简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Is ICM Brokers Legit? Checking Its Legitimacy and Scam Risks

Abstract:When you search for "Is ICM Brokers Legit," you are asking an important question about trust and safety. Before putting your money with them, you need to know if you are working with a trustworthy company or walking into a financial trap. Being worried about a scam is smart and shows you are being careful. This article gives you a fact-based answer to that question. The most important thing in deciding if a broker is legitimate is whether they are properly regulated. Our research, using information from the global broker regulation platform WikiFX, shows a clear conclusion: ICM Brokers operates without valid, high-quality financial regulation. It is marked with a "Suspicious Regulatory License" warning and has an extremely low trust score. We will now walk you through a detailed breakdown of the evidence, from its regulatory problems and company history to its trading conditions and user complaints, so you can make an informed decision and protect your money.

When you search for “Is ICM Brokers Legit,” you are asking an important question about trust and safety. Before putting your money with them, you need to know if you are working with a trustworthy company or walking into a financial trap. Being worried about a scam is smart and shows you are being careful. This article gives you a fact-based answer to that question. The most important thing in deciding if a broker is legitimate is whether they are properly regulated. Our research, using information from the global broker regulation platform WikiFX, shows a clear conclusion: ICM Brokers operates without valid, high-quality financial regulation. It is marked with a “Suspicious Regulatory License” warning and has an extremely low trust score. We will now walk you through a detailed breakdown of the evidence, from its regulatory problems and company history to its trading conditions and user complaints, so you can make an informed decision and protect your money.

A Look at Regulation

The foundation of any broker investigation is regulation. Trustworthy financial authorities create strict rules for brokers to ensure client money is kept separate, trades are executed fairly, and there is a way to resolve disputes. Therefore , we visited the official website of broker to know Is ICM Brokers Legit or Scam to Avoid.

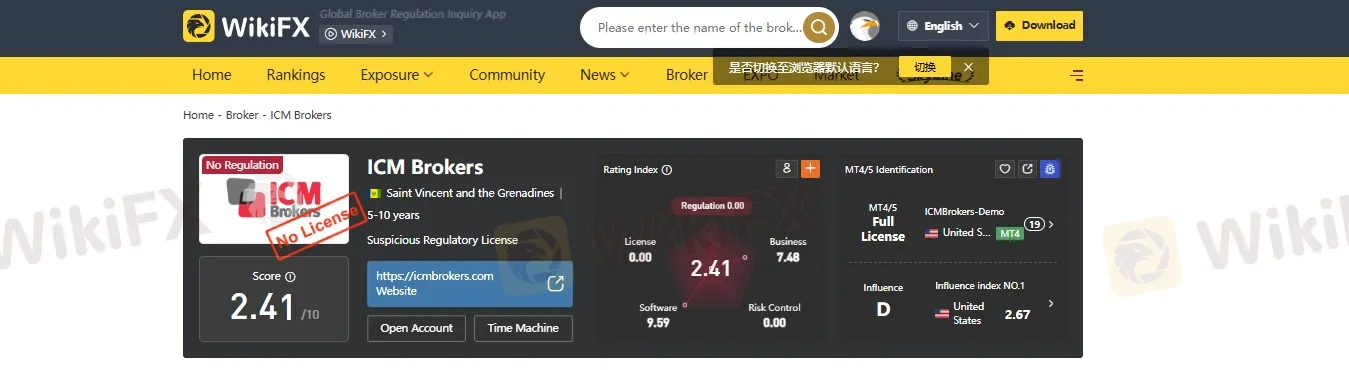

The Official Verdict

According to the detailed database maintained by WikiFX, ICM Brokers lacks a valid forex trading license from any reputable authority. This absence of oversight is the biggest red flag a trader can encounter. The platform gives the broker an extremely low score, currently under 2.41 out of 10, along with a clear warning: “Warning: Low score, please stay away!” This is not just an opinion but a conclusion based on the lack of verifiable, trustworthy regulatory credentials. You may look at the Screenshot below and reach at the conclusion Is ICM Brokers Legit or not .

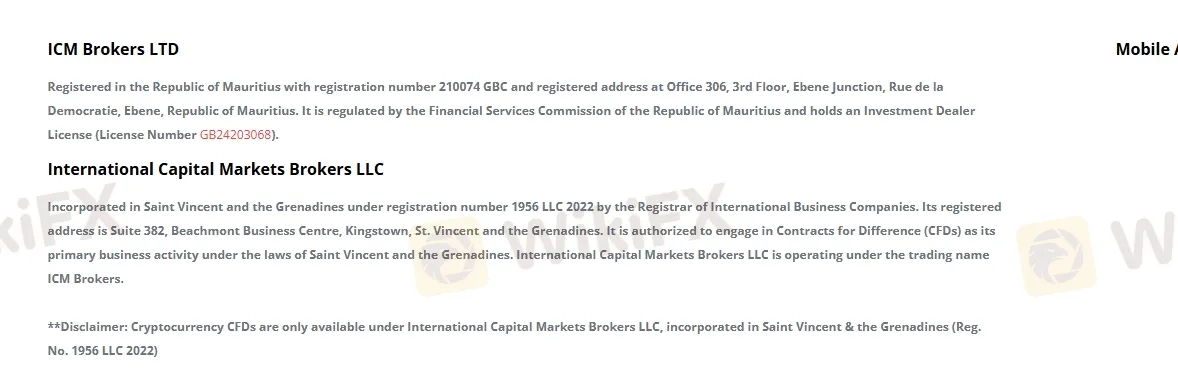

Understanding SVG Registration

ICM Brokers lists its registration in Saint Vincent and the Grenadines (SVG). This is a common trick used by high-risk brokers to create a false appearance of legitimacy. Through such regulation this broker also wants to address peoples Question Is ICM Brokers Legit. It is important for traders to understand the difference between registration and regulation. Registering a company in SVG is a simple paperwork process, similar to setting up any international business company. However, the SVG Financial Services Authority (FSA) has publicly and repeatedly stated that it does not regulate, license, supervise, or oversee forex brokers. Therefore, this registration provides zero financial protection or oversight for traders. Your money is not protected, and there is no governing body to appeal to if there is a dispute.

Official Red Flags

Since, you know exactly Is ICM Brokers Legit or Scam . You should avoid the broker. In an action conducted on February 2, 2022, Indonesia's commodity futures trading regulatory agency, BAPPEBTI, took steps to block hundreds of illegal trading websites to protect its citizens. The domain for this broker was included on that block list. This action by a government body serves as powerful, independent proof of the risks associated with the broker. When a national regulator actively blocks a broker's website, it is a clear signal to traders worldwide to be extremely careful.

The regulatory landscape can be confusing, but tools exist to make it simpler. We strongly advise traders to see the evidence firsthand. You can review the complete regulatory report, live warnings, and the broker's low score directly on their https://www.wikifx.com/en/dealer/4341793697.html to understand the full scope of the risk.

Unpacking the Profile

Beyond regulation, a broker's operational profile can reveal further inconsistencies and risks. We analyzed the company's structure, history, and user-reported experiences to build a complete picture.

Key Facts at a Glance reveals Is ICM Brokers Legit or not

Presenting the broker's core details in a clear format helps to cut through marketing claims and focus on the data. Here is what our investigation found.

| Feature | Detail from Investigation | Implication for Traders |

| Company Name | International Capital Markets Brokers LLC | The legal entity name. |

| Operating Period | 5-10 years | Longevity without regulation is a major red flag, not a sign of trust. |

| Registered Region | Saint Vincent and the Grenadines | An offshore location with no forex broker regulation. |

| Contact Info | Email & US Phone Number | Easy-to-get contact details do not guarantee legitimacy or fund safety. |

| Website | icmbrokers.com | Active, but has been flagged and blocked by at least one national regulator. |

The Danger of Longevity

A common mistake among traders is thinking that long history means trustworthiness. When asking Is ICM Brokers Legit, some traders point to the brokers claimed operating period of 5–10 years as a sign of stability . However, when dealing with an unregulated entity, this is a dangerous assumption. Unregulated brokers can operate for many years, slowly gathering clients and capital. During this time, they exist outside the law, with no authority monitoring their business practices. Problems such as withdrawal delays, price manipulation, or sudden account closures can appear at any time, often becoming widespread only after the broker has reached a large number of clients. Without a regulator to enforce rules, there is no accountability, and for anyone questioning Is ICM Brokers Legit, a decade of operation means nothing for your fund's safety.

A Trader's Warning

Claims from real users provide a glimpse into how a broker operates when it believes no one is watching. A significant complaint filed against ICM Brokers details a case of “profit elimination.” According to the report, a trader was actively trading, experiencing both wins and losses. Later, the broker allegedly removed the profitable trades from the account history without providing any reason or prior communication. The losing trades, however, remained. It tells you clearly Is ICM Brokers Legit or Danger.

This type of complaint is a classic example of the huge risk traders face with unregulated entities. A regulated broker would be subject to a serious investigation and penalties for such arbitrary actions against a client. An unregulated broker, however, can act without consequences. This report should not be viewed as an isolated incident but as a real demonstration of what can happen when your capital is held by a company that is not accountable to any higher authority.

This single report of 'profit elimination' is a serious claim. Before engaging with any broker, it is important to check for a pattern of such behavior. You can find more user reviews and complaint claims on the https://www.wikifx.com/en/dealer/4341793697.html providing a clearer picture of real client experiences.

A Look at Trading Conditions

Often, high-risk brokers use attractive-looking trading conditions as bait to distract traders from critical flaws like a lack of regulation. It is essential to analyze these offerings within the context of the broker's high-risk profile.

Accounts and Spreads

ICM Brokers offers several account types, but a closer look at the terms reveals they are not particularly competitive, especially when weighed against the risk. Through the table below you may know Is ICM Brokers Legit.

| Account Type | Minimum Deposit | Maximum Leverage | Spreads | Our Analysis |

| Standard | $50 | Up to 1:400 | Fixed, from 2 pips | The spread is high compared to industry norms. The leverage is extremely risky. |

| Prime | Not specified | Up to 1:400 | Market, from 1.2 pips | Leverage remains dangerously high. “Market” spreads can widen significantly. |

| Crypto | $1,000 | Up to 1:5 | Market | A very high entry cost for a specialized account with a completely unregulated broker. |

The fixed spread of 2 pips on the Standard account is not competitive in today's market, where many regulated brokers offer spreads well below 1.5 pips for major pairs. The high minimum deposit for the Crypto account is another warning sign, requiring a significant capital commitment to an untrustworthy entity.

The Leverage Double-Edge

The offer of 1:400 leverage is a significant red flag when assessing Is ICM Brokers Legit. Leverage is a tool that allows traders to control a large position with a small amount of capital. While it can increase profits, it just as easily increases losses, and it is the primary reason why many retail traders lose their entire investment quickly.

Recognizing this danger, reputable financial regulators in major locations like the UK, Europe (ESMA), and Australia (ASIC) have implemented strict leverage limits for retail clients, often limiting it to 1:30 for major forex pairs. The fact that ICM Brokers offers 1:400 leverage is a clear indication that it operates outside of these protective regulatory frameworks. It is a marketing tool designed to attract risk-seeking traders, without regard for client protection principles.

Platform and Safety

ICM Brokers provides access to the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. The data shows it holds a full license for MT4 and a white-label license for MT5. Many traders researching Is ICM Brokers Legit see the MT4/MT5 logo and assume a broker is safe. This is a critical error

The trading platform is merely the software—the tool for placing trades. The integrity of the broker behind the platform is what determines the safety of your funds, the fairness of your trade execution, and your ability to withdraw profits. A fraudulent company can easily use a legitimate platform to carry out its operations. Therefore, the presence of MT4 or MT5 does not, in any way, guarantee the legitimacy or safety of the broker. When evaluating Is ICM Brokers Legit, the focus must always remain on the broker's regulatory status and business practices.

Final Verdict and Protection

After a thorough review of the evidence, a clear and decisive conclusion can be drawn about the legitimacy of ICM Brokers. Anyone seriously asking Is ICM Brokers Legit should carefully review the facts outlined below.

The Evidence Speaks

The case against engaging with ICM Brokers is overwhelming. To summarize the critical red flags identified in our investigation:

• No Valid Regulation: The broker lacks a license from any reputable financial authority, leaving traders with zero protection.

• Offshore Registration: It is registered in St. Vincent and the Grenadines, an offshore zone that explicitly does not regulate forex brokers.

• Low Trust Score: Independent verification platforms assign it an extremely low score and issue direct warnings for traders to stay away.

• Government Warnings: Its website has been officially blocked by at least one national regulator for operating illegally.

• User Complaints: There are serious claims from users regarding unfair practices, such as the arbitrary elimination of profitable trades.

Based on this body of evidence, we conclude that depositing funds with ICM Brokers carries an exceptionally high and unacceptable risk to your capital. For those still questioning Is ICM Brokers Legit, its operational characteristics are entirely consistent with entities that traders should avoid to prevent potential ICM Brokers scam and financial loss.

Your Vetting Checklist

To protect yourself from similar high-risk brokers in the future, it is vital to adopt a systematic due diligence process. Use this non-negotiable checklist before considering any broker:

1. Verify Regulation First: Before anything else, use a trusted, independent third-party tool like WikiFX to check the broker's regulatory status, license number, and overall score.

2. Cross-Reference the Regulator: Do not take the broker's word for it. Go to the official website of the regulator they claim to be licensed by and search for the company in the public registry. If they are not there, it is a lie.

3. Examine History and Reviews: Look for patterns in user complaints on neutral platforms. Pay close attention to issues related to withdrawals, trade execution, and customer service. One bad review might be a fluke; a pattern is a warning.

4. Reject High-Pressure Tactics: Legitimate brokers do not need to promise guaranteed profits or use aggressive, unsolicited sales calls. Be wary of any entity that pressures you to deposit funds quickly.

The Ultimate Shield

Protecting your investment starts before you ever make a deposit. The single most important action a trader can take is proactive and independent due diligence. This process is not complicated and can prevent catastrophic financial loss. Make it a mandatory habit to conduct a thorough background check on any broker you consider.

This process takes only a few minutes and is your strongest defense. To see what a comprehensive investigation looks like and to verify all the facts in this article, we urge you to view the complete and continuously updated report on the https://www.wikifx.com/en/dealer/4341793697.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

US Crisis Deepens: Government Shutdown Odds Hit 78% Amid Winter Paralysis and Fed Feud

Gold Breaches $5,100 as 'De-Dollarization' and Tariff Wars Crush the Greenback

Emerging Markets: West Africa Projected for 4.4% Growth Amid Reforms

Is ICM Brokers Legit? Checking Its Legitimacy and Scam Risks

Geopolitical Risk Premium Rising: Russia Warns on Arms Treaty as Trump Pushes Ukraine Land Deal

China Industrial Profits Turn Positive; Yen Falters on Fiscal Woes

US Crisis Deepens: Government Shutdown Odds Hit 78% Amid Winter Paralysis and Fed Feud

APAC Outlook: 'Takaichi Trade' Returns to Tokyo; RBA Hike Bets Propel Aussie Dollar

Gold Breaches $5,100 as 'De-Dollarization' and Tariff Wars Crush the Greenback

Emerging Markets: West Africa Projected for 4.4% Growth Amid Reforms

Currency Calculator