مقدمة عن الشركة

| CCB Futures ملخص المراجعة | |

| تأسست | 2013 |

| البلد/المنطقة المسجلة | الصين |

| التنظيم | CFFE (منظم) |

| صكوك السوق | العقود الآجلة |

| حساب تجريبي | ✅ |

| منصة تداول | Wenhua Winshun Cloud Market Trading Software HD Version (wh6), Fast trading terminal, Infinite Easy (Pro Professional Edition), Flush Futures PC Version, Boyi Master, Polestar 9.5 Jianxin Futures Edition, Polestar 9.3 Jianxin Futures Edition, إلخ. |

| دعم العملاء | الدردشة المباشرة |

| هاتف: 400-90-95533 | |

| البريد الإلكتروني: ptg@ccbfutures.com | |

معلومات CCB Futures

CCB Futures هو وسيط مرخص، يقدم التداول في العقود الآجلة على منصات تداول مختلفة.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| منصات تداول متنوعة | أنواع محدودة من منتجات التداول |

| منظم بشكل جيد | |

| حسابات تجريبية متاحة | |

| دعم الدردشة المباشرة |

هل CCB Futures شرعي؟

نعم. CCB Futures مرخص من قبل CFFEX لتقديم الخدمات.

| البلد المنظم | الهيئة التنظيمية | الحالة الحالية | الكيان المنظم | نوع الترخيص | رقم الترخيص |

| بورصة العقود الآجلة المالية الصينية (CFFEX) | منظم | CCB Futures有限责任公司 | ترخيص العقود الآجلة | 0103 |

ما الذي يمكنني التداول به على CCB Futures؟

CCB Futures يقدم تداول على العقود الآجلة.

| الأدوات التجارية | مدعوم |

| العقود الآجلة | ✔ |

| الفوركس | ❌ |

| السلع | ❌ |

| المؤشرات | ❌ |

| الأسهم | ❌ |

| العملات الرقمية | ❌ |

| السندات | ❌ |

| الخيارات | ❌ |

| صناديق الاستثمار المتداولة | ❌ |

نوع الحساب

CCB Futures لم يوضح بوضوح أنواع الحسابات التي يقدمها، ولكنه يقدم حسابات تجريبية للعملاء.

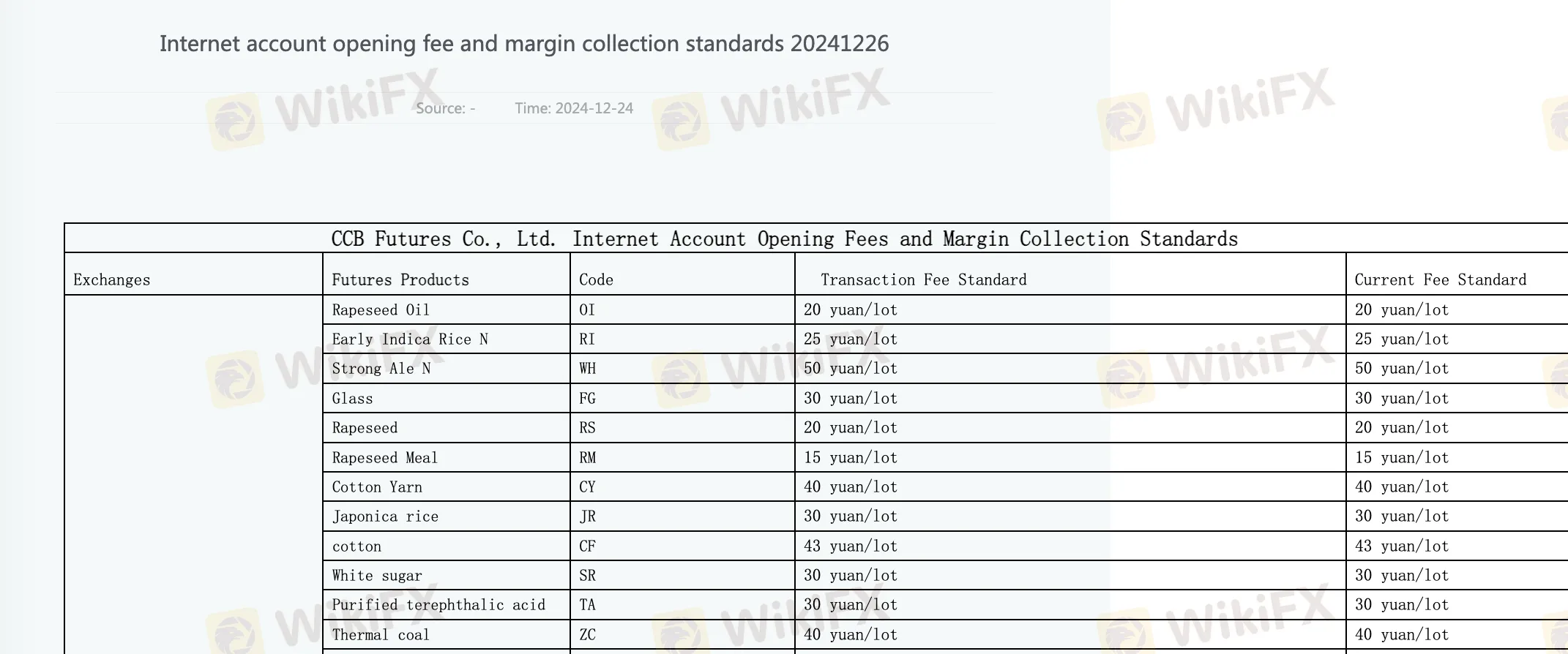

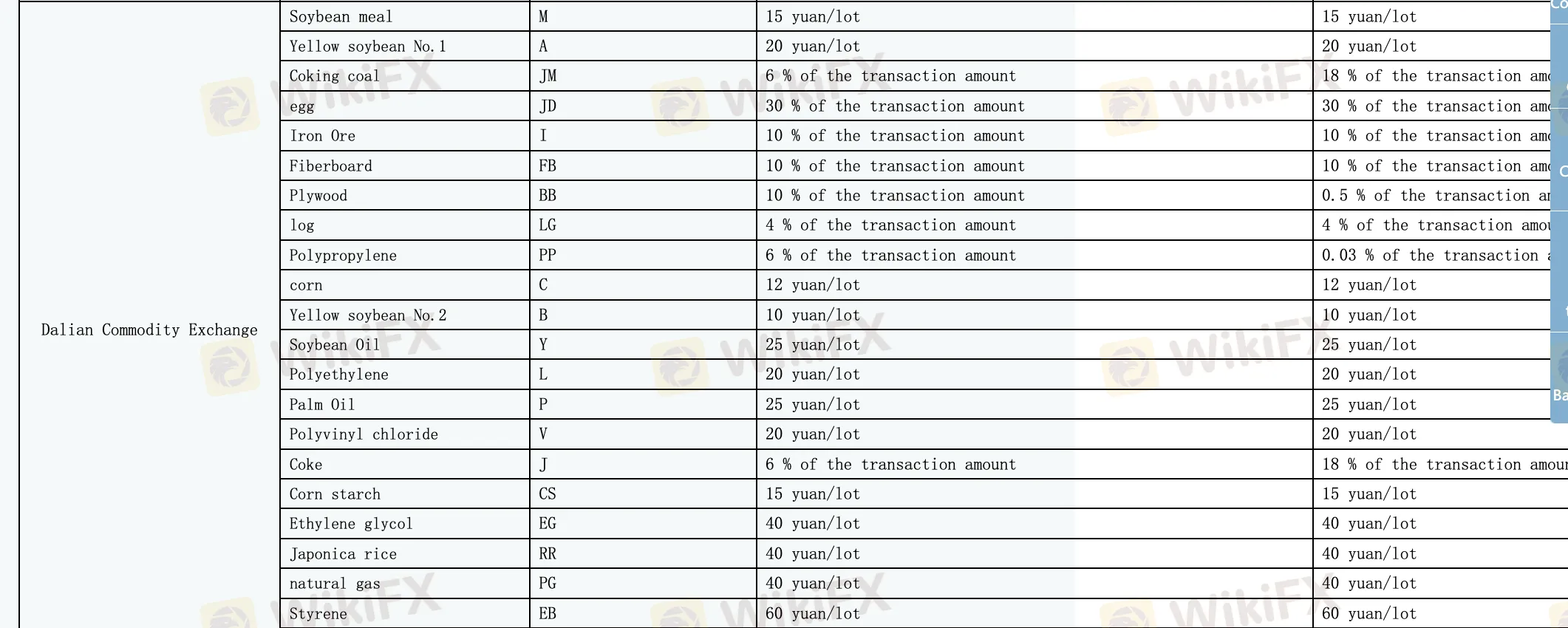

رسوم CCB Futures

CCB Futures يتطلب رسوم فتح حساب الإنترنت، ورسوم حالية ولديه معايير جمع الهامش.

| منتجات العقود الآجلة | معيار الرسوم الحالي |

| زيت الجليسرين | 20 يوان/الوحدة |

| القطن | 43 يوان/الوحدة |

| زيت النخيل | 25 يوان/الوحدة |

منصة التداول

الوسيط يوفر مجموعة متنوعة من منصات التداول، بما في ذلك برنامج تداول سحابي للسوق من وينشون وإصدار HD (wh6)، ومحطة تداول سريعة، وإنفينيت إيزي (إصدار احترافي)، وإصدار الكمبيوتر الشخصي لعقود الآجلة، وبوي ماستر، وإصدار جيانشين 9.5 لعقود الآجلة، وإصدار جيانشين 9.3 لعقود الآجلة، ومحطة تداول كوايكي V3، ورائد التداول، ونظام تداول قرار الهرم، ومحطة تداول سريعة بإصدار سري للأمان القومي، وتطبيق جيانشين لعقود الآجلة وبرنامج تداول الجوال ييشينج ييشينج.

الأجهزة المتاحة: سطح المكتب والهاتف المحمول.

الإيداع والسحب

خلال وقت التداول المستمر، يمكن للعملاء إيداع الأموال فقط وليس سحبها. لا يوجد مبلغ أدنى محدد للإيداع أو السحب ولا توجد رسوم أو تكاليف محددة.