Abstract:This article is about the two brokers, Valetax and Taebank Markets.

Overview of Valetax and Taebank

Valetax

- Offers a broad range of instruments: forex (60+ currency pairs), indices, metals, energy, cryptocurrencies, etc.

- Supports popular trading platforms (MT4, MT5) across desktop, web, and mobile.

- Provides multiple account types: cent, standard, ECN, booster, bonus, professional — with low minimum deposit (from $1) and high maximum leverage (up to 1:2000).

- Spread and execution environment look competitive per WikiFXs testing: low average slippage (~0.2), fast execution speed (for many trades), and generally acceptable performance metrics.

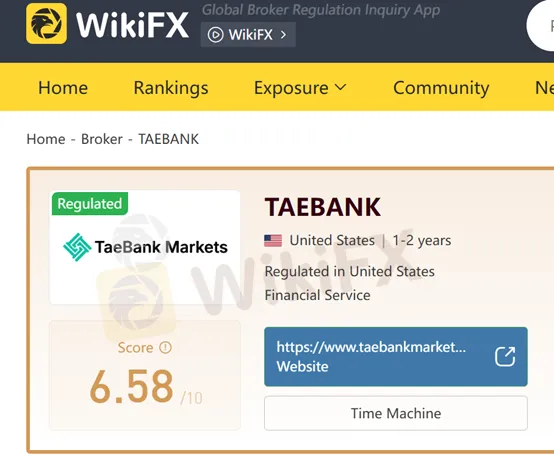

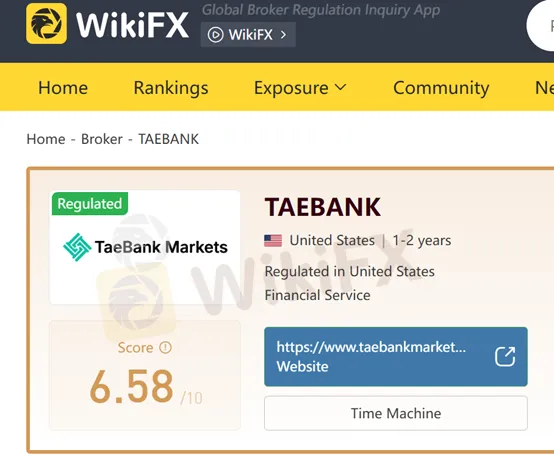

Taebank Markets

- According to WikiFX, Taebank Markets is registered with the U.S. Financial Crimes Enforcement Network (FinCEN) as a “Financial Service / MSB” under registration number 31000294262261.

- Marketed as offering trading in forex, commodities, shares, etc., with “ultra-fast execution” and access to a broad range (150+) of trading instruments.

Minimum deposit reportedly low when using cryptocurrency (e.g. USDT: $50), which may appeal to traders looking for an accessible entry.

Valetax

- Broad asset coverage, multiple account types, flexible min deposit — good for beginners and those who want flexibility.

- Competitive execution environment: low slippage and reasonable spreads (including ECN-type spreads) in many trades.

- Low-cost entry (from $1) and high leverage — can be appealing for traders using small capital or scaling up via leverage (though that increases risk).

Taebank Markets

- Registered with FinCEN (U.S.), which at least gives a baseline legal registration status.

- Offers a wide array of instruments and claims fast execution; low entry barrier (via crypto deposits) may appeal to some traders.

Trader Profiles & Recommendations

What to Watch Out For

- Use minimal capital: If you test either, treat it as “for trial” — deposit only what you can afford to lose.

- Monitor withdrawals and account history carefully: If delays, problems with withdrawal, or communication emerge, it may be a signal to withdraw entirely.

Consider regulated alternatives: Especially if you value fund security, regulatory oversight, and long-term stability — many brokers regulated by major authorities may offer lower leverage but much stronger protections.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.