简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

LONG ASIA Review: A Ghost Broker Trapped in a Liquidity Death Spiral

Abstract:With a dismal 2.0 WikiFX score and a trail of unpaid withdrawals spanning over a year, LONG ASIA is a textbook case of offshore regulatory theater masking a systemic liquidity crisis. Forget the 'payment gateway' excuses; the data points toward a terminal trap for retail capital.

If you enjoy watching your capital vanish into a black hole while a support bot copy-pastes “payment gateway issues,” then this LONG ASIA review is exactly the cautionary tale you need. Established in 2022 and operating out of the regulatory vacuum of Saint Vincent and the Grenadines, this broker LONG ASIA has managed to rack up a staggering volume of complaints in a remarkably short time.

The narrative is always the same: a glossy MT4/MT5 interface on the front end, and a locked vault on the back end.

The Mirage of LONG ASIA Regulation

Lets be clear: “Offshore” is often just another word for “untraceable.” The technical audit of their operational legitimacy reveals a disturbing lack of oversight. While they claim to serve a global audience from India to the United States, their actual LONG ASIA regulation status is a hollow shell. They list a connection to a South African entity, but the verification tells a far grimmer story.

| Regulator | License Type | Status |

|---|---|---|

| South Africa FSCA | Financial Service Provider | Unverified / Suspicious |

| St. Vincent & The Grenadines | IBC Registration | Unregulated (Registry only) |

Investors often mistake a business registration for a financial license. The regulation LONG ASIA claims is essentially non-existent in any capacity that protects your funds. If they decide to stop paying—which the data suggests they already have—there is no ombudsman, no insurance fund, and no law enforcement agency that is going to hunt them down for you.

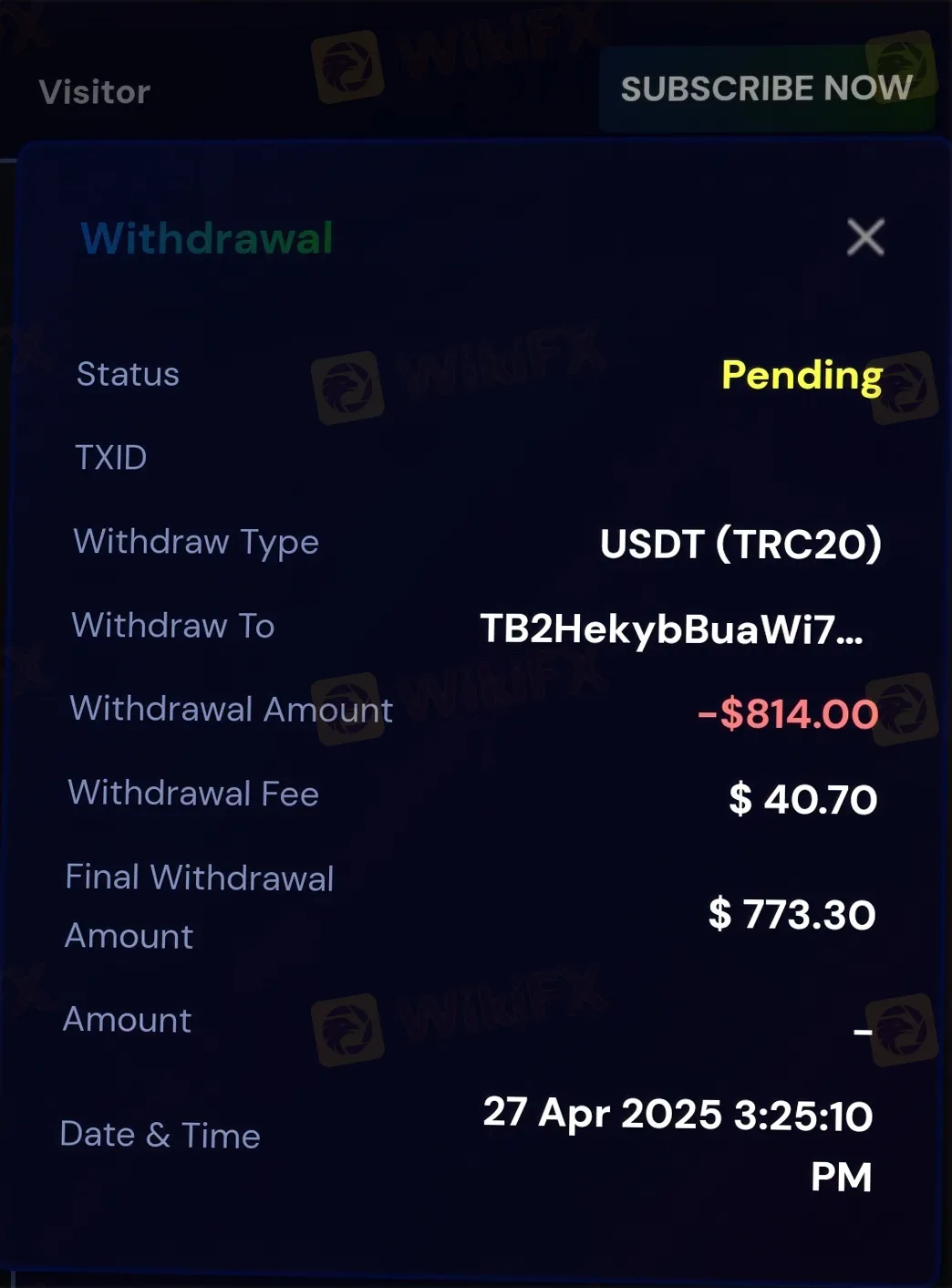

The Withdrawal Graveyard: A Systemic Failure

The “Pain Point” analysis for this platform isn't just a minor glitch; it is a total operational collapse. Multiple Malaysian investors have reported withdrawal delays stretching from 10 days to nearly a year. One particularly harrowing case from July 2024 detailed a user begging for their $306—an emergency fund—that had been trapped since November 2023.

Before you even reach the login LONG ASIA screen, you are greeted with the “Bonus Trap.” Investigative reports indicate that Forex LONG ASIA utilizes aggressive bonus terms filled with legalese loopholes. These terms allow the broker to seize profits at will, citing “technical errors” or “human errors” on the part of the broker as a justification to wipe out client earnings.

Technical Red Flags and the Login Trap

While the broker boasts about its MT4 and MT5 “Main Label” status, the software audit reveals a glaring lack of security. There is no two-step verification (2FA) and no biometric authentication. In the modern Forex market, omitting 2FA is a deliberate choice to keep the barriers to account manipulation low.

Users have reported being locked out of the login portal entirely after requesting significant withdrawals. This is the hallmark of a “soft scam”: allow the client to trade, allow the client to win, but the moment they try to exit the ecosystem, the LONG ASIA login credentials mysteriously fail, or the account is “terminated” for alleged rule violations.

The Ponzi Accusations

The evidence suggests that LONG ASIA may be operating on a “rob-Peter-to-pay-Paul” model. Reports from Pakistan specifically label the firm as a Ponzi scheme, noting that while small deposits might occasionally be returned to maintain a veneer of legitimacy, larger balances are systematically frozen.

The “payment gateway” excuse is the oldest lie in the book. If a broker's gateway is “broken” for twelve months, the broker is either insolvent or lying. In the case of this broker, both are equally likely.

Final Verdict: High-Risk Exclusion

This review LONG ASIA concludes that the platform is currently a financial hazard. With a WikiFX score of 2.0 and a mounting pile of evidence concerning unpaid withdrawals and predatory bonus terms, there is zero justification for depositing capital here.

Risk Warning: Trading Forex involves significant risk, but that risk should come from the market, not from your brokers refusal to hit the “send” button on your withdrawal. Avoid this entity at all costs. Your capital is safer in a paper shredder than in a LONG ASIA account.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Is ICM Brokers Legit? Checking Its Legitimacy and Scam Risks

Trade Nation Rebrands TD365 in Global Integration Move

NaFa Markets Review: An Important Warning & Analysis of Fraud Claims

TenTrade Review: Safety, Regulation & Forex Trading Details

USD Crisis: Capital Flight Accelerates as Europe Pivots Away from 'Political Risk'

Gold Breaches $5,110: 'Fear Trade' Dominates as Dollar Wavers

Italian Regulator Moves to Block Multiple Unauthorised Investment Platforms

Yen Awakening: Intervention Risks and Real Rates Signal Structural Turn

HERO Review: Massive Withdrawal Crisis and Platform Blackouts Exposed

PRCBroker Review: Where Profitable Accounts Go to Die

Currency Calculator