Informasi Dasar

Saint Lucia

Saint Lucia

Skor

Saint Lucia

|

5-10 tahun

|

Saint Lucia

|

5-10 tahun

| https://algoglobal.net/en/

Website

Peringkat indeks

Pengaruh

C

Indeks pengaruh NO.1

Meksiko 3.18

Meksiko 3.18 Lisensi

LisensiTidak ada informasi regulasi yang valid, harap waspada!

Saint Lucia

Saint Lucia algoglobal.net

algoglobal.net algogloballtd.com

algogloballtd.com

| Algo GlobalRingkasan Ulasan | |

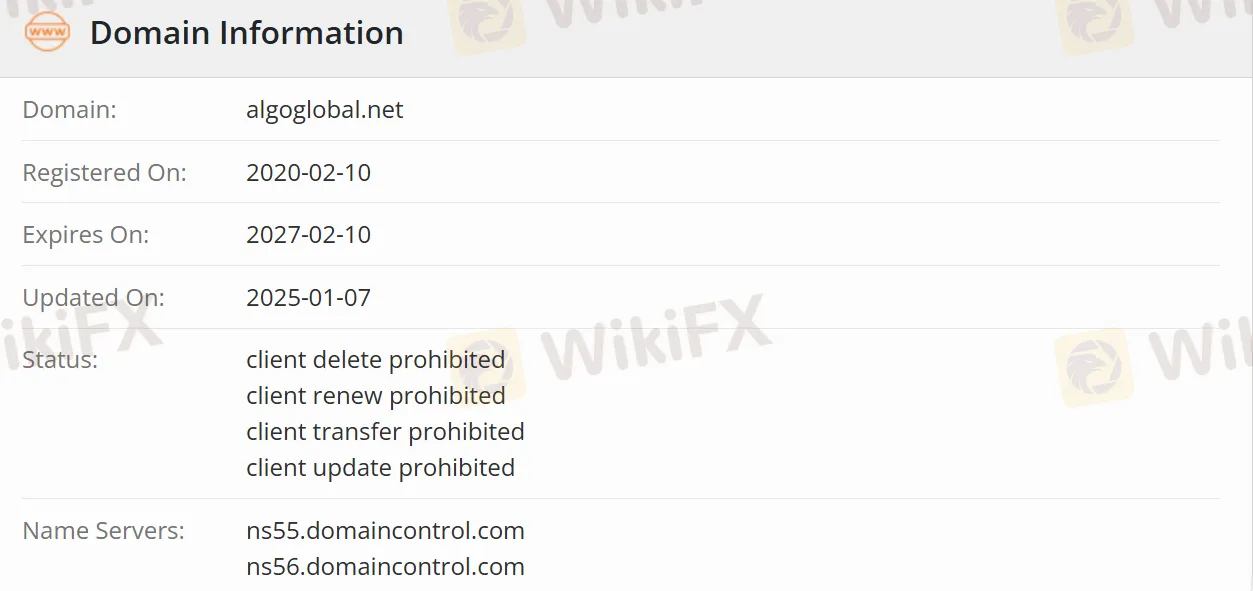

| Didirikan | 2020-02-10 |

| Negara/Daerah Terdaftar | Belize |

| Regulasi | Melebihi |

| Portofolio Investasi | Konservatif, Moderat, dan Agresif |

| Dukungan Pelanggan | 55 6447 9048 |

| info@algoglobal.net | |

| Facebook, Instagram, TikTok | |

Algo Global adalah perusahaan yang sangat berpengaruh di bidang keuangan, berkomitmen untuk menyediakan solusi investasi yang beragam bagi para investor. Dengan pengalaman lebih dari 15 tahun di industri ini, perusahaan ini menyesuaikan strategi investasi untuk para pelanggan. Algo Global menawarkan berbagai layanan investasi, termasuk portofolio investasi konservatif, moderat, dan agresif, dengan investasi minimum sebesar $1.000. Perusahaan ini juga menyediakan portofolio investasi likuiditas untuk alokasi dana yang fleksibel dan menawarkan berbagai cara untuk menghubungi layanan pelanggan guna menjawab pertanyaan kapan pun.

| Kelebihan | Kekurangan |

| Portofolio investasi yang beragam (tipe konservatif, tipe moderat, dan tipe agresif) | Melebihi |

| Ambang batas investasi minimum serendah $1000 | Ketidakpastian pengembalian |

| Portofolio investasi likuiditas | Keterbatasan transparansi informasi (seperti metode perhitungan denda penarikan dini) |

| Berbagai cara untuk menghubungi layanan pelanggan | Peringatan risiko yang tidak memadai (terutama mengenai risiko portofolio investasi agresif) |

Algo Global memiliki pengalaman bertahun-tahun di industri keuangan dan membutuhkan proses KYC (verifikasi akun), yang sesuai dengan praktik umum lembaga keuangan yang patuh. Namun, saat ini terdapat kurangnya informasi regulasi yang tersedia secara publik, sehingga sulit untuk menentukan dengan akurat apakah perusahaan ini tunduk pada pengawasan keuangan yang ketat. Selain itu, ketidakpastian pengembalian dan masalah mengenai transparansi beberapa informasi juga menjadi perhatian.

Sebagai platform manajemen aset digital profesional, Algo Global menyediakan solusi layanan keuangan komprehensif bagi para investor. Layanan portofolio investasi inti dari platform ini dibagi menjadi tiga kategori sesuai dengan preferensi risiko pelanggan:

Portofolio konservatif mengutamakan keamanan prinsipal dan pengembalian yang stabil. Prinsipal dan pengembalian yang disepakati dapat dijamin setelah berakhirnya kontrak.

Portofolio moderat mengejar pertumbuhan moderat berdasarkan pengendalian risiko. Ini mendukung penarikan pengembalian bulanan dan pengembalian prinsipal pada akhir jangka waktu.

Portofolio agresif mengadopsi strategi investasi dinamis untuk mengejar apresiasi maksimum modal. Ini juga menyediakan distribusi pengembalian bulanan dan pengembalian prinsipal pada akhir jangka waktu.

Untuk memenuhi kebutuhan khusus pelanggan berkekayaan tinggi, platform ini juga meluncurkan produk investasi likuiditas. Produk ini mengadopsi strategi investasi agresif tetapi menghilangkan batasan jangka waktu tetap, memungkinkan jumlah dana yang besar untuk disetor dan ditarik kapan saja, yang sempurna seimbang antara profitabilitas dan likuiditas.

Dalam hal layanan pelanggan, Algo Global telah membentuk sistem dukungan yang efisien. Investor dapat memperoleh konsultasi profesional melalui sistem pesanan kerja online atau email layanan pelanggan eksklusif (support@algoglobal.net). Tim layanan pelanggan berjanji untuk merespons dalam waktu 24 jam pada hari kerja.

Platform ini juga menyediakan layanan manajemen akun lengkap, termasuk pembukaan dan pendaftaran akun, otentikasi KYC (Kenali Pelanggan Anda), pemeliharaan informasi akun, dan pengaturan keamanan seperti otentikasi dua faktor, yang secara komprehensif melindungi keamanan akun.

Dalam hal operasi dana, platform ini mendukung penyetoran dan penarikan mata uang kripto utama (Bitcoin, Ethereum, dan stablecoin USDT) dan menyediakan layanan kartu KLU untuk pelanggan korporat. Bersama dengan fungsi lengkap untuk mengkonsultasikan catatan transaksi dana, ini membuat pengelolaan aset investor lebih nyaman dan transparan.

Based on my review of Algo Global, I was unable to find clear and specific information regarding the typical spread for EUR/USD on a standard account. As a trader with a strong focus on minimizing trading costs and managing risk, I always prioritize transparency in a broker’s trading conditions, including detailed spread data. Algo Global does offer the widely-used MetaTrader 5 platform, which is known for competitive pricing at many reputable brokers, but the lack of published spread information leaves me concerned. Furthermore, the absence of valid regulatory oversight and a low broker score on independent evaluations make it even more important to have such details upfront in order to make fully informed decisions. Personally, I don’t feel comfortable operating in an environment where I cannot quantify execution costs ahead of time, especially on major pairs like EUR/USD, which usually see tight spreads at most regulated brokers. For me, this lack of transparency, combined with regulatory uncertainty, would play a significant role in my overall assessment and willingness to deposit funds with this broker. Until Algo Global publicly discloses typical spread levels and provides more robust regulatory assurances, I would approach them with greater caution, particularly regarding cost-related aspects like spreads.

From my research and direct experience exploring Algo Global as a potential trading platform, one of the more immediate concerns I've had is the lack of clear, publicly available information regarding leverage—especially for major forex pairs or alternative asset classes. On their own site and trusted third-party sources, I wasn’t able to find any definitive leverage ratios, which does raise my risk antenna as an experienced trader. In the forex industry, transparency about leverage is crucial so traders can manage their risk appropriately. Given that Algo Global currently has no valid regulatory oversight and is flagged as a high-risk broker, this absence of disclosure becomes even more problematic for me. While the platform claims to offer a variety of investment portfolios—including conservative, moderate, and aggressive allocations—it never specifies the leverage metrics tied to any of those strategies. From my professional standpoint, this ambiguity significantly limits my willingness to commit funds or pursue an aggressive strategy, as I can’t accurately gauge position sizing or worst-case scenarios. Ultimately, as a trader whose capital protection is paramount, I believe reliable, regulated brokers always state leverage levels for every tradable asset upfront. The absence of such detail with Algo Global is a red flag, and I would need full transparency around leverage before considering opening an account there.

After carefully examining Algo Global and drawing from my own experience as a forex trader, I find it essential to weigh both the apparent advantages and the underlying concerns. One benefit I see is the diversity in portfolio options, allowing traders to select approaches—conservative, moderate, or aggressive—that align with their personal risk tolerance. This flexibility can be valuable for tailoring investment strategies, especially for those who prefer a more structured approach to managing risk. Another positive aspect is the minimum investment threshold, which, at $1,000, is relatively accessible compared to some asset management services. For traders who are testing the waters with managed accounts, this lower barrier might be appealing, as it doesn’t force a large upfront commitment. Additionally, the platform’s use of MetaTrader 5 (MT5) suggests a certain level of technological capability and user familiarity, since MT5 is a recognized standard for many traders. However, it’s important to emphasize that while these features stand out, the lack of transparent and robust regulatory oversight, unclarified early withdrawal policies, and reports of user dissatisfaction demand extra caution. For me, these risks would outweigh the benefits, so I’d only consider Algo Global for non-critical funds and with meticulous due diligence.

As an experienced trader who regularly evaluates brokers, I approached Algo Global with caution, especially given the lack of clear regulatory oversight and the high-risk warnings associated with this platform. In my research and due diligence, I noted that Algo Global does allow deposits and withdrawals using mainstream cryptocurrencies, including Bitcoin, Ethereum, and USDT stablecoin. For me, this is a notable feature, as it theoretically makes fund transfers more convenient and globally accessible, which is especially relevant if I’m seeking flexibility in funding methods. However, while the functionality itself is present, I cannot ignore the larger risk profile of the broker. Algo Global’s absence of solid and verifiable regulatory status means I am wary about the security and recourse options should any disputes or issues arise with my crypto deposits. The inherent irreversibility of cryptocurrency transactions only heightens my caution—there’s little protection if something goes awry. While the platform’s support for crypto is a technical plus, personally, I weigh this against the potential pitfalls of entrusting my funds, especially digital assets, to a broker that doesn’t offer strong transparency or oversight. Thus, although technically possible, I would approach crypto deposits at Algo Global with significant restraint and robust risk management.

Silakan masukan...

TOP

TOP

Chrome

Plugin Chrome

Pertanyaan Regulasi Pialang Forex Global

Jelajahi situs web broker forex dan kenali broker resmi dan penipu secara akurat

Pasang sekarang