简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Beware Malaysians! EmiraX Markets is the New Broker on the Block

Abstract:How do you determine whether a broker is truly legitimate and professional? To the dismay of many, flashy websites and rebranded platforms often conceal deeper issues. EmiraX Markets is one such broker currently under scrutiny.

How do you determine whether a broker is truly legitimate and professional? To the dismay of many, flashy websites and rebranded platforms often conceal deeper issues. EmiraX Markets is one such broker currently under scrutiny. While it may appear legitimate at first glance, a closer look at its WikiScore, licence status, and trader feedback reveals worrying signals that Malaysian investors should not ignore.

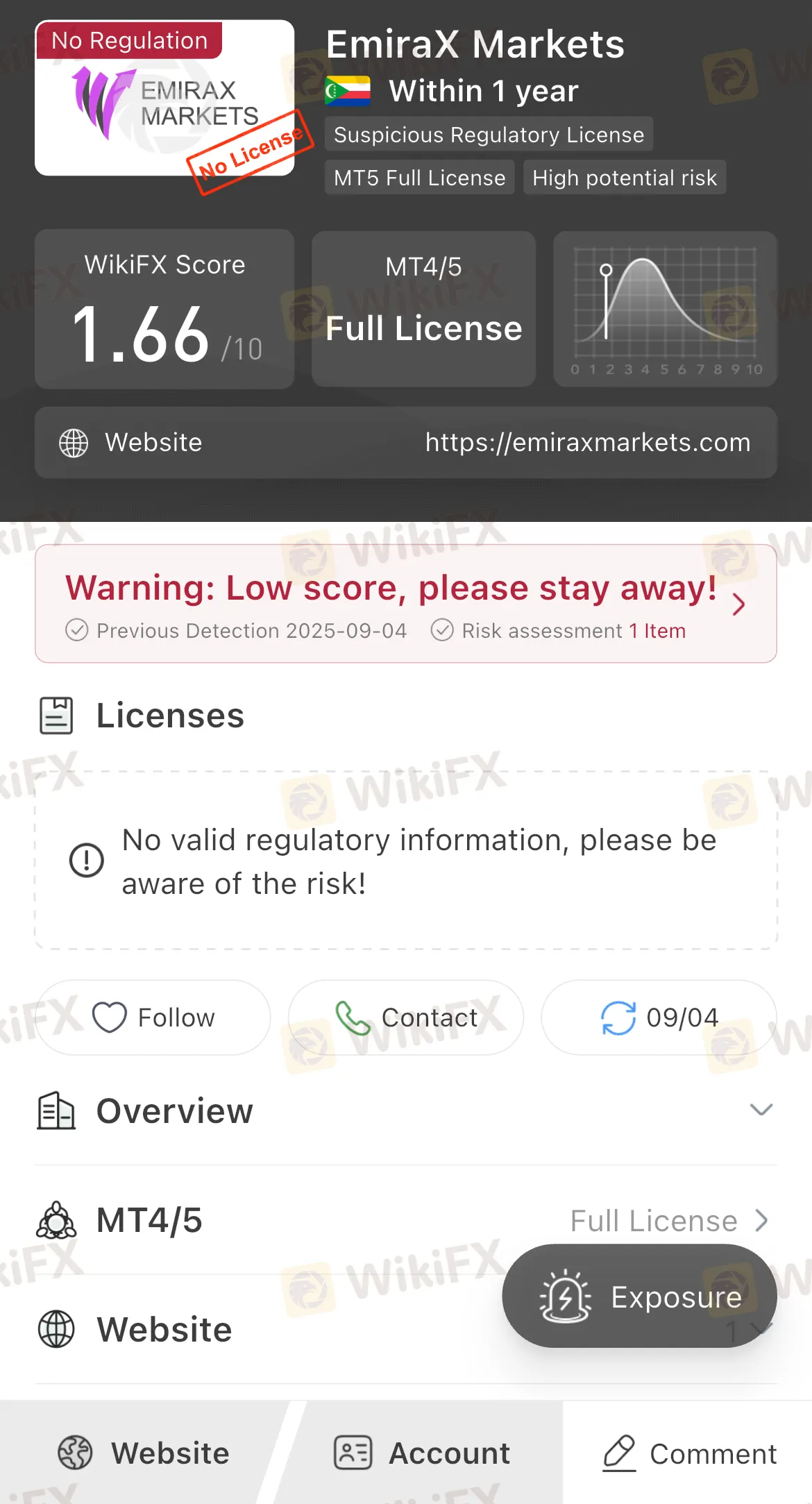

WikiScore and Regulatory Standing

According to WikiFX, EmiraX Markets carries a very low WikiScore, reflecting concerns about its credibility and performance. WikiScores are calculated using a mix of licensing information, regulatory compliance, market reputation, and trader feedback. A low rating is not a technicality, but a clear indicator of risk.

View WikiFXs full review on EmiraX Markets here: https://www.wikifx.com/en/dealer/1020332792.html

In terms of regulation, EmiraX Markets claims to operate under offshore authorisation. However, no regulatory licence is tied to this broker. Without oversight from established regulators such as the UKs Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC), traders are left with minimal to no protection should disputes arise. For Malaysian investors, this is particularly concerning, as local protection is not available in cases involving offshore entities.

Not on the SC‘s Investor Alert List, But Still Risky

It is important to highlight that EmiraX Markets has not yet been added to the Securities Commission Malaysia’s (SC) Investor Alert List. However, absence from this list does not mean safety. The SCs Investor Alert List is updated periodically, and many brokers with questionable practices may continue operating until official action is taken. Malaysian traders should therefore exercise caution and not assume that being “off the list” equates to being risk-free.

Underlying Risks on EmiraX Markets Official Website

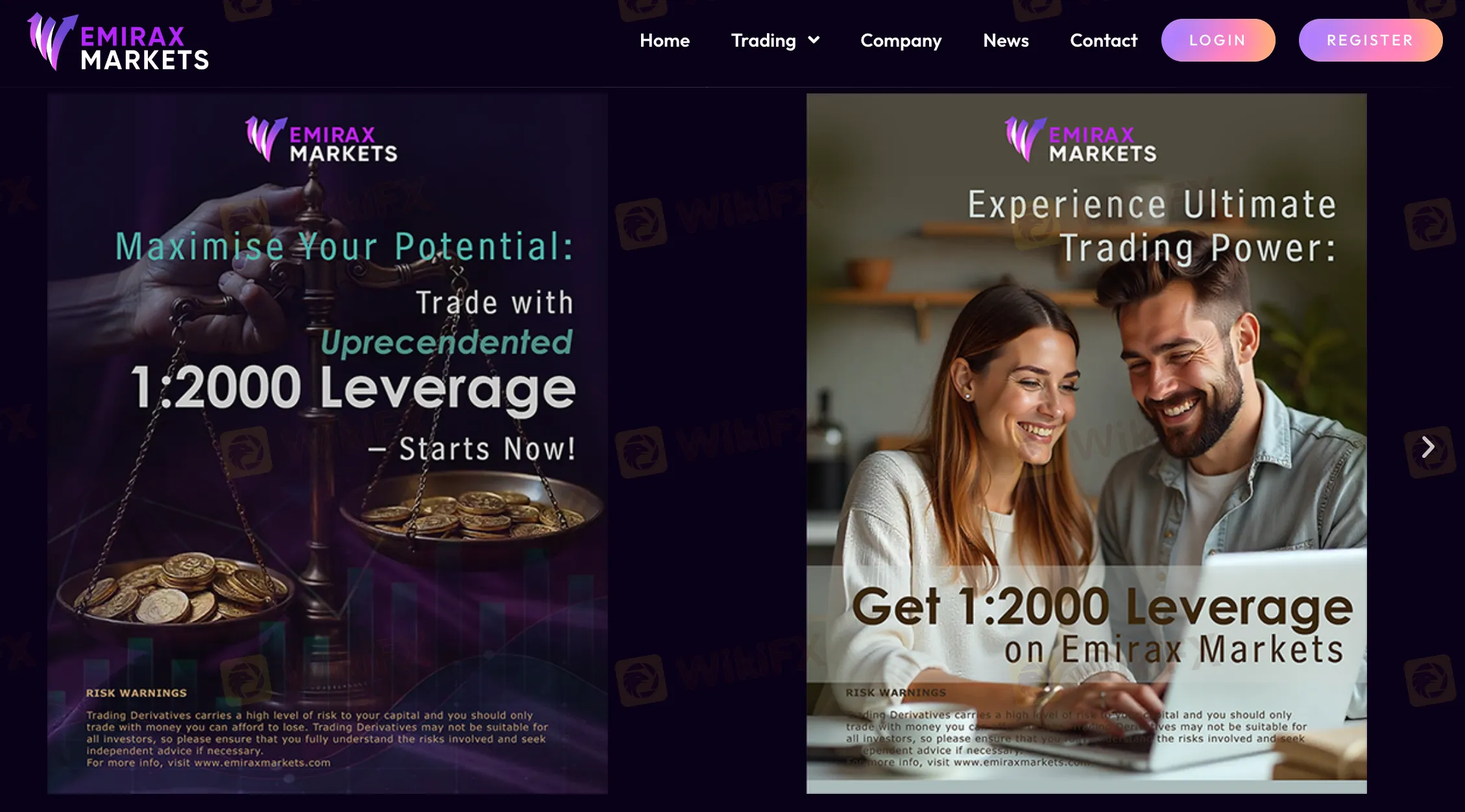

EmiraX Markets raises immediate concerns with its aggressive promotion of 1:2000 leverage. While such leverage may entice traders with the promise of larger profits, in practice, it exposes them to devastating losses, where even a price swing of less than one per cent can wipe out an entire account. This is why respected regulators such as the FCA, ASIC and CySEC cap retail leverage at far safer levels, usually 1:30 on major forex pairs. By ignoring these standards, EmiraX Markets appears more interested in gathering deposits than protecting clients.

The broker also offers only one Standard Account with a minimum deposit of just USD 15. Although this looks attractive to beginners, it is less about accessibility and more about strategy. Offshore brokers often set ultra-low deposits to lure inexperienced traders, knowing these clients are least likely to challenge poor execution, hidden costs or difficulties in withdrawing funds.

Even its website slogan, “trading bigger,” reflects a push to encourage deposits rather than provide a safe environment.

Most troubling is the lack of transparency around withdrawals. While EmiraX Markets advertises “instant deposits and withdrawals,” it does not disclose which payment methods are supported, what the limits are, how long transactions take, or whether fees apply. For regulated brokers, publishing this information is standard practice. Here, the silence is a red flag. Without clear withdrawal rules, traders risk facing blocked transfers, unexplained delays, or unexpected deductions, with little or no legal recourse due to the broker‘s offshore status. In forex, withdrawals are the ultimate measure of a broker’s integrity, and EmiraX Markets fails this test by keeping its policies hidden.

Why Malaysian Traders Must Prioritise Regulation and Reviews

For Malaysian investors, the number one rule when choosing a broker is clear: licence first, reputation second. Both go hand in hand in ensuring a secure trading environment.

- Regulation Equals Protection

A valid licence from a strong regulatory authority ensures client funds are held securely, disputes are arbitrated fairly, and misconduct is punishable. Offshore licences often lack these protections.

- Trader Reviews Reflect Reality

While a broker may claim competitive spreads and innovative platforms, reviews from traders reveal how the broker actually treats its clients, whether withdrawals are smooth, support is responsive, and rules are transparent.

- Local Jurisdiction Is Critical

No matter how attractive a broker may seem, if it is not regulated in Malaysia, traders have no legal recourse under Malaysian law. This leaves investors vulnerable to scams or unresolvable disputes.

Conclusion: Safety Is Always Number 1!

EmiraX Markets may present itself as a legitimate broker, but its low WikiScore, questionable licence status, and negative trader reviews point towards significant risks. The fact that it has not yet appeared on the SCs Investor Alert List should not be mistaken for a green light.

For Malaysian traders, the lesson is simple but crucial: always place regulatory compliance and trader reviews above marketing claims. A brokers glossy image or offshore licence is no substitute for the protection offered by local and reputable regulatory authorities.

When trading your hard-earned money, remember: safety is not negotiable.

t

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

New AI laws to arrest deepfakes

Global Macro: Real Wage Growth Expected to Return by 2026

XAU/USD: Gold Rally Signals 'Paradigm Shift' as Middle East Tensions Simmer

MONAXA Review 2026: Comprehensive Safety Assessment

BoC Preview: Macklem to Hold at 2.25% Amidst Trade Anxiety

Fed Holds Rates as Political Storm Intensifies; Trump to Name New Chair Imminently

Meta and Samsung Fuel AI Capex Boom, Keeping Risk Sentiment Alive

Gold Smashes $5,600 Record on Shutdown Fears; Analysts Flash Crash Warning for Silver

FxPro Enhances MetaTrader 5 Execution with New LD4 Cross-Connect

Fed Holds Rates Amidst Political Siege; Dollar Sinks to Four-Year Lows

Currency Calculator