Profil perusahaan

| WorldFirst Ringkasan Ulasan | |

| Didirikan | 2004 |

| Negara/Daerah Terdaftar | Australia |

| Regulasi | ASIC (diatur); FCA (Melebihi) |

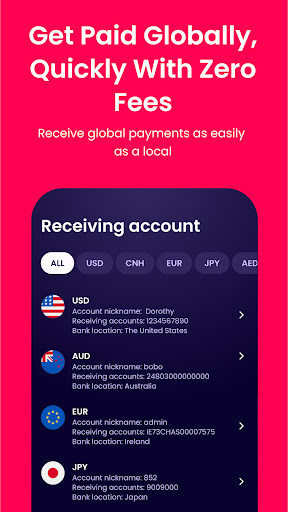

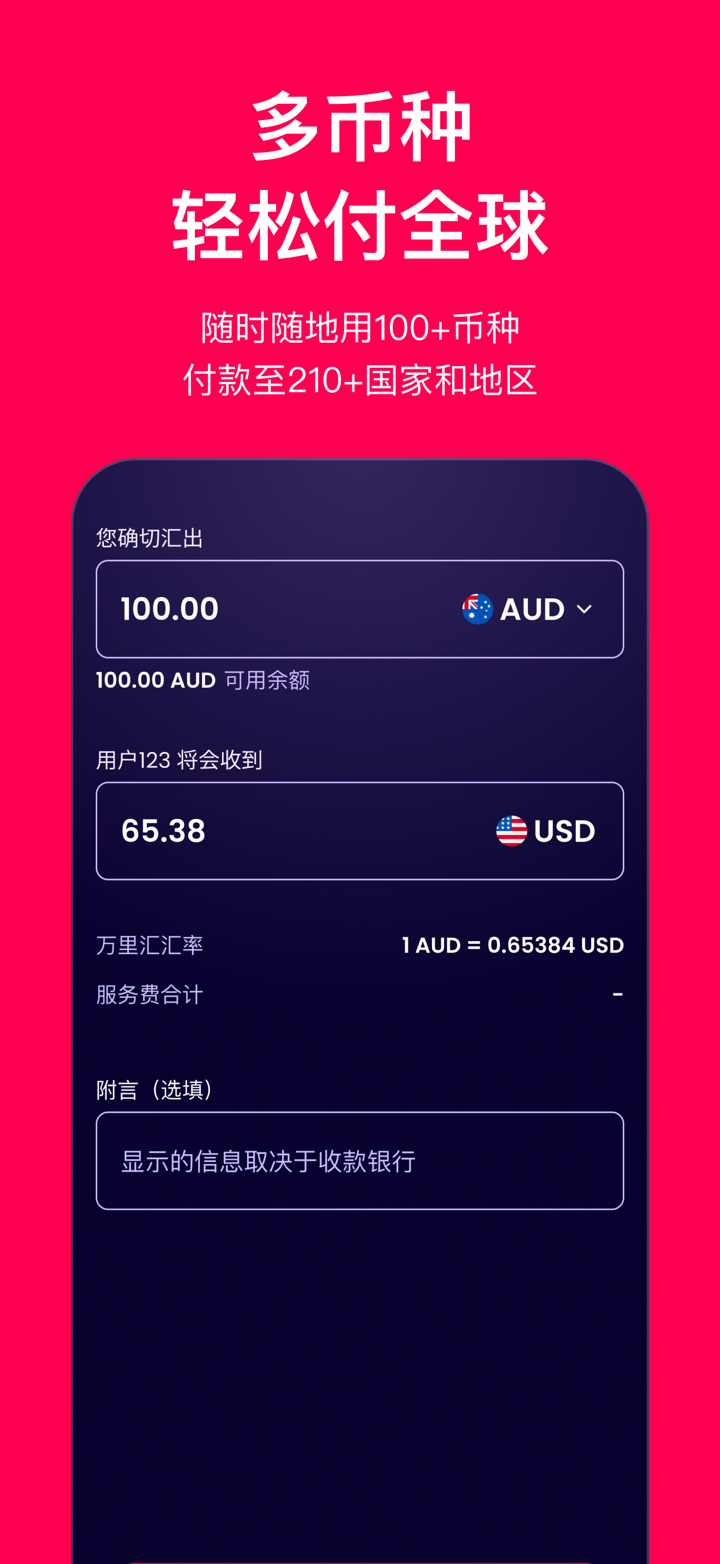

| Produk & Layanan | Penukaran mata uang, pembayaran internasional, akun multi-mata uang, kartu debit virtual, pembayaran massal, kontrak berjangka |

| Dukungan Pelanggan | Telepon (Australia): 1800 326 667 |

| Telepon (NZ): 0800 666 114 | |

| Telepon (Internasional): +61 2 8298 4990 | |

| Email: media@worldfirst.com | |

Informasi WorldFirst

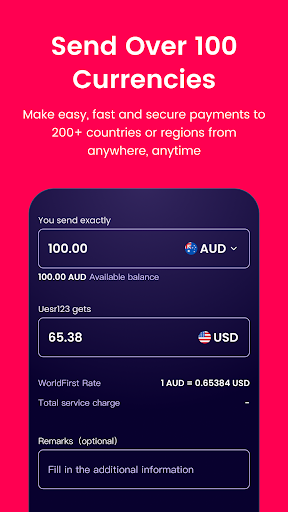

WorldFirst, didirikan pada tahun 2004, adalah organisasi layanan keuangan yang berbasis di Australia dan diatur oleh ASIC yang mengkhususkan diri dalam pembayaran bisnis global dan konversi mata uang. Fitur utamanya termasuk akun multi-mata uang, solusi pertukaran valuta asing, dan kartu debit virtual, semuanya tanpa biaya pemeliharaan berkelanjutan, sehingga cocok untuk bisnis e-commerce dan UMKM.

Pro dan Kontra

| Pro | Kontra |

| Diatur oleh ASIC | Terutama ditujukan untuk bisnis, bukan individu |

| Akun multi-mata uang gratis dan transfer dalam satu hari | |

| Biaya konversi FX yang transparan dan terbatas | |

| Sejarah operasional yang panjang |

Apakah WorldFirst Legal?

WorldFirst adalah institusi keuangan yang diatur. Australian Securities and Investments Commission (ASIC) telah menyetujui World First Pty Ltd sebagai Market Maker. Lisensi ini aktif dan valid.

Selain itu, Financial Conduct Authority (FCA) Inggris memberikan lisensi layanan pembayaran. Namun, status FCA saat ini adalah "Melebihi", yang mengimplikasikan bahwa lisensi mungkin tidak lagi aktif atau sesuai.

| Otoritas yang Diatur | Status Saat Ini | Negara yang Diatur | Jenis Lisensi | No. Lisensi |

| Australian Securities and Investments Commission (ASIC) | Diatur | Australia | Market Maker (MM) | 000331945 |

| Financial Conduct Authority (FCA) | Melebihi | Inggris | Lisensi Pembayaran | 900508 |

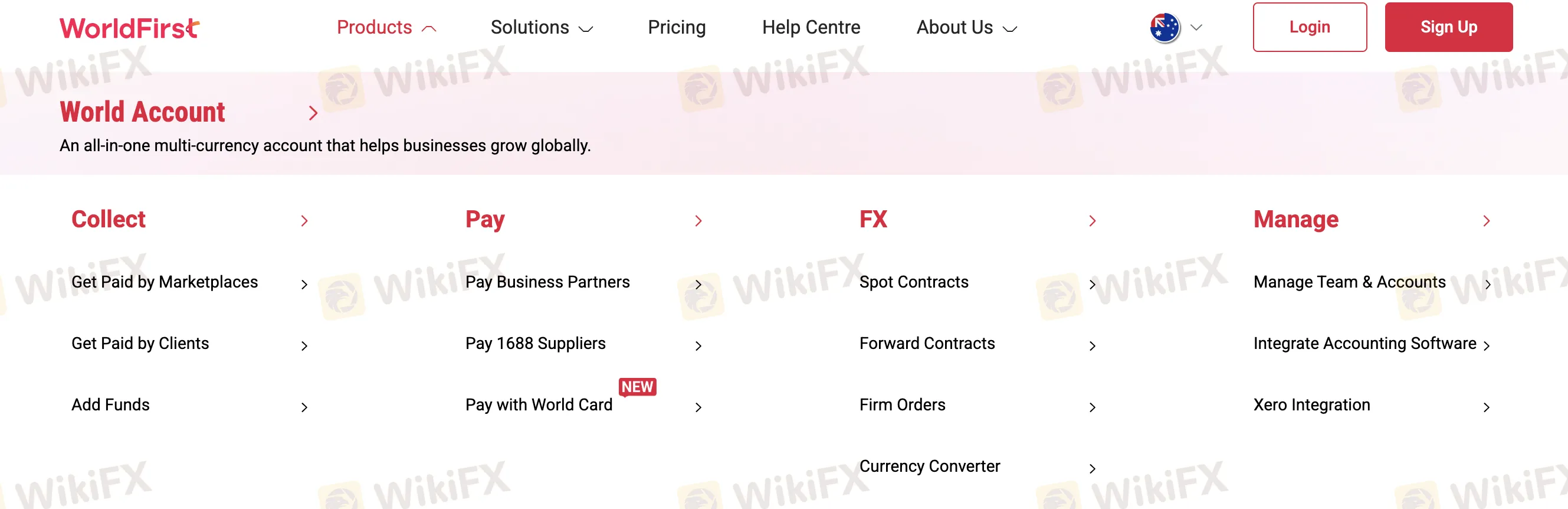

Produk dan Layanan

WorldFirst jelas diposisikan sebagai solusi B2B (bisnis ke bisnis), dengan fokus pada pembayaran lintas batas, layanan pertukaran valuta asing, dan manajemen akun untuk perdagangan global.

| Produk/Layanan | Fitur | Dukungan |

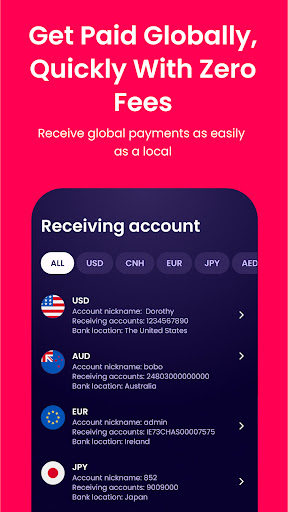

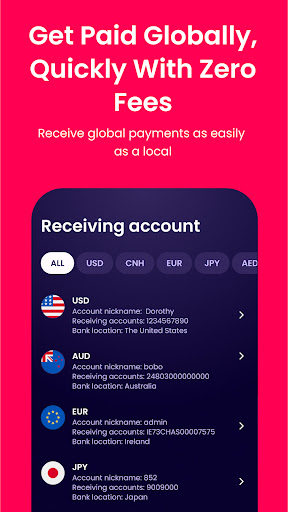

| Akun Multi-Mata Uang | Akun Dunia - untuk kebutuhan bisnis global | ✔ |

| Koleksi Marketplace | Dapatkan pembayaran dari Amazon, Etsy, Shopify, dll. | ✔ |

| Penagihan Klien | Menerima pembayaran langsung dari klien | ✔ |

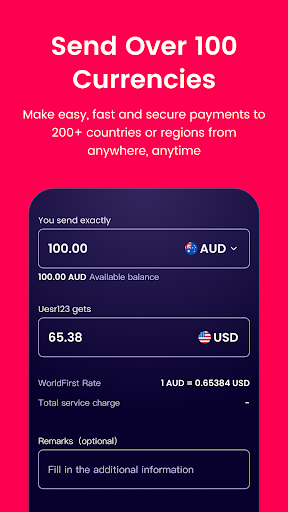

| Transfer Dana | Kirim dana ke mitra bisnis atau pemasok | ✔ |

| Layanan Valuta Asing | Kontrak spot, kontrak berjangka, pesanan tetap | ✔ |

| Pembayaran Kartu Dunia | Bayar menggunakan Kartu Dunia | ✔ |

| Pembayaran Korporat | Solusi untuk importir/eksportir | ✔ |

| Pembayaran China | Pembayaran langsung ke China | ✔ |

| Manajemen Tim & Akun | Alat admin untuk tim internal | ✔ |

| Integrasi Perangkat Lunak | Integrasi dengan sistem akuntansi seperti Xero | ✔ |

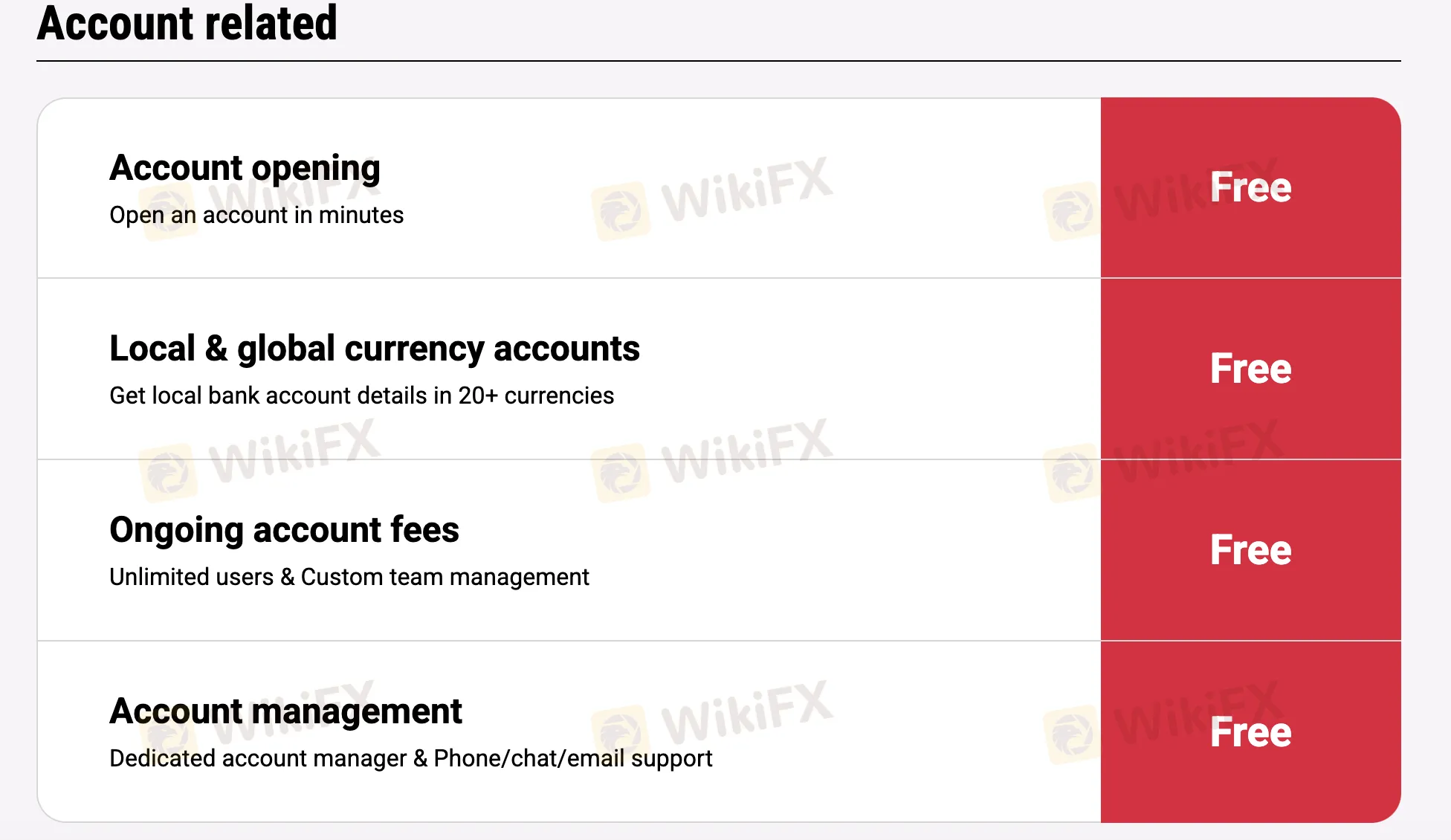

Biaya WorldFirst

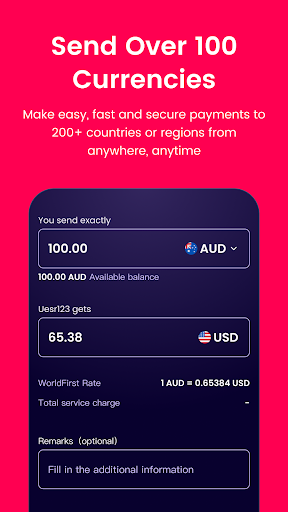

Tarif WorldFirst seringkali lebih rendah dari standar industri, terutama untuk organisasi yang menangani pembayaran lintas batas dan valuta asing. Sebagian besar layanan penting gratis, dan di mana biaya dikenakan (misalnya, pertukaran mata uang), biaya tersebut jelas dibatasi atau dipertahankan pada persentase minimal.

| Kategori Layanan | Detail | Biaya |

| Pembukaan & Pemeliharaan Akun | Buka dan kelola Akun Dunia | 0 |

| Akun Mata Uang Lokal & Global | 20+ mata uang | |

| Biaya Akun Berkelanjutan | Pengguna tak terbatas, manajemen tim | |

| Dukungan Khusus | Dukungan telepon, obrolan, dan email | |

| Menerima & Menahan Pembayaran | Menerima pembayaran dari pasar/klien | |

| Dana Akun Anda | Dari akun pribadi atau bisnis | |

| Menahan Dana | Hingga 20+ mata uang | |

| Pembayaran & Konversi Mata Uang | Pembayaran AUD/NZD lokal | |

| Pembayaran Mata Uang Lain | Lokal/lintas batas (non-AUD/NZD) | Dari 0,4%, dibatasi pada AUD 15 |

| Pembayaran ke Akun Dunia Lain | Di mana saja, instan | 0 |

| Pembayaran ke 1688 | Instan ke pemasok | Hingga 0,8% |

| Valuta Asing untuk Mata Uang Utama | USD, EUR, GBP, AUD, CAD, JPY | Hingga 0,6% |

| Valuta Asing untuk Mata Uang Minor | 40+ mata uang | Dari 0,67% |

| Kontrak Berjangka | Solusi manajemen risiko | Hingga 0,2%/bulan |

| Transfer Nilai Penuh (FVT) - USA/UK/EEA | Memastikan jumlah penuh diterima | 0 |

| FVT - Negara Lain | Fixed AUD 25 | |

| Kartu Dunia (Kartu Debit) | Aplikasi, 25 pengguna, penggunaan | 0 |

| Mata Uang Tidak Tersimpan dalam Saldo | Konversi valuta asing di WorldFirst atau Mastercard | Hingga 1,5% |

| Alat & Integrasi | Pembayaran massal, integrasi Xero, NetSuite | 0 |

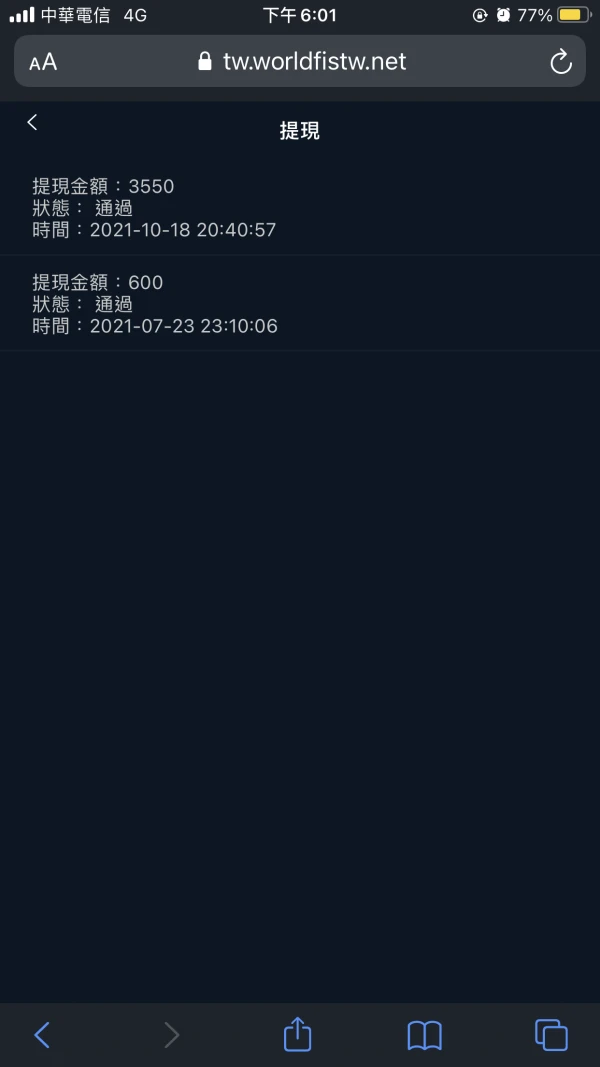

蘇義盛

Taiwan

Layanan pelanggan menjawab dan meminta saya membayar $10.000 untuk membuka kunci deposit. Karena otoritas pengatur keuangan memiliki persyaratan keamanan akun dan aset yang lebih ketat, maka diperlukan lebih banyak setoran. Tidak ada peraturan yang jelas tentang platform. Tampaknya tidak masuk akal untuk menarik deposit yang tidak dibekukan.

Paparan

蘇義盛

Taiwan

Balasan layanan pelanggan: Halo, perusahaan menginformasikan bahwa karena departemen teknis mendeteksi masalah abnormal dengan akun Anda, yang mungkin dicuri. Jadi penarikan tidak lolos tinjauan, dan Anda harus membayar dana risiko $5000 . Pertanyaan: Saya tidak beroperasi secara tidak normal, dan penarikan $20,572 tidak berhasil. Layanan pelanggan meminta saya untuk membayar $5.000 karena pengoperasian yang tidak benar. Apakah ini masuk akal?

Paparan

蘇義盛

Taiwan

Tidak dapat menarik. Platform meminta saya untuk menyetor $5.000 untuk biaya risiko. Ini tidak masuk akal. Kami hanya investor, dan tidak dapat mengontrol penarikan dan penyetoran di platform. Saya kira itu adalah platform penipuan. Hanya layanan pelanggan resmi yang merespons. Tidak ada telepon. Saya masih memiliki $25.124 di akun saya, tetapi tidak dapat menarik.

Paparan

FX1485573802

Filipina

WorldFirst telah menjadi pilihan saya untuk transfer internasional. Menenangkan untuk mengetahui bahwa mereka diatur oleh ASIC dan terdaftar di AUSTRAC. Transfer uangnya tanpa ribet, dan mereka cukup jelas tentang biaya yang terlibat.

Baik

Alfred

Indonesia

Jujur WorldFirst bisa kasih bintang 5, tapi dana saya belum masuk sampai sekarang, karena sudah lima hari. Saya menulis ulasan ini sambil menunggu…

Baik

葉翰隆

Taiwan

Saya pikir itu adalah platform valuta asing tetapi akun saya terkunci ketika saya menarik. Ia meminta saya untuk membayar $5000 sebagai margin tetapi saya hanya bisa menghubunginya secara online. Saya tidak yakin apakah saya bisa mendapatkan margin kembali.

Paparan