简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Solitaire PRIME User Reputation: A Look at Real Complaints and Scam Claims

Abstract:When people ask, Is Solitaire PRIME Safe or Scam the facts point to one clear answer. After carefully studying how it works, user complaints, and its legal status, we must label Solitaire PRIME as a high-risk and dangerous platform for any investor. This is not a real, legally approved brokerage. It shows all the warning signs of a financial scam. In this review, we will break down the main problems that make this platform so risky. These include having no real financial oversight, a clear pattern of lying to customers, and many user complaints about not being able to get their money back. We strongly advise against using this broker. The information here serves as an important Information to know Is Solitaire PRIME Safe or Scam.

When people ask, Is Solitaire PRIME Safe or Scam the facts point to one clear answer. After carefully studying how it works, user complaints, and its legal status, we must label Solitaire PRIME as a high-risk and dangerous platform for any investor. This is not a real, legally approved brokerage. It shows all the warning signs of a financial scam. In this review, we will break down the main problems that make this platform so risky. These include having no real financial oversight, a clear pattern of lying to customers, and many user complaints about not being able to get their money back. We strongly advise against using this broker. The information here serves as an important Information to know Is Solitaire PRIME Safe or Scam.

The Unregulated Broker Warning Sign

The most important thing when checking if any broker is safe is whether it has proper legal approval. Good financial regulators, like the UK's Financial Conduct Authority (FCA) or Australia's Securities & Investments Commission (ASIC), exist for one main reason: to protect customers. They make strict rules about keeping client money separate, being transparent, and having enough capital. A broker without regulation works outside these laws, giving you no protection. If your money disappears, no authority can force the broker to give it back.

Our research into Solitaire PRIME's regulatory claims shows clear results. The company is not authorized to provide financial services in any major country. This is not a small mistake. It is a deliberate choice to operate in secret, without any accountability. This sign is clear Answer to Is Solitaire PRIME Safe or Scam

Question.

Solitaire PRIME Regulatory Checklist

To give you a Verified answer of Is Solitaire PRIME safe or scam ? we checked for Solitaire PRIME's license with the world's top financial watchdogs. The results are obvious.

| Regulatory Body | Country/Region | Authorization Status |

| FCA (Financial Conduct Authority) | UK | No Record of Authorization |

| ASIC (Australian Securities & Investments Commission) | Australia | No Record of Authorization |

| CySEC (Cyprus Securities and Exchange Commission) | EU | No Record of Authorization |

| SEC / CFTC (U.S. Regulators) | US | No Record of Authorization |

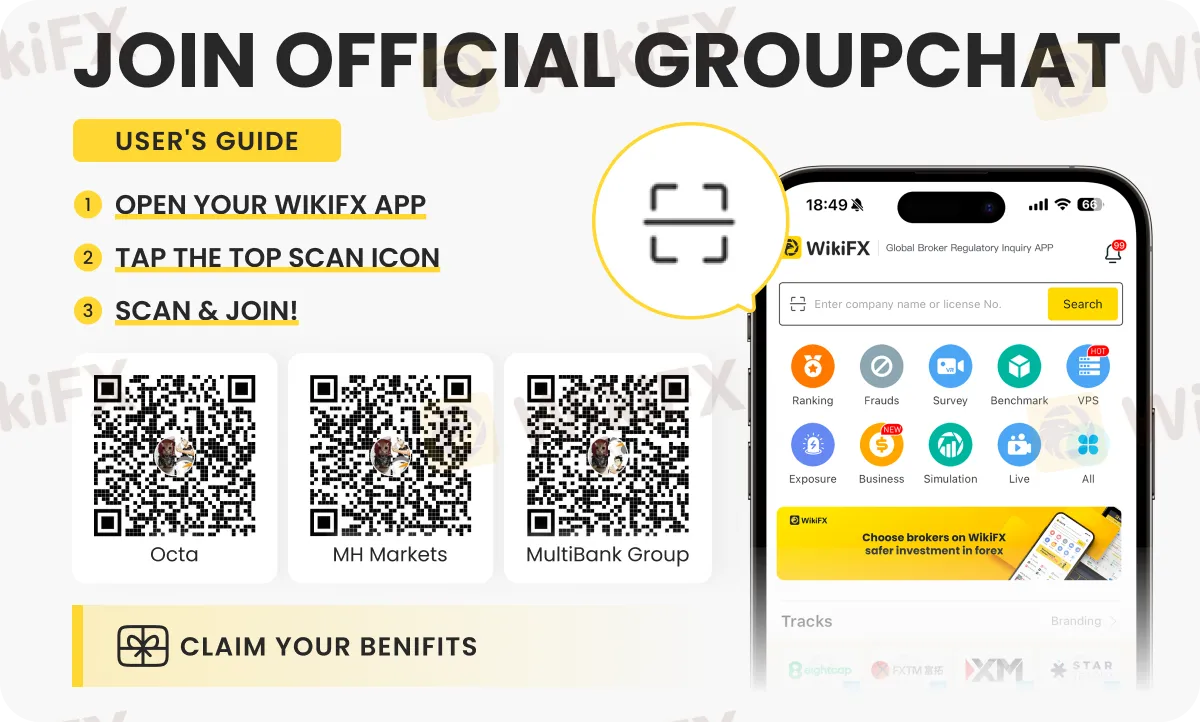

This is why it's important to check any broker's regulatory claims on an independent platform like WikiFX before you even think about opening an account. Not having regulation is a deal breaker.

How The Scam Process Works

Unregulated brokers like Solitaire PRIME often follow a predictable and harmful plan designed to take as much money as possible from their targets. Based on user reports and our analysis, the process is organized and manipulative. Understanding these steps can help you spot the trap before you fall into it. The operation typically happens in four clear stages.

The Four-Step Scam Process

1. The First Contact: The process almost always starts with an unexpected phone call. A friendly but pushy agent will pressure you to make a “small” minimum deposit, often between $250 and $500. They create a feeling of urgency and opportunity to get you to act without thinking. At this stage, victims rarely stop to ask, Is Solitaire PRIME Safe or Scam

2. The Unrealistic Promise: To overcome doubt, these agents make promises that are impossible in real trading. You may be told you can earn “guaranteed hundreds of dollars per day” or offered a 100% deposit bonus that “doubles your investment.” These are misleading marketing tricks designed to appeal to greed and override logical thinking. Real brokers never guarantee profits.

3. The “Retention Agent”: Once you make the first deposit, you are passed to a more senior and aggressive salesperson, often called a “retention agent.” This person's only job is to build fake trust and convince you to deposit much larger amounts of money. They will use your initial “profits” (which are often fake on the platform) as proof that their system works, pushing you to invest thousands more to “maximize the opportunity.”

4. The Managed Account Trap (MAA): A particularly dangerous trick is convincing you to sign a Managed Account Agreement (MAA). This document gives the broker's “analysts” power to trade for you. Victims who sign this agreement often report that their account balance is quickly wiped out through a series of fast, losing trades, leaving nothing to withdraw. The broker then uses the MAA to claim they are not responsible for the losses.

The Withdrawal Problem Complaints

The most common and harmful issue across all Solitaire PRIME complaints is the withdrawal process. While putting money in is easy, trying to get it back is, by all accounts, an impossible nightmare. This is the final and most painful stage of the scam, where the broker's true intentions are revealed and victims finally realize the answer to Is Solitaire PRIME Safe or Scam.

Users report a consistent pattern of behavior. When a withdrawal request is submitted, a series of delay tactics begin. At first, the broker may simply ignore the request. If the user keeps trying, they are often told that their request is “being processed” or that they need to submit more verification documents. Weeks turn into months, with each inquiry met with a new excuse.

This is not just poor customer service. It is a planned strategy. Many credit card companies have a time limit for starting a chargeback, often around 120 to 180 days. By delaying the withdrawal process for six months or more, brokers like Solitaire PRIME try to run out the clock, removing the victim's most effective way to recover their money. This behaviour of the broker tells you clearly Is Solitaire PRIME Safe or Scam.

User reports consistently describe how, after months of frustrating back-and-forth, the broker either stops all communication or an “account manager” suddenly loses the entire account balance in a few bad trades. The outcome is almost always the same: a total loss of both initial money and any supposed profits.

Spotting Fake Broker Reviews

When you search for information on Solitaire PRIME, you may find a mix of reviews about Is Solitaire PRIME Safe or Scam. While most are negative, some glowing, 5-star reviews can create confusion. It's important to understand that unregulated brokers often pay for fake positive reviews to manipulate their online reputation and attract new victims. Learning to tell the difference between real feedback and paid propaganda is a vital skill for any online investor.

Checklist for Spotting Fake Reviews:

• Vague and Overly Positive Language: Look for generic, emotional praise like “This is the best broker ever!” or “I made so much money so fast!” without any specific details. Real reviews often mention platform features, customer service interactions, or specific trading conditions.

• No Mention of Problems: No broker is perfect. A real review from an experienced user will often mention both good and bad points, such as high costs, a clunky interface, or slow support responses. A review that is 100% positive is a major red flag.

• Recent, Similar-Looking Reviews: Be careful of a sudden flood of 5-star reviews all posted within a short time. This often shows a coordinated campaign to bury negative feedback.

• Profiles with No History: Click on the reviewer's profile. If the account was created recently and has only ever posted one review (for that specific broker), it is highly likely to be fake.

• Focus on Easy Money, Not Features: Fake reviews sell a dream. They focus almost only on the outcome (“I bought a new car with my profits!”) rather than the process or the platform's tools (e.g., platform stability, charting tools, spread costs).

Your Defense and Recovery Strategy

Whether you are thinking about investing or have already fallen victim, there are concrete steps you can take to protect yourself and try to recover your money. Acting quickly and decisively is essential.

Prevention: The Most Important Step

The best defense is checking ahead of time. Before you deposit a single dollar with *any* online broker, you must confirm they are legitimate.

Use an independent, comprehensive verification platform like WikiFX. These platforms are designed to provide transparency in a high-risk industry. On WikiFX, you can perform a background check in minutes. You can verify a broker's license number against official regulatory databases, review its operational history, easily know Is Solitaire PRIME Safe or Scam , assess whether its business claims are real, and, most importantly, read unfiltered user reviews and exposure reports from other traders. As of 2025, using such a tool is a necessary first step for safe trading and can save you from scams like Solitaire PRIME.

Recovery: A Guide for Victims

If you have already put money with Solitaire PRIME and are facing withdrawal problems, do not wait for them to cooperate. You must act immediately.

1. Act Immediately: Time is your enemy. The broker's goal is to delay you until your recovery options expire. Start the recovery process now.

2. Save All Evidence: Download and save every email, live chat transcript, and transaction record. Take screenshots of your account balance and your pending withdrawal requests. This documentation is your proof of the deception.

3. Start a Chargeback (Credit/Debit Cards): This is your most powerful tool. Contact your bank or credit card company immediately. State clearly that you were deceived by an unregulated online trading company that is refusing to return your funds. Provide them with the evidence you've collected. Do not let the broker know you are doing this.

4. For Wire Transfers: Chargebacks are not possible with wire transfers, so you must increase your pressure. Inform the broker in writing (email is fine) that if your funds are not returned promptly, you will be filing official complaints with financial authorities and law enforcement.

5. File Official Complaints: Prepare a detailed letter outlining the entire experience, from the initial promises to the refusal to process your withdrawal. You can then send this to the primary financial regulatory agency in your own country. Sometimes, showing a copy of this formal complaint letter to the broker before sending it can pressure them into giving a refund to avoid official scrutiny.

Conclusion: Trust Evidence, Not Promises

The evidence against Solitaire PRIME is clear and consistent. It is an unregulated broker with a business model built on misleading promises and a history defined by user complaints of withdrawal failures. The answer to the question Is Solitaire PRIME Safe or Scam is a definitive no. The platform represents an unacceptable risk to any investor's money.

The most important lesson from the countless Solitaire PRIME complaints is the need for checking ahead of time. In the world of online trading, promises are worthless, but evidence is everything. Always put verification first. Before engaging with any broker, protect your hard-earned money by checking their credentials on a trusted verification platform like WikiFX.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Is ICM Brokers Legit? Checking Its Legitimacy and Scam Risks

Winter Storm Fern To Lower Q1 GDP By 0.5% To 1.5%

Central Bank Watch: Fed Policy in Gridlock as Inflation Fighters Clash with Growth Doves

Belgian Investors Lost €23M to Scams in 2025 Surge

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Japanese Premier Vows Action on Speculative Yen Moves Amid Policy Jitters

Gold Elephant Review: Safety, Regulation & Forex Trading Details

Weltrade Review 2025: Is This Forex Broker Safe?

ONE ROYAL Review 2026: Is this Forex Broker Legit or a Scam?

Intervention Watch: NY Fed 'Rate Check' Signals US-Japan Alliance Against Yen Weakness

Currency Calculator