Buod ng kumpanya

| BTGPactual Buod ng Pagsusuri | |

| Itinatag | 1983 |

| Nakarehistrong Bansa/Rehiyon | Brazil |

| Regulasyon | Hindi nairehistro |

| Mga Produkto at Serbisyo | Fixed Income, Treasury Direct, Investment Funds, Exchange, Cryptoassets, at iba pa. |

| Demo Account | ❌ |

| Platform ng Paggagalaw | BTG Banking App, BTG Investments App |

| Minimum na Deposit | Walang minimum |

| Suporta sa Customer | Telepono: 4007-2511 / 0800-001-2511 |

| WhatsApp: (11) 4007-2511 | |

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Zero deposit and custody fees | Hindi nairehistro |

| Malawak na hanay ng mga produkto (10+ kategorya) | Walang demo o Islamic (swap-free) account options |

| User-friendly na mga apps para sa bangko at pamumuhunan | Walang suporta para sa MT4/MT5 o desktop trading |

Totoo ba ang BTGPactual?

Ang BTG Pactual ay hindi nirehistro bilang isang brokerage firm sa pangunahing mga awtoridad sa pinansya ng Brazil para sa retail trading, tulad ng Comissão de Valores Mobiliários (CVM). Bukod dito, wala itong lisensya mula sa kilalang global na mga regulator sa pinansya tulad ng Financial Conduct Authority (FCA) sa UK o ang Australian Securities and Investments Commission (ASIC).

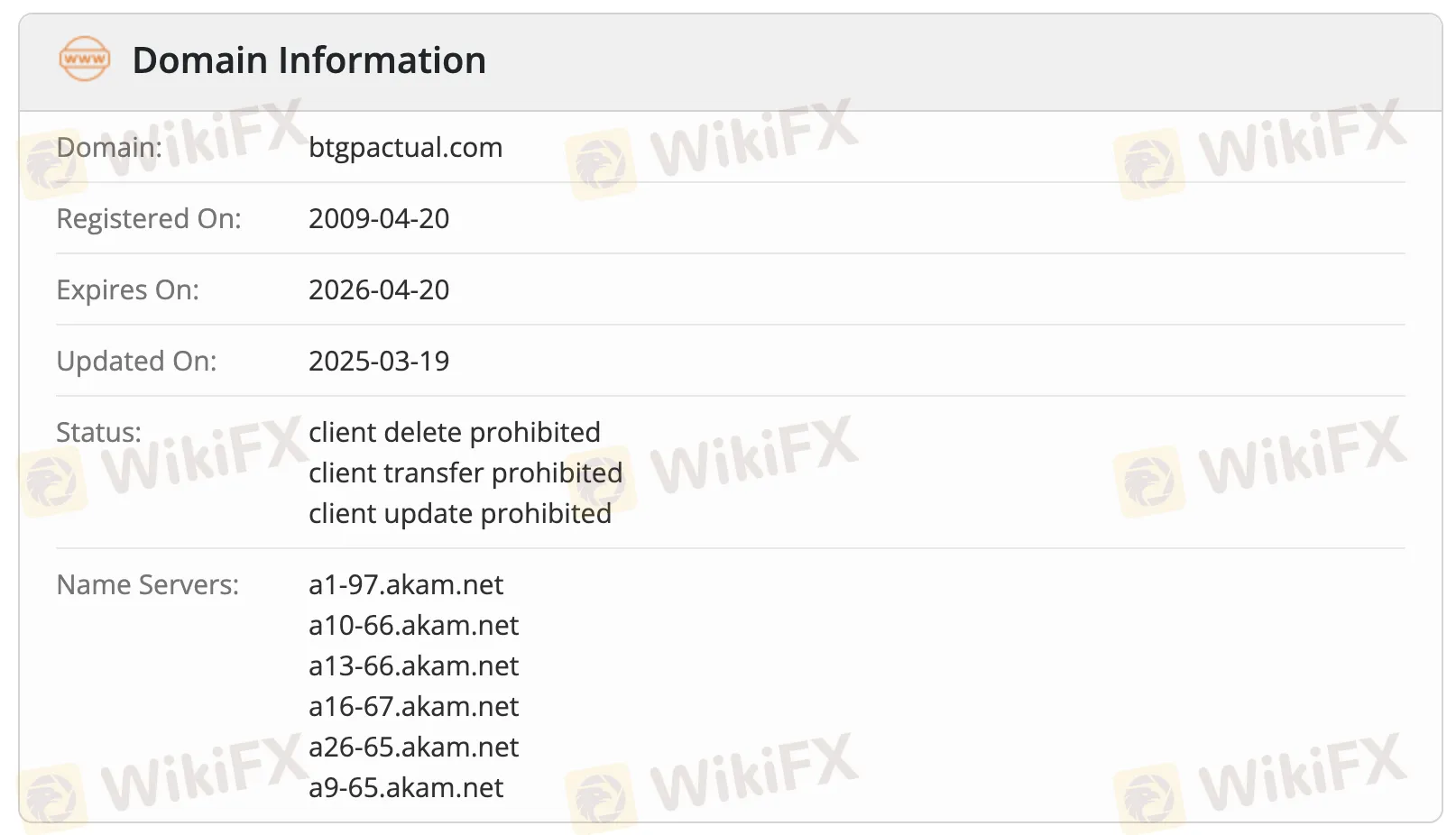

Ayon sa mga rekord ng WHOIS, ang domain na btgpactual.com ay nirehistro noong Abril 20, 2009, at kasalukuyang aktibo. Ito ay huling na-update noong Marso 19, 2025, at may bisa hanggang Abril 20, 2026.

Mga Produkto at Serbisyo

Ang BTG Pactual ay nagbibigay ng iba't ibang uri ng mga produkto at serbisyo sa larangan ng pinansya sa sampung magkakaibang lugar, kabilang ang fixed income, investment funds, exchange services, cryptoassets, at iba pa.

| Produkto/Serbisyo | Available |

| Fixed Income | ✅ |

| Treasury Direct | ✅ |

| Investment Funds | ✅ |

| Private Pensions | ✅ |

| Exchange | ✅ |

| COE | ✅ |

| Invest Flex | ✅ |

| Variable Income | ✅ |

| Cryptoassets | ✅ |

Uri ng Account

Nagbibigay ang BTG Pactual ng tatlong uri ng live accounts, bawat isa ay nakatuon sa partikular na pangangailangan ng user: isang normal na checking account, isang eksklusibong Ultrablue account, at isang overseas resident account (CDE). Ang broker ay hindi nagbibigay ng demo accounts o Islamic (swap-free) accounts.

| Uri ng Account | Mga Tampok | Angkop Para Sa |

| Standard Checking Account | Zero-fee account para sa mga pagbabayad, paglilipat, at pang-araw-araw na pangangailangan sa pinansya | Mga ordinaryong gumagamit sa Brazil |

| Ultrablue Account | Premium account na may concierge services, travel benefits, at luxury perks | Mga mayaman at premium na gumagamit |

| CDE (Overseas Account) | Para sa mga non-residents na namamahala ng pinansya o nag-iinvest sa Brazil nang remote | Mga Brazilian o dayuhan na naninirahan sa ibang bansa |

BTGPactual Fees

Kumpara sa mga karaniwang pamantayan ng industriya, mayroong makatuwirang at karaniwang mababang istruktura ng singil ang BTG Pactual. Karamihan sa kanilang mga produkto sa pamumuhunan—Fixed Income, Treasury Direct, Investment Funds, atbp.—ay walang bayad sa pag-aari o pagpapanatili; ang brokerage ay singil nang regressively—mas mababa ang presyo bawat order habang mas maraming kalakal ang iyong isinasagawa. Ang mga madalas mag-trade ay magugustuhan ito. Gayunpaman, ang mga bayad para sa mga serbisyong tulad ng currency conversion at interes sa margin (INVEST FLEX) ay medyo normal o medyo mataas.

| Produkto | Custody Fee | Iba Pang Mga Bayad |

| Fixed Income | Zero | – |

| Treasury Direct | Zero | B3 custody fee: 0.25% |

| Investment Funds | Zero | Management & performance fees apply |

| Private Pensions | Zero | Entry/exit loading rates |

| Exchange | – | Contract fee: R$90.00 |

| COE | Zero | – |

| Invest Flex | – | Interest: 5.99%/month |

| Variable Income | Zero | – |

| Cryptoassets | Zero | Brokerage: 0.5% |

| BTG DOL | Zero | Regressive brokerage fee |

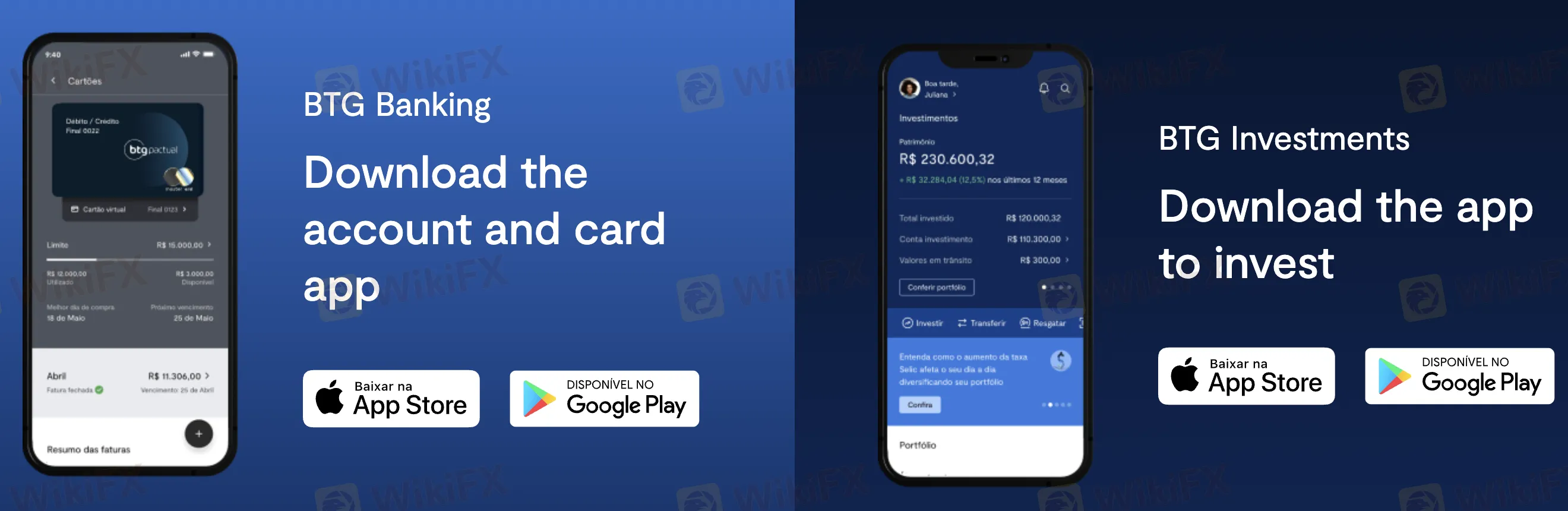

Plataforma ng Paggawa ng Kalakalan

| Plataforma ng Paggawa ng Kalakalan | Supported | Available Devices | Angkop para sa Anong Uri ng mga Mangangalakal |

| BTG Banking App | ✔ | iOS, Android (Mobile) | Mga retail client na namamahala ng bangko, card, at araw-araw na pagbabayad |

| BTG Investments App | ✔ | iOS, Android (Mobile) | Mga mamumuhunan na nakatuon sa portfolio at mga pamumuhunan sa pondo |

| MetaTrader (MT4/MT5) | ❌ | Hindi available | Hindi angkop (hindi suportado) |

| Desktop/Web Terminal | ❌ | Hindi available | Hindi angkop (hindi suportado) |

Pagdedeposito at Pag-eepekto

Nakakakita ng abot-kayang mga transaksyon ang mga gumagamit dahil walang bayad sa pagdedeposito o pag-withdraw ang BTG Pactual. Ang site rin ay walang patakaran sa minimum na deposito, kaya maaaring magsimula ang mga customer sa anumang halaga.

Mga Pagpipilian sa Pagdedeposito

| Pamamaraan | Min. Halaga | Bayad | Oras ng Paghahatid |

| Bank Transfer (Pix) | Walang minimum | Libre | Instant |

| TED Transfer | Walang minimum | Libre | Same business day |

| Remittance via Exchange | Walang minimum | Libre | Nag-iiba depende sa provider/bansa |