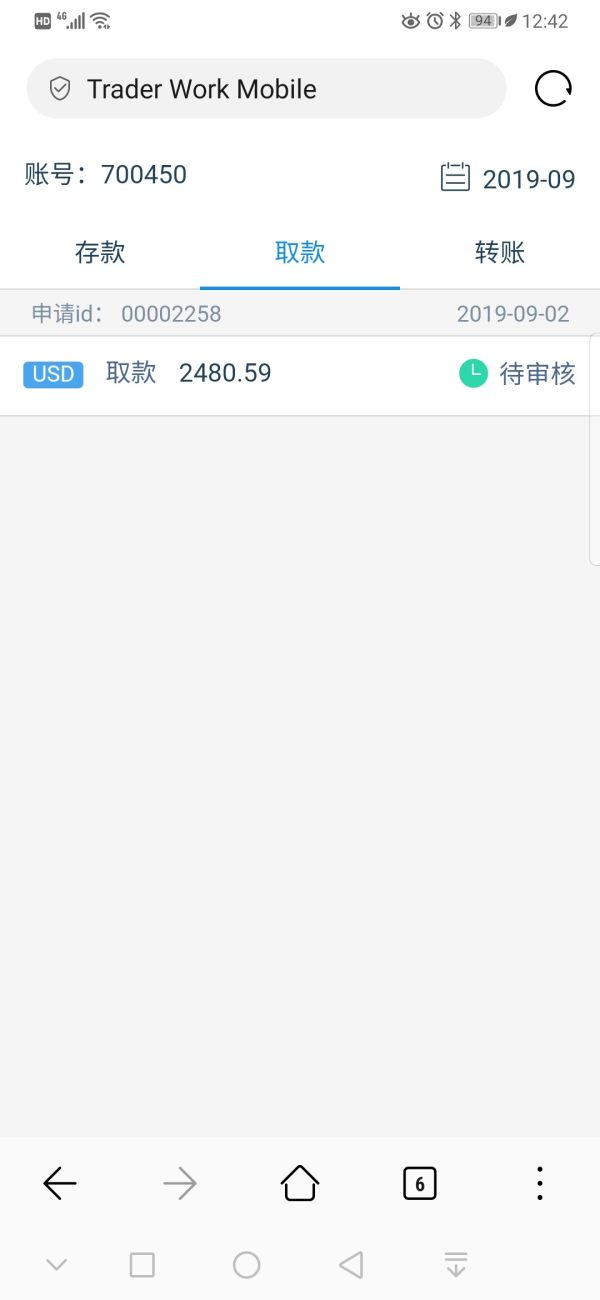

平台出金不被受理,一个星期了还是审核中,疑是跑路,打电话就飙鸟语,然后直接挂断,大家一定要小心了,我会发更多的帖子来曝光他,黑平台。

曝光

Fighting for life

香港

出金申请都一个星期了,就是不给处理,一直显示待审核

曝光

FX8361640492

香港

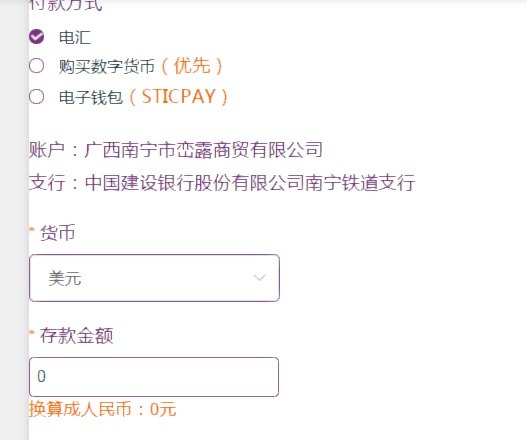

我在今年6月初不知道被谁拉到一个股票群,是QQ群。叫:“一品红”。一名女的叫孟秋晨老师帮我们免费上课。 直播名字:一品红。里面有5位老师:孟秋晨 王弘毅 杨刚 陈宗耀 朱守义。孟秋晨说他们在比赛,要我们每天进去帮她投票。有时候在课堂上直接操作道琼斯指数,几分钟就赚钱几十万美金。她说她的资金大,设置好止损止盈,控制好仓位 加上她有一个师兄是做美股20多年,有一个团队专门研究的。所以他们的盈利很高。正确率也很高。可以跑赢市场80%。 所以一直听课一直看他们操作,还说每年只招88名新人入名人汇。名人汇才能操作美股,道琼斯等。所谓的每天考勤,看出勤率和做功课,表现好的才能加入。最后我加入名人汇了。 在期间,有2个人每天联系我。监督我学习,考勤。还发签到卡。2人分别是Jason现改名 我在他们的所谓的监督和关心下,和孟秋晨的鼓吹下,她推荐了一名客服经理-李铮,说他是专门为她服务的经理呢。现在推荐给我们帮我们开户。所以在6月12日注册了账号。操作系统的使用和按照都是李铮全程指导的。 在6月13日-6月21日当中,我筹集全家的资金入了101600美元。是打款合计人民币到平台上的显示的个人账号(熊平平、左志威、袁春艳) 他们不许自己操作,有所谓的队长按照我们每个人投入的金额分组。刚开始是一个叫智多星的,也就是孟秋晨的大师兄,也是最牛的一个人。带好操作的叫过江龙貌似信龙。.后来跟着他做了2次,盈利了10多万人民币。 我刚开始没投入这么多,他们不停的要我加资金,说给我升级组,这样可以多操作,盈利更多。所以脑子糊涂,到处筹集资金,一下子入了70多万人民币。 6月21日也就是周五,孟秋晨说上课暂时不上了。下周全部操作。你们各自找自己的队长沟通操作。我在21-28期间没操作,也没接到通知。他们说是他们的资金大的人在操作,行情不稳定不会通知我们资金少的人。我在27号就想把赚的提现出来。结果过了3天还没有到账,这下觉得不对,和客服经理沟通,他做最晚3天,叫我耐心等待。那天我就把其他的资金全部出金。所有的单子都是出金管理员确认中。一直不给出金,第4天6.28我联系他们所有人,没人理睬我了。才知道上当受骗了。

曝光