Giới thiệu doanh nghiệp

| Tracom Tóm tắt Đánh giá | |

| Thành lập | 2008 |

| Quốc gia/Vùng | Ấn Độ |

| Quy định | Không có quy định |

| Sản phẩm & Dịch vụ | Thị trường vốn, Demat, Quỹ chung, Phân phối PMS, Ứng dụng IPO, Đầu tư vào NCD / Trái phiếu, Tiền gửi cố định doanh nghiệp, Trái phiếu RBI, Trái phiếu tiết kiệm thuế thu nhập vốn |

| Tài khoản Demo | ❌ |

| Nền tảng Giao dịch | Ứng dụng di động |

| Hỗ trợ Khách hàng | Điện thoại: 079 - 29666001 |

| Email: info@tracom.co.in | |

| Mạng xã hội: Facebook, X, Instagram, Telegram | |

| Địa chỉ: A 705 The First, Phía sau Keshavbaug Party Plot, Gần ITC Narmada, Vastrapur, Ahmedabad 380015. Gujarat | |

Thông tin về Tracom

Tracom là một nhà cung cấp dịch vụ không được quy định hàng đầu về môi giới và dịch vụ tài chính tại Sở giao dịch chứng khoán Ấn Độ. Tracom cung cấp các sản phẩm và dịch vụ trên Thị trường vốn, Demat, Quỹ chung, Phân phối PMS, Ứng dụng IPO, Đầu tư vào NCD / Trái phiếu, Tiền gửi cố định doanh nghiệp, Trái phiếu RBI, Trái phiếu tiết kiệm thuế thu nhập vốn.

Ưu điểm và Nhược điểm

| Ưu điểm | Nhược điểm |

| Đa dạng sản phẩm & dịch vụ | Thiếu quy định |

| Nhiều kênh liên hệ | Không có tài khoản demo |

| Thời gian hoạt động lâu |

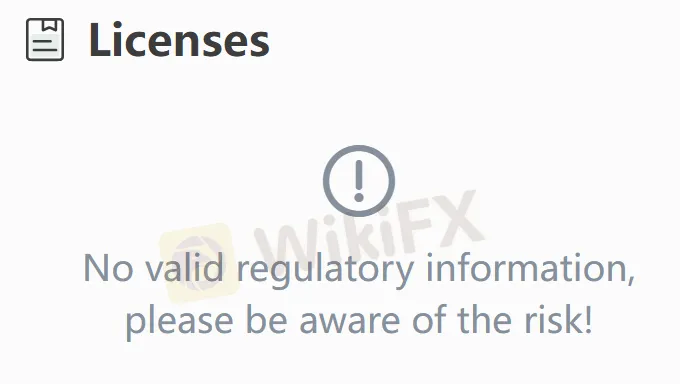

Tracom Có Uy tín không?

Số Tracom hiện tại không có quy định hợp lệ. Vui lòng chú ý đến rủi ro!

Sản phẩm và Dịch vụ

| Sản phẩm & Dịch vụ | Hỗ trợ |

| Thị trường vốn | ✔ |

| Demat | ✔ |

| Quỹ tương hỗ | ✔ |

| Phân phối PMS | ✔ |

| Ứng dụng IPO | ✔ |

| Đầu tư vào NCDs | ✔ |

| Trái phiếu | ✔ |

| Tiền gửi cố định doanh nghiệp | ✔ |

| Trái phiếu RBI | ✔ |

| Trái phiếu tiết kiệm thuế thu nhập từ vốn lợi nhuận | ✔ |

Nền tảng Giao dịch

Nhà môi giới có ứng dụng riêng làm nền tảng giao dịch.

| Nền tảng Giao dịch | Hỗ trợ | Thiết bị có sẵn | Phù hợp với |

| Ứng dụng di động | ✔ | Di động | / |