점수

Test Flight(test)

오스트리아 | 10-15년 |

오스트리아 | 10-15년 |http://wotoowo.com/en

공식 사이트

평점 지수

영향력

영향력

AAA

영향력 지수 NO.1

중국 9.99

중국 9.99 연락처

싱글 코어

1G

40G

1M*ADSL

- 해당 브로커가 주장하는 키프로스 CYSEC 라이선스(라이선스 번호: 776522(测试))는 검증되지 않았습니다. 위험에 유의하시기 바랍니다!

기본 정보

오스트리아

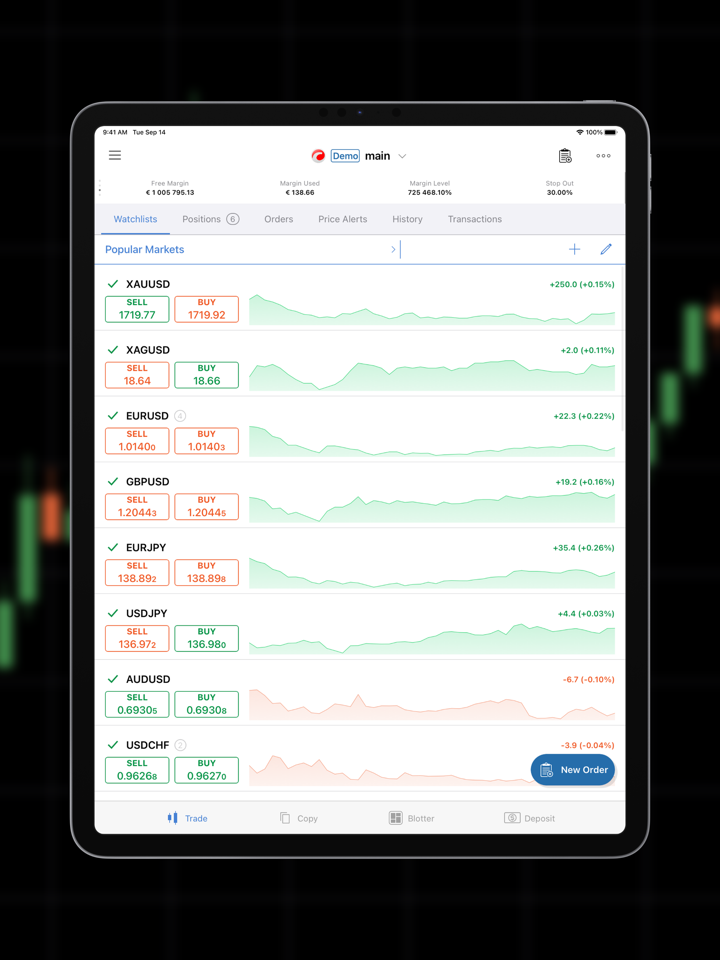

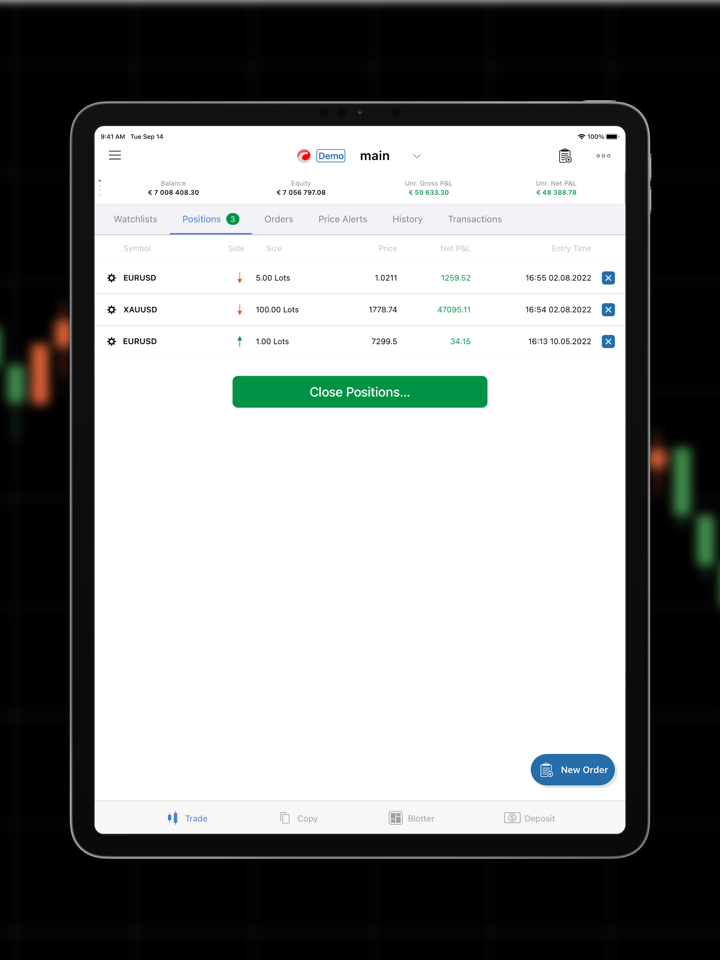

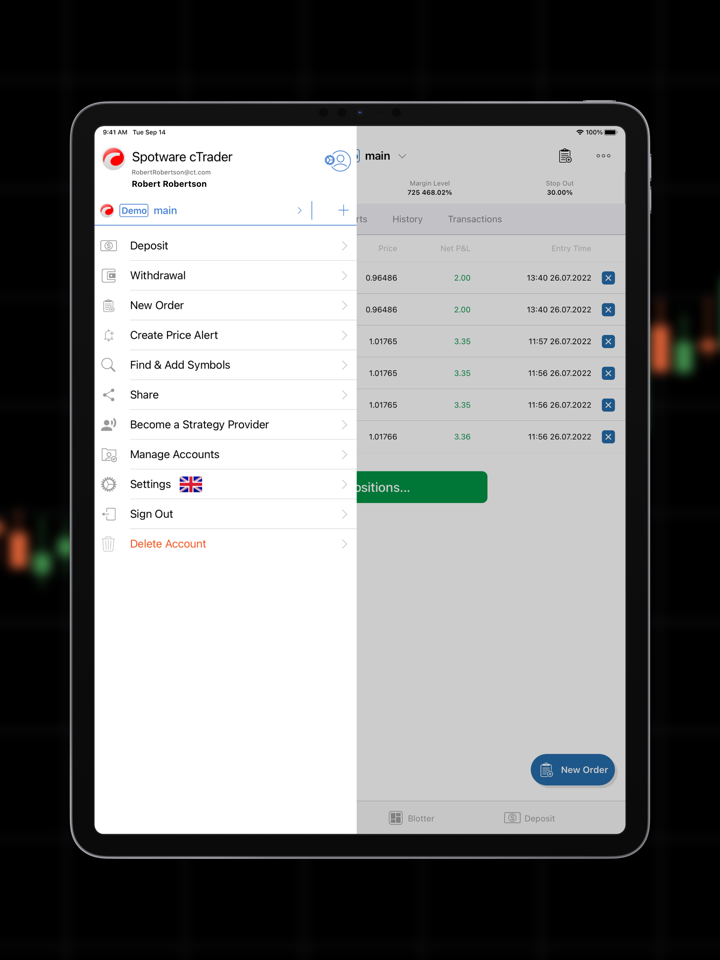

오스트리아 계정 정보

- 환경--

- 통화--

- 최대 레버리지50

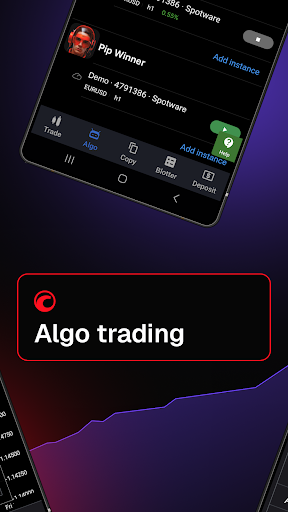

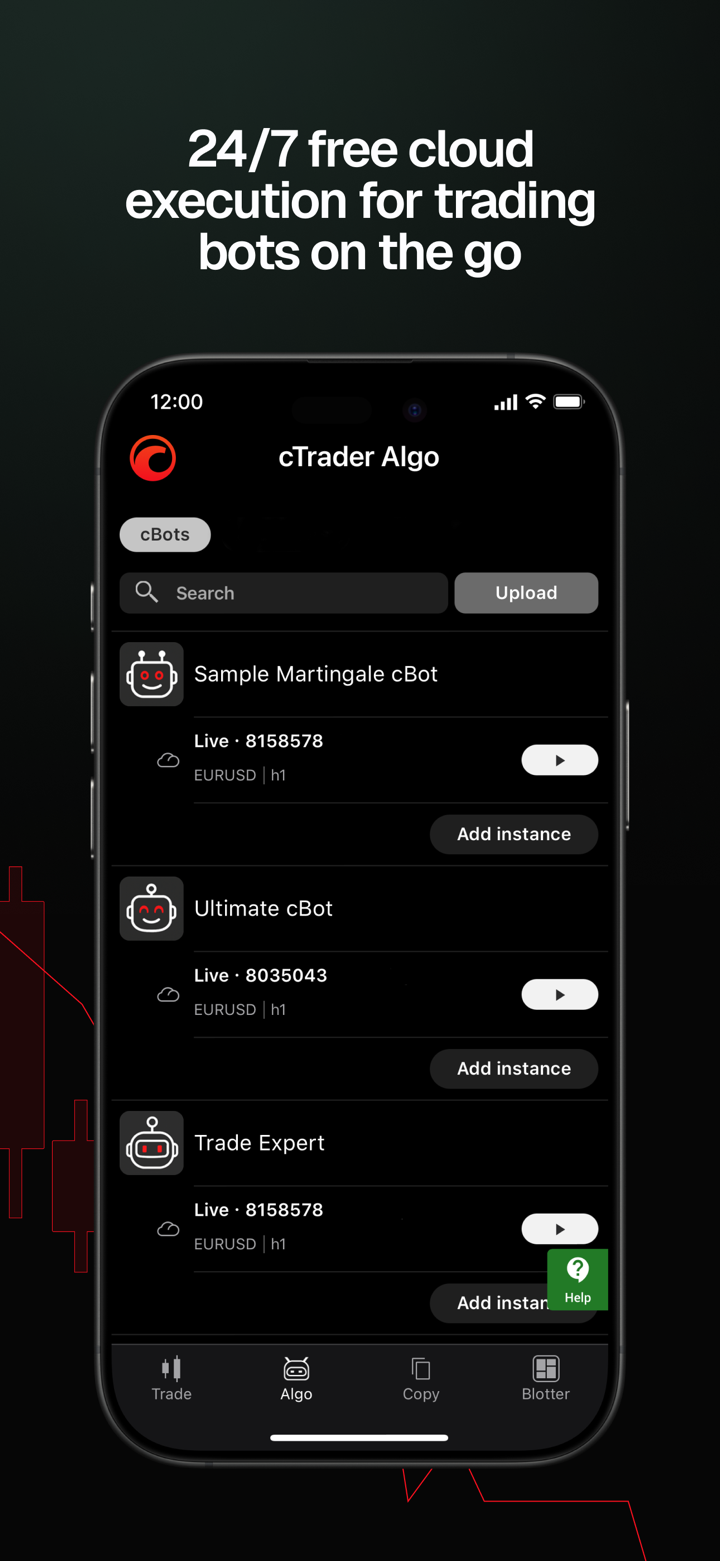

- 지원EA

- 최소 입금--

- 최소 스프레드--

- 입금 방식(1+) MASTER

- 출금 방식--

- 최소 포지션100

- 커미션2%

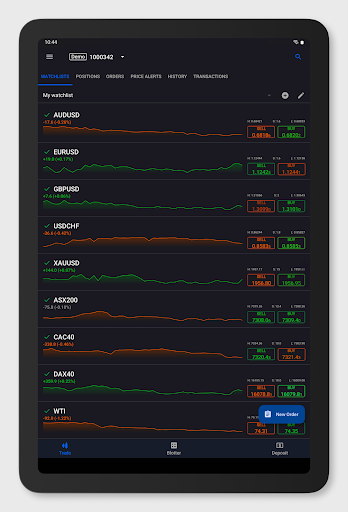

- 거래 종목--

Test Flight(test) 을(를) 본 사용자는 또다시 열람했습니다...

FXCM

STARTRADER

Vantage

IC Markets Global

협력사

웹사이트 감정

중국

중국qq.com

123.150.76.218wotoowo.com

13.35.37.46baiduddd.com

38.55.214.245testflight.com

159.182.31.50

관계 계보

관련 회사

위키 Q&A

Does Test Flight(test) apply any fees when you deposit or withdraw funds?

In my own experience reviewing brokers, one of the first things I pay close attention to is the clarity surrounding deposit and withdrawal fees, because unexpected costs can eat into my trading capital and signal underlying transparency issues. With Test Flight (test), the available information indicates a commission of 2%, but it is not explicitly clear whether this applies to deposits, withdrawals, or trading activities in general. For me, this lack of clear, accessible fee structure raises concerns. Knowing exactly what charges will be incurred is a fundamental part of risk management, and in this case, Test Flight (test) makes it difficult to confidently plan around such costs. Additionally, I’ve noticed a report from another user who experienced difficulties withdrawing funds. This, combined with ambiguity around fee transparency, suggests to me that traders should approach Test Flight (test) with caution if straightforward funding and withdrawal processes are a priority. Until I see a more detailed, explicit breakdown of deposit and withdrawal fees directly provided by the broker, I would be hesitant to commit significant funds. For me, a broker’s openness about their fee structure is essential for trust and smooth trading.

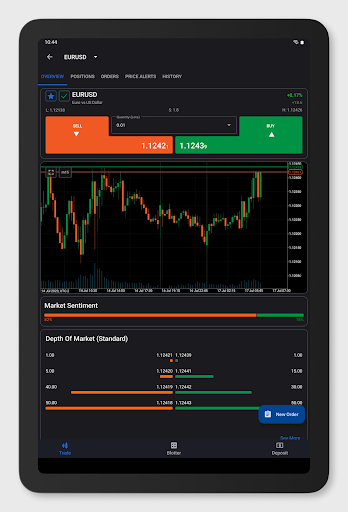

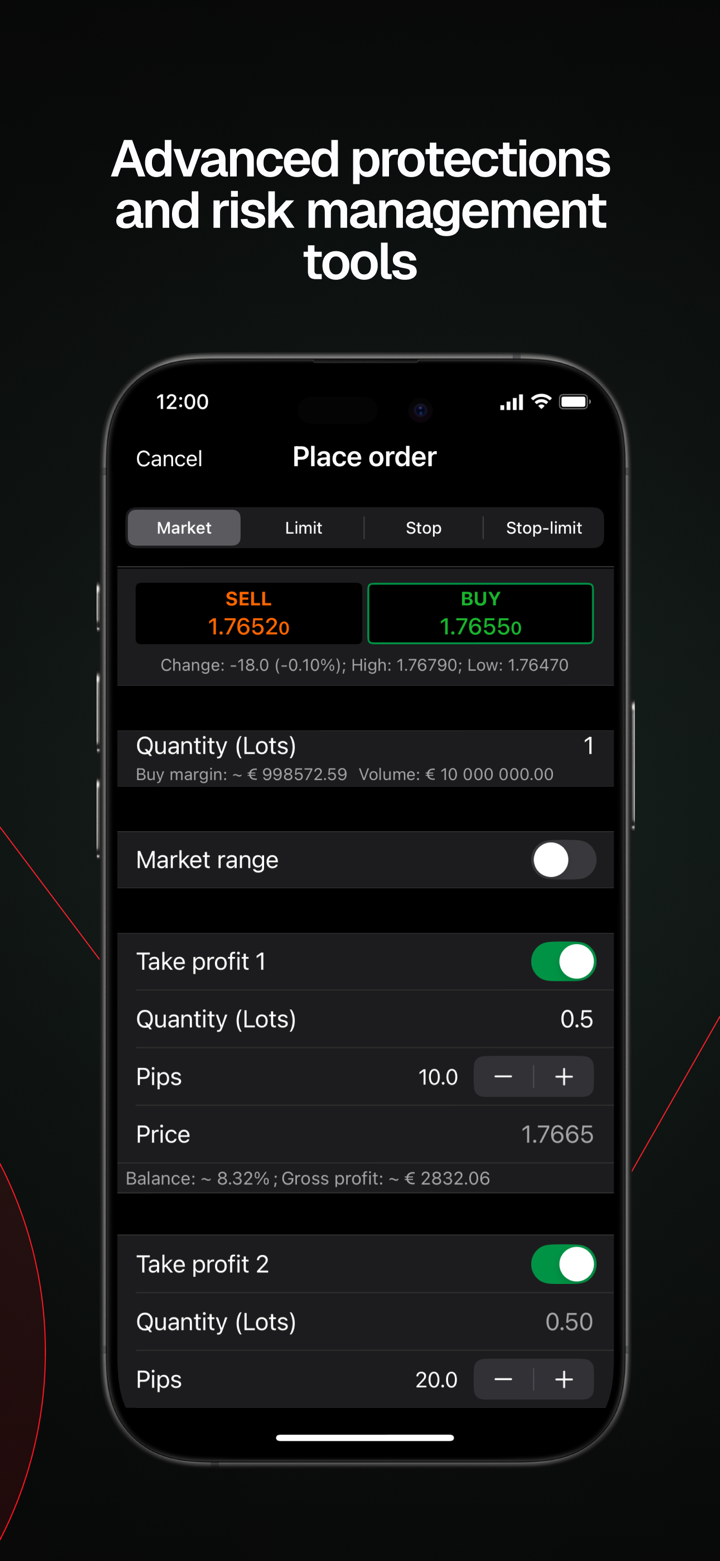

Could you tell me what the highest leverage is that Test Flight(test) provides for major forex pairs, and how this leverage differs for other asset types?

Based on my deep dive into Test Flight(test) as an independent trader, I noticed that their stated maximum leverage is 1:50. In my experience, when a broker offers a leverage cap of 50:1, this often applies specifically to major forex pairs since those are typically considered less volatile and thus less risky from a broker’s risk management perspective. However, it’s important to note that the information provided didn't clarify if this leverage changes for other asset classes like commodities or indices. From my own dealings with brokers of similar profiles, regulators such as ASIC—under which Test Flight(test) claims to be regulated in Australia—generally require lower leverage for CFDs on equities, commodities, or indices than for forex majors, often going down to 20:1 or even lower. Given Test Flight(test)’s offshore presence in Saint Vincent and the Grenadines and its labeling as a market maker, I am particularly cautious. Offshore registration may sometimes allow for higher leverage on non-forex instruments, but the absence of clear, transparent details around leverage by asset type is a significant consideration for me, as regulatory requirements and actual practices can differ. I personally would not assume uniform leverage across all assets unless explicitly confirmed and would take extra steps to verify these specifics directly with the broker prior to trading, especially given the highlighted medium potential risk and user feedback surrounding withdrawal challenges.

Does Test Flight (test) charge a commission for each lot traded on their ECN or raw spread accounts?

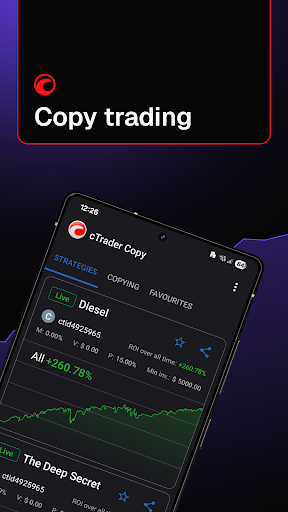

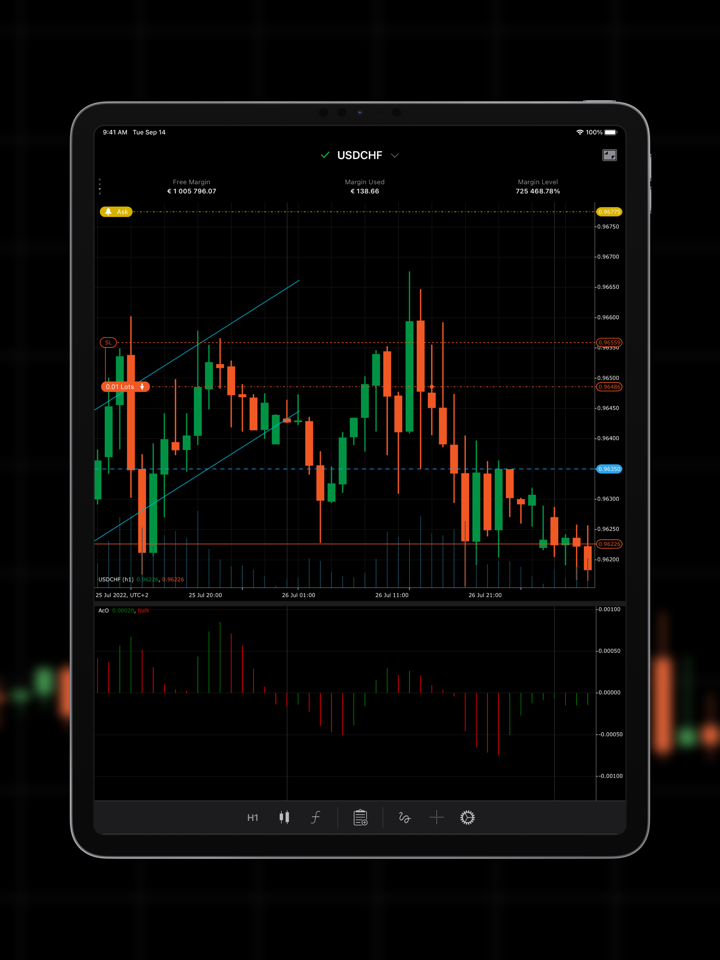

Based on my experience analyzing Test Flight (test), I found that they do list a 2% commission, but their account types and fee structure lack full transparency. There is no specific mention of ECN or raw spread accounts in the available information. Instead, the details are limited—there’s a “Market Maker (MM)” designation, mention of cTrader as the platform, and the regulatory status is somewhat complex, involving both Australia and Saint Vincent and the Grenadines. From what I can gather, the 2% commission appears to be charged, but whether this applies per lot or operates differently remains unclear, given the provided data is incomplete. For me, the lack of clear disclosure on how commissions are charged by account type is a red flag. In my own trading, broker transparency is crucial, especially for commission-based structures on ECN or raw accounts, as hidden costs or ambiguous terms can negatively impact long-term profitability. Additionally, I pay close attention to user feedback before depositing. One review mentioned withdrawal difficulties, which raises additional concerns about overall reliability. Personally, unless I receive explicit confirmation, ideally in writing from customer support, I avoid brokers that do not specify commission calculations and account structures. My approach is to prioritize platforms where fee schedules—including lot commissions—are detailed and independently verifiable.

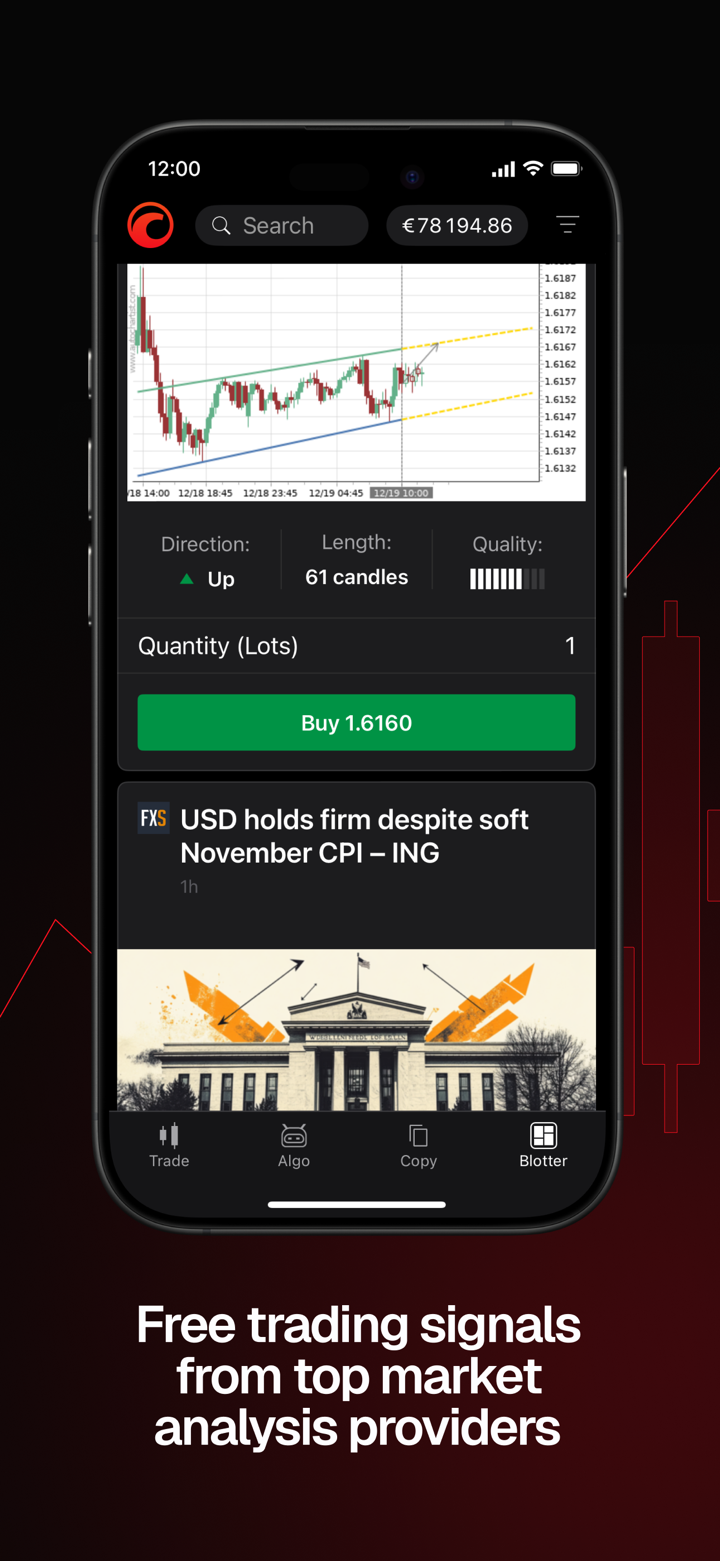

Can you outline the particular advantages that Test Flight(test) offers in terms of its available trading instruments and its fee structure?

Drawing from my own experience as a forex trader, I approach every broker with diligence and emphasize the importance of regulatory status, transparency, and user feedback before making any judgment. When evaluating Test Flight (test), I noticed the broker lists itself as regulated in Australia through ASIC and also registered offshore in Saint Vincent and the Grenadines. However, the presence of “Suspicious Scope of Business” and “Offshore Regulated” labels raises concerns for me, as jurisdictional regulatory strength can greatly affect client fund safety and dispute resolution. Regarding trading instruments, Test Flight's public materials don’t specify a wide range of products—there is a lack of clear information about available symbols or asset classes. This ambiguity makes it difficult for me to confidently assess whether their offering meets the standards I expect from an established broker. In my experience, a broker’s transparency regarding available instruments is critical for planning my trading strategies. As for the fee structure, what stands out is the stated commission of 2%. For me, this appears relatively high in today’s competitive brokerage landscape, where fees are fiercely contested. The lack of clarity around spreads or other standard charges is also concerning. Without transparent information about minimum deposits, spreads, or withdrawal costs, I personally would be hesitant to allocate significant capital. In short, while Test Flight demonstrates some regulatory credentials and uses cTrader technology, the lack of detail about trading instruments and an arguably steep commission, coupled with transparency issues, limit the broker’s appeal for me as a cautious, experienced trader.

사용자리뷰2

댓글을 달고 싶은 내용

입력해 주세요....

평가 2