Описание компании

| MITOОбзор | |

| Основана | 1997 |

| Страна/Регион регистрации | Япония |

| Регулирование | FSA |

| Торговые инструменты | Акции, Облигации, ETF |

| Демо-счет | ❌ |

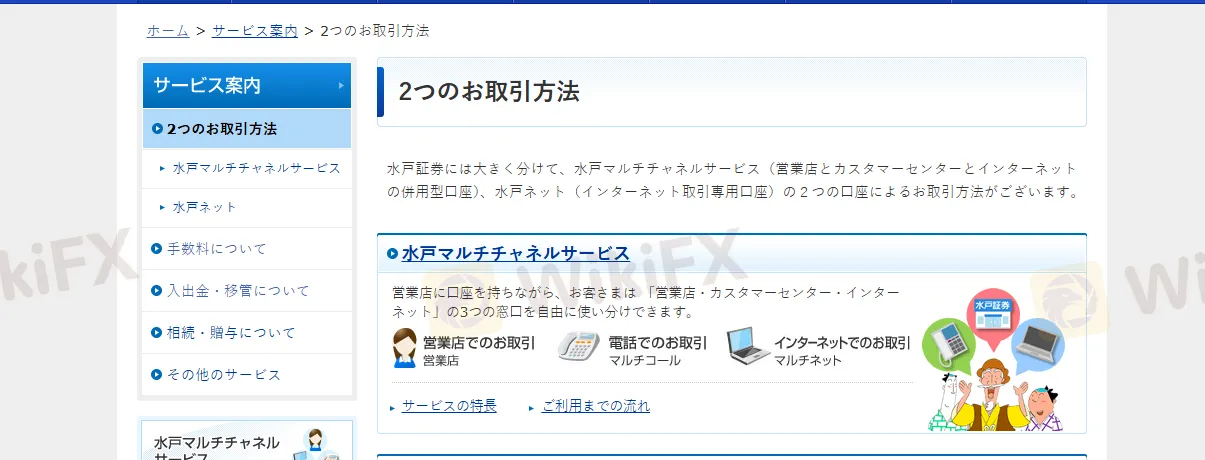

| Торговая платформа | MITO Мультиканальные услуги, MITO Веб |

| Служба поддержки | Тел:0120-310-273 |

MITO, японская финансовая компания, основанная в 1997 году, действует в соответствии с регулированием Финансового агентства (FSA). Компания предлагает широкий спектр торговых возможностей, включая акции, облигации и ETF. Учитывая различные предпочтения инвесторов.

Плюсы и минусы

| Плюсы | Минусы |

| регулируется | Отсутствие торговых инструментов |

| Отсутствие демо-счета | |

| Отсутствие MT4/MT5 |

Является ли MITO законным?

Да. MITO имеет лицензию от FSA на предоставление услуг.

| Регулятор | Текущий статус | Регулируемая организация | Тип лицензии | Номер лицензии |

| Финансовое агентство | Регулируется | 水戸証券株式会社 | Лицензия на розничный форекс | 関東財務局長(金商)第181号 |

На что я могу торговать на MITO?

MITO предоставляет акции, облигации и ETF.

| Торгуемые инструменты | Поддерживается |

| Облигации | ✔ |

| Акции | ✔ |

| ETF | ✔ |

| Форекс | ❌ |

| Товары | ❌ |

| Индексы | ❌ |

| Криптовалюты | ❌ |

| Опционы | ❌ |

Торговая платформа

| Торговая платформа | Поддерживается | Доступные устройства | Подходит для |

| Многофункциональные сервисы MITO | ✔ | / | / |

| Веб-платформа MITO | ✔ | / | / |

| MT5 | ❌ | / | Опытные трейдеры |

| MT4 | ❌ | / | Новички |

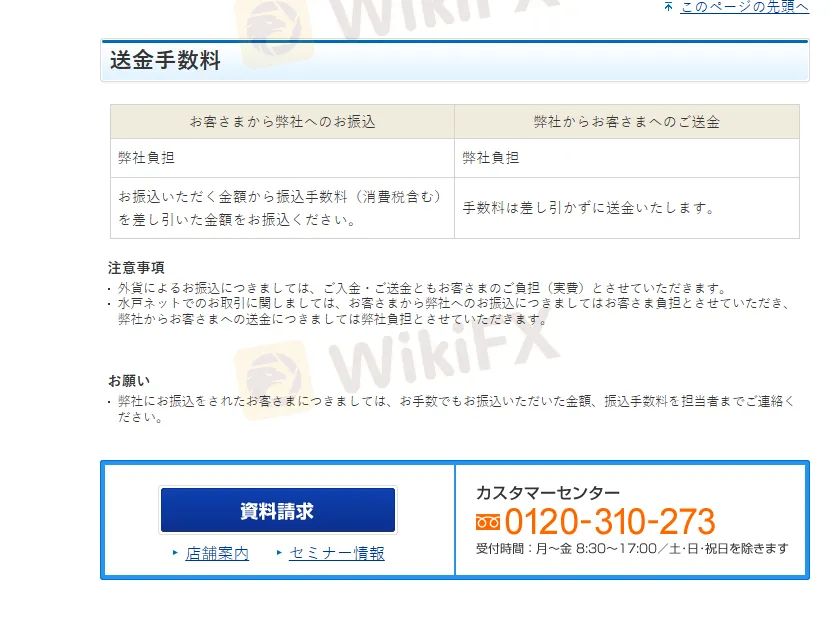

Депозит и вывод средств

Для переводов иностранной валюты расходы на депозит и перевод несет клиент (фактические расходы).

Для операций через Mito Net все комиссии за перевод, уплаченные клиентом MITO, несет MITO, и все комиссии за перевод, уплаченные клиенту, несет MITO.