Puan

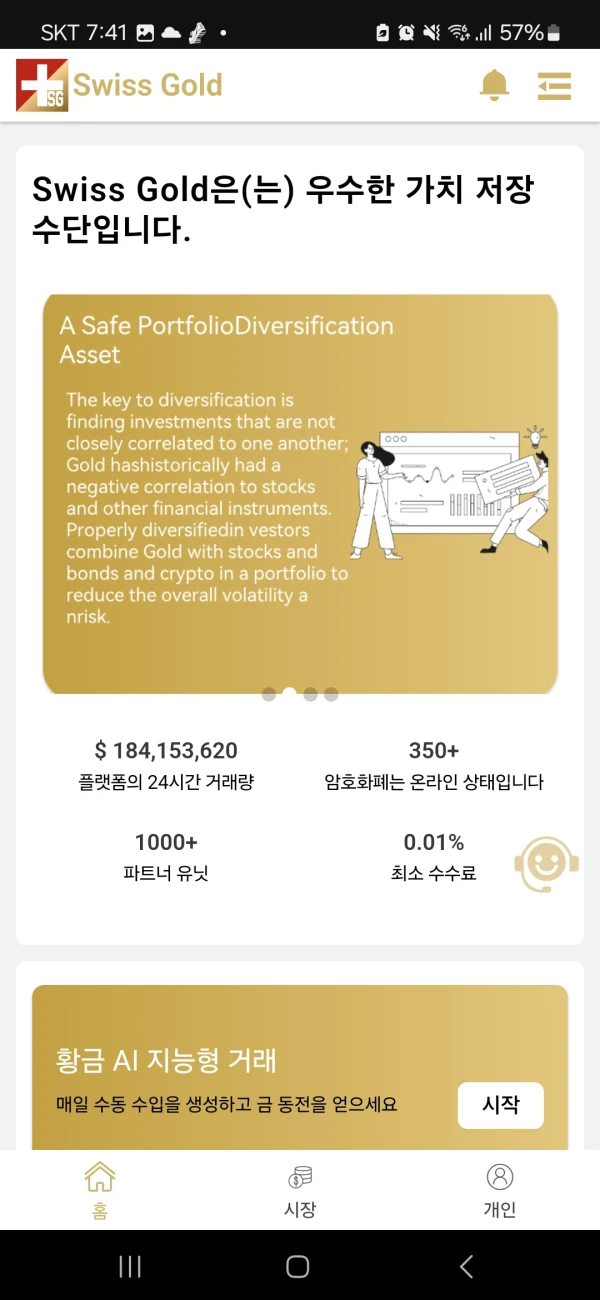

Swiss Gold

Fransa | 1-2 yıl |

Fransa | 1-2 yıl |https://swissgold.cc/

Web Sitesi

Derecelendirme Endeksi

İletişim

Forex Lisansı

Forex Lisansı

Forex işlem lisansı bulunamadı. Lütfen risklerin farkında olun.

- Bu aracı kurumun geçerli bir forex düzenlemesi bulunmamaktadır. Lütfen riskin farkında olun!

Temel Bilgiler

Fransa

Fransa Swiss Gold ürününü görüntüleyen kullanıcılar bunları da görüntüledi..

AVATRADE

Neex

VT Markets

Exness

Web sitesi

swissgold.cc

172.67.174.220Sunucu KonumuAmerika Birleşik Devletleri

ICP kaydı--En çok ziyaret edilen ülkeler/alanlar--Etki Alanı Yürürlük Tarihi--Web Sitesi--Şirket--

Şecere

İlgili Şirketler

Wiki Soru & Cevap

In what ways does Swiss Gold’s regulatory status help safeguard my funds?

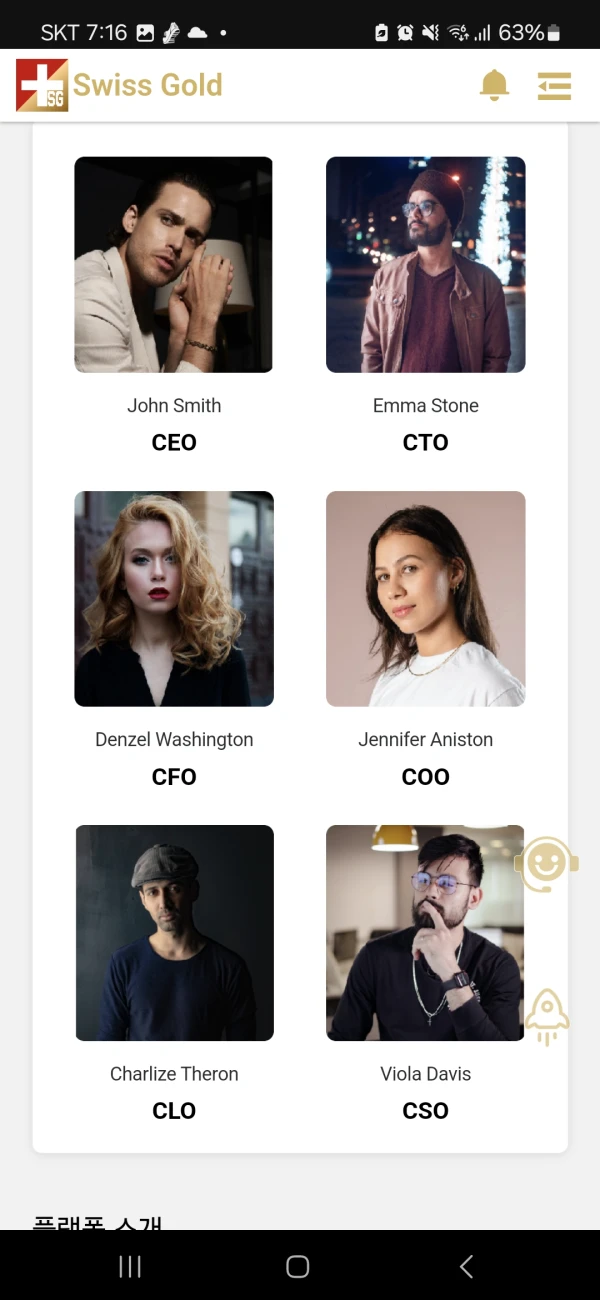

Speaking from my own experience and research into Swiss Gold, I have deep reservations regarding the safety of funds with this broker. The key concern for me is that Swiss Gold currently operates without any recognized regulatory oversight. There is no valid license presented, and reputable third-party sources flag the company for suspicious business activity and a lack of regulation. As an experienced trader, I know that regulation by established authorities is not just a formality; it is fundamental in providing investor protection—regulations typically mandate segregation of client funds, regular audits, transparent operations, and dispute resolution mechanisms. In the absence of such oversight, there is an increased risk that clients’ funds could be mismanaged or not properly safeguarded, and there are few, if any, external avenues for recourse should an issue arise. From what I’ve found, Swiss Gold’s business is less than a year old and there are also first-hand reports suggesting red flags such as questionable withdrawal requirements and potentially deceptive practices. For me, the complete lack of regulatory protections means I would not trust this broker with my own funds, and I would advise others to take an equally cautious approach. In my view, the risk level is simply too high when safeguarding your capital is a top priority.

How do the different account types provided by Swiss Gold compare to each other?

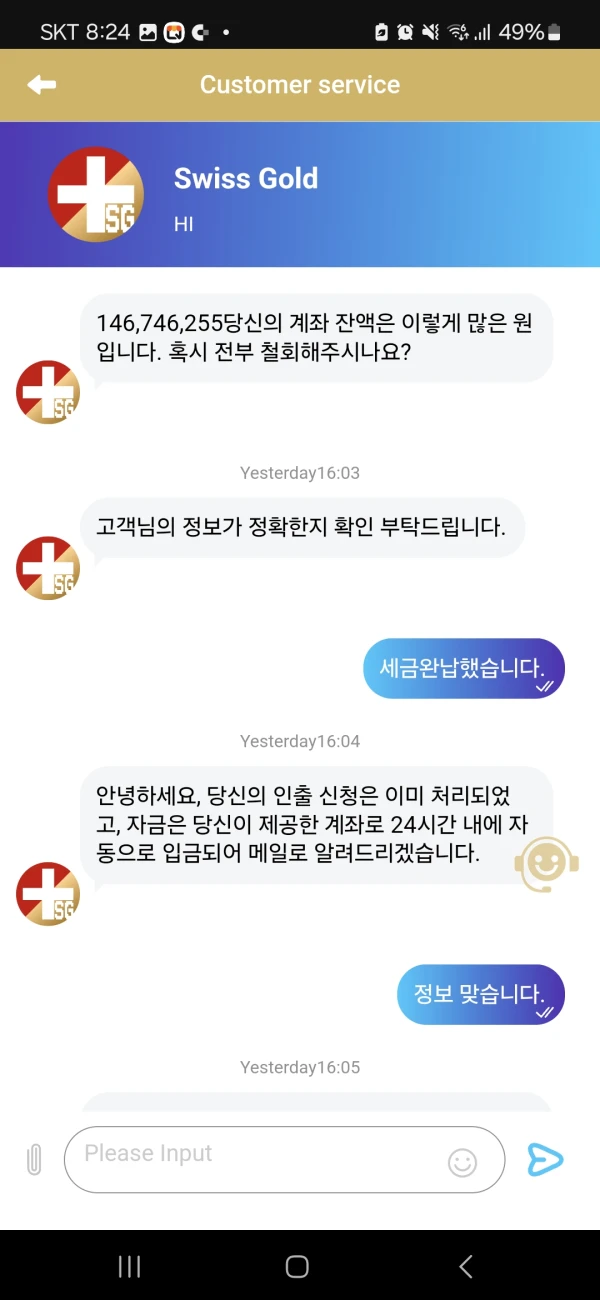

Based on my research and direct review of the available information, I was unable to find any clear or reliable details about account types provided by Swiss Gold. This lack of transparency is immediately concerning for me as an experienced trader because established brokers typically provide clear descriptions of their account offerings, including features, minimum deposits, spreads, and leverage. What stands out with Swiss Gold is not just the absence of account type information, but also their broader lack of regulatory oversight and extremely low trust scores. Moreover, the only user experience I encountered pointed to serious concerns, not just about account conditions but about the fundamental operation of the broker itself. There are reports of questionable practices, such as being requested to deposit additional funds under the pretense of tax requirements, which is a classic warning sign for scams in the industry. In my own trading journey, I have learned that transparency and regulation are the foundations of trust. When neither are present and when account information is vague or missing, that alone is enough for me to exercise extreme caution, regardless of any promotional claims a broker might make about their services.

Is a free demo account available with Swiss Gold, and if so, are there any restrictions such as an expiry period?

After thoroughly reviewing the available information about Swiss Gold, I could not find any clear indication that a free demo account is offered, nor details about potential restrictions such as an expiry period. As someone with years of experience in the forex market, I pay close attention to signs of legitimacy and transparency, especially when evaluating a new broker. Legitimate brokers typically present demo account features, trading conditions, and clear terms upfront. In Swiss Gold’s case, the lack of regulatory oversight and the warnings about suspicious business practices already put me on high alert. Moreover, there is a user exposure describing a problematic withdrawal process and what appears to be misleading communication from the broker’s representatives. Given that, I would adopt a very conservative approach and personally avoid engaging with any real funds—or even demo trials—until the company can provide verifiable and concrete information about its account offerings. Transparency around demo accounts, including whether they are genuinely free, how long they last, and if there are any restrictions, is fundamental for building trust. If Swiss Gold cannot offer this transparency, in my view as a trader, it's an additional red flag that reinforces my caution.

Have you encountered any drawbacks with Swiss Gold's customer service or issues related to the stability of their platform?

As a trader who prioritizes safety and transparency, my experience evaluating Swiss Gold has raised several major concerns—especially with regard to customer service and platform reliability. The most glaring issue for me is the complete absence of valid regulatory oversight. Their WikiFX risk assessment specifically highlights a glaringly low regulatory index, which is a fundamental red flag when considering the security of client funds or dispute resolution options. The company is newly established, which inherently carries extra risk, but in Swiss Gold’s case, it is compounded by reports of suspicious business practices and a lack of clear background. I am especially troubled by the user exposure report describing a withdrawal process that required an upfront “tax” payment. This alone, in my experience, is a deeply problematic sign in any financial operation. When a broker not only fails to process withdrawals smoothly but also demands additional payments, it signals structural issues with both customer service and operational integrity. The claim of representatives using obviously fake names is concerning, as it erodes trust and signals a lack of professionalism. Given these factors, I must stress that, in my own process of due diligence, Swiss Gold does not meet the standards I require for customer service responsiveness or platform stability. For me, these drawbacks are significant enough that I would strictly avoid engaging any funds with them in their current state.

Değerlendirmek istedikleriniz

Lütfen giriş yapın...

Yorum 1

TOP

TOP

Chrome

Chrome uzantısı

Küresel Forex Broker Düzenleyici Sorgulama

Forex brokerlerinin web sitelerine göz atın ve hangilerinin güvenilir hangilerinin dolandırıcı olduğunu doğru bir şekilde belirleyin

Şimdi Yükle