Điểm

R Wadiwala

Ấn Độ | 5-10 năm |

Ấn Độ | 5-10 năm |http://www.rwsec.com

Website

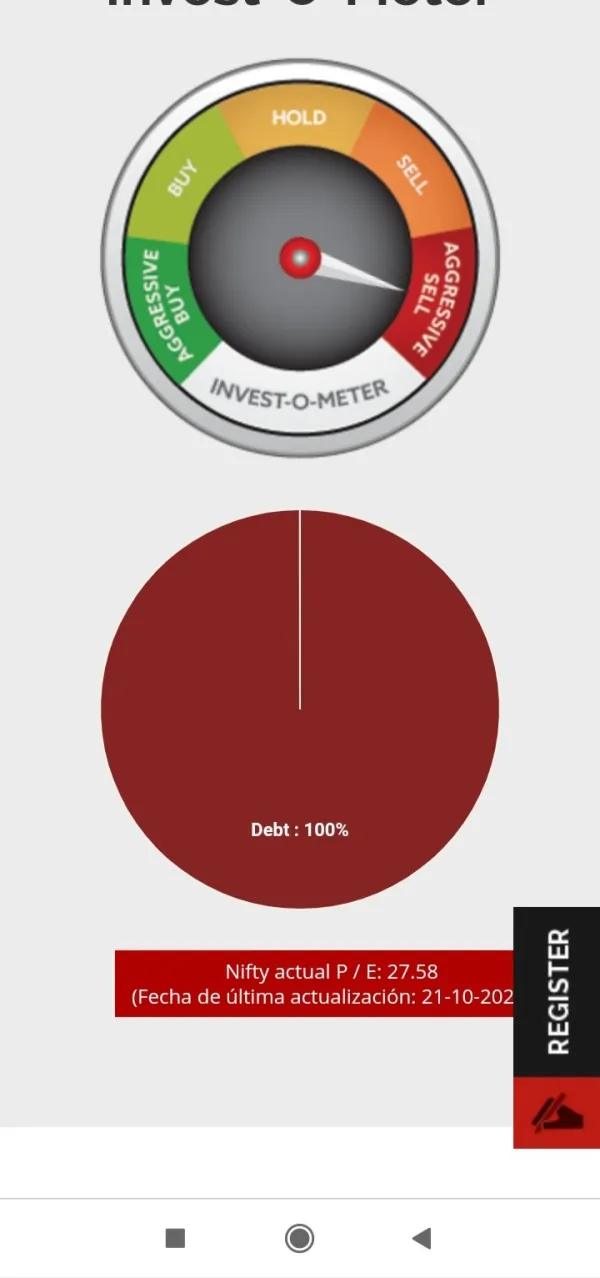

Chỉ số đánh giá

Mức ảnh hưởng

Mức ảnh hưởng

C

Mức ảnh hưởng NO.1

Ấn Độ 4.97

Ấn Độ 4.97 Liên hệ

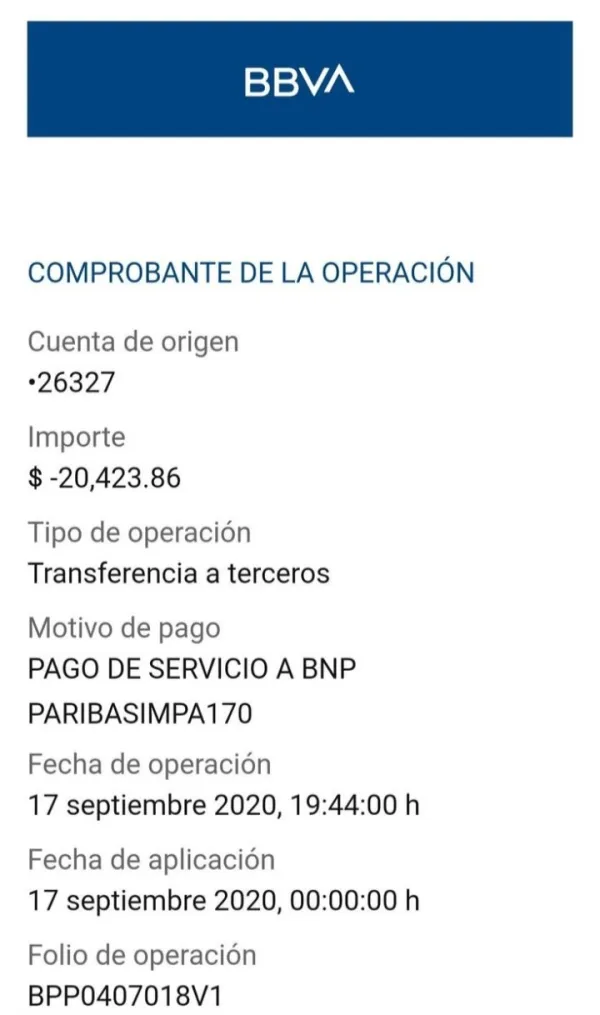

Cơ quan quản lý Forex

Cơ quan quản lý Forex

Không tìm thấy giấy phép giao dịch ngoại hối. Vui lòng lưu ý những rủi ro.

- Sàn giao dịch này thiếu quy định ngoại hối hợp lệ. Vui lòng lưu ý rủi ro!

Thông tin chung

Ấn Độ

Ấn Độ Người dùng đã xem R Wadiwala cũng đã xem..

AVATRADE

MiTRADE

GTCFX

Neex

Website

rwsec.com

123.108.43.92Vị trí ServerẤn Độ

Số lưu hồ sơ--Quốc gia/khu vực phổ biến--Thời gian thành lập tên miền--Website--Công ty--

Sơ đồ quan hệ

Các công ty liên quan

Hỏi & Đáp về Wiki

Can you tell me the highest leverage R Wadiwala provides on major forex pairs, and how their leverage policies differ across other asset classes?

From my research and personal due diligence, I haven't been able to verify the specific leverage levels offered by R Wadiwala on major forex pairs or other asset classes. When I looked into R Wadiwala, one of the main issues I found was the lack of transparent and reliable regulatory information; the broker currently operates without a recognized license. This absence of oversight means critical trading parameters like leverage are neither easily accessible nor clearly outlined by the broker. For me, that’s a considerable red flag because leverage policies directly impact trading risk. As an experienced trader, I’m well aware that regulated brokers must disclose leverage limits as part of their compliance with financial authorities, making it easier for traders to assess and manage risk. In contrast, brokers with “suspicious regulatory licenses” and “high potential risk” scores, as I noted R Wadiwala has, are not bound by such consumer protections. Without clear regulatory guidelines or published details, there’s an inherent uncertainty about leverage arrangements for forex, equities, or any other assets on their platform. For this reason, I would proceed with extreme caution. Personally, I would not engage live capital with any provider that cannot clearly and transparently communicate its leverage structure and risk policies, especially in the absence of credible oversight. My experience has taught me that lack of clarity on such essential matters can expose traders to unacceptable levels of risk.

What documents do I usually need to provide in order to complete my initial withdrawal with R Wadiwala?

Based on my experience, whenever I approach a broker like R Wadiwala—especially one that is flagged with a suspicious regulatory license and lacks valid oversight—I proceed with heightened caution regarding document requirements for withdrawals. While the specific instructions are not clearly outlined in the available details, my general practice, especially with brokers operating in India or similar markets, has been to expect requests for a government-issued photo ID, recent proof of address (such as a utility bill or bank statement), and possibly documentation verifying the source of funds. This is typical to adhere to local compliance practices and anti-money laundering policies, even if regulation is questionable. Due to the high potential risk associated with R Wadiwala and the concerning user report of unapproved withdrawals and significant financial loss, I would personally ensure that any documents I submit do not expose unnecessary personal data beyond the essential requirements. My past experience has taught me that it is prudent to confirm document submission protocols directly with the broker via official support channels, and to retain copies of every communication. Given these risks, I only provide the minimum acceptable verification documents and always hesitate if I feel my information might not be handled securely. Ultimately, clarity and security around document handling are priorities for me, especially when there is a persistent lack of regulatory transparency.

How do the different account types available at R Wadiwala differ from each other?

Drawing from my thorough review of R Wadiwala as a trading platform, one of the most significant challenges I encountered was the lack of transparent information regarding account types. In my experience as a forex trader, a broker’s clarity on its offerings—be it account minimums, spreads, commissions, or available trading platforms—is critical for making informed decisions. However, after carefully reviewing available details, I found no specific outlines or distinctions regarding differing account types at R Wadiwala. This absence of clear account differentiation makes it difficult for me, or any trader, to accurately assess which type of account, if any, might meet particular trading needs or preferences. For someone like myself who relies on comparing costs, leverage options, and platform features, this is a considerable drawback. Further compounding my reservations, the broker is flagged for a suspicious regulatory license, no verified regulation, and high potential risk. The overall low score and reports of unresolved withdrawal issues underline why I approach such a broker with great caution. Given these factors, I cannot provide a reliable comparison of R Wadiwala’s account types, simply because the broker does not supply this information transparently. In my professional judgment, this lack of clarity is, itself, a risk that all serious traders should weigh heavily before opening an account.

Does R Wadiwala offer swap-free or Islamic trading account options for its clients?

Based on my careful review of R Wadiwala’s available information, I see no clear indication that they provide swap-free or Islamic trading account options for clients. As someone who has encountered brokers of varying standards over the years, I tend to be especially vigilant when it comes to regulatory status and transparency around account offerings—particularly for features as crucial as swap-free accounts, given their importance for traders with religious considerations. One of my top priorities when evaluating a broker is established, credible oversight. In R Wadiwala’s case, not only is there a lack of valid regulatory information, but there is also an explicit warning about their suspicious license and scope of business. The risk highlighted by their extremely low regulatory score weighs heavily for me, as I strongly prefer brokers that operate under strict international supervision and offer clearly documented account types with all relevant conditions spelled out. In my experience, legitimate brokers prominently detail whether they support Islamic accounts, either on their website or during the onboarding process. Here, I could not identify any such offering, nor sufficient transparency on specialized account types. Such gaps are concerning and, for me, would be a decisive factor in choosing to move forward with caution or to consider better-regulated alternatives, especially if swap-free trading is a must for my strategy or beliefs.

người dùng Đánh giá1

Nội dung bình luận

Vui lòng nhập...

Đánh giá 1

TOP

TOP

Chrome

Chrome extension

Yêu cầu về quy định của nhà môi giới ngoại hối toàn cầu

Đánh giá nhanh chóng website của các sàn giao dịch

Tải ngay