Profil perusahaan

| MARUCHIKA Ringkasan Ulasan | |

| Didirikan | 1918 |

| Negara Terdaftar | Jepang |

| Regulasi | FSA |

| Produk Perdagangan | Efek, trust investasi |

| Akun Demo | ❌ |

| Platform Perdagangan | / |

| Deposit Minimum | / |

| Dukungan Pelanggan | Telepon: 075-341-5110 |

Informasi MARUCHIKA

Didirikan pada tahun 1918, Maruchika Securities adalah salah satu pialang tertua di Jepang. Spesialisasinya adalah saham dan trust investasi. FSA Jepang mengawasinya, dan memiliki sejarah panjang dalam pelayanan yang baik. Namun, tampaknya tidak memiliki platform web modern sebanyak pialang global yang lebih besar.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Sejarah panjang, reputasi terpercaya | Informasi platform perdagangan online terbatas |

| Diatur oleh FSA | Tidak ada akun demo |

| Fokus pada layanan khusus Jepang |

Apakah MARUCHIKA Legal?

Ya, MARUCHIKA (MARUCHIKA株式会社) adalah lembaga keuangan yang diatur oleh Financial Services Agency (FSA) Jepang yang telah diberikan Lisensi Forex Ritel, nomor 近畿財務局長(金商)第35号.

Apa yang Dapat Saya Perdagangkan di Maruchika Securities?

Maruchika Securities menyediakan sejumlah layanan keuangan terbatas, yang sebagian besar difokuskan pada efek dan trust investasi, baik untuk klien individu maupun institusi.

| Produk Perdagangan | Didukung |

| Efek | ✔ |

| Trust Investasi | ✔ |

| Forex | × |

| Komoditas | × |

| Indeks | × |

| Saham | × |

| Kripto | × |

| Obligasi | × |

| Opsi | × |

| ETF | × |

Biaya MARUCHIKA

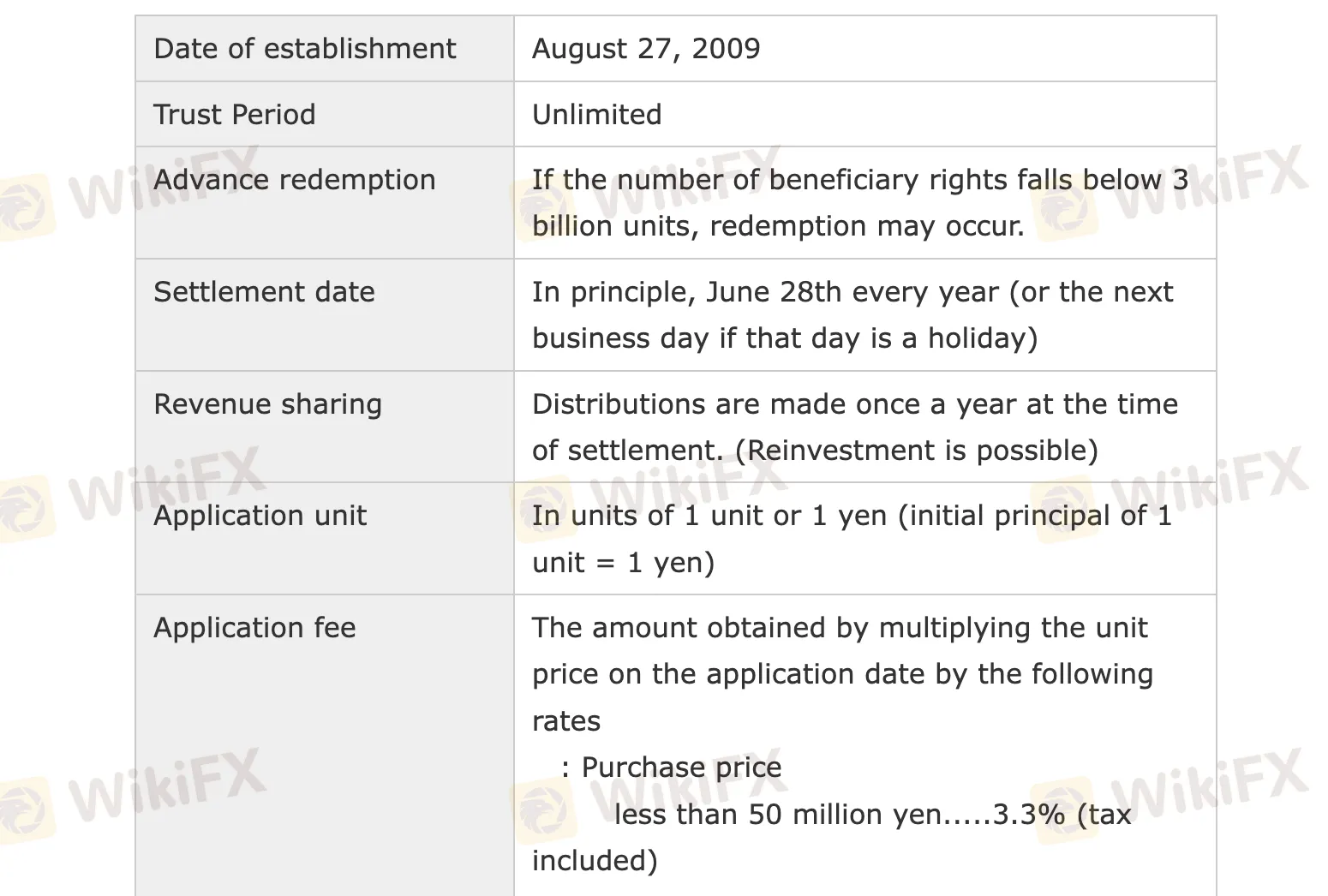

Biaya untuk produk kepercayaan investasi Maruchika Securities sebagian besar sesuai dengan standar yang berlaku di Jepang. Mereka menagih biaya biasa untuk pembelian, pengelolaan, dan penarikan aset, meskipun memberikan diskon untuk investasi besar.

| Jenis Biaya | Detail |

| Biaya Aplikasi (Pembelian) | < ¥50Jt: 3.3%; ¥50Jt–200Jt: 2.2%; ¥200Jt–500Jt: 1.65%; > ¥500Jt: 1.1% (semua termasuk pajak) |

| Biaya Pengelolaan Kepercayaan | Tahunan 1.65% (termasuk pajak) dari total aset bersih |

| Biaya Penarikan (Cadangan Kepercayaan) | 0.3% dari harga unit per unit yang ditarik |

| Biaya Lainnya | Biaya pialang, biaya penitipan, biaya audit, pajak dana — bervariasi, tidak tetap atau ditetapkan di muka |

| Frekuensi Dividen | Sekali setahun pada tanggal penyelesaian (28 Juni atau hari kerja berikutnya) |