Basic Information

United Kingdom

United KingdomScore

United Kingdom

|

Above 20 years

|

United Kingdom

|

Above 20 years

| https://www.bankofscotland.co.uk/

Website

Rating Index

Influence

A

Influence index NO.1

United States 4.83

United States 4.83 Licenses

LicensesLicensed Entity:Bank of Scotland plc

License No. 169628

Single Core

1G

40G

1M*ADSL

United Kingdom

United Kingdom

JONATHAN SCOTT WHEWAY

United Kingdom

Director

Start date

Status

Employed

BANK OF SCOTLAND PLC(United Kingdom)

ROBIN FRANCIS BUDENBERG

United Kingdom

Director

Start date

Status

Employed

BANK OF SCOTLAND PLC(United Kingdom)

SARAH CATHERINE LEGG

United Kingdom

Director

Start date

Status

Employed

BANK OF SCOTLAND PLC(United Kingdom)

| Bank of Scotland Review Summary | |

| Founded | 1695 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA |

| Products & Services | Personal, Business, Private Banking |

| Demo Account | ❌ |

| Trading Platform | Mobile Banking App (iOS, Android), Online Banking (Web) |

| Customer Support | Phone: 0345 721 3141 / +44 131 337 4218 |

| Online Chat | |

Bank of Scotland, which was established in 1695, is among the oldest financial institutions in the UK. Under FCA regulation, it offers a thorough spectrum of financial services including personal services, corporate services, and private banking services. Serving families and people, it offers several account options via mobile and internet banking services.

| Pros | Cons |

| Regulated by the UK FCA | No demo or Islamic account |

| Comprehensive financial services | Relatively high fees on premium accounts |

| Strong mobile and online banking platforms | Limited trading instruments |

Yes, it is regulated. Effective since 2001, it holds a Market Maker (MM) license from the UK Financial Conduct Authority (FCA) under license number 169628.

Bank of Scotland offers personal services, business services, and private banking services. When it comes to persenal services, the products include savings, loans, credit cards, mortgages, insurance, and investment products.

| Personal Services | Description |

| Savings Accounts | Multiple account options to help achieve various savings goals |

| Investments | Ready-Made Investments starting from £50/month |

| Current Accounts | Includes Silver Account with travel, breakdown, and mobile insurance benefits |

| Credit Cards | Different credit card options with eligibility check that doesnt affect credit score |

| Personal Loans | Personalized loan offers based on financial profile |

| Mortgages | Halifax mortgage solutions with low rates |

| Life Insurance | Life and critical illness cover up to £500,000 via Scottish Widows |

| Home Insurance | Bronze, Silver, and Gold tiers with flexible monthly payment options |

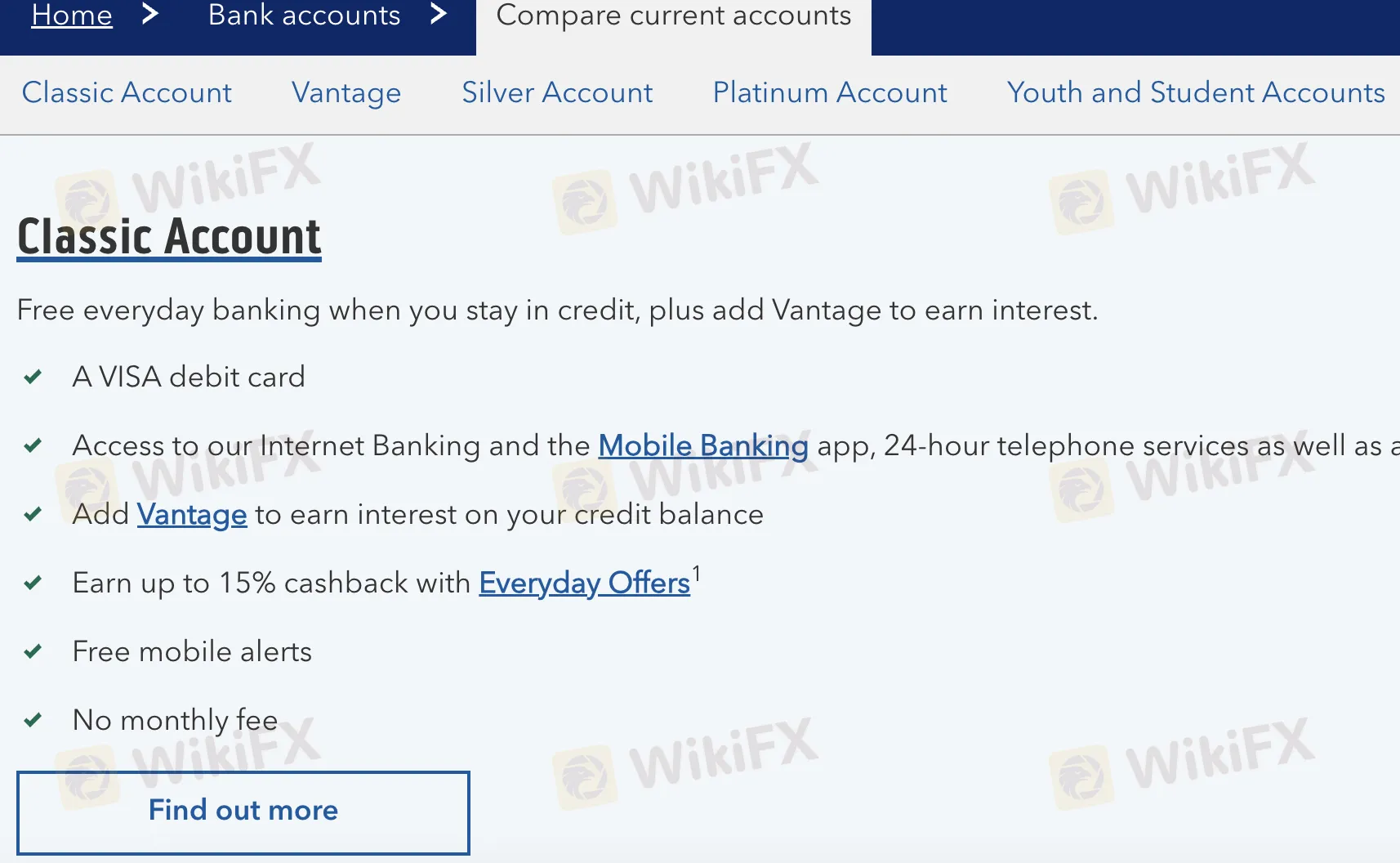

Designed for different age groups and financial needs, Bank of Scotland provides seven types of live (real) accounts. It does not offer Islamic or demo accounts. From simple banking to premium services with travel and insurance benefits, every account has different features.

| Account Type | Monthly Fee | Key Features | Suitable For |

| Classic Account | £0 | Everyday banking, cashback, add Vantage for interest | General personal banking users |

| Silver Account | £11.50 | Travel insurance, mobile insurance, no card fees abroad | Travelers and users wanting perks |

| Platinum Account | £22.50 | Enhanced travel cover, AA Breakdown, mobile insurance | Frequent travelers & families |

| Student Account | £0 | Interest-free overdraft, student-targeted offers | Full-time students |

| Smart Start | £0 | Linked parent-child accounts with savings interest | Kids aged 11–15 |

| Under 19s Account | £0 | Interest-earning, limited online banking, no overdraft | Teenagers aged 11–17 |

| Basic Account | £0 | Simple account with no overdraft or charges for going overdrawn | Those needing essential banking only |

Bank of Scotland's fees are generally moderate to high compared to standard UK retail banking. While some basic accounts come with no monthly fee, packaged accounts (like Silver and Platinum) include service bundles with monthly charges. Overdraft and credit card charges follow standard UK industry ranges.

| Service/Account Type | Fee |

| Classic Account | £0/month |

| Silver Account | £11.50/month |

| Platinum Account | £22.50/month |

| Student Account | £0/month |

| Under 19s/Smart Start | £0/month |

| Basic Account | £0/month |

| Overdraft (Arranged) | Variable (based on credit profile) |

| Foreign Card Usage (Classic) | 2.99% transaction fee |

| ATM Withdrawals (UK) | Free from Bank of Scotland ATMs |

| Late Payment (Credit Card) | Up to £12 |

| Trading Platform | Supported | Available Devices | Suitable For |

| Mobile Banking App | ✔ | iOS, Android smartphones | Everyday users manage finances on the go |

| Online Banking (Web) | ✔ | Desktop, Laptop, Tablet (via browser) | Users who prefer website |

| MetaTrader (MT4/MT5) | ❌ | – | Not available |

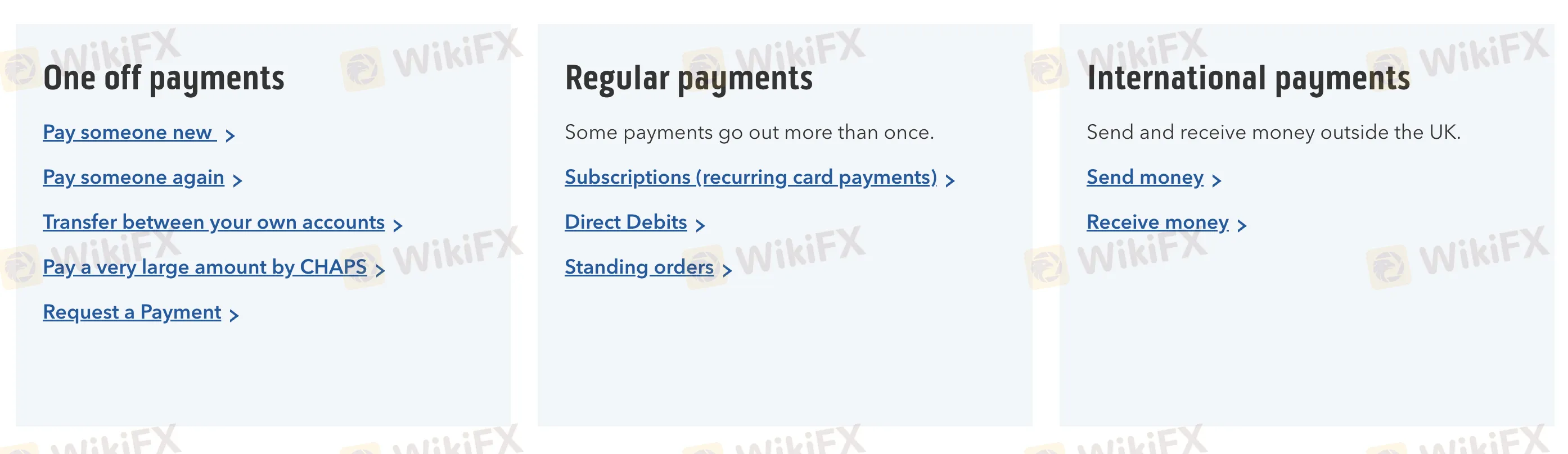

Bank of Scotland supports domestic and international payment methods, including one-off payments, recurring transfers, and international transactions.

| Category | Available Actions |

| One-off Payments | Pay someone new, Pay someone again, Transfer between own accounts, CHAPS large payments, Request a payment |

| Regular Payments | Set up recurring card payments (subscriptions), Direct Debits, Standing Orders |

| International Payments | Send money abroad, Receive money from outside the UK |

Bank of Scotland does charge certain fees for credit card services, including an annual fee for some types of credit cards. For example, their Platinum Credit Card comes with a £24 annual fee, which is relatively standard for premium credit cards offering added benefits like travel insurance and purchase protection. However, these fees are in addition to interest charges on any outstanding balances, so I must be cautious when carrying a balance month-to-month. Additionally, there are charges for late payments, typically up to £12, and foreign transaction fees of 2.99% on purchases made outside the UK. The Bank of Scotland online account system gives me easy access to track my credit card usage and ensure that I am managing payments effectively to avoid unnecessary fees. The credit card fees could be considered high, especially for frequent travelers or those with large balances, so it’s essential to assess if the benefits outweigh the costs for my specific needs.

Unfortunately, Bank of Scotland does not offer a demo account, which is a notable downside for me as someone who likes to test out platforms before committing real funds. A demo account would allow me to practice without the financial risk, especially for those new to investing or banking platforms. The absence of this feature makes it harder for me to explore Bank of Scotland’s products, particularly investment products, without making a financial commitment upfront. Given that they focus on personal and business banking, offering a demo account for financial products like investments or savings could have been an excellent addition. I recommend that Bank of Scotland consider providing this feature in the future to allow potential customers to better understand their services.

Bank of Scotland offers various accounts with differing fee structures. While some accounts, such as the Classic Account, do not charge monthly fees, premium accounts like the Silver Account and Platinum Account come with monthly fees of £11.50 and £22.50, respectively. These fees cover added benefits such as travel insurance, mobile insurance, and breakdown cover. However, these charges may seem high compared to other banks, especially if I don't use all the benefits provided. Additionally, Bank of Scotland applies fees for services like overdrafts, credit card late payments, and foreign card usage, which can add up quickly. The Bank of Scotland online account platform allows me to easily check these fees and monitor my usage, which helps in managing costs. It’s important to be mindful of fees for services like international transactions or foreign card usage, which could incur a 2.99% transaction fee. As a customer, I would recommend reviewing the fee structure carefully to ensure I am not paying for features I don't fully utilize.

Bank of Scotland does not specify a minimum deposit requirement for most of their accounts, which is convenient for me as I don’t need a large upfront commitment. However, for some of their premium accounts, such as the Silver Account and Platinum Account, there are monthly fees of £11.50 and £22.50, respectively, so I need to factor these costs into my budgeting. The lack of a minimum deposit for accounts means that I can open an account with a small initial balance, but I must ensure I can cover the monthly fees for the more feature-rich accounts. As someone who likes flexible banking options, I find this structure appealing. The Bank of Scotland online account system makes it easy for me to manage my funds and check my balance, which adds convenience to the account management process.

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now