DeltaFX Broker: No Regulation Exposed

DeltaFX Broker: No Regulation Exposed risks, scams & blocked withdrawals with zero oversight. High fraud exposure—read full review now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Errante presents itself as a regulated forex broker with multiple platforms and instruments. However, user complaints about withdrawals and account issues raise red flags despite its licenses. Our analysis delves into its compliance, features, and risks to determine whether it’s reliable or shady.

Errante launched in 2019 and operates from Seychelles with entities in Cyprus. It offers trading in forex, indices, commodities, metals, shares, and cryptocurrencies via MT4, MT5, cTrader, and TradingView. Minimum deposits start at $50, with leverage up to 1:500 on standard accounts.

The broker supports 24/7 customer service through phone, email, and live chat. It accepts deposits via wire transfer, cards, e-wallets, and crypto, though regional restrictions apply in countries such as the US and Canada. Four account types cater to different traders, from Standard to Tailor Made.

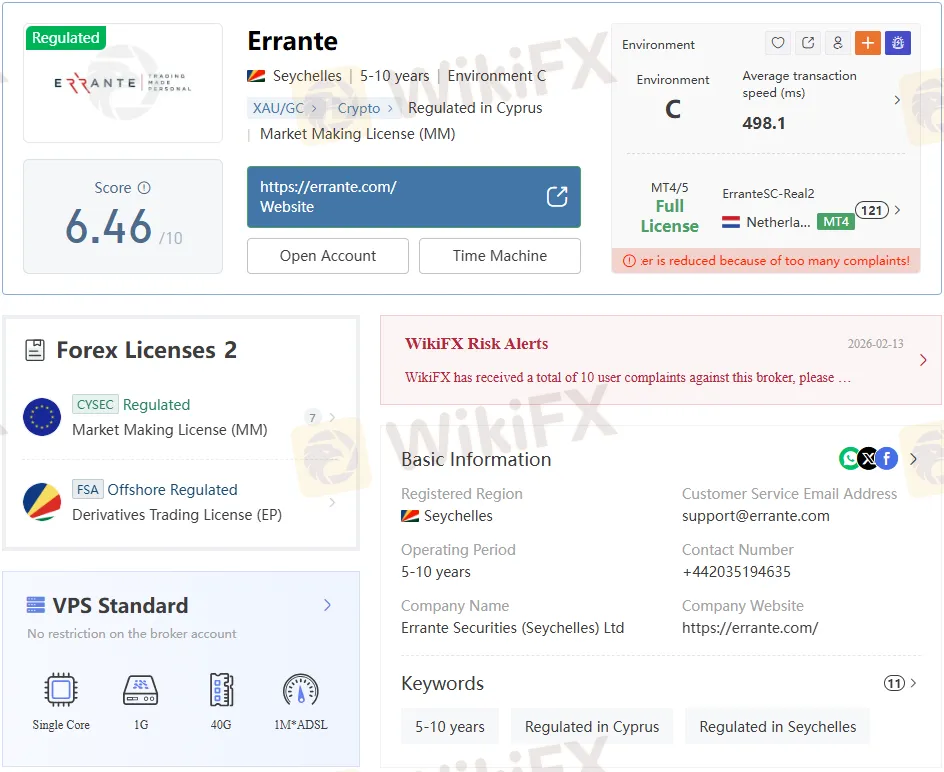

Errante holds a CYSEC regulation under license 383/20 for Notely Trading Ltd as a Market Maker. It also holds an FSA Seychelles license, SD038, for retail forex via Errante Securities (Seychelles) Limited, indicating offshore regulation. While listed as “Regulated” on WikiFX, CYSEC primarily protects EU clients, leaving non-EU traders with limited safeguards.

Concerns arise from CYSECs light penalties, like an €80,000 fine in 2024 for misleading marketing without license revocation. Offshore setups mean funds may sit outside strict oversight, amplifying risks for global users. Download the WikiFX App to verify broker regulation in real-time before trading.

Errante provides spreads from 1.5 pips on Standard accounts, dropping to 0 pips on VIP accounts with commissions. Platforms like MT5 suit experienced traders, while MT4 works for beginners, all available on PC, web, and mobile. Demo accounts help test conditions without risk.

Instruments cover major categories but exclude options, bonds, and ETFs. Leverage reaches 1:500, with a stop-out at 20%, appealing for aggressive strategies. Popular payment options ease funding, though crypto deposits have sparked disputes.

Trustpilot rates Errante “Poor” at 2.2/5 from 38 reviews, citing account blocks, dormant fees, and unresponsive support. Traders report profits wiped out as “abnormal transactions” go unproven, and withdrawals are denied after large gains. One user lost $24,000 due to alleged system errors that blocked their accounts.

Platforms like Forex Peace Army and BrokerHivex highlight frozen accounts demanding settlements, slippage, and server downtimes. Reddit threads echo struggles with “handling fees” or repeated KYC for payouts. WikiFX logs exposure cases of deposit-only scams, urging caution.

| Complaint Type | Common Issues | Examples from Reviews |

| Withdrawals | Delays, denials, profit cancels | $24K blocked; principal returned minus gains |

| Account Handling | Sudden blocks, dormant fees | $40 deducted; no documentation |

| Support | False info, unhelpful | Worst ever; infinite delays |

| Trading Execution | Slippage, stop-loss fails | Server crashes during volatility |

CYSEC regulation sounds strong, but it mainly covers EU clients, routing others to Seychelles entities with weaker protections. MSB registration aids payments but offers no investor safeguards, misleading non-EU traders. WikiFX App users report low risk scores due to withdrawal difficulties.

Fines haven‘t curbed issues; 2024’s €80K penalty ignored compensation. Offshore funds evade full scrutiny; matching scam patterns: small withdrawals are okay, but large ones are frozen. Check the WikiFX App for updated complaints and scores on Errante regulation.

Pros include diverse instruments, multiple platforms, and 24/7 support. Cons include offshore risks, regional bans, and persistent withdrawal woes. BrokerHivex scores it 3.2/10 overall, flagging fund security at 2/10.

Non-EU clients face high exposure; profits vanish under vague “violations.” Use the WikiFX App to scan for similar brokers with stronger oversight. Errantes setup prioritizes marketing over reliability for most users.

Errante is regulated, but concerns persist over enforcement gaps and trader ordeals. Features attract, but complaints suggest shady practices for big withdrawals. Verify via the WikiFX App and proceed slowly if so—better safe than scammed.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

DeltaFX Broker: No Regulation Exposed risks, scams & blocked withdrawals with zero oversight. High fraud exposure—read full review now!

Have you experienced illegitimate profit cancellations by INVESTIZO, a Saint Vincent and the Grenadines-based forex broker? Did the broker deduct unfair amounts in the name of a dividend or swap adjustment? Was your trading account frozen because the broker let someone trade on your behalf? Facing withdrawal blocks and no response from the customer support team to your queries? Many traders have highlighted these alleged forex trading activities online. It’s time we take a close look at some complaints through this INVESTIZO review article. Keep reading!

Mazi Finance is a trading company registered in Saint Lucia, an offshore location. Recently, it has received a lot of attention in the trading world. The company shows off many modern trading features, but when we look closer, we find many potential dangers. Before any trader thinks about opening an account, they need to understand the most important finding from our research: Mazi Finance does not have proper regulation. This single fact creates major warning signs about whether client capital is safe.

When you look for information about a forex broker, you often find a confusing mix of great reviews and serious warnings. This is especially true for Pemaxx, where traders have one main question: Is Pemaxx Safe or Scam? The internet has many different user experiences, making it hard to know what's true. This article won't give you a simple yes or no answer. Instead, we'll do an objective, fact-based study to help you make a smart choice. We'll look at the available information, focusing on real user reviews, common Pemaxx Complaints, and whether it follows proper regulations. By looking at patterns in both good and bad reports, we want to give you a clear picture of the risks and warning signs with this broker, helping you protect your capital.