مقدمة عن الشركة

| GPB FS ملخص المراجعة | |

| تأسست | 2009 |

| البلد/المنطقة المسجلة | قبرص |

| التنظيم | CySEC |

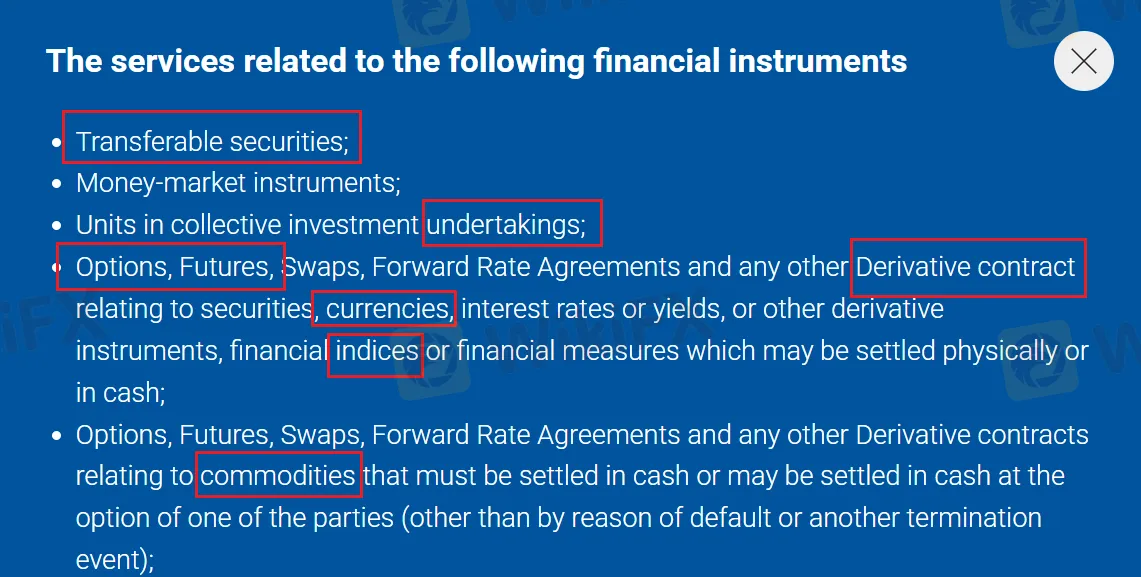

| أدوات السوق | الأسهم، الفوركس، العقود الآجلة، الخيارات، المؤشرات، السلع، المشتقات، السندات |

| حساب تجريبي | / |

| الرافعة المالية | / |

| الانتشار | / |

| منصة التداول | / |

| الحد الأدنى للإيداع | / |

| دعم العملاء | هاتف: +357 25 055 000 / +357 25 055 100 |

| فاكس: +357 25 055 101 | |

| البريد الإلكتروني: brokerage@gpbfs.com.cy | |

| العنوان: 65 شارع سبيرو كيبريانو، ميسا جيتونيا، مركز كريستالسيرف للأعمال، الطابق الثاني 4003 ليماسول، قبرص | |

GPB FS هي شركة تقدم خدمات استثمارية وخدمات مالية. مسجلة في قبرص ومنظمة من قبل CySEC. GPB FS توفر الأسهم، الفوركس، العقود الآجلة، الخيارات، المؤشرات، السلع، المشتقات، السندات، وما إلى ذلك. للأسف، GPB FS لا تقدم ما يكفي من المعلومات حول تفاصيل التداول.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| منتجات تداول متنوعة | نقص في الشفافية |

| تنظيم CySEC | |

| تاريخ عمل طويل | |

| قنوات اتصال متعددة |

هل GPB FS شرعية؟

نعم، GPB FS مُنظمة بواسطة CySEC.

| السلطة المنظمة | الهيئة القبرصية للأوراق المالية والبورصة (CySEC) |

| الحالة الحالية | منظمة |

| الدولة المنظمة | قبرص |

| الكيان المنظم | GPB Financial Services Ltd |

| نوع الترخيص | صانع سوق (MM) |

| رقم الترخيص | 113/10 |

ما الذي يمكنني التداول به على GPB FS؟

| الأدوات التجارية | مدعومة |

| الأسهم | ✔ |

| الفوركس | ✔ |

| العقود الآجلة | ✔ |

| الخيارات | ✔ |

| المؤشرات | ✔ |

| السلع | ✔ |

| المشتقات | ✔ |

| السندات | ✔ |

| العملات الرقمية | ❌ |

| صناديق الاستثمار المتداولة | ❌ |