Profil perusahaan

| Okasan Securities Ringkasan Ulasan | |

| Dibentuk | 1923 |

| Negara/Daerah Terdaftar | Jepang |

| Regulasi | FSA |

| Produk dan Layanan | Saham, ETF/ETN/REIT, FX, CFD, Reksadana, iDeCo, NISA, IPO, MRF, dll. |

| Akun Demo | ✅ |

| Platform Perdagangan | Okasan Net Trader Series, Pemesanan Mudah, Aplikasi Cub, Aplikasi FX/Web/iPad Online, NetTrader365FX, Seri FX Aktif, Platform Saham 365, Alat RSS |

| Deposit Minimum | Tidak ditentukan |

| Dukungan Pelanggan | Ibukota: 4007-2511 |

| Lokasi lain: 0800-001-2511 | |

| WhatsApp: (11) 4007-2511 | |

Informasi Okasan Securities

Beroperasi dengan nama 岡三証券株式会社, Okasan Securities menyediakan layanan keuangan yang komprehensif di Jepang, didirikan pada tahun 1923. Meskipun perusahaan aslinya terkenal, FSA Jepang telah mengidentifikasi cabang online Okasan Securities証券株式会社 sebagai klon yang meragukan karena perbedaan lisensi. Pilihan investasi yang luas termasuk program pensiun NISA dan iDeCo, FX, reksadana, saham Jepang dan Tiongkok, dan lainnya.

Pro dan Kontra

| Pro | Kontra |

| Beragam produk termasuk akses pensiun dan IPO | Entitas terdaftar menunjukkan status klon yang mencurigakan |

| Biaya perdagangan rendah hingga nol pada beberapa saham/dana tertentu | Beberapa layanan canggih memiliki biaya perdagangan yang tinggi |

| Platform tersedia untuk berbagai kelas aset dan tingkat pengguna | Tidak ada akun Islami (bebas swap) |

Apakah Okasan Securities Legal?

Meskipun memiliki lisensi valid di bawah Otoritas Jasa Keuangan Jepang (FSA) untuk entitas 岡三証券株式会社 (Okasan Securities Co., Ltd.) dengan nomor lisensi 関東財務局長(金商)第53号, ada juga klon yang meragukan menggunakan informasi serupa dengan nama Okasan Securities証券株式会社 (Okasan Online Securities Co., Ltd.), dengan nomor lisensi 2010001097479. Inkonsistensi dalam nama entitas berlisensi dan alamat yang tidak sesuai menyebabkan status klon terdeteksi.

| Status Regulasi | Klon yang Mencurigakan |

| Diregulasi Oleh | Jepang (FSA) |

| Institusi Berlisensi | Okasan Securities証券株式会社 (Okasan Online Securities Co., Ltd.) |

| Jenis Lisensi | Lisensi Forex Ritel |

| Nomor Lisensi | 2010001097479 |

Produk dan Layanan

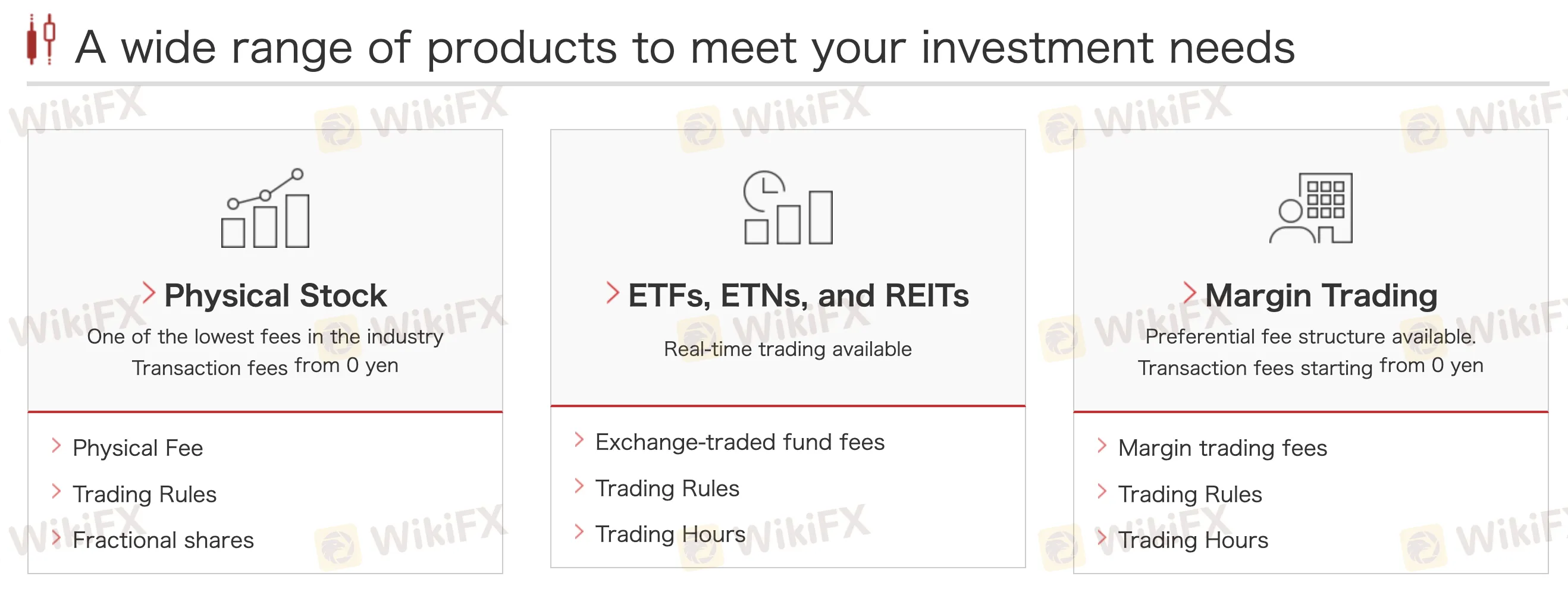

Disesuaikan untuk investor pemula maupun berpengalaman, Okasan Online menawarkan berbagai alat keuangan lengkap. Produk-produknya termasuk saham nyata, ETF, perdagangan marjin, dana investasi, FX, CFD, akses IPO, dan investasi terkait pensiun seperti iDeCo dan NISA.

| Produk / Layanan | Tersedia |

| Saham Fisik | ✅ |

| ETF / ETN / REIT | ✅ |

| Perdagangan Marjin | ✅ |

| Investasi Dana (Dana Investasi) | ✅ |

| FX Pertukaran | ✅ |

| FX Luar Bursa | ✅ |

| CFD Pertukaran | ✅ |

| IPO | ✅ |

| NISA (Akun Bebas Pajak) | ✅ |

| iDeCo (Rencana Pensiun) | ✅ |

| Saham Tiongkok | ✅ |

| MRF (Dana Cadangan Uang) | ✅ |

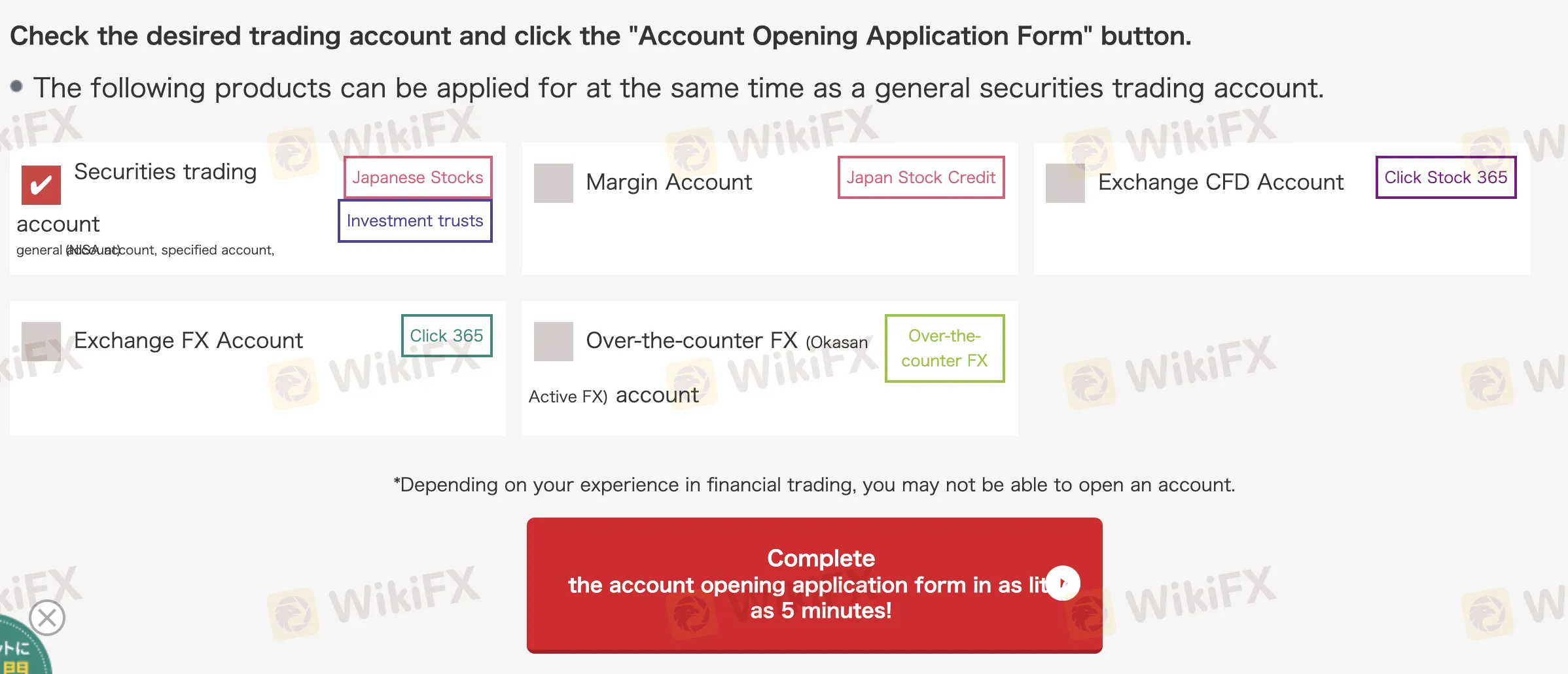

Jenis Akun

Okasan Securities memiliki lima akun live: Perdagangan Efek, Marjin, Pertukaran CFD (Click Stock 365), Pertukaran FX (Click 365), dan FX Luar Bursa (Active FX). Akun demo juga dapat diakses untuk latihan; akun Islami (bebas swap) tidak disediakan.

| Jenis Akun | Produk yang Didukung | Cocok Untuk |

| Akun Perdagangan Efek | Saham Jepang, Dana Investasi | Investor Umum |

| Akun Marjin | Kredit Saham Jepang (Perdagangan Leverage) | Trader yang mencari leverage |

| Akun CFD Pertukaran | CFD Indeks (Click Stock 365) | Trader fokus pada indeks menggunakan JPY |

| Akun FX Pertukaran | Click 365 FX (Perdagangan FX berbasis pertukaran) | Trader FX yang lebih memilih platform yang teregulasi |

| Akun FX Luar Bursa | Active FX (platform FX yang disesuaikan) | Trader FX aktif yang menginginkan fitur lebih banyak |

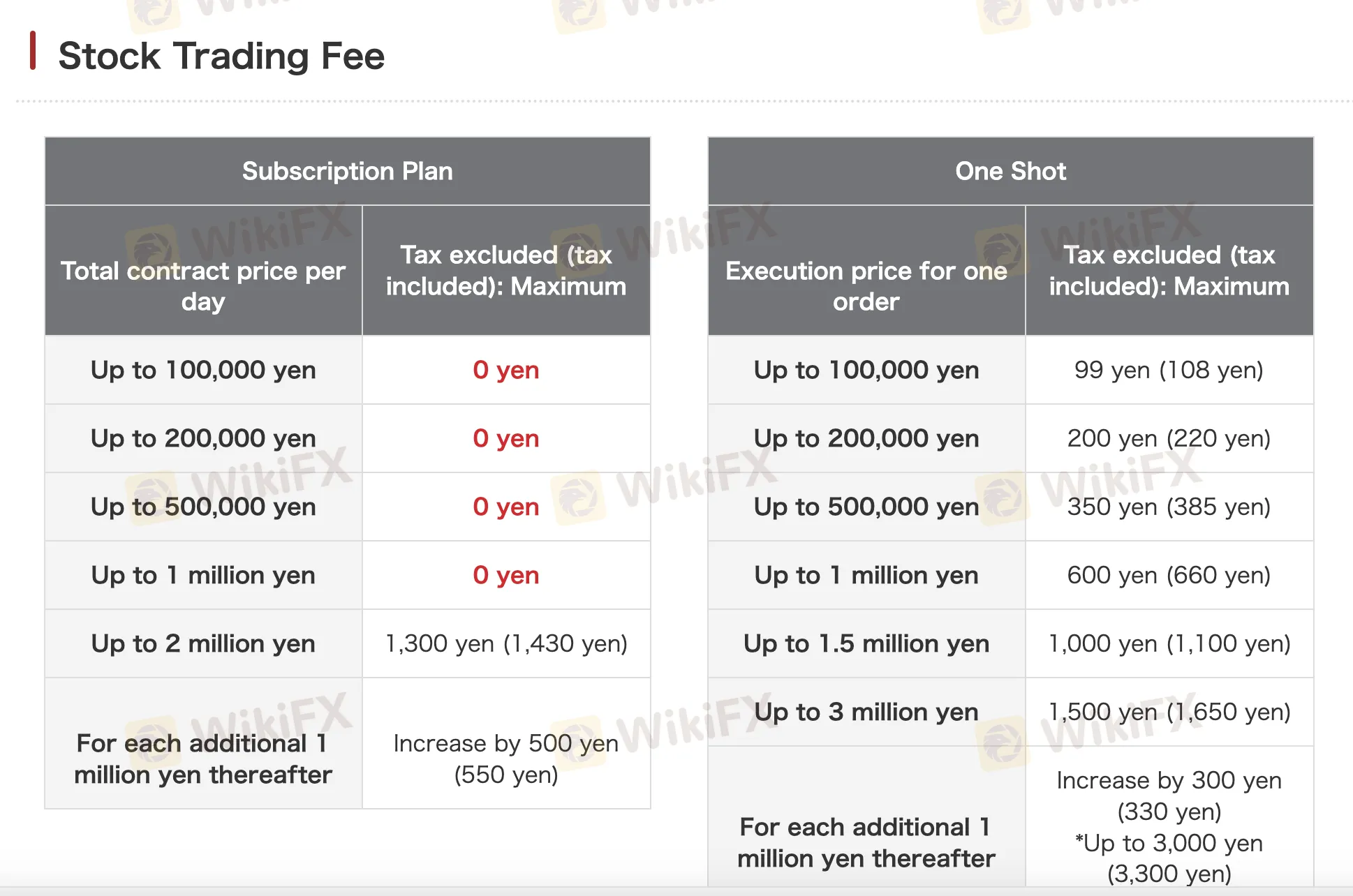

Biaya Okasan Securities

Khusus untuk saham Jepang dan trust investasi, biaya perdagangan Okasan Securities biasanya rendah dibandingkan dengan standar industri. Banyak item tidak dikenakan komisi dalam rencana atau kriteria tertentu, yang menarik bagi trader agresif dan pendatang baru. Di mana relevan, biaya tambahan jelas adil dan terorganisir dengan baik. Namun, beberapa layanan, seperti perdagangan yang didukung oleh dukungan di Click 365, memiliki biaya yang jauh lebih tinggi.

| Produk | Kondisi/Volume | Biaya (Excl. Pajak) | Biaya (Incl. Pajak) |

| Perdagangan Saham (Rencana Langganan) | ≤ ¥100,000 | ¥0 | ¥0 |

| ≤ ¥200,000 | ¥0 | ¥0 | |

| ≤ ¥500,000 | ¥0 | ¥0 | |

| ≤ ¥1,000,000 | ¥0 | ¥0 | |

| ≤ ¥2,000,000 | ¥1,300 | ¥1,430 | |

| Setiap tambahan ¥1M | ¥500 | ¥550 | |

| Perdagangan Saham (Rencana Sekali Pakai) | ≤ ¥100,000 | ¥99 | ¥108 |

| ≤ ¥200,000 | ¥200 | ¥220 | |

| ≤ ¥500,000 | ¥350 | ¥385 | |

| ≤ ¥1,000,000 | ¥600 | ¥660 | |

| ≤ ¥1,500,000 | ¥1,000 | ¥1,100 | |

| ≤ ¥3,000,000 | ¥1,500 | ¥1,650 | |

| Setiap tambahan ¥1M | ¥300 | ¥330 | |

| Perdagangan Margin | ≤ ¥2,000,000 (Super Premium) | ¥0 | ¥0 |

| ≤ ¥2,000,000 (Platinum) | ¥300 | ¥330 | |

| ≤ ¥2,000,000 (Standar) | ¥1,000 | ¥1,100 | |

| Trust Investasi | Pembelian | ¥0 | ¥0 |

| Penebusan (Dana Saham) | Hingga 0.5% | Hingga 0.5% | |

| Biaya Cadangan Trust | ¥110/10K unit | ¥110/10K unit | |

| Biaya Trust Tahunan | Hingga 2.42% | Hingga 2.42% | |

| Pertukaran FX (Click365) | Kurs Sendiri (Reguler) | ¥0 | ¥0 |

| Kurs Sendiri (Besar) | ¥1,018 | ¥1,018 | |

| Kurs Dukungan (Reguler) | ¥1,100 | ¥1,100 | |

| Kurs Dukungan (Besar) | ¥11,000 | ¥11,000 | |

| FX OTC | Semua klien | ¥0 | ¥0 |

| CFD Pertukaran | Nikkei, DAX, FTSE100 (Sendiri) | ¥156 | ¥156 |

| Nikkei, DAX, FTSE100 (Dukungan) | ¥3,300 | ¥3,300 | |

| Micro, NYD, NASDAQ (Sendiri) | ¥30 | ¥30 | |

| Micro, NYD, NASDAQ (Dukungan) | ¥330 | ¥330 | |

| ETF (Emas/Perak/dll.) Sendiri | ¥330 | ¥330 | |

| ETF (Emas/Perak/dll.) Dukungan | ¥3,300 | ¥3,300 |

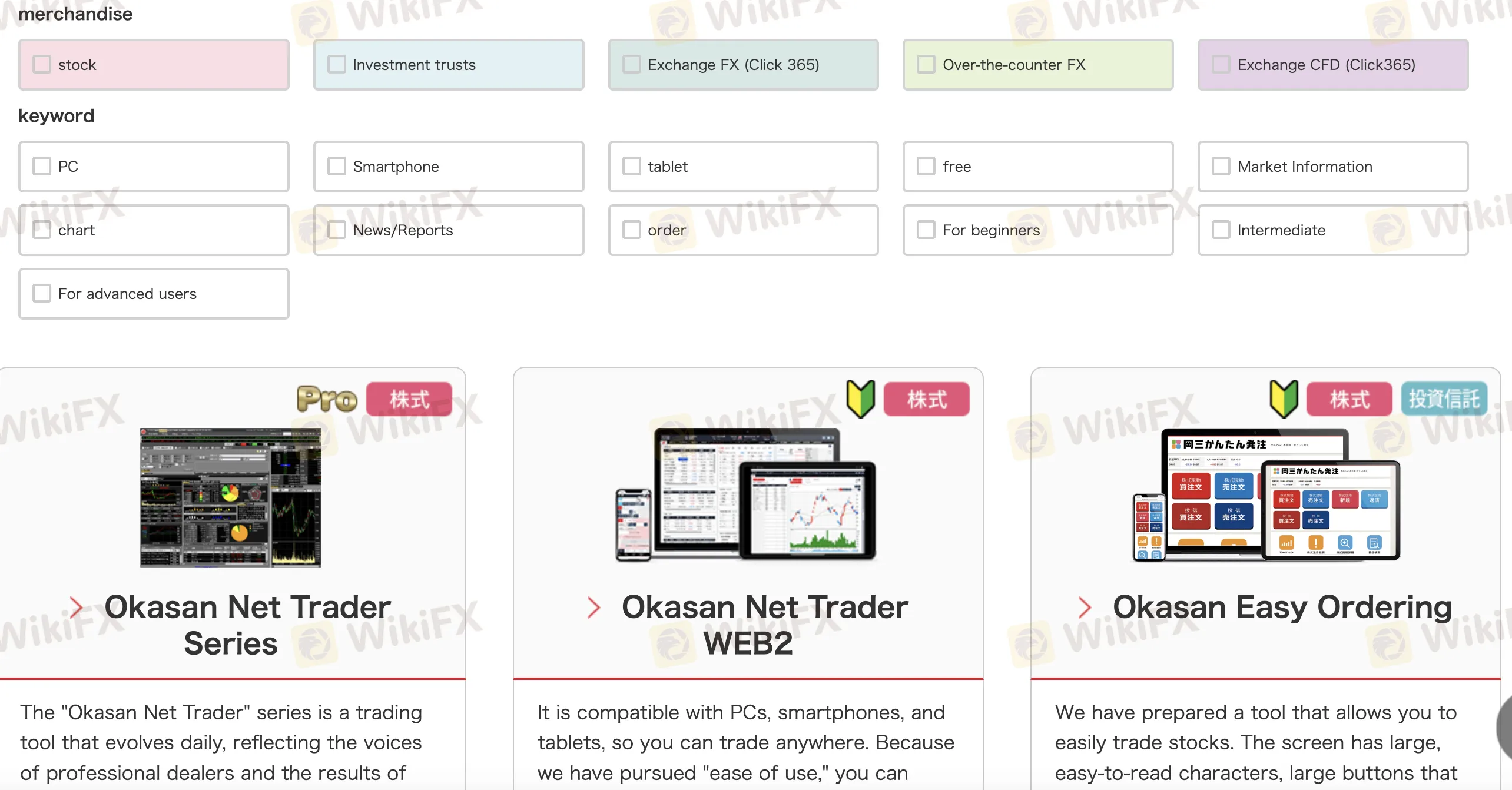

Platform Perdagangan

Okasan Securities menawarkan berbagai platform perdagangan yang disesuaikan dengan kebutuhan trader yang berbeda, termasuk pemula dan pengguna yang lebih mahir. Platform-platform ini mendukung berbagai kelas aset seperti saham Jepang, FX, dan CFD.

| Platform Perdagangan | Didukung | Perangkat Tersedia | Cocok untuk jenis trader apa |

| Okasan Net Trader Series | ✔ | PC | Trader saham profesional |

| Okasan Net Trader WEB2 | ✔ | PC, Smartphone, Tablet | Pemula |

| Okasan Easy Ordering | ✔ | PC | Pemula, trust investasi |

| Okasan Cub Smartphone | ✔ | iOS, Android | Trader saham tingkat menengah dan lanjutan |

| Okasan RSS | ✔ | Excel | Trader saham yang menggunakan Excel |

| Okasan Online FX versi WEB | ✔ | Web | Pemula dalam FX |

| NetTrader365FX | ✔ | PC | Trader FX tingkat lanjut |

| Okasan Online FX aplikasi smartphone | ✔ | iOS, Android | Pemula dalam FX |

| Okasan Online FX untuk iPad | ✔ | iPad | Pemula dalam FX |

| RSS 365FX | ✔ | Excel | Trader FX yang menggunakan Excel |

| e-profit FX | ✔ | PC | Trader FX tingkat lanjut |

| Okasan Active FX (Versi Instal) | ✔ | PC | Trader FX tingkat lanjut |

| Okasan Active FX C2 | ✔ | PC | Trader FX serbaguna |

| Okasan Active FX versi WEB | ✔ | Web | Pemula dalam FX |

| Okasan Active FX aplikasi smartphone | ✔ | iOS, Android | Pemula dalam FX |

| Okasan Active FX Aplikasi iPad | ✔ | iPad | Pemula dalam FX |

| Okasan Online Saham 365 versi WEB | ✔ | Web | Pemula dalam CFD |

| Net Trader Saham 365 | ✔ | PC | Trader CFD aktif |

| Okasan Online Saham 365 Aplikasi Smartphone | ✔ | Smartphone | Pemula dalam CFD |

| RSS 365CFD | ✔ | Excel | Trader CFD yang menggunakan Excel |

| e-profit saham 365 | ✔ | PC | Pemula dalam CFD |