公司简介

| 元大证券 评论摘要 | |

| 成立时间 | 1992 |

| 注册国家/地区 | 香港 |

| 监管 | SFC |

| 市场工具 | 股票、衍生品、期货和期权 |

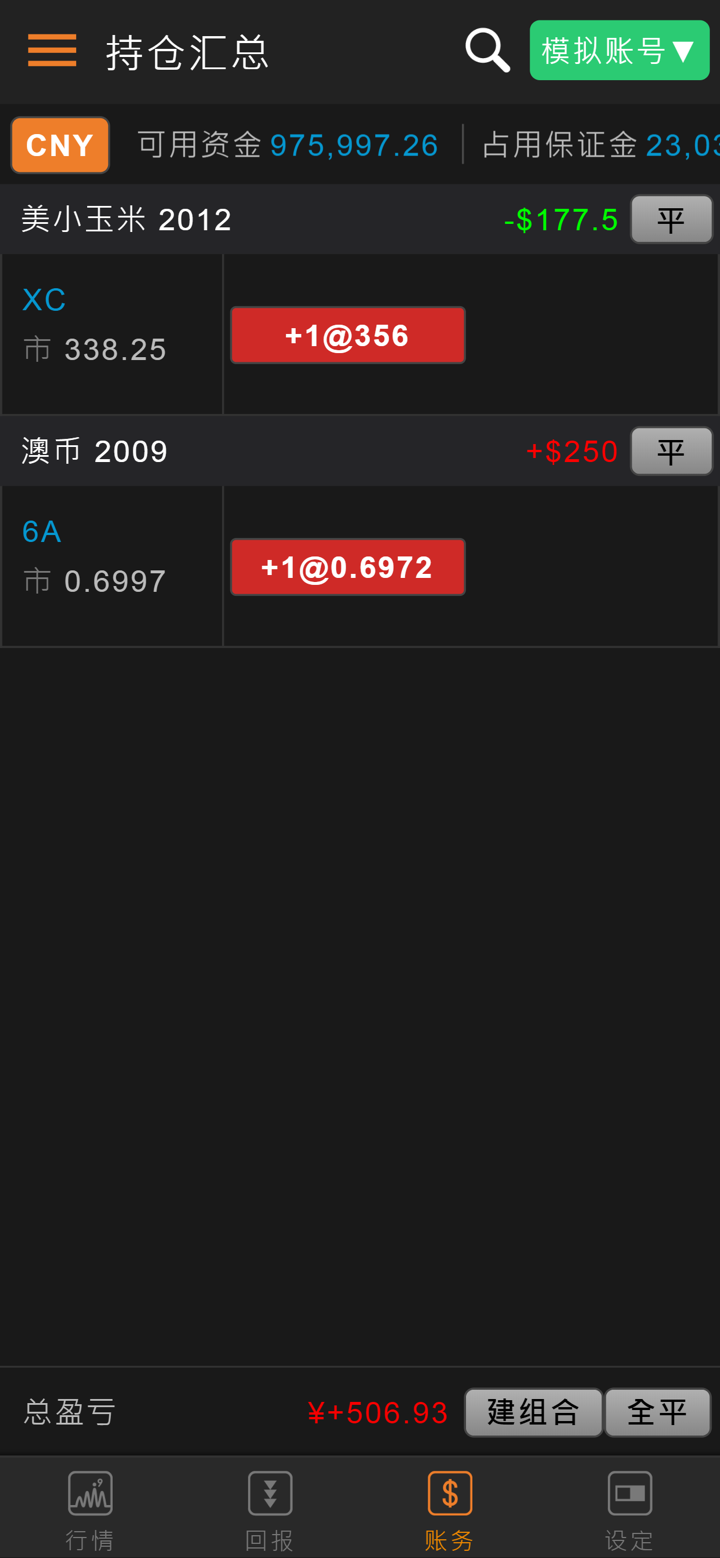

| 模拟账户 | ❌ |

| 交易平台 | eWinner、YSHK SP Trader |

| 最低存款 | / |

| 客户支持 | 电话:(852) 3555-7878 |

| 传真:(852) 3555-7889 | |

| 电子邮件:HK.services.brk@yuanta.com | |

元大证券 信息

成立于1992年,元大证券 受香港证券及期货事务监察委员会监管。该公司提供包括股票、期货和衍生品在内的各种交易工具。虽然没有模拟账户,但通过内部技术支持多平台交易,并通过电话和电子邮件提供本地化支持。

优缺点

| 优点 | 缺点 |

| 受香港SFC监管 | 无模拟账户账户 |

| 支持通过一次登录进行多市场交易 | 部分服务手续费(例如,提名服务)可能较昂贵 |

| 提供广泛的产品覆盖范围:股票、期货、期权 | 未明确规定最低存款 |

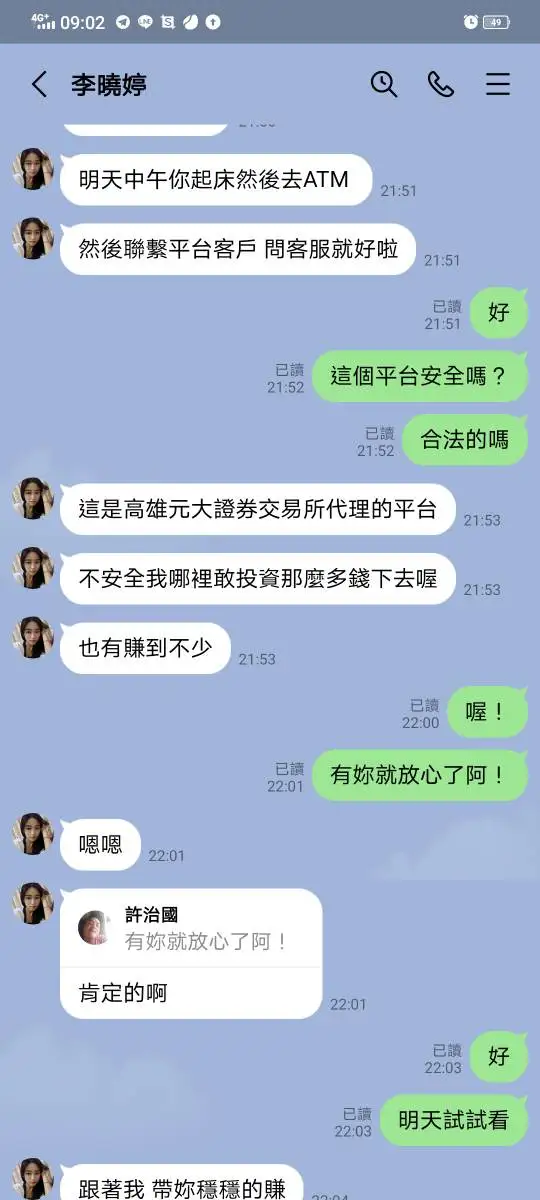

元大证券 是否合法?

是的,元大证券 受香港证券及期货事务监察委员会监管。

| 持牌实体 | 监管机构 | 监管许可 | 当前状态 | 许可类型 | 许可证号 |

| 元大证券 证券(香港)有限公司 | 中国香港 | SFC | 受监管 | 期货合约交易 | ABS015 |

| 元大证券 期货(香港)有限公司 | 中国香港 | SFC | 受监管 | 期货合约交易 | AXQ690 |

| 元大证券 亚洲投资(香港)有限公司 | 中国香港 | SFC | 超出 | 证券交易 | ABZ023 |

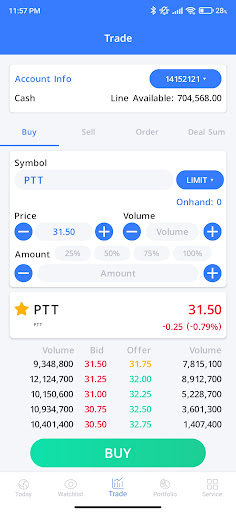

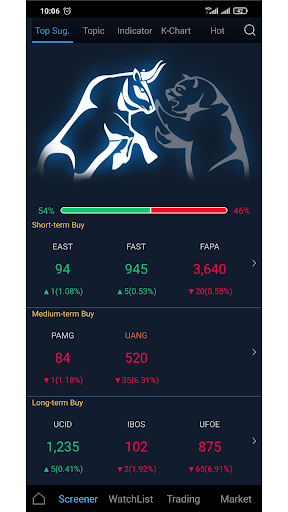

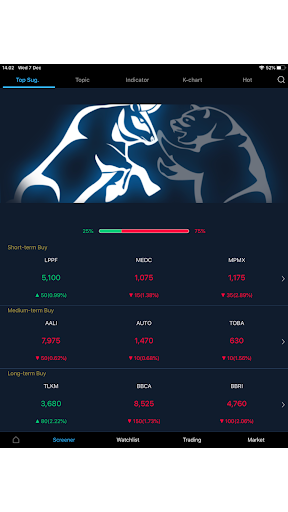

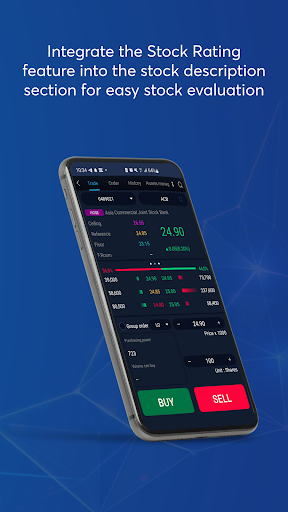

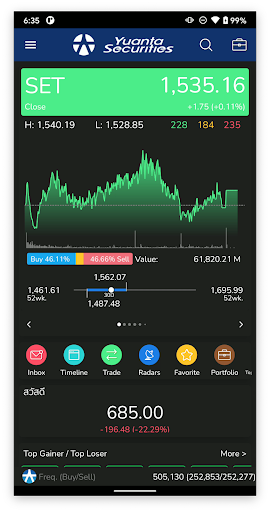

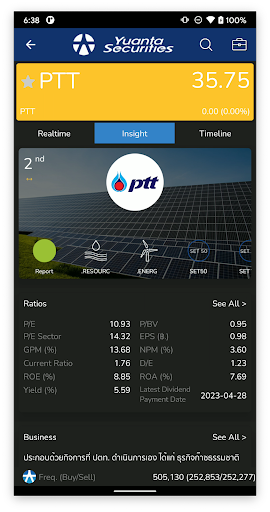

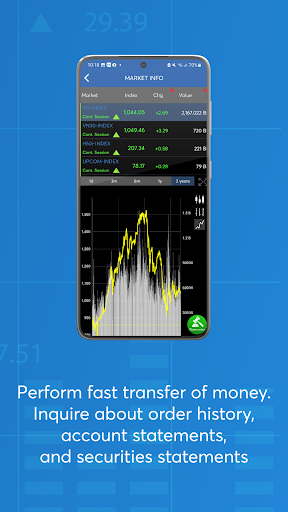

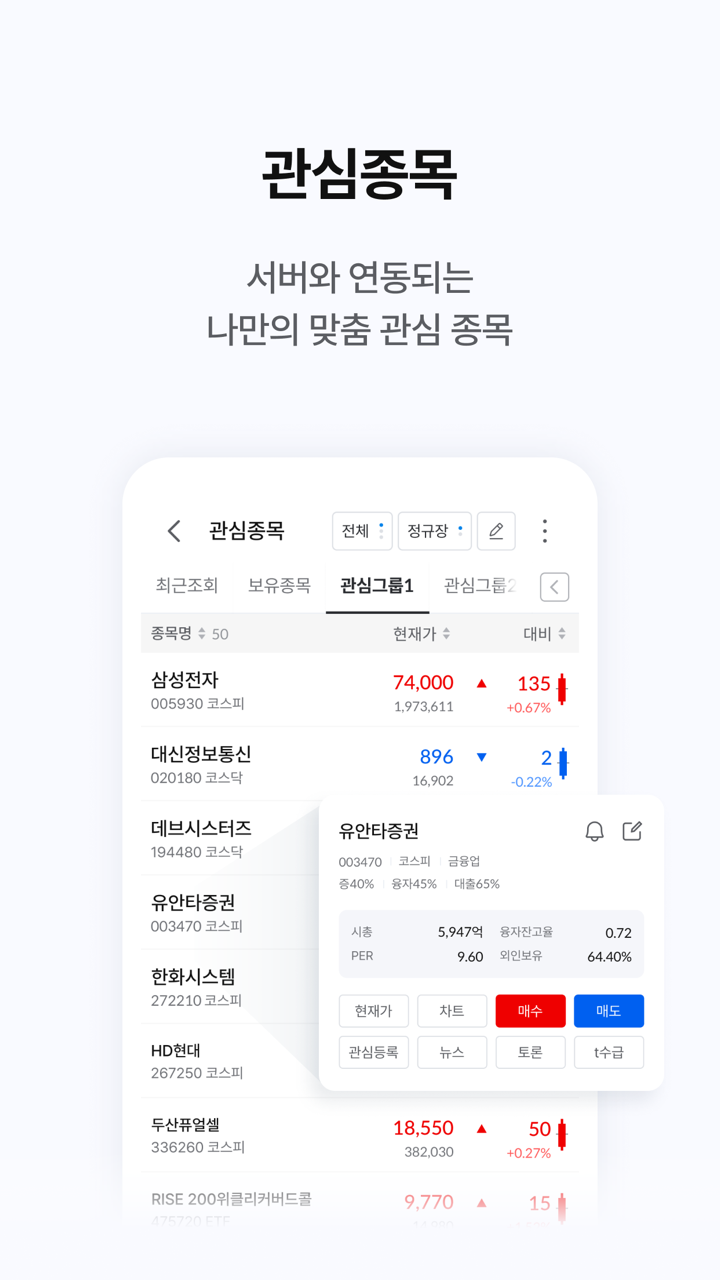

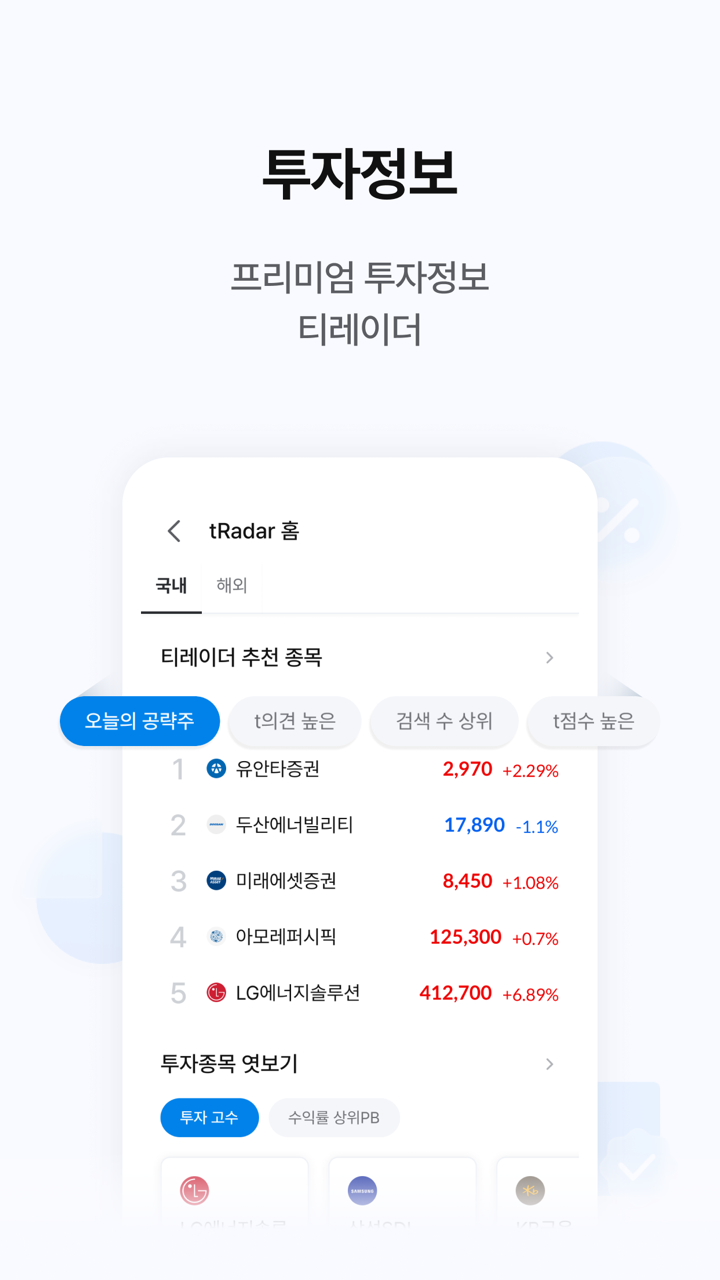

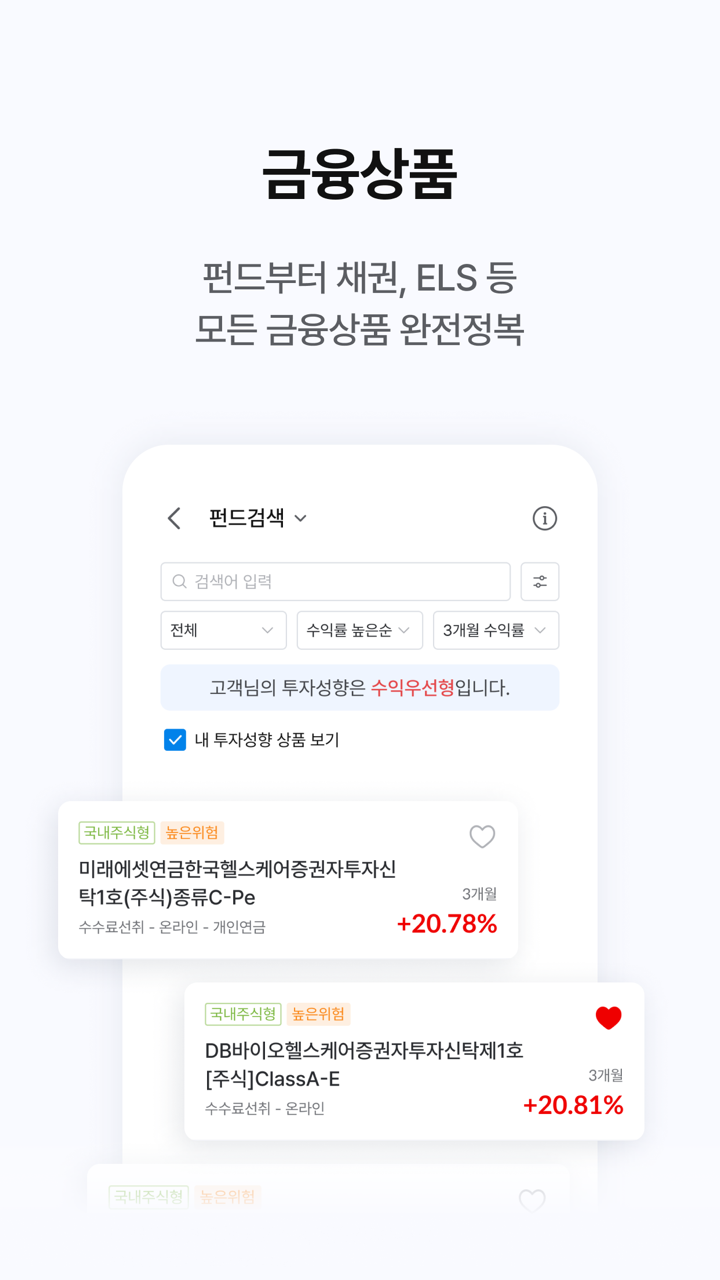

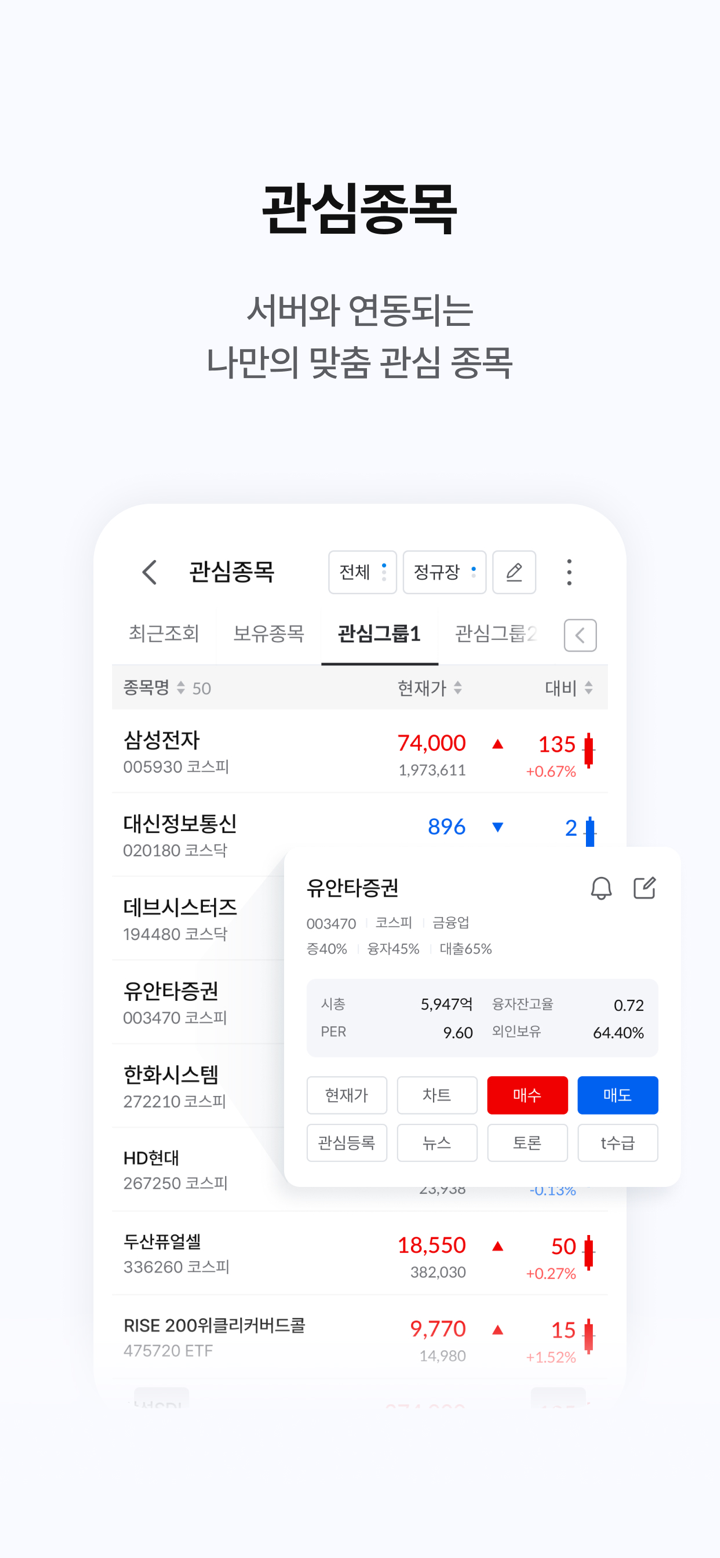

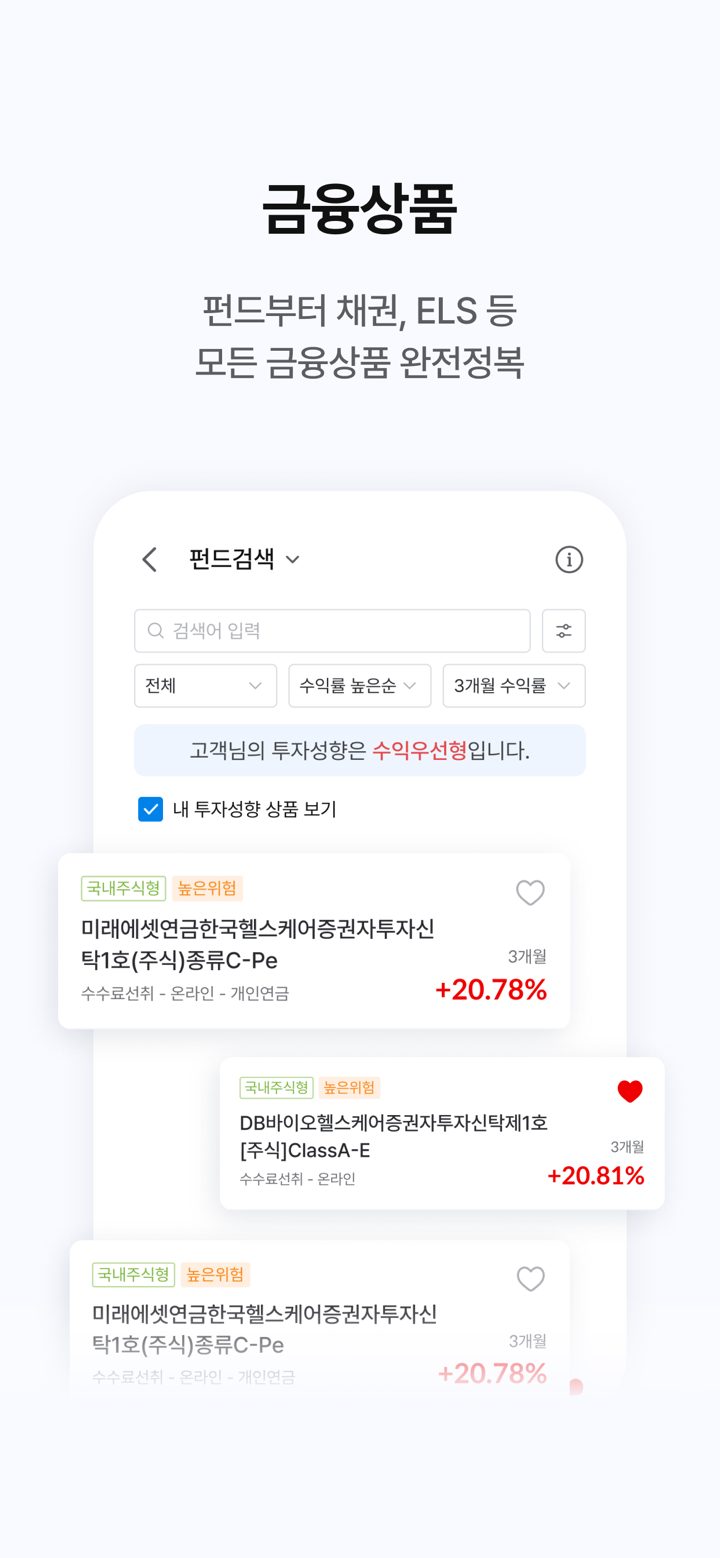

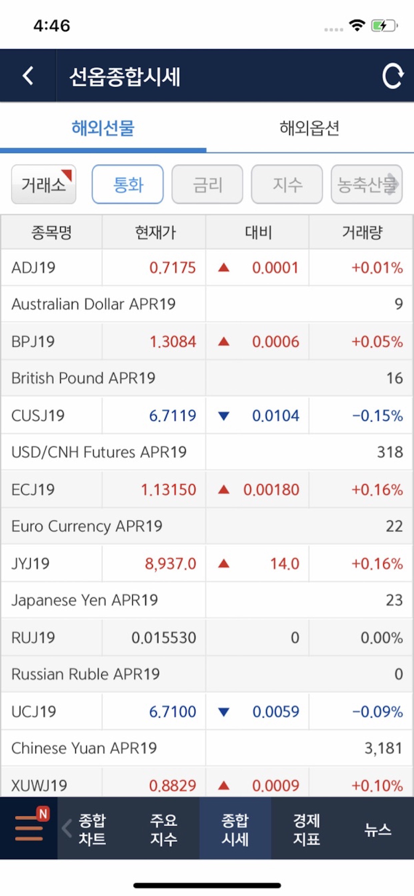

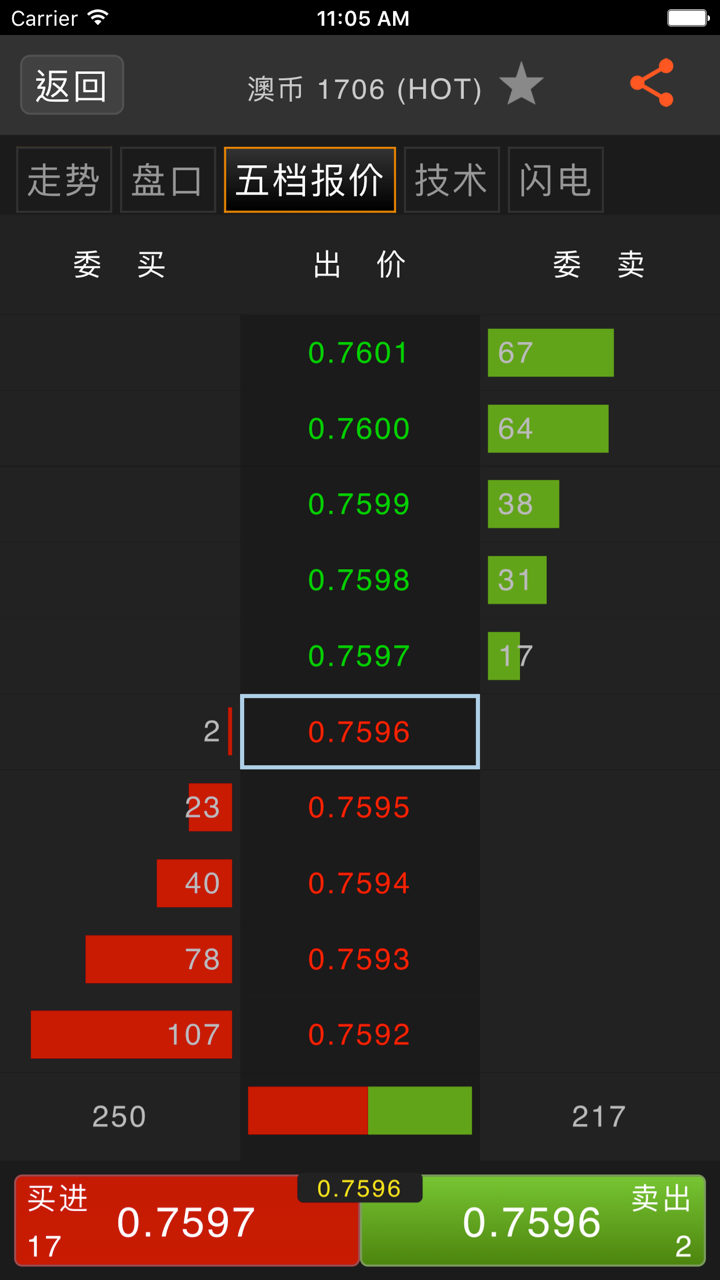

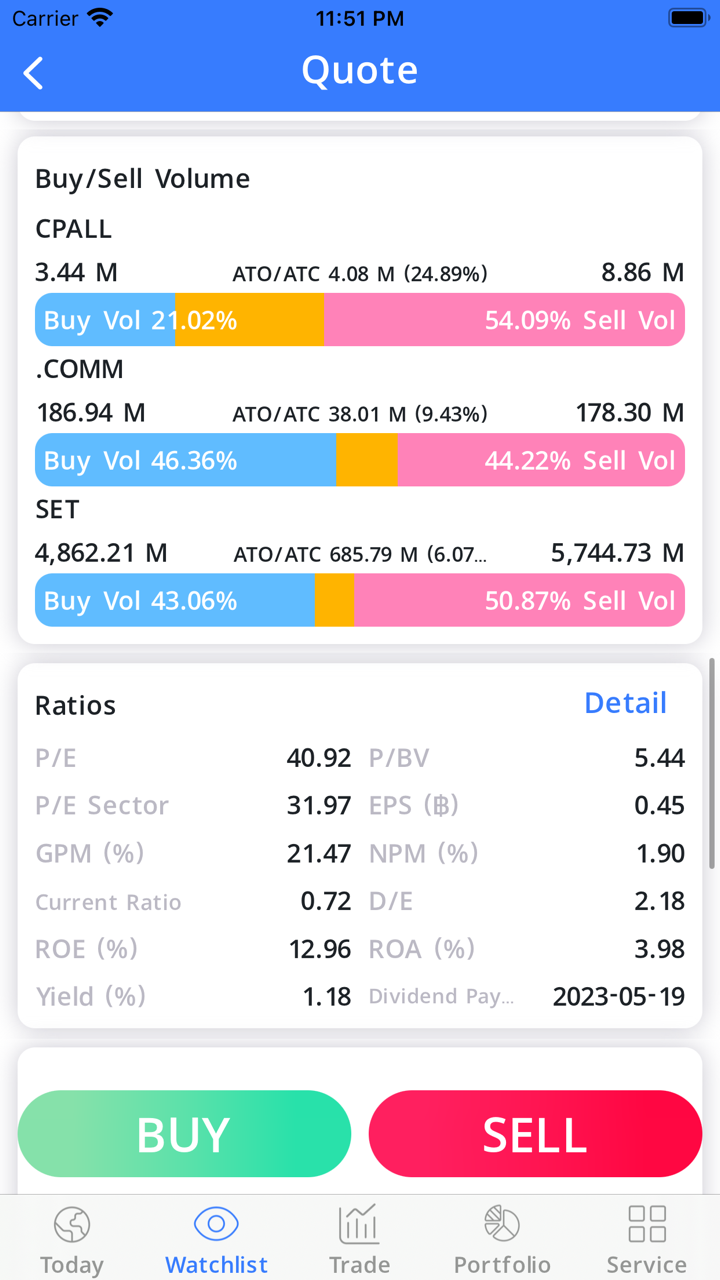

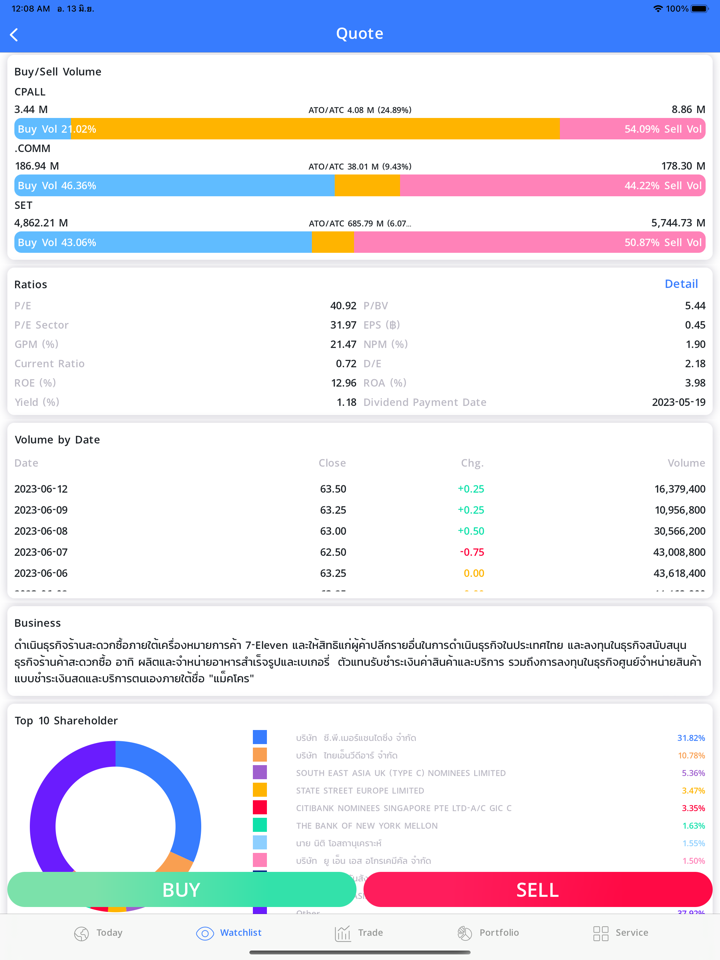

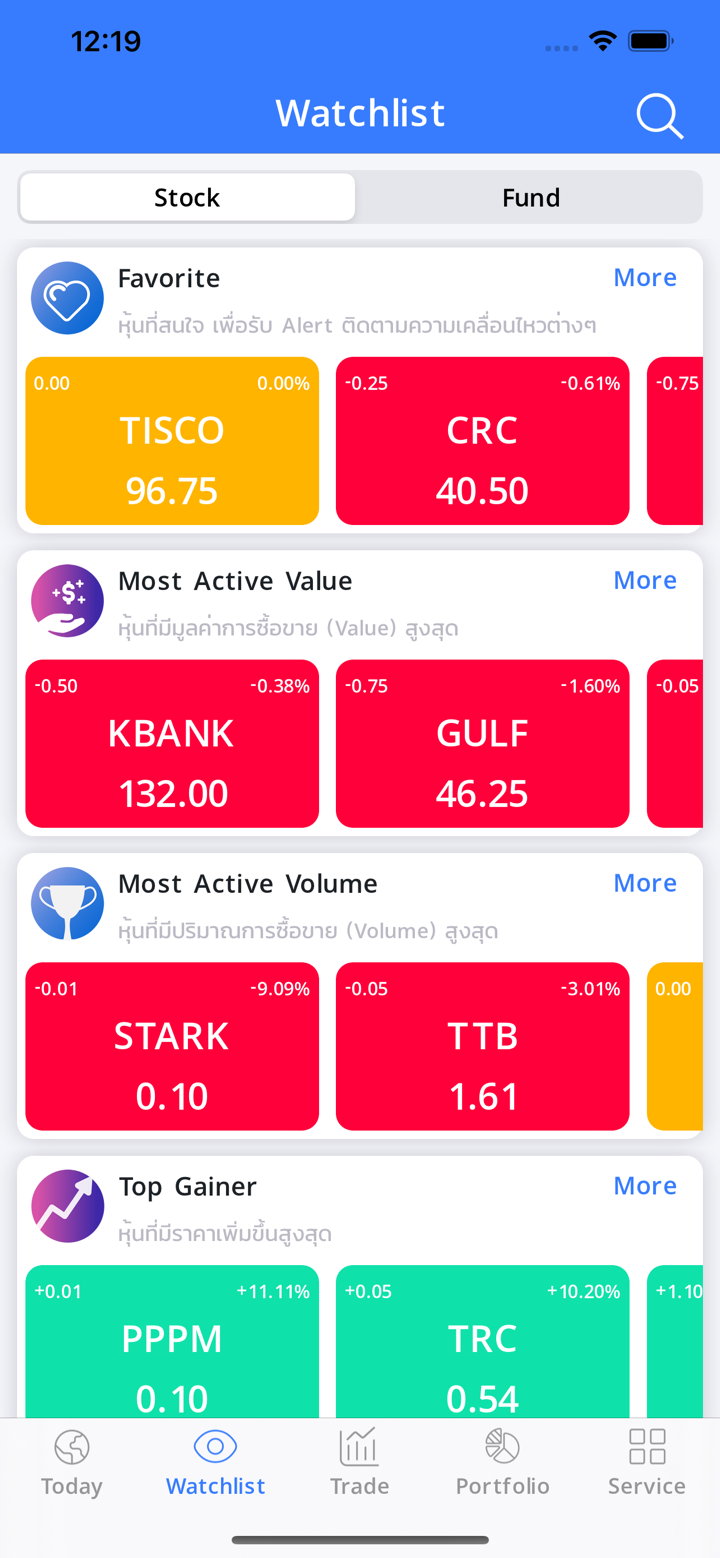

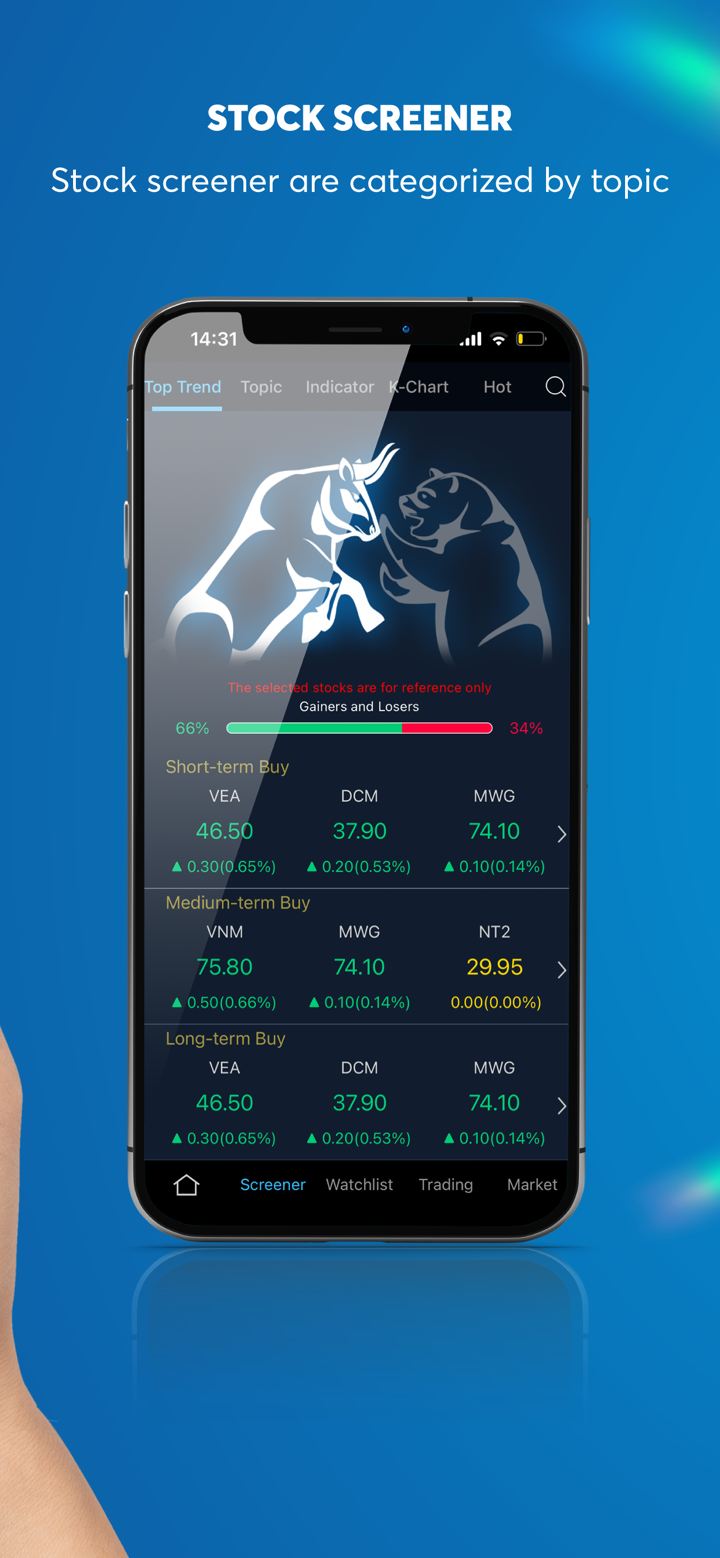

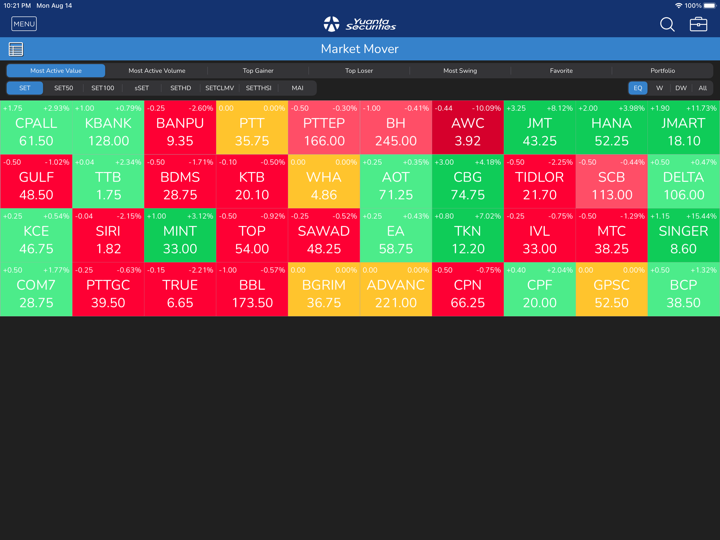

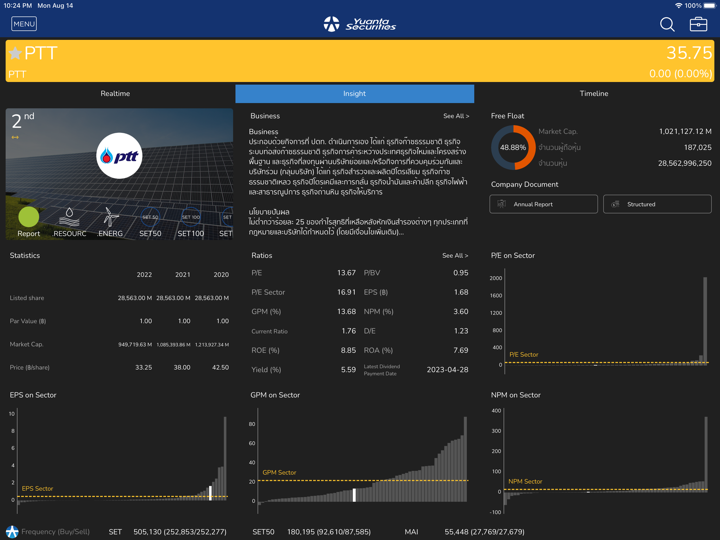

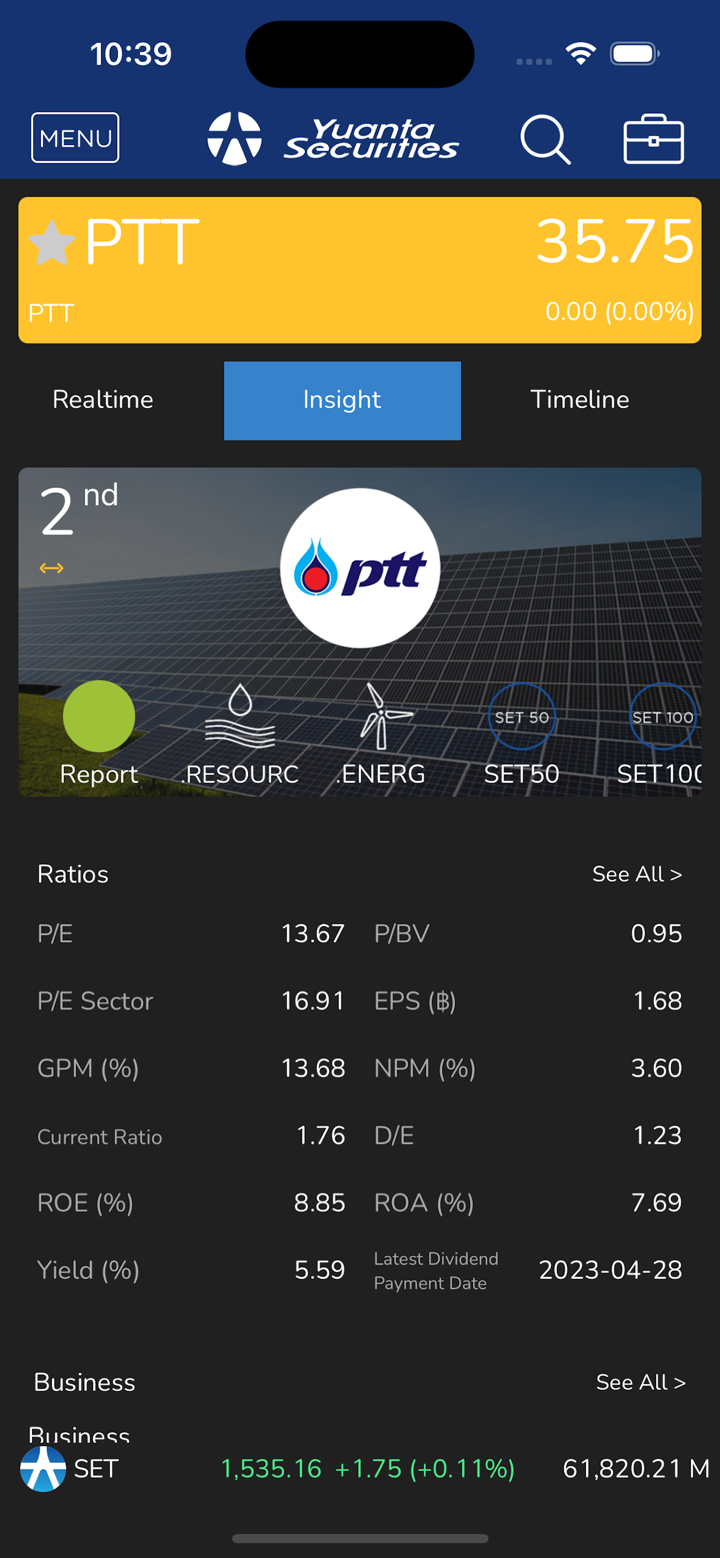

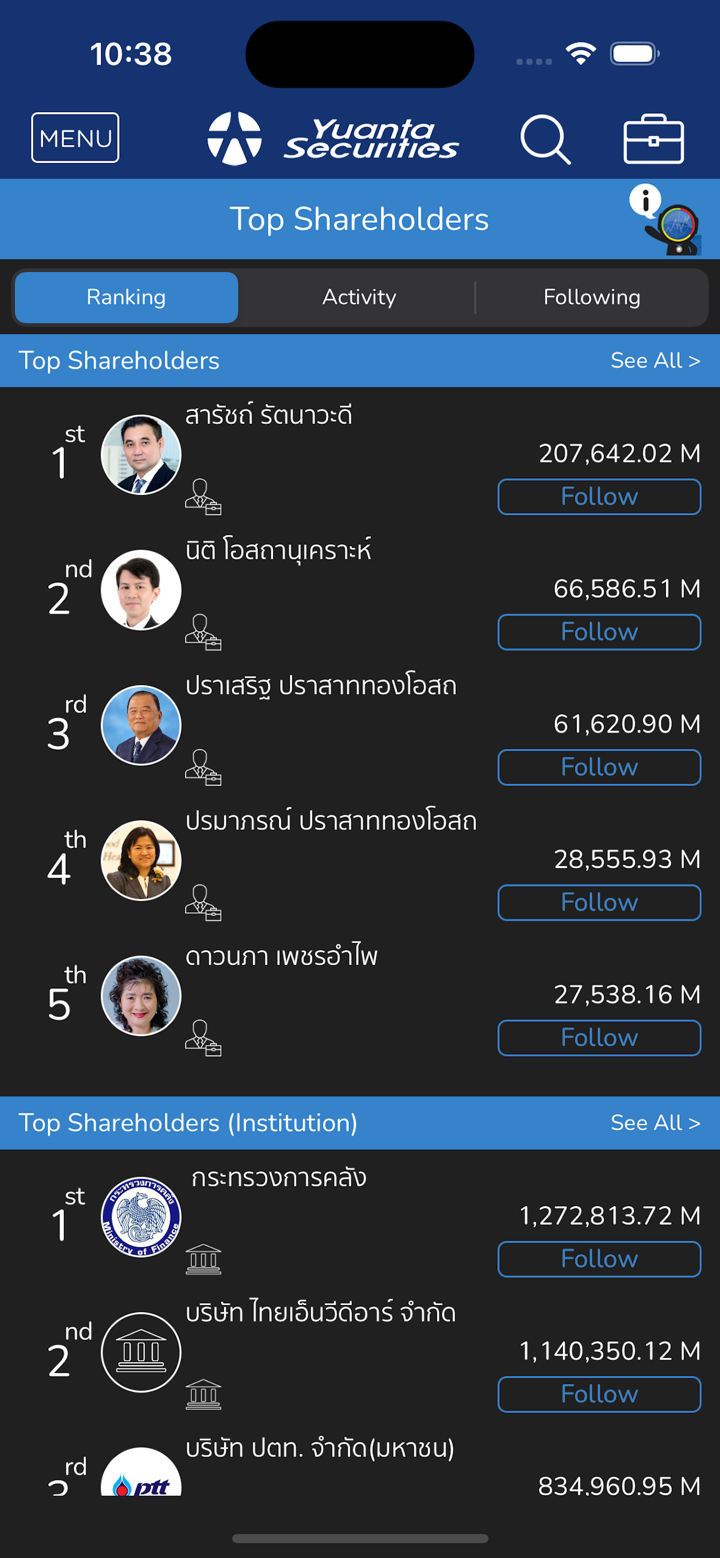

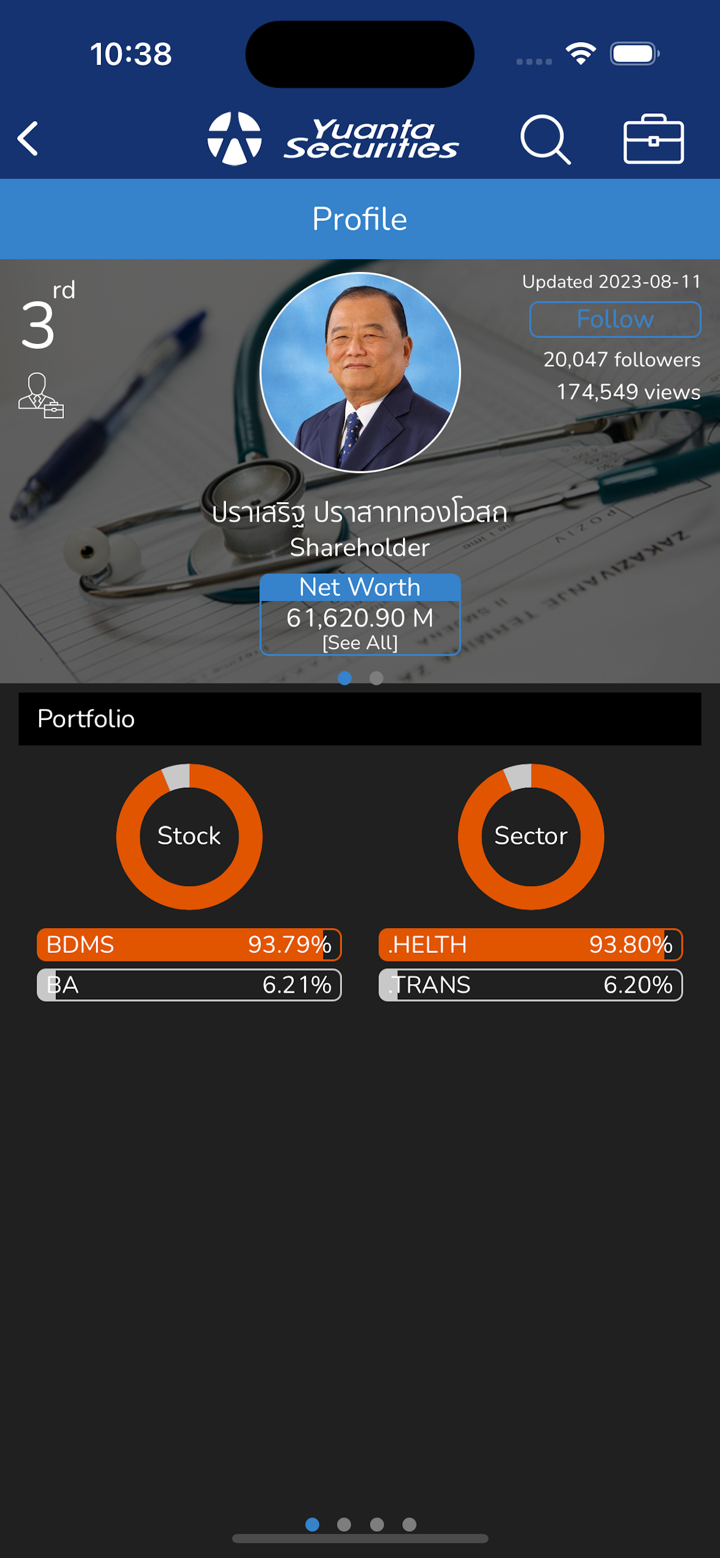

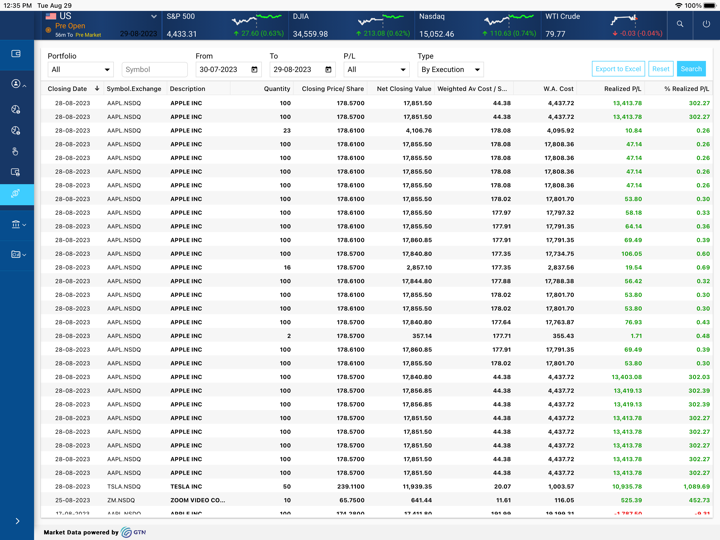

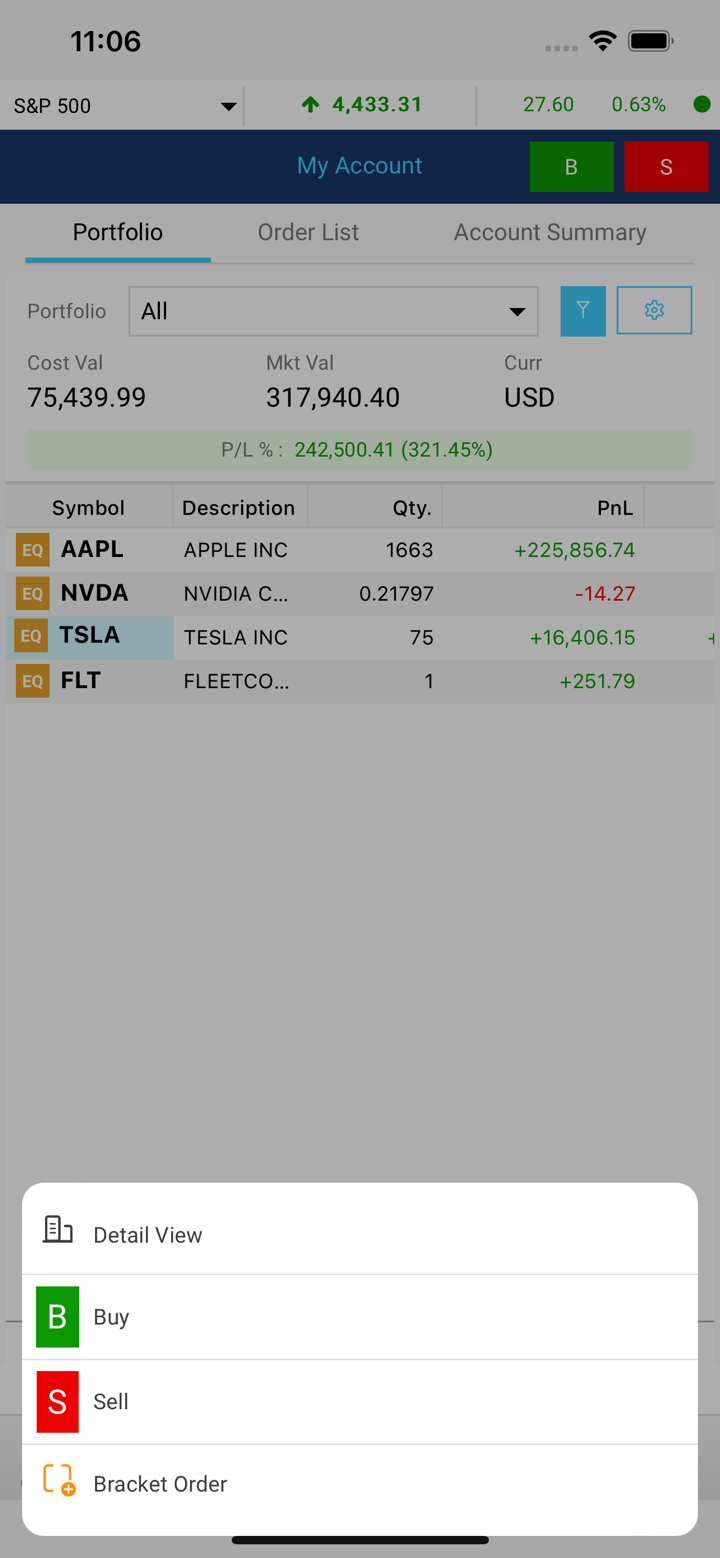

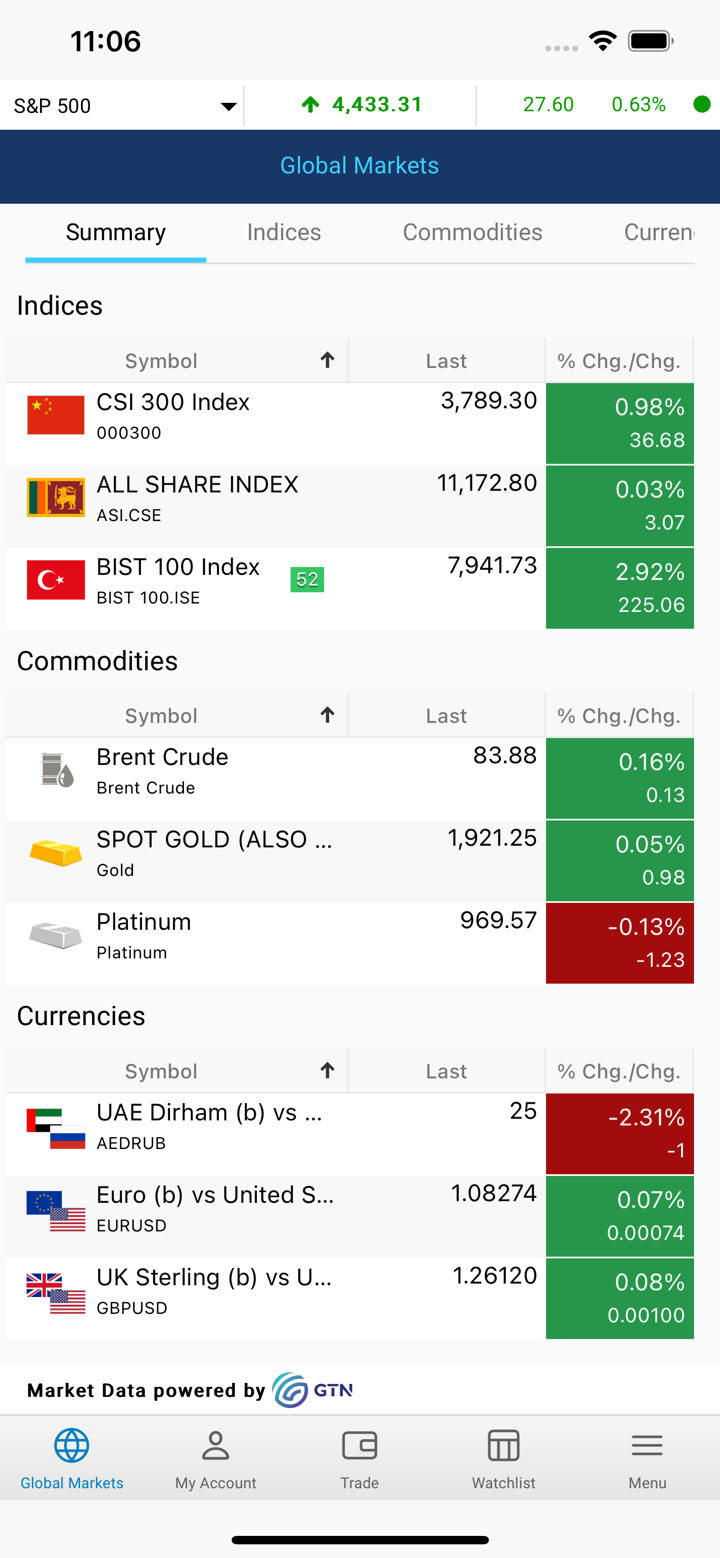

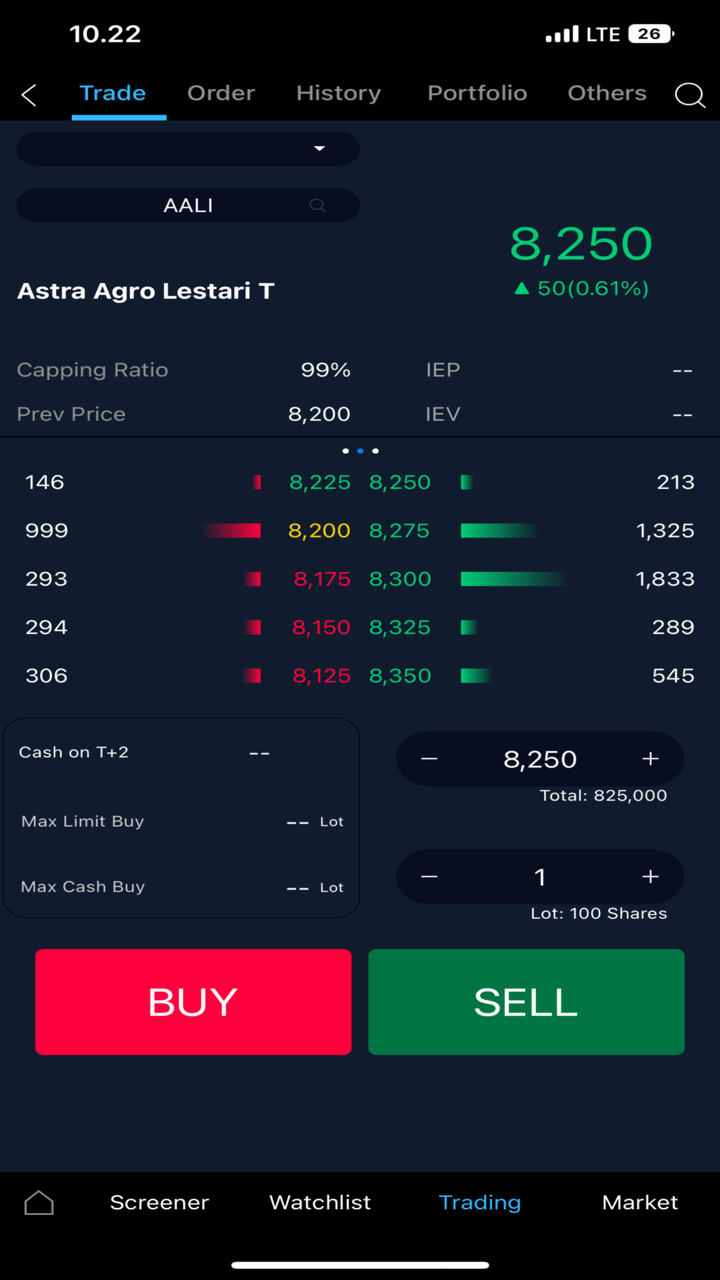

我可以在 元大证券 上交易什么?

主要涵盖股票交易、衍生产品以及期货和期权,该机构提供广泛的金融产品和服务。

| 交易产品 | 详情 |

| 股票交易 | 港股、沪股、深股、台股、美股、中国B股、海外股票 |

| 衍生产品 | 牛熊证、衍生权证 |

| 期货和期权 | 期货、期权、交易细节、合约规格、保证金要求 |

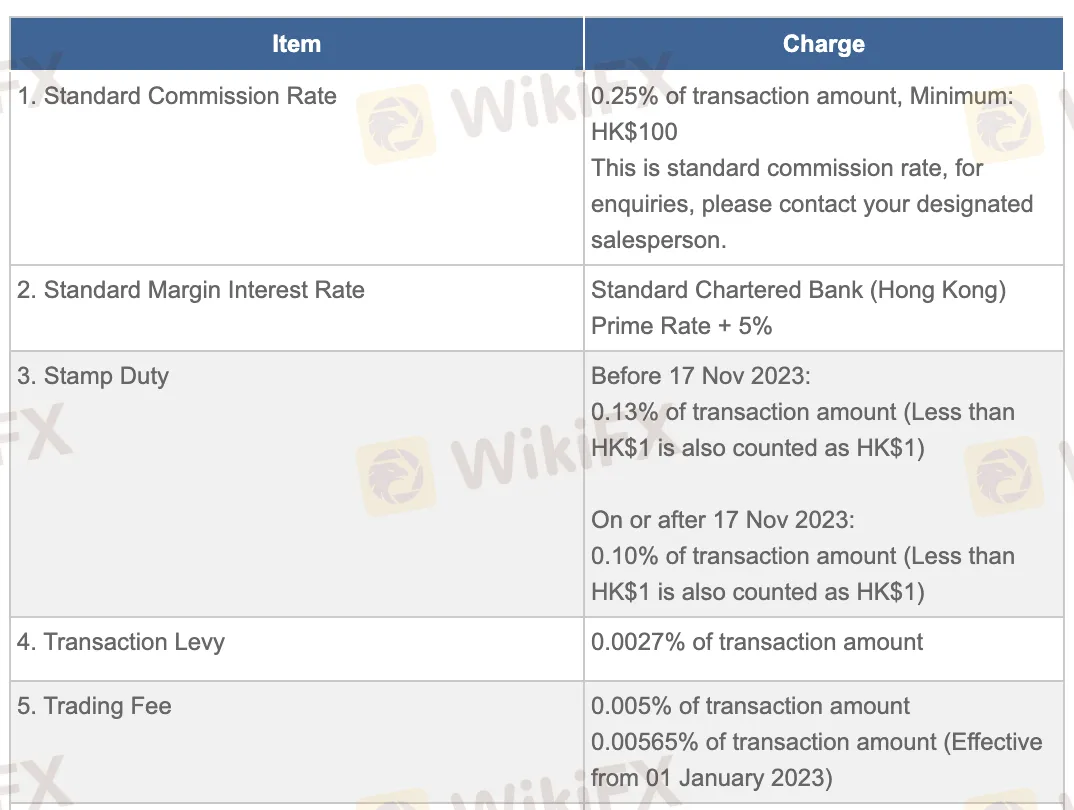

元大证券 费用

尽管一些行政和提名服务可能偏高,元大证券的费用通常符合行业标准,标准佣金和利率与主要香港经纪商类似。

| 项目 | 收费 |

| 标准佣金费率 | 交易金额的0.25%,最低100港币 |

| 标准保证金利率 | 基准利率+5% |

| 印花税 | 0.10%(2023年11月17日后),0.13%(之前),最低1港币 |

| 交易征费 | 交易金额的0.0027% |

| 交易费 | 交易金额的0.00565%(自2023年1月起) |

| CCASS费 | 0.002%,最低2港币,最高100港币 |

| 意大利金融交易税 | 交易金额的0.2% |

| FRC交易征费 | 交易金额的0.00015% |

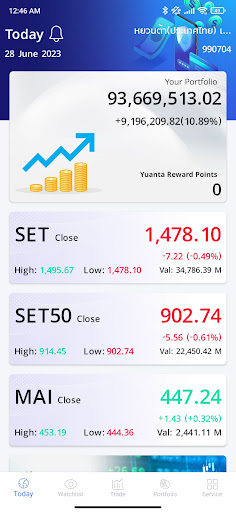

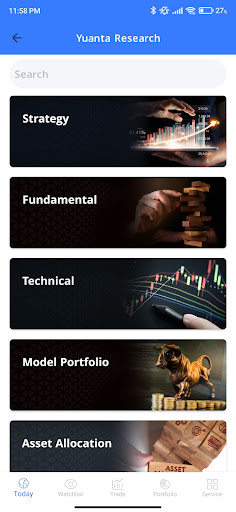

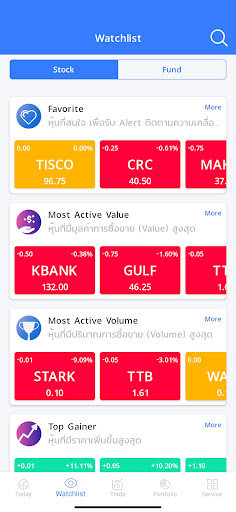

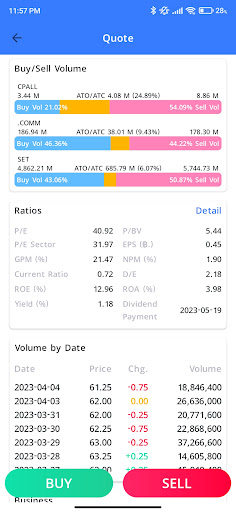

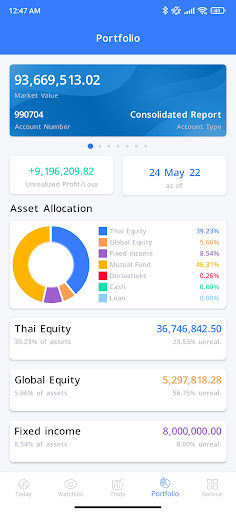

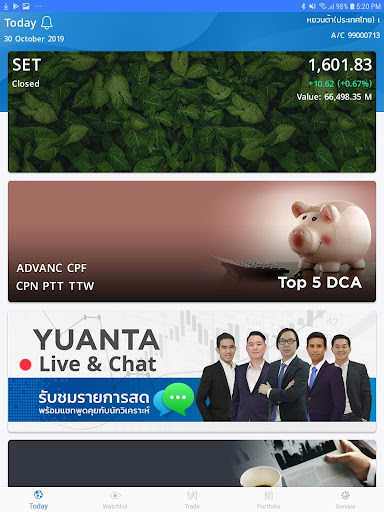

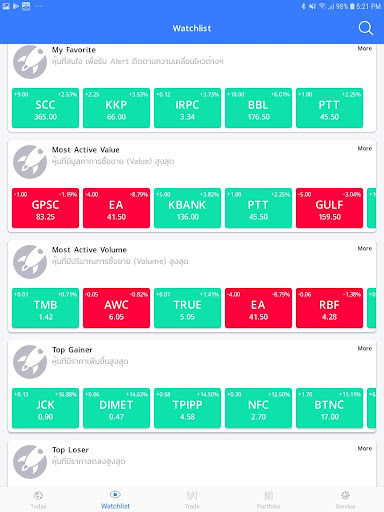

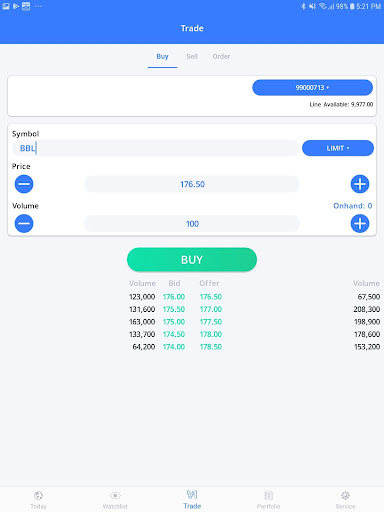

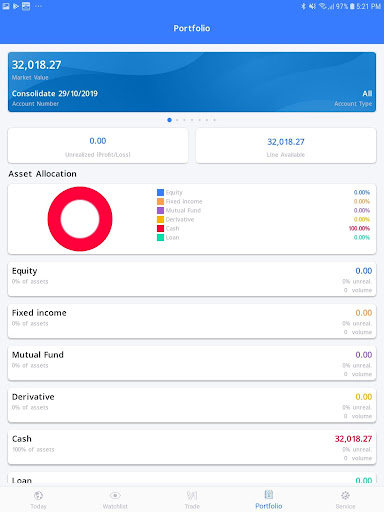

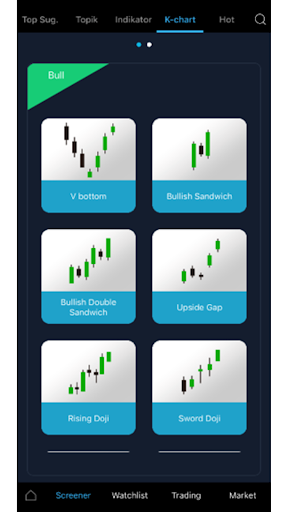

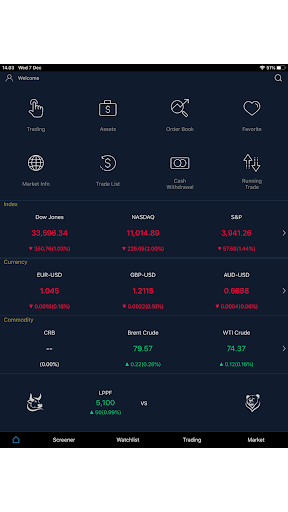

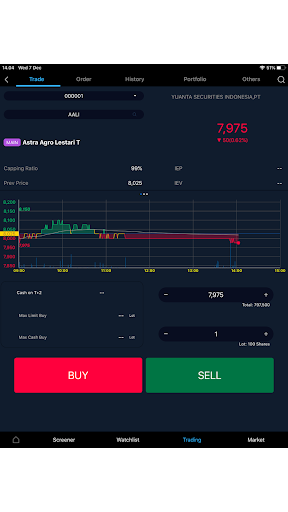

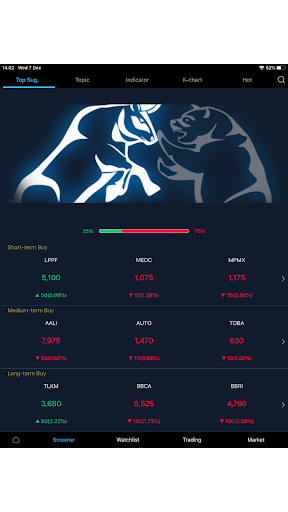

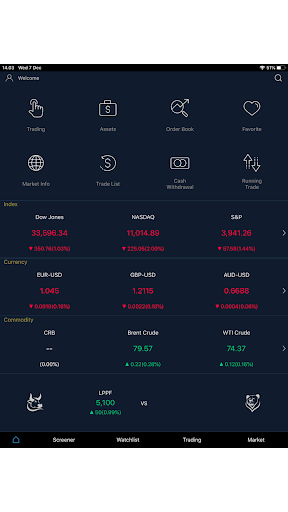

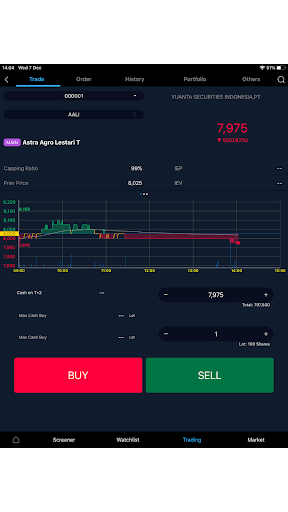

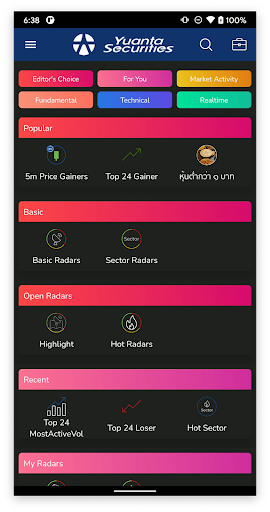

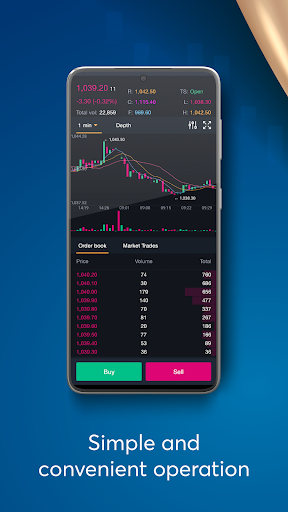

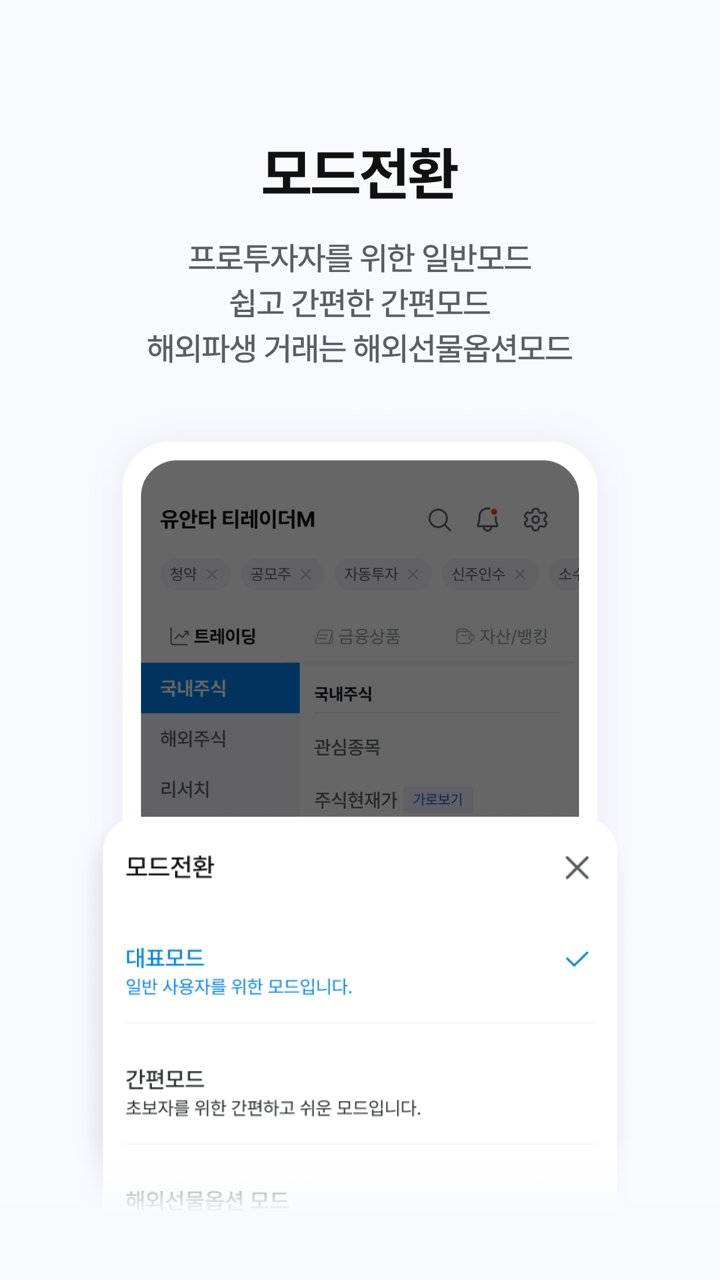

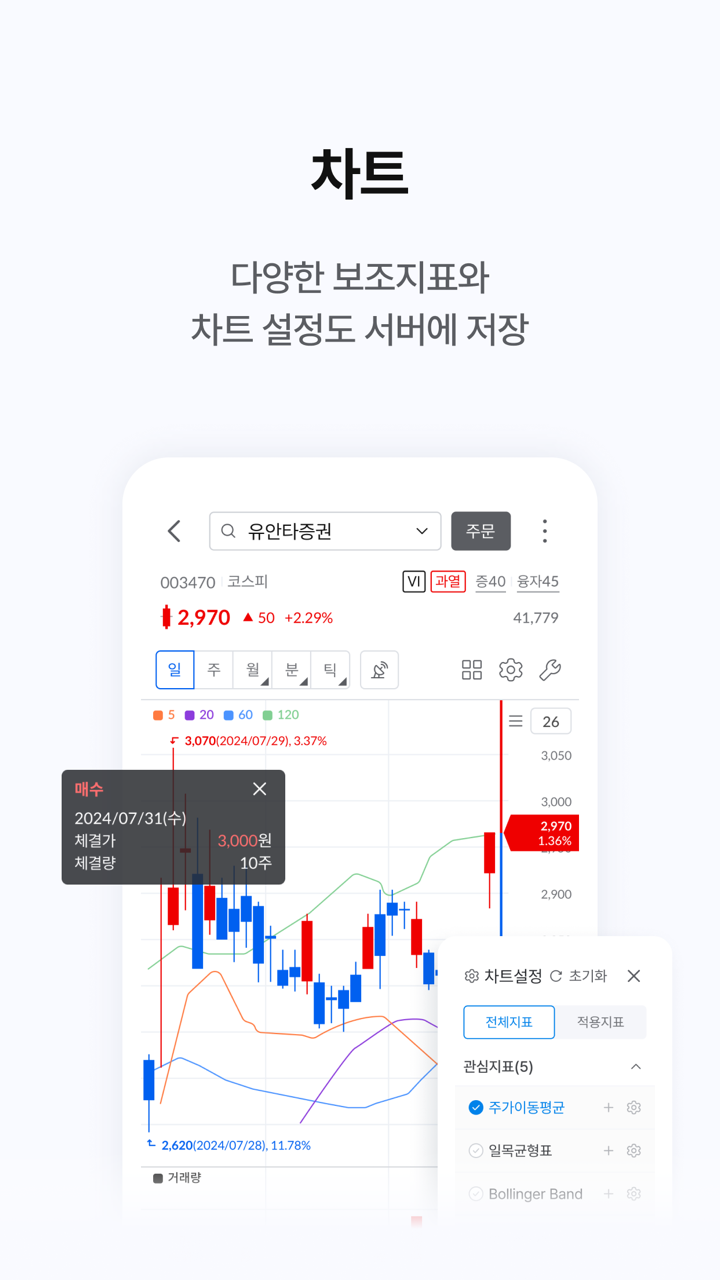

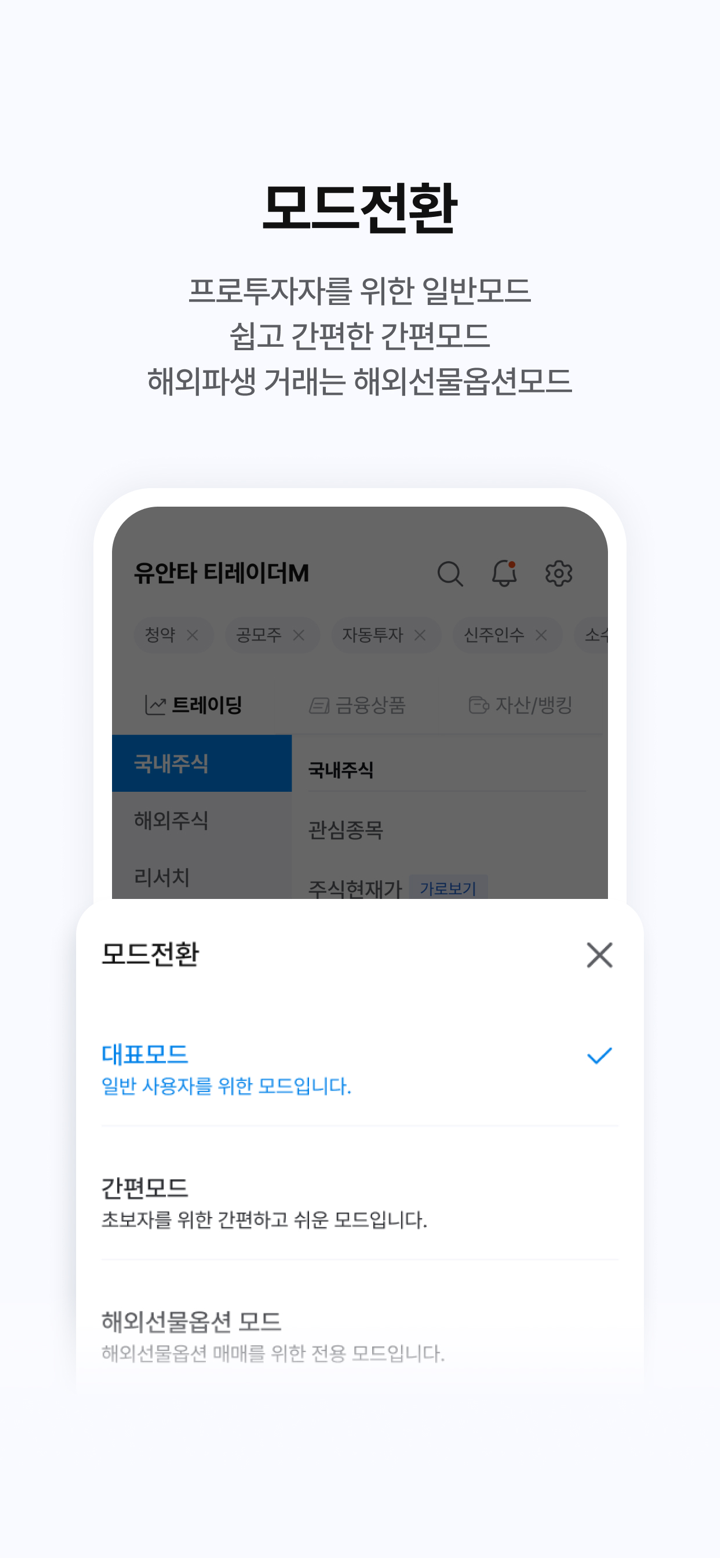

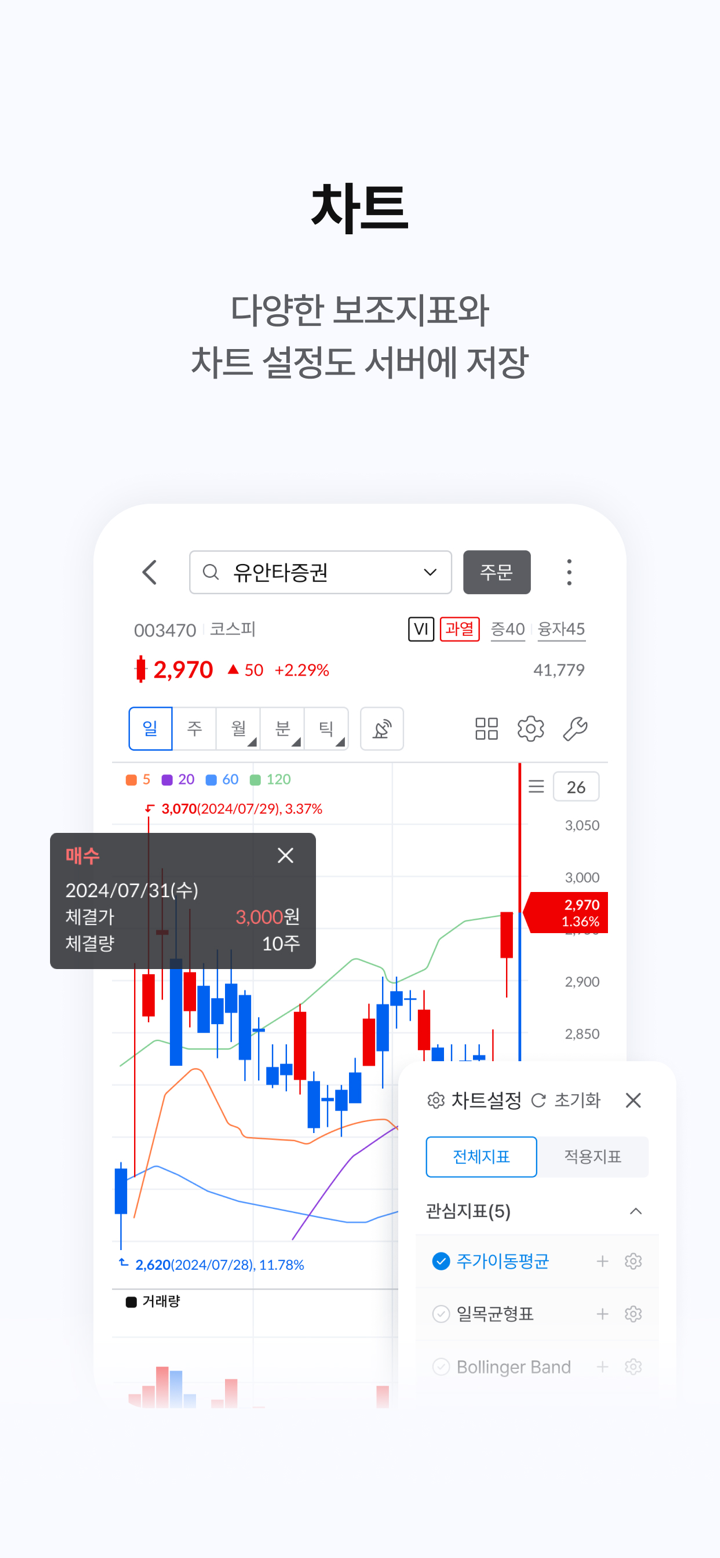

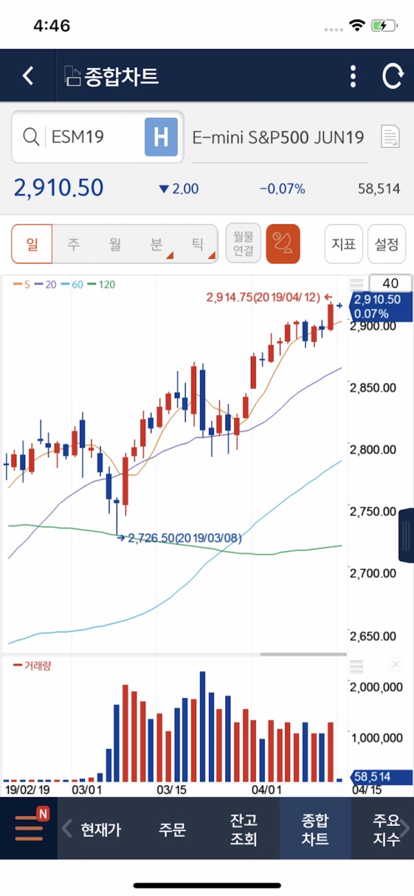

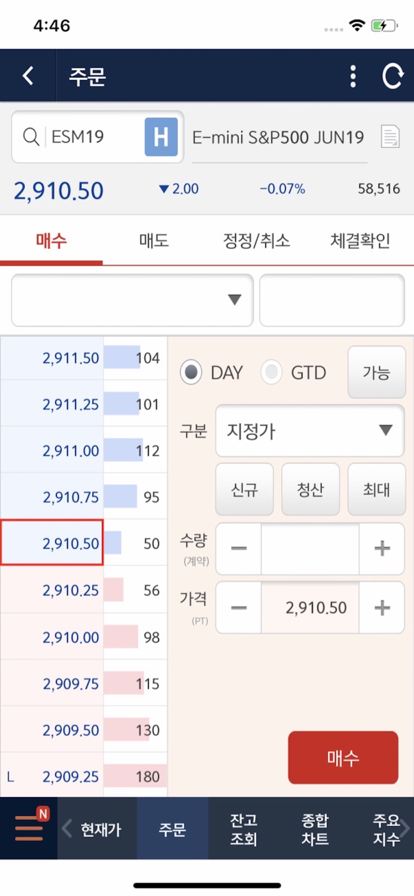

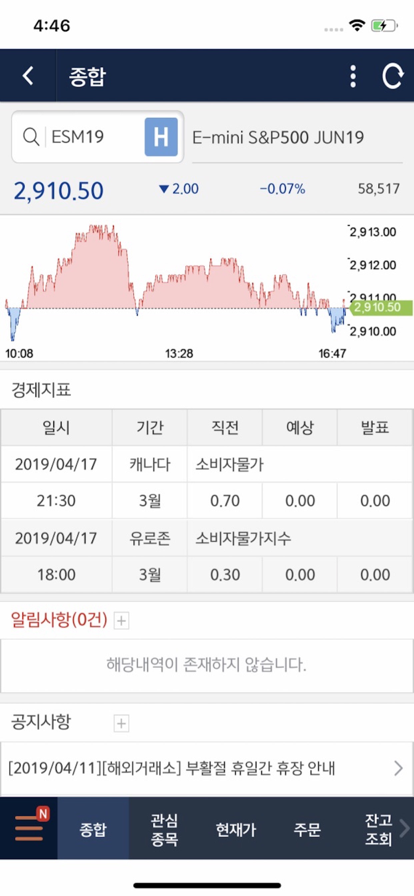

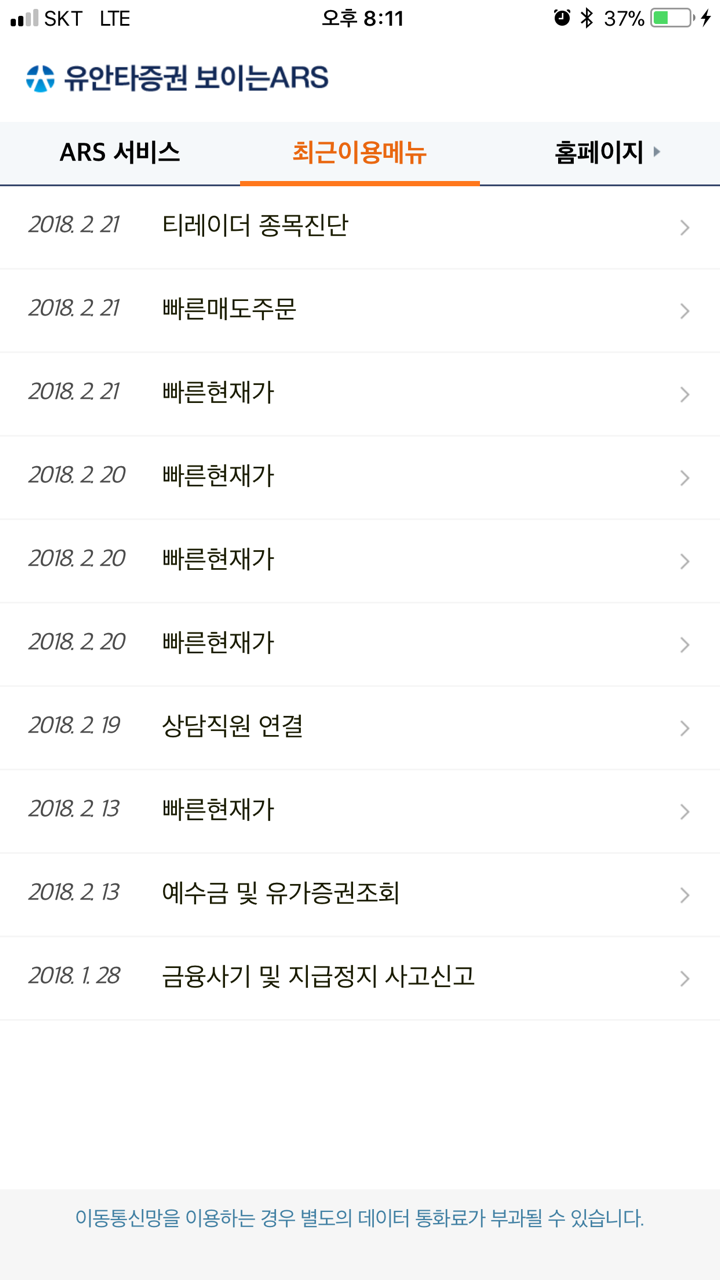

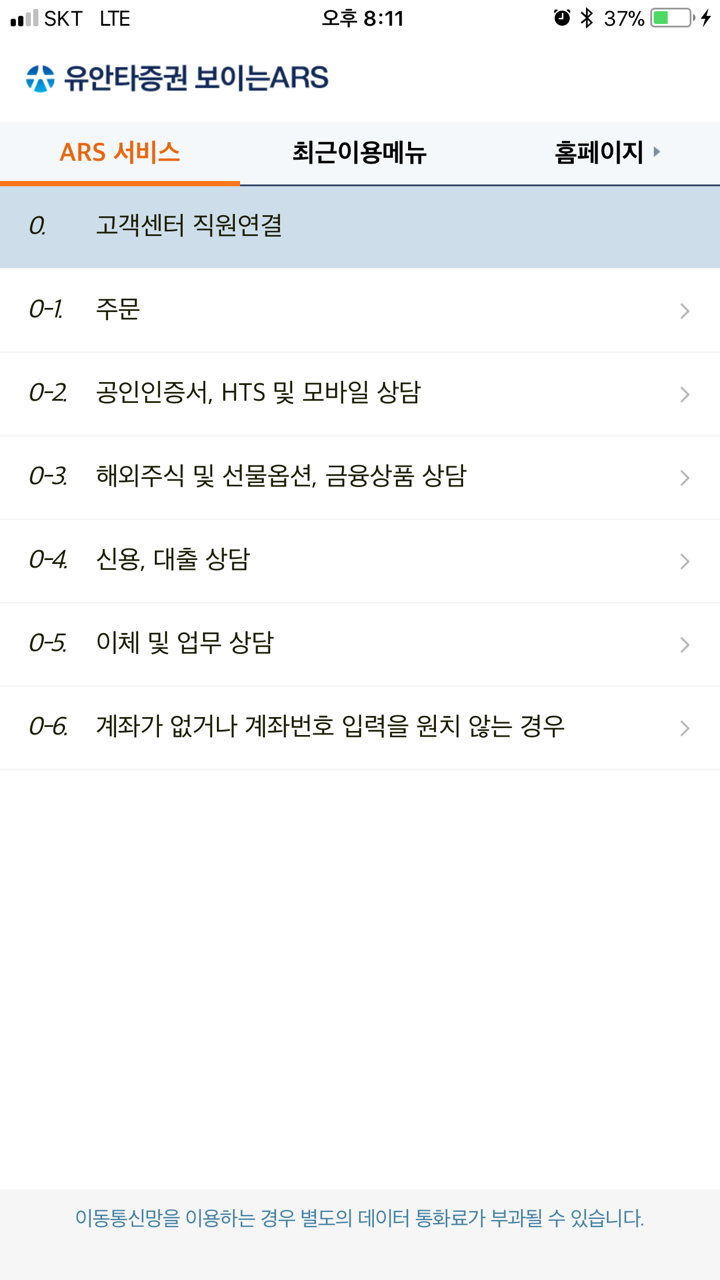

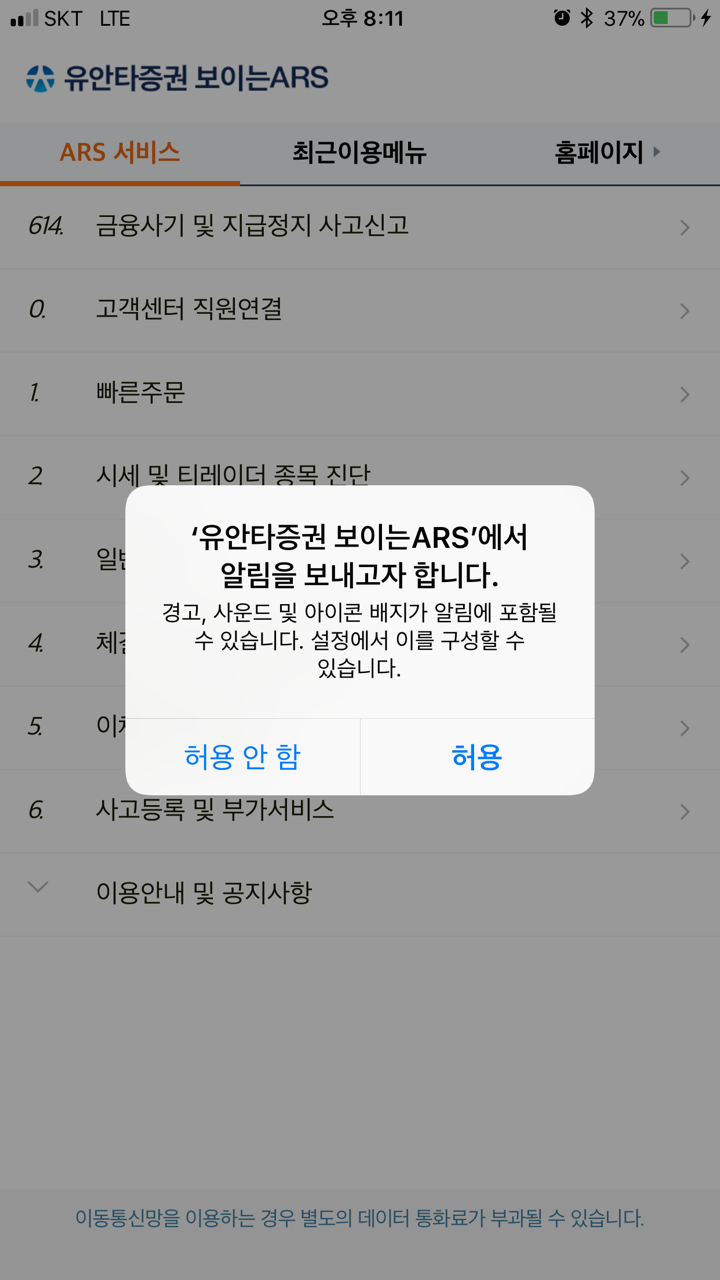

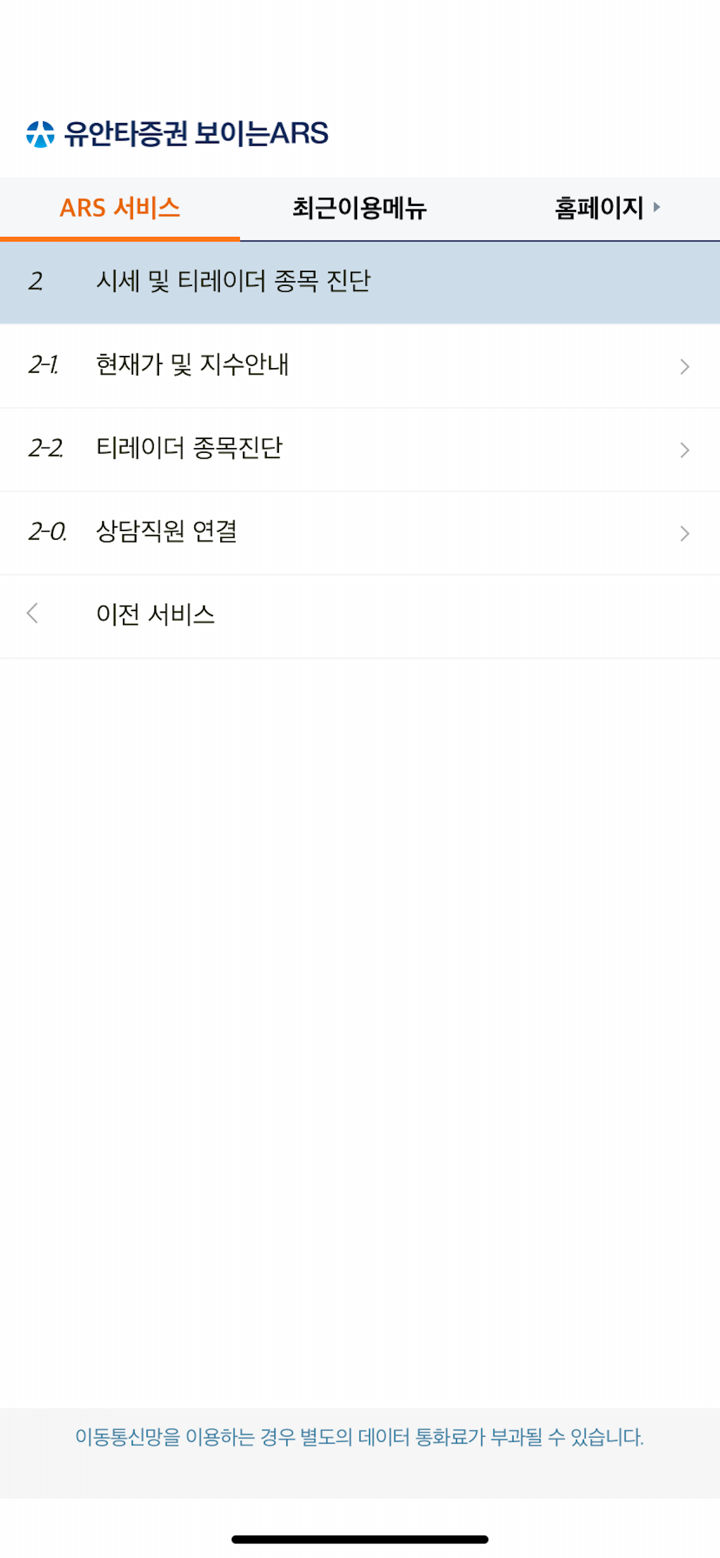

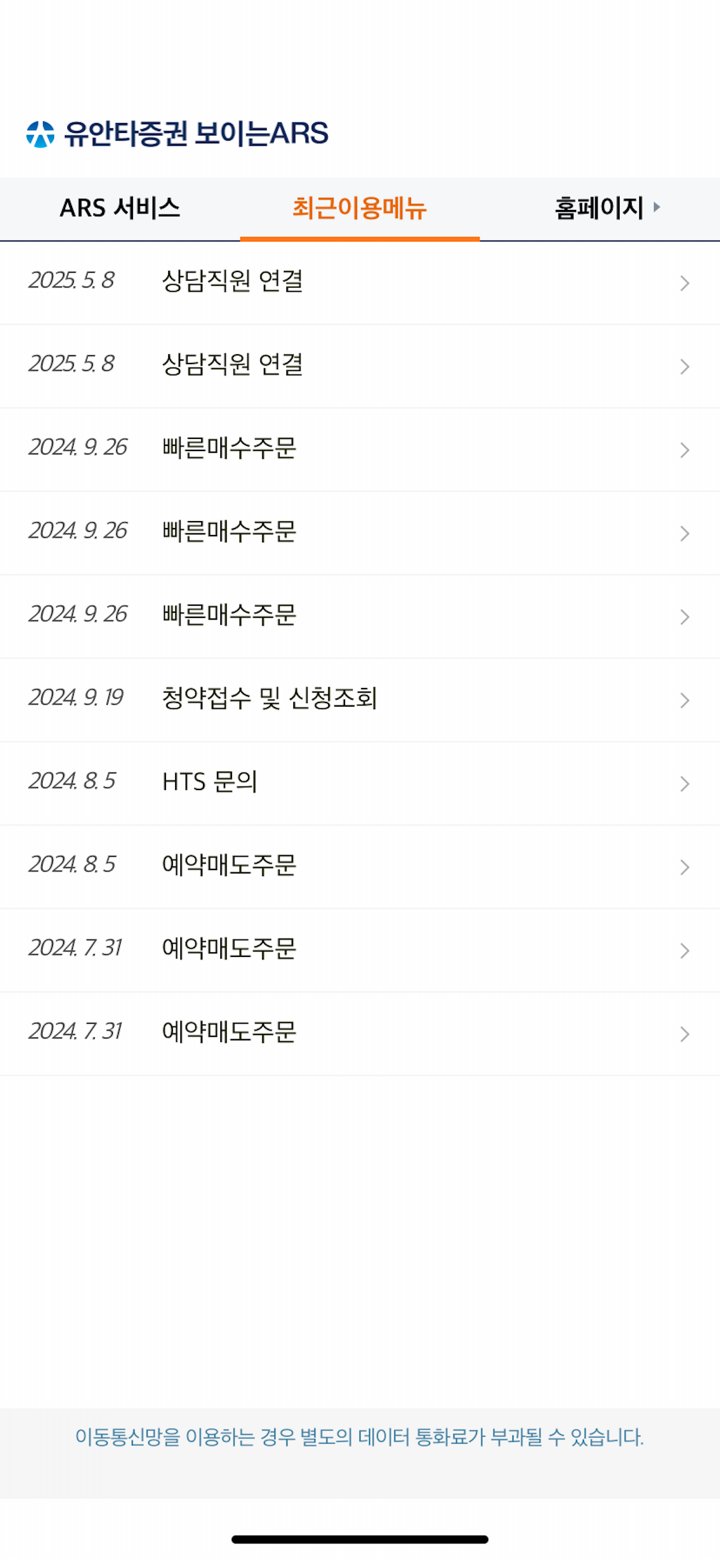

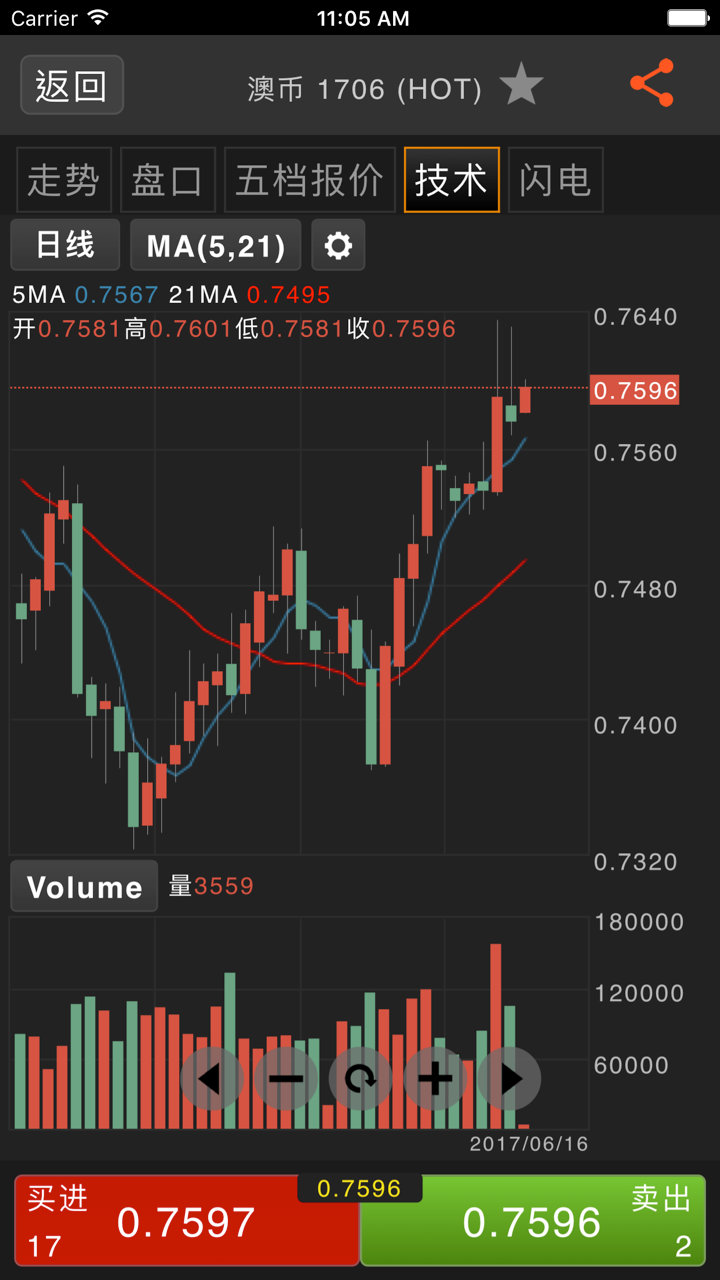

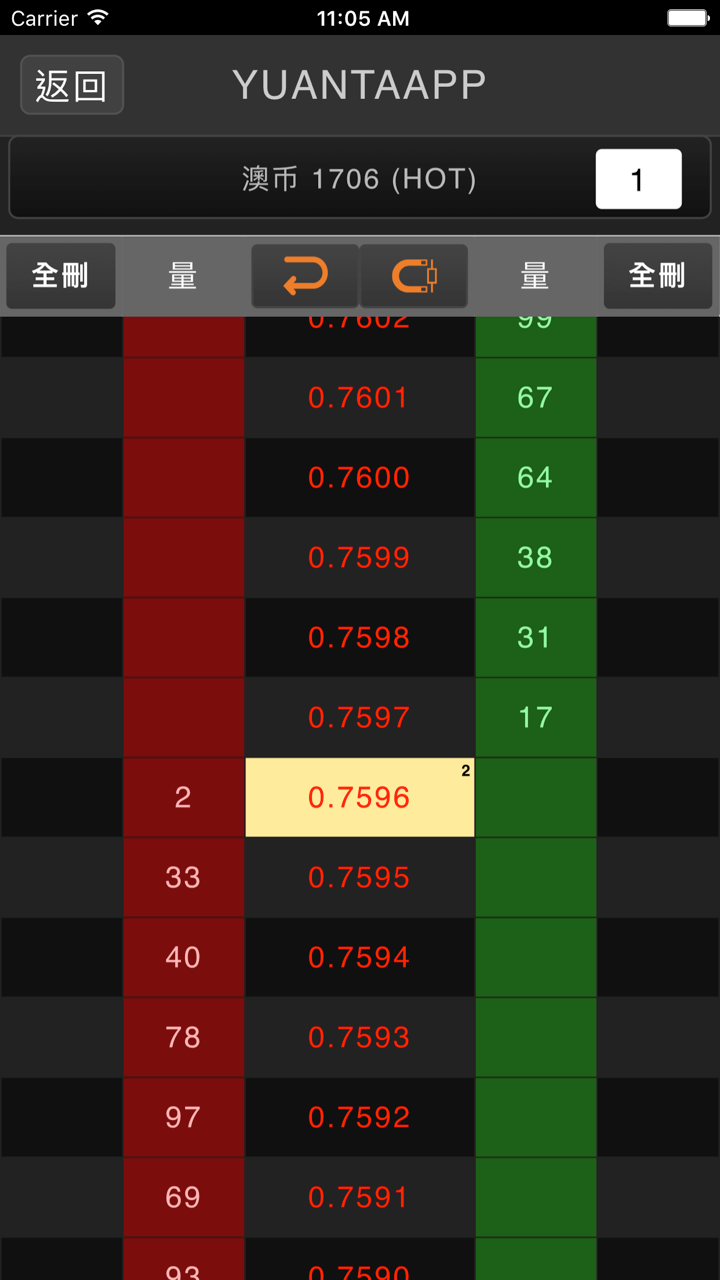

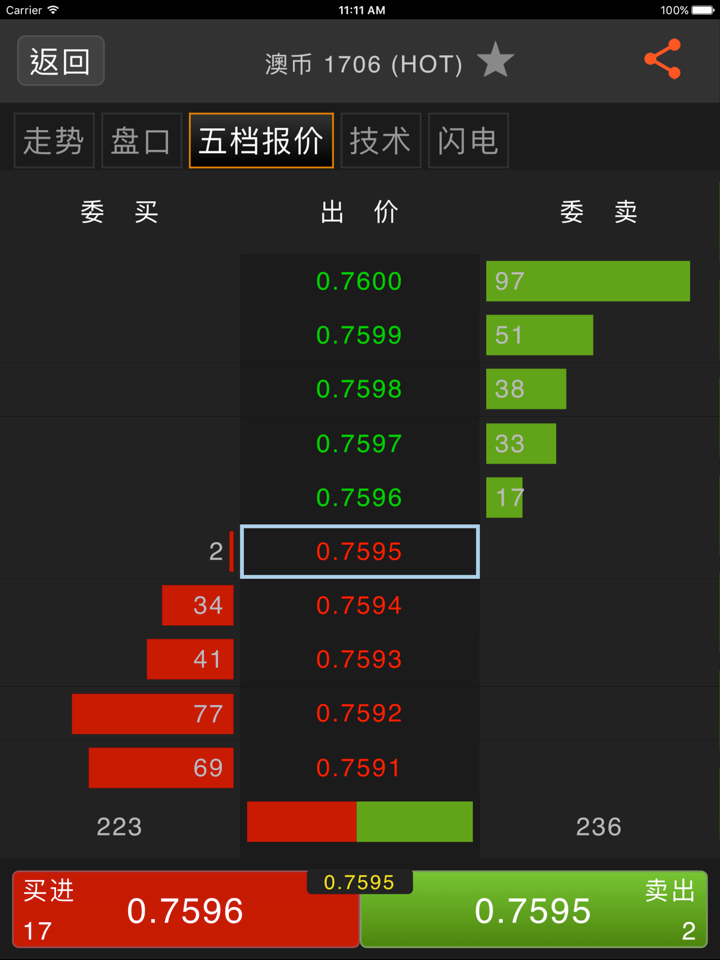

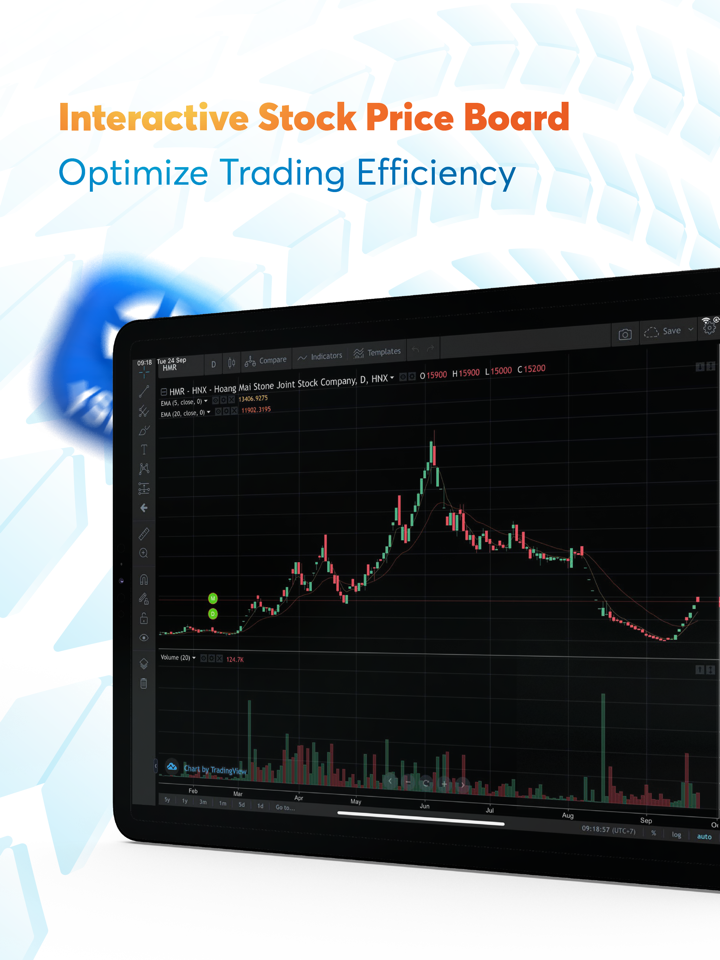

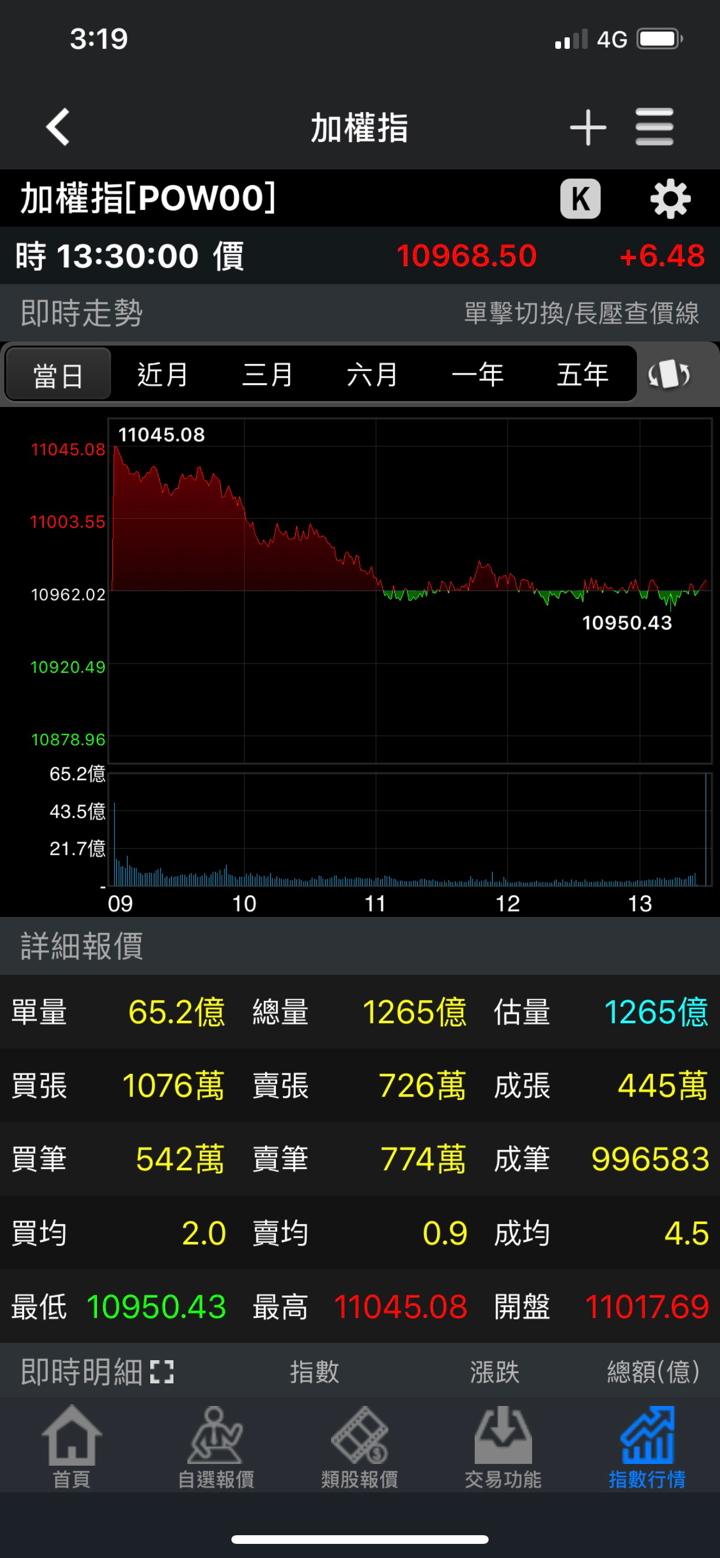

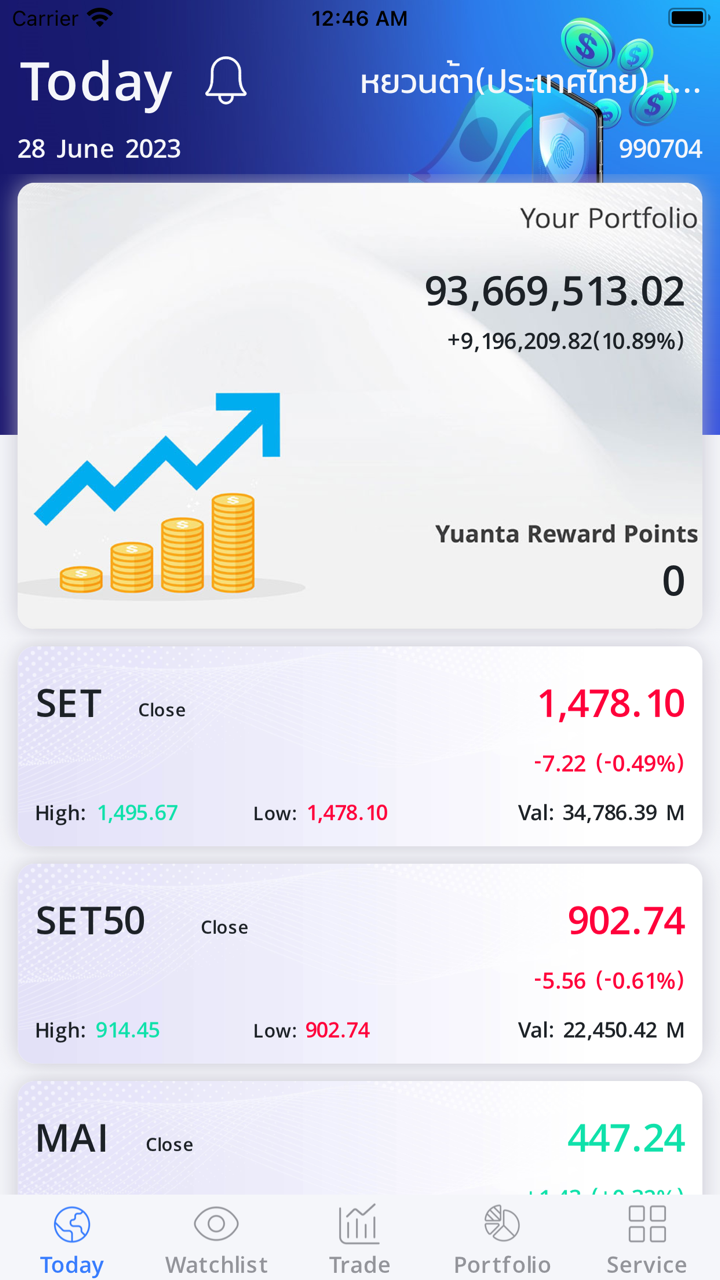

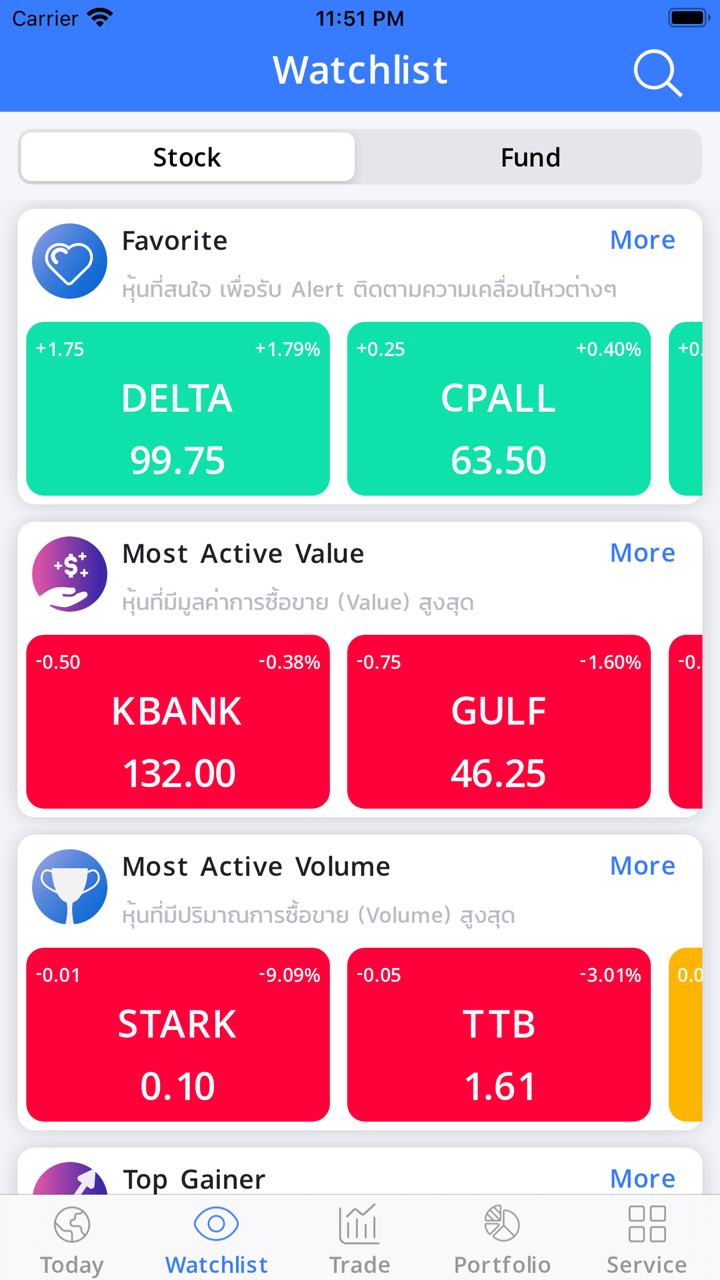

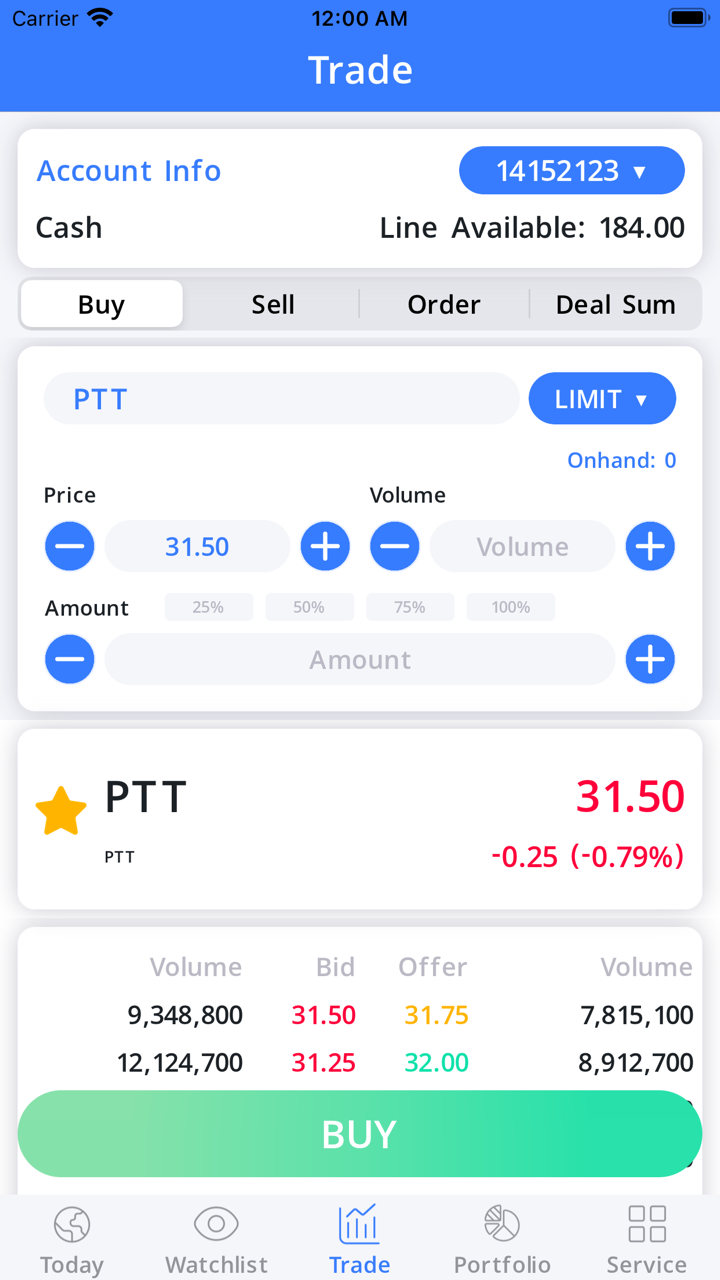

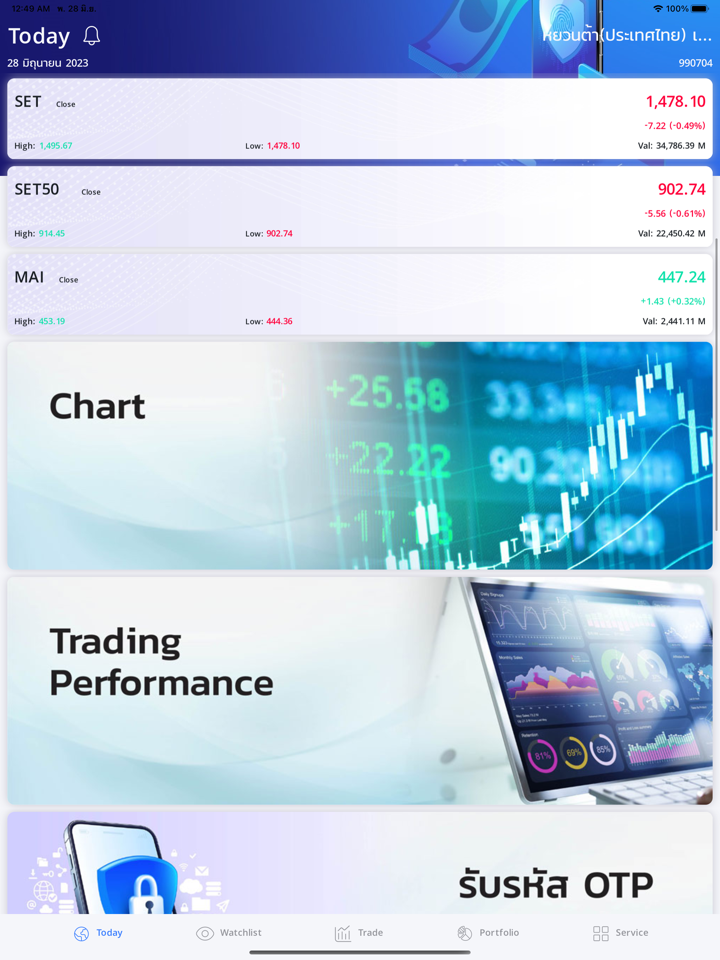

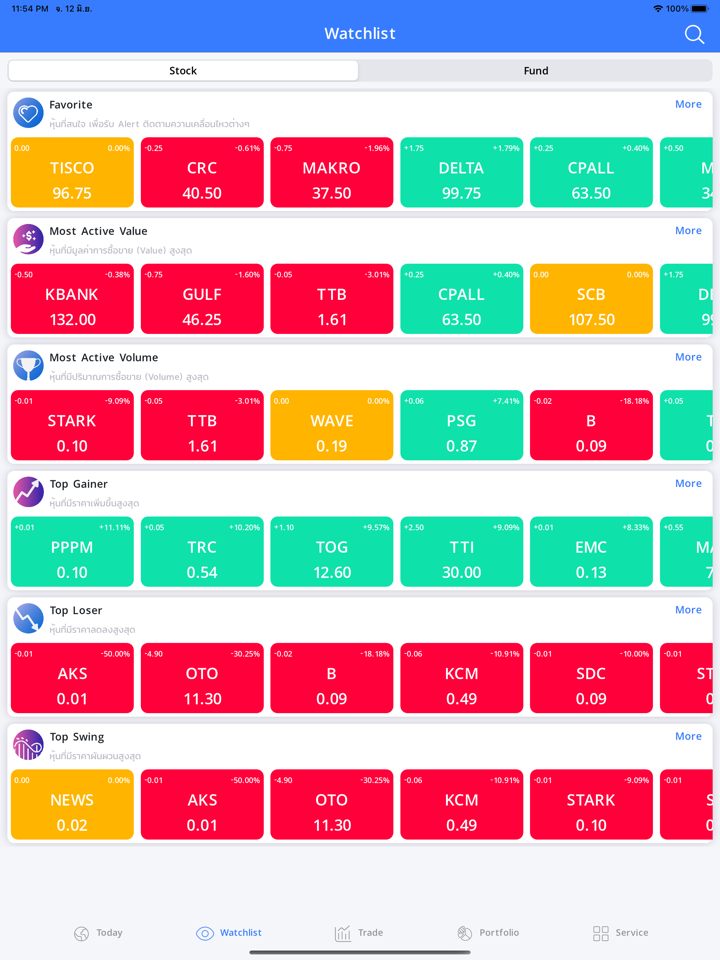

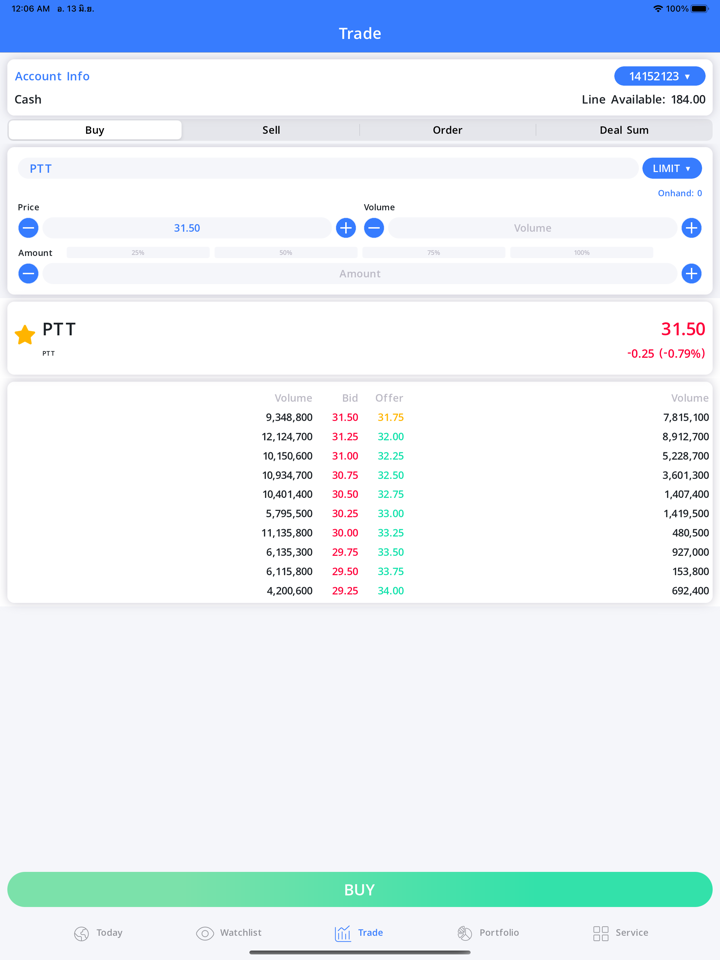

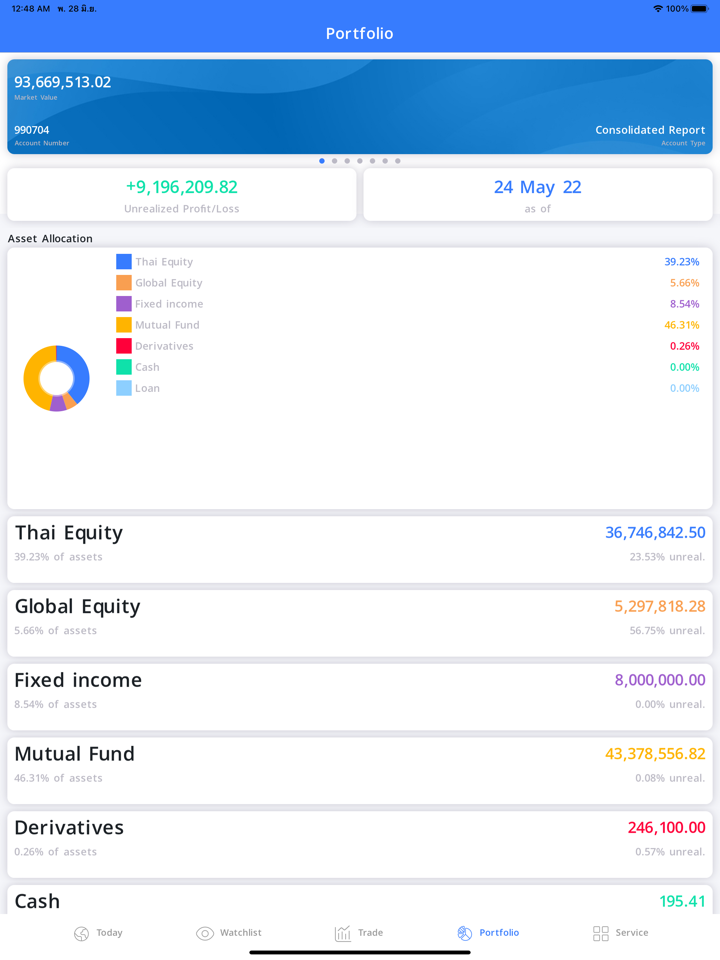

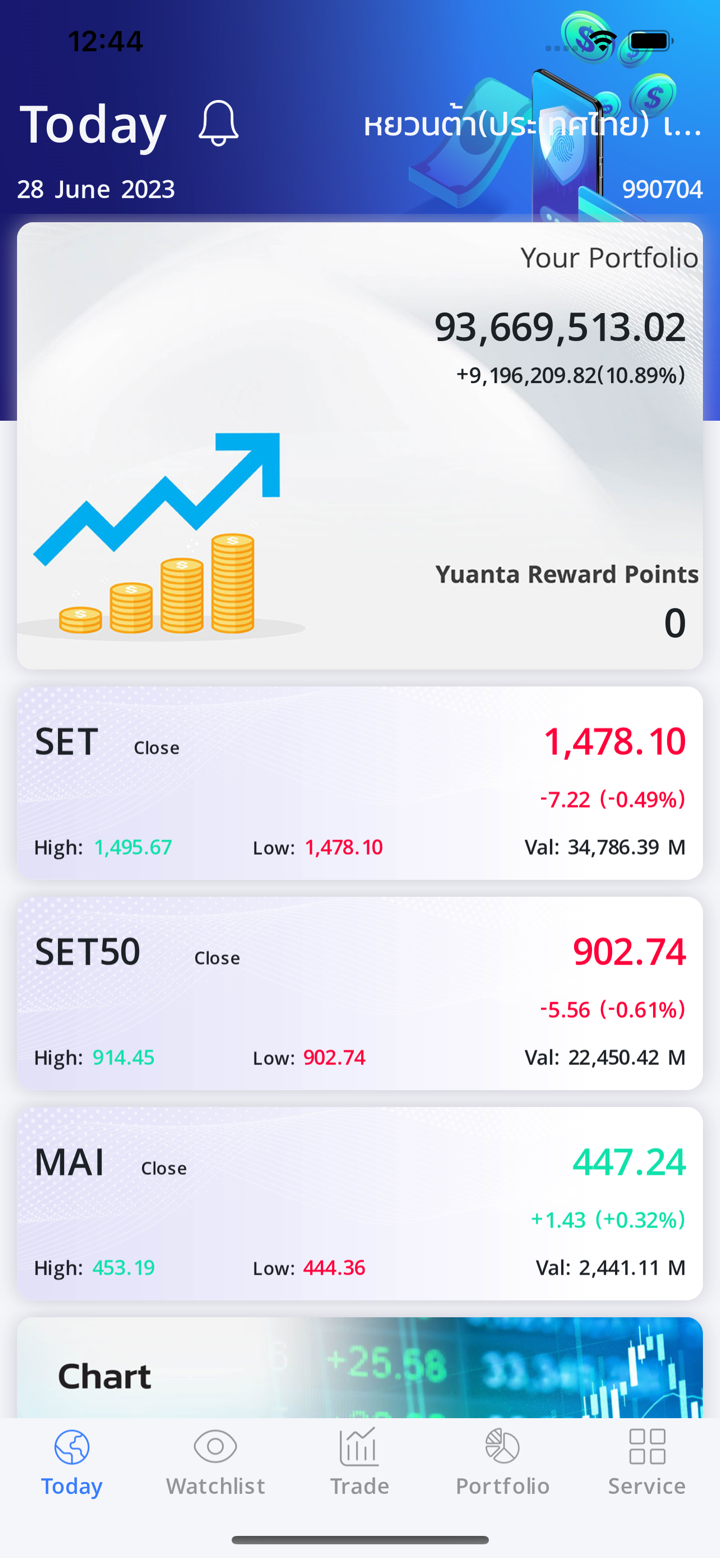

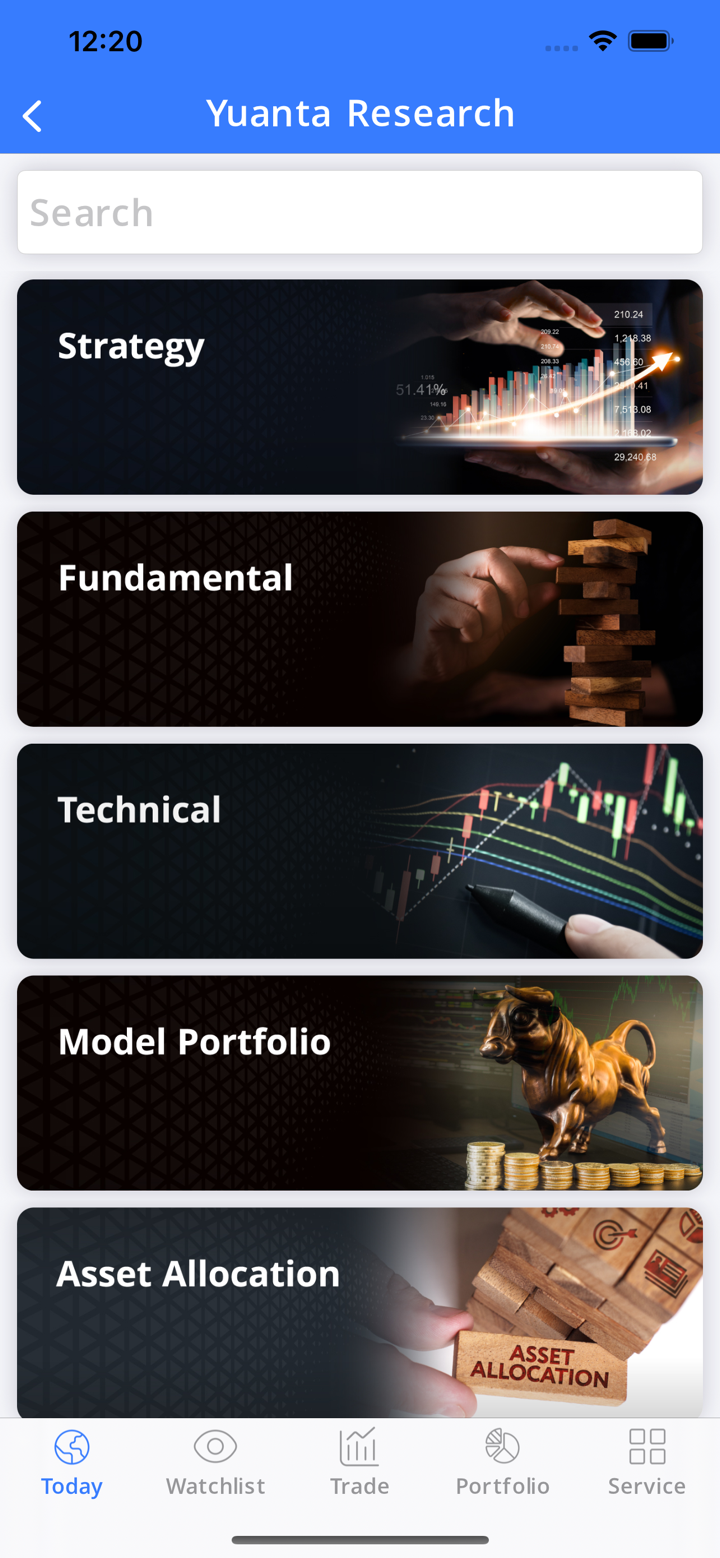

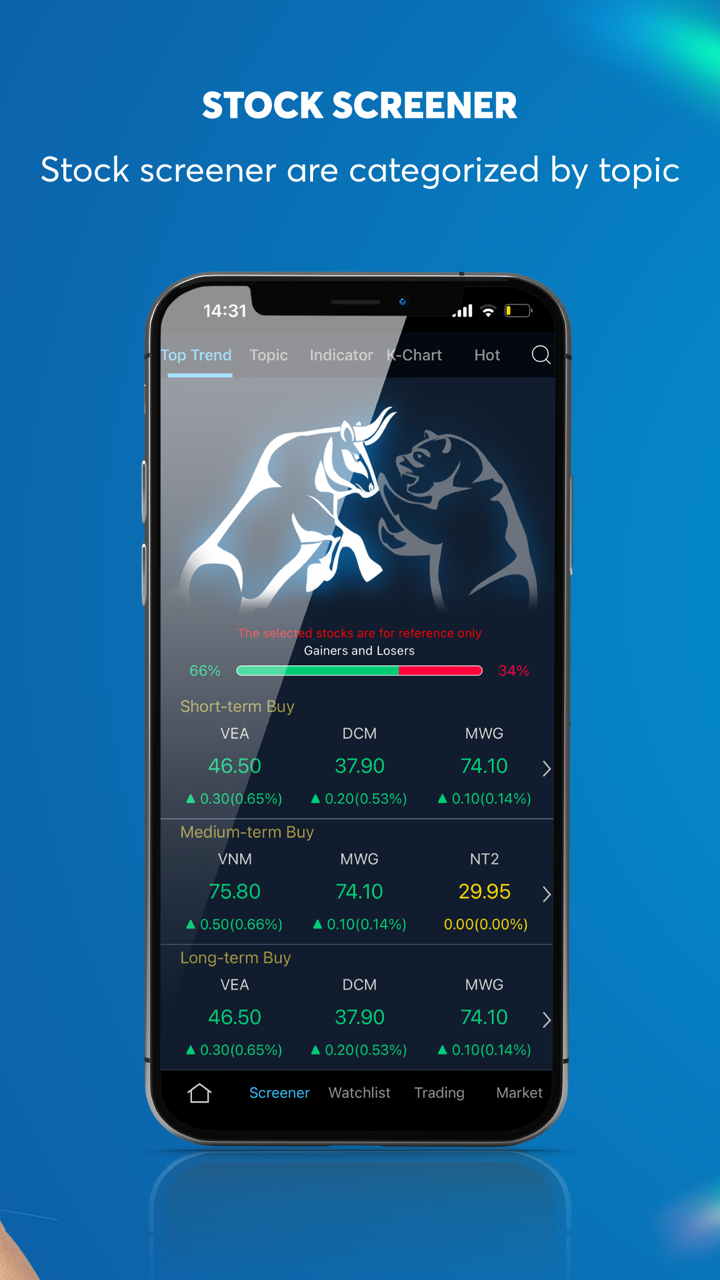

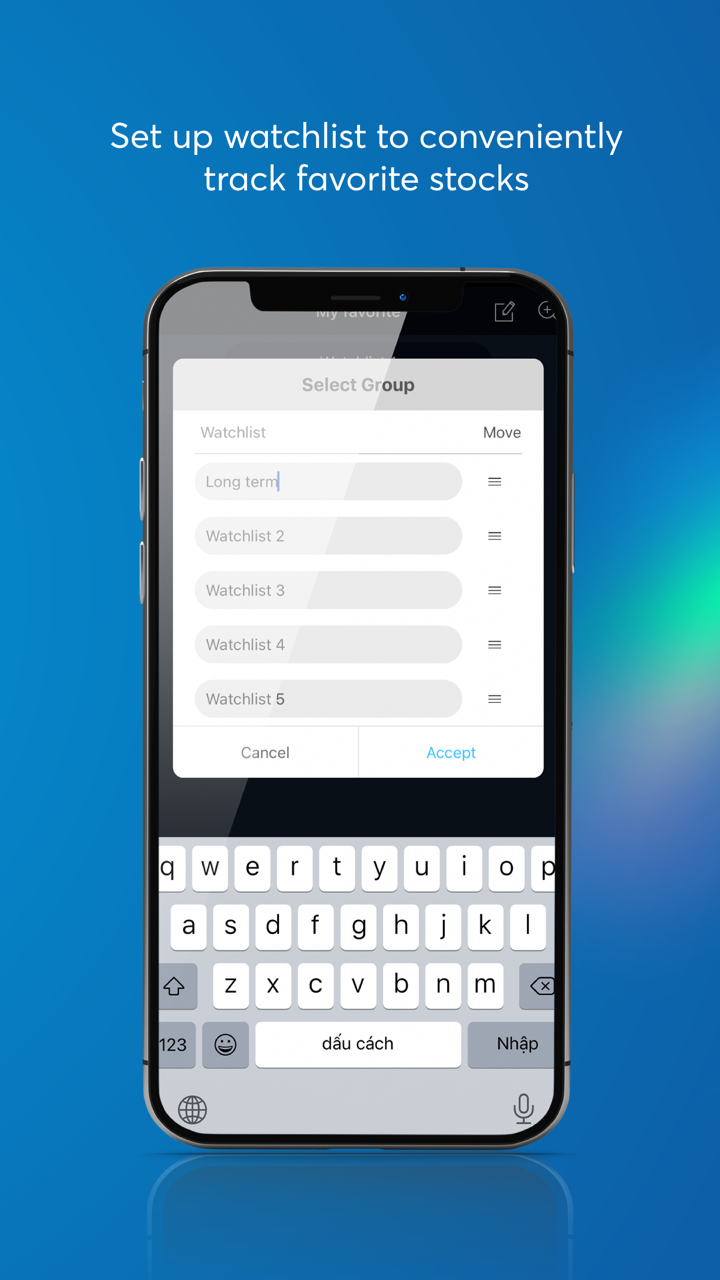

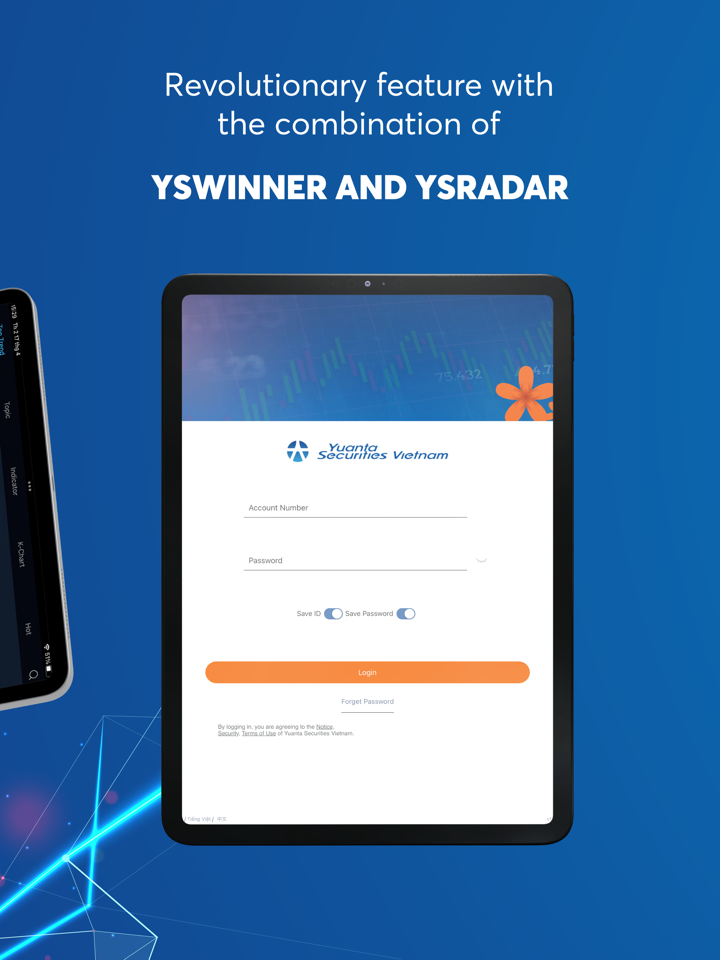

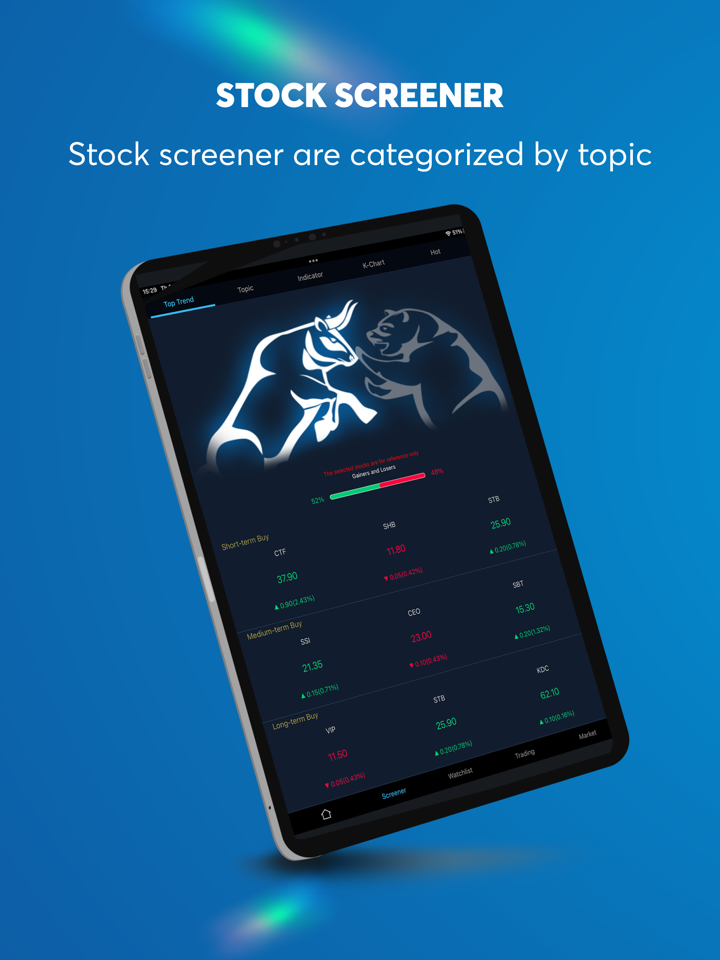

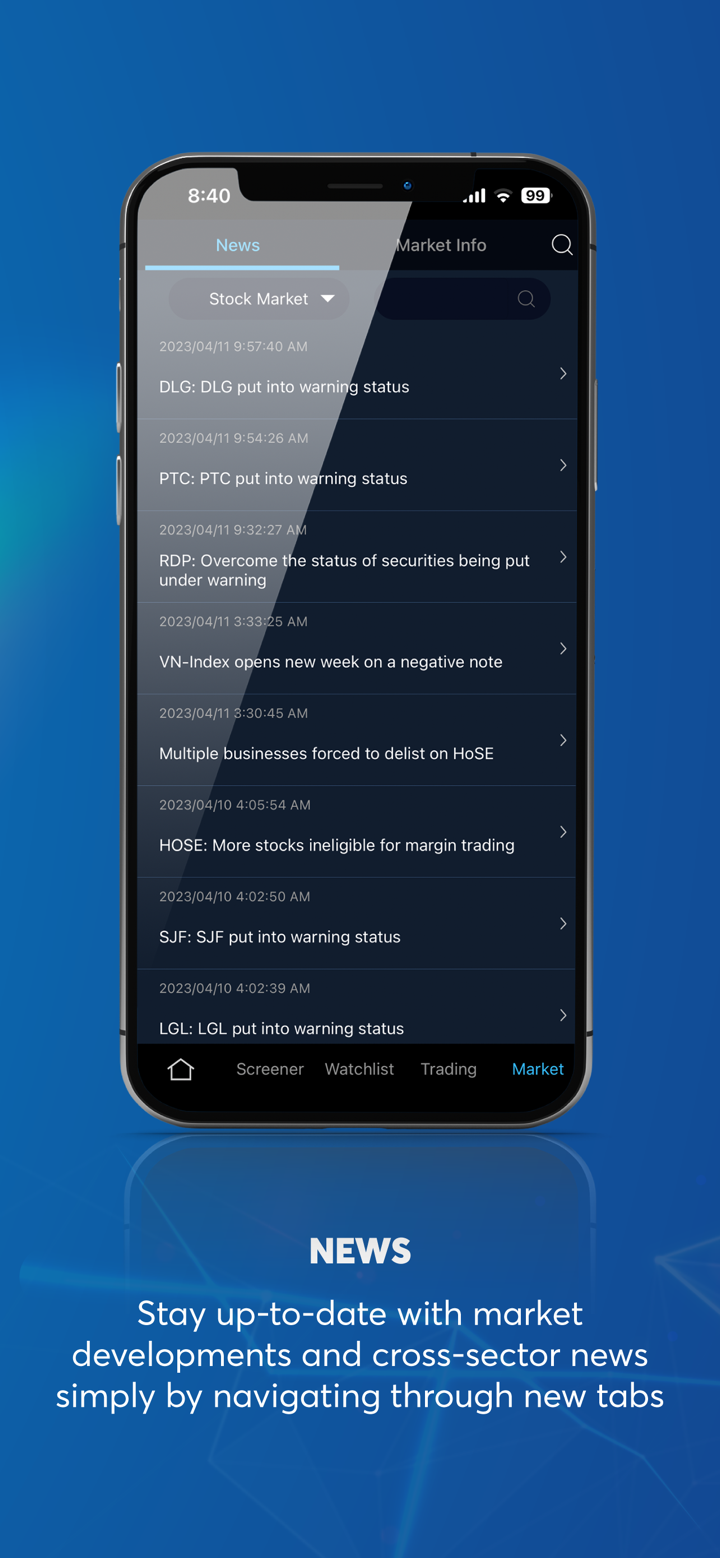

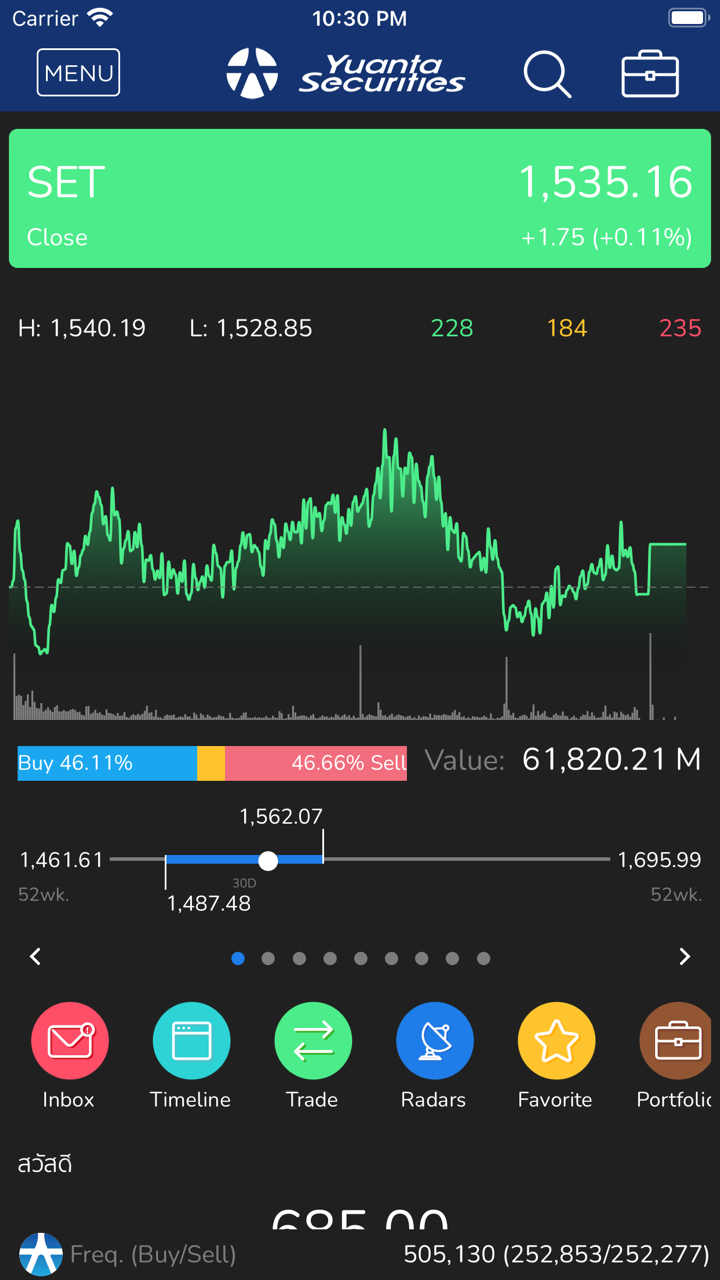

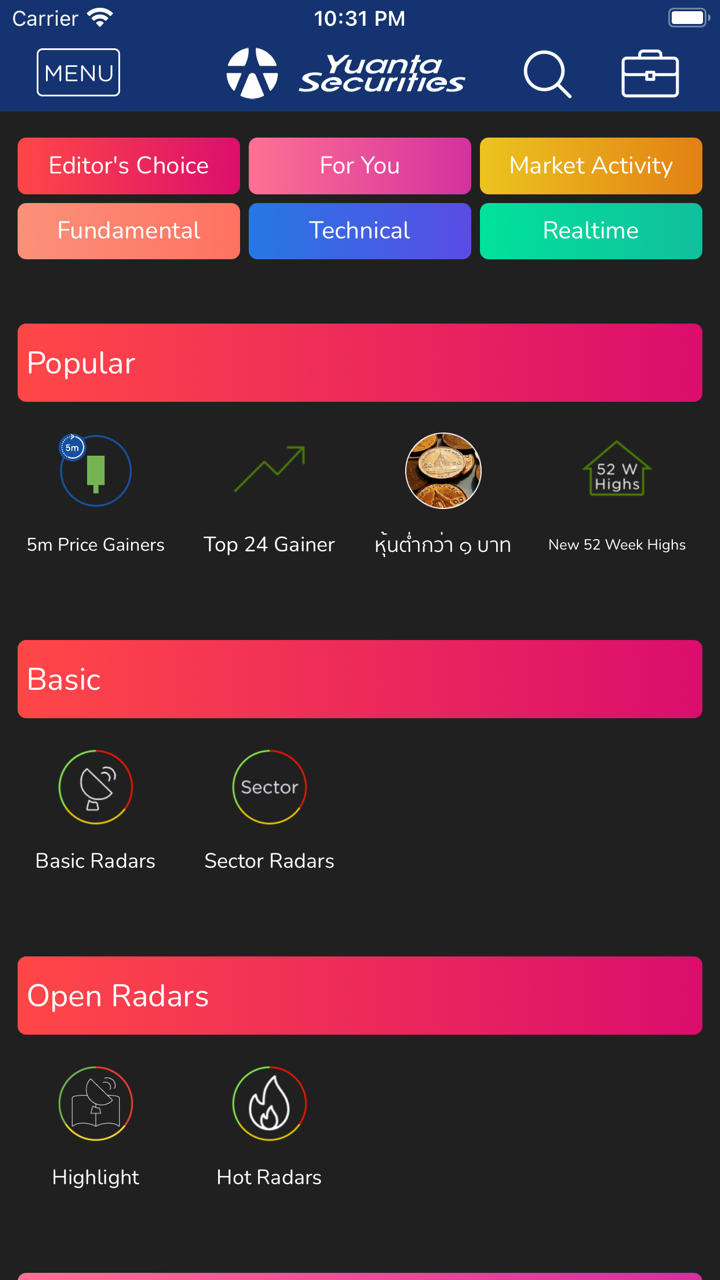

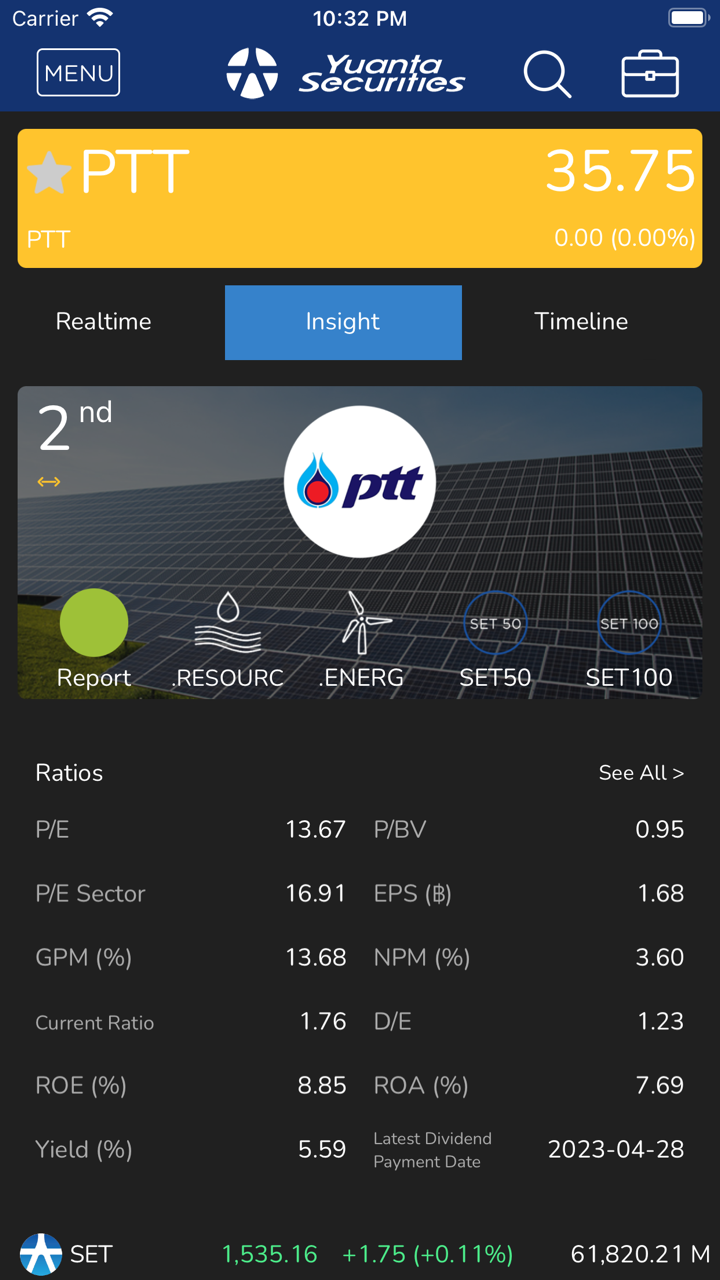

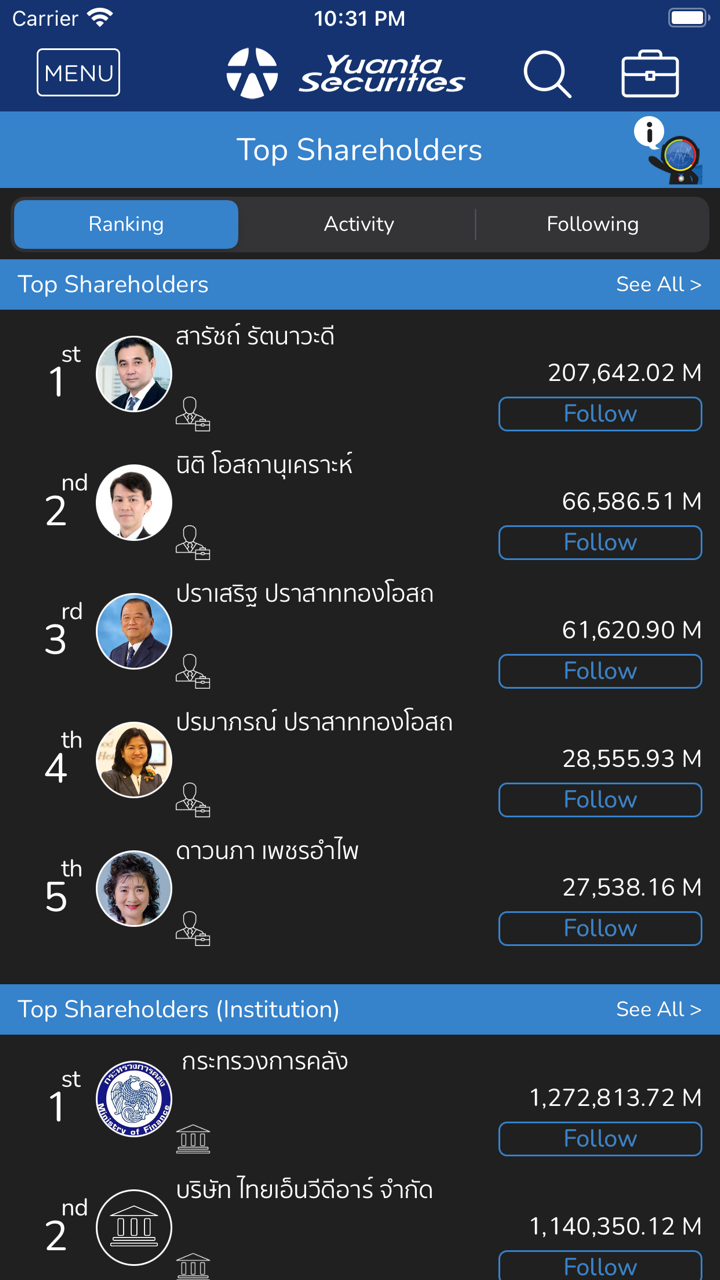

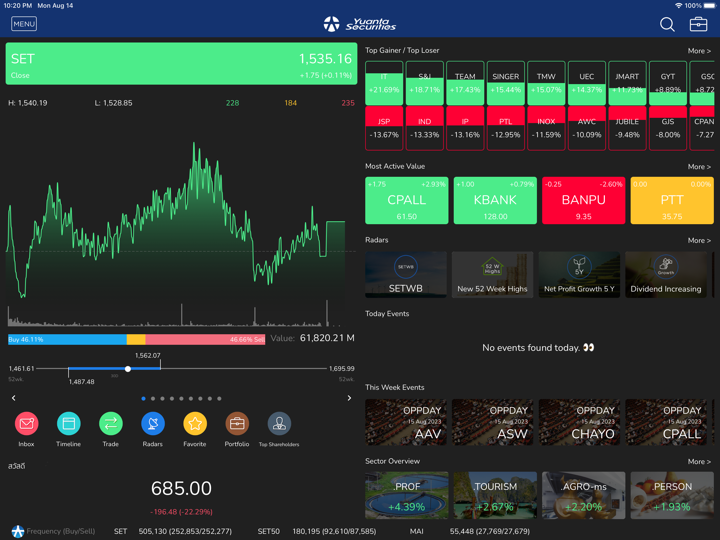

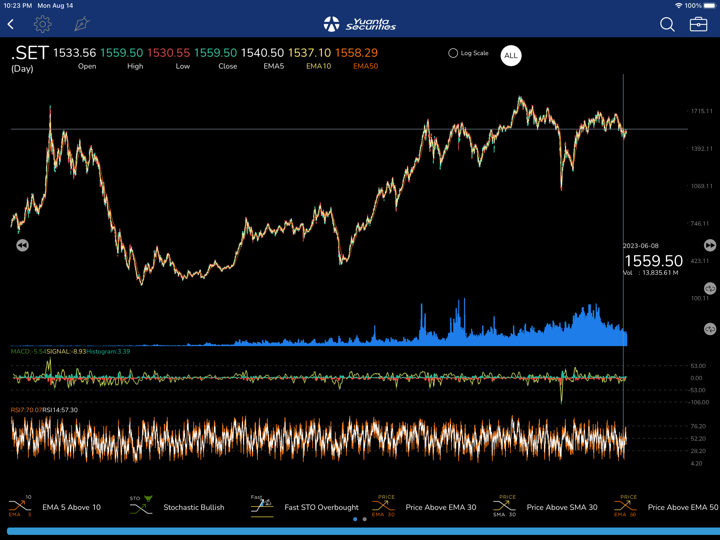

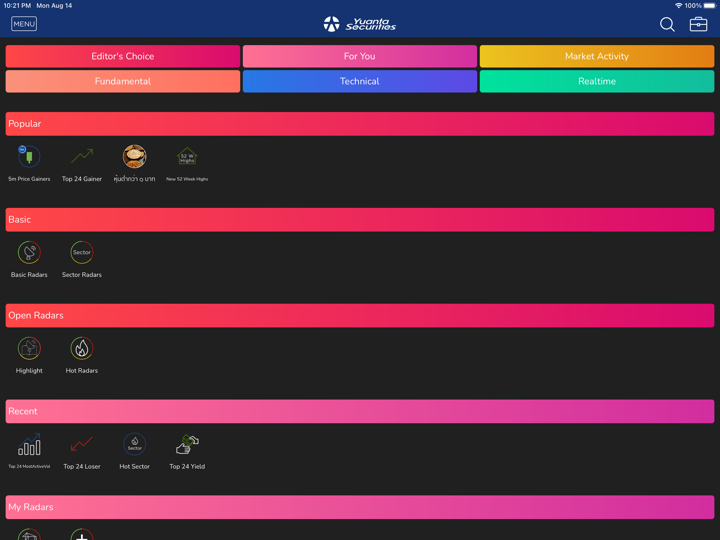

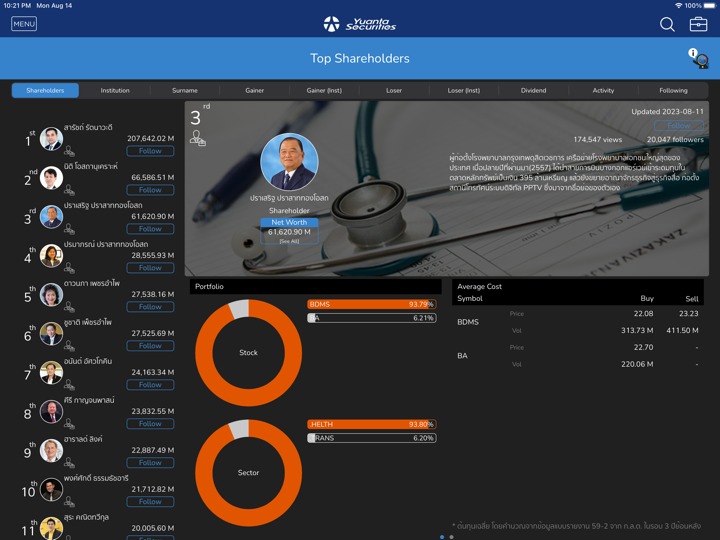

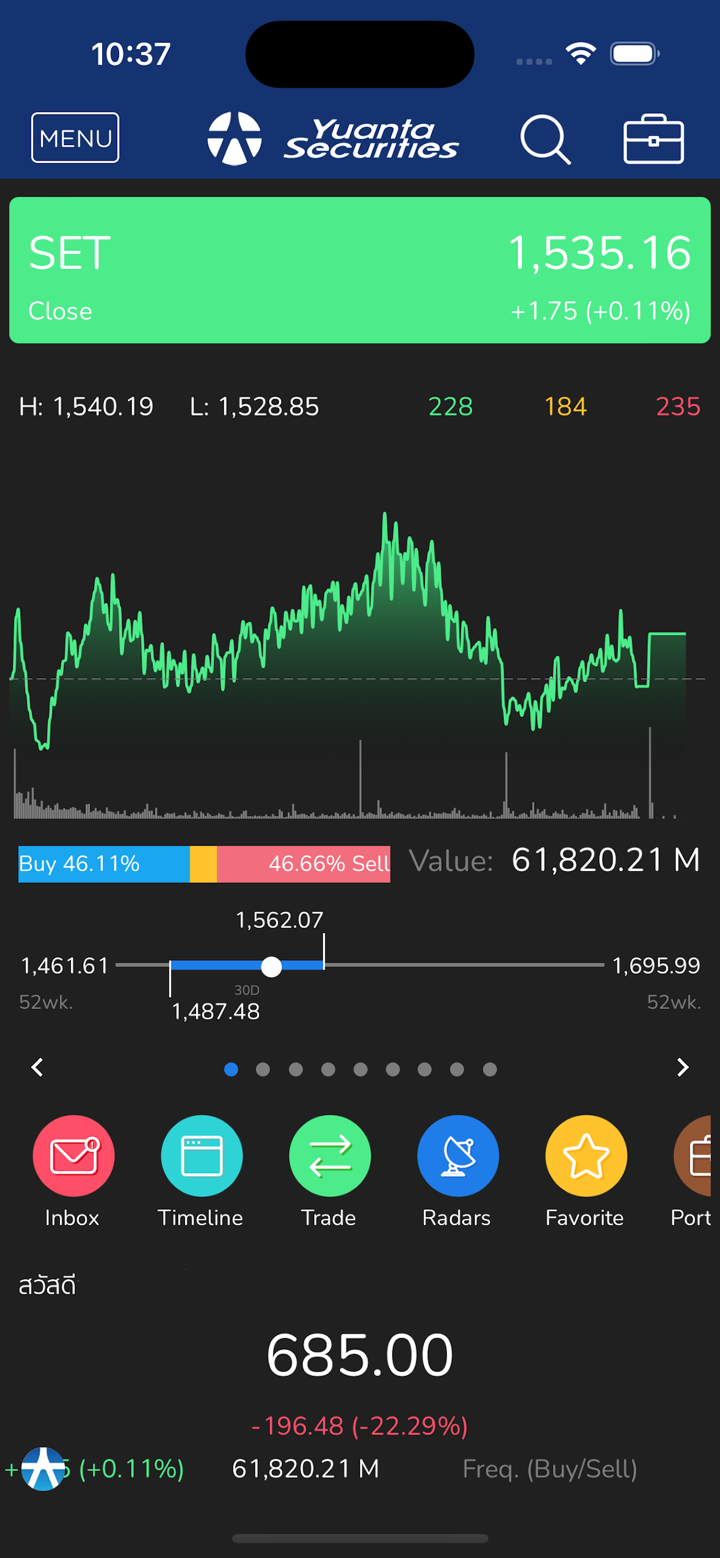

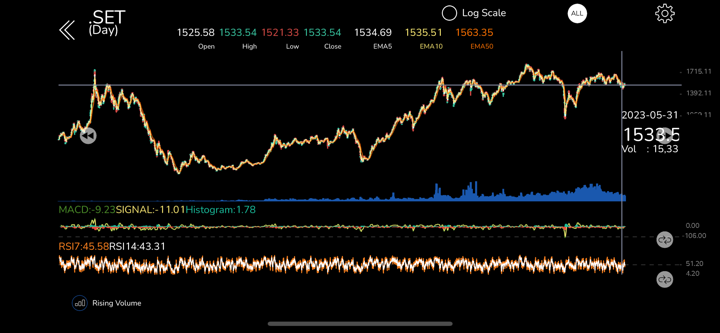

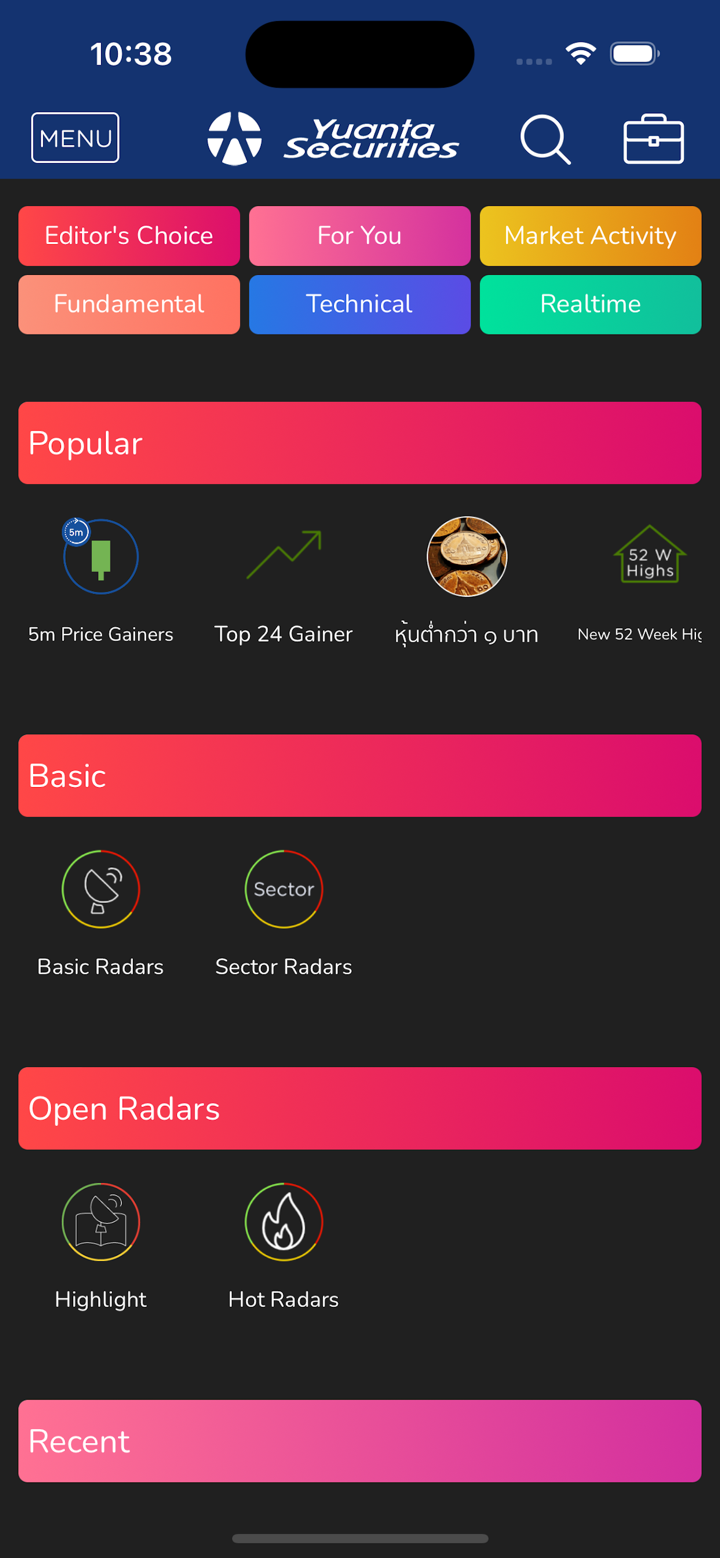

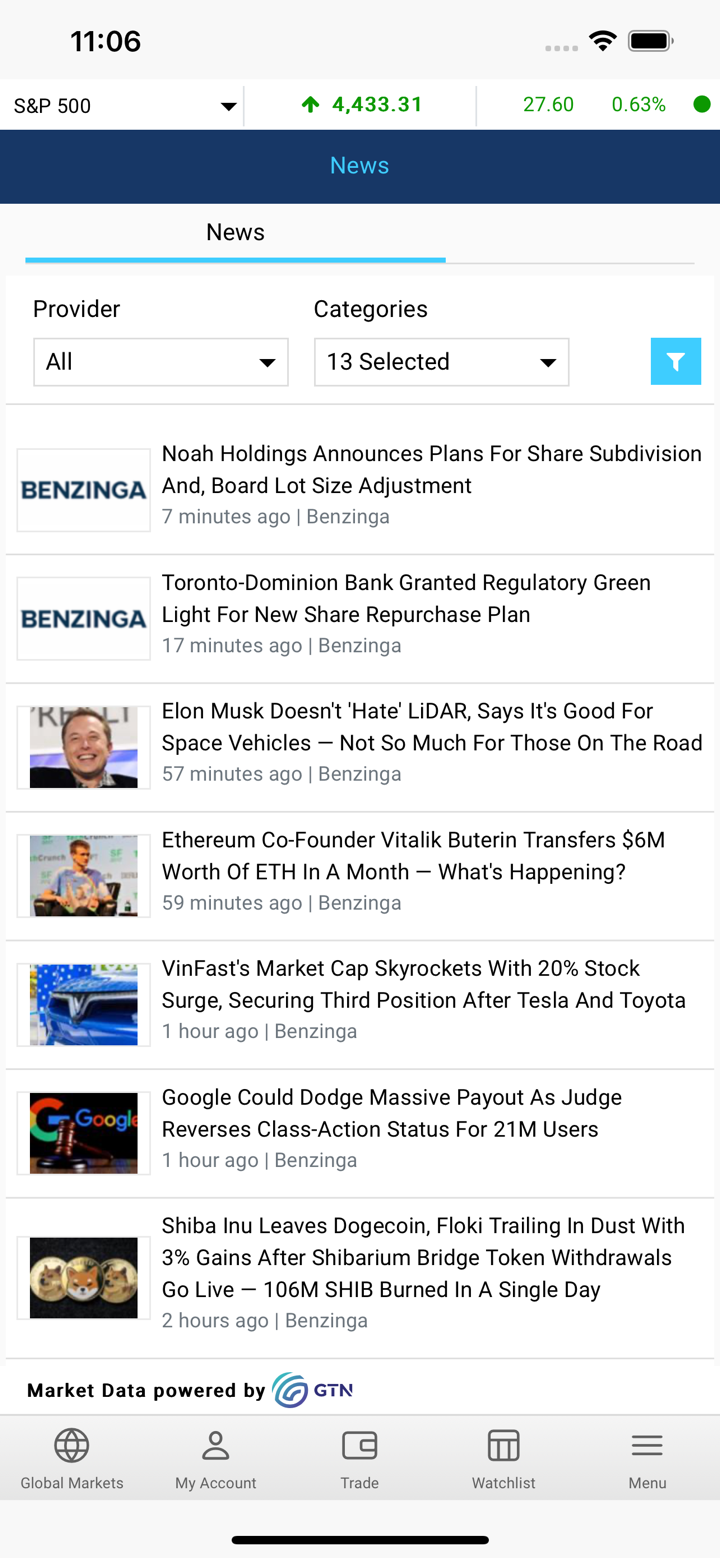

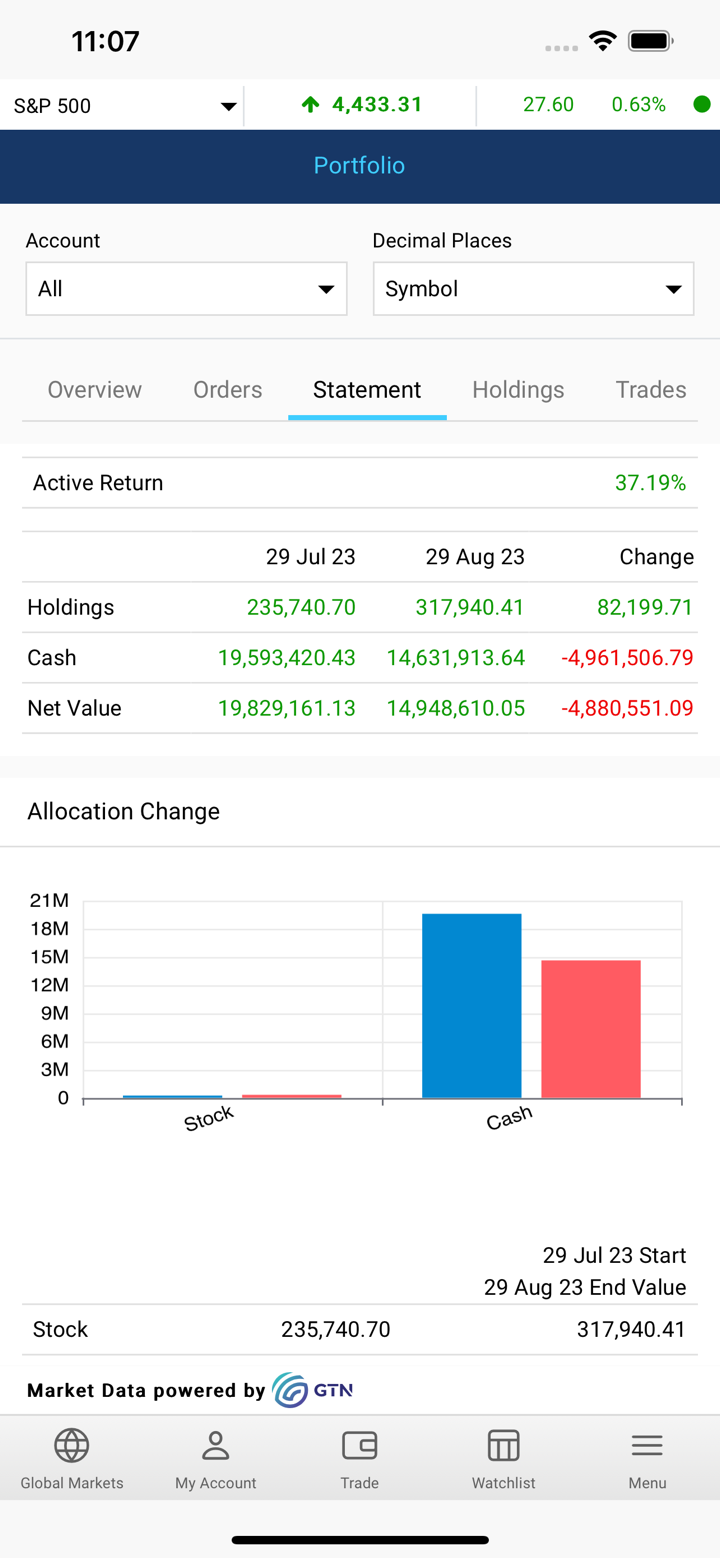

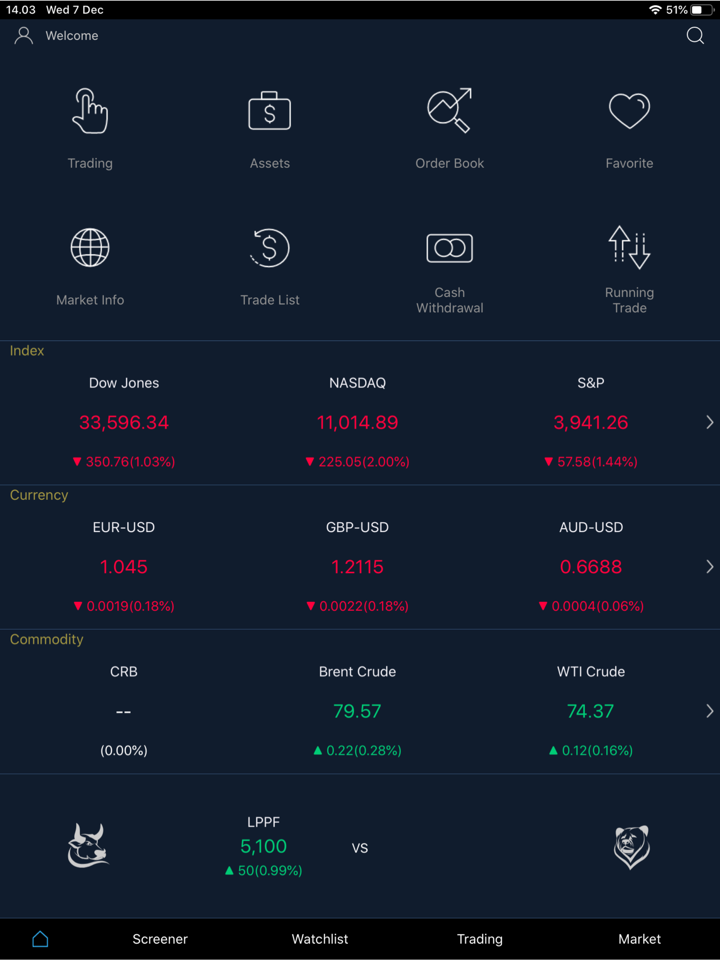

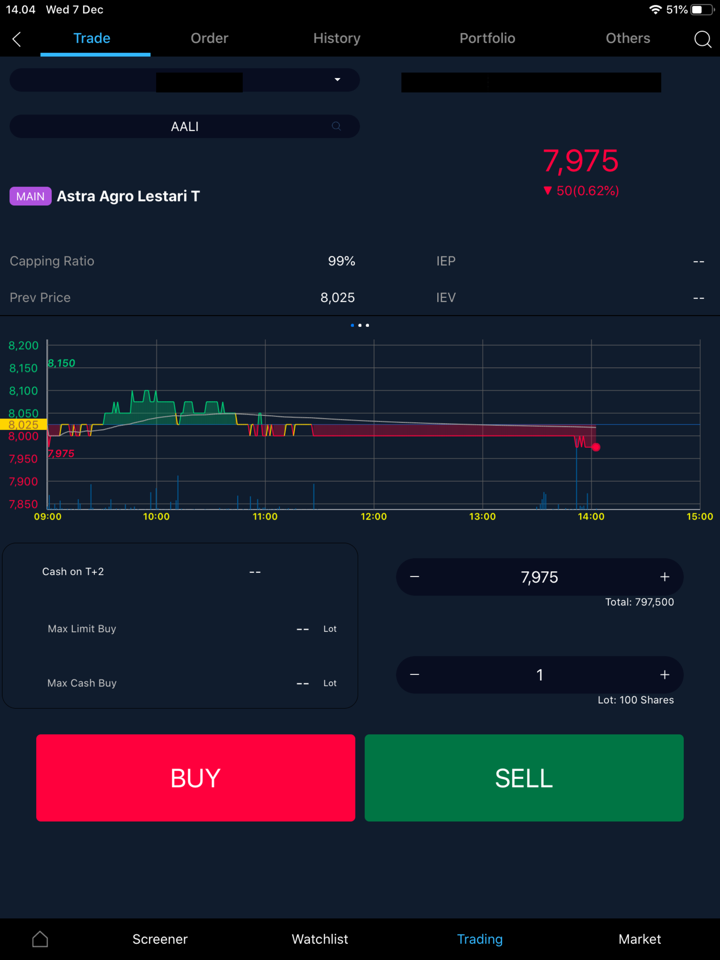

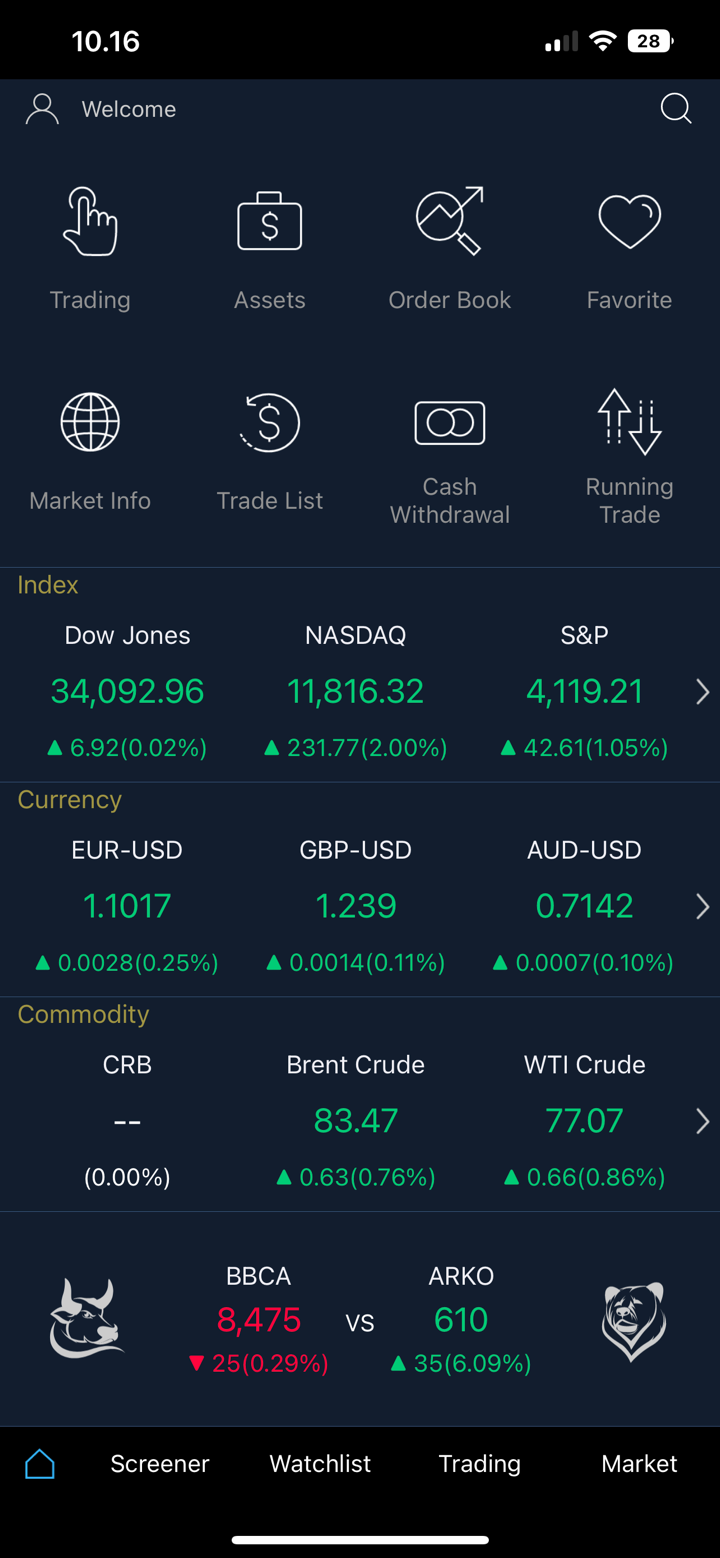

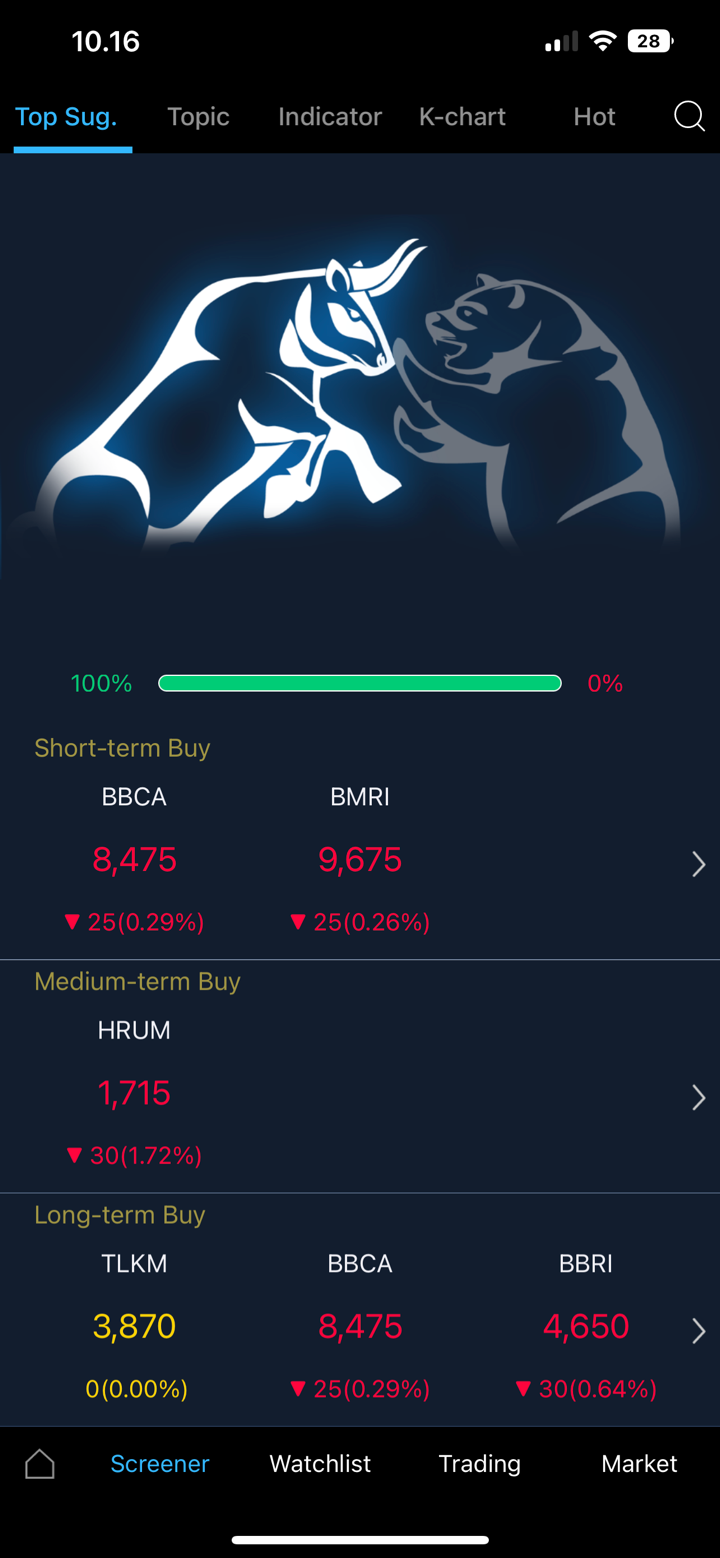

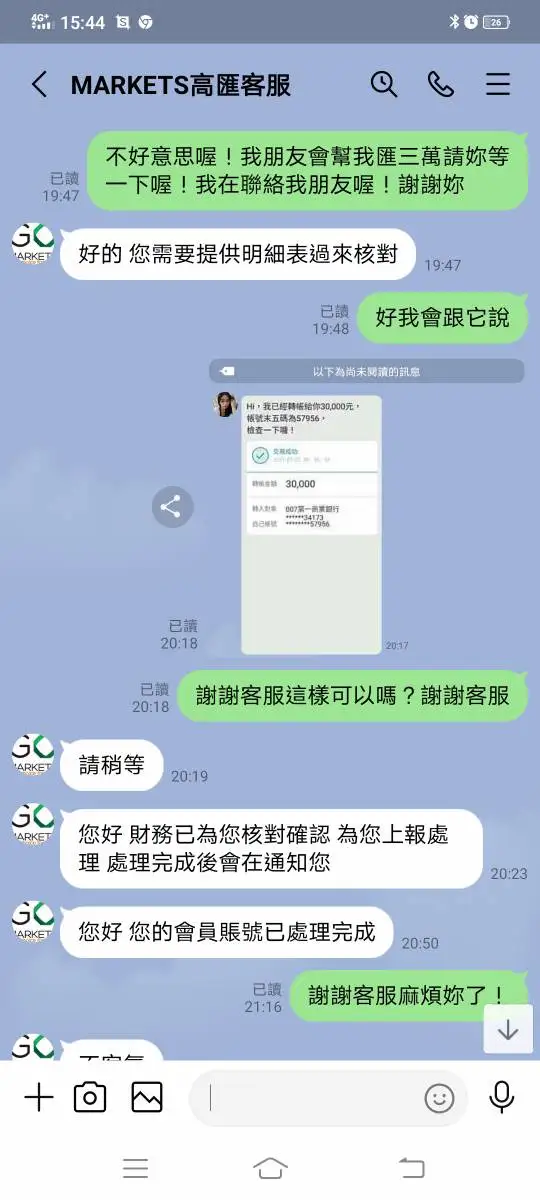

交易平台

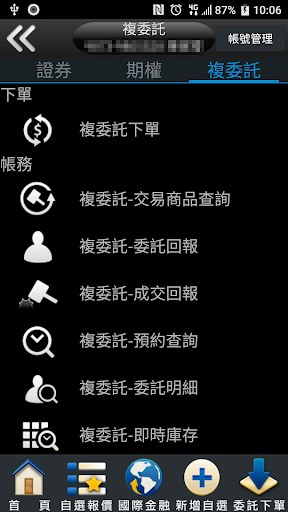

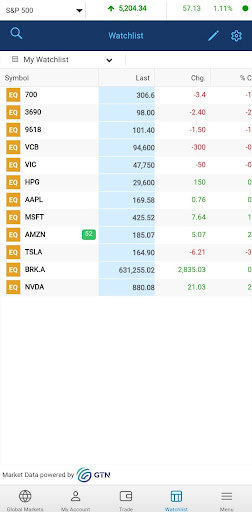

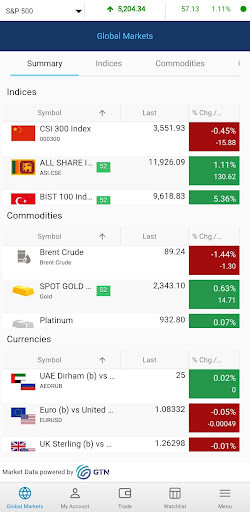

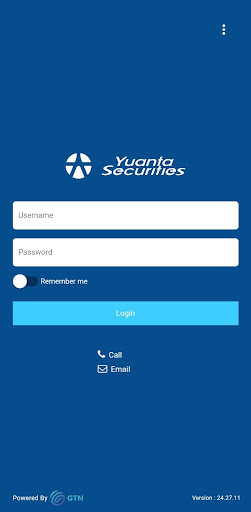

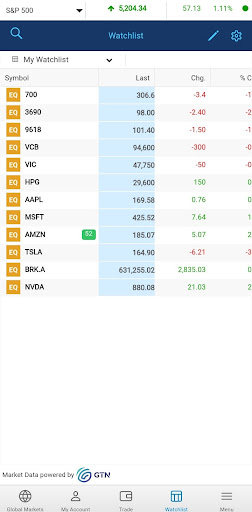

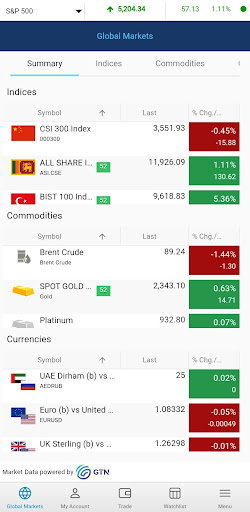

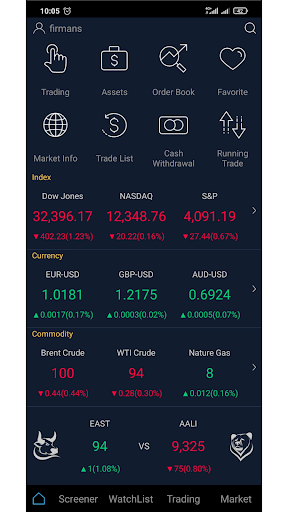

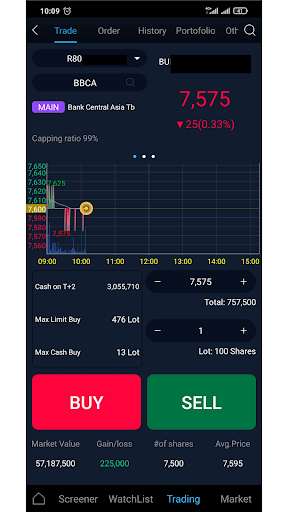

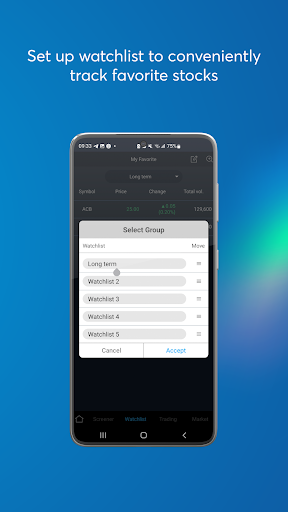

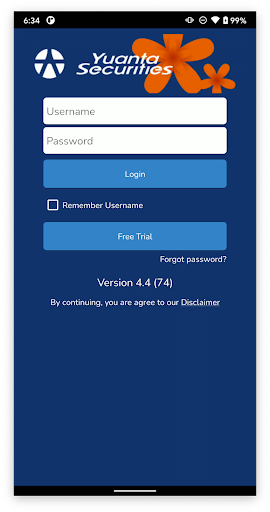

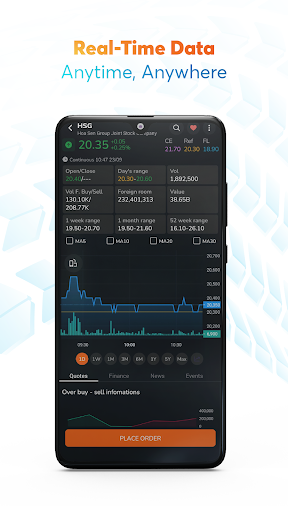

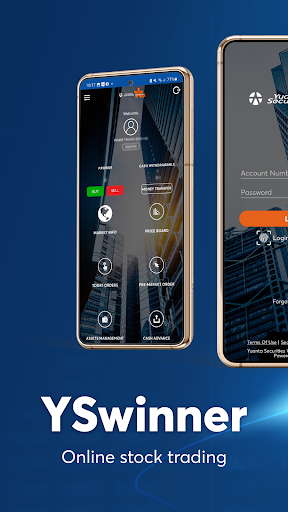

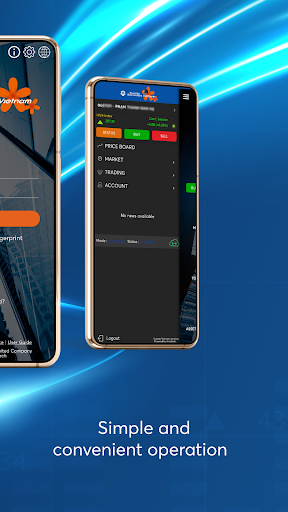

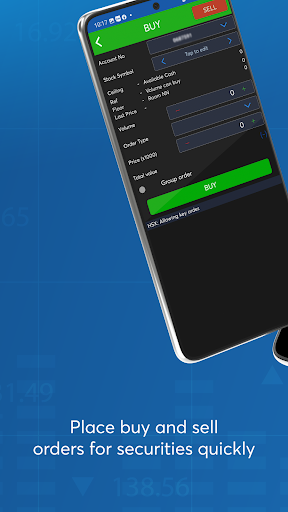

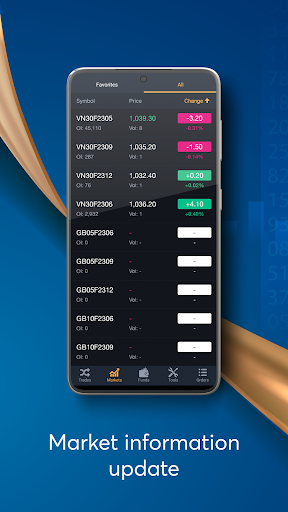

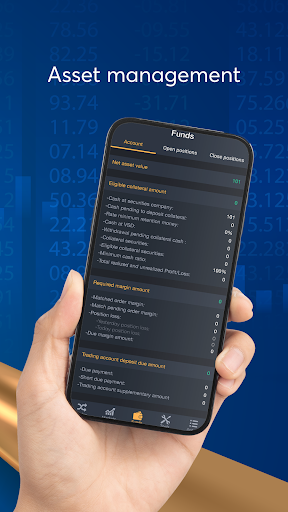

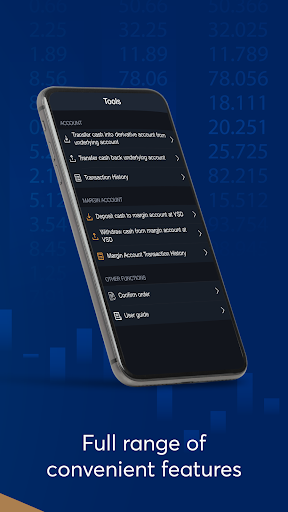

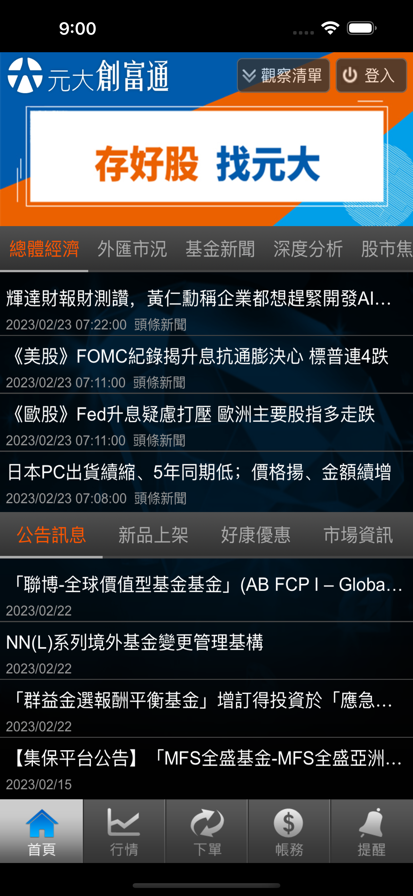

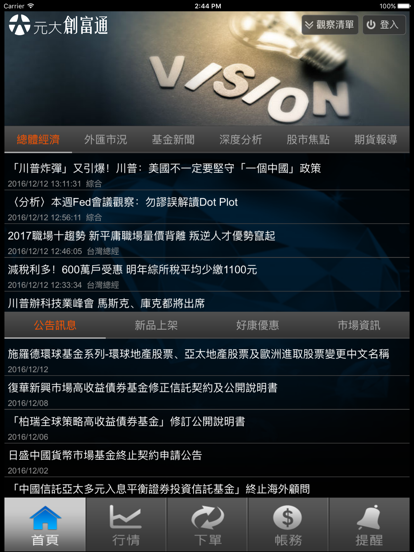

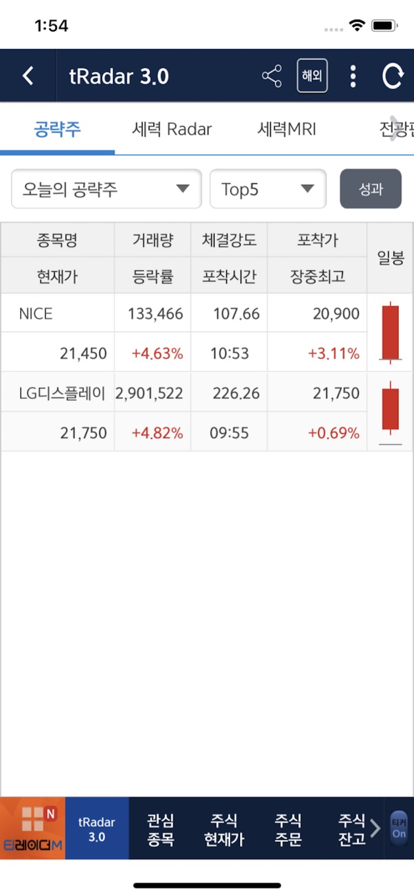

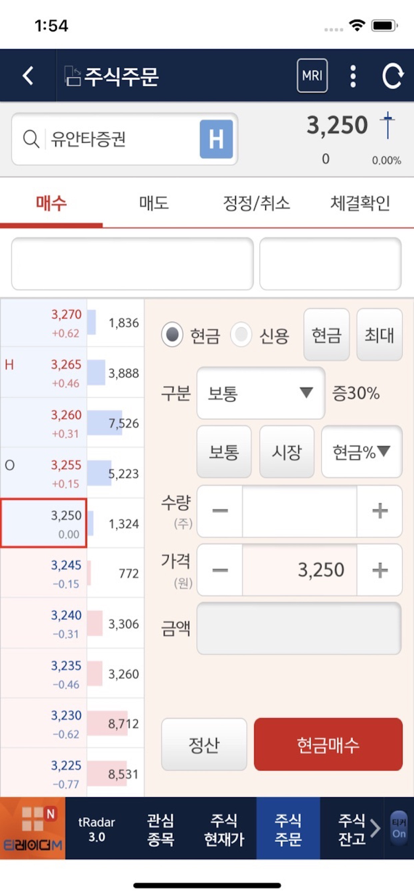

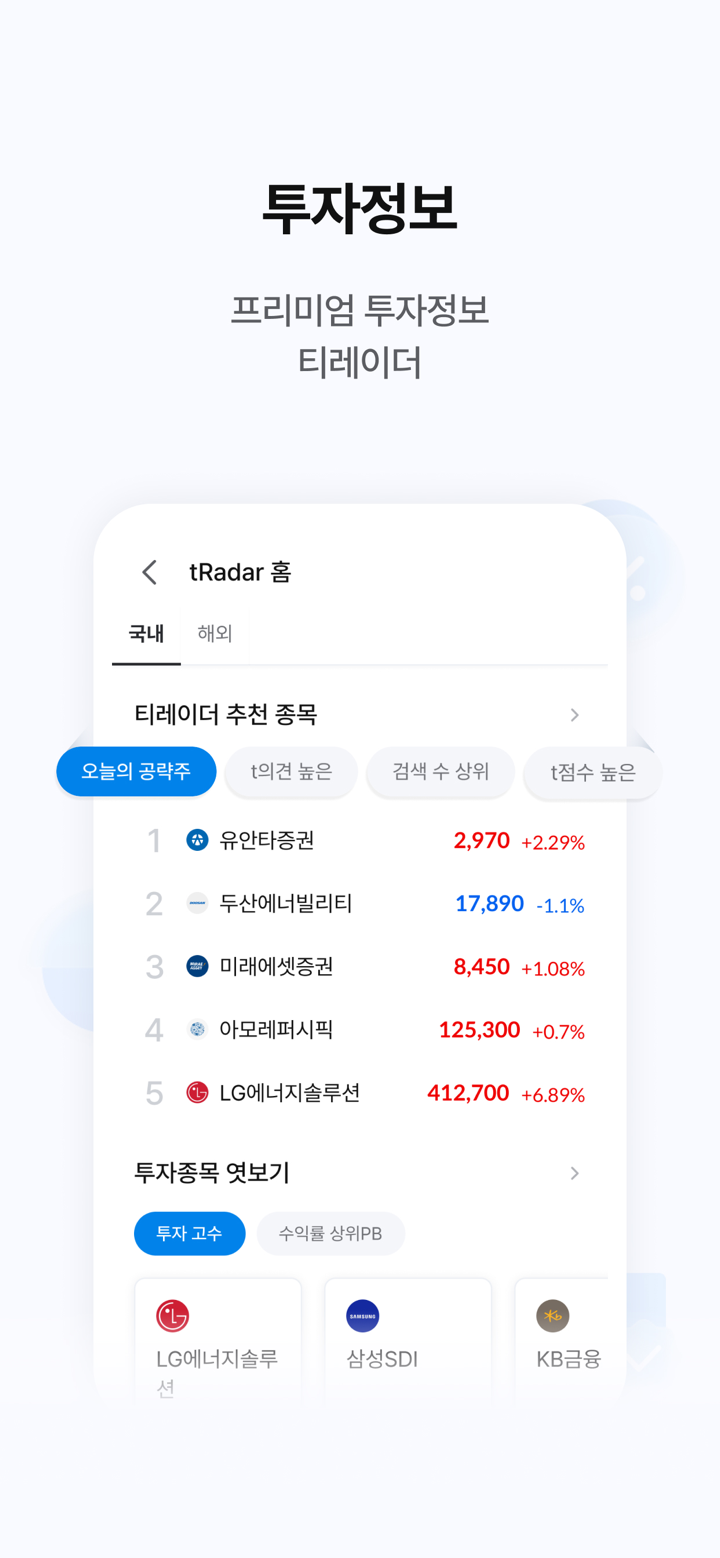

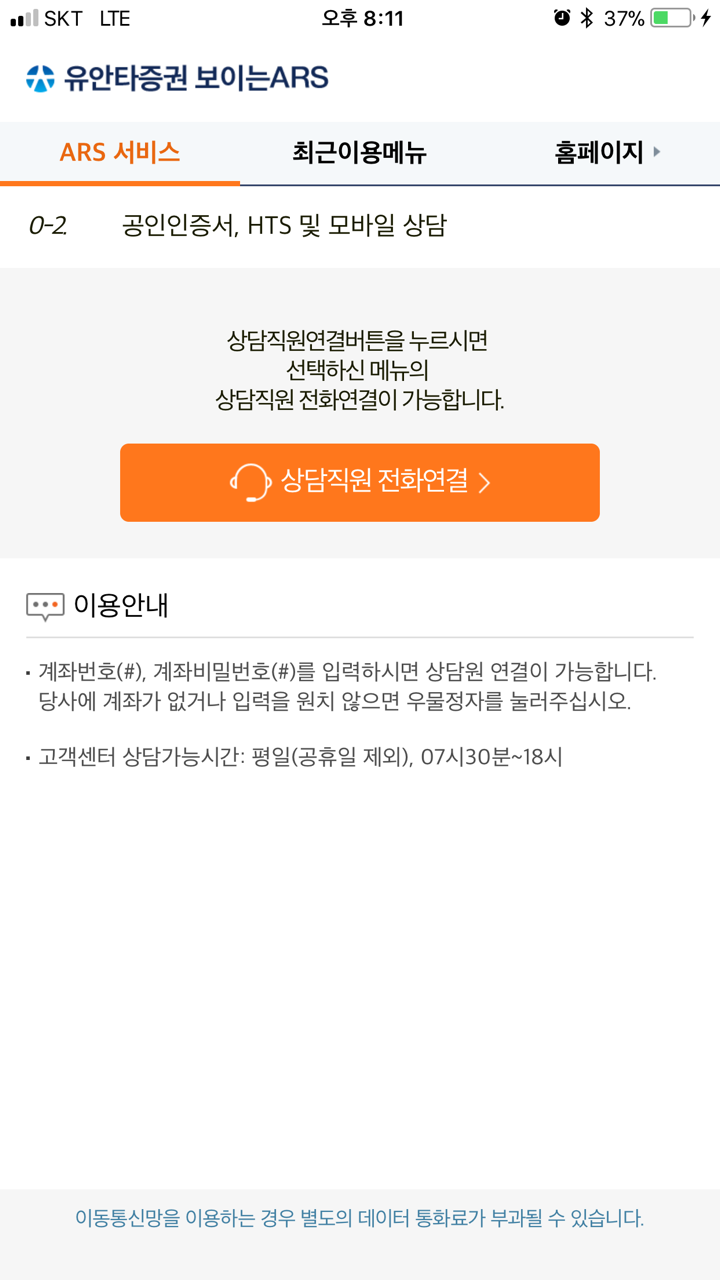

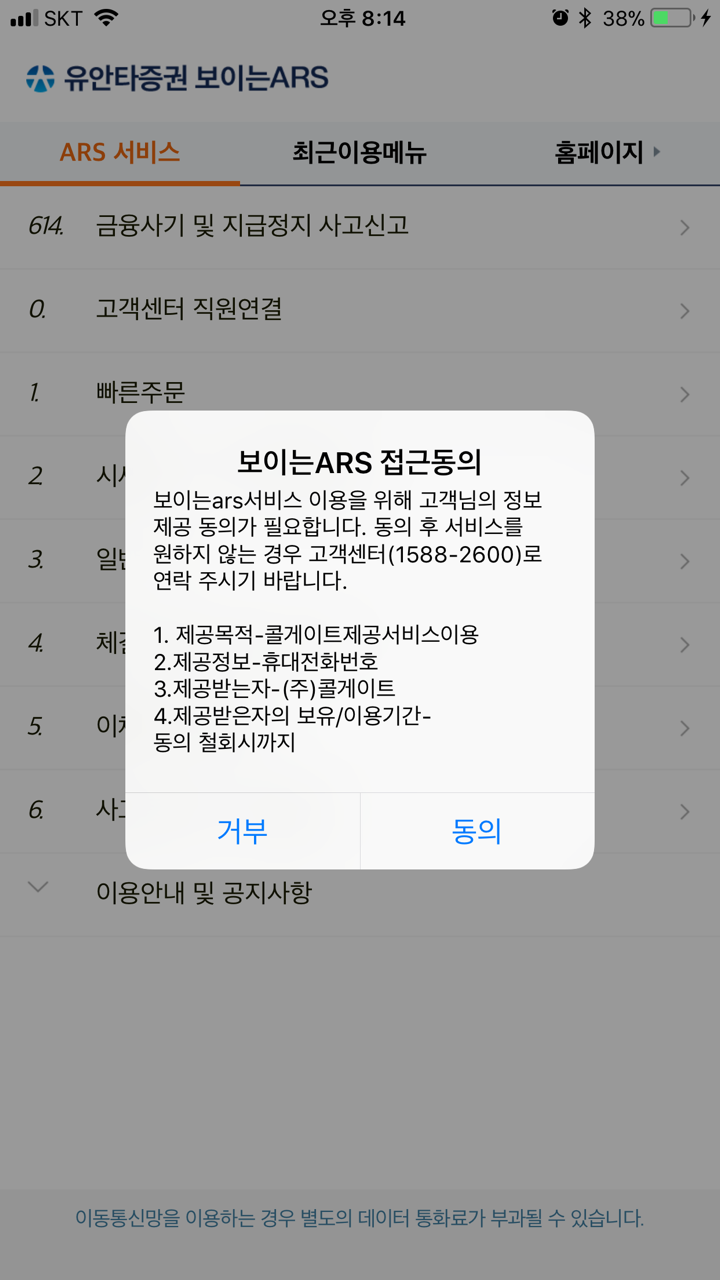

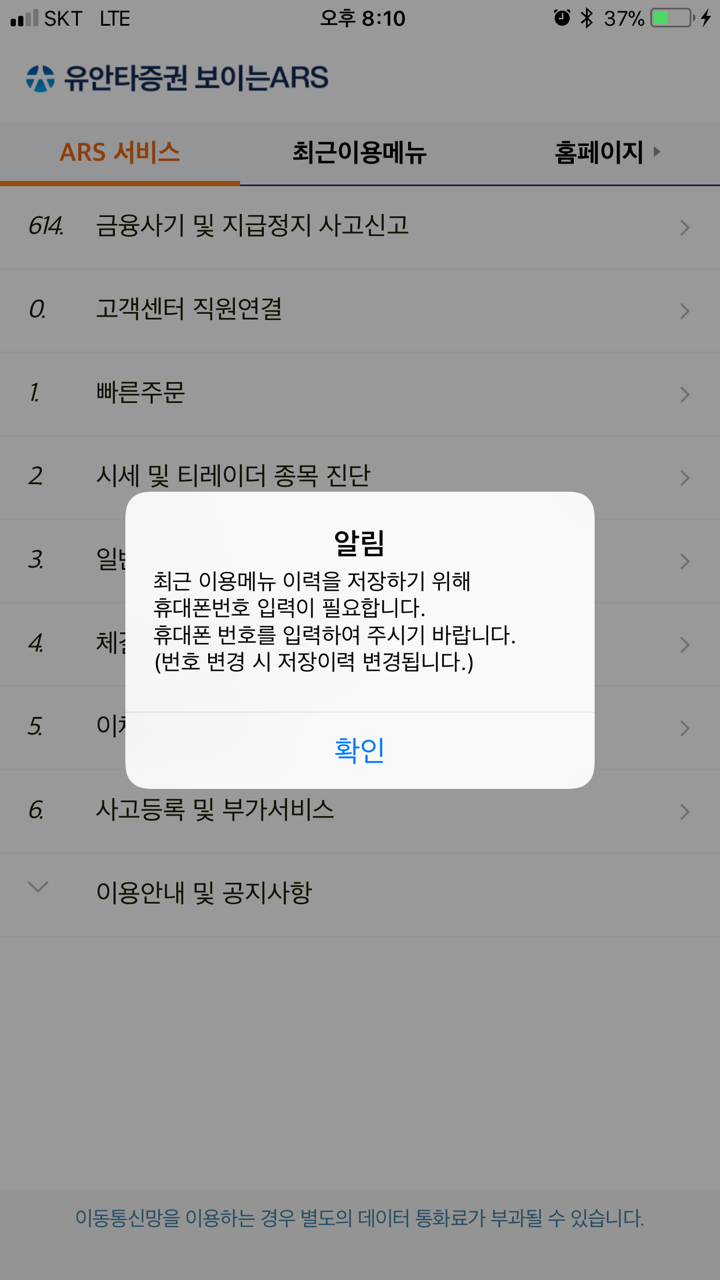

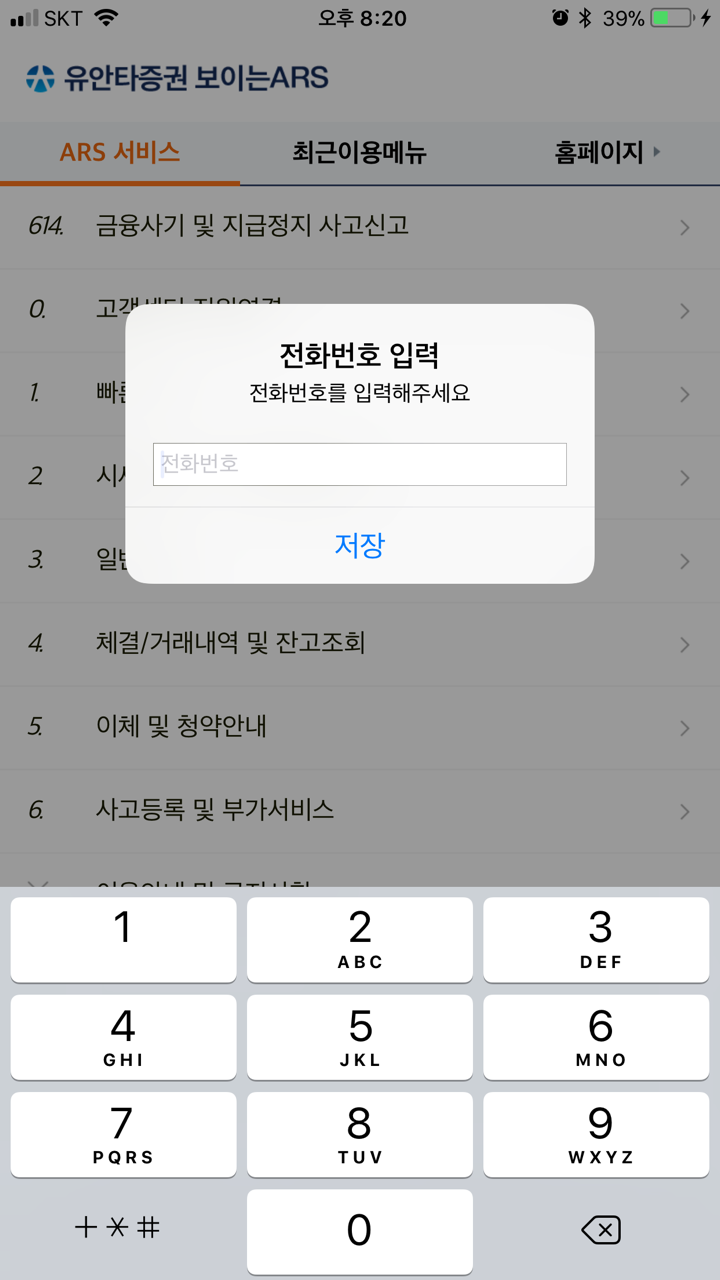

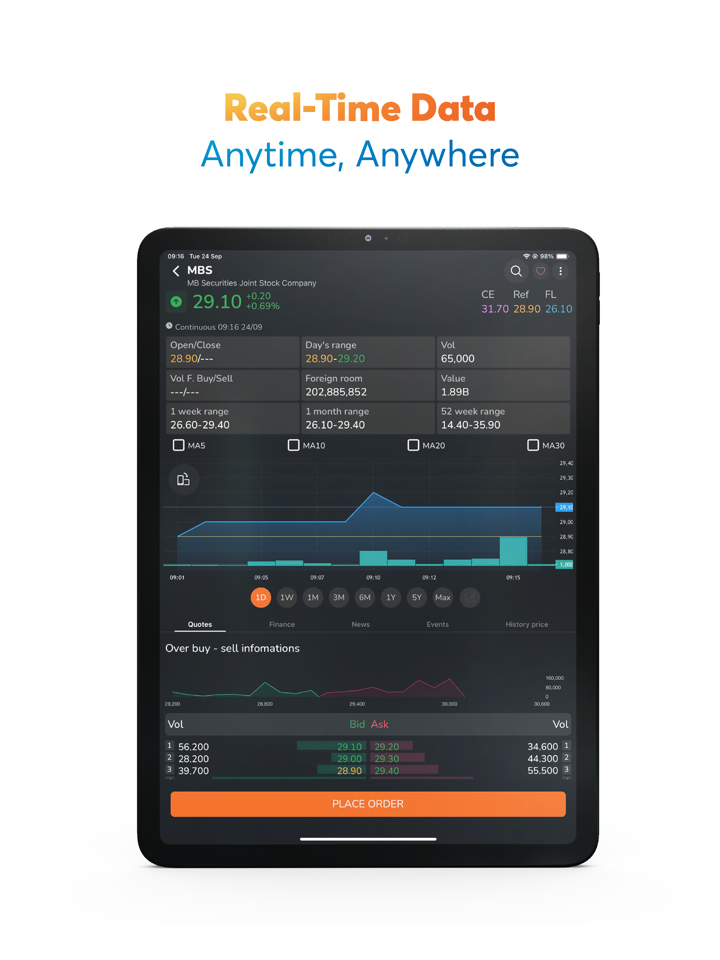

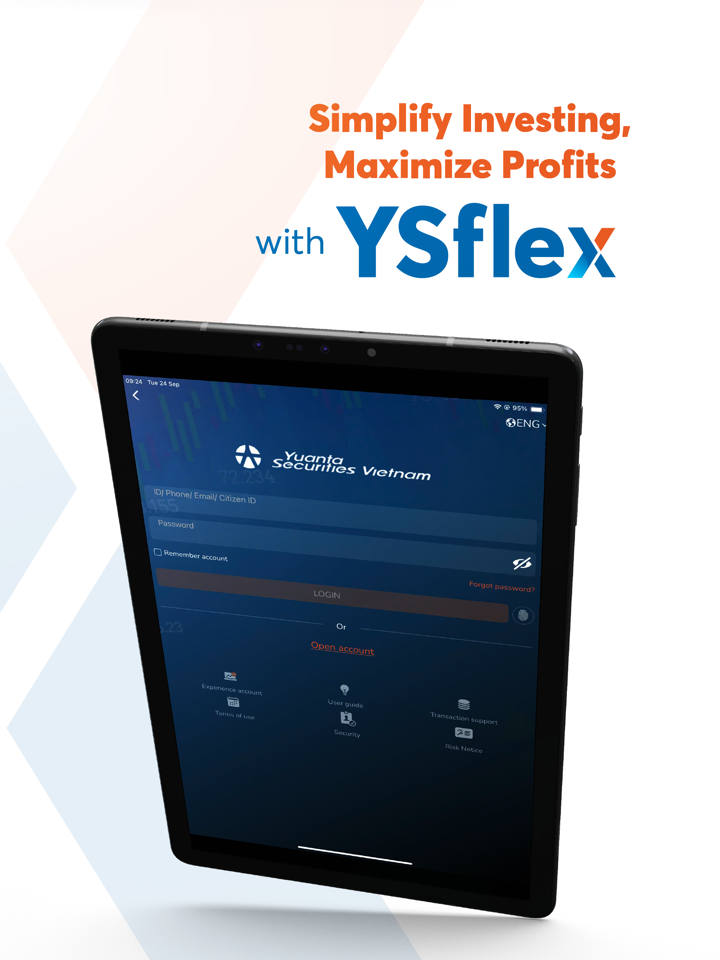

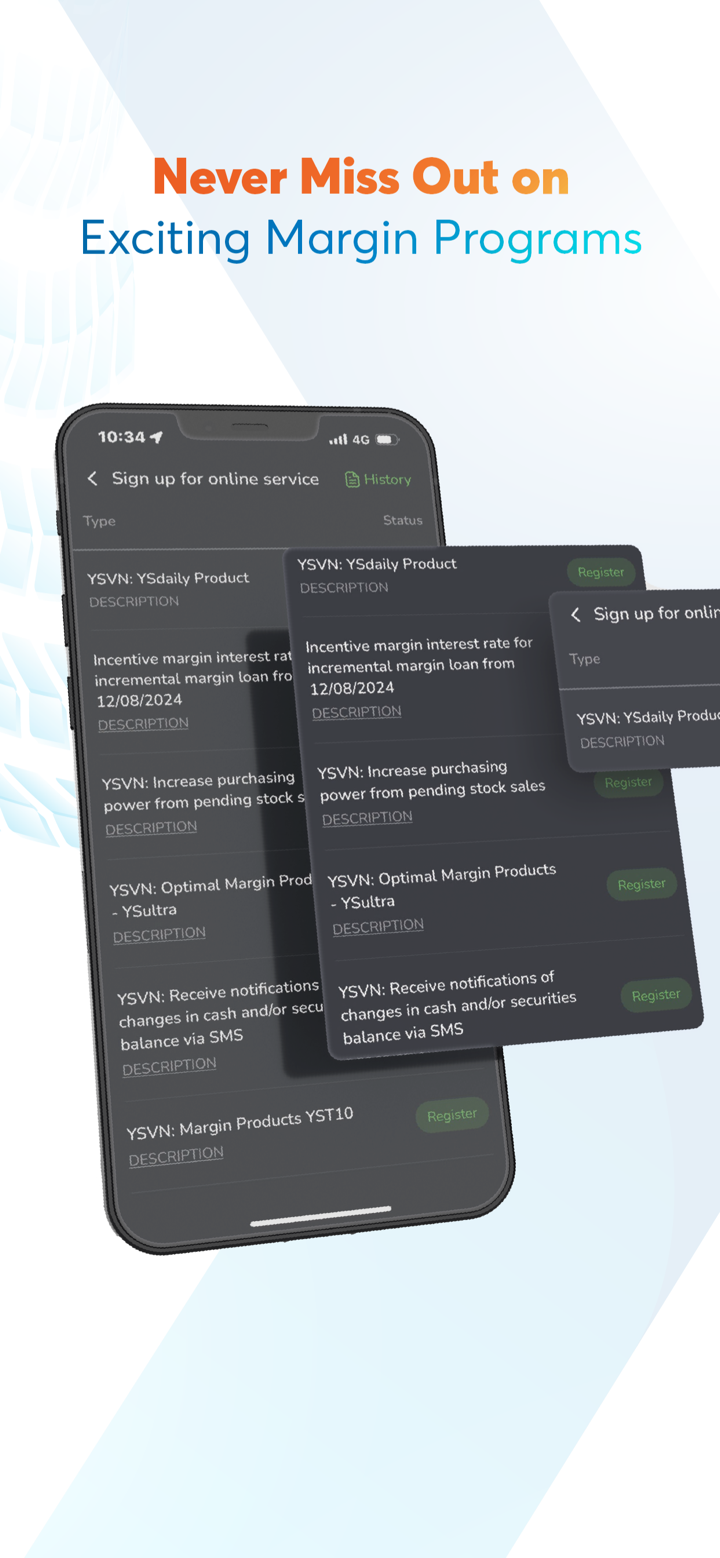

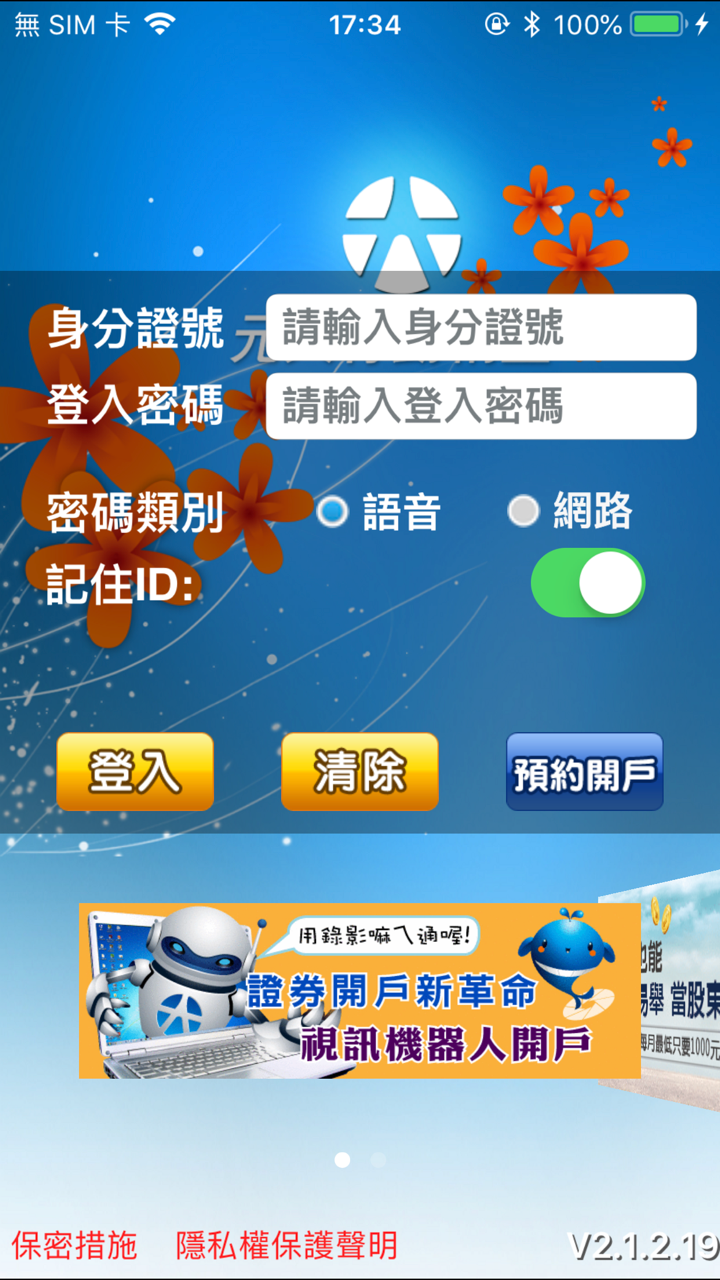

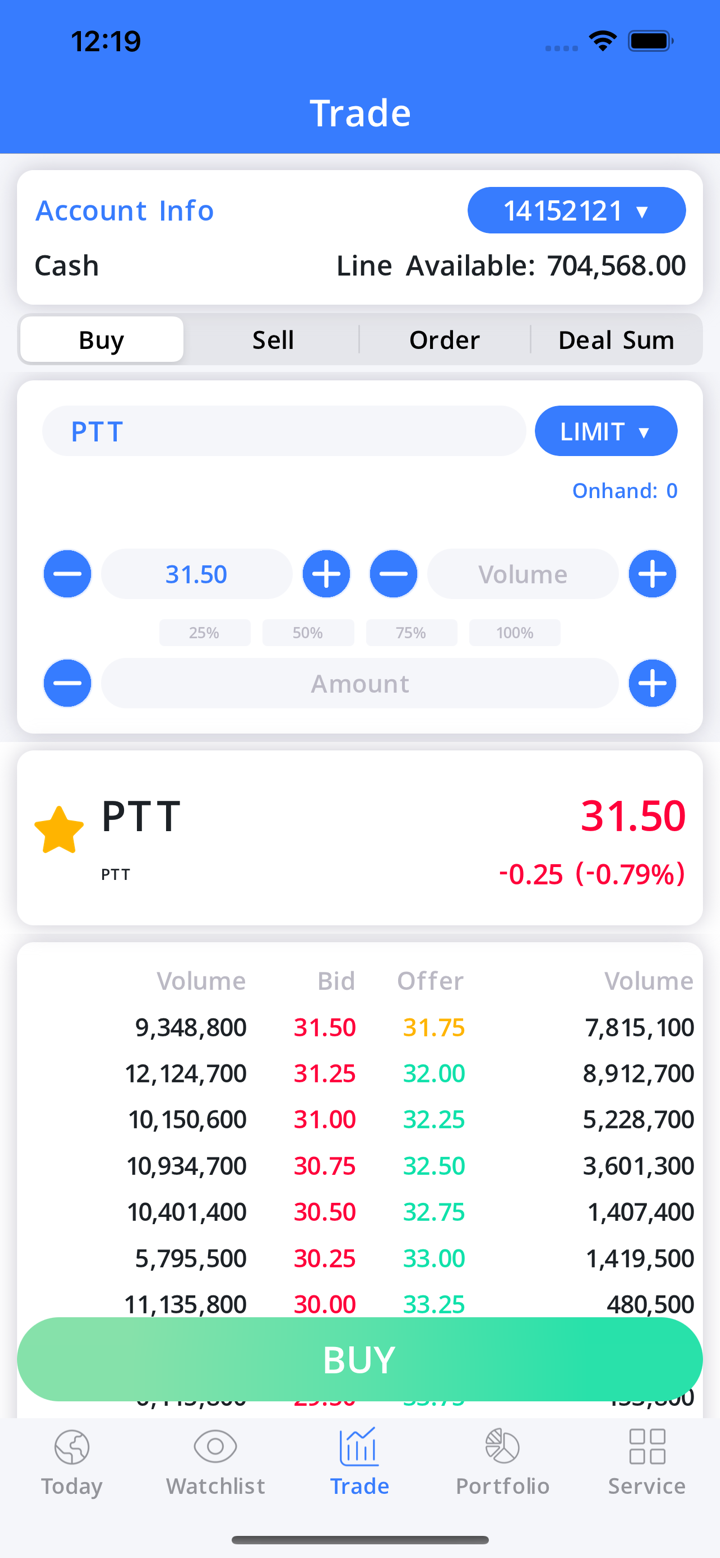

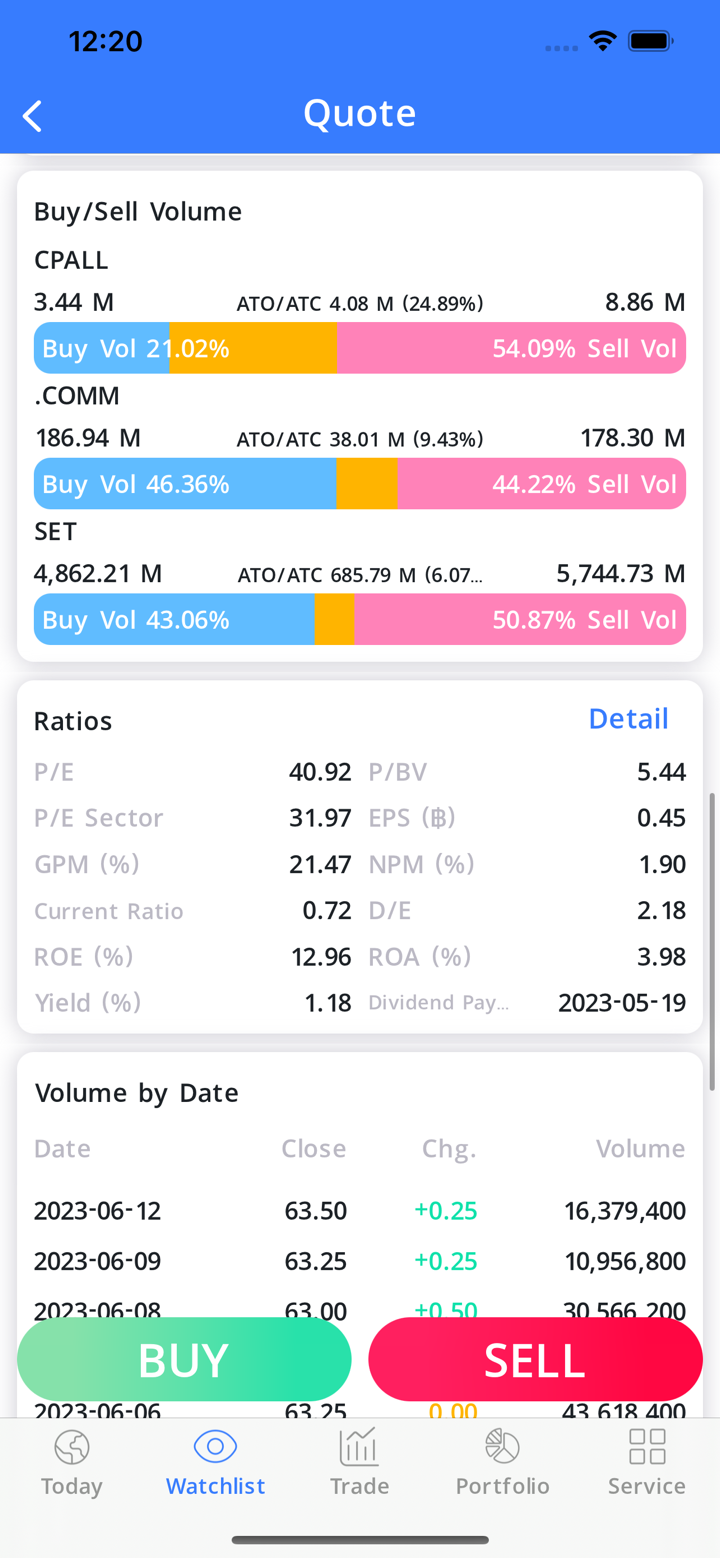

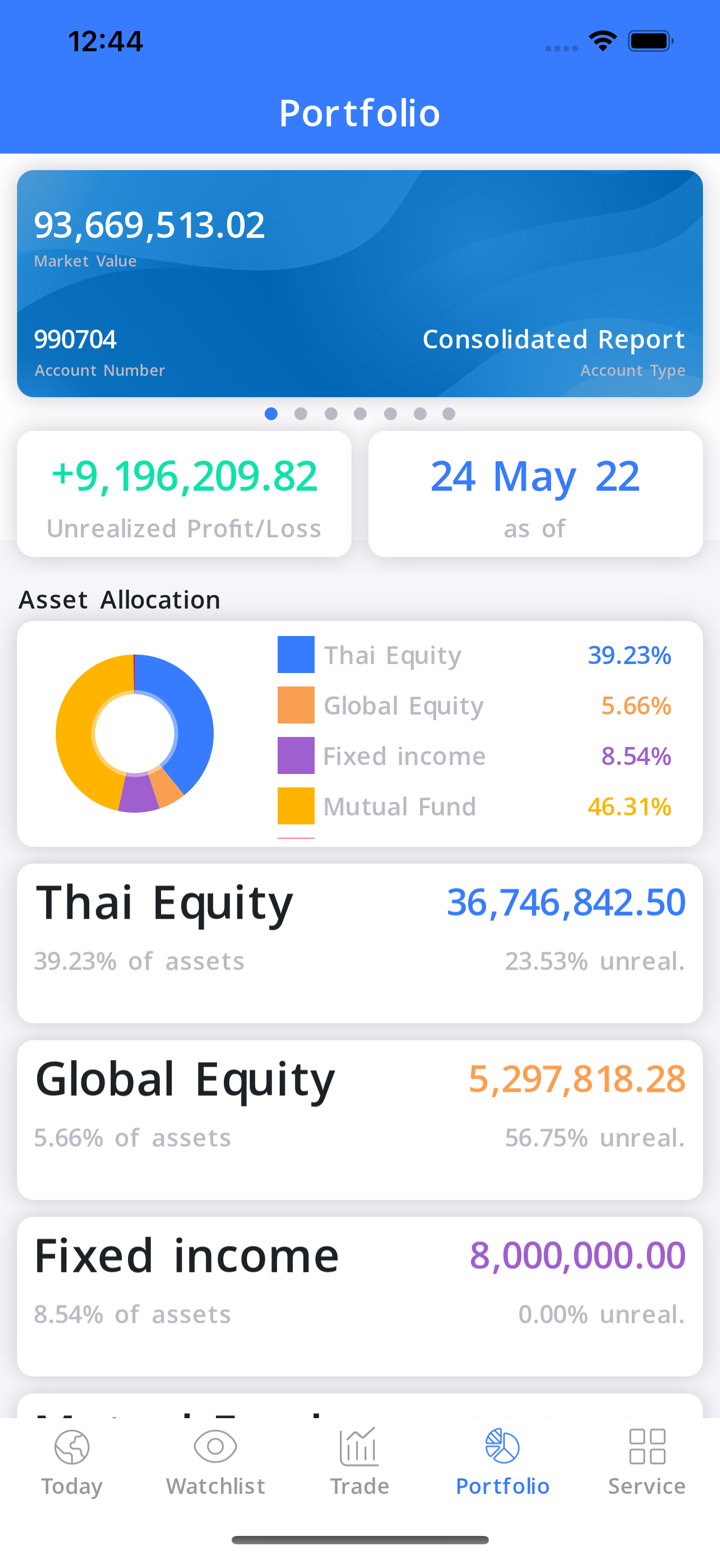

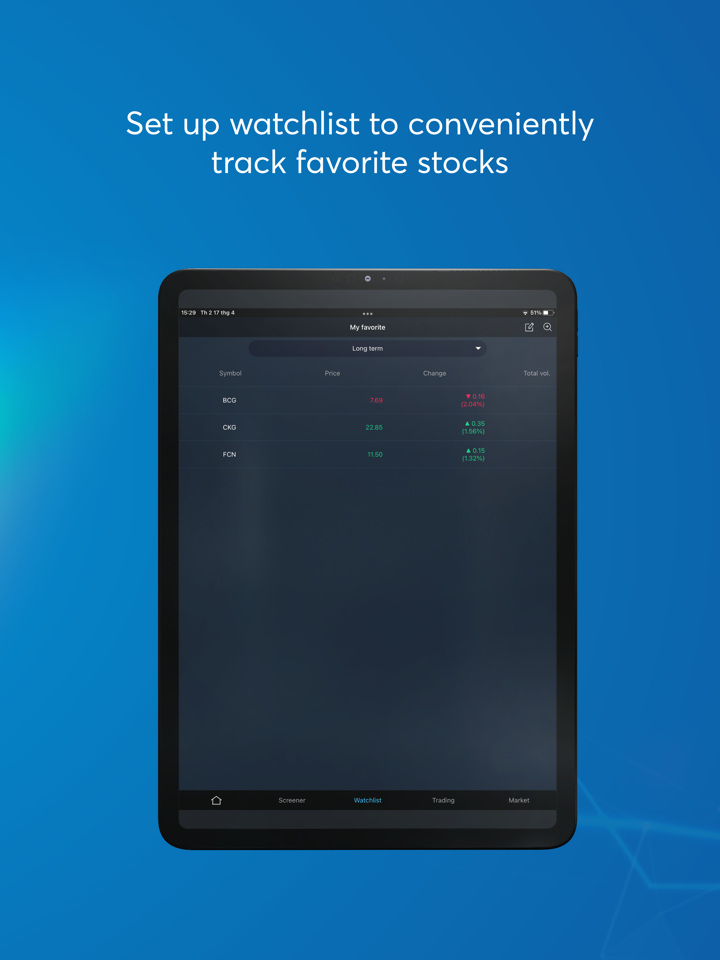

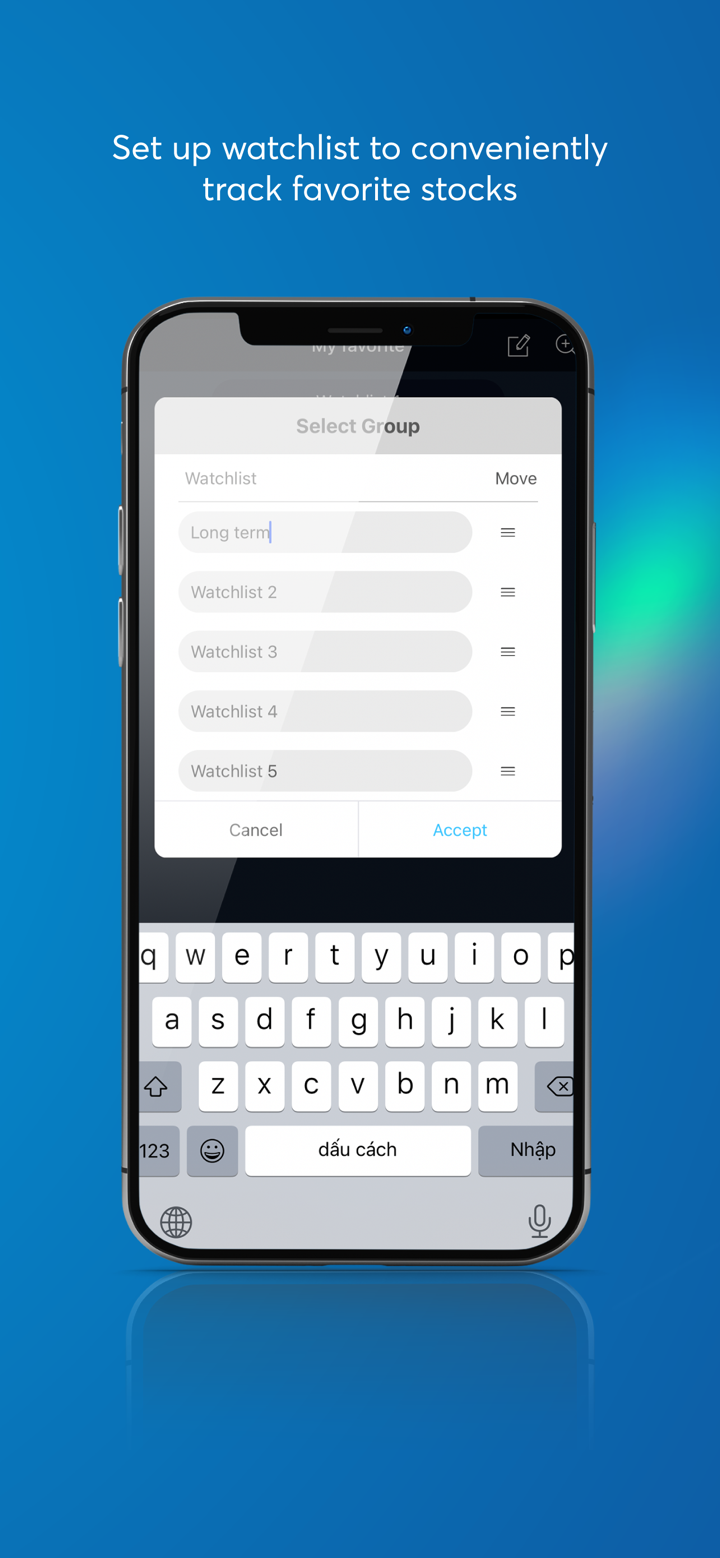

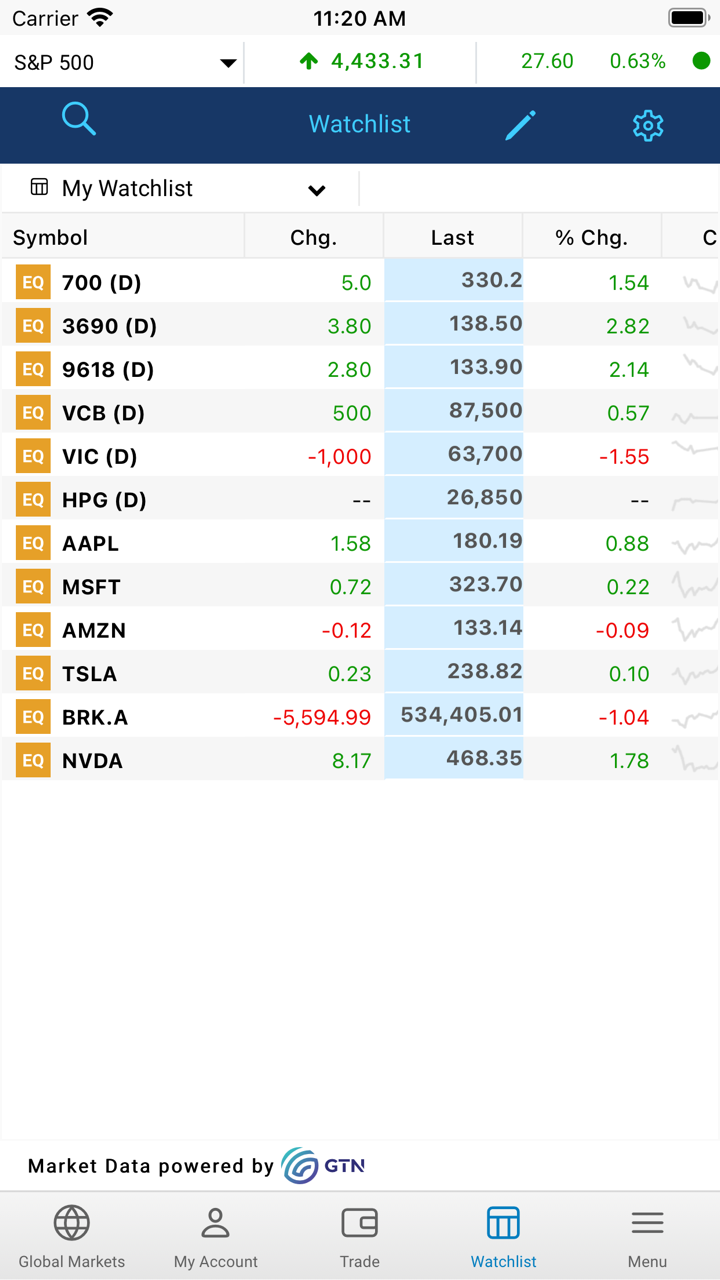

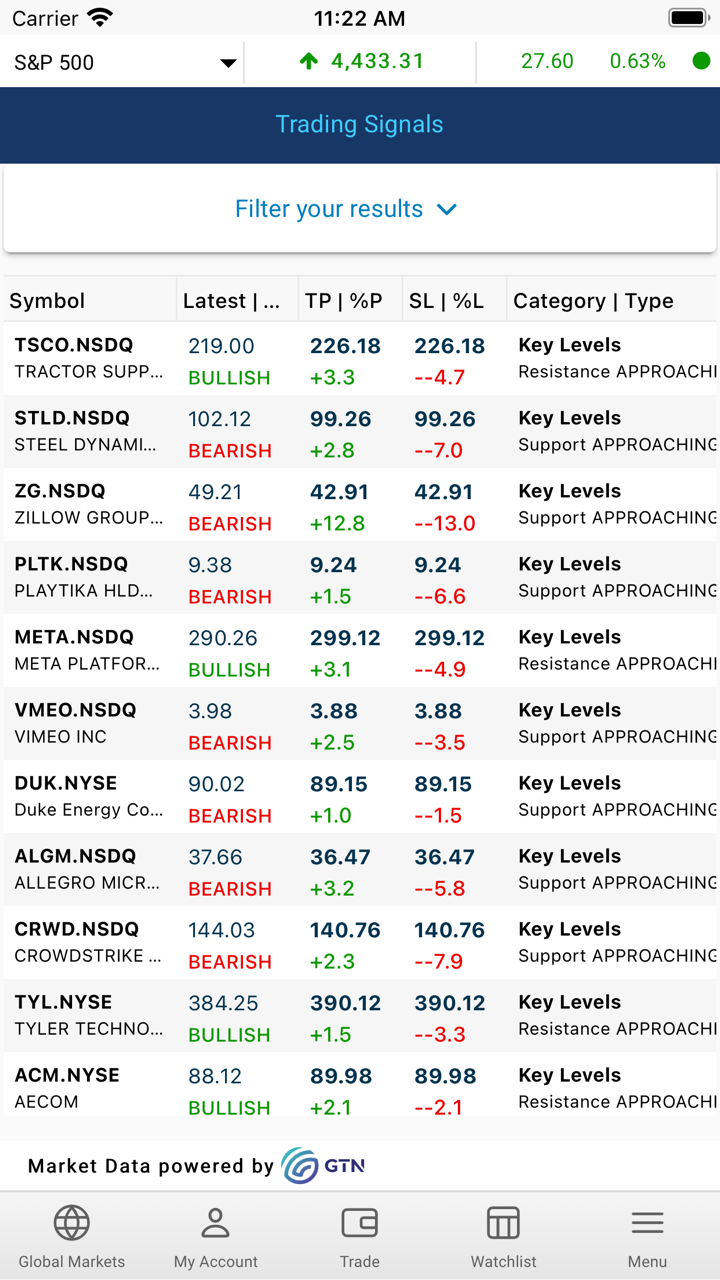

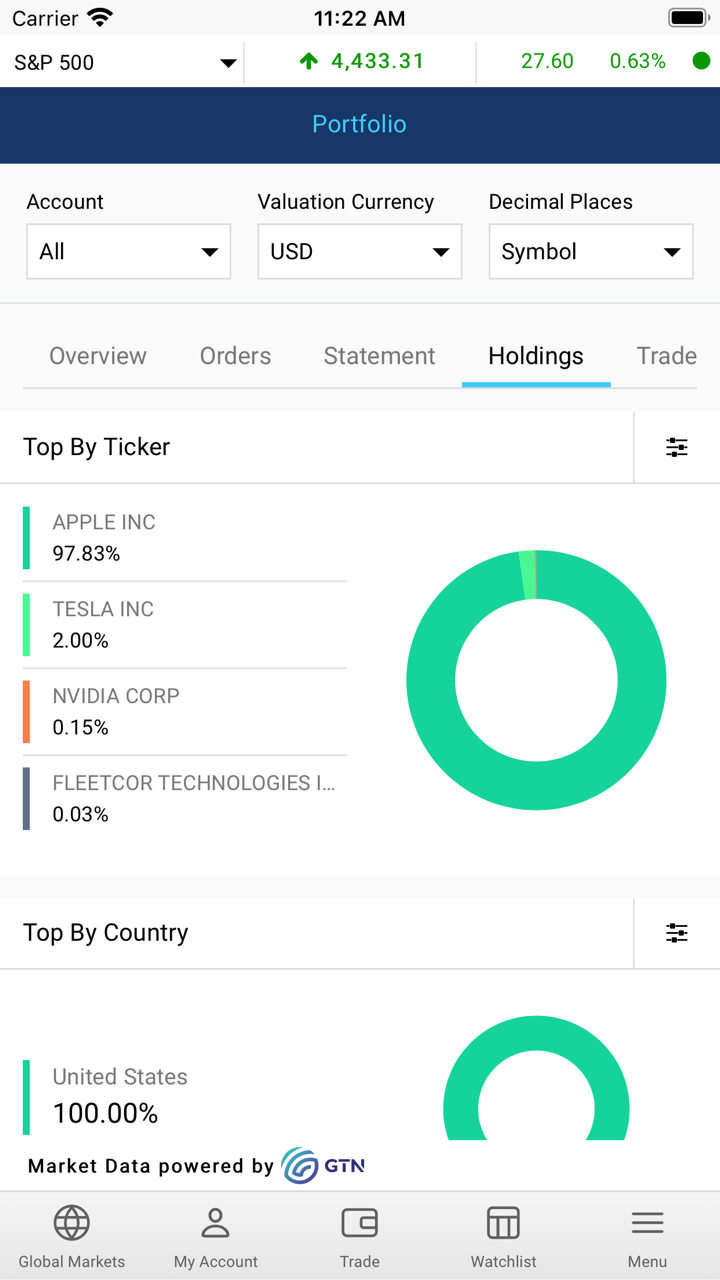

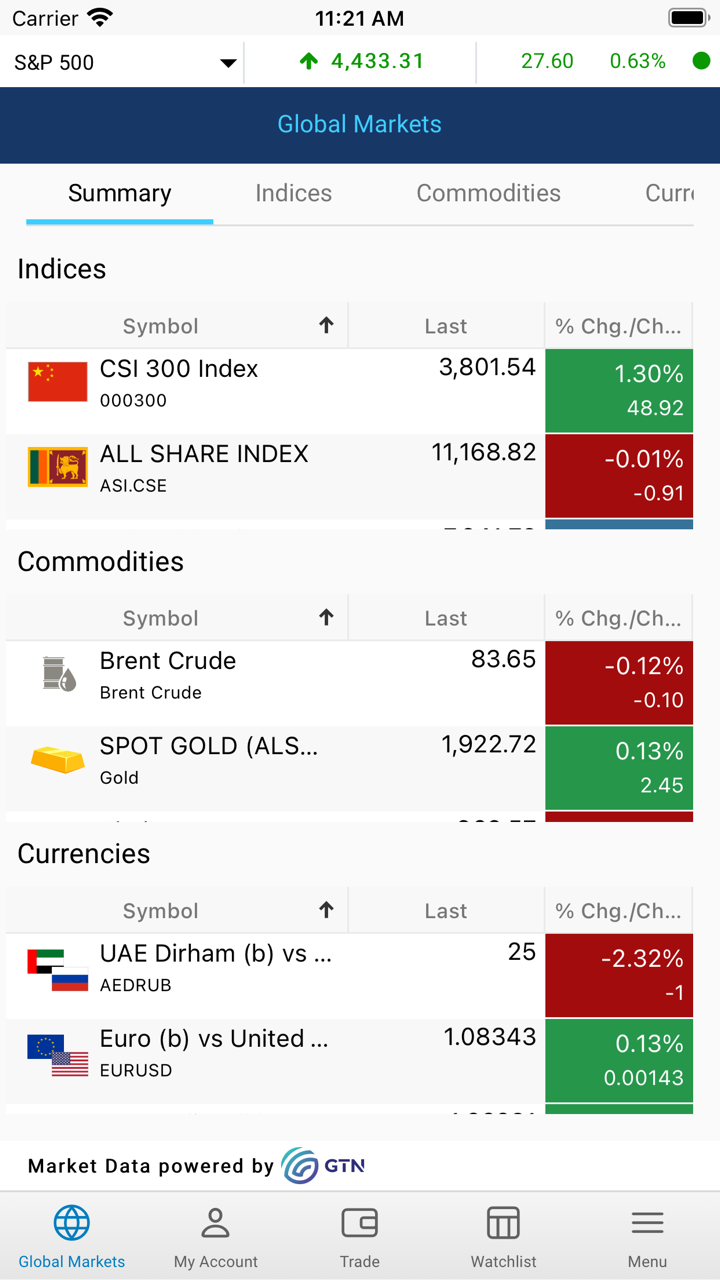

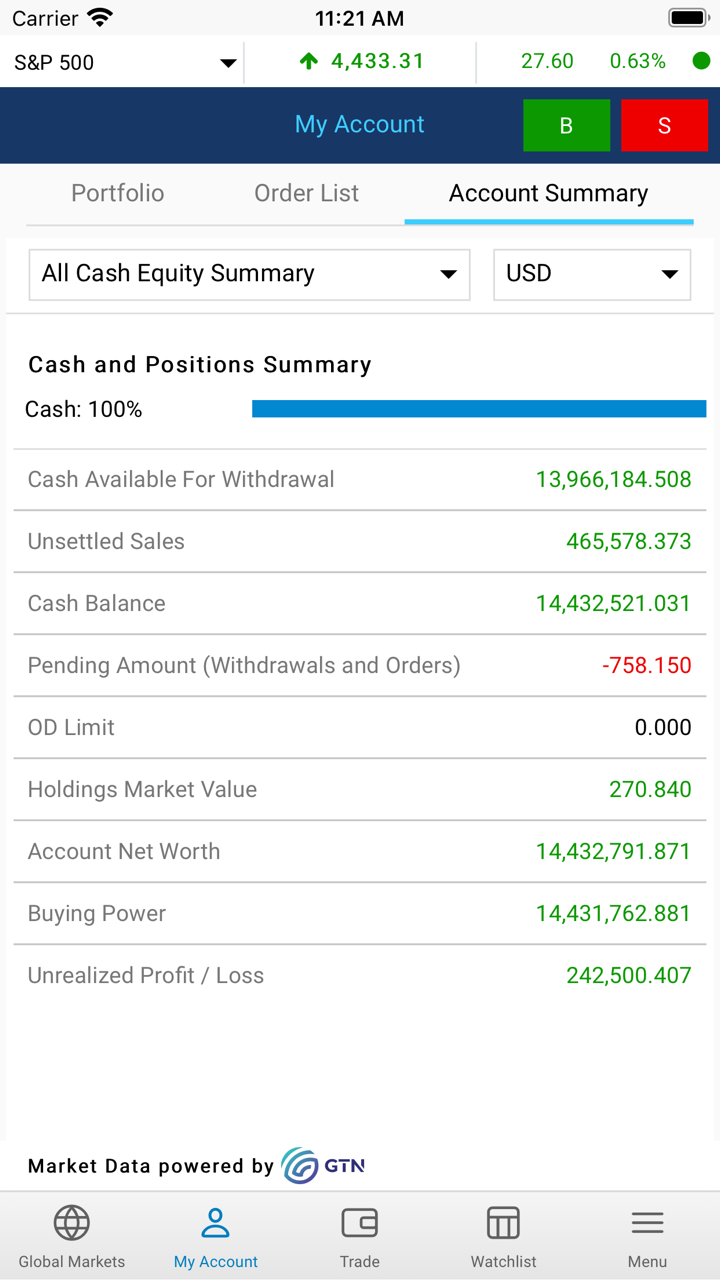

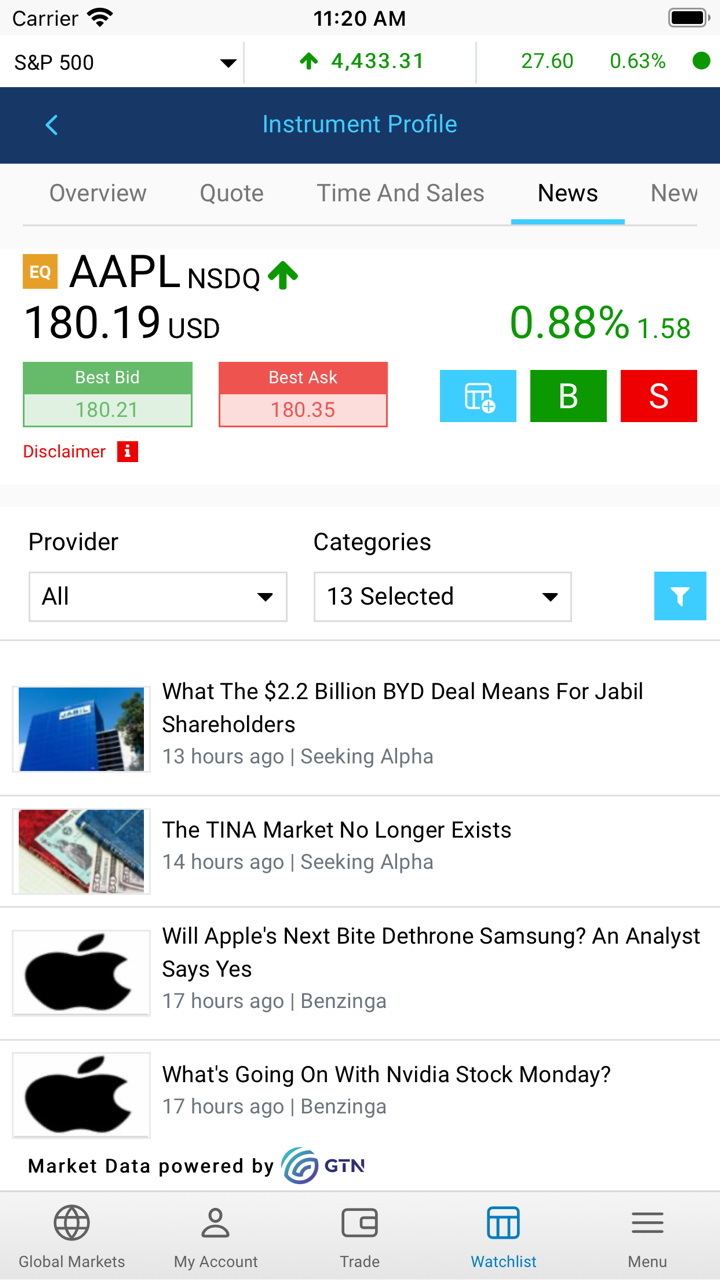

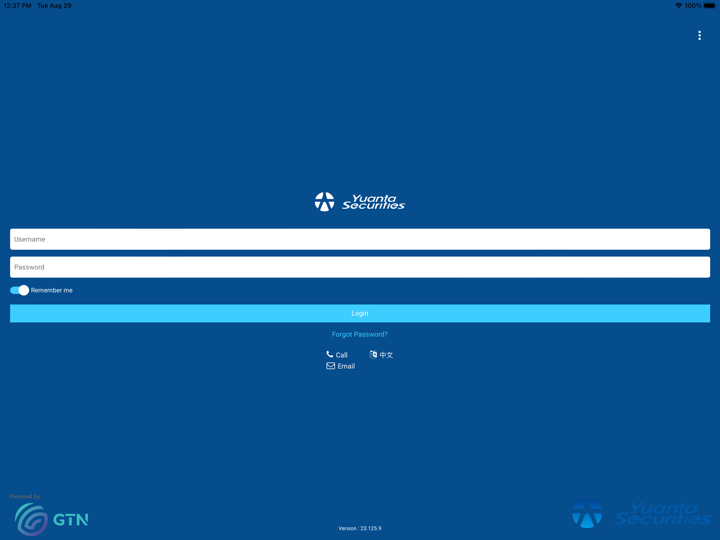

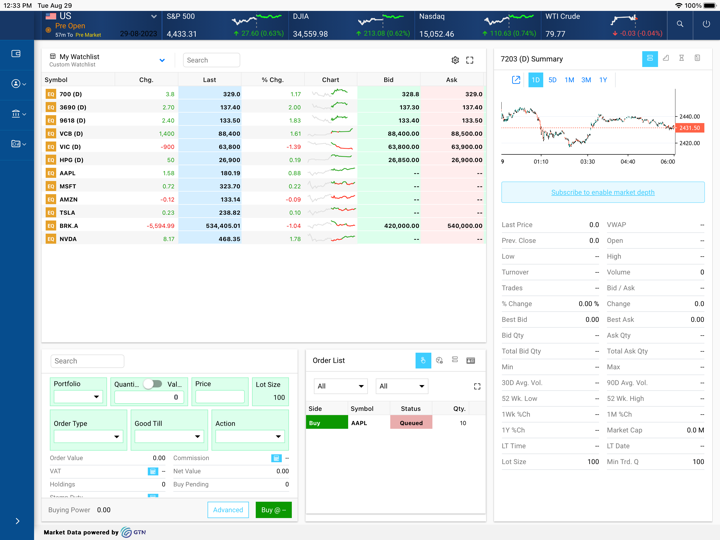

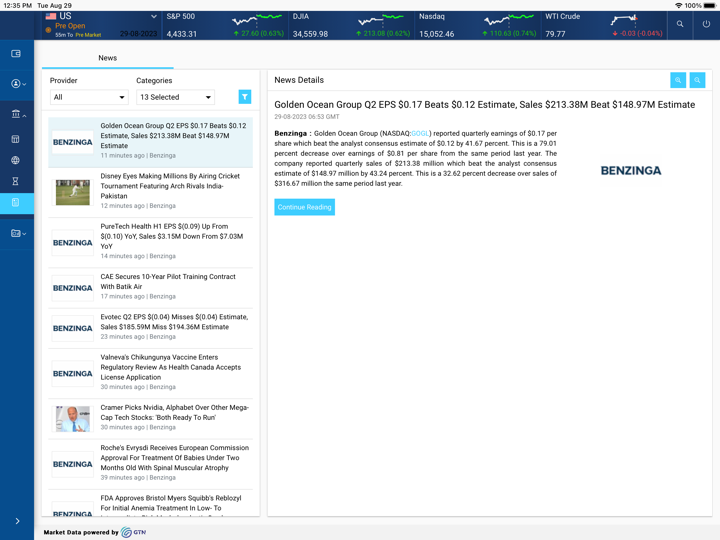

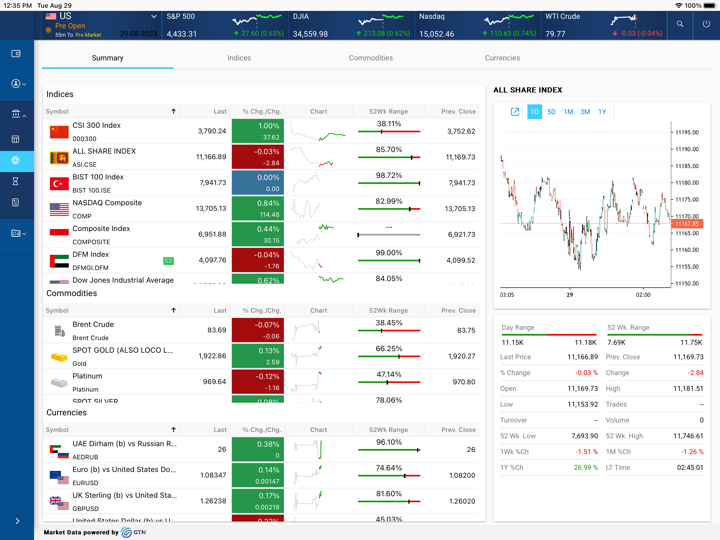

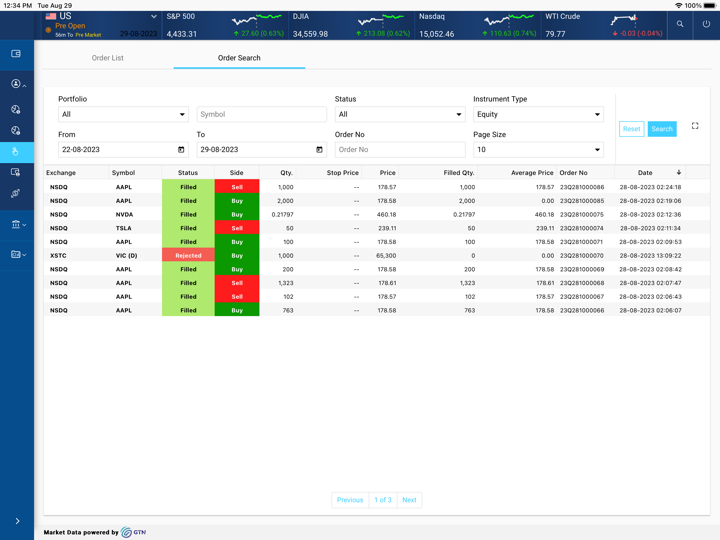

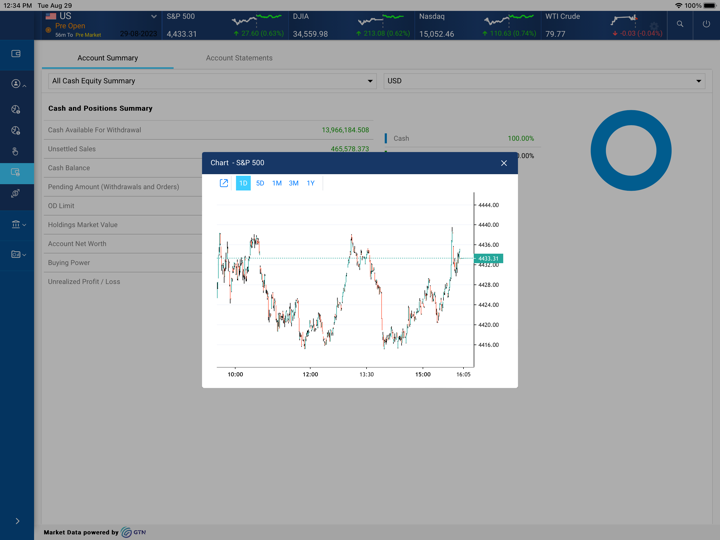

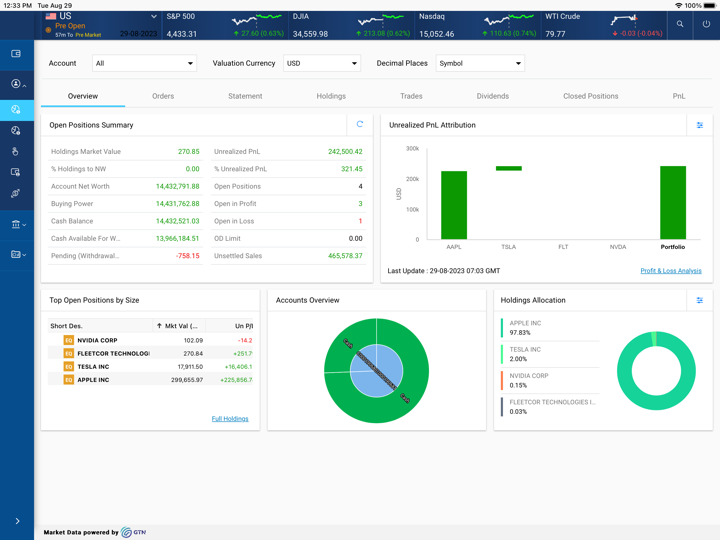

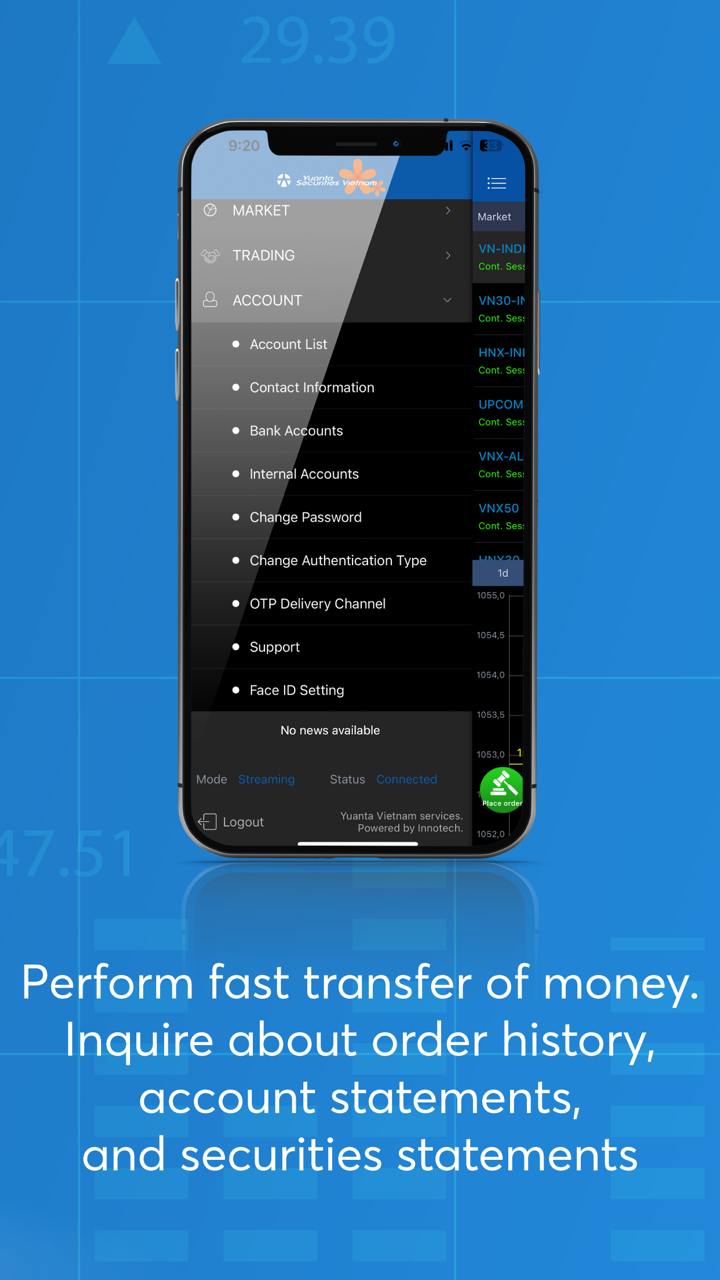

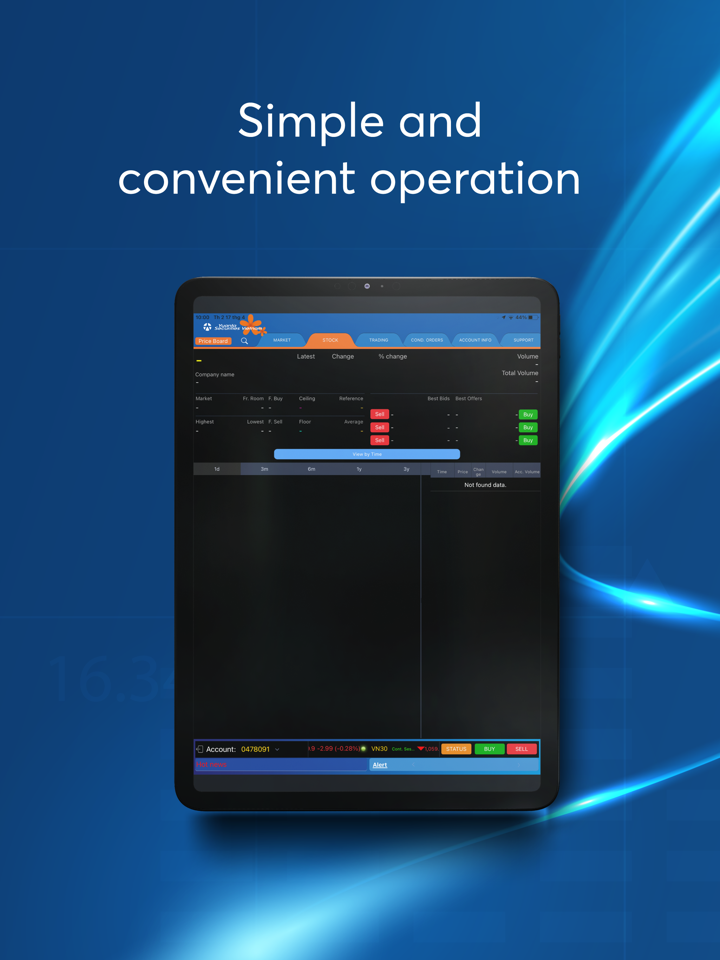

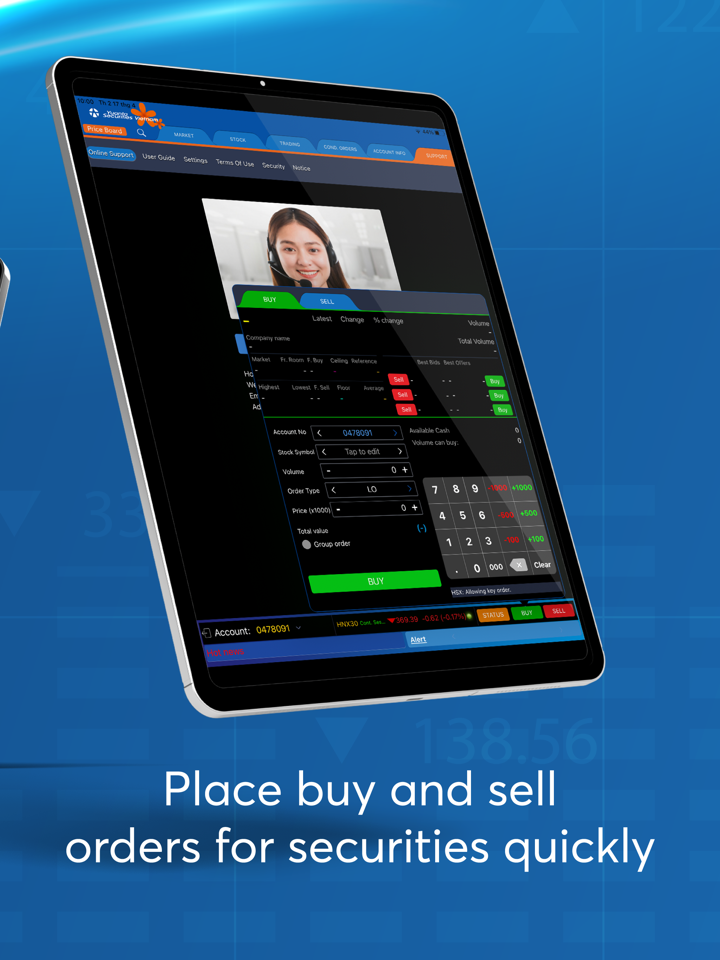

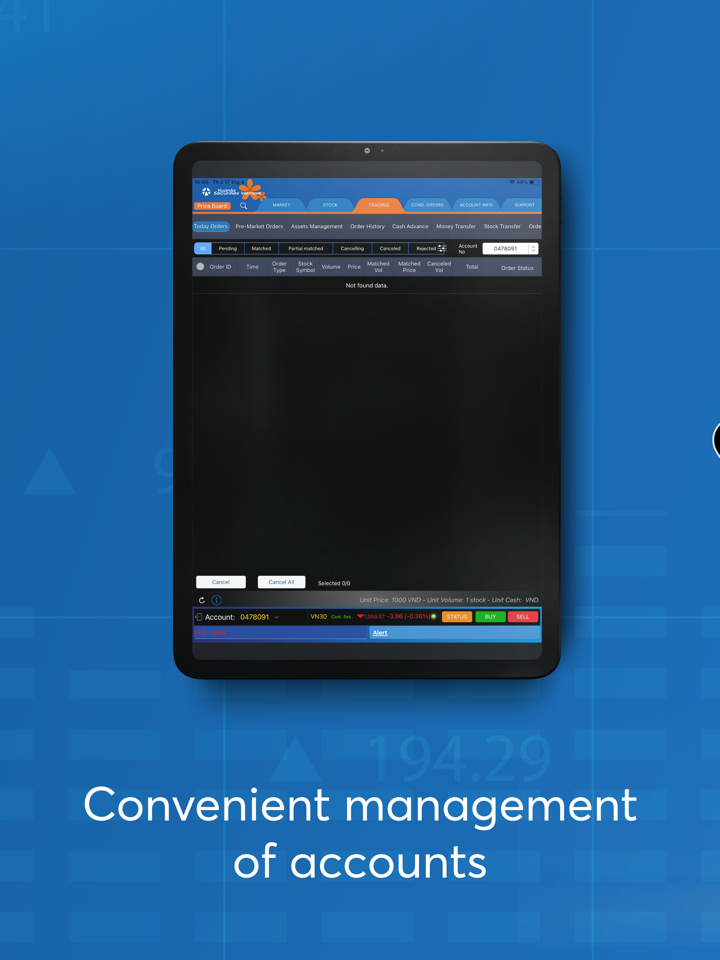

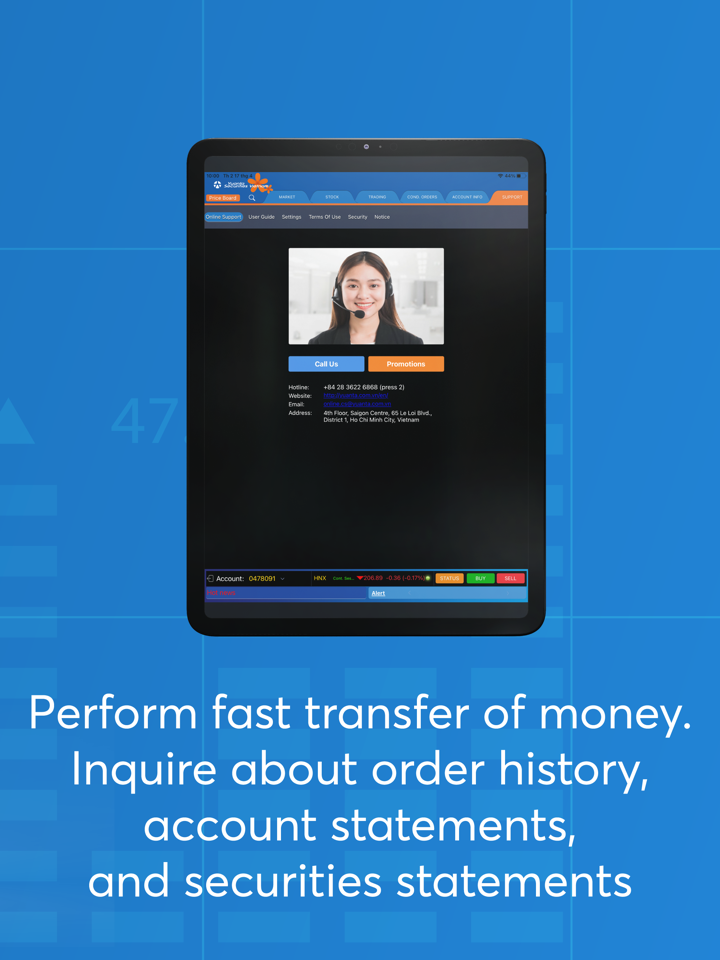

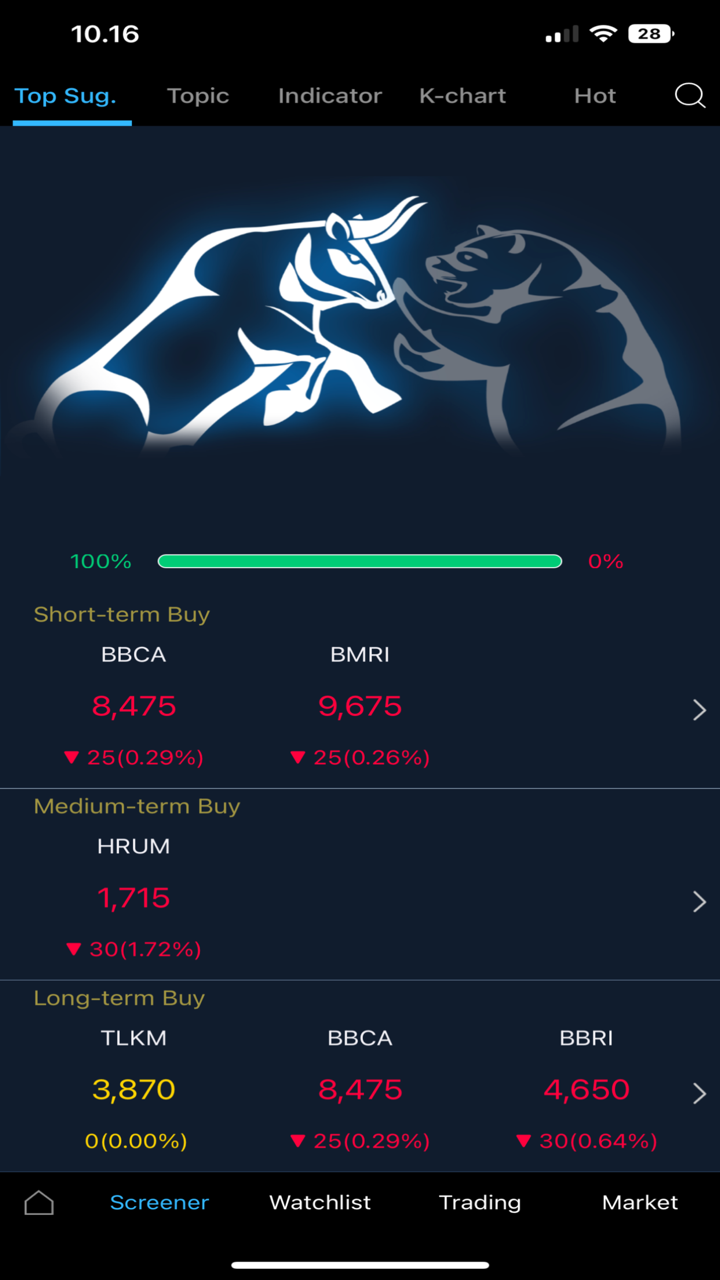

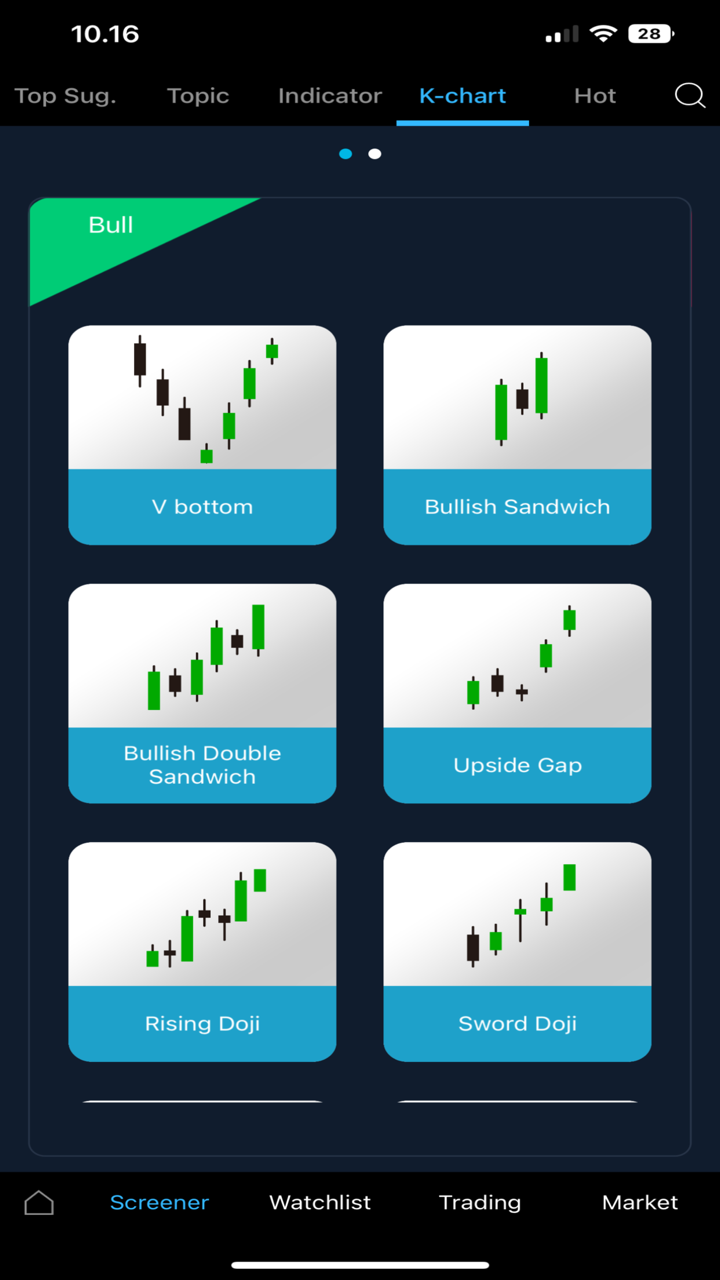

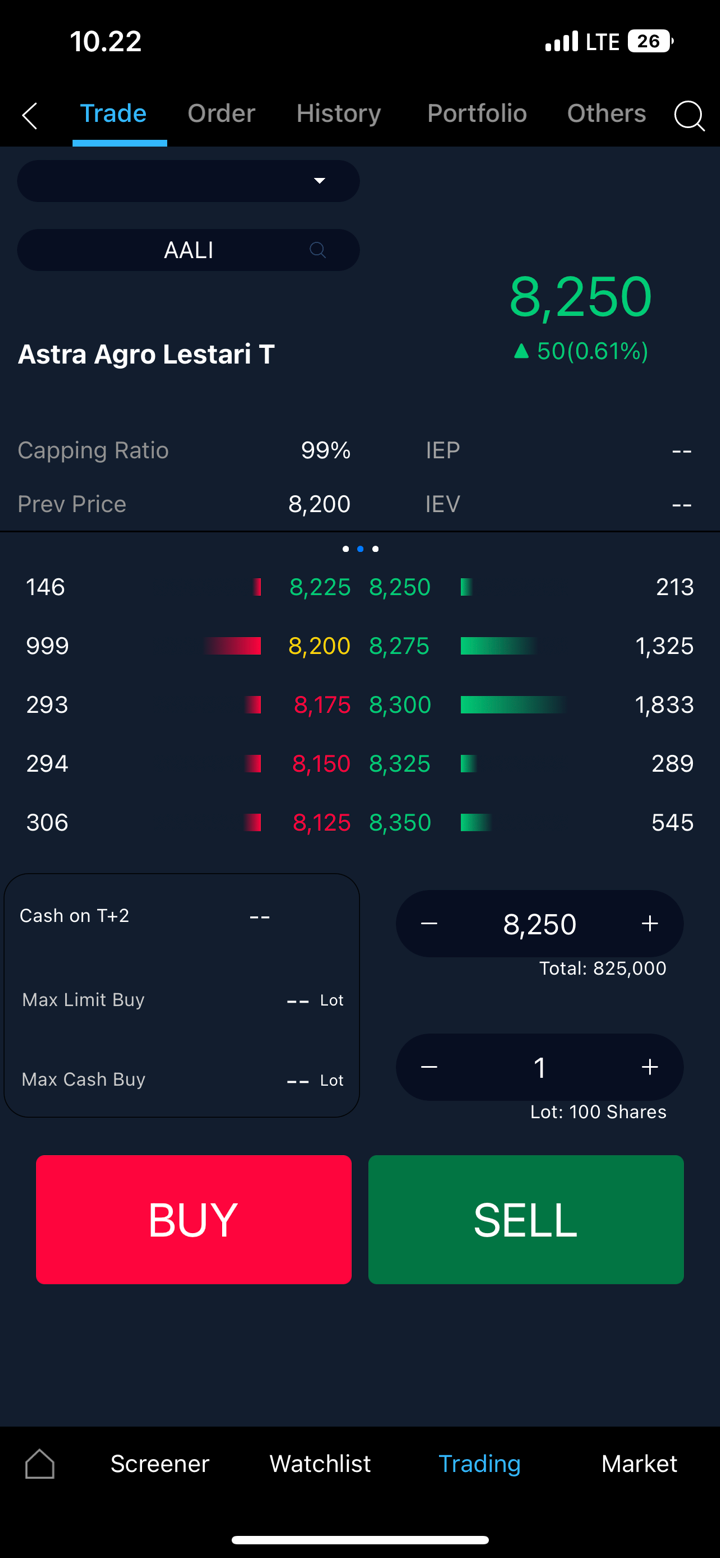

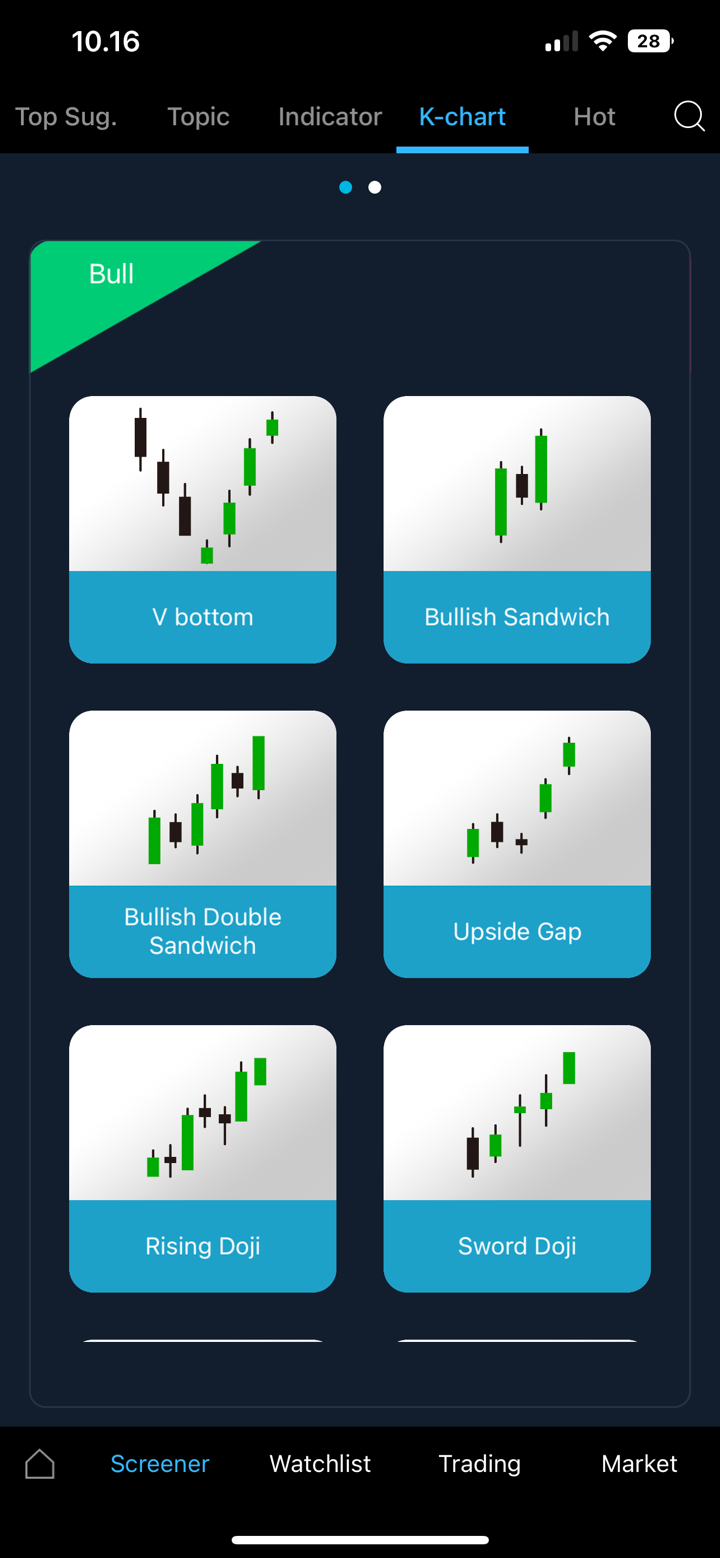

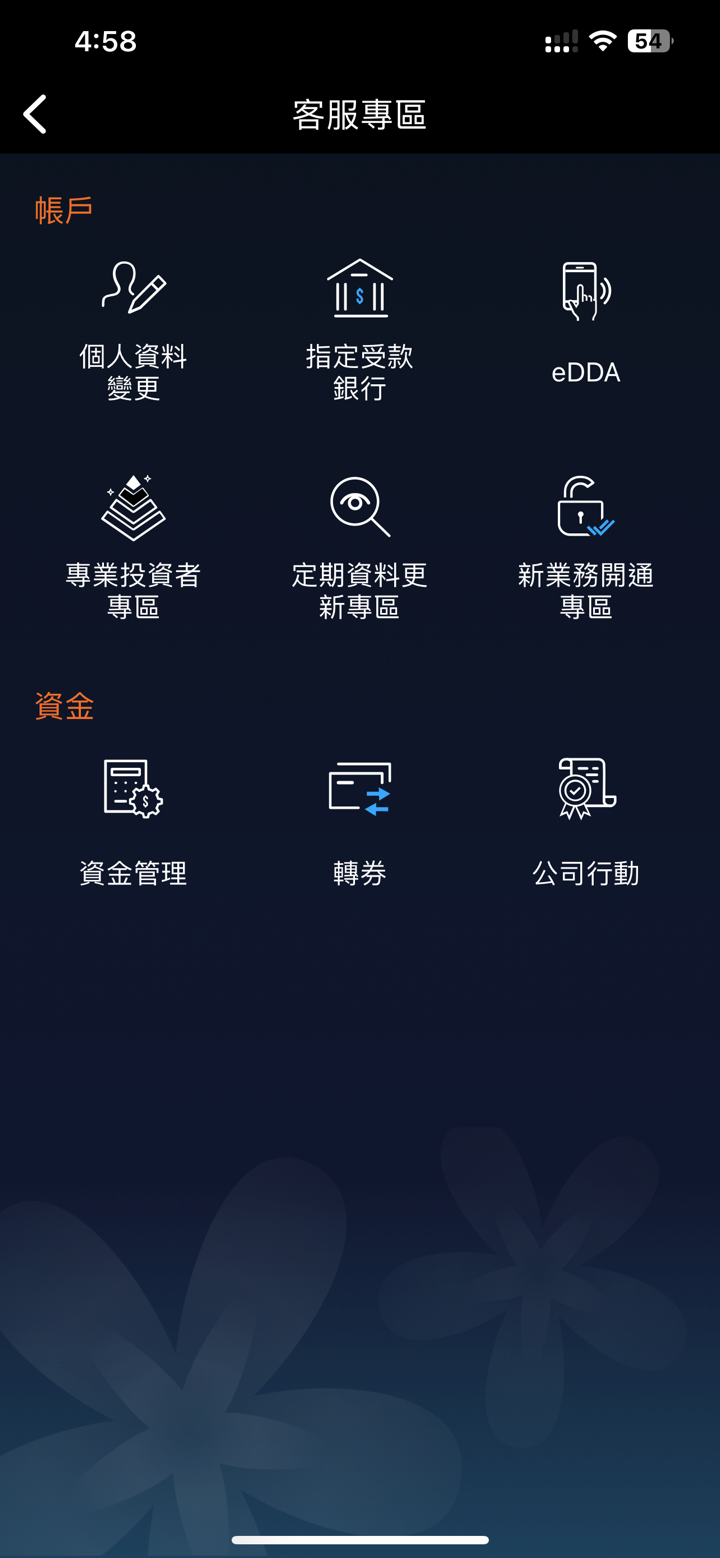

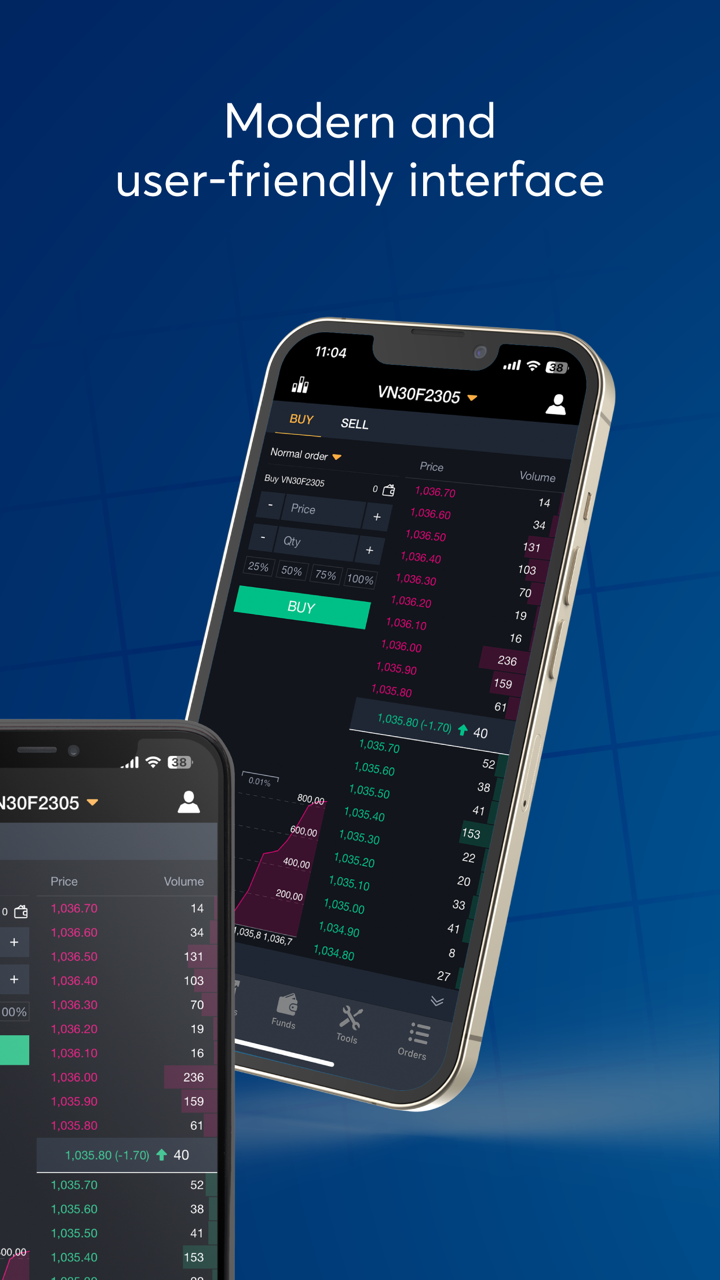

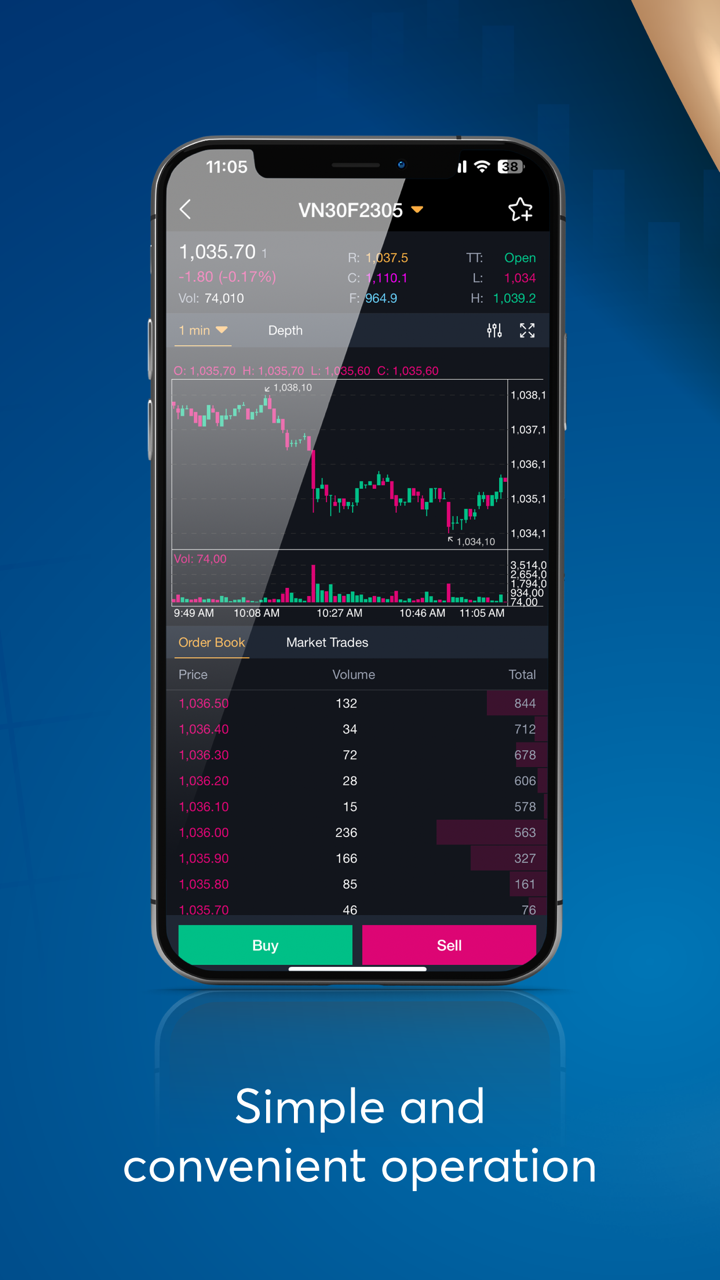

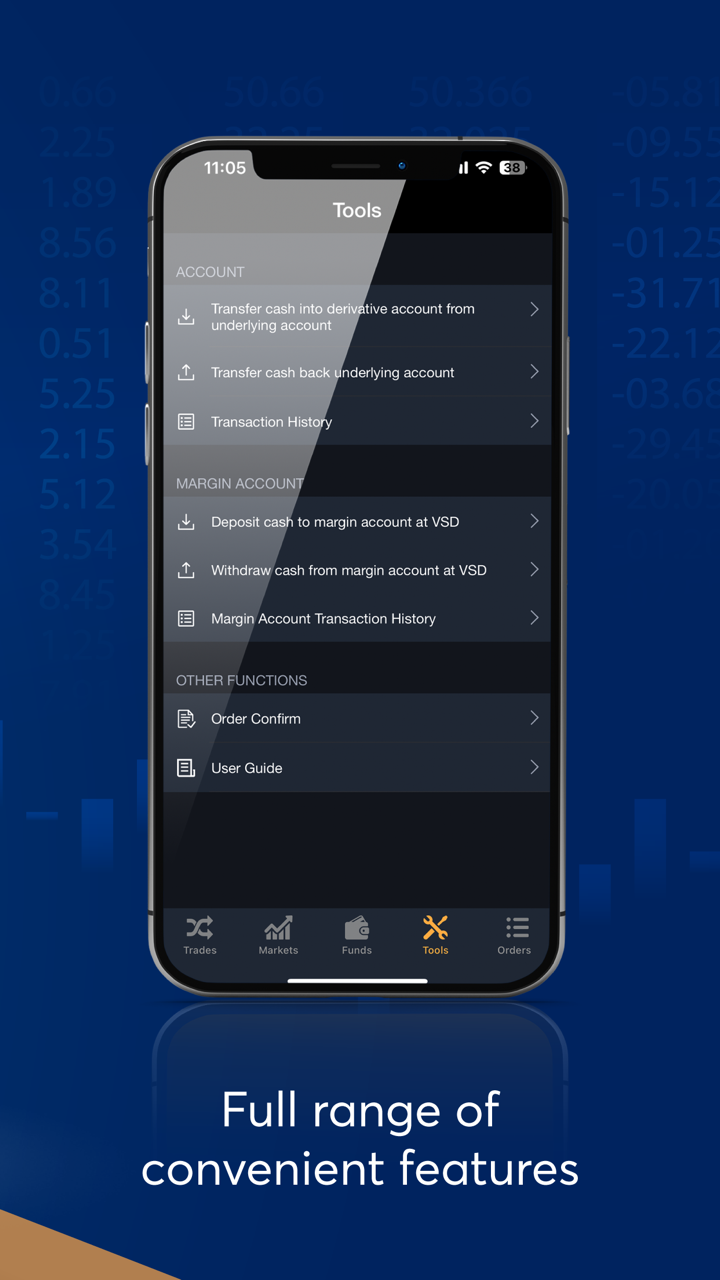

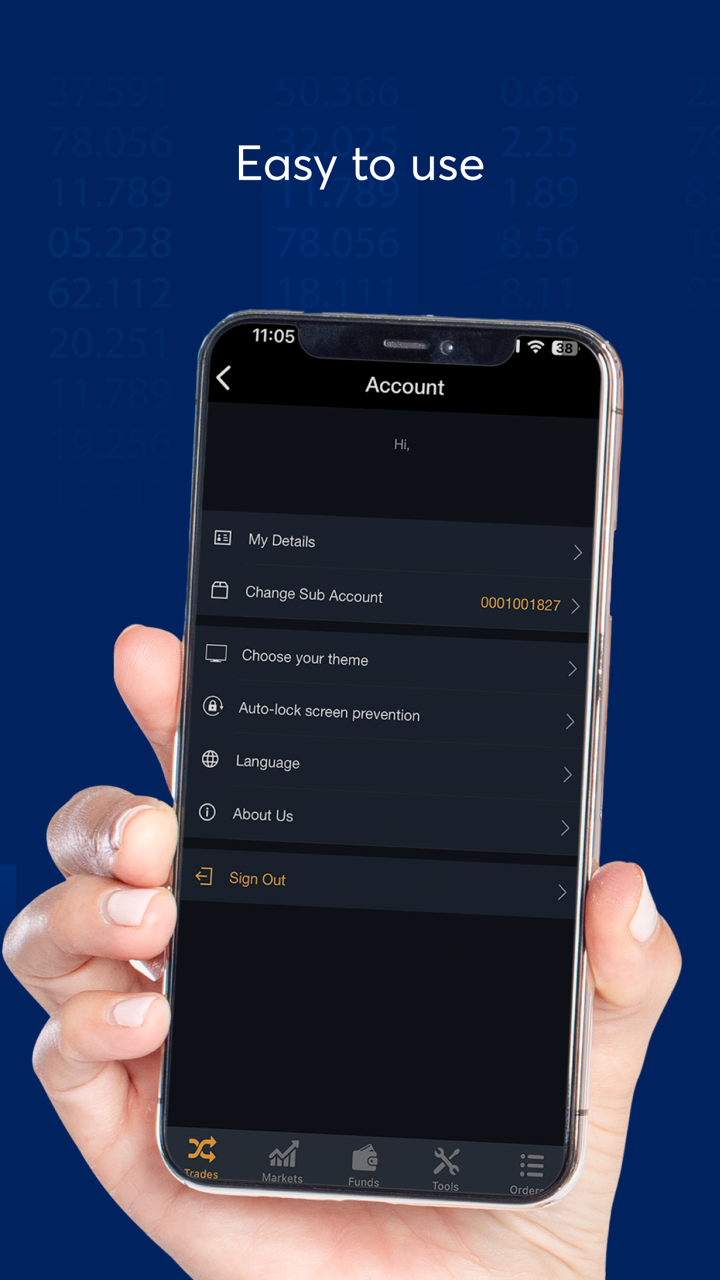

元大证券提供了eWinner和YSHK SP Trader品牌下的一套交易平台,适用于桌面和移动用户。

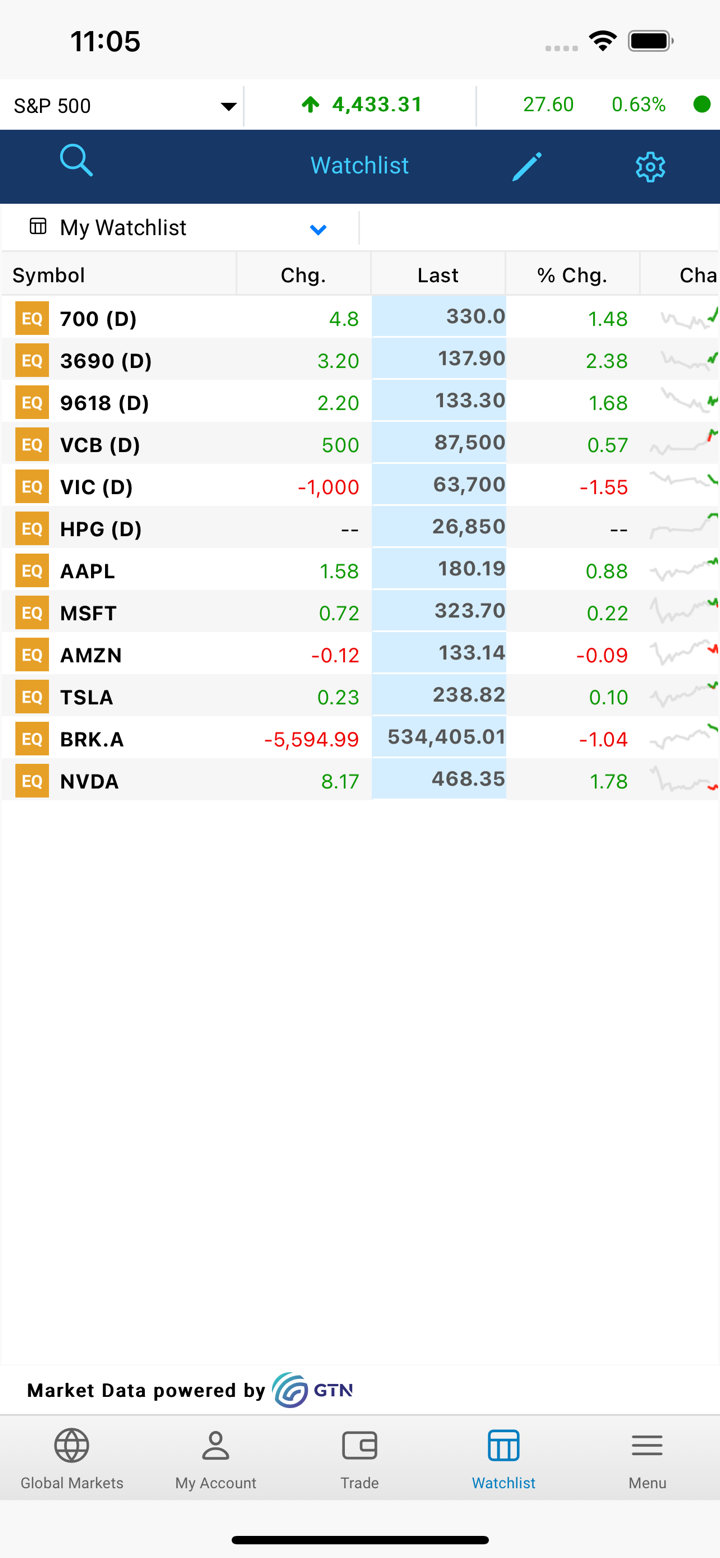

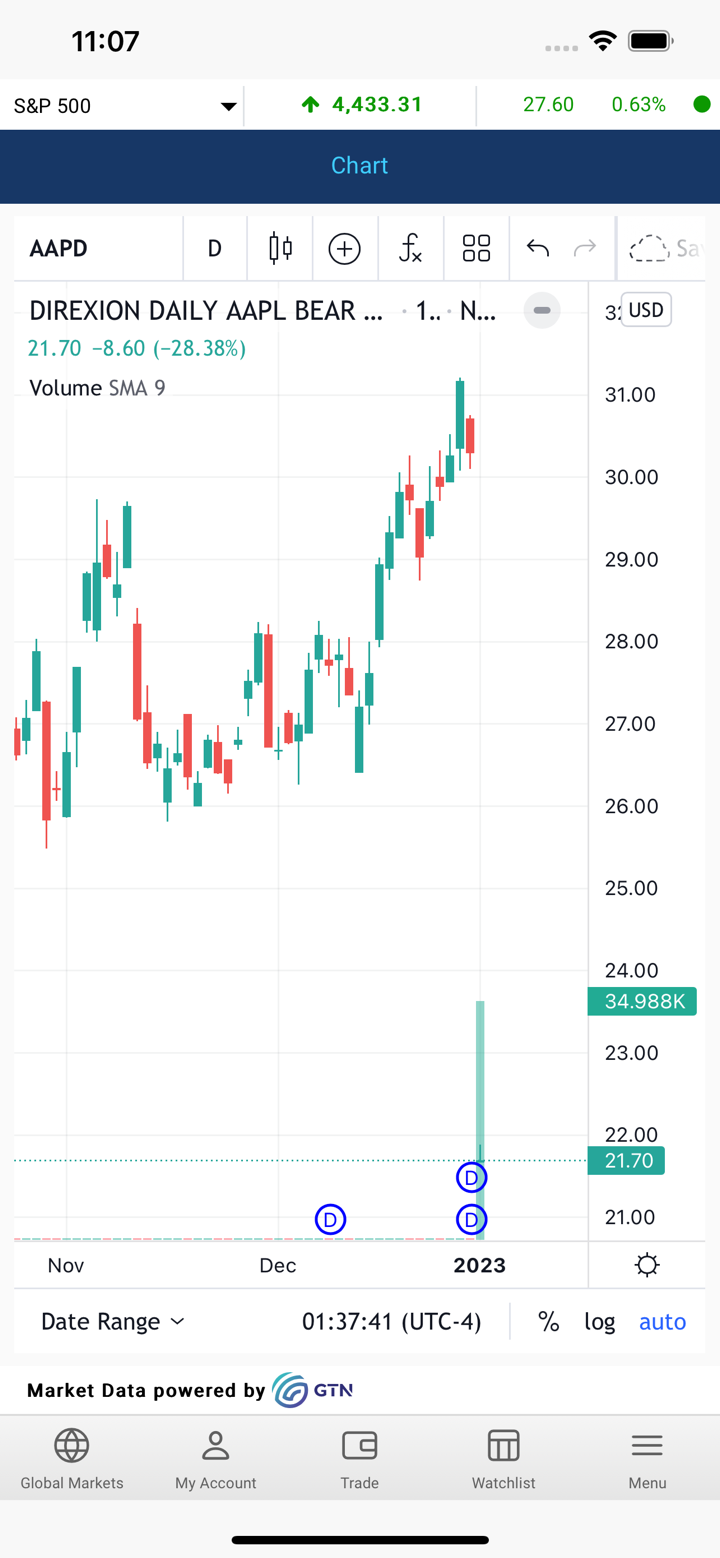

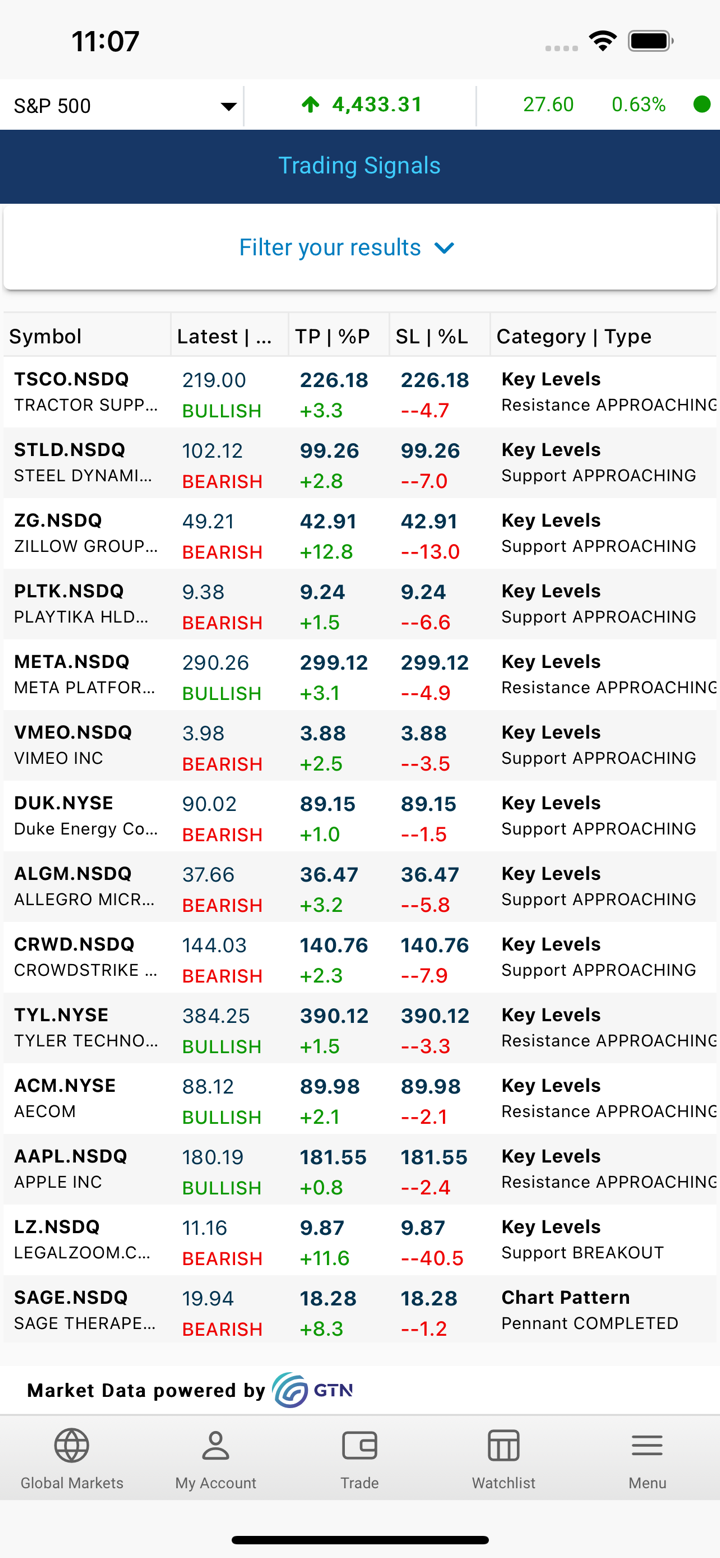

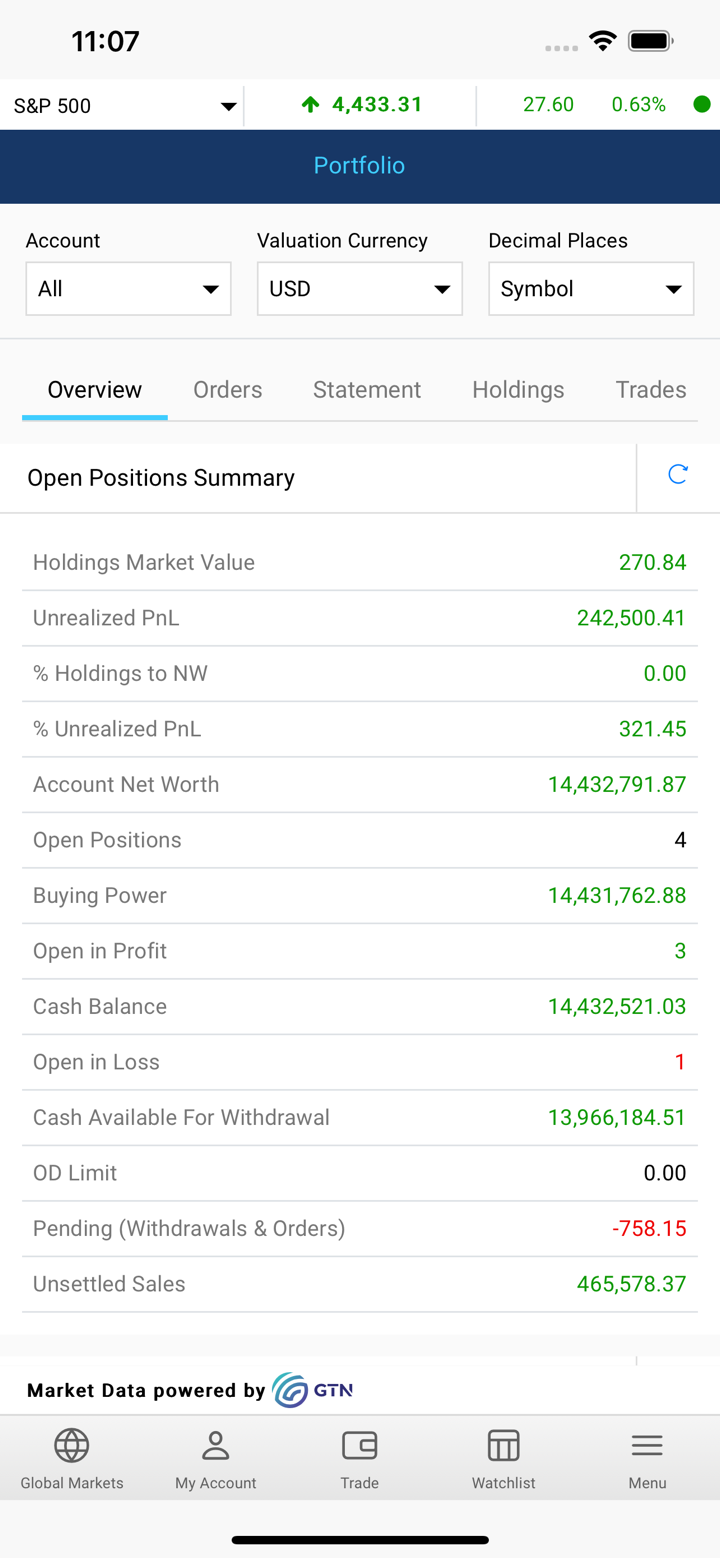

| 交易平台 | 支持 | 可用设备 |

| eWinner | ✔ | Web、PC、iOS、Android |

| YSHK SP Trader | ✔ | PC、iOS、Android |

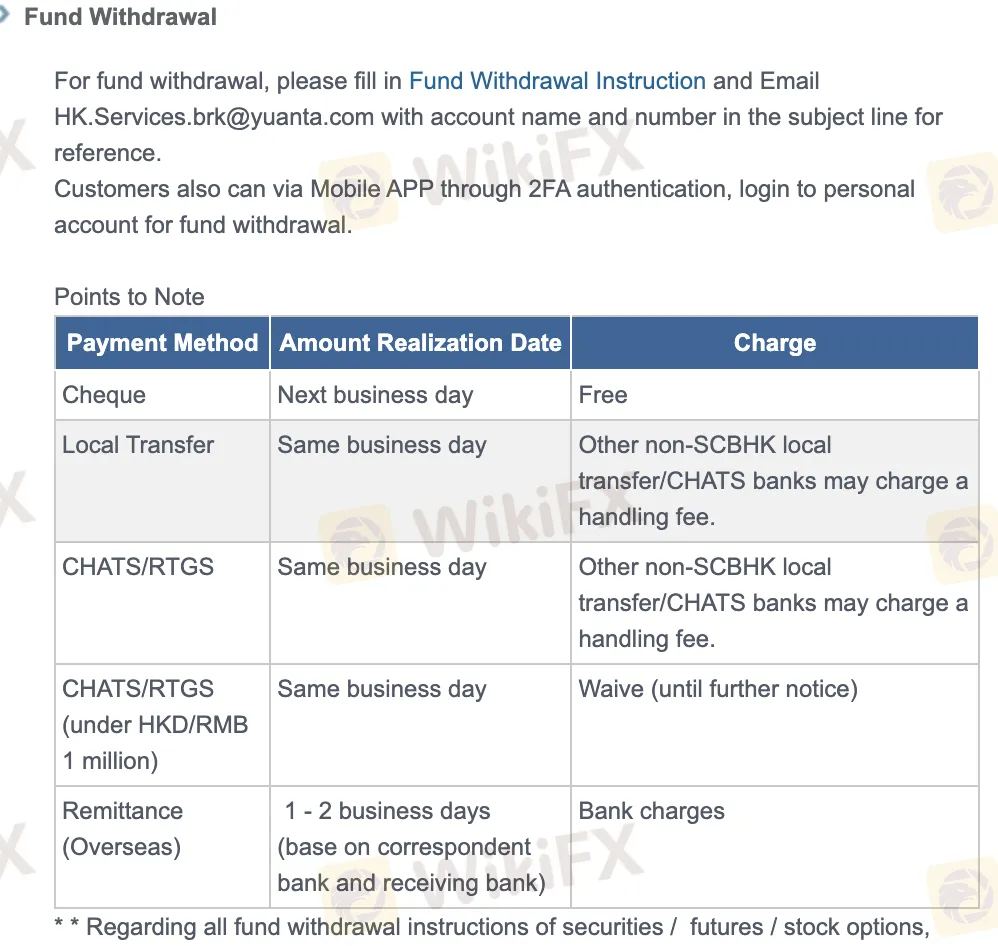

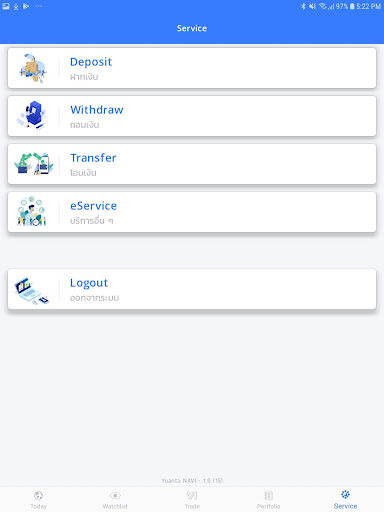

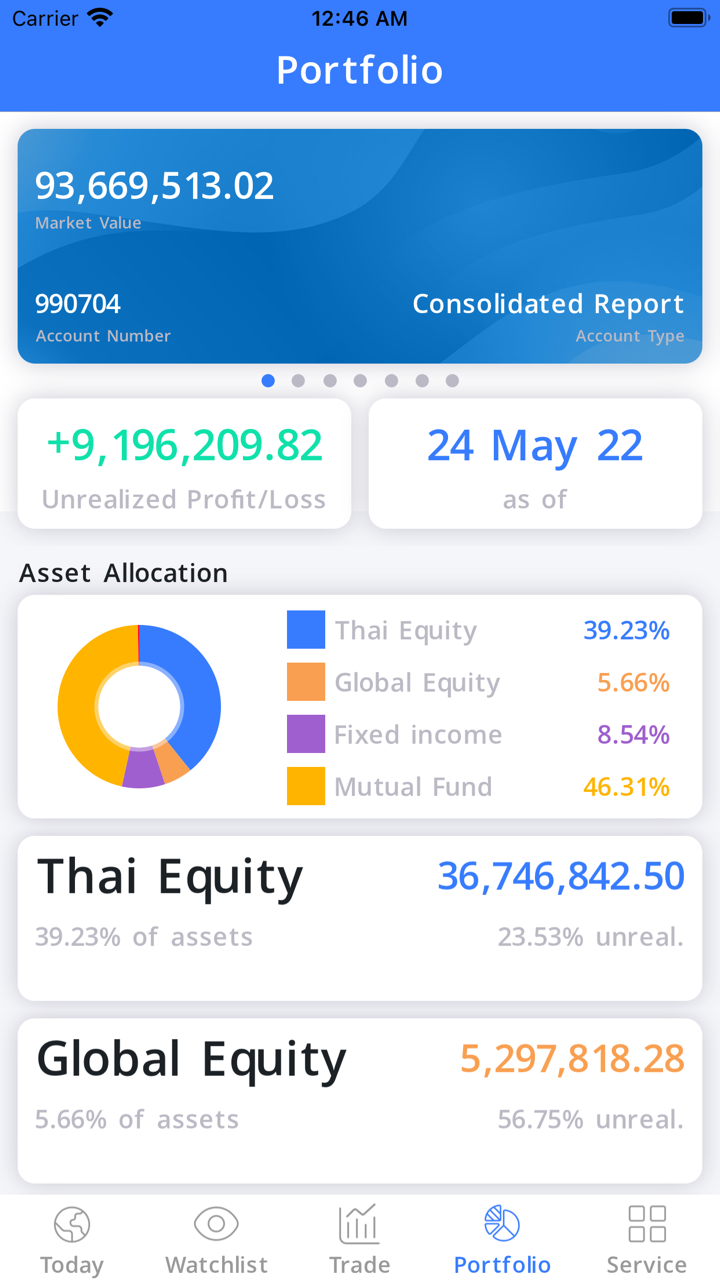

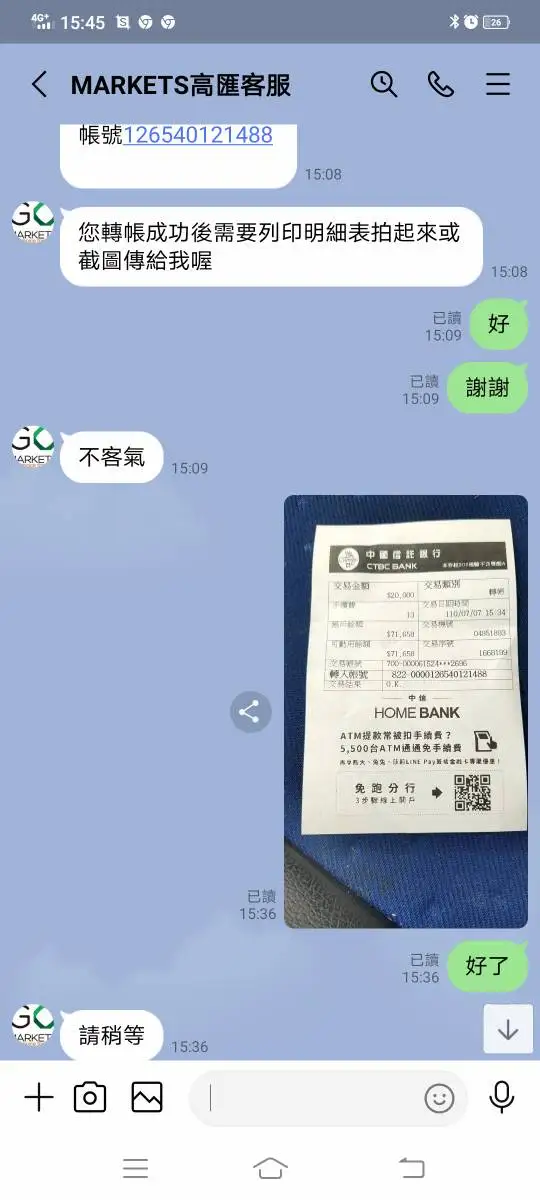

存款和取款

元大证券 不直接收取存款或取款费用,但第三方银行可能根据方式收取费用(特别是对于CHATS/RTGS和海外汇款)。政策中未提及具体的最低存款金额。

| 支付方式 | 费用(元大证券) | 处理时间 | 备注 |

| 支票存款 | 0 | 下一个工作日 | 需要支票副本和带有账户信息的收据 |

| 本地银行转账 | 0(通过SCBHK),其他可能收费 | 同一工作日 | SCBHK转账免费;非SCBHK/CHATS可能会产生费用 |

| CHATS/RTGS | 港币/人民币100万以下免费 | 较大金额可能会产生第三方费用 | |

| 海外汇款 | 元大证券:0;银行收费 | 1-2个工作日(取决于对应银行) | 每种货币需要完整的银行和S钱包导入格T详细信息 |

| 移动应用(双因素认证) | 0 | 同一天(如果在截止时间之前) | 通过移动应用提款需要认证 |

| 电子邮件指示 | 0 | 在同一工作日或下一个工作日处理 | 必须在截止时间(香港时间下午5:00)之前通过电子邮件提供账户名和号码 |