Описание компании

| Pubali Bank Обзор | |

| Основана | 1959 |

| Страна/Регион регистрации | Бангладеш |

| Регулирование | Нет регулирования |

| Торговая платформа | PI Banking |

| Поддержка клиентов | Телефонная линия: +8809666016253, 16253 |

| PABX Номер: +88 02223381614 | |

| IPPBX Номер: +88 09666 82 00 00, +88 09666 82 08 20 | |

| Факс: 880-2-9564009 | |

| Эл. почта: info@pubalibankbd.com | |

Информация о Pubali Bank

Pubali Bank, в Бангладеше, является долговечным учреждением, предлагающим разнообразные банковские продукты и услуги, включая цифровое банкинг и различные инвестиции.

Плюсы и минусы

| Плюсы | Минусы |

| Разнообразный портфель продуктов | Отсутствие регулирования |

| Долговечность и опытность | Ограниченная информация о торговых комиссиях |

Является ли Pubali Bank законным?

Pubali Bank - это нерегулируемая платформа. Пожалуйста, будьте внимательны к риску!

Домен pubalibangla.com в WHOIS был зарегистрирован 24 января 2002 года и истекает 24 января 2027 года. Его текущий статус - "клиент запрещено удалять/переоформлять/переносить/обновлять".

Услуги

Pubali Bank предлагает быстрый доступ к услугам, включая расположение отделений и банкоматов/УСД/УСДМ, прибыль и процентные ставки, расписание сборов и общий обзор своих услуг.

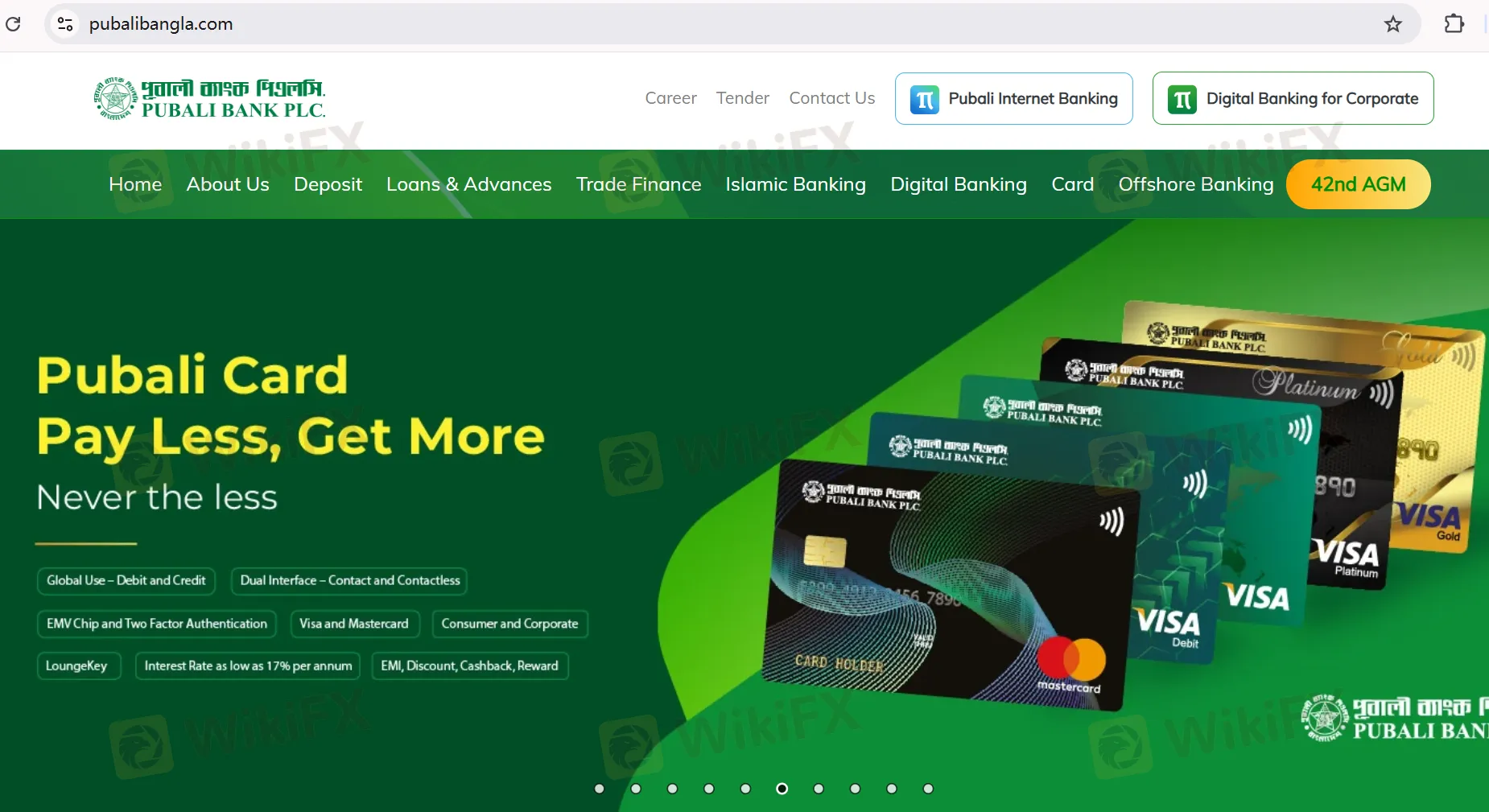

Продукты

Pubali Bank предлагает разнообразные продукты, включая цифровое и мобильное банкинг, различные услуги по картам, исламскую финансовую деятельность, бизнес и личное финансирование (например, лизинговое финансирование), фиксированные депозиты, денежные переводы и решения по оффшорному банкингу.

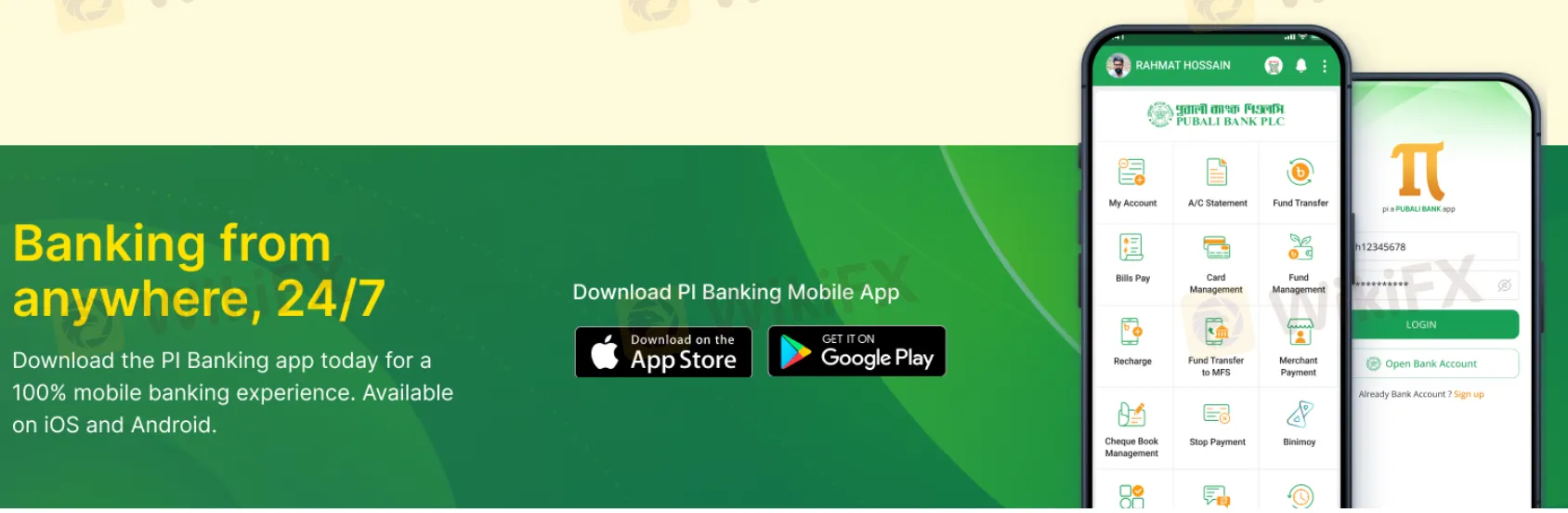

Торговая платформа

| Торговая платформа | Поддерживается | Доступные устройства |

| PI Banking | ✔ | iOS, Android |