Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:OneRoyal is an Australian-based brokerage established in 2012 that offers trading services across global markets. With over a decade of operation, the broker has established a significant presence, holding licenses from top-tier regulators like ASIC and CySEC. However, despite its strong regulatory framework, recent user feedback paints a conflicting picture involving withdrawal struggles and severe slippage.

OneRoyal is an Australian-based brokerage established in 2012 that offers trading services across global markets. With over a decade of operation, the broker has established a significant presence, holding licenses from top-tier regulators like ASIC and CySEC. However, despite its strong regulatory framework, recent user feedback paints a conflicting picture involving withdrawal struggles and severe slippage.

With a WikiFX score of 6.42 and an “AA” trading environment ranking, OneRoyal appears solid on paper. However, a recent surge in complaints requires a closer look at whether this broker is truly safe for retail investors.

The primary indicator of a broker's safety is its regulatory oversight. OneRoyal operates under a complex structure involving multiple legal entities, ranging from top-tier protection to offshore regulation.

Regulatory Licenses:

| Regulator | Country | License Type | Status |

|---|---|---|---|

| ASIC | Australia | Tier 1 (High Safety) | Regulating |

| CySEC | Cyprus | Tier 2 (Europe) | Regulating |

| AMF | France | Tier 1 (Europe) | Regulating |

| VFSC | Vanuatu | Offshore | Offshore Regulation |

Regulatory Analysis:

OneRoyal holds highly respected licenses from the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC). These regulators enforce strict capital requirements and segregation of client funds.

However, many international clients are onboarded through the Vanuatu (VFSC) entity. This offshore license allows for higher leverage (up to 1:1000) but offers significantly less protection than Australian or European standards. Additionally, investors should be aware that the Securities Commission of Malaysia (SC) has issued a warning regarding OneRoyal for carrying out unauthorized capital market activities.

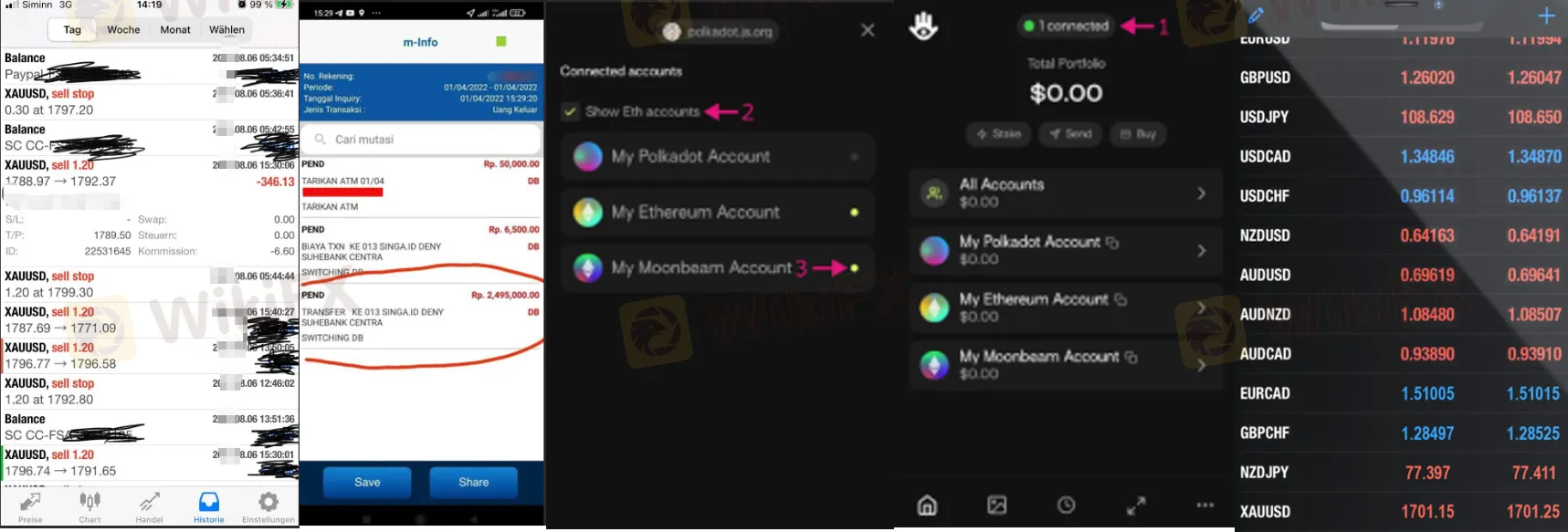

While the regulatory background is strong, the practical user experience has raised red flags. In the last three months alone, there have been 23 formal complaints lodged against the broker. The allegations fall into three alarming categories: withdrawal failures, platform dominance, and bonus traps.

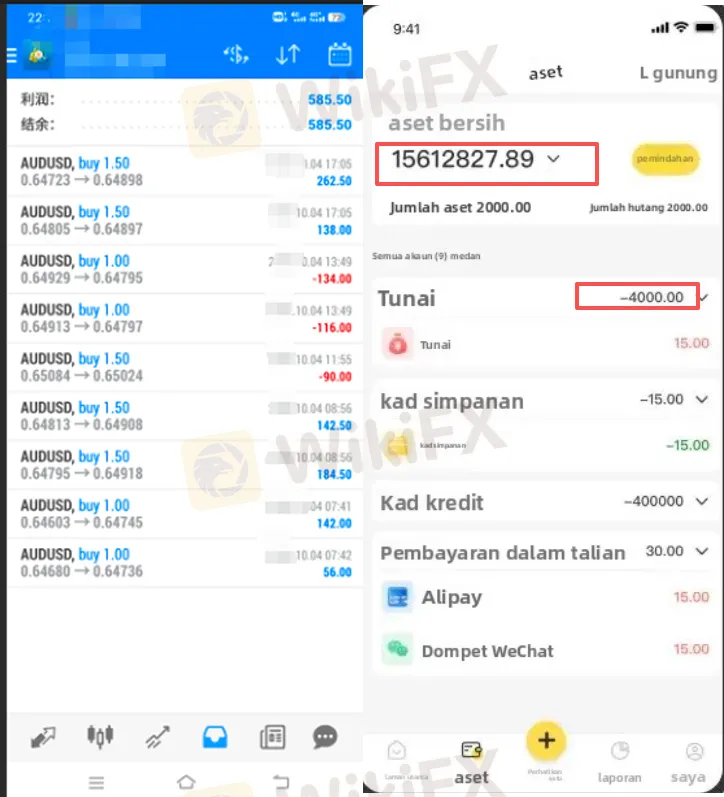

A significant number of traders have reported being unable to access their funds. Reports from users in Malaysia and other regions detail instances where withdrawal requests are rejected without clear justification or remain “under review” for over 15 days.

Deducted Profits: Some traders claimed their profits were deducted under accusations of “illegal trading” or “abnormal market fluctuations,” even when they believed they traded legitimately.

Multiple case studies highlight massive slippage, where the price a trade is executed at differs vastly from the requested price.

Price Discrepancies: Traders have accused the platform of showing price feeds that differ from the international market rate, specifically fluctuating wildly during attempts to close positions to force losses.

Several complaints mention an “AI Intelligent Trading System” promoted by the broker (or affiliates) guaranteeing high returns (e.g., 20% monthly). Users reported that backtest data was manipulated to look profitable, but real trading resulted in rapid losses.

Additionally, one user reported a 50% deposit bonus trap where funds were locked until a trading volume turnover of 30 times the bonus amount was achieved—a requirement often impossible to meet without losing the principal.

For users who do not encounter these operational issues, OneRoyal offers a robust technical environment with flexible account options.

OneRoyal supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These are the industry standards, offering advanced charting and automated trading capabilities (EAs). The platform availability is rated “Perfect,” though it lacks proprietary mobile apps for smoother account management.

The broker offers five distinct account types to suit different traders:

OneRoyal offers extremely high leverage up to 1:1000. While this allows for maximizing small deposits, it also increases the risk of rapid liquidation, especially given the slippage reports mentioned in user reviews.

Pros:

Cons:

The verdict on OneRoyal is complicated. Legally, it is a legitimate broker with valid licenses from top-tier regulators like ASIC and CySEC. However, the operational reality reported by recent users contradicts this safety. The accumulation of complaints regarding denied withdrawals, price manipulation, and misleading bonus schemes suggests significant risk, particularly for clients registered under the offshore (Vanuatu) entity.

While the trading conditions (spreads and platforms) are competitive, the risk of capital being locked or lost to “technical errors” currently outweighs the benefits for many retail traders. Caution is strongly advised.

To ensure you stay protected and avoid brokers with withdrawal issues, verify the specific entity you are registering with. Use the WikiFX app to check the latest regulatory warnings and real-time user reviews before making any deposit.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a "Use with Caution" designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones. Read on for an insightful review.