مقدمة عن الشركة

| OSL ملخص المراجعة | |

| تأسست | 2013 |

| البلد/المنطقة المسجلة | باكستان |

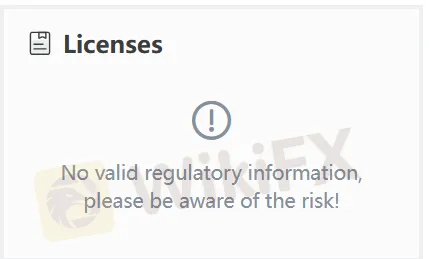

| التنظيم | لا يوجد تنظيم |

| صكوك السوق | الأسهم |

| حساب تجريبي | ❌ |

| منصة التداول | OSL |

| دعم العملاء | نموذج الاتصال |

| WhatsApp: +92 300 8204 910 | |

| الهاتف: 922132446744 & 922132446747 | |

| البريد الإلكتروني: info@osl.com.pk | |

| العنوان: مكتب مسجل # 731–732، الطابق السابع، مبنى بورصة الأوراق المالية، شارع بورصة الأوراق المالية، قبالة شارع إ. إ. تشندريغار، كراتشي. | |

معلومات OSL

OSL هي شركة غير منظمة تأسست في عام 2013 في باكستان. تقدم منتجات وخدمات في وساطة الأسهم، التداول عبر الإنترنت، الدعم الإداري، خدمة الرسائل القصيرة، وخدمة البريد الإلكتروني. بالإضافة إلى ذلك، تستخدم منصتها الخاصة للتداول ولا تدعم MT4 أو MT5.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| منتجات وخدمات متنوعة | لا يوجد تنظيم |

| قنوات اتصال متنوعة | لا توجد حسابات تجريبية |

| أنواع محدودة من خيارات الدفع |

هل OSL شرعية؟

لا يوجد تنظيم حاليًا للرقم OSL. يرجى أخذ الحيطة والحذر من المخاطر!

ما الذي يمكنني التداول به على OSL؟

| الأدوات التجارية | مدعومة |

| الأسهم | ✔ |

| الفوركس | ❌ |

| السلع | ❌ |

| المؤشرات | ❌ |

| الأسهم | ❌ |

| العملات الرقمية | ❌ |

| السندات | ❌ |

| الخيارات | ❌ |

| صناديق الاستثمار المتداولة | ❌ |

منصة التداول

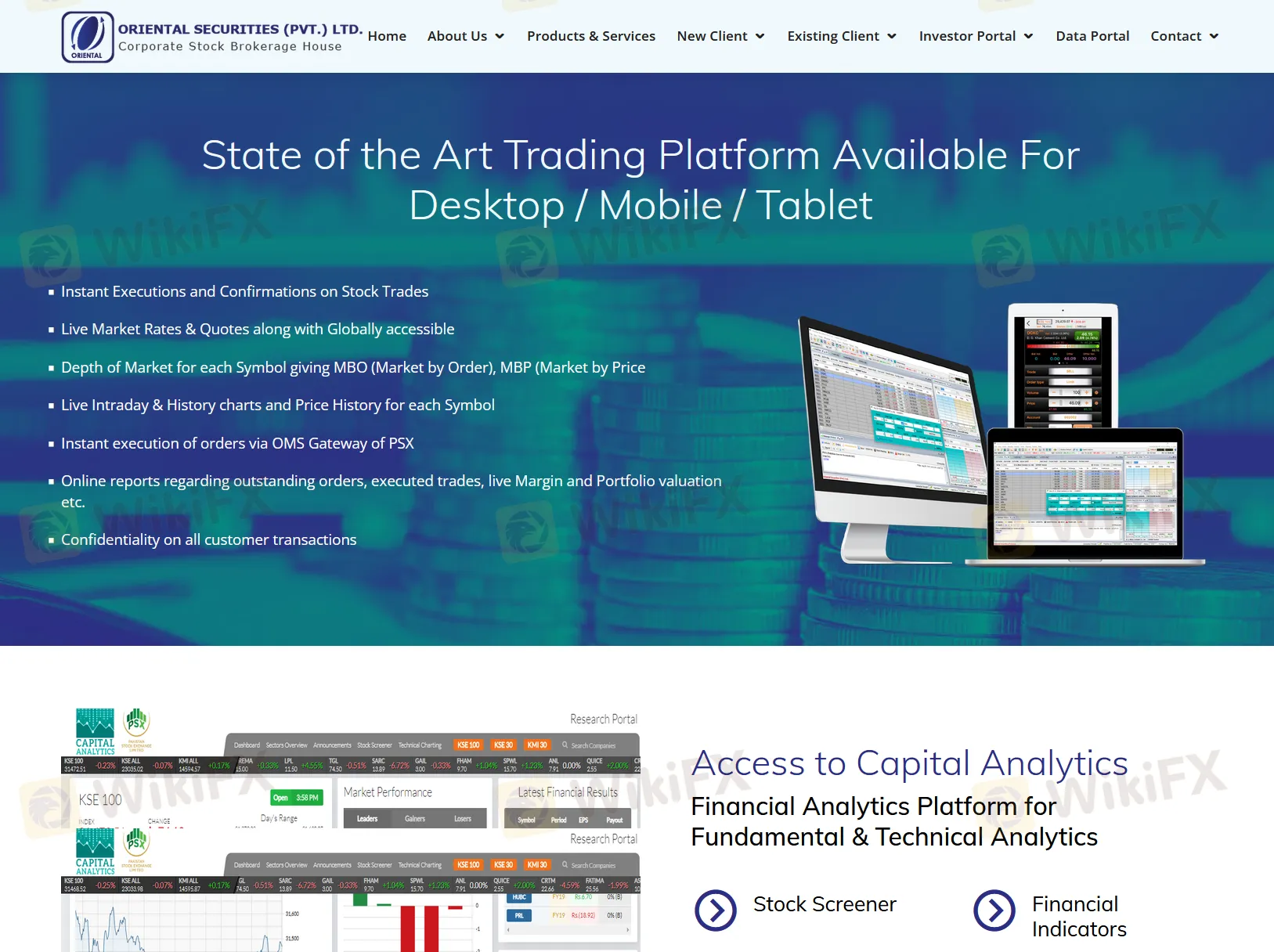

OSL تقدم منصة تداول متاحة على أجهزة سطح المكتب والهاتف المحمول والأجهزة اللوحية.

| منصة التداول | مدعومة | الأجهزة المتاحة | مناسبة لـ |

| OSL | ✔ | سطح المكتب، الهاتف المحمول، اللوحي | / |

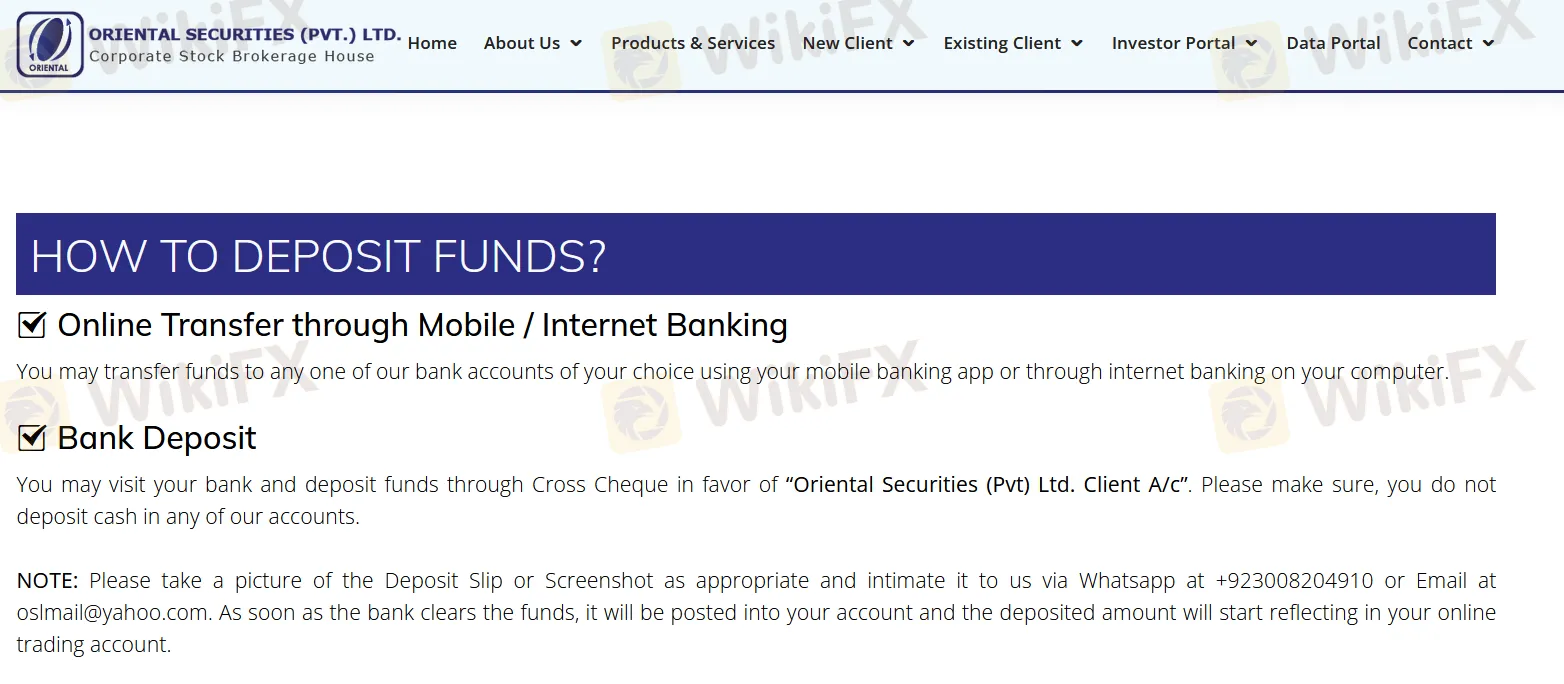

الإيداع والسحب

OSL تقدم خيارين للتمويل:

الخيار 1: التحويل عبر الإنترنت عبر الهاتف المحمول / الخدمات المصرفية عبر الإنترنت

- التحويل إلى أي حساب بنكي OSL باستخدام الهاتف المحمول أو الخدمات المصرفية عبر الإنترنت.

الخيار 2: الإيداع البنكي

- الإيداع عبر شيك متقاطع قابل للدفع إلى:

- “Oriental Securities (Pvt.) Ltd. حساب العميل”

- لا تقم بإيداع النقود في أي حساب OSL.