기본 정보

방글라데시

방글라데시

점수

방글라데시

|

5-10년

|

방글라데시

|

5-10년

| http://www.shahjalalbanksecurities.com.bd

공식 사이트

평점 지수

영향력

D

영향력 지수 NO.1

방글라데시 2.54

방글라데시 2.54 라이선스

라이선스효력 있는 규제 정보가 없습니다. 위험에 유의해 주세요!

방글라데시

방글라데시 shahjalalbanksecurities.com.bd

shahjalalbanksecurities.com.bd 방글라데시

방글라데시

| Shahjalal Islami Bank Securities Ltd 리뷰 요약 | |

| 설립 연도 | 2008 |

| 등록 국가/지역 | 방글라데시 |

| 규제 | 규제 없음 |

| 서비스 | 사리아 기반 마진 투자, IPO 신청 서비스, 거래 워크스테이션, 온라인 거래, 기관 투자, 외환 거래, 전자 서비스 (거래 확인/포트폴리오 평가/SMS 알림), DP 서비스, 패널 브로커, 연구 및 투자자 인식 프로그램 |

| 고객 지원 | 전화: 88-02-7163253, 7173008, 7111384, 7118425 |

| 팩스: 88-02-7161877 | |

| 이메일: info@shahjalalbanksecurities.com.bd | |

| 주소: 1/C, DIT Avenue (3rd floor), Dainik Bangla, Motijheel, Dhaka-1000. | |

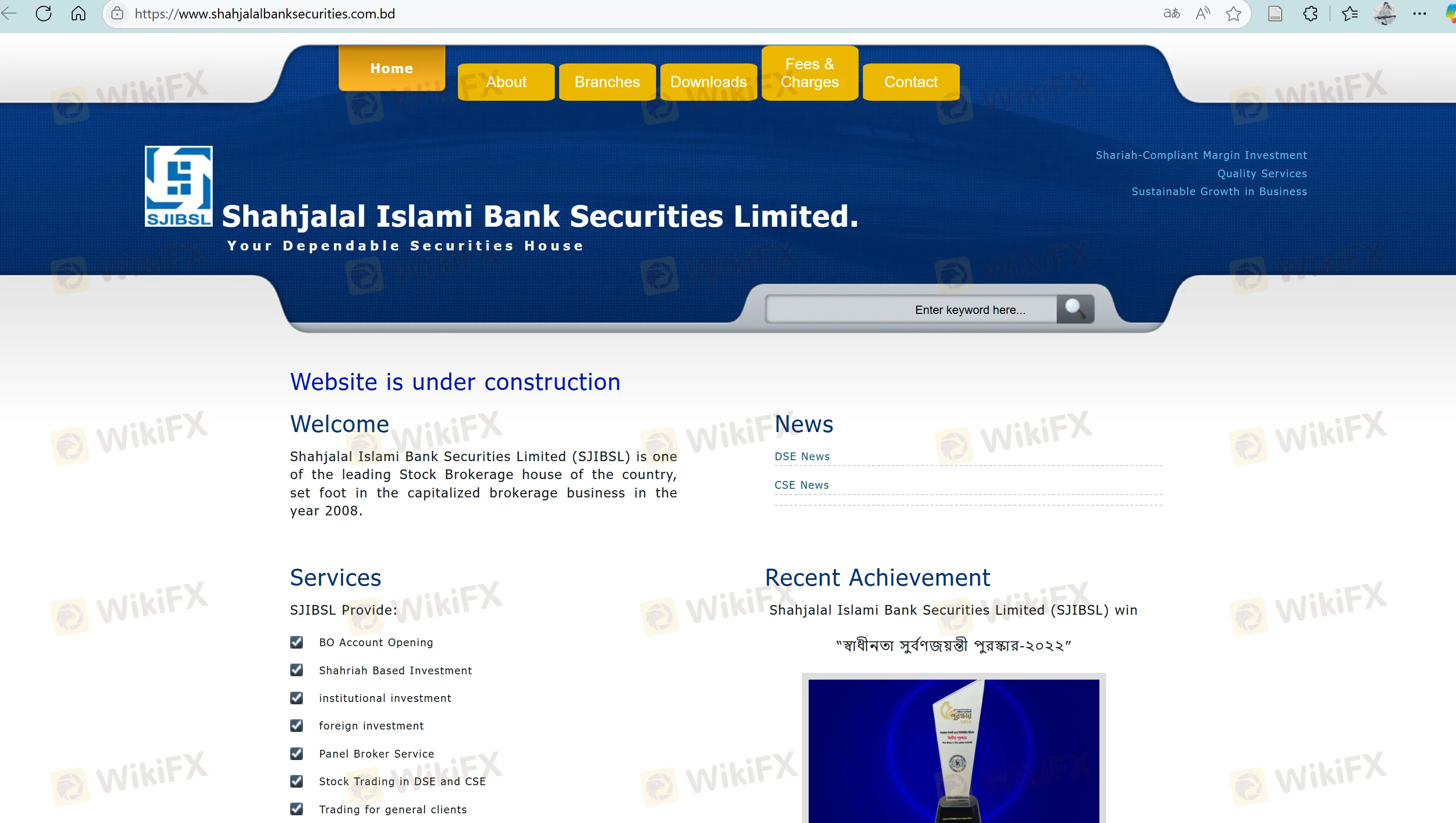

2008년 방글라데시에서 설립된 Shahjalal Islami Bank Securities Ltd은 방글라데시에 기반을 둔 규제되지 않은 금융 기관입니다. 이는 사리아 기반 마진 투자, IPO 신청 지원, 거래 워크스테이션, 온라인 거래, 기관 투자, 외환 거래 서비스, 전자 서비스, DP 서비스, 패널 브로커, 연구 및 투자자 인식 프로그램을 포함한 다양한 서비스를 제공합니다.

| 장점 | 단점 |

| 운영 시간이 길다 | 규제가 없음 |

| 다양한 금융 서비스 | |

| 다양한 고객 지원 채널 |

현재 Shahjalal Islami Bank Securities Ltd은 유효한 규제가 없습니다. 해당 도메인은 유효하지 않거나 지원되지 않는 도메인으로 보입니다. 규제를 받는 다른 브로커를 고려하시기 바랍니다.

Shahjalal Islami Bank Securities Ltd은 사리아 기반 마진 투자, IPO 신청 서비스, 거래 워크스테이션, 온라인 거래, 기관 투자, 외환 거래, 전자 서비스, DP 서비스, 패널 브로커, 연구 및 투자자 인식 프로그램과 같은 서비스를 제공합니다.

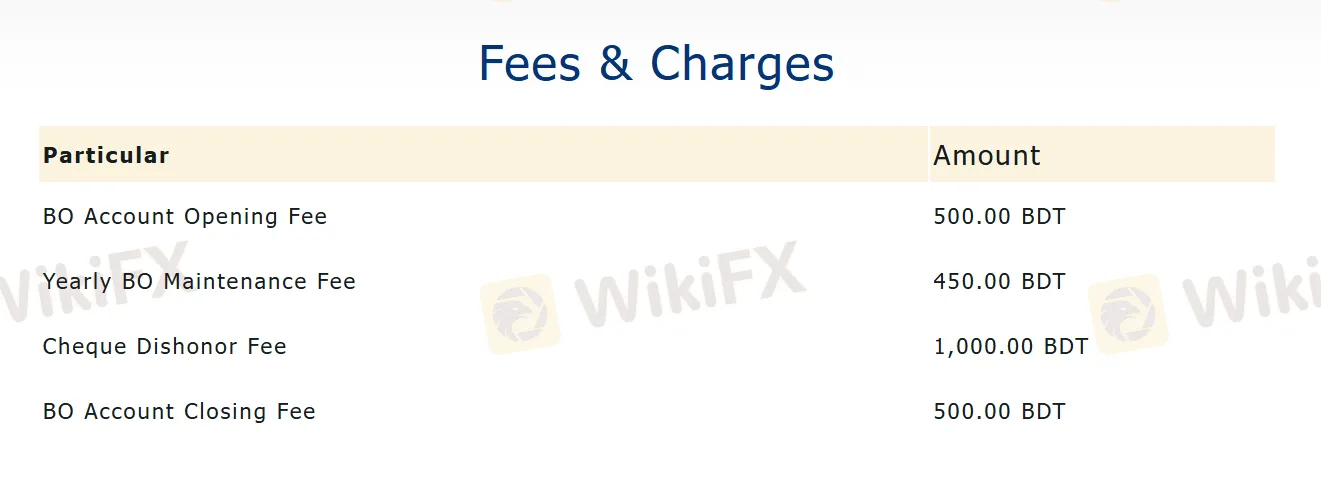

| 수수료 유형 | 금액 |

| BO 계좌 개설 수수료 | 500.00 BDT |

| 연간 BO 유지 보수 수수료 | 450.00 BDT |

| 수표 반려 수수료 | 1,000.00 BDT |

| BO 계좌 해지 수수료 | 500.00 BDT |

Based on my review of Shahjalal Islami Bank Securities Ltd, I was unable to find any clear indication that they offer a free demo account. This is particularly important to me as a trader because a demo platform is essential for testing strategies and understanding a broker’s trading environment before committing real funds. While the firm advertises a range of services, such as online trading and Shariah-based margin investment, there is no mention of demo account availability, nor of any restrictions like time limits. For me, this absence is a significant drawback. Demo accounts are a standard feature among reputable, regulated brokers, both for risk management and for allowing clients to evaluate service quality without financial exposure. The lack of clear information on this point, combined with the firm’s unregulated status and various risk warnings highlighted in my research, leads me to be particularly cautious. Without regulatory oversight and lacking even basic trader protections like a demo environment, I personally would not proceed with Shahjalal Islami Bank Securities Ltd until more transparent, concrete details and safer trading conditions are provided.

In my experience as a forex trader, the most significant drawback for me when considering Shahjalal Islami Bank Securities Ltd is its lack of valid regulatory oversight. Operating without proper regulation introduces a high level of risk, as it means client funds and trading activity aren’t subject to the stringent protections or dispute resolution processes found with regulated brokers. This absence of accountability increases the likelihood of potential issues, such as operational inconsistencies or difficulty resolving client complaints. Additionally, my review of their track record reveals alerts regarding a suspicious license and possible high-risk business scope. For anyone prioritizing security, these red flags cannot be ignored. Legitimate regulation exists precisely to safeguard traders, so a broker not meeting these standards is a serious concern for me. While the company has been operational for a fair stretch and offers a variety of services, these factors don’t offset the risks associated with unregulated status. Choosing to trade with an unregulated broker like Shahjalal Islami Bank Securities Ltd is, in my view, not a conservative path. Personally, I prefer to entrust my capital to brokers with clear, reputable regulatory credentials. Ultimately, the absence of regulation—and the uncertainty it brings—outweighs the firm’s longevity or service breadth for me.

As someone who has navigated the world of forex and indices trading for many years, I always start by carefully assessing both explicit and hidden costs before engaging with any broker. With Shahjalal Islami Bank Securities Ltd, my initial concern arises from their lack of regulatory oversight, according to available information, which in itself introduces significant ambiguity in terms of fee transparency and potential security for client funds. From what I’ve gathered, Shahjalal Islami Bank Securities Ltd advertises a suite of services, including online trading, but there is little concrete detail on spreads, commissions, or swap rates—key components that make up total trading costs for products like the US100 index. The only explicit costs presented relate to account maintenance: opening a BO account at 500 BDT, yearly maintenance at 450 BDT, and closing at 500 BDT. While these are standard administrative fees, they do not clarify the ongoing trading costs for actual index trades. For someone like me, who relies on transparent cost structures to manage risk, this opacity is problematic. Without published information on spreads or transaction commissions, I can’t accurately calculate if trading the US100 here is cost-effective or if unforeseen fees may erode my returns. This lack of detail is a natural consequence of the broker operating without formal regulation, which typically obligates brokers to publish such information. Given the current absence of clarity around total trading costs for instruments like the US100, I would exercise significant caution. In my experience, choosing a broker with clear regulatory status and explicit fee schedules is much more prudent, both for cost control and overall account security.

Based on my personal experience examining Shahjalal Islami Bank Securities Ltd, there are several important considerations regarding the potential use of Expert Advisors (EAs) or other forms of automated trading. The information I was able to gather about their services highlights offerings such as Shariah-based margin investment, IPO application services, online trading, and a suite of digital portfolio tools. However, I found no clear mention of compatibility with MetaTrader platforms (like MT4 or MT5), nor any explicit support for third-party trading software or automated trading systems. For me, as someone who often relies on EAs to minimize emotional trading and enhance efficiency, the absence of transparent platform details or API/EA integration is a significant limitation. Additionally, the lack of regulatory oversight and the warnings about suspicious business practices greatly increase the risk for traders considering any kind of advanced strategy, including automation. In my view, when a broker does not provide verified support for automated trading, and especially when they lack regulation, it is essential to exercise heightened caution. For my trading to be sustainable and secure, I always prefer brokers with established, regulated platforms that openly support EA functionality. Given the current state of information, I would not assume that Shahjalal Islami Bank Securities Ltd supports Expert Advisors, and I would not risk deploying any automated trading strategies there without clear, documented assurance from the broker.

입력해 주세요....