Buod ng kumpanya

| HMFS Buod ng Pagsusuri | |

| Itinatag | 2008 |

| Rehistradong Bansa/Rehiyon | Pakistan |

| Regulasyon | Walang regulasyon |

| Instrumento sa Merkado | Equity |

| Demo Account | ❌ |

| Platform ng Paggagalaw | HMFS Insta Trade |

| Minimum na Deposit | PKR. 50,000 |

| Suporta sa Customer | Tel: +9221-35364665-68 |

| Fax: +9221-35364682 | |

| Email: info@hmfs.com.pk | |

| Social media: Facebook, LinkedIn | |

Impormasyon Tungkol sa HMFS

Ang HMFS ay isang hindi nairehistrong tagapagbigay ng pangunahing brokerage at serbisyong pinansyal sa Pakistan Stock Exchange. Nag-aalok ito ng mga produkto at serbisyo sa equity brokerage, equity research, at online trading.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Iba't ibang mga paraan ng pakikipag-ugnayan | Limitadong mga produkto sa trading |

| Mababang pangangailangan sa minimum na deposito | Walang demo accounts |

| Walang platapormang MT4/MT5 | |

| Kawalan ng regulasyon |

Totoo ba ang HMFS?

Hindi. Sa kasalukuyan, ang HMFS ay walang mga wastong regulasyon. Mangyaring maging maingat sa panganib!

Ano ang Maaari Kong I-trade sa HMFS?

| Mga Asset sa Trading | Supported |

| Equity | ✔ |

| Forex | ❌ |

| Commodity | ❌ |

| Indice | ❌ |

| Stock | ❌ |

| Cryptocurrency | ❌ |

| Bond | ❌ |

| Option | ❌ |

| ETF | ❌ |

Uri ng Account

Ang broker ay hindi nagbibigay ng anumang impormasyon tungkol sa kanilang mga account maliban sa Roshan digital account.

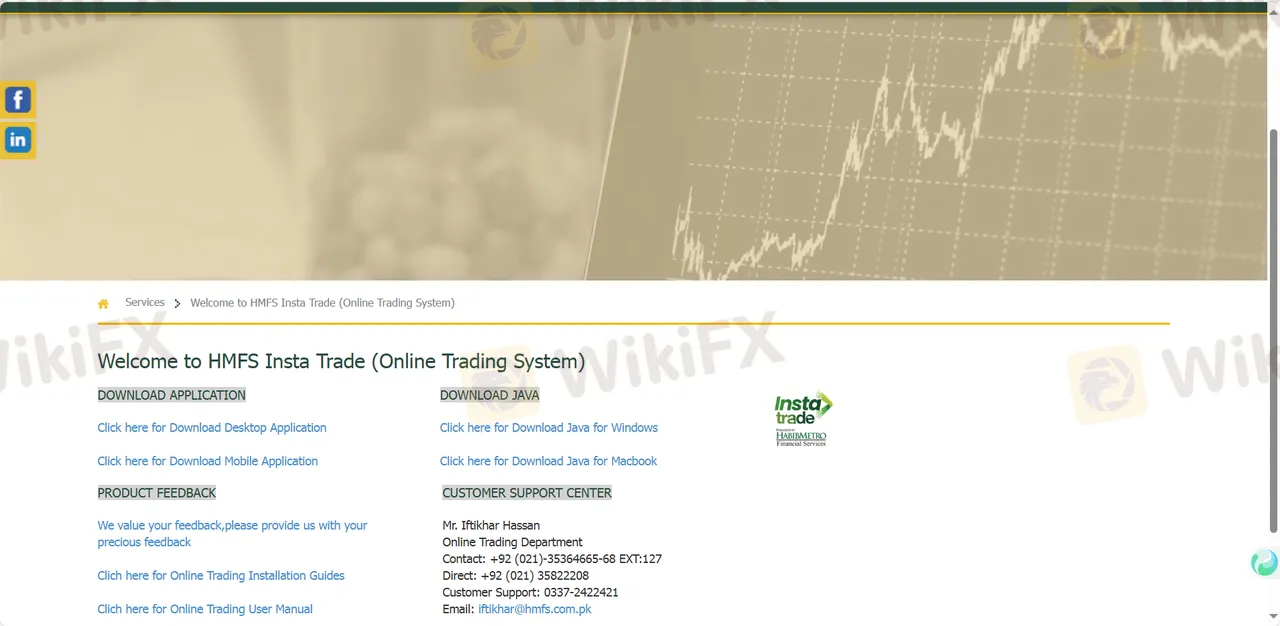

Plataforma ng Pag-ttrade

| Plataforma ng Pag-ttrade | Supported | Available Devices | Suitable for |

| HMFS Insta Trade | ✔ | Mobile, desktop | / |

| MT4 | ❌ | / | / |

| MT5 | ❌ | / | / |

Deposito at Pag-wiwithdraw

Ang minimum deposit ay PKR. 50,000 ngunit walang itinakdang minimum na halaga para sa withdrawal at walang mga bayarin o singil na tinukoy.