Abstract:Despite holding a reputable regulatory license, the broker Libertex has become the subject of intense scrutiny, accumulating 43 user complaints within just three months. Our investigation into trader feedback reveals a disturbing pattern: aggressive "account managers" who allegedly guide clients toward financial devastation, coupled with a withdrawal system that traps funds indefinitely. Is this a safe trading environment, or a "wolf in sheep's clothing"?

Abstract: Despite holding a reputable regulatory license, the broker Libertex has become the subject of intense scrutiny, accumulating 43 user complaints within just three months. Our investigation into trader feedback reveals a disturbing pattern: aggressive “account managers” who allegedly guide clients toward financial devastation, coupled with a withdrawal system that traps funds indefinitely. Is this a safe trading environment, or a “wolf in sheep's clothing”?

Note: All cases mentioned are based on real user records submitted to WikiFX. To protect privacy, the identities of the traders have been anonymized.

The “Personal Advisor” Trap

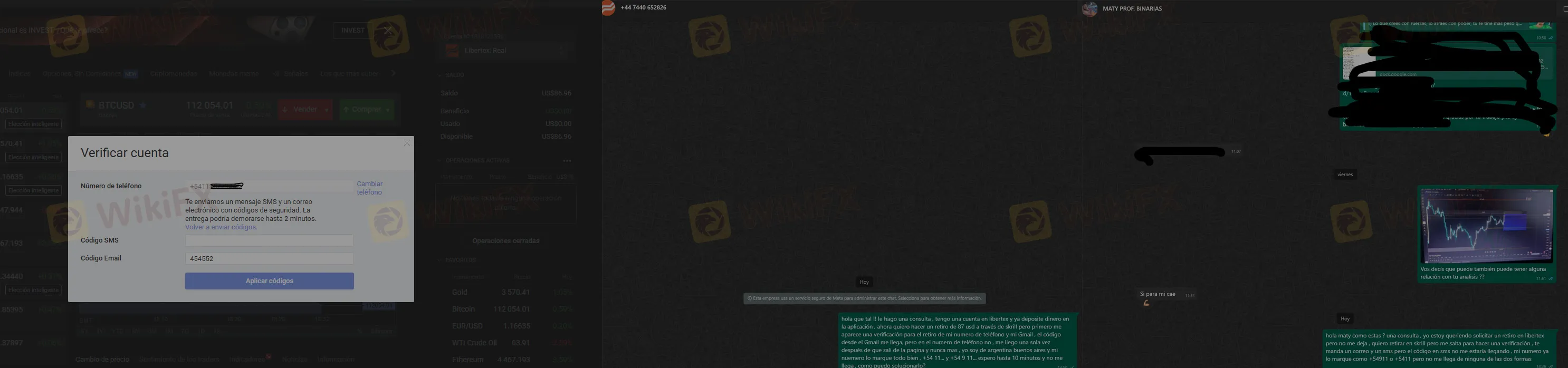

For many novice traders, the promise of a professional “Account Manager” implies safety and guidance. However, WikiFX has received numerous reports suggesting that at Libertex, this feature may be the primary mechanism for client losses.

Traders describe a highly organized process. It begins with unsolicited, persistent phone calls. A trader from Romania detailed an experience where he was contacted by individuals posing as “Chief Managers,” specifically named “Jose Heredia” and “Andreas.” These figures presented themselves with the polish of Wall Street professionals, promising consistent profitability and risk-free strategies. Similarly, a user from the Dominican Republic reported being harassed by advisors promising “secure returns,” only to be guided toward a total loss.

The psychological manipulation appears to be sophisticated. In one case from Argentina, a trader described being groomed by an advisor named “Julia” (or “Juliana”). The pattern involved an initial period of small, successful trades to build trust, followed by aggressive pressure to deposit more funds to unlock “bonuses” that never materialized.

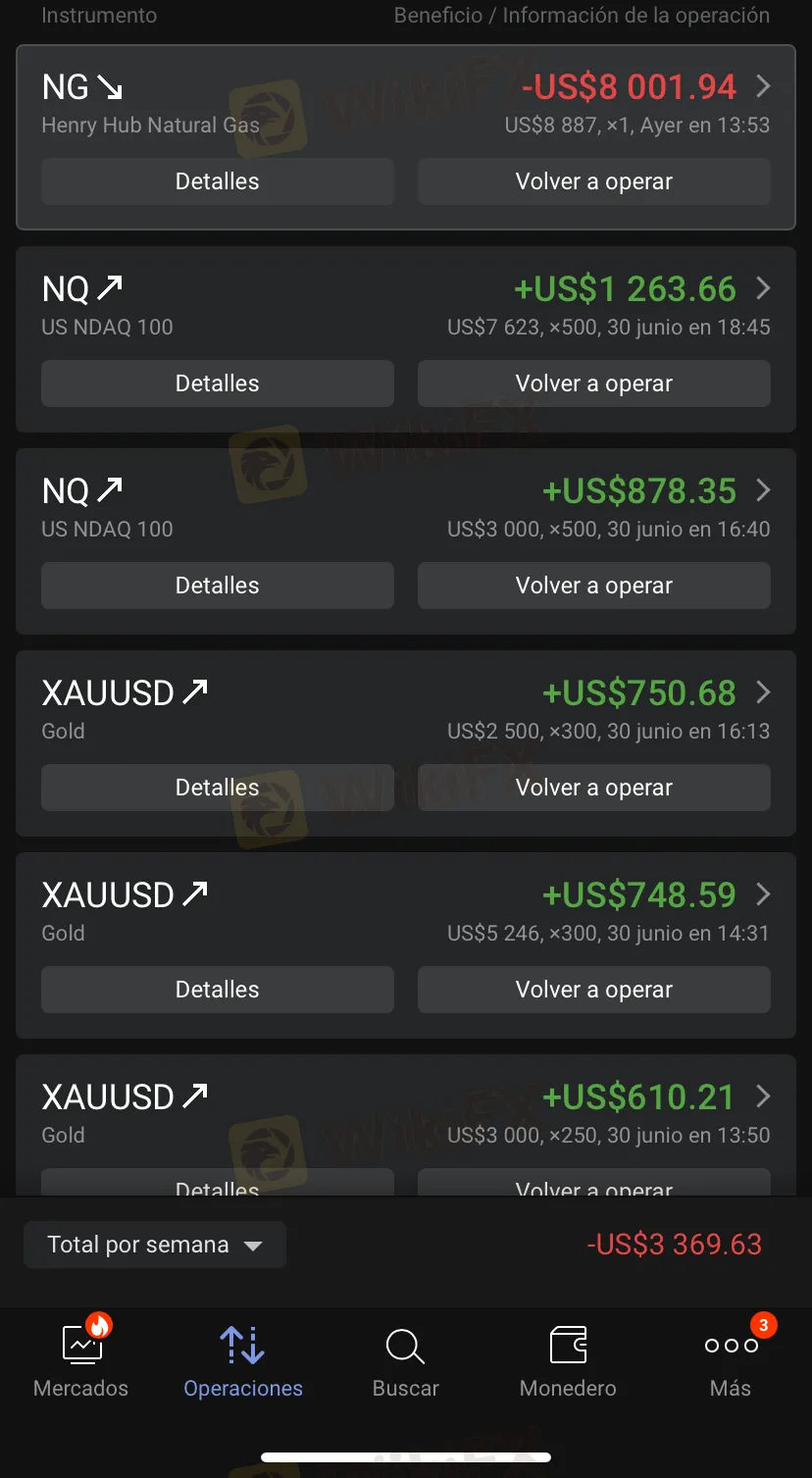

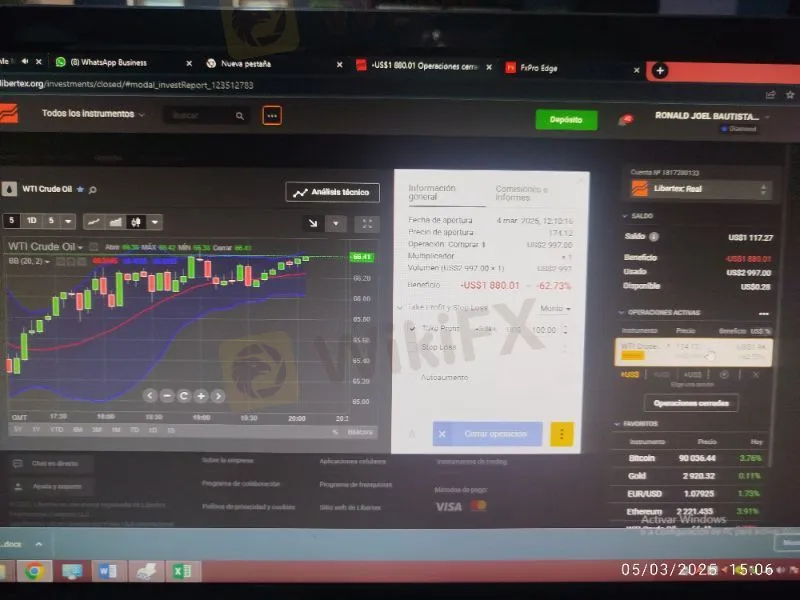

The “One-Trade Wipeout” Mechanism

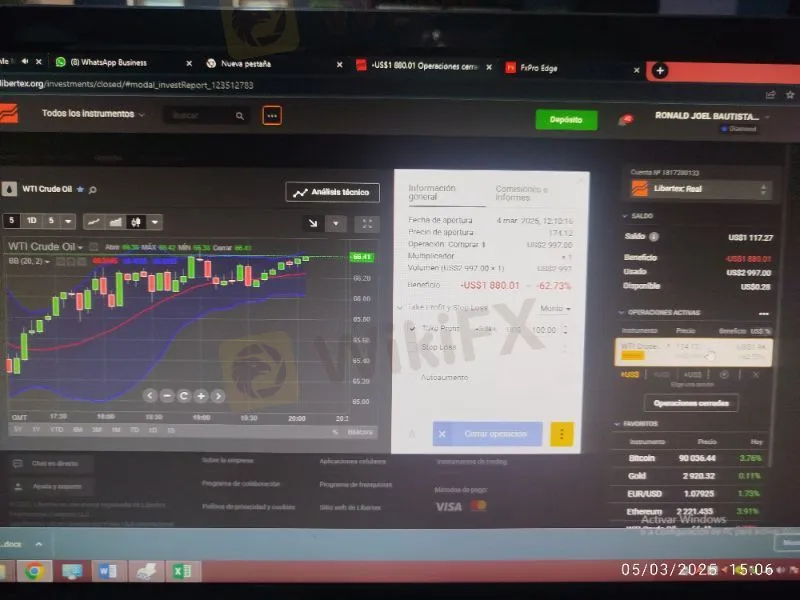

The most alarming trend identified in the complaints is the sudden shift from conservative trading to high-risk gambling—all under the direct instruction of Libertex representatives.

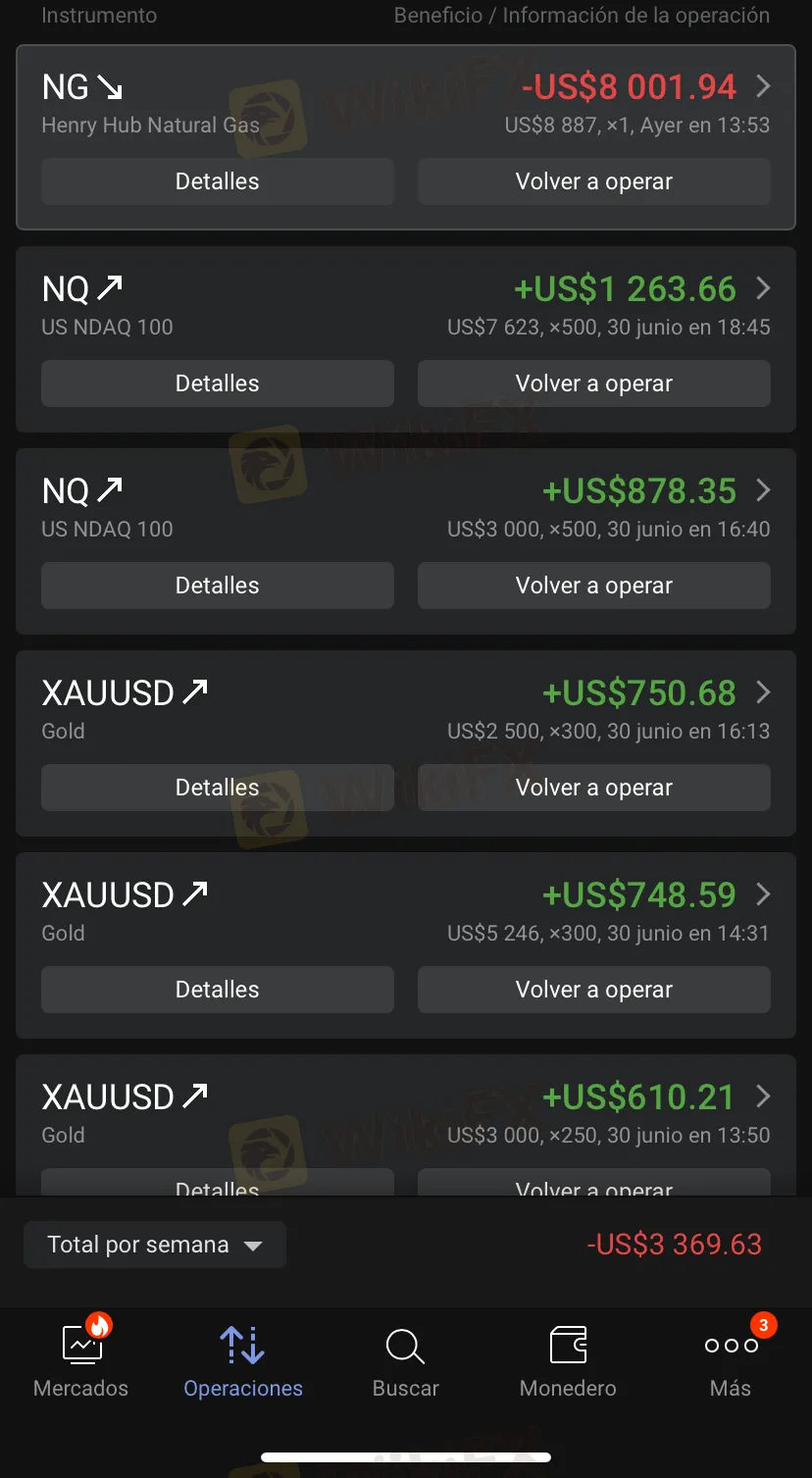

Multiple traders from Colombia, Peru, and Panama have reported identical scenarios. After building up the account balance, the advisor recommends a specific, high-leverage trade—often involving assets like Natural Gas (NG).

A trader from Colombia recounted a harrowing experience on May 28, 2025. While on the phone with an advisor, they were instructed to open an operation with a 60x multiplier on Henry Hub Natural Gas. When the trade immediately went negative, a second call came from the “Risk Team,” demanding more liquidity to save the operation. The result? A loss of $3,400 in a single session.

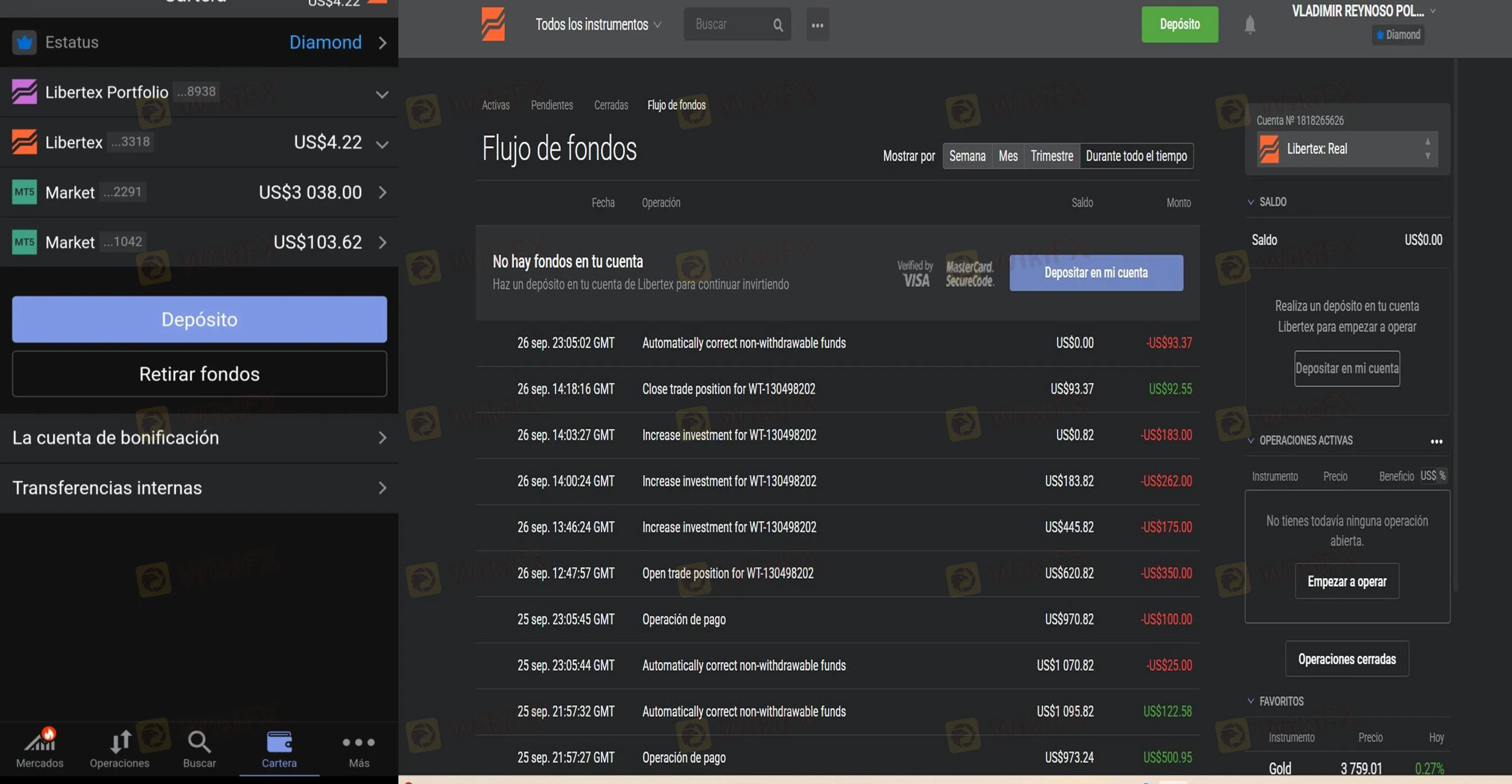

Another victim from Peru, managed by an advisor named “Melania,” was encouraged to deposit nearly $11,000 over time. After six successful trades, the advisor guided the client into a Gas trade that utilized the “auto-increase” feature, draining the entire capital and profits in minutes. These are not isolated incidents; they appear to be a systemic method of erasing client liabilities.

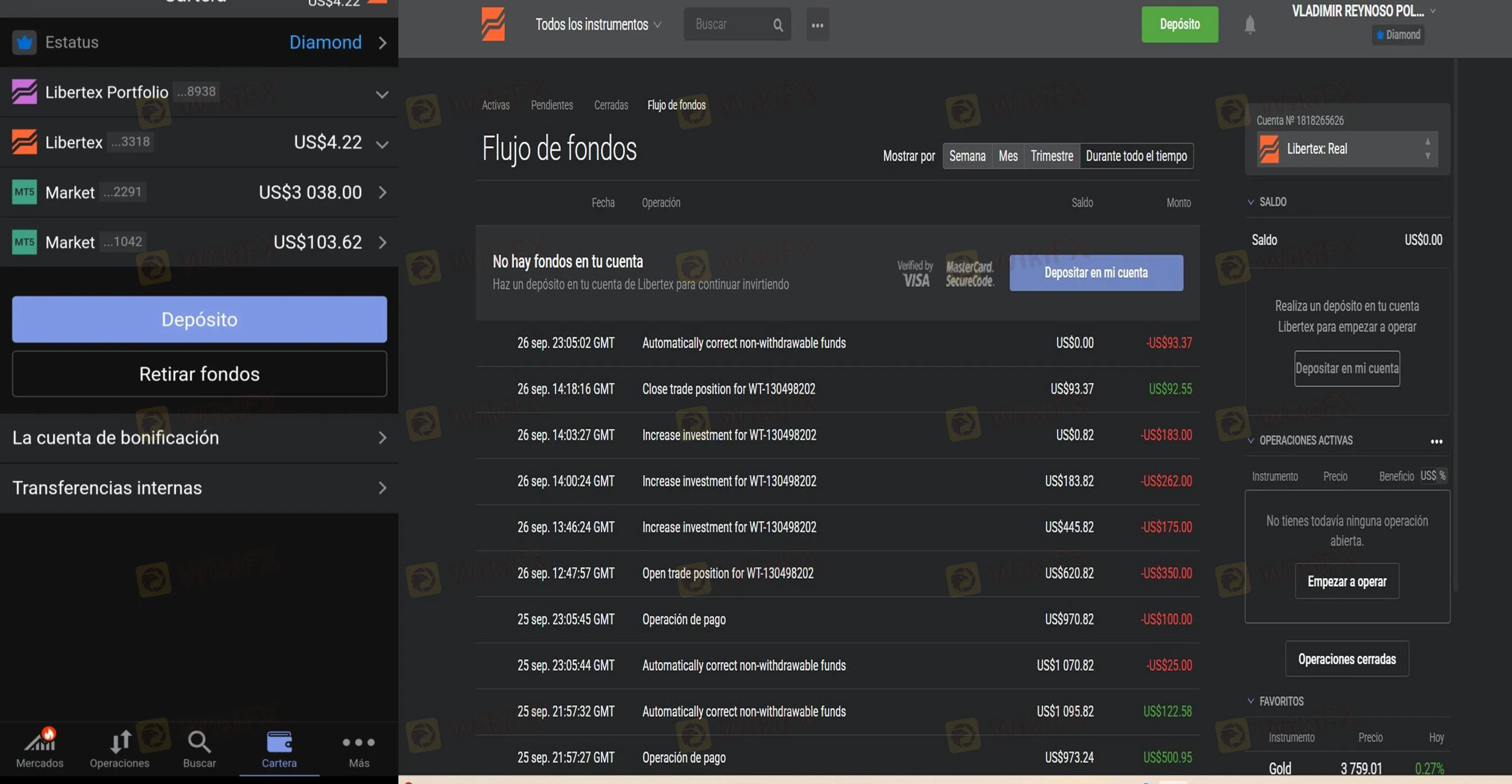

The Withdrawal Maze: “Technical Errors” and Infinite Verification

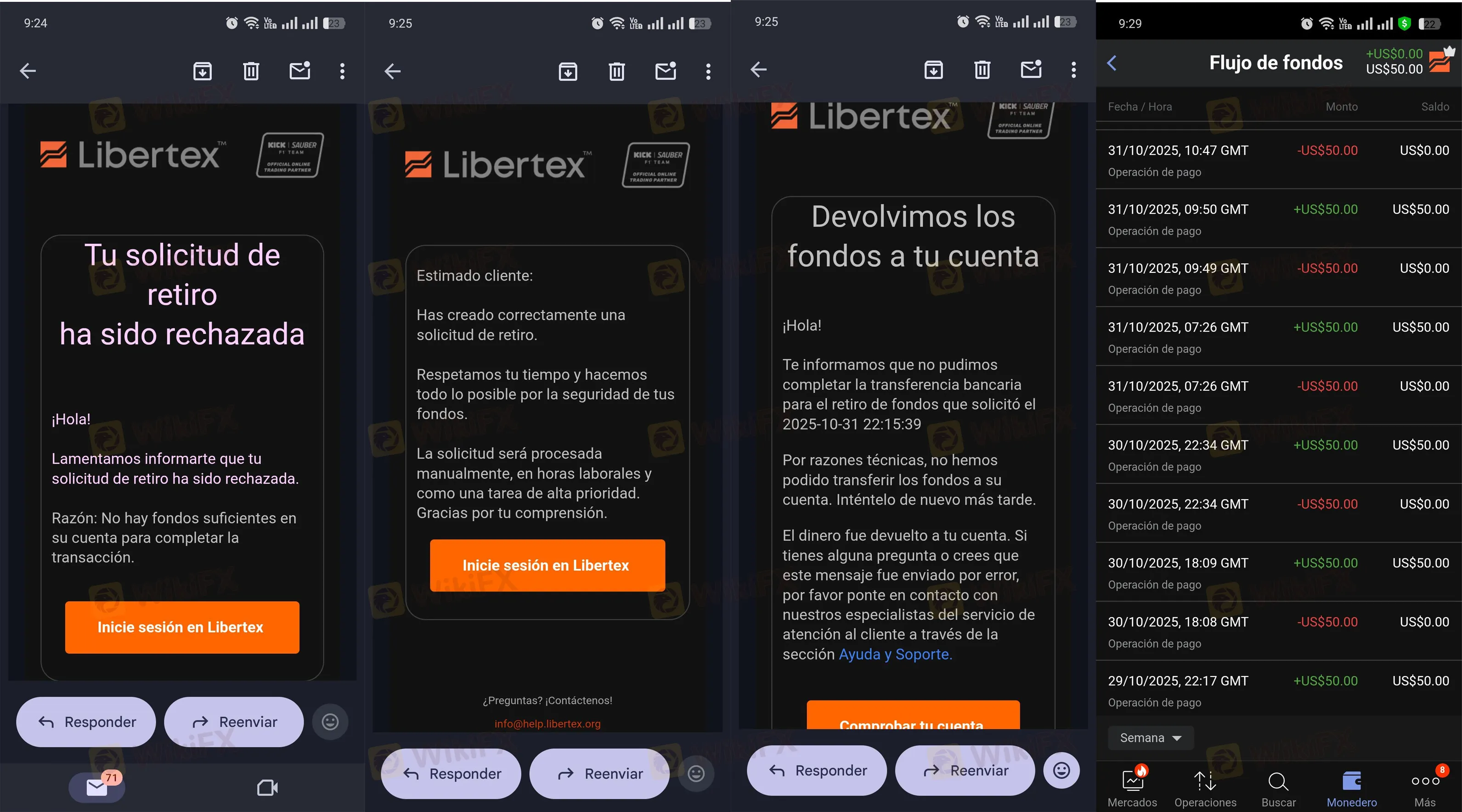

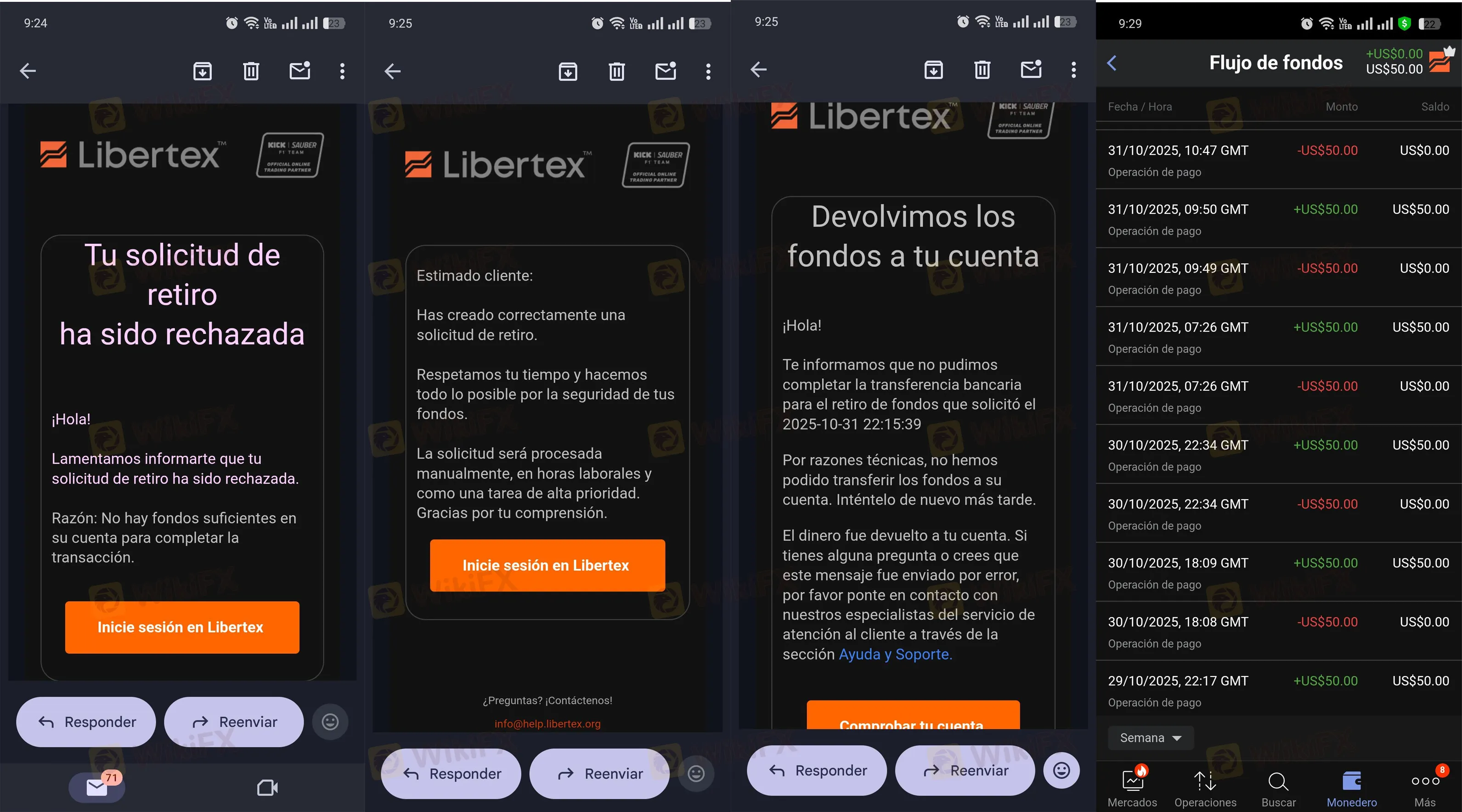

If a trader chooses to ignore the advisors and attempts to withdraw their own funds, they often face a different set of hurdles. The feedback suggests that money flows into Libertex instantly, but retrieving it is an arduous battle.

A trader from Mexico, who had successfully withdrawn small amounts previously, found their account frozen when attempting to withdraw over $3,000. The platform demanded endless verification documents, including screenshots of payment methods with specific commercial logos and timestamps. Even after compliance, the withdrawal remained unprocessed, accompanied by threats of account suspension.

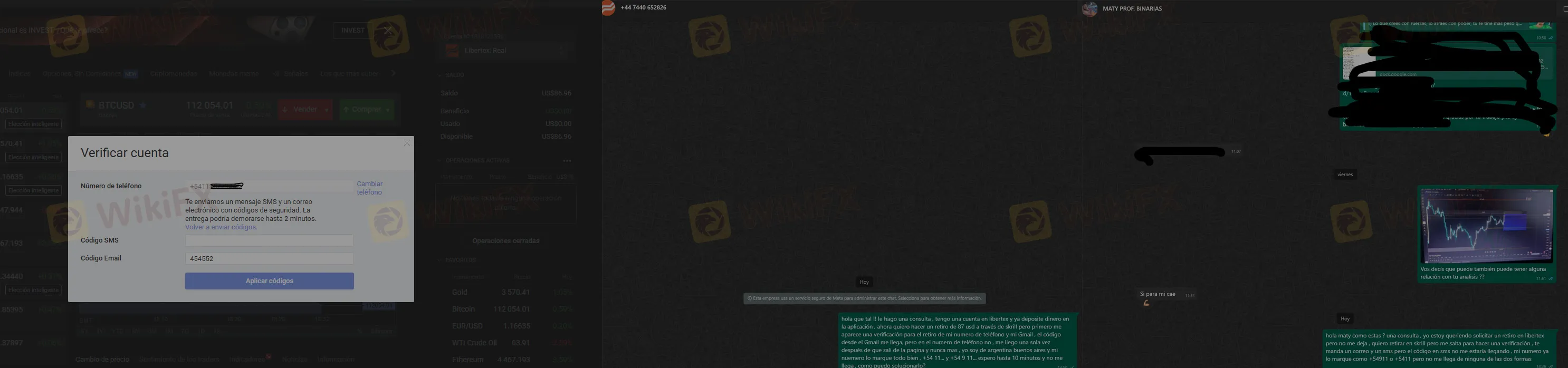

In Argentina, another user reported that while waiting for a withdrawal verification code (which arrived via email but never via SMS, blocking the process), their account balance mysteriously began to decrease.

Others report “technical errors” where approved withdrawals are bounced back to the trading account, trapping the user in a cycle of futility.

Anomalies in Market Data

Beyond the human element, there are concerns regarding the integrity of the platform itself. A trader from Pakistan described a “trading dilemma” where price lines seemingly moved in direct opposition to their orders the moment buttons were pressed. While market volatility is real, allegations of “countermove lines” suggest potential backend manipulation designed to trigger stop-losses or liquidate accounts faster.

Combined with reports from Malaysia stating that the website returns “404 Errors” immediately after registration and deposits, the technical stability of Libertex raises serious questions about its reliability for retail clients.

Regulatory Reality check

Libertex presents a complex regulatory profile. While they hold a valid license from a top-tier European regulator, their offshore entity allows them to onboard clients from Latin America and Asia without the stringent protections mandated by EU laws. Furthermore, regulatory bodies in Southeast Asia have already taken action against the brand's domain.

Below is the verified regulatory status of Libertex as per WikiFX records:

It is crucial to note that the Indonesian regulator (BAPPEBTI) blocked Libertex domains, categorizing them alongside gambling and illegal futures trading sites. This serves as a significant warning sign for traders globally regarding the broker's operational compliance outside of Europe.

Verdict

While Libertex possesses a legitimate CySEC license, the overwhelming volume of complaints regarding aggressive “advisory” practices creates a stark divergence between their regulatory status and their treatment of clients in unregulated jurisdictions. The pattern of advisors guiding clients to high-leverage losses, combined with persistent withdrawal obstructions, suggests a high-risk environment.

WikiFX urges traders to be extremely cautious of any broker offering “personal investment advice” via phone, as this often constitutes a conflict of interest.

Risk Warning: Foreign exchange and CFD trading involve a high level of risk and may not be suitable for all investors. Leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your initial investment.