Buod ng kumpanya

| Shin Buod ng Pagsusuri | |

| Nakarehistro Noong | 15-20 taon |

| Nakarehistrong Bansa/Rehiyon | Hapon |

| Regulasyon | FSA |

| Mga Kasangkapan sa Merkado | Mga Stock, Investment trusts, Bonds |

| Demo Account | / |

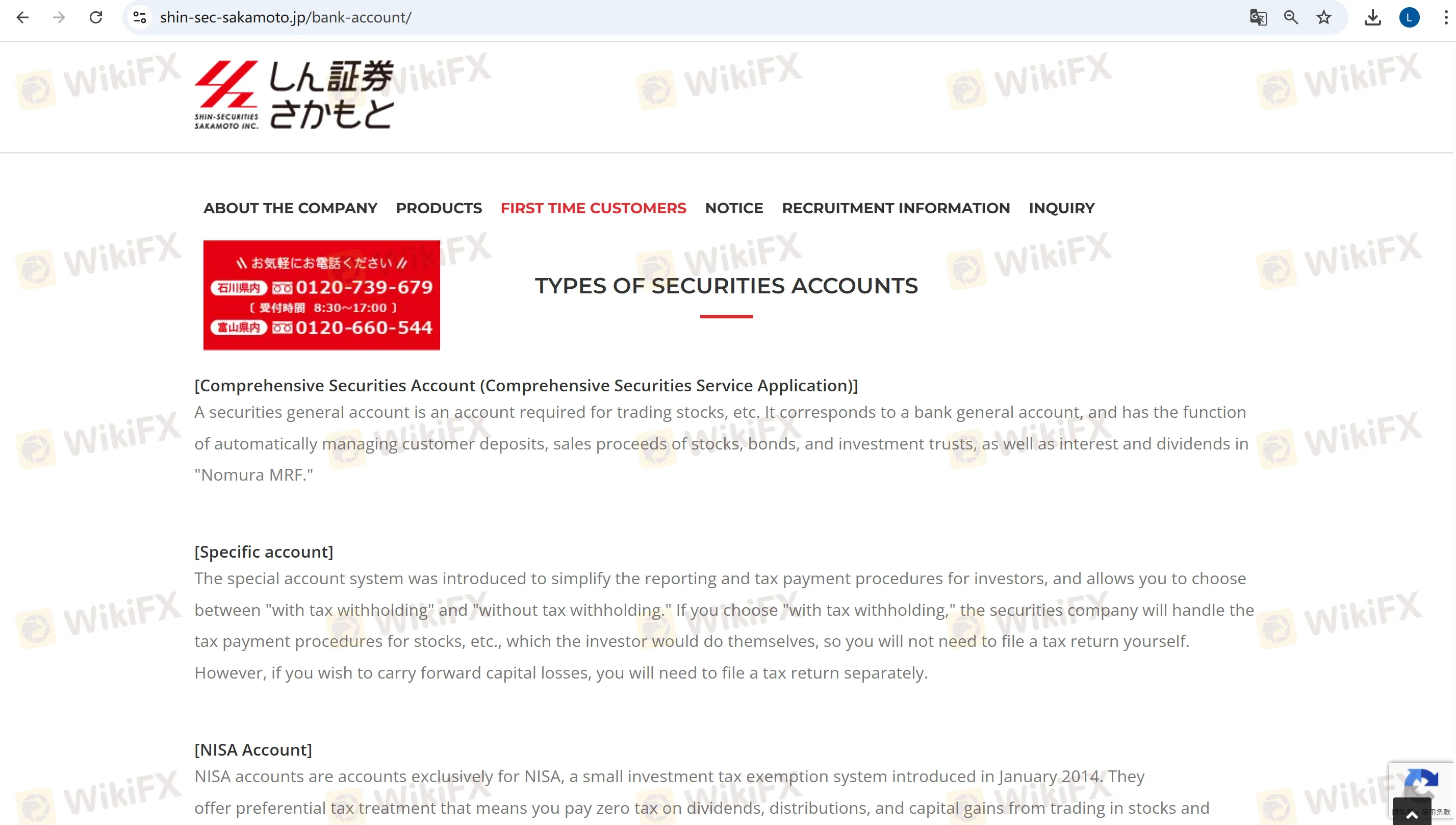

| Suporta sa Customer | 076-222-8088 |

| 0120-739-679 | |

| 0120-660-544 | |

Mga Benepisyo Hadlang Nireregula Walang online trading platform Mababang bayad sa komisyon Di-malinaw na impormasyon sa bayad Libreng konsultasyon sa investment Mababang saklaw sa overseas market Magagamit na NISA tax-exempt account Iba't ibang serbisyo ng produkto Ano ang Maaari Kong I-trade sa Shin?

Ano ang Maaari Kong I-trade sa Shin?

| Mga Tradable Instruments | Supported |

| Stocks | ✔ |

| Investment trusts | ✔ |

| Bonds | ✔ |

| Shares | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Uri ng Account

| Uri ng Account | Mga Pangunahing Function |

| Securities Comprehensive Account | Isang pangunahing trading account na sumusuporta sa pagbili at pagbebenta ng mga stocks, investment trusts, at bonds. Ang pondo ay awtomatikong na-transfer sa "Nomura MRF" money market fund upang kumita ng interes. |

| Specific Account | 1. Dito may withholding tax: Ang securities company ang nagwi-withhold ng buwis, na nag-aalis ng pangangailangan para sa indibidwal na pahayag. 2. Walang withholding tax: Nangangailangan ng self-declaration ng buwis. |

| NISA Account | Isang tax-exempt na eksklusibong investment account na nangangailangan ng pagsusuri ng tax office (humigit-kumulang 2 linggo). |