Temel Bilgiler

Hong Kong

Hong Kong

Puan

Hong Kong

|

5-10 yıl

|

Hong Kong

|

5-10 yıl

| https://www.hungsing.org/sc/index.php?

Web Sitesi

Derecelendirme Endeksi

Etkilemek

D

Etki endeksi NO.1

Malezya 2.72

Malezya 2.72 Hong Kong

Hong Kong hungsing.org

hungsing.org Hong Kong

Hong Kong

| HUNGSING İnceleme Özeti | |

| Kuruluş Yılı | 1999 |

| Kayıtlı Ülke/Bölge | Hong Kong |

| Regülasyon | SFC (aşıldı, iptal edildi) |

| Hizmetler | Borç Finansmanı, Yatırım Ürünleri, Varlık Yönetimi, IPO Başvurusu, vb. |

| Deneme Hesabı | ❌ |

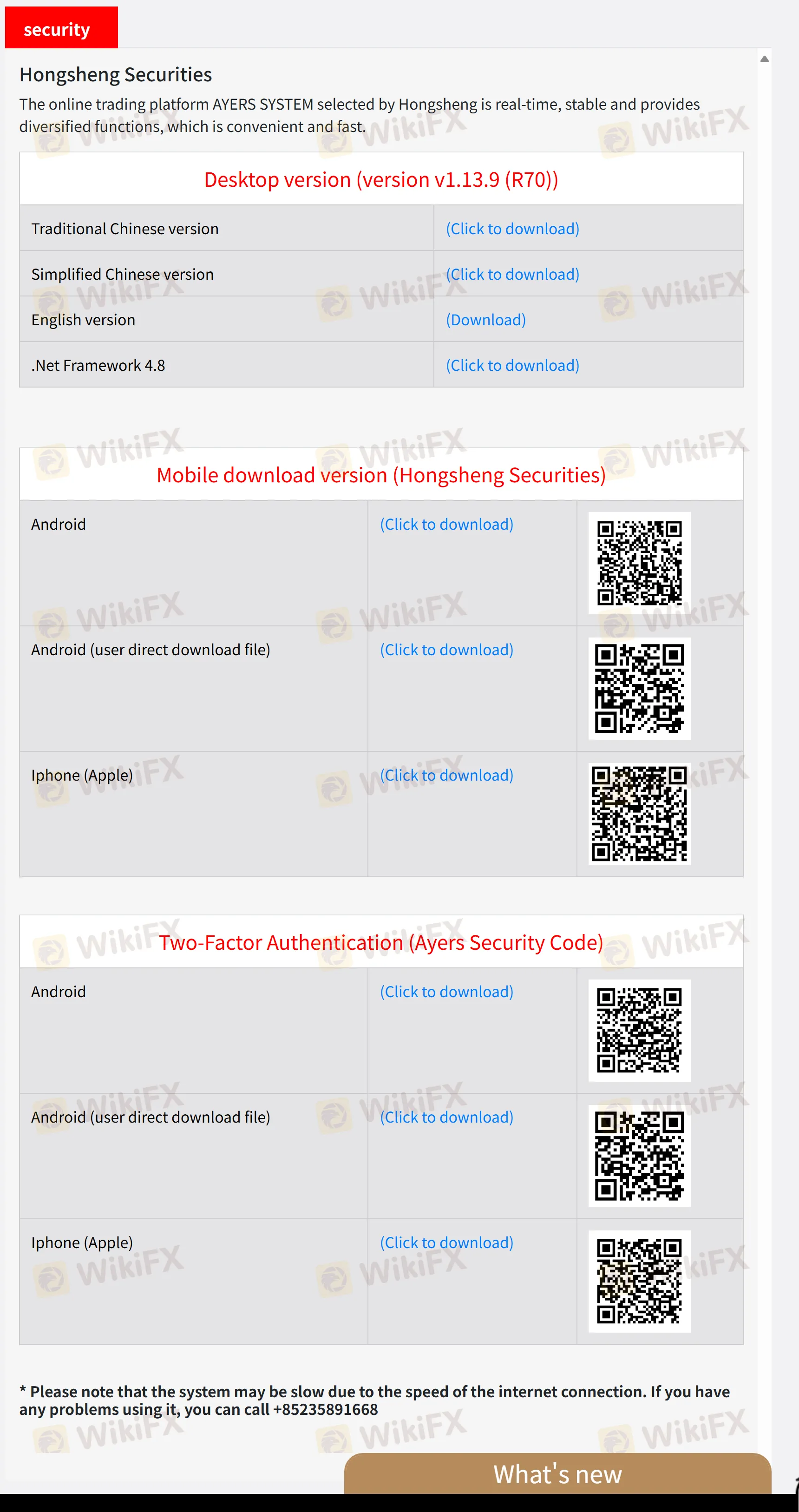

| İşlem Platformu | Hongsheng Securities (web ve mobil sürüm) |

| Minimum Yatırım | / |

| Müşteri Desteği | İletişim formu |

| Telefon: (852) 3589 1623 | |

| E-posta: settlement@hungsing.org | |

| Çalışma Saatleri: Pazartesi'den Cuma'ya 9:00 - 18:00Cumartesi, Pazar ve resmi tatillerde kapalı | |

| Adres: Room 2505, 25/F, West Tower, Shun Tak Centre, 200 Connaught Road Central, Sheung Wan, Hong Kong | |

HUNGSING, 1999 yılında kurulan ve Hong Kong'da kayıtlı olan bir finansal kuruluştur. Çeşitli hizmetler sunmaktadır: borç finansmanı, yatırım ürünleri, varlık yönetimi ve IPO başvurusu. Şirket, web ve mobil sürümlerde mevcut olan Hongsheng Securities platformunu sağlar. Ancak, menkul kıymetler işleme lisansı aşılmış ve vadeli işlemler lisansı iptal edilmiştir by the Securities and Futures Commission (SFC).

| Artıları | Eksileri |

| Çeşitli hizmetler | Aşılmış ve iptal edilmiş lisanslar |

| Çoklu müşteri destek kanalları | Hesaplarla ilgili sınırlı bilgi |

| İşlem ücretleri hakkında sınırlı bilgi | |

| Deneme hesabı yok |

Şu anda, HUNGSING sadece Menkul Kıymetler ve Vadeli İşlemler Komisyonu (SFC)'dan vadeli işlemler yapma lisansını aşmış durumda. Onun menkul kıymetler işlemi lisansı iptal edilmiştir. Diğer düzenlenmiş şirketlerden hizmet almanızı öneririz.

| Düzenlenmiş Ülke | Düzenleyici Otorite | Düzenlenmiş Kuruluş | Mevcut Durum | Lisans Türü | Lisans Numarası |

| Menkul Kıymetler ve Vadeli İşlemler Komisyonu (SFC) | Hung Sing Futures Limited | İptal Edildi | Vadeli işlemler yapma | AFC168 |

| Menkul Kıymetler ve Vadeli İşlemler Komisyonu (SFC) | Hung Sing Securities Limited | Aşıldı | Menkul kıymetler işlemi | ABS697 |

HUNGSING müşterilere Borç Finansmanı, Yatırım Ürünleri, Varlık Yönetimi, Halka Arz Aboneliği, vb. gibi çeşitli finansal hizmetler sunmaktadır.

| İşlem Platformu | Desteklenen | Kullanılabilir Cihazlar |

| Hongsheng Securities | ✔ | Web, mobil |

From my own investigation and experience as a trader, I find that HUNGSING presents significant limitations when it comes to account type transparency and options. Based on the information available, I was unable to locate clear, detailed descriptions of account types or structures, which already raises some concerns for me. Unlike many established brokers who specify features such as minimum deposits, spreads, leverage, and tailored account conditions, HUNGSING simply does not provide this essential information. There is also no mention of demo accounts, which means prospective clients cannot test the broker’s platform or services before committed capital is at risk—a key factor I always recommend beginners to look for. Further, it’s necessary to highlight that HUNGSING’s regulatory standing is compromised. Their futures contracts license has been revoked, and their securities license is officially exceeded, both with the Hong Kong regulator. This fact alone makes it extremely difficult to trust any claims regarding account safety or customer protections. In my view, when a broker lacks both regulatory clarity and transparency about account offerings, this represents a notable risk. I value clear, upfront communication about account features from brokers, as it allows me to compare options and make informed decisions. With HUNGSING, the lack of such transparency and weakened regulatory status signals a high degree of caution is warranted, and for me, this is a critical dealbreaker.

From my perspective as an experienced trader, there are several major drawbacks and risks with HUNGSING that raise serious concerns for me. The most striking issue is their regulatory status: both their securities dealing and futures contracts licenses in Hong Kong have either been exceeded or outright revoked by the Securities and Futures Commission (SFC). For any firm handling client funds and offering trading services, up-to-date regulation is essential—lapsed or revoked licenses leave traders exposed to elevated risks without meaningful protection or oversight. When regulation is no longer valid, any assurances of fair dealing, recourse for grievances, or transparent operations become deeply questionable. For me, the lack of a demo account is another problem. I rely on demo accounts to evaluate new platforms and conditions before committing real money. With HUNGSING, this isn’t an option, denying me the opportunity to test their systems for reliability and usability. There’s limited transparency around trading accounts and fee structures, making it hard to assess the true cost of trading or to compare fairly with other brokers. The only existing user review I found alleges difficulties with withdrawals and even accuses the platform of fraudulent practices. While one complaint doesn't prove a pattern, it’s enough—especially in the absence of strong regulation—to make me extremely cautious. Overall, the combination of revoked and exceeded licenses, lack of transparent information, and user warnings would lead me to exercise a high degree of caution and prefer regulated alternatives when trading.

As an independent trader who carefully examines brokers before considering them for my own portfolio, I always prioritize access to a free demo account as a sign of transparency and client focus. With HUNGSING, I discovered that, unfortunately, there is no demo account option available at all. For me, the absence of a demo account is a fundamental drawback. In my experience, the ability to test trading platforms and strategies in a risk-free environment is essential, especially when unfamiliar with a broker’s proprietary platform like Hongsheng Securities. This lack of a demo account means that any trader—including myself—would have to commit real funds right from the start, which increases risk and limits opportunities for due diligence. Furthermore, without a demo account, I am unable to assess live spreads, order execution, or platform reliability before making financial decisions. In my view, and based on risk management principles, this restricts transparency and makes it harder for any trader to adequately judge whether the broker meets their personal trading requirements. Considering these factors, I approach HUNGSING with extra caution and would strongly favor brokers that offer unrestricted demo access as a minimum standard.

In my experience as a forex trader, I believe evaluating any broker requires careful scrutiny, and with HUNGSING, I've found both advantages and areas of concern. The first potential benefit is the diverse range of financial services they advertise beyond just forex—including debt financing, investment products, asset management, and IPO subscription. For traders and investors seeking a wider spectrum of services consolidated under one provider, this diversity could offer added flexibility and financial planning options. Secondly, HUNGSING claims to provide a proprietary trading platform accessible via both web and mobile. While I always compare proprietary platforms carefully, having multi-device access is convenient for monitoring positions and managing investments on the go. In my trading routine, access to trading tools at any time of the day is non-negotiable. Finally, I noticed their customer service covers several contact options, including a phone line and email, within standard weekday business hours. In a market where prompt support can be critical, especially if issues arise with funding, clarity on how to reach help is important for me. However, I stress that any benefits must be weighed against HUNGSING’s significant regulatory warnings: their futures license was revoked, and their securities license is exceeded. For me, the security of client funds always takes precedence, and I would urge anyone considering HUNGSING to be extremely cautious, verify all legal statuses, and ensure all decisions are risk-aware.

Lütfen giriş yapın...

TOP

TOP

Chrome

Chrome uzantısı

Küresel Forex Broker Düzenleyici Sorgulama

Forex brokerlerinin web sitelerine göz atın ve hangilerinin güvenilir hangilerinin dolandırıcı olduğunu doğru bir şekilde belirleyin

Şimdi Yükle