Trade Nation Rebrands TD365 in Global Integration Move

Trade Nation completes TD365 integration, unifying its brand and platforms under one global identity to enhance user experience and streamline trading operations.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Belgian consumers lost over €23M to crypto and WhatsApp investment scams in late 2025, financial regulator warns amid rising fraud cases.

Belgian investors lost more than €23 million to fraudulent investment schemes and illegal financial offers during the second half of 2025, according to new data from the Financial Services and Markets Authority (FSMA). The regulator attributed much of the surge to bogus cryptocurrency trading sites and fast-spreading scams promising “exclusive investment tips” through WhatsApp groups.

Between July and December, the FSMA received 1,622 consumer complaints linked to unauthorized financial offers—an alarming rise not only in cases but also in the average loss per victim. The trend points to increasingly sophisticated and coordinated fraud networks targeting consumers online.

Fake trading platforms were responsible for the heaviest toll, draining more than €10.5 million from victims. Many of these operations masqueraded as legitimate cryptocurrency or investment services, enticing users through slick advertisements that encouraged quick fund transfers. Despite often appearing professional, these platforms operated without any regulatory approval.

A newer wave of deception—WhatsApp groups sharing supposedly privileged stock market tips—proved almost as damaging. Losses tied to these schemes exceeded €9.5 million over the same six-month period, making them one of Belgiums fastest-growing financial frauds.

The FSMA detailed how these scams typically begin with social media ads on platforms like Facebook and Instagram. Users are invited to join exclusive WhatsApp groups that promise insider stock advice or unusually high returns. To appear credible, the ads frequently misuse the names and branding of reputable banks, financial firms, or news outlets.

Inside these groups, participants are bombarded with messages from fake financial analysts or executives. Many of these identities are stolen or entirely fabricated. Members are sometimes urged to take part in fake lotteries that harvest personal information, buy specific U.S. stocks as part of price manipulation schemes, or install malicious apps posing as crypto trading tools—all with the goal of extracting money or sensitive data.

The typical victim, according to the FSMA, is a Dutch-speaking man aged 50 to 69—an age group often possessing higher savings and confidence in online investing. Reported losses averaged around €73,000, with some cases reaching several hundred thousand euros. In just six months, 263 reports were filed on these WhatsApp scams, and roughly 60% of victims had already transferred funds before seeking help.

Beyond crypto and messaging-app schemes, the FSMA also logged significant losses from fake credit offers, fraudulent portfolio management services, and “recovery room” scams—where con artists promise to recover previous losses for a fee. Recovery scams alone cost consumers nearly €860,000, while deceptive alternative investment schemes contributed another €700,000 in damage.

Across 2025, the FSMA recorded a total of 2,911 reports of unlawful financial activity—an 11% increase from 2024 and a continuation of a trend that has grown nearly 20% per year since 2017. Monthly data shows sharp spikes in autumn, with October marking the peak of reported offenses. The regulator linked these surges to coordinated advertising pushes and periods of market instability that often leave investors more vulnerable to risky offers.

In response, Belgian authorities issued warnings against 240 fraudulent entities and 316 websites throughout 2025, more than 65% of which were tied to fake trading platforms. The FSMA urged consumers to remain skeptical of unsolicited investment proposals, particularly those spread through social media or private messaging apps.

The regulator also stressed the importance of verifying whether a firm is authorized before transferring any funds and pledged to keep working with international partners to track and dismantle cross-border fraud operations that continue to evolve across digital platforms.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Trade Nation completes TD365 integration, unifying its brand and platforms under one global identity to enhance user experience and streamline trading operations.

Have you had a terrible TrioMarkets withdrawal experience? Did the broker executive delay your fund withdrawals for days without any clear explanation? Have you found contradictions between the deposit and withdrawal experience? Lost all your profits due to the illegitimate closing of trades by TrioMarkets? You have probably made the wrong choice of a broker for forex trading! Many traders have opposed the broker on several review platforms. We have highlighted some of their comments when writing this TrioMarkets review article. Take a look!

INFINOX secures UAE CMA Category 5 license, expanding its regulated presence in the Middle East with a focus on transparency and strategic growth.

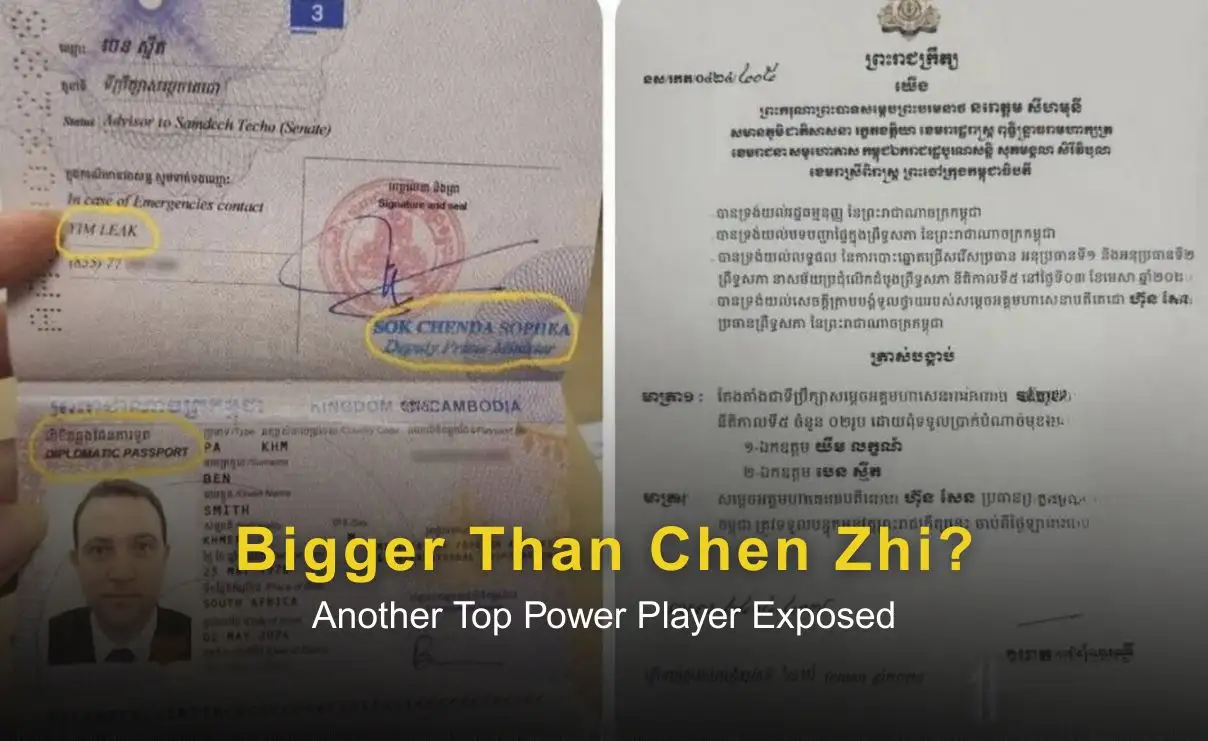

Amid ongoing scrutiny over Chen Zhi’s Cambodian citizenship, a separate case involving alleged money-laundering figure Benjamin Moberg has raised fresh concerns. Reports that Moberg held a Cambodian diplomatic passport and advisory role despite links to criminal investigations have prompted questions about possible high-level protection and systemic misuse of citizenship and diplomatic status. Analysts warn the case may reflect deeper governance and enforcement challenges rather than isolated incidents.