Riepilogo dell'azienda

avviso: BLUEMOUNT · BLUEMOUNT sito web: http://www. BLUEMOUNT .com/index.php? lang=hk non può essere inserito normalmente al momento. pertanto, possiamo raccogliere informazioni pertinenti solo da Internet.

avviso di rischio

Il trading online comporta rischi significativi e potresti perdere tutto il capitale investito. Non è adatto a tutti i trader o investitori. Assicurati di aver compreso i rischi coinvolti e tieni presente che le informazioni contenute in questo articolo sono solo per informazioni generali.

Informazioni di base e regolamenti

BLUEMOUNT· BLUEMOUNT , nome e cognome BLUEMOUNT FINANCIAL GROUP LIMITED , è una società di servizi finanziari registrata a Hong Kong. ecco la homepage del sito ufficiale del broker:

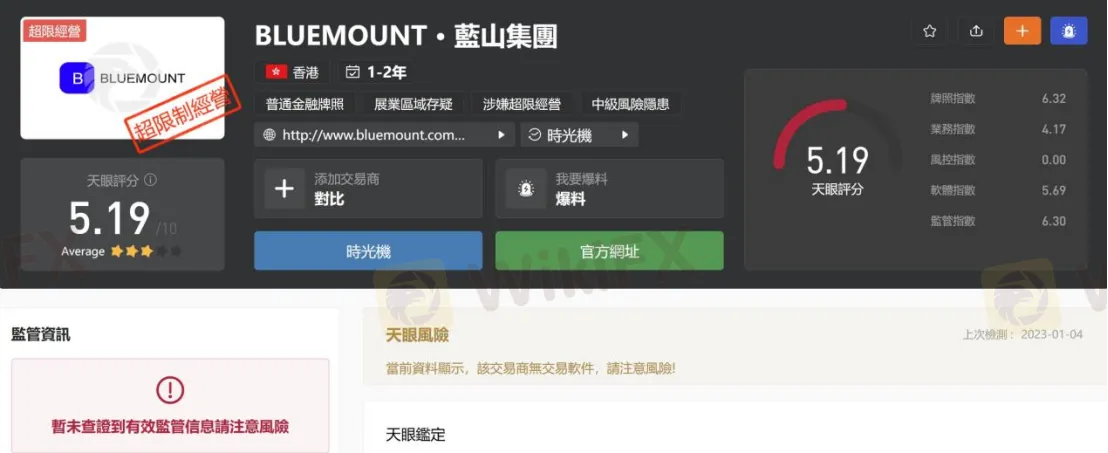

per quanto riguarda la situazione normativa, non sono stati ancora effettuati accertamenti. BLUEMOUNT · BLUEMOUNT informazioni normative efficaci. e il broker sembra operare al di fuori dei limiti, motivo per cui il suo stato normativo su wikifx è elencato come "operante oltre i limiti" con un punteggio di 5.19/10.

Servizi finanziari

BLUEMOUNT· BLUEMOUNT promuovere la fornitura di vari servizi finanziari, inclusi titoli, azioni, fondi, gestione di fondi di private equity e servizi di consulenza sugli investimenti, quotazione di servizi di finanziamento (margin financing), ecc.

piattaforma commerciale

BLUEMOUNT· BLUEMOUNT la piattaforma disponibile per il trading è un software di trading mobile.

deposito e prelievo

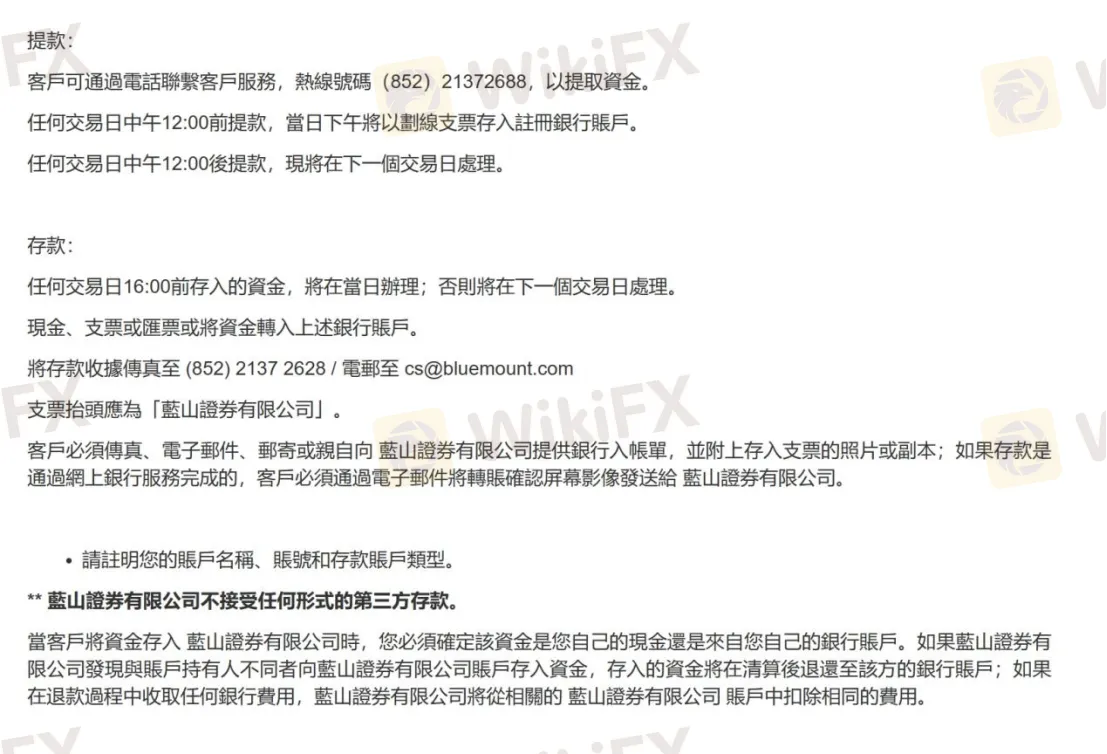

BLUEMOUNT· BLUEMOUNT sono supportati solo depositi e prelievi tramite bonifico bancario, inclusi bank of china, hang seng bank e chong hing bank, vedere lo screenshot qui sotto per i dettagli.

costo

BLUEMOUNT· BLUEMOUNT verranno addebitate varie commissioni di servizio, vedere gli screenshot e il sito Web ufficiale del broker per i dettagli. sebbene il costo del servizio sia elevato, è comunque aperto e trasparente. assicurati di comprendere l'addebito di queste commissioni prima di fare trading.

Servizio Clienti

Telefono: +852 2137 2688;

Telefax: + 852 2137 2628;

e-mail: cs@ BLUEMOUNT .com;

Puoi anche lasciare un messaggio online;

Indirizzo: Room 1007, 10th Floor, Capital Center, 151 Gloucester Road, Wanchai, Hong Kong.

Vantaggi e svantaggi

| vantaggio | discordanza |

| • Fornire vari servizi finanziari | • non regolato |

| • Metodi di deposito e prelievo limitati | |

| • Le spese sono elevate e complicate |

problema comune

| Domanda 1: | BLUEMOUNT· BLUEMOUNT è regolamentato? |

| UN 1: | non ne ho ancora trovato nessuno BLUEMOUNT · BLUEMOUNT informazioni normative efficaci. |

| Q 2: | BLUEMOUNT· BLUEMOUNT supporta le piattaforme di trading mt4 e mt5? |

| UN 2: | non supporta. BLUEMOUNT · BLUEMOUNT è supportato solo il software di trading mobile. |

| Domanda 3: | BLUEMOUNT· BLUEMOUNT è amichevole per i neofiti? |

| UN 3: | Non è consigliabile a nessuno fare trading con un broker senza licenza. |