简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Deriv Review 2026: Comprehensive Safety Assessment

Abstract:Deriv holds a WikiFX score of 6.87 and is regulated by multiple authorities including the MFSA and UAE CMA, though it relies heavily on offshore entities for global clients. This audit highlights critical risks regarding recent user complaints about sudden leverage reduction and withdrawal blocks.

Executive Summary

In this in-depth review, we analyze the key metrics and operational history of Deriv to determine its viability for modern traders. The broker was established in 2019 and has quickly garnered an “AAA” influence rank, indicating significant market presence across regions like the UAE, South Africa, and Southeast Asia. Despite its relatively short history, it has occupied a substantial market share.

However, a high influence rank does not automatically equate to safety. With a WikiFX score of 6.87, Deriv sits in a tier that suggests decent regulatory standing but raises concerns regarding operational consistency. As a broker entity operating with a hybrid regulatory structure, it utilizes both top-tier and offshore licenses. This report evaluates whether the convenience of its proprietary technology outweighs the rising volume of user grievances.

1. Regulation & Safety Protocols

The most critical aspect of our audit is the regulation Deriv operates under. The broker maintains a complex multi-jurisdictional license structure:

- High-Tier Regulatory Oversight: The entity is regulated by the Malta Financial Services Authority (MFSA) and the UAE Capital Markets Authority (CMA). These jurisdictions generally enforce strict capital requirements and segregation of client funds.

- Offshore Jurisdictions: A significant portion of its global clientele is onboarded through subsidiaries regulated by the British Virgin Islands FSC, Vanuatu VFSC, and Cayman Islands CIMA.

While this multi-license approach is common for global expansion, it creates varying levels of client protection. Traders under the offshore entities may not benefit from the same compensation schemes as those under the MFSA. Furthermore, the regulation status in 2023 showed four specific disclosures from regulators, suggesting that while the broker is legal, it is under active scrutiny in certain regions. This dichotomy requires traders to confirm which specific entity they are contracting with before depositing funds.

2. Forex Trading Conditions

For traders focusing on Forex instruments, Deriv offers access via the industry-standard MT5 platform. The trading environment presents a mix of high-risk and standard opportunities.

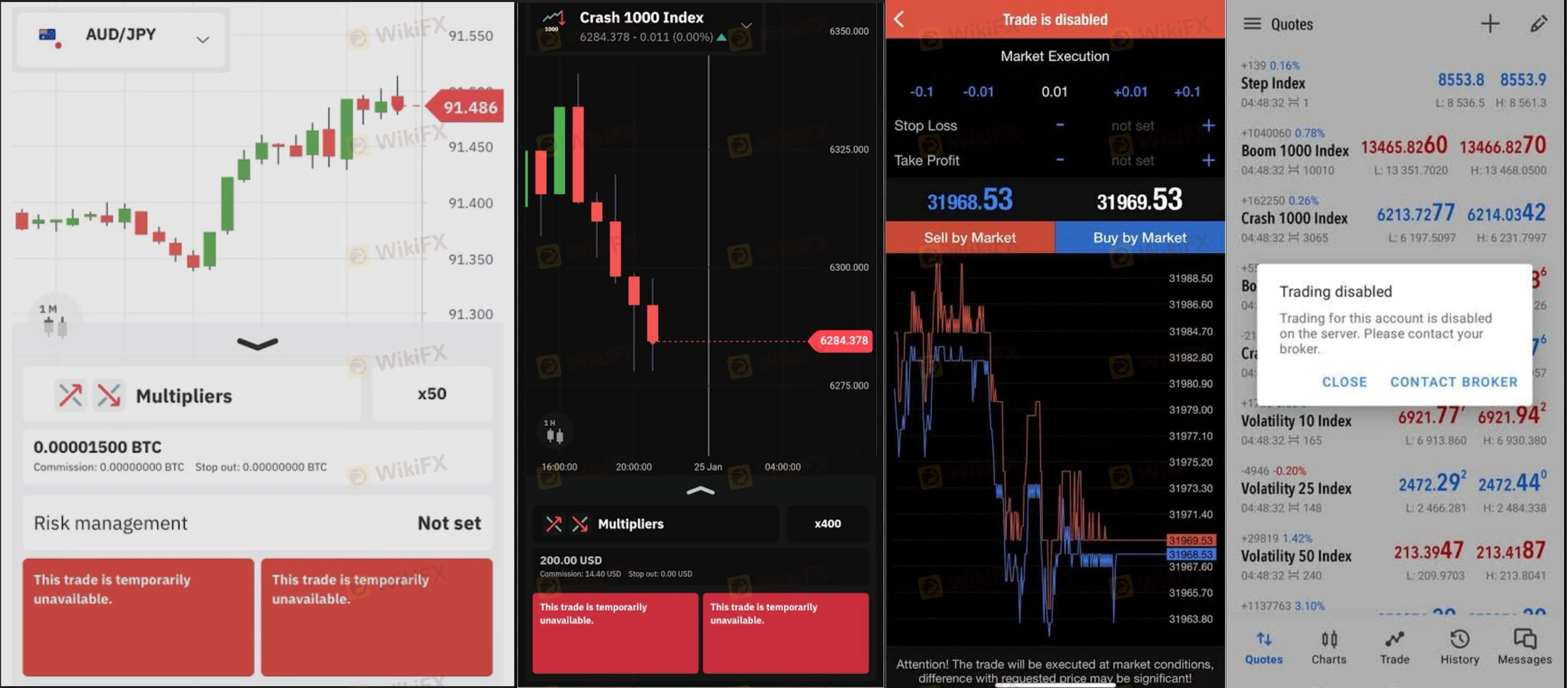

Leverage & Execution

While the official data does not explicitly cap the leverage, user feedback indicates that Deriv offers high leverage, which appeals to aggressive traders. However, this comes with substantial risk. Complaints (specifically cases from India and Indonesia) highlight instances where leverage was drastically reduced from 1:200 or higher down to 1:50 during active holding periods like the Non-Farm Payrolls. Such shifts can instantly trigger margin calls.

Pricing & Slippage

Does Forex pricing compete with top-tier providers? User evidence suggests inconsistency. Traders have reported significant slippage—execution at prices far worse than the stop-loss settings—even during stable market conditions. For a platform marketing itself on technological prowess, reports of “price jumps” and latency (up to 800ms difference from mainstream feeds) are concerning for high-frequency or scalping strategies.

3. User Feedback & Complaints

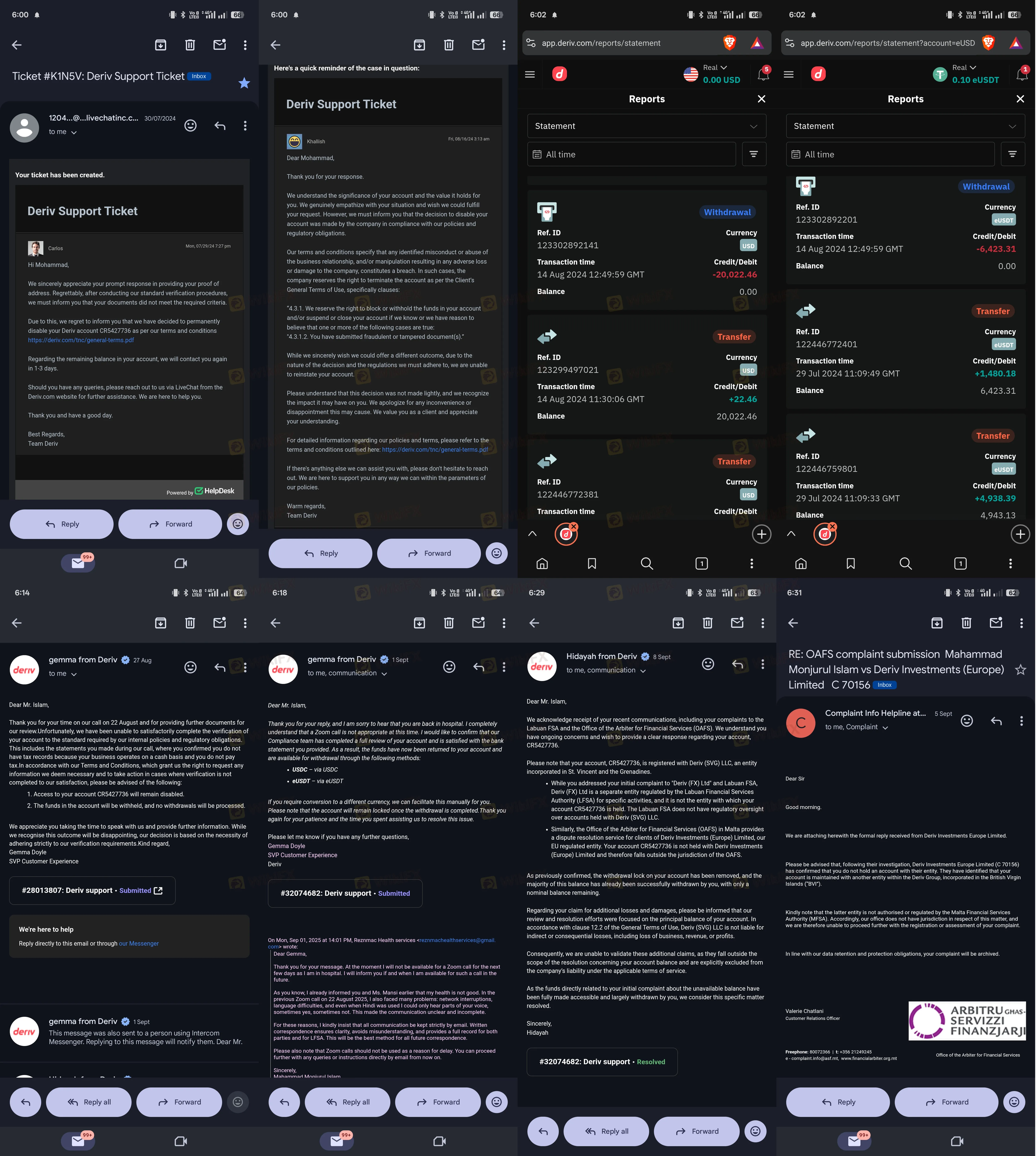

The volume of complaints against Deriv has surged, with WikiFX receiving 50 complaints within a recent three-month window. Analyzing the `casesText`, several alarming patterns emerge beyond standard trading losses.

Capital Access Issues

Numerous users from Nigeria, India, and Colombia have reported severe frictions when attempting to access their capital. Allegations range from “unusual trading” accusations used to freeze accounts to prolonged delays in processing withdrawals. One case detailed a 13-month delay requiring regulatory intervention before funds were released.

Technical Instability

Users have also reported difficulties with their login stability during critical trading windows. Case files describe scenarios where accounts were disabled while positions were open, preventing traders from managing risk. One user noted, “I couldn't close or manage my positions... [customer support] could not be reached through the website login,” highlighting a potential failure in crisis management protocols.

4. Software & Access

Deriv primarily utilizes the MetaTrader 5 (MT5) platform, known for its advanced charting and algorithmic capabilities.

Security Measures

To access the platform, traders must complete the login security steps. However, the software audit reveals a significant gap: the platform currently lacks two-step login (2FA) enforcement and biometric authentication for the standard interface. In an era where cybersecurity is paramount, this omission leaves accounts vulnerable to unauthorized access if primary credentials are compromised.

Platform Reliability

While MT5 is robust, Deriv's implementation has faced scrutiny. Reports of server name errors preventing access (Case 25) and the inability to use the login process during volatile markets suggest that the broker's server infrastructure may struggle under peak loads. For professional traders, reliable access is as vital as low spreads.

Final Verdict

Deriv presents a conflicting profile. On one hand, it is a highly influential broker with valid regulations in reputable jurisdictions like Malta and the UAE. On the other, the reliance on offshore regulation for global clients and a worrying trend of operational complaints—ranging from leverage manipulation to withdrawal denials—cannot be ignored.

Pros:

- Regulated by MFSA and UAE CMA.

- High market influence (AAA Rank).

- Access to MT5 software.

Cons:

- High volume of complaints (50 in 3 months).

- Reports of account freezing and slippage.

- Lack of 2FA for enhanced login security.

For real-time updates on regulation status or to verify the official login page, consult the WikiFX App before opening an account.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

China Holds Rates Steady After Hitting 5% Growth Target, Easing Expected in Q1

JPY Volatility Ahead: PM Takaichi Calls Snap Election Amid Rate Hike Speculation

Is Forex Still Worth It in 2026? Global Central Banks Are Splitting

The Fed on Trial: Markets Brace for Supreme Court Showdown Over Central Bank Independence

Trade War 2.0: Trump’s Greenland Ultimatum Rattles Transatlantic Alliance

Euro Stabilizes as France Forces 2026 Budget; Bond Spreads Narrow

JPY Volatility Spikes as PM Takaichi Calls Snap Election and Fiscal Gamble

JGB Yields Breach 4% as PM Takaichi's Fiscal Gambit Triggers 'Sell-Off'

Scrolled, Clicked, Lost RM166,000: Factory Worker Trapped by Online Investment Scam

China Macro: Liquidity Trap Signals Persist Despite Credit Bump

Currency Calculator