Buod ng kumpanya

| Bank of Scotland Pagsusuri ng Buod | |

| Itinatag | 1695 |

| Nakarehistrong Bansa/Rehiyon | United Kingdom |

| Regulasyon | FCA |

| Mga Produkto at Serbisyo | Personal, Negosyo, Pribadong Bangko |

| Demo Account | ❌ |

| Platform ng Paggagalaw | Mobile Banking App (iOS, Android), Online Banking (Web) |

| Suporta sa Customer | Telepono: 0345 721 3141 / +44 131 337 4218 |

| Online Chat | |

Impormasyon Tungkol sa Bank of Scotland

Ang Bank of Scotland, na itinatag noong 1695, ay isa sa pinakamatandang institusyon sa UK. Sa ilalim ng regulasyon ng FCA, ito ay nag-aalok ng malawak na hanay ng mga serbisyong pinansyal kabilang ang personal na mga serbisyo, korporasyon na mga serbisyo, at mga serbisyong pribadong bangko. Naglilingkod sa mga pamilya at tao, ito ay nag-aalok ng ilang mga pagpipilian ng account sa pamamagitan ng mobile at internet banking services.

Mga Kalamangan at Disadvantages

| Kalamangan | Kahinaan |

| Regulado ng UK FCA | Walang demo o Islamic account |

| Kumprehensibong mga serbisyong pinansyal | Relatibong mataas na bayad sa premium accounts |

| Matatag na mga plataporma ng mobile at online banking | Limitadong mga instrumento sa pagtetrade |

Tunay ba ang Bank of Scotland?

Oo, ito ay regulated. Epektibo mula noong 2001, ito ay may Market Maker (MM) license mula sa UK Financial Conduct Authority (FCA) sa ilalim ng lisensyang numero 169628.

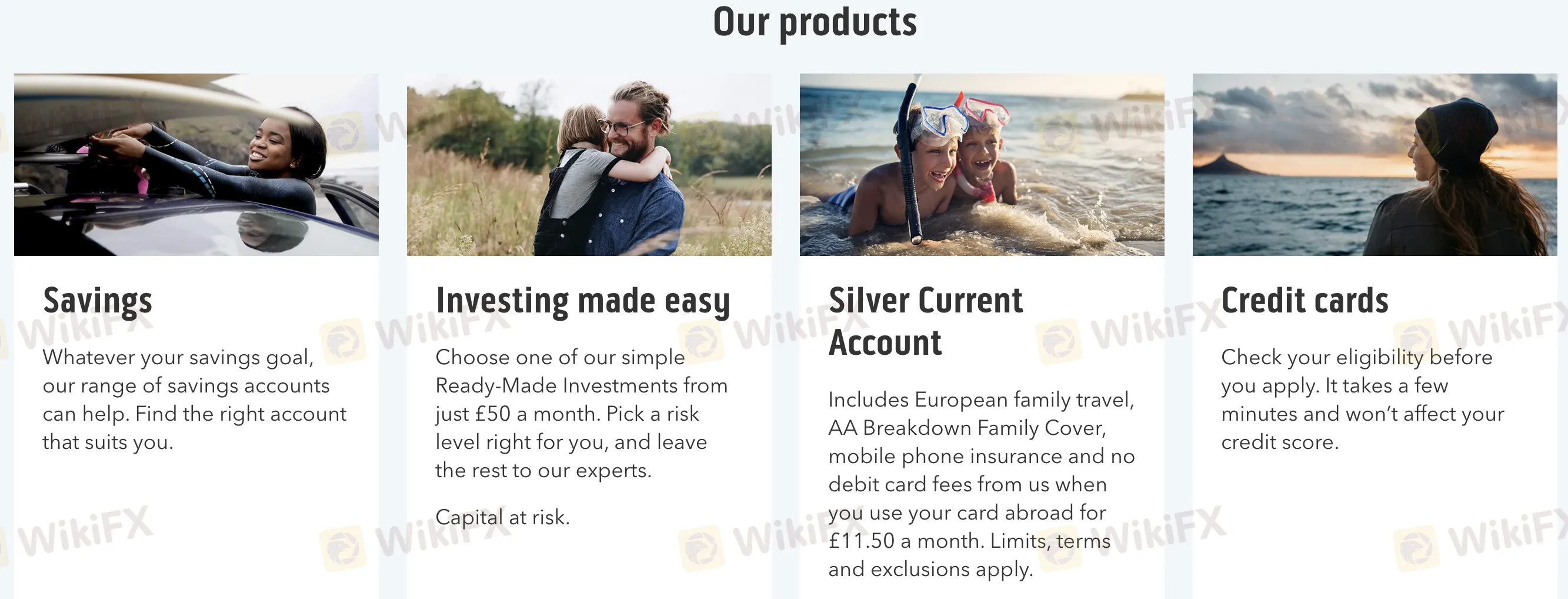

Mga Produkto at Serbisyo

Nag-aalok ang Bank of Scotland ng personal na mga serbisyo, mga serbisyong pangnegosyo, at mga serbisyong pribadong bangko. Kapag personal na mga serbisyo ang usapan, kasama sa mga produkto ang mga savings, loans, credit cards, mortgages, insurance, at investment products.

| Personal Services | Paglalarawan |

| Mga Savings Account | Mga pagpipilian ng account upang matulungan ang iba't ibang layunin sa pag-iipon |

| Mga Investments | Mga Ready-Made Investments na nagsisimula mula £50/buwan |

| Mga Current Account | Kasama ang Silver Account na may travel, breakdown, at mobile insurance benefits |

| Mga Credit Card | Iba't ibang mga pagpipilian ng credit card na may eligibility check na hindi nakakaapekto sa credit score |

| Personal na mga Pautang | Personalized na mga alok ng pautang batay sa financial profile |

| Mga Mortgages | Halifax mortgage solutions na may mababang rates |

| Life Insurance | Life at critical illness cover hanggang £500,000 sa pamamagitan ng Scottish Widows |

| Home Insurance | Mga tier ng Bronze, Silver, at Gold na may mga flexible na monthly payment options |

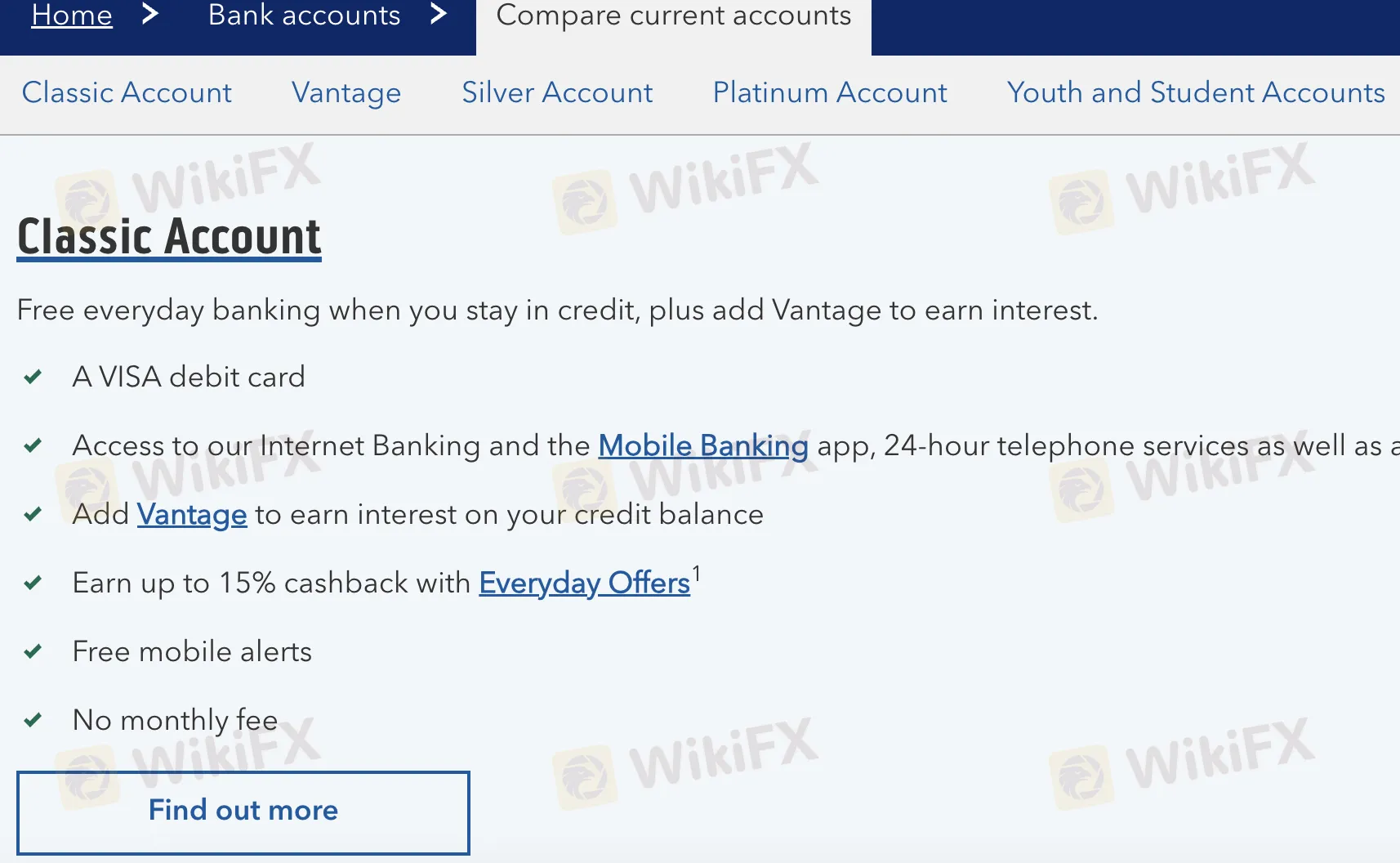

Uri ng Account

Binuo para sa iba't ibang age groups at pangangailangan sa pinansyal, nagbibigay ang Bank of Scotland ng pitong uri ng live (real) accounts. Hindi ito nag-aalok ng Islamic o demo accounts. Mula sa simpleng banking hanggang sa premium na mga serbisyo na may mga benepisyo sa travel at insurance, iba't iba ang mga feature ng bawat account.

| Uri ng Account | Buwang Bayad | Key Features | Angkop Para Sa |

| Classic Account | £0 | Araw-araw na banking, cashback, magdagdag ng Vantage para sa interes | Pangkalahatang mga gumagamit ng personal na bangko |

| Silver Account | £11.50 | Travel insurance, mobile insurance, walang bayad sa card sa ibang bansa | Mga nagtatravel at mga gumagamit na gustong perks |

| Platinum Account | £22.50 | Enhanced na travel cover, AA Breakdown, mobile insurance | Mga madalas na nagtatravel at pamilya |

| Student Account | £0 | Interest-free overdraft, student-targeted na mga alok | Mga full-time students |

| Smart Start | £0 | Linked na parent-child accounts na may savings interest | Mga bata na may edad na 11–15 |

| Under 19s Account | £0 | Kumikita ng interes, limitadong online banking, walang overdraft | Mga teenager na may edad na 11–17 |

| Basic Account | £0 | Simpleng account na walang overdraft o bayad para sa pag-overdrawn | Ang mga nangangailangan ng essential banking lamang |

Mga Bayad ng Bank of Scotland

Ang mga bayarin ng Bank of Scotland ay karaniwang katamtaman hanggang mataas kumpara sa karaniwang UK retail banking. Bagaman may ilang mga basic account na walang buwanang bayad, kasama sa packaged accounts (tulad ng Silver at Platinum) ang mga bundle ng serbisyo na may buwanang bayarin. Sumusunod sa standard UK industry ranges ang mga bayad sa overdraft at credit card.

| Serbisyo/Uri ng Account | Bayad |

| Classic Account | £0/buwan |

| Silver Account | £11.50/buwan |

| Platinum Account | £22.50/buwan |

| Student Account | £0/buwan |

| Under 19s/Smart Start | £0/buwan |

| Basic Account | £0/buwan |

| Overdraft (Naayos) | Variable (batay sa credit profile) |

| Paggamit ng Dayuhang Card (Classic) | 2.99% bayad sa transaksyon |

| ATM Withdrawals (UK) | Libre mula sa mga ATM ng Bank of Scotland |

| Late Payment (Credit Card) | Hanggang £12 |

Plataforma ng Paggawa ng Kalakalan

| Plataforma ng Paggawa ng Kalakalan | Supported | Available Devices | Suitable For |

| Mobile Banking App | ✔ | iOS, Android smartphones | Ang mga araw-araw na gumagamit ng pamamahala ng pinansya habang nasa biyahe |

| Online Banking (Web) | ✔ | Desktop, Laptop, Tablet (sa pamamagitan ng browser) | Mga user na mas gusto ang website |

| MetaTrader (MT4/MT5) | ❌ | – | Hindi available |

Deposito at Pag-Atas

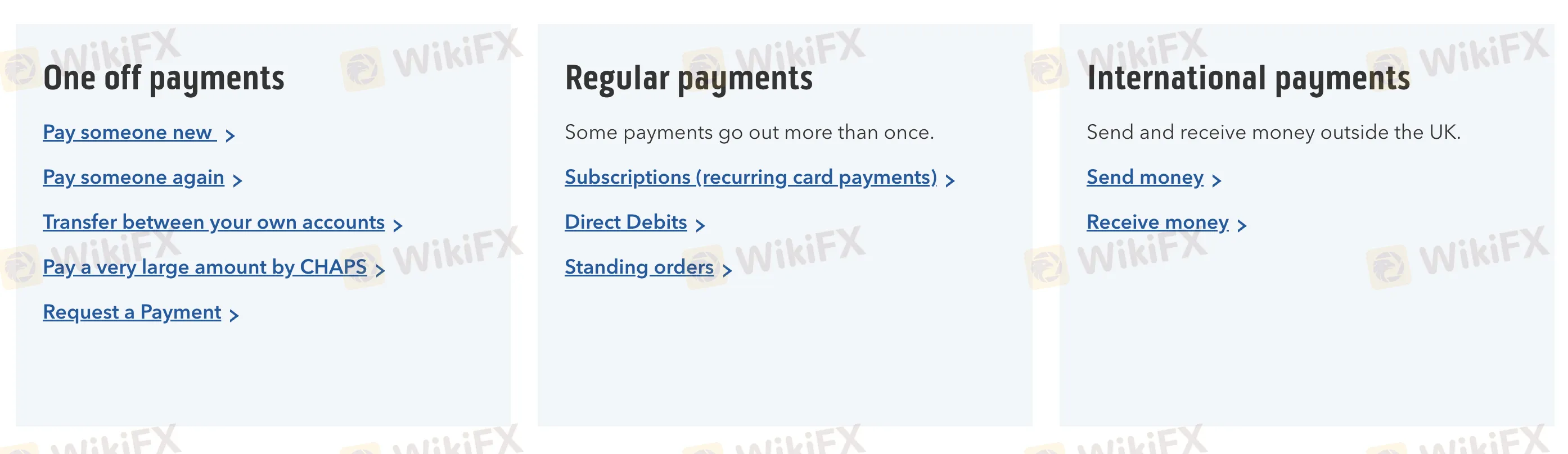

Sinusuportahan ng Bank of Scotland ang domestic at international payment methods, kasama ang one-off payments, recurring transfers, at international transactions.

| Kategorya | Available Actions |

| One-off Payments | Magbayad sa bagong tao, Magbayad muli sa isang tao, I-transfer sa pagitan ng sariling mga account, CHAPS malalaking bayad, Humiling ng pagbabayad |

| Regular Payments | Mag-set up ng recurring card payments (subscriptions), Direct Debits, Standing Orders |

| International Payments | Ipadala ang pera sa ibang bansa, Tanggapin ang pera mula sa labas ng UK |