简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Everyone's A Lender Now: Shadow Banking USA

Abstract:Everyone wants to lend us money now, even though they're not banks:the insurance company Progressive

Everyone wants to lend us money now, even though they're not banks:the insurance company Progressive offered us a loan, PayPal offers us a business loan every time we log in, and the payment processor Stripe includes a pitch to borrow money on its dashboard page.

Then there's the ubiquitous offered by seemingly every vendor / retailer.

These are parts of the (SBS) that we see, but most of the system is hidden in the global economy's complex financial plumbing.The shadow banking system differs from nation to nation, as it developed to avoid whatever is tightly regulated or restricted within each banking system.

Here is a general definition:

In a global economy dependent on credit, leverage, artifice and speculation, the expansion of shadow banking is highly incentivized.How much of this activity and debt ends up in official statistics of credit is hard to know, even for experts, given that the goal of shadow banking is to avoid the regulations and restrictions that increase transaction costs and limit risk.

Risk brings us to the treacherous territory between and , as risk is a funny thing: it cannot be extinguished, but it can be cloaked, transferred to others, sold to the unsuspecting as “safe,” or buried beneath complexity. It can also lay dormant, slowly dissolving whatever holds the system together, a process that remains hidden until the avalanche surprises everyone who thought the snowmass was stable because it appeared stable.

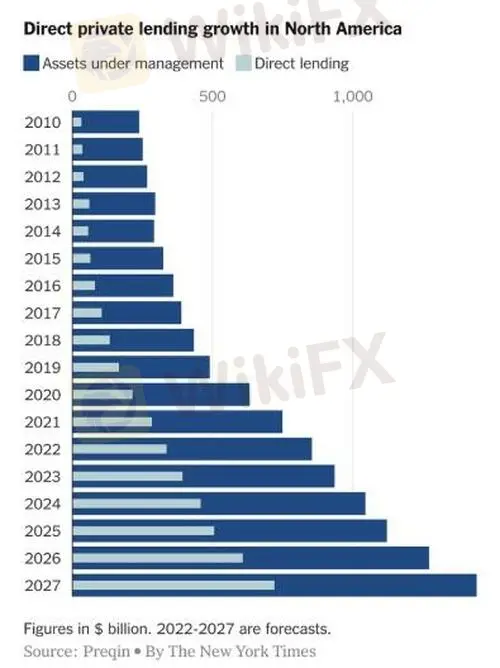

These links shed some light on the scale, asymmetries and risks built into a sprawling, highly interconnected, highly leveraged shadow banking system with few institutional safeguards or backstops.

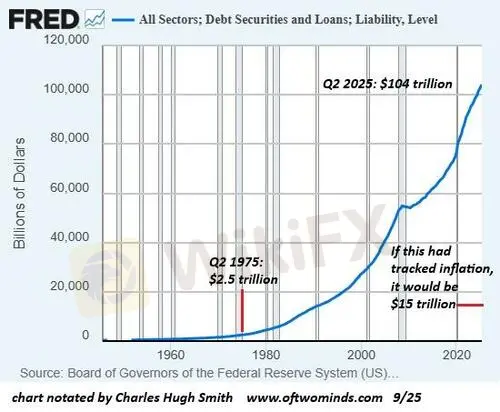

Total known credit is already a systemic risk.

How much private credit has been put in place but isn't in the official credit total is unknown and very likely unknowable. That means total systemic risk is also unknowable.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Understanding Dbinvesting Deposit and Withdrawal: What Traders Should Know

TradeEU Global Review 2026: Is this Forex Broker Legit or a Scam?

Emerging Markets: South African Fiscal Strains in Focus Amid Calls for SOE Reform

China Economic Watch: PMI Divergence and "Two Sessions" Signal Structural Shift

Is Tradier a trustworthy broker? A Tradier review and licensing overview based on WikiFX data.

Oil Spikes 9% and Shipping Rates Soar as Middle East Logistics Fracture

AssetsFX Review 2026: Is this Broker Safe?

Fed Beige Book: Stagflation Risks Rise as Growth Stalls While Prices Stick

Asia Market Volatility: KOSPI Stages Historic 12% Rebound as Capital Flows Pivot

Evest Broker Review: Regulated, but Complaints Persist

Currency Calculator