Buod ng kumpanya

| Okasan Securities Buod ng Pagsusuri | |

| Itinatag | 1923 |

| Nakarehistrong Bansa/Rehiyon | Hapon |

| Regulasyon | FSA |

| Mga Produkto at Serbisyo | Stocks, ETFs/ETNs/REITs, FX, CFDs, Mutual Funds, iDeCo, NISA, IPOs, MRF etc. |

| Demo Account | ✅ |

| Plataporma ng Pagtrade | Okasan Net Trader Series, Easy Ordering, Cub App, Online FX/Web/iPad Apps, NetTrader365FX, Active FX Series, Stock 365 Platforms, RSS Tools |

| Minimum na Deposito | Hindi tinukoy |

| Suporta sa Kustomer | Mga kabisera: 4007-2511 |

| Iba pang lokasyon: 0800-001-2511 | |

| WhatsApp: (11) 4007-2511 | |

Mga Benepisyo at mga Cons

| Mga Benepisyo | Cons |

| Malawak na hanay ng mga produkto kabilang ang access sa pensyon at IPO | Ang rehistradong entidad ay nagpapakita ng kahina-hinalang status ng clone |

| Mababang hanggang zero ang mga bayad sa pagttrade sa ilang mga stocks/funds | May mataas na bayad sa assisted-trading para sa ilang advanced na serbisyo |

| Mga plataporma na available para sa iba't ibang uri ng asset at antas ng user | Walang Islamic (swap-free) accounts |

Tunay ba ang Okasan Securities?

Bagaman mayroong wastong lisensya sa Japan Financial Services Agency (FSA) para sa entidad na 岡三証券株式会社 (Okasan Securities Co., Ltd.) na may numero ng lisensya na 関東財務局長(金商)第53号, mayroon ding isang dudosong clone na gumagamit ng katulad na impormasyon sa pangalang Okasan Securities証券株式会社 (Okasan Online Securities Co., Ltd.), na may numero ng lisensya na 2010001097479. Ang mga hindi pagkakatugma sa pangalan ng lisensyadong entidad at hindi tugma sa mga address ang nagdudulot ng pagkakadiskubre sa status ng clone.

| Regulatory Status | Suspicious Clone |

| Regulated By | Japan (FSA) |

| Licensed Institution | Okasan Securities証券株式会社 (Okasan Online Securities Co., Ltd.) |

| License Type | Retail Forex License |

| License Number | 2010001097479 |

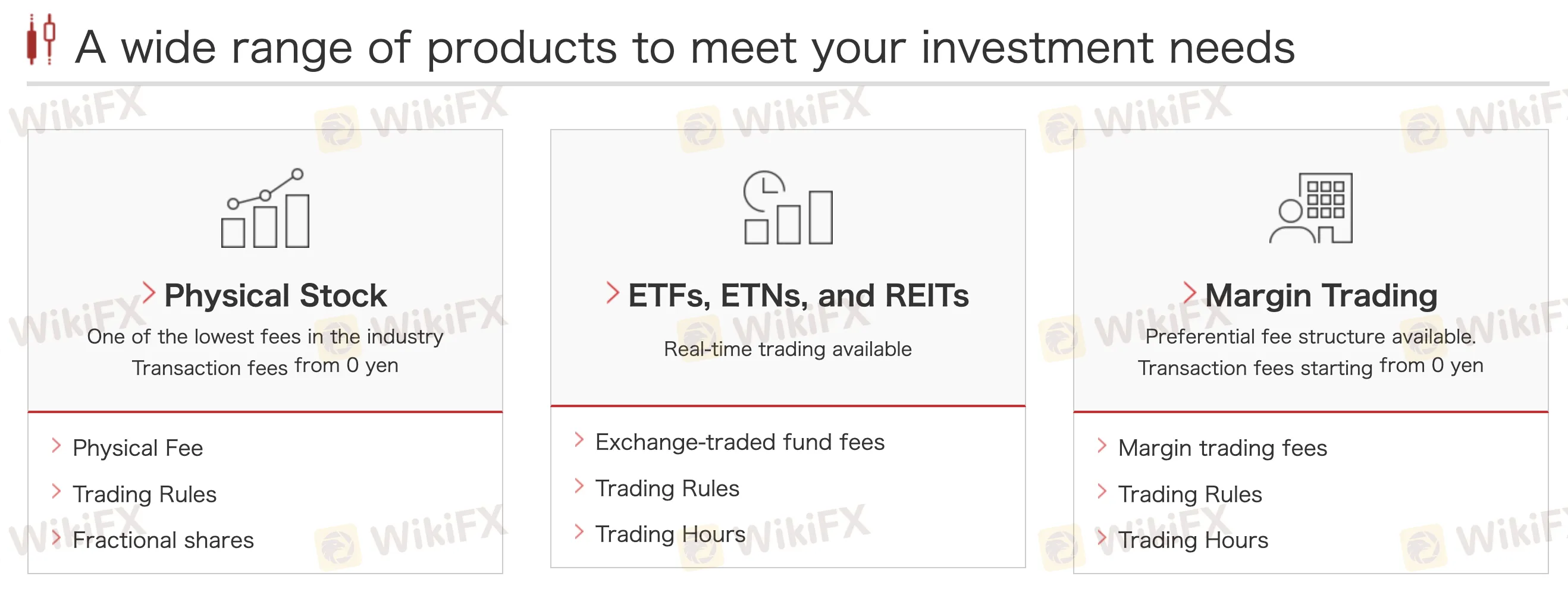

Mga Produkto at Serbisyo

Nakatuon sa parehong mga baguhan at may karanasan na mamumuhunan, nag-aalok ang Okasan Online ng kumpletong hanay ng mga tool sa pinansyal. Kasama sa kanilang mga produkto ang tunay na mga stocks, ETFs, margin trading, mutual funds, FX, CFDs, access sa IPO, at mga investment kaugnay sa pensyon tulad ng iDeCo at NISA.

| Produkto / Serbisyo | Magagamit |

| Physical Stocks | ✅ |

| ETFs / ETNs / REITs | ✅ |

| Margin Trading | ✅ |

| Investment Trusts (Mutual Funds) | ✅ |

| Exchange FX | ✅ |

| Over-the-Counter FX | ✅ |

| Exchange CFDs | ✅ |

| IPOs | ✅ |

| NISA (Tax-Exempt Account) | ✅ |

| iDeCo (Pension Plan) | ✅ |

| Chinese Stocks | ✅ |

| MRF (Money Reserve Fund) | ✅ |

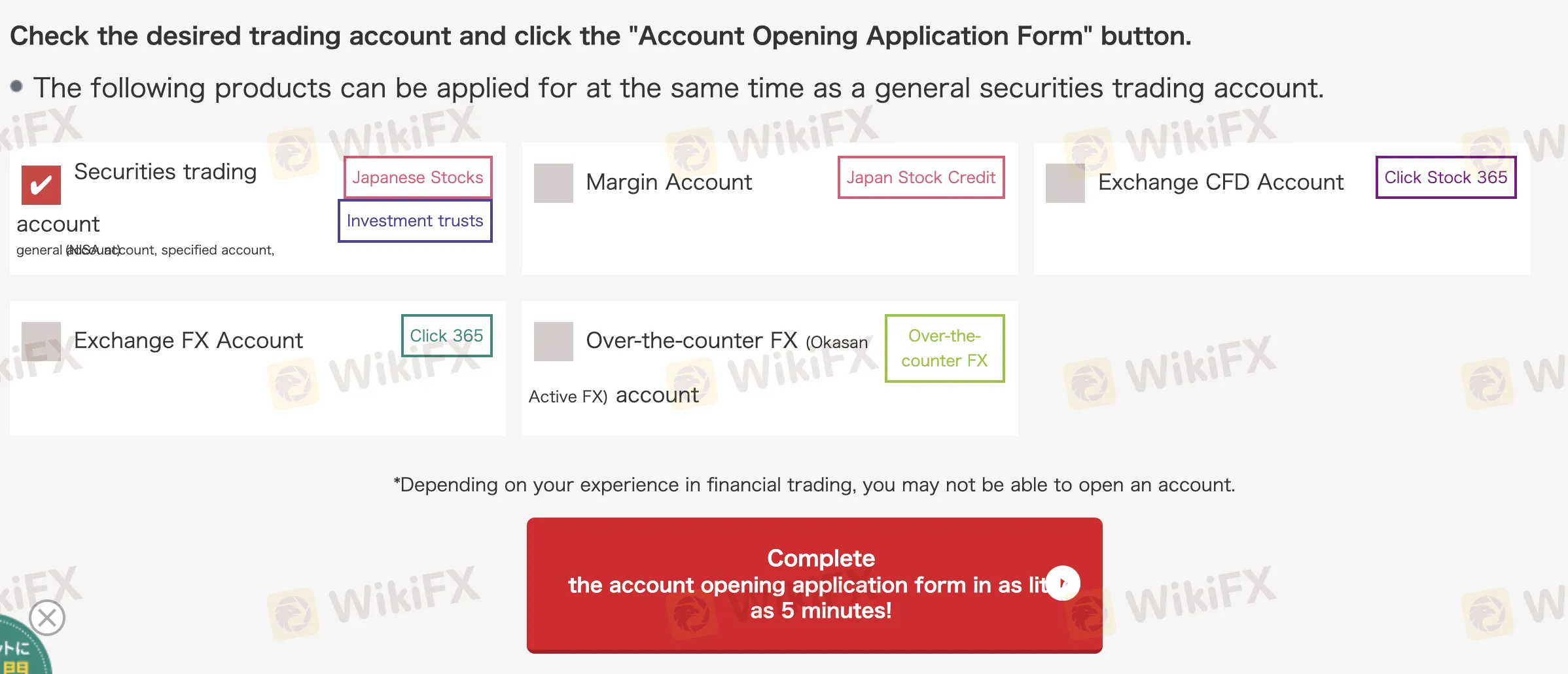

Uri ng Account

Ang Okasan Securities ay may limang live accounts sa lahat: Securities Trading, Margin, Exchange CFD (Click Stock 365), Exchange FX (Click 365), at Over-the-counter FX (Active FX). Mayroon ding demo account para sa pagsasanay; hindi ibinibigay ang Islamic (swap-free) accounts.

| Uri ng Account | Sinusustentuhang Produkto | Nararapat Para Sa |

| Securities Trading Account | Japanese Stocks, Investment Trusts | Pangkalahatang mamumuhunan |

| Margin Account | Japan Stock Credit (Leverage trading) | Mga mangangalakal na naghahanap ng leverage |

| Exchange CFD Account | Index CFDs (Click Stock 365) | Mga mangangalakal na nakatuon sa index na gumagamit ng JPY |

| Exchange FX Account | Click 365 FX (Exchange-based FX trading) | Mga mangangalakal ng FX na mas gusto ang regulated platforms |

| Over-the-counter FX Account | Active FX (customized FX platform) | Mga aktibong mangangalakal ng FX na nais ng mas maraming features |

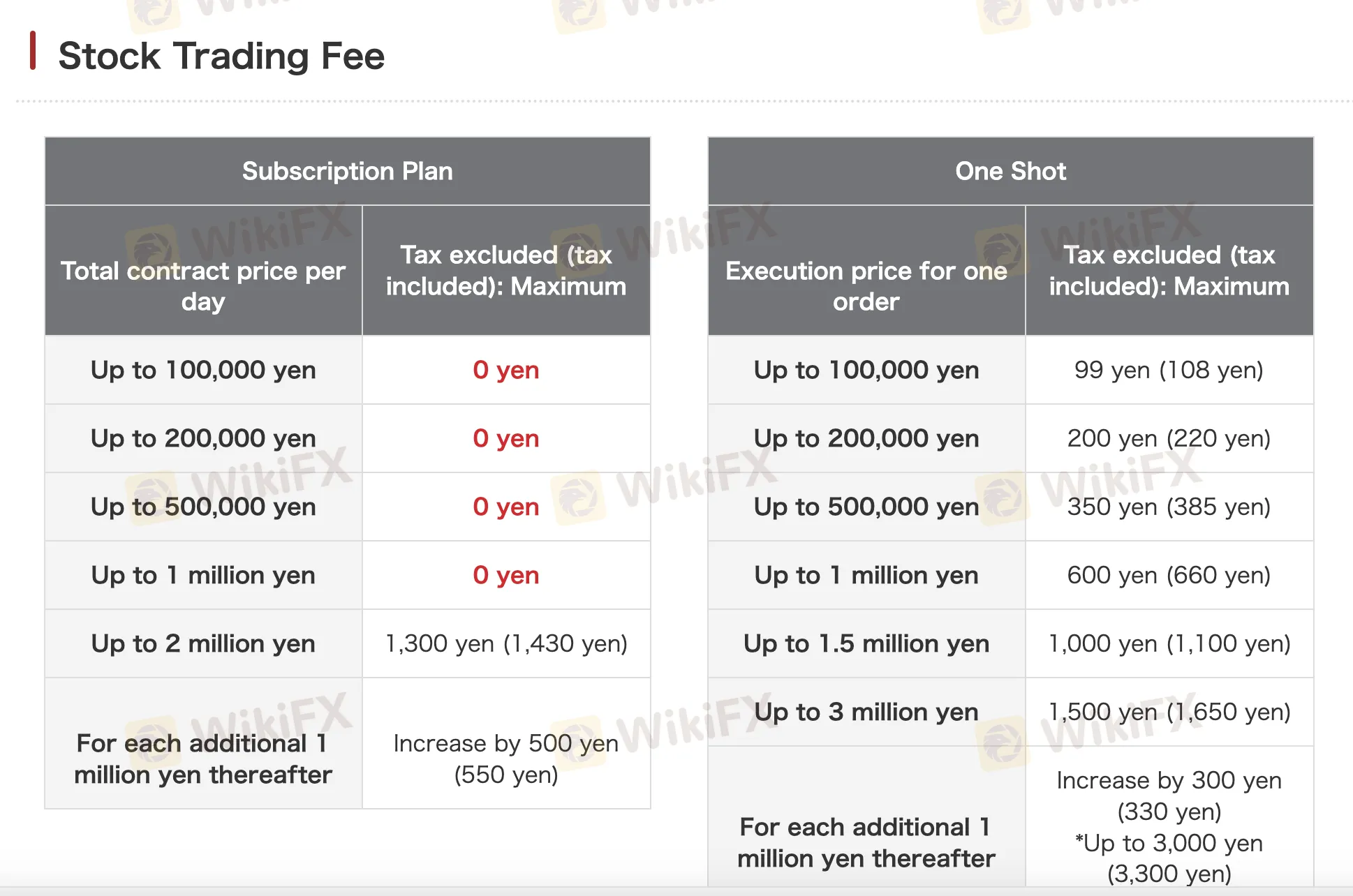

Okasan Securities Mga Bayad

Lalo na para sa mga Hapones na equities at investment trusts, ang mga gastos sa trading ng Okasan Securities ay karaniwang mababa kumpara sa mga pamantayan ng industriya. Maraming item ang walang komisyon sa ilalim ng tiyak na mga plano o kundisyon, na kahanga-hanga para sa mga agresibong mangangalakal at baguhan. Kung saan nararapat, ang karagdagang gastos ay malinaw na patas at maayos ang pagkakasunud-sunod. Gayunpaman, mayroong mga serbisyo, tulad ng support-assisted trading sa Click 365, na may significantly mas mataas na gastos.

| Produkto | Kundisyon/Volume | Gastos (Excl. Buwis) | Gastos (Incl. Buwis) |

| Stock Trading (Subscription Plan) | ≤ ¥100,000 | ¥0 | ¥0 |

| ≤ ¥200,000 | ¥0 | ¥0 | |

| ≤ ¥500,000 | ¥0 | ¥0 | |

| ≤ ¥1,000,000 | ¥0 | ¥0 | |

| ≤ ¥2,000,000 | ¥1,300 | ¥1,430 | |

| Bawat karagdagang ¥1M | ¥500 | ¥550 | |

| Stock Trading (One-Shot Plan) | ≤ ¥100,000 | ¥99 | ¥108 |

| ≤ ¥200,000 | ¥200 | ¥220 | |

| ≤ ¥500,000 | ¥350 | ¥385 | |

| ≤ ¥1,000,000 | ¥600 | ¥660 | |

| ≤ ¥1,500,000 | ¥1,000 | ¥1,100 | |

| ≤ ¥3,000,000 | ¥1,500 | ¥1,650 | |

| Bawat karagdagang ¥1M | ¥300 | ¥330 | |

| Margin Trading | ≤ ¥2,000,000 (Super Premium) | ¥0 | ¥0 |

| ≤ ¥2,000,000 (Platinum) | ¥300 | ¥330 | |

| ≤ ¥2,000,000 (Standard) | ¥1,000 | ¥1,100 | |

| Investment Trusts | Pagbili | ¥0 | ¥0 |

| Pagbawi (Stock Funds) | Hanggang sa 0.5% | Hanggang sa 0.5% | |

| Trust Reserve Fee | ¥110/10K yunit | ¥110/10K yunit | |

| Annual Trust Fees | Hanggang sa 2.42% | Hanggang sa 2.42% | |

| Exchange FX (Click365) | Self Course (Regular) | ¥0 | ¥0 |

| Self Course (Large) | ¥1,018 | ¥1,018 | |

| Support Course (Regular) | ¥1,100 | ¥1,100 | |

| Support Course (Large) | ¥11,000 | ¥11,000 | |

| OTC FX | Lahat ng kliyente | ¥0 | ¥0 |

| Exchange CFD | Nikkei, DAX, FTSE100 (Self) | ¥156 | ¥156 |

| Nikkei, DAX, FTSE100 (Support) | ¥3,300 | ¥3,300 | |

| Micro, NYD, NASDAQ (Self) | ¥30 | ¥30 | |

| Micro, NYD, NASDAQ (Support) | ¥330 | ¥330 | |

| ETF (Ginto/ Pilak/ atbp.) Self | ¥330 | ¥330 | |

| ETF (Ginto/ Pilak/ atbp.) Support | ¥3,300 | ¥3,300 |

Plataforma ng Pagtitingi

Okasan Securities ay nag-aalok ng iba't ibang mga plataporma ng kalakalan na naayon sa iba't ibang pangangailangan ng mga mangangalakal, kabilang ang mga nagsisimula at mga advanced na gumagamit. Ang mga platapormang ito ay sumusuporta sa iba't ibang uri ng mga asset tulad ng mga Hapones na stocks, FX, at CFDs.

| Plataporma ng Kalakalan | Sumusuporta | Available Devices | Nararapat para sa anong uri ng mga mangangalakal |

| Okasan Net Trader Series | ✔ | PC | Mga propesyonal na mangangalakal ng stocks |

| Okasan Net Trader WEB2 | ✔ | PC, Smartphone, Tablet | Mga nagsisimula |

| Okasan Madaling Pag-order | ✔ | PC | Mga nagsisimula, mga investment trust |

| Okasan Cub Smartphone | ✔ | iOS, Android | Mga intermediate at advanced na mangangalakal ng stocks |

| Okasan RSS | ✔ | Excel | Mga mangangalakal ng stocks na gumagamit ng Excel |

| Okasan Online FX WEB version | ✔ | Web | Mga nagsisimula sa FX |

| NetTrader365FX | ✔ | PC | Mga advanced na mangangalakal sa FX |

| Okasan Online FX smartphone app | ✔ | iOS, Android | Mga nagsisimula sa FX |

| Okasan Online FX para sa iPad | ✔ | iPad | Mga nagsisimula sa FX |

| RSS 365FX | ✔ | Excel | Mga mangangalakal sa FX na gumagamit ng Excel |

| e-profit FX | ✔ | PC | Mga advanced na mangangalakal sa FX |

| Okasan Active FX (Install version) | ✔ | PC | Mga advanced na mangangalakal sa FX |

| Okasan Active FX C2 | ✔ | PC | Mga versatile na mangangalakal sa FX |

| Okasan Active FX WEB version | ✔ | Web | Mga nagsisimula sa FX |

| Okasan Active FX smartphone app | ✔ | iOS, Android | Mga nagsisimula sa FX |

| Okasan Active FX iPad App | ✔ | iPad | Mga nagsisimula sa FX |

| Okasan Online Stock 365 WEB version | ✔ | Web | Mga nagsisimula sa CFD |

| Net Trader Stock 365 | ✔ | PC | Aktibong mga mangangalakal sa CFD |

| Okasan Online Stock 365 Smartphone App | ✔ | Smartphone | Mga nagsisimula sa CFD |

| RSS 365CFD | ✔ | Excel | Mga mangangalakal sa CFD na gumagamit ng Excel |

| e-profit stock 365 | ✔ | PC | Mga nagsisimula sa CFD |