Abstract:Forex trading has become increasingly popular among Muslim traders seeking financial freedom and global investment opportunities. It’s essential to ensure that trading activities remain halal (permissible) and comply with Shariah law. This article offers tips for Muslim traders to stay halal while trading in the forex market.

Forex trading has become increasingly popular among Muslim traders seeking financial freedom and global investment opportunities. However, for those following Islamic principles, its essential to ensure that trading activities remain halal (permissible) and comply with Shariah law. This article offers tips for Muslim traders to stay halal while trading in the forex market.

Understanding Forex Trading in Islam

Forex (foreign exchange) trading involves buying and selling currencies to profit from price movements. While the concept of trade is not prohibited in Islam, certain aspects of modern forex trading may raise Shariah concerns, such as:

• Riba (interest): Earning or paying interest is strictly forbidden in Islam.

• Gharar (excessive uncertainty): Highly speculative or uncertain trades are considered haram.

• Leverage and margin: Using borrowed funds (especially with interest) is problematic in Islamic finance.

Is Forex Trading Halal or Haram?

Islamic scholars are divided on whether forex trading is halal. Some consider it permissible if done under specific conditions, while others caution against it due to its speculative nature. The consensus among many scholars is that forex trading can be halal, provided it avoids interest-based transactions and follows ethical practices.

Tips to Stay Halal While Trading Forex

1. Use an Islamic Forex Account (Swap-Free Account)

Many trusted forex brokers offer Islamic trading accounts that follow Shariah law, so Muslim traders can trade without going against their beliefs. These accounts are swap-free, which means they don‘t charge or pay any interest when you keep trades open overnight. They also don’t have any hidden charges that act like interest. To make sure everything is in line with Islamic rules, these accounts are usually checked and approved by experts in Islamic finance. This makes it easier for Muslim traders to trade with confidence and peace of mind.

2. Avoid High-Risk, Speculative Trading

In Islam, trading that involves too much uncertainty (gharar) or feels like gambling (maysir) is not allowed. To keep your trading halal, you should avoid risky strategies like binary options or scalping, which are more like guessing than real trading. Instead, make sure you use proper analysis to guide your trades, not just luck or hunches. Also, its important to manage your risk and stay disciplined so that your trading stays safe, responsible, and in line with Islamic principles.

3. Avoid Leverage with Interest-Based Loans

Many forex platforms offer leverage, which means you can trade larger amounts with a small amount of money. This can help increase your profits, but it also comes with risks. In Islam, if using leverage involves paying or receiving interest (riba), it is considered haram (not allowed). Interest is not allowed in Islamic finance because it is unfair and goes against Shariah rules. So, Muslim traders should be careful and only use leverage that does not include any interest.

4. Choose a Halal Trading Strategy

Currency hedging is also allowed if it's done for real business needs and not just for making quick profits. However, traders should avoid short-selling or any trades that feel like gambling, as these go against Islamic teachings. Choosing the right trading style helps Muslim traders stay within the limits of Shariah law while still being active in the market.

5. Work With Shariah-Compliant Broker

When choosing a forex broker, its important for Muslim traders to partner with one that follows Islamic values. The broker should also be regulated and have a good reputation to make sure your money is safe and handled properly. Most importantly, the broker should be compliant with Islamic finance principles, so you can trade with confidence, knowing your activities are halal and in line with your faith.

Conclusion

Forex trading can be halal if done correctly. By choosing Islamic accounts, avoiding interest and speculation, and trading ethically, Muslim traders can participate in global markets without compromising their faith. Always consult with a qualified Islamic scholar or financial advisor to ensure your trading practices align with Shariah principles.

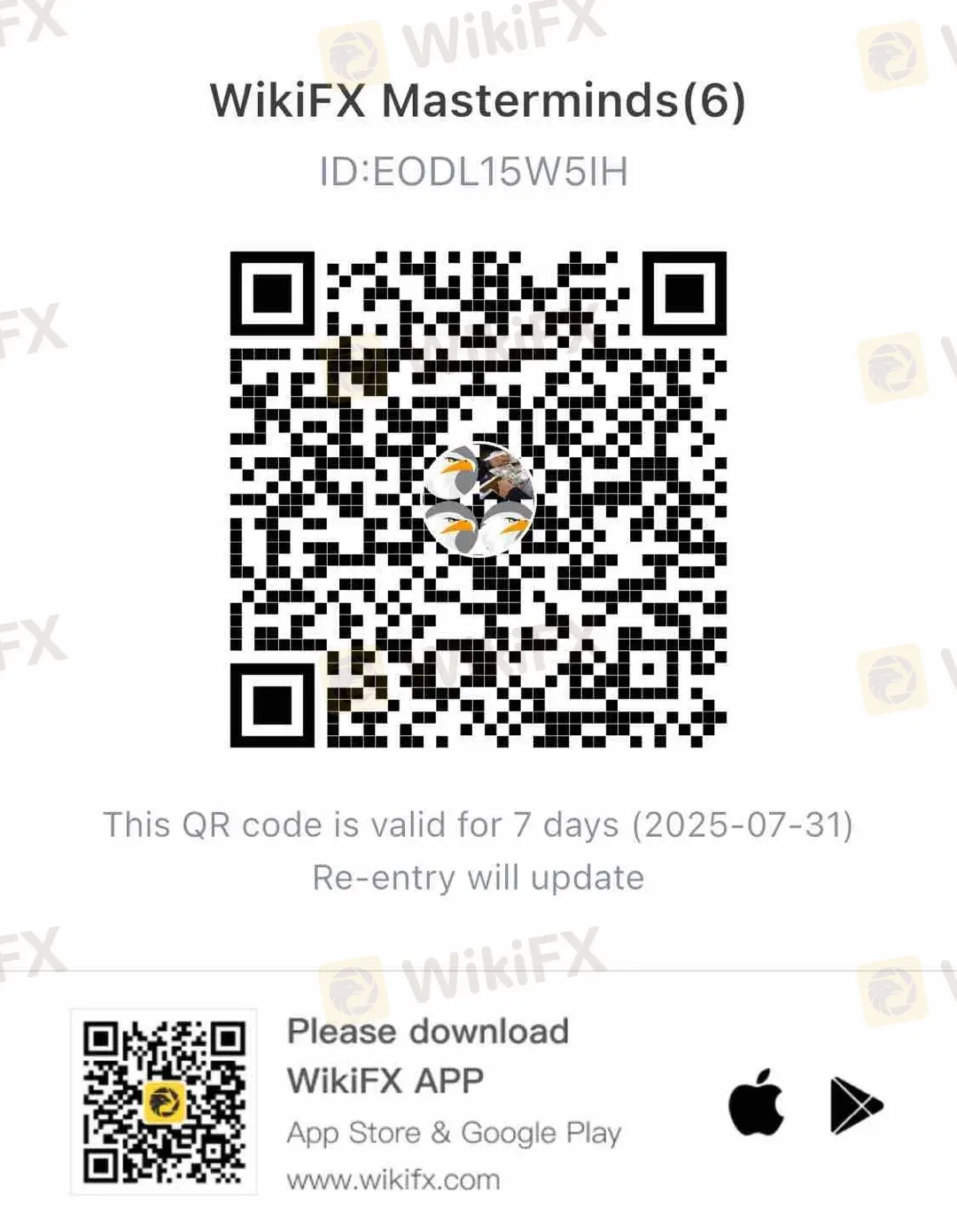

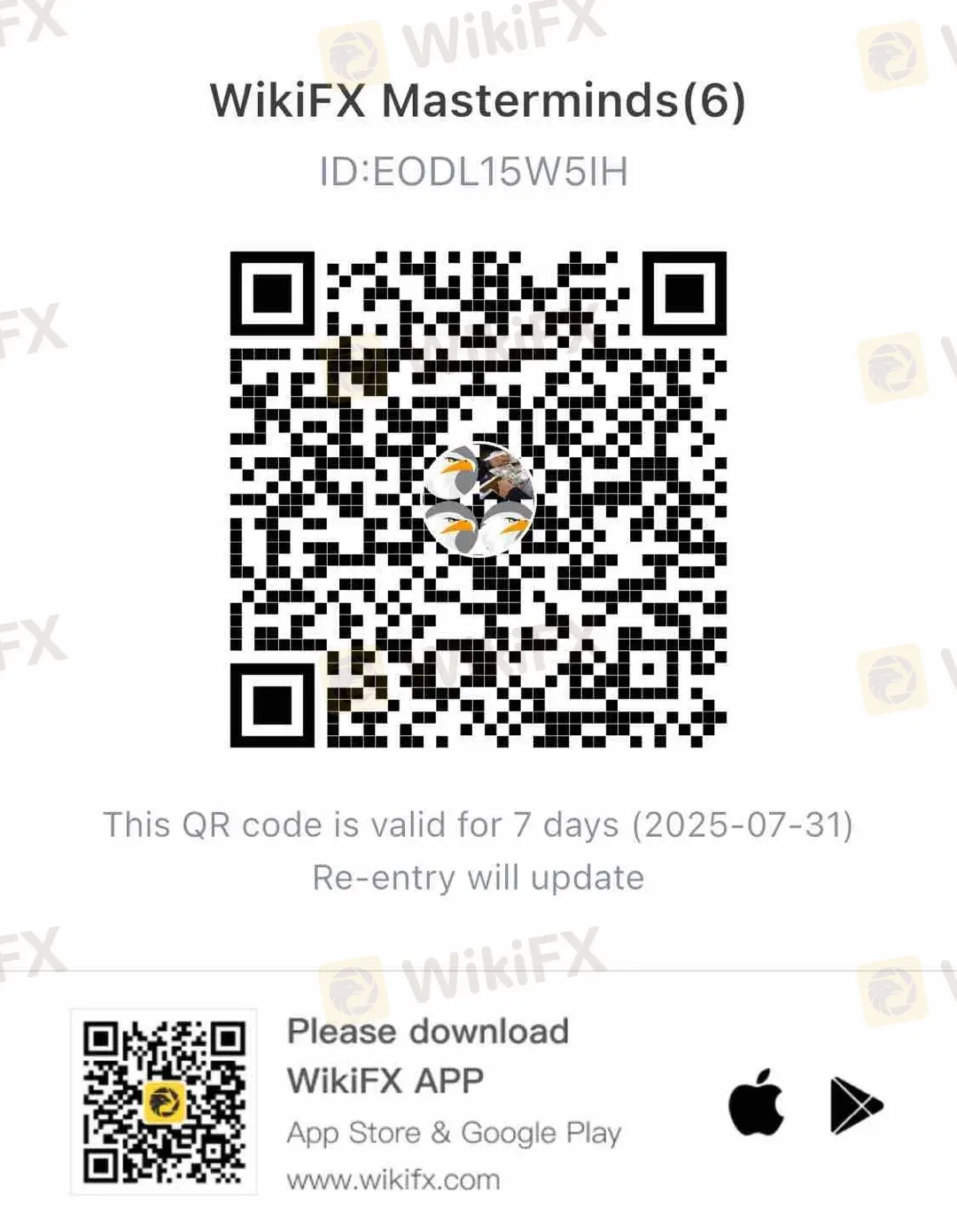

Join WikiFX Community

Stay alert and informed with WikiFX- your one-stop destination for everything related to the Forex market. Whether you're looking for the latest market updates, scam alerts, or reliable information about brokers. Its the go-to platform for traders who want to protect their investments and make smarter decisions. Join the WikiFX Community today by scanning the QR code at the bottom and stay one step ahead in the world of Forex trading.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!