Profil perusahaan

| Swiss CapitalRingkasan Ulasan | |

| Didirikan | 2020 |

| Negara/Daerah Terdaftar | Inggris Raya |

| Regulasi | FCA (Melebihi) |

| Instrumen Pasar | Forex, ETF, saham, indeks, komoditas |

| Akun Demo | ❌ |

| Daya Ungkit | / |

| Spread | / |

| Platform Perdagangan | Swiss Capital |

| Deposit Minimum | / |

| Dukungan Pelanggan | Formulir kontak |

Informasi Swiss Capital

Swiss Capital adalah broker yang terdaftar di Inggris Raya. Instrumen yang dapat diperdagangkan meliputi forex, ETF, saham, indeks keuangan, dan komoditas. Swiss Capital masih berisiko karena status Melebihi dan informasi transparansi yang terbatas.

Pro dan Kontra

| Pro | Kontra |

| Berbagai instrumen perdagangan | Lisensi Melebihi |

| Berbagai metode deposit | MT4/MT5 tidak tersedia |

| Akun demo tidak tersedia | |

| Informasi waktu dan biaya transfer yang tidak spesifik | |

| Hanya dukungan formulir kontak |

Apakah Swiss Capital Legal?

| Negara yang Diatur | Otoritas yang Diatur | Status Saat Ini | Entitas yang Diatur | Tipe Lisensi | Nomor Lisensi |

| Financial Conduct Authority (FCA) | Melebihi | SWISS CAPITAL LIMITED | Pendaftaran Bisnis Umum | 11638236 |

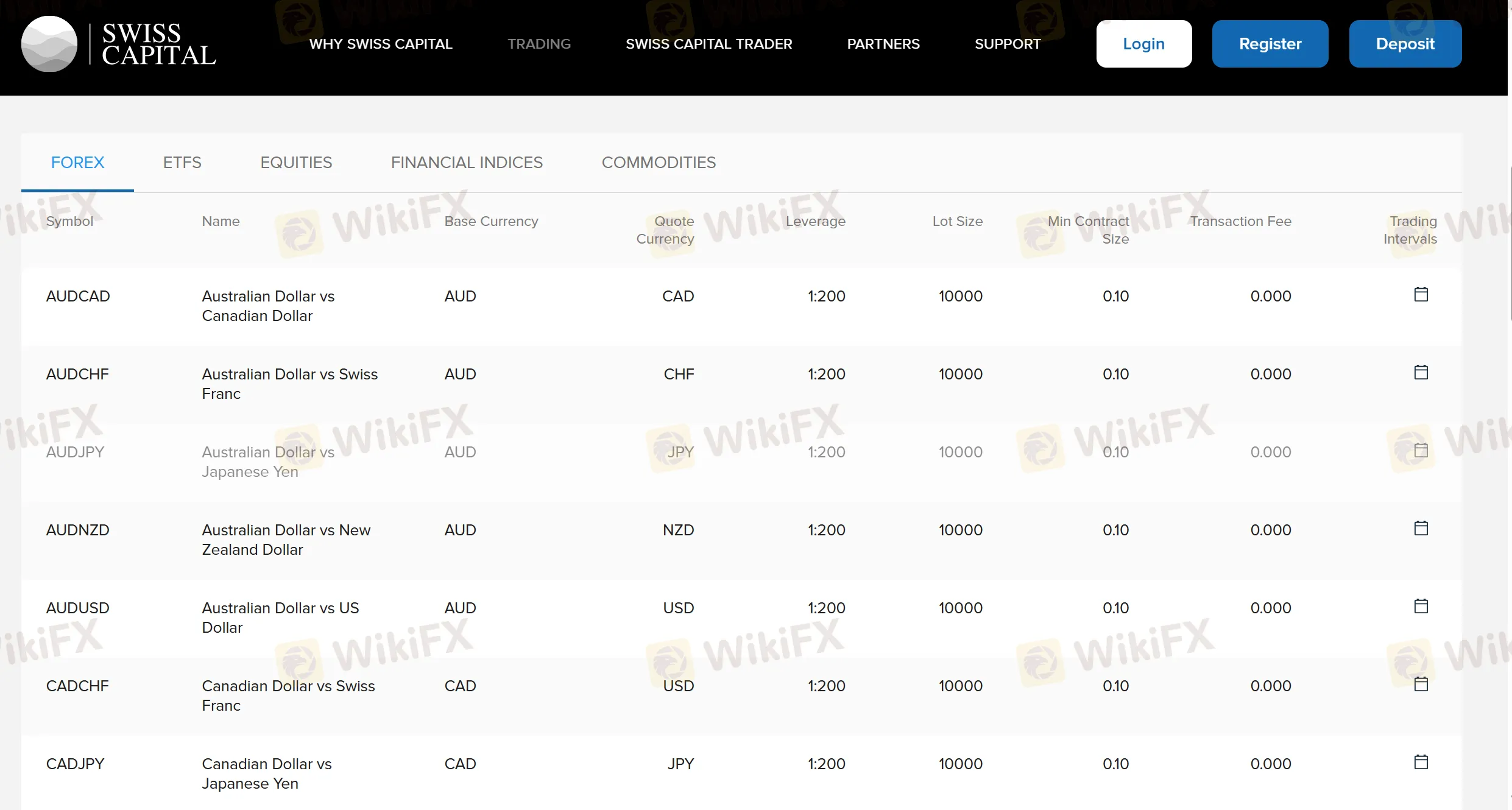

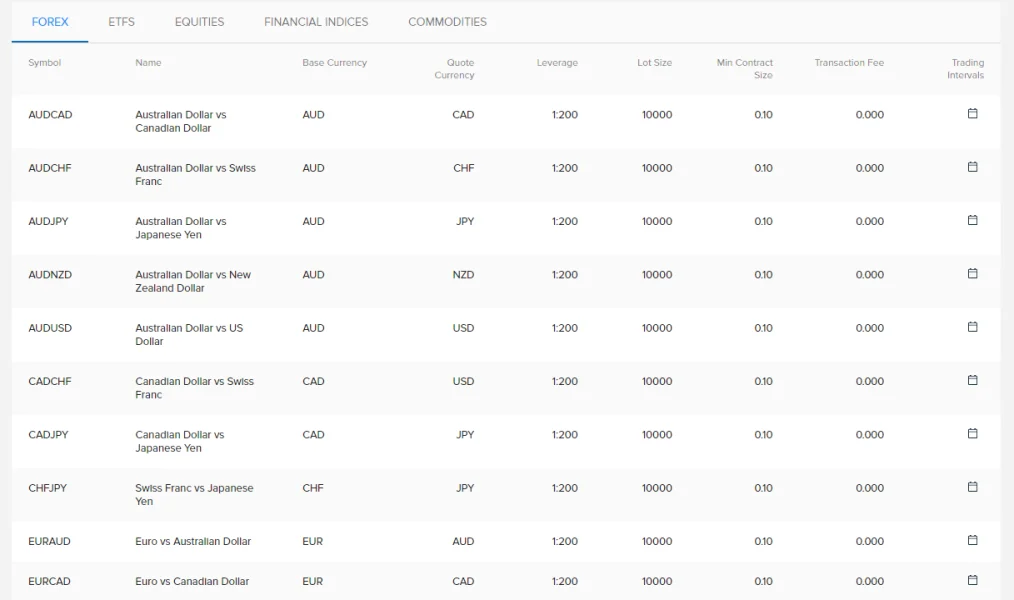

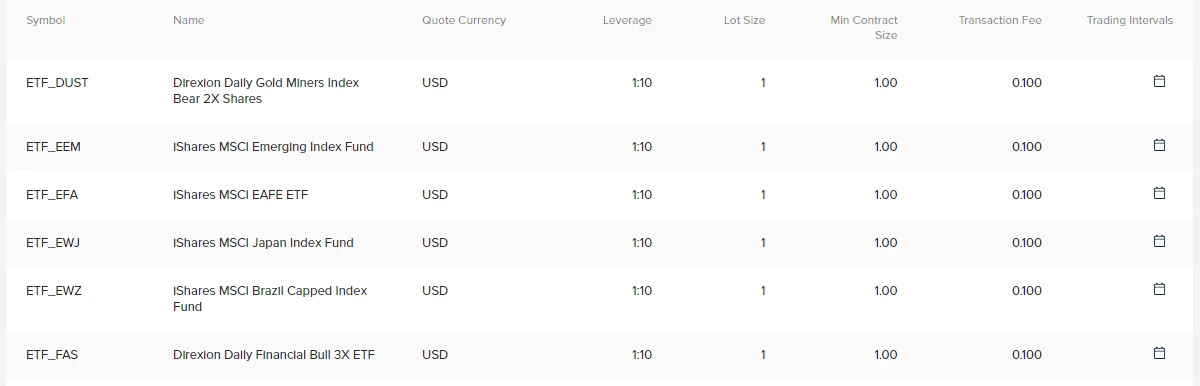

Apa yang Dapat Saya Perdagangkan di Swiss Capital?

Swiss Capital menawarkan berbagai instrumen pasar, termasuk forex, ETF, saham, indeks keuangan, dan komoditas.

| Instrumen yang Dapat Diperdagangkan | Didukung |

| Forex | ✔ |

| ETF | ✔ |

| Saham | ✔ |

| Indeks | ✔ |

| Komoditas | ✔ |

| Logam Mulia | ❌ |

| Saham | ❌ |

| Kripto | ❌ |

| Obligasi | ❌ |

| Reksadana | ❌ |

Platform Perdagangan

Swiss Capital menyediakan platform perdagangan properti yang tersedia di ponsel untuk diperdagangkan, bukan MT4/MT5 yang berwibawa dengan alat analisis matang dan sistem cerdas EA.

| Platform Perdagangan | Didukung | Perangkat Tersedia | Cocok untuk |

| Swiss Capital | ✔ | Ponsel | / |

| MT4 | ❌ | / | Pemula |

| MT5 | ❌ | / | Trader berpengalaman |

Deposit dan Penarikan

Swiss Capital menerima Visa, Mastercard, Apple Pay, Samsung Pay, Union Pay, Alipay, dan lainnya untuk deposit dan penarikan. Namun, waktu pemrosesan transfer dan biaya terkait tidak diketahui.

TysonM

Albania

Saya masuk dengan mengetahui bahwa tidak ada kripto, dan saya baik-baik saja dengan itu. Hanya membutuhkan tempat untuk perdagangan forex dan saham. Semuanya berjalan dengan baik, dan saya tidak mengalami masalah dalam pendanaan atau penarikan. Mereka terlihat stabil.

Baik

Willi Kohler

Italia

Melakukan trading di ponsel saya sebanyak 90% dari waktu. Versi mobile platform ini agak kaku tapi fungsional.

ulasan netral

Johann

Jerman

Swiss Capital berfungsi dengan baik untuk perdagangan standar di FX, ETF, dan saham. Platform webnya sederhana, mungkin terlalu sederhana bagi pecinta grafik yang canggih. Saya bukan penggemar penahanan kartu kredit, tetapi pembayaran dalam waktu 1-2 hari kemudian konsisten. Secara keseluruhan, jika Anda tidak keberatan dengan saluran dukungan yang lambat dan tidak ada penawaran kripto, ini adalah pilihan yang layak.

ulasan netral

Gilbert Heb

Jerman

Bagus jika ada opsi deposit cryptocurrency, tetapi mereka tidak menawarkan itu.

ulasan netral

Kailash2

Jerman

Transaksi dieksekusi dengan cepat. Belum mengalami slippage yang signifikan.

Baik

Andree770

Italia

Saya suka trading ETF dan indeks, dan mereka menawarkan pilihan yang bagus.

Baik

Moritz Lange

Jerman

Platform ini mudah digunakan, dan membuat akun juga mudah. Saya pikir swiss capital adalah pilihan yang solid untuk pemula dalam trading.

Baik

Holdenkemmer

Slovenia

MT4 adalah platform yang familiar bagi saya, dan implementasi Swiss Capital stabil dan efisien.

Baik

Blaise

Spanyol

Harap mereka memiliki obrolan langsung. Dukungan melalui email oke tetapi tidak tercepat saat Anda membutuhkan jawaban cepat.

ulasan netral

RosarioD

Kerajaan Inggris

Broker yang bagus untuk pemula. Platformnya mudah dinavigasi, dan dukungan pelanggan telah dengan cepat menjawab email saya. Saya harap mereka memiliki fitur live chat, meskipun.

Baik

Klemens884

Kerajaan Inggris

penarikan diproses dengan cepat. Namun, saya akan menghargai lebih banyak pilihan perdagangan, terutama mata uang kripto.

Baik

Juri

Norwegia

Rekomendasi. Kecepatan eksekusi yang cepat.

Baik

Jayde

Spanyol

mt4 didukung, broker yang dapat diandalkan.

Baik

Sandence

Taiwan

Perangkat lunak perdagangan intuitif, tetapi pilihan metode pembayaran terbatas. Ingin melihat lebih banyak pilihan.

ulasan netral

gerlinde

Kerajaan Inggris

Platform yang bagus, mudah digunakan, dan pembayaran yang cepat. Sangat baik.

Baik

Liesel Doring

Spanyol

Semua berjalan lancar dalam penarikan pertama saya.

Baik

Samuel Harris

Afrika Selatan

Ugh, berdagang di sini tidaklah lancar dibandingkan dengan IC Markets atau eToro, tahu kan? Platform-platform lainnya, semuanya terasa begitu intuitif dan mudah untuk dinavigasi. Di sini, rasanya mereka mengambil sesuatu yang sederhana dan membuatnya jauh lebih rumit dari yang seharusnya.

ulasan netral

ArturH

Prancis

Melakukan perdagangan berita tanpa terlalu khawatir tentang slippage.

Baik

Iacopo Parisi

Jerman

Komisi rendah untuk perdagangan ECN. Tidak mengurangi penghasilan saya.

Baik

Hohmann

Italia

Saya suka bagaimana Swiss Capital tidak meminta banyak uang di muka. Persyaratan margin mereka rendah.

Baik