公司简介

| Aspect | Information |

| Registered Country/Area | 中国 |

| Founded year | 2023 |

| Company Name | Apex Trader Funding Inc. |

| Regulation | 未受监管 |

| Spreads or Fees | 终身费用选项:各种账户规模的费用为130美元至360美元;月费用选项:Rithmic PA为85美元,Tradovate PA为105美元 |

| Trading Platforms | NinjaTrader 8, Tradovate, Rithmic RTrader Pro, WealthCharts, ATAS, Bookmap, Edge Clear EdgeProX, Finamark, Jigsaw Trading, MotiveWave, Quantower, Sierra Chart, VolFix |

| Tradable assets | 股票、利率、货币、大宗商品、加密货币、指数期货、农产品、其他商品 |

| Account Types | 绩效账户(PA)、评估账户(Eval) |

| Demo Account | 可用 |

| Payment Methods | Visa、Mastercard、Discover、American Express |

概览

Apex Trader Funding 是一家总部位于中国的非监管交易公司,提供各种账户类型和交易平台,以满足交易者的需求。该公司成立于2023年,为交易者提供了在其绩效账户中选择终身和按月付费结构的选项,fees的范围从130美元到360美元不等。交易者可以交易各种资产,包括股票、利率、货币、大宗商品、加密货币等。该平台支持流行的交易平台,如NinjaTrader 8、Tradovate和Rithmic RTrader Pro,为交易者提供灵活性和便利性。此外,Apex Trader Funding 提供电话客户支持和全天候帮助台,确保在需要时提供帮助。接受的付款方式包括Visa、Mastercard、Discover和American Express,为资金提供便利。总体而言,Apex Trader Funding 的目标是为交易者提供易于访问和可靠的交易服务,尽管交易者应意识到缺乏监管监督。

监管

Apex Trader Funding 在没有监管监督的情况下运作,给投资者带来潜在风险。缺乏监管意味着没有强制性的保障措施或标准来保护交易者的利益。投资者在与像Apex Trader Funding这样没有受到监管监督的实体打交道时应谨慎行事。

优缺点

Apex Trader Funding 提供给交易者考虑的优点和缺点。虽然该平台提供了广泛的交易工具和账户类型,但缺乏监管可能会给投资者带来潜在风险。此外,该平台强大的客户支持和灵活的支付选项增强了交易体验,但由于缺乏监管保障,交易者应谨慎行事。

| 优点 | 缺点 |

|

|

|

|

|

|

|

|

|

|

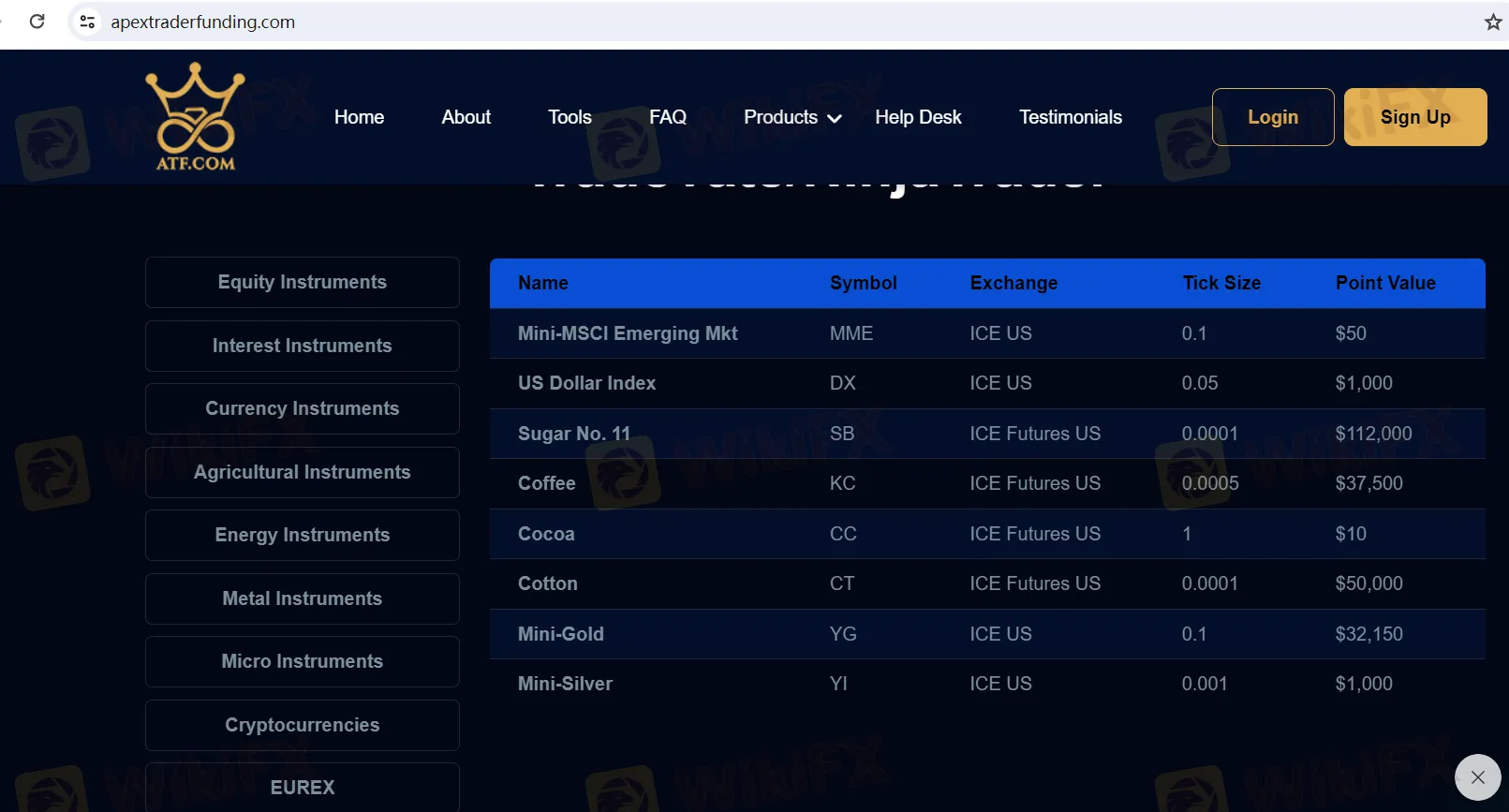

市场工具

Apex Trader Funding 提供跨越各种资产类别和 exchange 的交易产品:

股指期货:

E-mini S&P 500 (ES)

微型E-Mini标普500(MES)

微型纳斯达克100指数期货(MNQ)

日经指数(NKD)

E-mini纳斯达克100(NQ)

Mini-DOW (YM)

E-mini Midcap 400 (EMD)

罗素2000(RTY)

微型E-Mini道琼斯(MYM)

微型E-Mini Russell 2000 (M2K)

利率期货:

微型10年期收益率期货(10Y)

2年期国债(ZT)

5年期国债(ZF)

10年期国债(ZN)

30年期国债(ZB)

Ultra-Bond (UB)

货币期货:

澳大利亚元 (6A)

欧元外汇(6E)

日元(6J)

英镑 (6B)

加拿大元(6C)

瑞士法郎(6S)

微型E-Mini AUD/USD (M6A)

微型欧元/美元期货(M6E)

商品期货:

玉米(ZC)

黄金(GC)

微原油(MCL)

小麦(ZW)

大豆(ZS)

大豆粕(ZM)

大豆油(ZL)

原油(CL)

迷你原油(QM)

天然气(NG)

E-mini Natural Gas (QG)

暖气油(HO)

纽约港(RB)

白银(SI)

铜(HG)

白金(PL)

钯(PA)

E-mini白银(QI)

迷你黄金(QO)

Cryptocurrency 衍生品:

微型外汇交易(MBT)

Micro Ethereum (MET)

指数期货:

DAX指数(FDAX)

Micro DAX指数(FDXS)

Euro-Buxl (FGBX)

欧元博布尔(FGBM)

Mini-MSCI新兴市场(MME)

Mini-DAX (FDXM)

欧洲斯托克50指数(FESX)

VSTOXX (FVS)

STOXX欧洲600(FXXP)

微型欧洲斯托克50 (FSXE)

欧元短期国债(FGBS)

欧元国债 (FGBL)

美元指数(DX)

农产品商品:

糖 No. 11 (SB)

咖啡 (KC)

可可 (CC)

棉花(CT)

其他商品:

迷你黄金(YG)

Mini-Silver (YI)

有了这么多种产品,交易者可以多样化他们的投资组合,并参与各种市场,以适应他们的策略和偏好。

账户类型

Apex Trader Funding 提供两种不同类型的账户,以满足交易者不同的需求:绩效账户(PA)和评估账户(Eval)。 绩效账户涉及使用交易者自己的资金进行实际交易,根据所产生的利润可能会奖励他们。另一方面,评估账户为交易者提供了一个模拟环境,让他们在没有财务风险的情况下测试他们的策略,成功的交易者可能会过渡到绩效账户,与公司进行真实交易机会。

费用

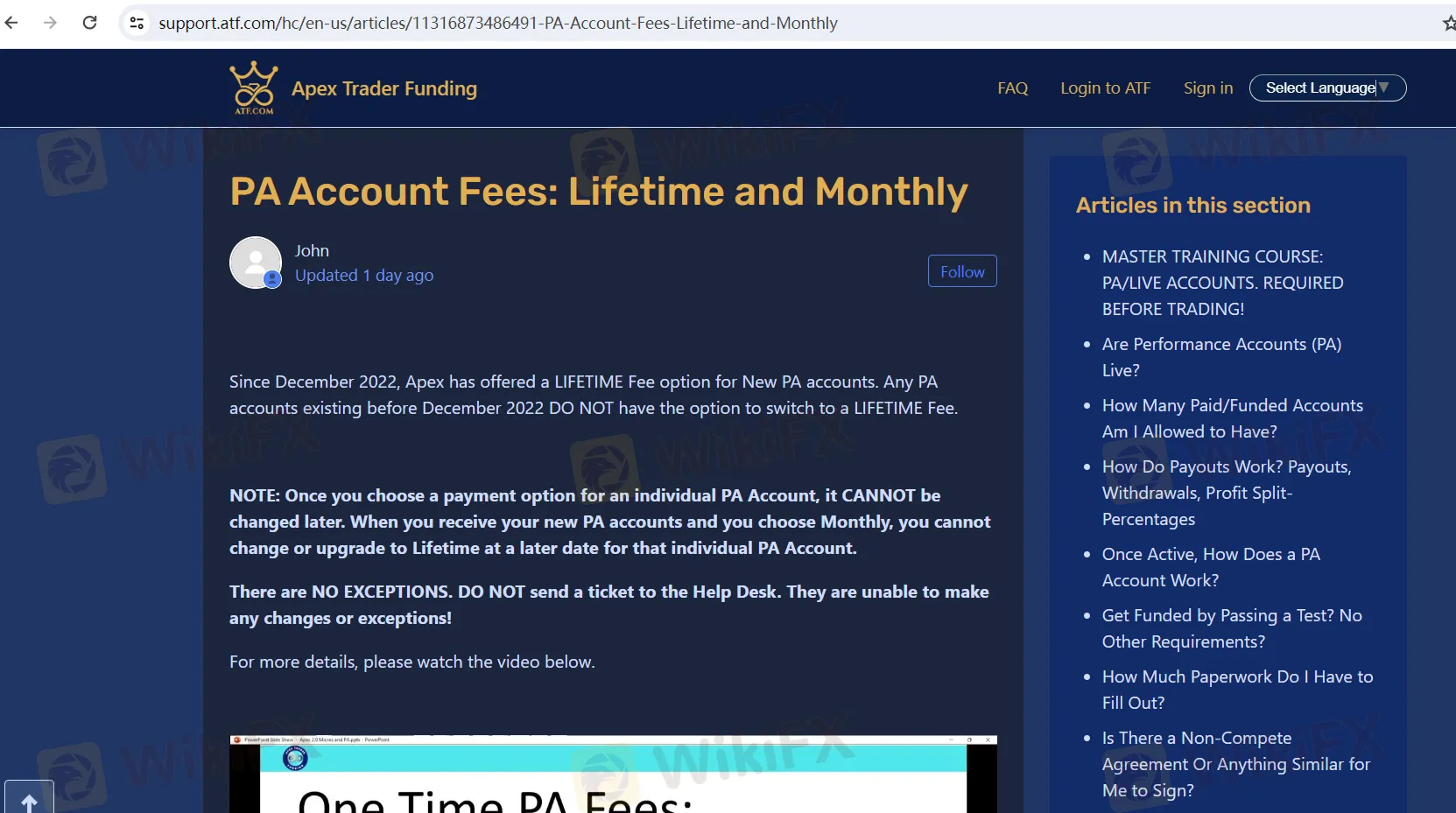

Apex Trader Funding 为其绩效账户(PA)提供两种付款选项:终身和月度。以下是与每个选项相关的费用的详细说明:

终身费用选项:

这个选项自2022年12月起适用于新的PA accounts。

根据账户激活金额不同,有不同的终身会员资格,从25k PA激活账户的130美元到300k PA Tradovate激活账户的360美元不等。

终身费用选项意味着对所选择的特定账户进行一次性付款。

一旦选择了,对于该个人PA账户,就不能再更改。

2022年12月之前存在的PAaccounts没有选择切换到终身费用的选项。

月费选项:

交易者可以选择按月付费选项,需要每月支付一定费用。

一旦选择了,对于该个人PA账户,就不能再更改。

这个选项适合那些更喜欢按月付款而不是一次性费用的交易者。

Rithmic PA accounts 的月费为$85,Tradovate PA accounts 的月费为$105。

需要注意的是,一旦为个人PA账户选择了支付选项,就无法在以后更改。建议交易者在做出决定之前仔细考虑他们的首选支付方式。此外,fees可能会根据特定账户激活金额和选择的平台(Rithmic或Tradovate)而有所不同。

交易平台

Apex Trader Funding 通过各种交易平台提供其服务,包括:

NinjaTrader 8: NinjaTrader 8 是Apex Trader Funding首选的交易平台。交易者可以使用NinjaTrader 8进行桌面交易,并且会在会员区提供免费密钥。然而需要注意的是,NinjaTrader 7不受支持。

Tradovate: Tradovate 可通过 Tradovate Web 或 Mobile、TradingView 或 NinjaTrader(桌面版或移动应用程序)访问。交易者可以使用 NinjaTrader 移动应用程序与 Tradovate 进行交易,但 NinjaTrader 网页平台不兼容。

Rithmic RTrader Pro: 交易者可以在会员区免费访问Rithmic RTrader Pro。该平台允许交易者激活他们的数据源,监控账户balances,亏损,并进行交易。登录时必须打开RTrader Pro以确保正确连接。

其他平台: Apex Trader Funding 支持通过支持Rithmic登录的其他平台访问其服务。这些平台包括 WealthCharts, ATAS, Bookmap, Edge Clear EdgeProX, Finamark, Jigsaw Trading, MotiveWave, Quantower, RTrader Pro (仅限PC), Rithmic Trader Pro Mobile, Rithmic RTrader Pro-Web, Sierra Chart 和 VolFix。

支付方式

Apex Trader Funding 提供多种支付方式,以便为其绩效账户fees的交易提供便利。

Visa: Visa是全球范围内广泛接受的信用卡网络,允许交易者使用其Visa品牌的信用卡或借记卡方便地进行支付。

万事达卡: 万事达卡是另一个主要的信用卡网络,被Apex Trader Funding接受,为用户提供了一种安全高效的方式,使用其万事达卡付款Performance Account fees。

发现:发现是一个知名的信用卡网络,Apex Trader Funding接受通过发现品牌的信用卡或借记卡进行的付款。交易者可以利用他们的发现卡无缝完成交易。

American Express: 美国运通(Amex)是一家著名的信用卡公司,交易者可以使用他们的美国运通品牌的信用卡或借记卡支付 Performance Account fees 在 Apex Trader Funding。

通过接受这些主要的信用卡网络——Visa、Mastercard、Discover和American Express——Apex Trader Funding为交易者提供了灵活性和便利性,使他们可以为其绩效账户进行付款。交易者可以选择最适合他们偏好的付款方式,并享受在线安全完成交易的便利。

客户支持

Apex Trader Funding Inc. 提供强大的客户支持服务:

联系信息: 交易者可以在CST工作时间内,周一至周五上午9点至下午5点,通过电话1-855-273-9873联系客户支持。这条直线提供账户查询、技术问题和一般咨询的帮助。

帮助台:交易者可以访问 24/7 帮助台 提交咨询,报告技术问题或请求帮助。这个集中平台确保了与支持团队的高效沟通和及时回应。

结论

总的来说,Apex Trader Funding 为交易者提供了跨越各种资产类别和exchange的全面交易机会。尽管缺乏监管监督可能带来潜在风险,但交易者可以从多样化的账户类型、灵活的支付选项以及强大的客户支持服务中获益。Apex Trader Funding 致力于赋予交易者信心地驾驭他们的交易之旅,提供了一系列平台和工具,以满足交易者的偏好和策略,使他们能够实现投资组合的多样化,并追求他们的财务目标。

常见问题

问:Apex Trader Funding 是否受监管?

A: 不,Apex Trader Funding 在没有监管监督的情况下运作,给投资者带来潜在风险。

问:Apex Trader Funding提供哪些账户类型?

A: Apex Trader Funding 为真实交易提供绩效账户(PA),为模拟交易提供评估账户(Eval)。

问:Apex Trader Funding接受哪些支付方式?

A: Apex Trader Funding 接受Visa、Mastercard、Discover和American Express进行支付。

问:交易者可以在营业时间以外获得客户支持吗?

A: 是的,交易者可以通过24/7的帮助台获取帮助,解决咨询和技术问题。

问:Apex Trader Funding支持哪些交易平台?

A: Apex Trader Funding 支持多种交易平台,包括NinjaTrader 8,Tradovate。

风险警示

在线交易存在着巨大的风险,可能导致投资资金的全部损失。这种交易可能并不适合所有的交易者或投资者。在参与交易活动之前,充分理解相关风险是至关重要的。此外,本评价内容可能会发生变化,反映公司服务和政策的更新。评价的创建日期也很重要,因为信息可能已经过时。读者在做出任何投资决策之前应该与公司确认最新信息。利用本文提供的信息的责任完全由读者承担。