Profil perusahaan

| BLUEMOUNT Ringkasan Ulasan | |

| Didirikan | 1996 |

| Negara/Daerah Terdaftar | China Hong Kong |

| Regulasi | SFC (Melebihi) |

| Instrumen Pasar | Efek, Saham |

| Platform Perdagangan | BLUEMOUNT APP |

| Dukungan Pelanggan | Hotline: +852 2137 2688 |

| Fax: + 852 2137 2628 | |

| Email: cs@bluemount.com | |

Informasi BLUEMOUNT

BLUEMOUNT adalah perusahaan sekuritas yang berbasis di China, Hong Kong, yang menyediakan layanan perdagangan efek untuk pasar Hong Kong dan Global. BLUE juga menawarkan berbagai layanan, termasuk pengumpulan layanan manajemen akun, dividen tunai, saham bonus/waransi, langganan saham baru, langganan saham, pelaksanaan waran, dan konsolidasi/pemecahan saham, dll. Saat ini beroperasi tanpa regulasi.

Pro dan Kontra

| Pro | Kontra |

| Struktur biaya transparan | Melebihi Lisensi SFC |

| Menawarkan akun Individu dan Gabungan | Akun demo tidak tersedia |

| Waktu operasi panjang | Instrumen pasar terbatas |

| Pilihan pembayaran terbatas |

Apakah BLUEMOUNT Legal?

Tidak, BLUEMOUNT memiliki lisensi yang melebihi dari Komisi Sekuritas dan Berjangka (SFC) Hong Kong, yang berarti kegiatan saat ini dijalankan tanpa pengawasan regulasi.

| Negara yang Diatur | Otoritas yang Diatur | Status Regulasi | Entitas yang Diatur | Tipe Lisensi | Nomor Lisensi |

| Komisi Sekuritas dan Berjangka Hong Kong (SFC) | Melebihi | Bluemount Securities Limited | Bertransaksi dalam efek | BHR496 |

Apa yang Bisa Saya Perdagangkan di BLUEMOUNT?

Para pedagang di BLUEMOUNT mendapatkan akses ke saham dan surat-surat berharga (uang tunai dan margin).

| Aset Perdagangan | Tersedia |

| surat-surat berharga | ✔ |

| saham | ✔ |

| forex | ❌ |

| komoditas | ❌ |

| indeks | ❌ |

| cryptocurrency | ❌ |

| obligasi | ❌ |

| opsi | ❌ |

| dana | ❌ |

| ETF | ❌ |

Jenis Akun

Pedagang diizinkan untuk membuka akun individu dan akun bersama di platform ini.

Selain itu, platform ini menawarkan Layanan Akun Diskresioner, yang mengacu pada layanan manajemen investasi di mana seorang penasihat keuangan atau manajer portofolio diberi wewenang untuk membuat keputusan investasi atas nama klien tanpa perlu mencari persetujuan sebelum setiap transaksi.

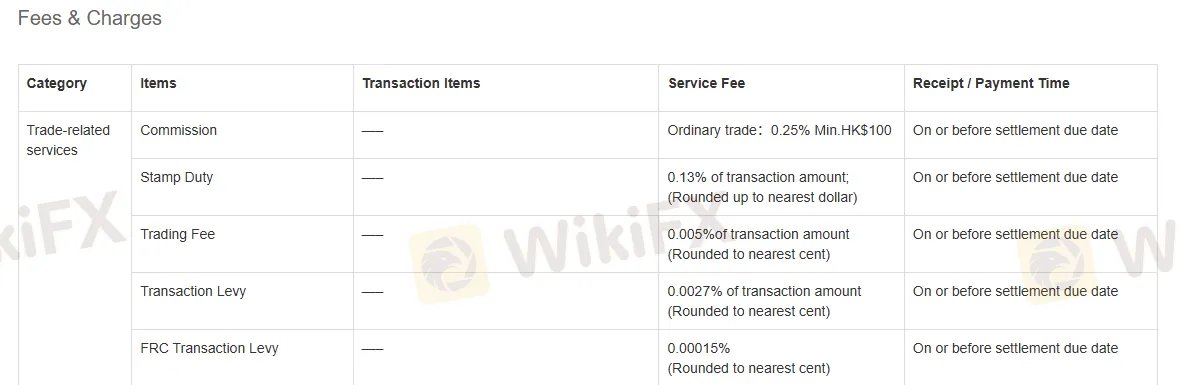

Biaya

BLUEMOUNT menyediakan struktur biaya yang jelas bagi para pedagang, dengan rincian biaya untuk setiap layanannya. Misalnya, BLUEMOUNT menagih komisi sebesar 0,25%, dan jumlah minimumnya adalah HK$ $100.

Untuk informasi lebih lanjut tentang biaya dan tarif di platform ini, silakan kunjungi https://www.bluemount.com/fees-charges?lang=en.

Berikut adalah berbagai biaya terkait transaksi, beserta aturan perhitungannya dan jadwal pembayarannya.

| Item | Biaya Layanan | Waktu Penerimaan/Pembayaran |

| Komisi | Perdagangan biasa: 0,25%; Min. HK$100 | Pada atau sebelum tanggal jatuh tempo penyelesaian |

| Pajak Cap | 0,13% dari jumlah transaksi; (Dibulatkan ke dollar terdekat) | |

| Biaya Perdagangan | 0,005% dari jumlah transaksi (Dibulatkan ke cent terdekat) | |

| Pajak Transaksi | 0,0027% dari jumlah transaksi (Dibulatkan ke cent terdekat) | |

| Pajak Transaksi FRC | 0,00015% (Dibulatkan ke cent terdekat) |

Platform Perdagangan

BLUEMOUNT menawarkan aplikasi perdagangan yang dapat diakses di Google Play dan App Store.

| Platform Perdagangan | Didukung | Perangkat Tersedia |

| Aplikasi BLUEMOUNT | ✔ | Mobile |

Deposit dan Penarikan

Proses Deposit:

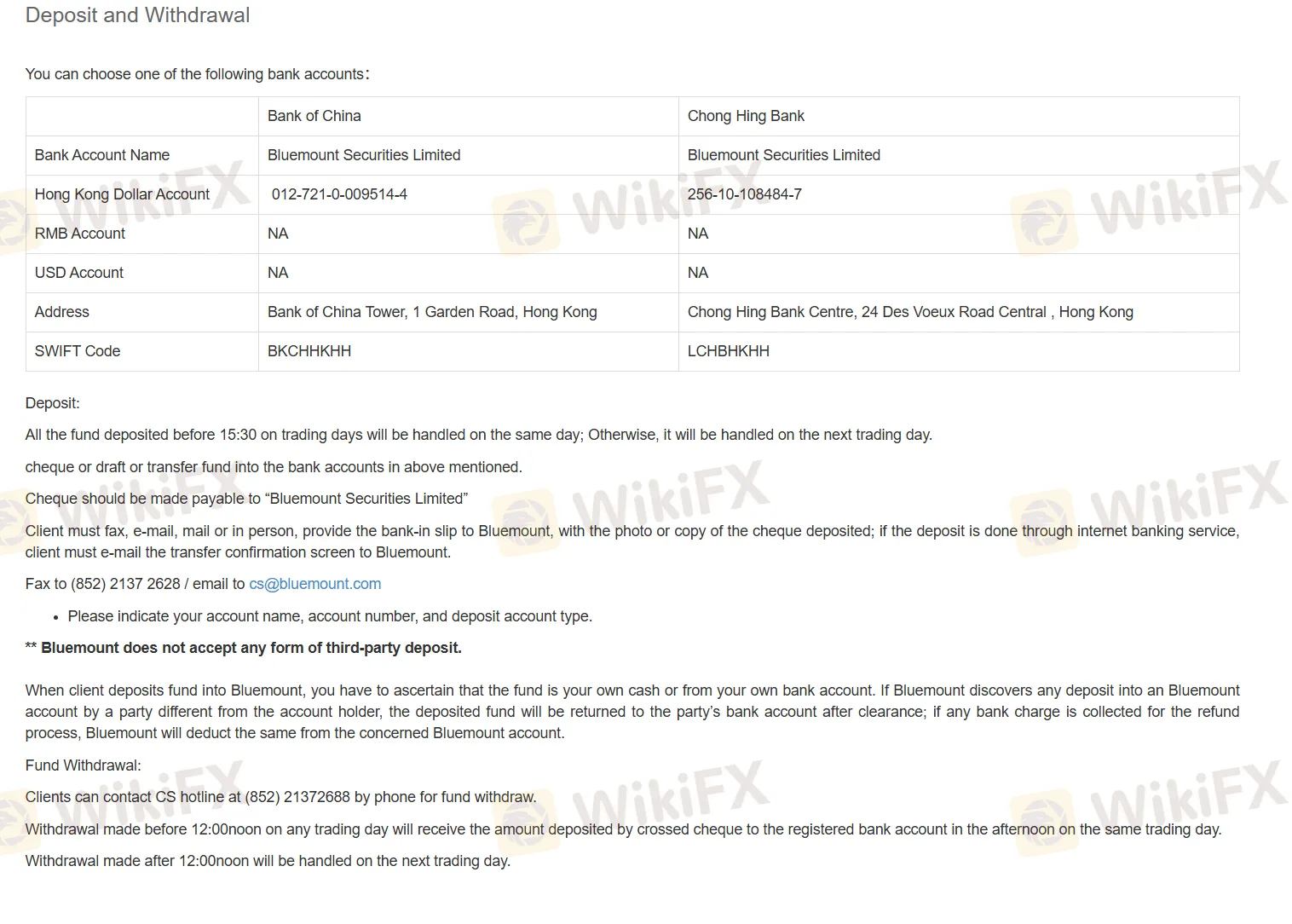

- Akun Bank untuk Deposit:

- Anda dapat melakukan deposit dana ke akun Bluemounts di Bank of China atau Chong Hing Bank. Jenis akun yang tersedia termasuk Akun Dolar Hong Kong, tetapi tidak ada akun RMB atau USD. Kode SWIFT dan alamat disediakan untuk setiap bank.

- Waktu Deposit:

- Sebelum pukul 15:30 pada hari perdagangan: Diproses pada hari yang sama. Setelah pukul 15:30: Diproses pada hari perdagangan berikutnya.

- Metode Deposit:

- Cek/Draft/Transfer Bank: Dibuat atas nama Bluemount Securities Limited. Jika melakukan deposit dengan cek, Anda harus menyediakan slip setoran bank, foto atau salinan cek, atau konfirmasi transfer.

Catatan Penting: Deposit dari pihak ketiga tidak diterima. Semua deposit harus berasal dari akun Anda. Jika Bluemount mengidentifikasi deposit dari pihak ketiga, dana akan dikembalikan ke akun pengirim (dengan potongan biaya bank apa pun).

Proses Penarikan:

- Cara Menarik:

- Anda dapat menghubungi Layanan Pelanggan (CS) di (852) 2137 2688 untuk meminta penarikan.

- Waktu Penarikan:

- Sebelum pukul 12:00 siang: Penarikan diproses di sore hari dan dikirimkan melalui cek bersilang ke rekening bank terdaftar Anda pada hari perdagangan yang sama. Setelah pukul 12:00 siang: Penarikan diproses pada hari perdagangan berikutnya.