Şirket özeti

| Pubali Bank İnceleme Özeti | |

| Kuruluş Yılı | 1959 |

| Kayıtlı Ülke/Bölge | Bangladeş |

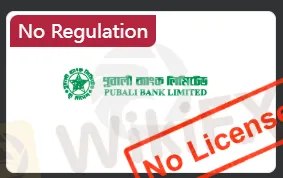

| Düzenleme | Düzenleme Yok |

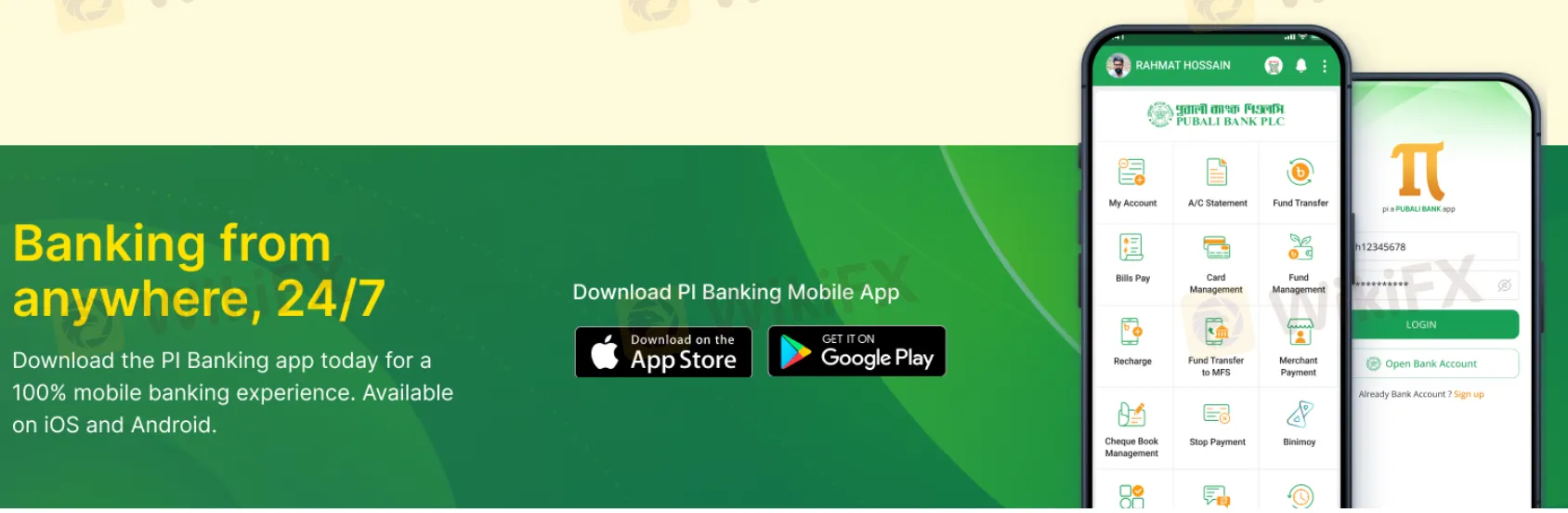

| İşlem Platformu | PI Banking |

| Müşteri Desteği | Yardım Hattı: +8809666016253, 16253 |

| PABX Numarası: +88 02223381614 | |

| IPPBX Numarası: +88 09666 82 00 00, +88 09666 82 08 20 | |

| Faks: 880-2-9564009 | |

| E-posta: info@pubalibankbd.com | |

Pubali Bank Bilgileri

Bangladeş'te bulunan Pubali Bank, dijital bankacılık ve çeşitli yatırımlar da dahil olmak üzere çeşitli bankacılık ürünleri ve hizmetleri sunan köklü bir kuruluştur.

Artıları ve Eksileri

| Artılar | Eksiler |

| Çeşitli ürün portföyü | Düzenleme eksikliği |

| Köklü ve deneyimli | İşlem ücretleri hakkında sınırlı bilgi |

Pubali Bank Güvenilir mi?

Pubali Bank düzenlenmemiş bir platformdur. Lütfen riskin farkında olun!

WHOIS'te pubalibangla.com alanı 24 Ocak 2002'de kaydedildi ve 24 Ocak 2027'de sona eriyor. Şu anda durumu "müşteri silme/yenileme/transfer/güncelleme yasaklı" olarak belirlenmiştir.

Hizmetler

Pubali Bank, şube ve ATM/CDM/CRM konumlarına, kar ve faiz oranlarına, ücret tarifelerine ve genel hizmetlerine genel bir bakış da dahil olmak üzere hızlı erişim sağlar.

Ürünler

Pubali Bank, dijital ve mobil bankacılık, çeşitli kart hizmetleri, İslami finans, iş ve kişisel finansman (kira finansmanı gibi), vadeli mevduatlar, havaleler ve offshore bankacılık çözümleri de dahil olmak üzere çeşitli ürünler sunmaktadır.

İşlem Platformu

| İşlem Platformu | Desteklenen | Kullanılabilir Cihazlar |

| PI Banking | ✔ | iOS, Android |