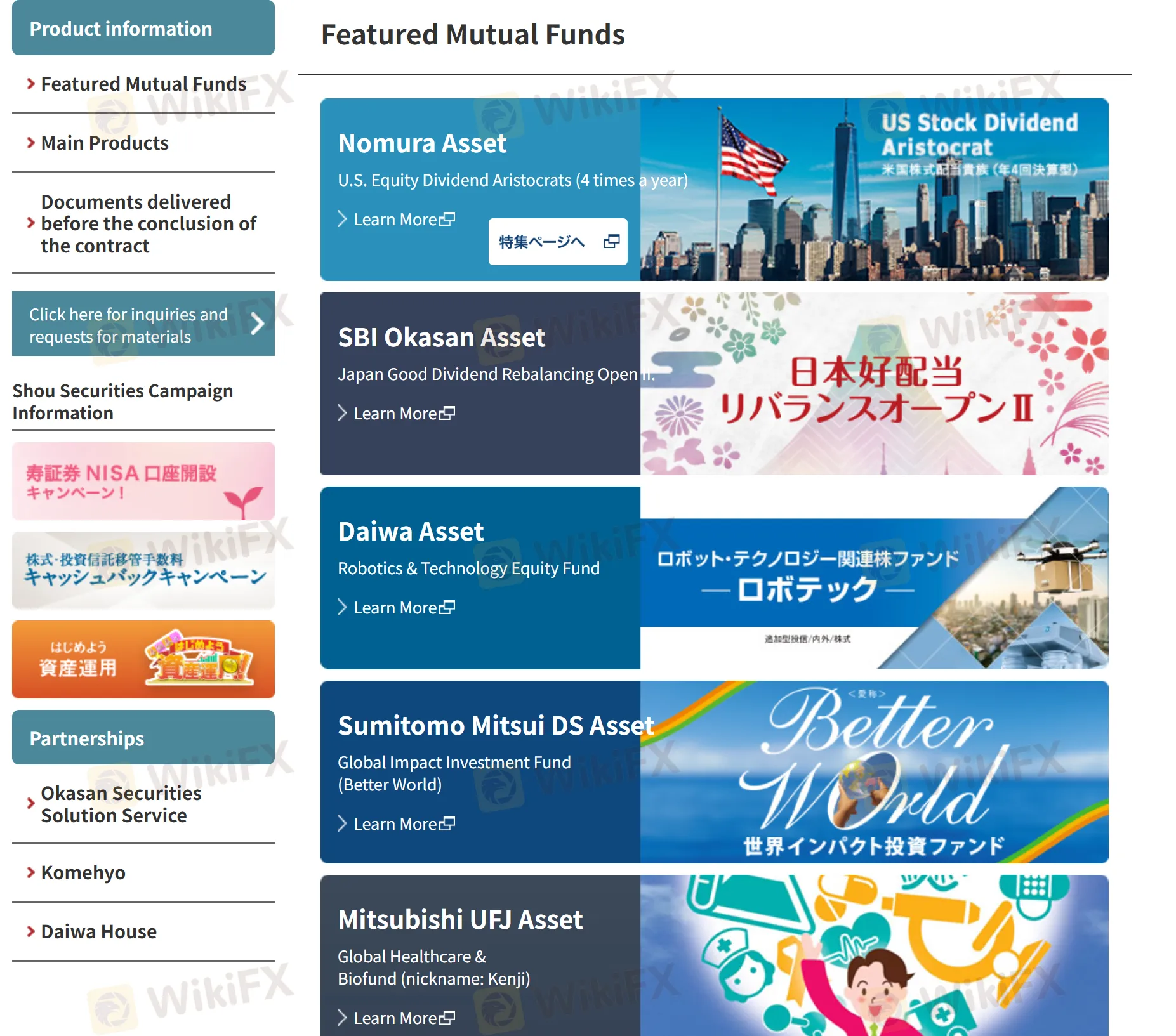

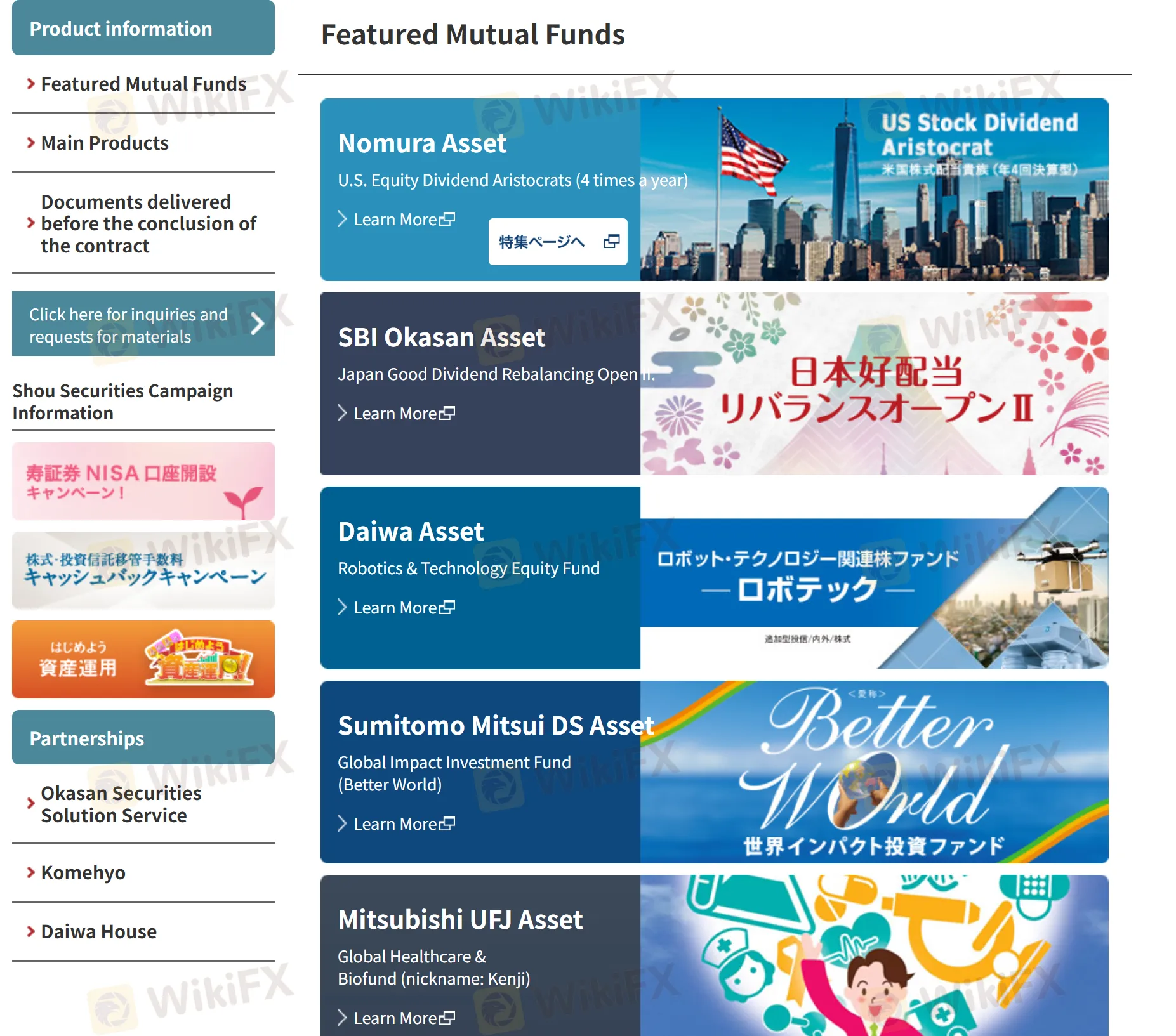

Itinatag noong 2005 at naka-rehistro sa Hapon, ang Kotobuki Securities ay isang kumpanyang brokerage na regulado ng Financial Services Agency (FSA). Nag-aalok ito ng malawak na hanay ng mga instrumento sa merkado, kabilang ang mga itinatampok na mutual funds, domestic listed stocks para sa parehong spot at margin trading (na limitado sa institutional credit), IPOs, ETFs, REITs, convertible bonds, investment trusts, MRFs, foreign stocks at bonds, foreign currency-denominated MMFs, at trading ng market derivatives tulad ng futures at options.

Mga Kalamangan at Disadvantages

Tunay ba ang Kotobuki Securities?

Oo, ang Kotobuki Securities ay kasalukuyang regulado ng FSA, may hawak na Retail Forex License.

Ano ang Maaari Kong Kalakalan sa Kotobuki Securities?

Sa Kotobuki Securities, maaari kang mag-trade ng Featured Mutual Funds, Domestic Listed Stocks Spot Trading, Domestic listed stocks margin trading (institutional credit only), IPO (Initial Public Offering), ETFs (Exchange Traded Funds), REITs (Real Estate Investment Trusts), CB (Convertible Bond), investment trust, MRF, Foreign Stocks, Foreign Bonds, Currency Denominated MMF, Market Derivatives Trading (Futures & Options).