Giới thiệu doanh nghiệp

| Chibagin Securities Tóm tắt Đánh giá | |

| Thành lập | 1883 |

| Quốc gia/Vùng | Nhật Bản |

| Quy định | FSA |

| Sản phẩm Giao dịch | Cổ phiếu Trong nước, Cổ phiếu Nước ngoài, quỹ đầu tư, Fund Wrap, REIT, ETF, ETN, trái phiếu, Ruitou (Đầu tư Tích lũy Cổ phiếu), Quỹ Tích lũy, và NISA của Chibagin Securities |

| Tài khoản Demo | ❌ |

| Nền tảng Giao dịch | / |

| Yêu cầu Tiền gửi tối thiểu | / |

| Hỗ trợ Khách hàng | Giờ tiếp nhận: Thứ Hai đến Thứ Sáu 8:00 ~ 17:00 |

| Mẫu Liên hệ | |

| Điện thoại: 0120-154-702 | |

| Địa chỉ: 〒260-0013, 2-5-1 Chuo, Chuo-ku, Chiba-shi | |

Chibagin Securities là một công ty tài chính được thành lập vào năm 1883 và đăng ký tại Nhật Bản. Được quy định bởi Cơ quan Dịch vụ Tài chính (FSA) với Giấy phép Ngoại hối Bán lẻ, Chibagin Securities cung cấp các sản phẩm giao dịch đa dạng: Cổ phiếu Trong nước, Cổ phiếu Nước ngoài, quỹ đầu tư, Fund Wraps, REITs, ETFs, ETNs, trái phiếu, Ruitou (Đầu tư Tích lũy Cổ phiếu), Quỹ Tích lũy.

Ưu điểm và Nhược điểm

| Ưu điểm | Nhược điểm |

| Được quy định bởi FSA | Thông tin hạn chế về tài khoản |

| Một loạt các sản phẩm giao dịch | Không có tài khoản demo |

| Thiếu thông tin về các nền tảng giao dịch |

Chibagin Securities Có Uy tín không?

Có, Chibagin Securities hiện đang được quy định bởi FSA, giữ Giấy phép Ngoại hối Bán lẻ.

| Quốc gia được quy định | Cơ quan được quy định | Thực thể được quy định | Tình trạng Hiện tại | Loại Giấy phép | Số Giấy phép |

| Cơ quan Dịch vụ Tài chính (FSA) | Chibagin Securities株式会社 | Được quy định | Giấy phép Ngoại hối Bán lẻ | 関東財務局長(金商)第114号 |

Tôi có thể Giao dịch gì trên Chibagin Securities?

Trên Chibagin Securities, bạn có thể giao dịch với Cổ phiếu Trong nước, Cổ phiếu Nước ngoài, quỹ đầu tư, Fund Wrap, REIT, ETF, ETN, trái phiếu, Ruitou (Đầu tư Tích lũy Cổ phiếu), Quỹ Tích lũy, và NISA của Chibagin Securities.

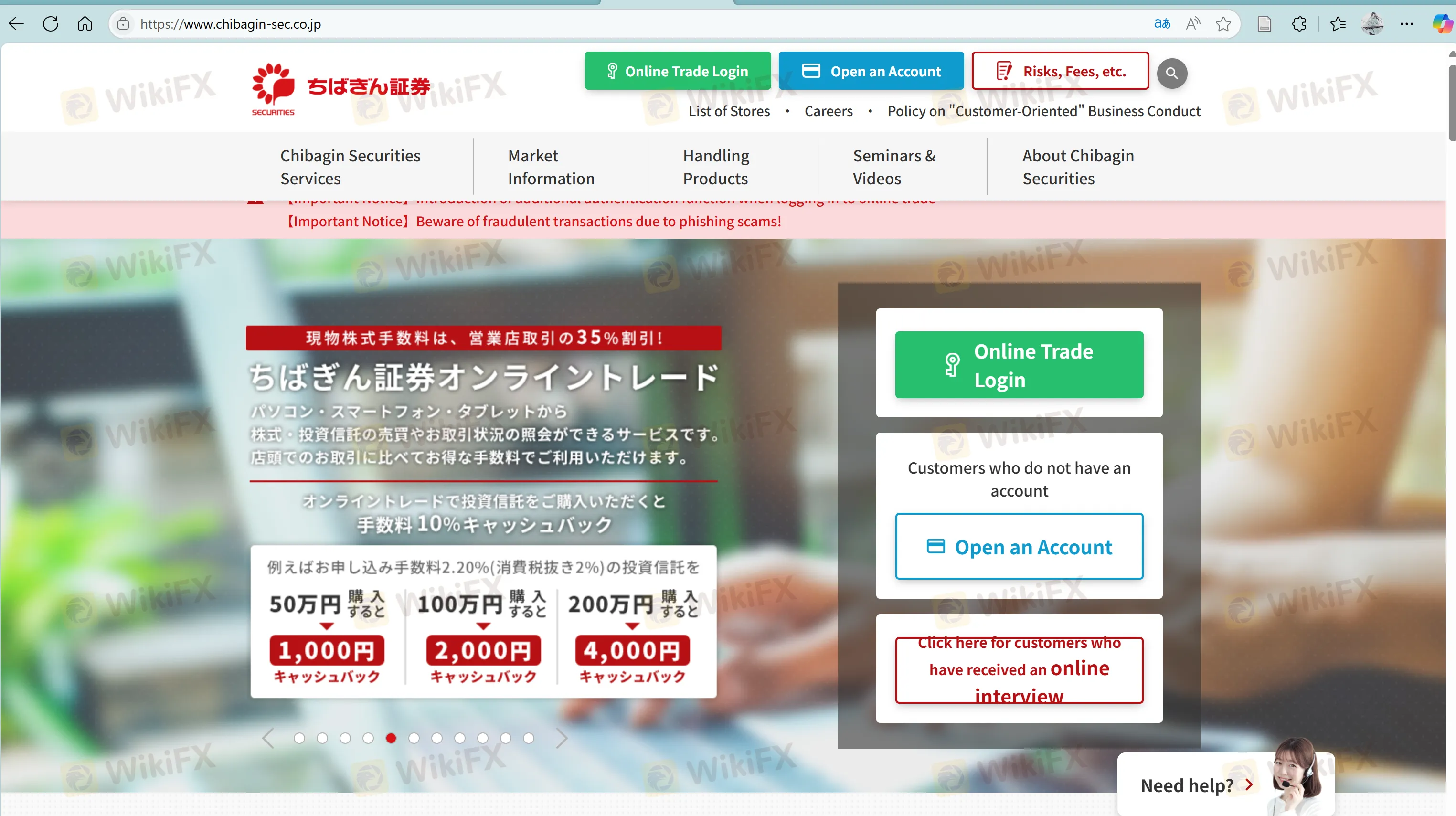

Phí

Chibagin Securities cung cấp một danh sách các loại phí cho các giao dịch trực tiếp, bạn có thể tham khảo trên trang web của họ. https://www.chibagin-sec.co.jp/service/commission/