Abstract:For traders asking, "Is ZarVista legit?", the evidence points to a clear and strong conclusion: ZarVista operates as a high-risk broker. While it shows a modern interface and different account types, these features are overshadowed by major weaknesses in how it is regulated, a history of legal problems, and many user complaints. This article will break down these issues to give you a complete view of the risks involved.

Our analysis shows that the chance of losing capital when dealing with ZarVista is very high. The combination of weak overseas licensing and documented problems creates a situation where trader funds are not properly protected.

Decision: Scam or Real?

This investigation answers the important question traders are asking: Is ZarVista a scam? After looking carefully at its rules, legal history, and what users say, the answer is clear. While ZarVista works as a trading platform, it shows many serious warning signs that match risky and possibly fake operations. The main problems we will explain in detail are: it uses weak overseas rules, many users complain about withdrawal problems, and government authorities are watching it closely. This report gives you the facts you need to decide if your capital is safe.

The Decision Summary

ZarVista, which used to be called ZaraFX, is too risky for any trader who wants their money to be safe. It works under weak rules that don't really protect investors. This problem gets worse because of legal troubles and many believable user reports about big problems getting their capital out. We say ZarVista is a high-risk broker, and the facts show that using this platform could mean losing a lot of funds.

What This Investigation Covers

To give a clear answer, this fraud investigation is written like a detective report. We will examine ZarVista's licenses and legal problems, look at patterns of real user complaints, and compare what the broker promises against the real risks to your capital. Our goal is to give you a clear, fact-based understanding of the dangers.

Warning Sign 1: Rules and Oversight

A broker's regulatory status shows how trustworthy it is. For ZarVista, this foundation has serious problems. The broker works under licenses from places known for weak oversight and poor investor protection, which is common among risky companies. This weak regulatory system gets worse because of a major legal incident with government authorities, raising serious questions about whether the company operates legally and honestly.

Looking at ZarVista's Licenses

ZarVista's regulatory claims depend on two offshore licenses, and neither provides the strong protection seen with top regulators like the FCA or ASIC.

· Comoros (MISA): The company has license number T2023293 / HY00623401 from the Mwali International Services Authority. The Comoros Union is popular with brokers wanting light regulation. This place has low international recognition, small capital requirements, and weak enforcement, making it poor protection for client funds.

· Mauritius (FSC): Under the name Zara Trading Limited, the company has a license number GB23202450 from the Financial Services Commission of Mauritius. An important warning about this license: the Mauritius FSC doesn't publicly show the domain names of its licensed companies. This lack of transparency creates a big risk of identity fraud, as it becomes hard for a trader to definitely confirm that the website they're using is the same one covered by the license.

Importantly, both of these offshore regulatory systems offer no investor compensation fund. This means if ZarVista became bankrupt or simply disappeared, there is no safety net or established legal process to help clients get back their deposited capital.

India's ED Raid Warning

The most alarming warning sign is the legal action taken against the broker. In August 2025, India's Enforcement Directorate (ED) conducted raids on four office locations connected to ZaraFX (ZarVista's previous name). The operation resulted in freezing bank accounts containing about ₹39 million (around USD 445,000).

The official accusations were serious: running an illegal forex trading platform and breaking India's strict currency laws under the Foreign Exchange Management Act (FEMA). The investigation also targeted the company's CEO, Jamsheer Thazhe Veettil. While the company responded by saying it doesn't have operations or subsidiaries in India and doesn't market to Indian residents, the raid by a major government financial crime agency is an undeniable and serious criticism of the company's practices and reputation. It suggests a willingness to operate in legal grey areas, which puts client interests at extreme risk.

Action Step: Check Licenses

Regulatory information can change, and brokers can lose licenses or have new warnings issued against them. Before working with any broker, especially one with an offshore profile like ZarVista, independent checking is not optional—it is essential.

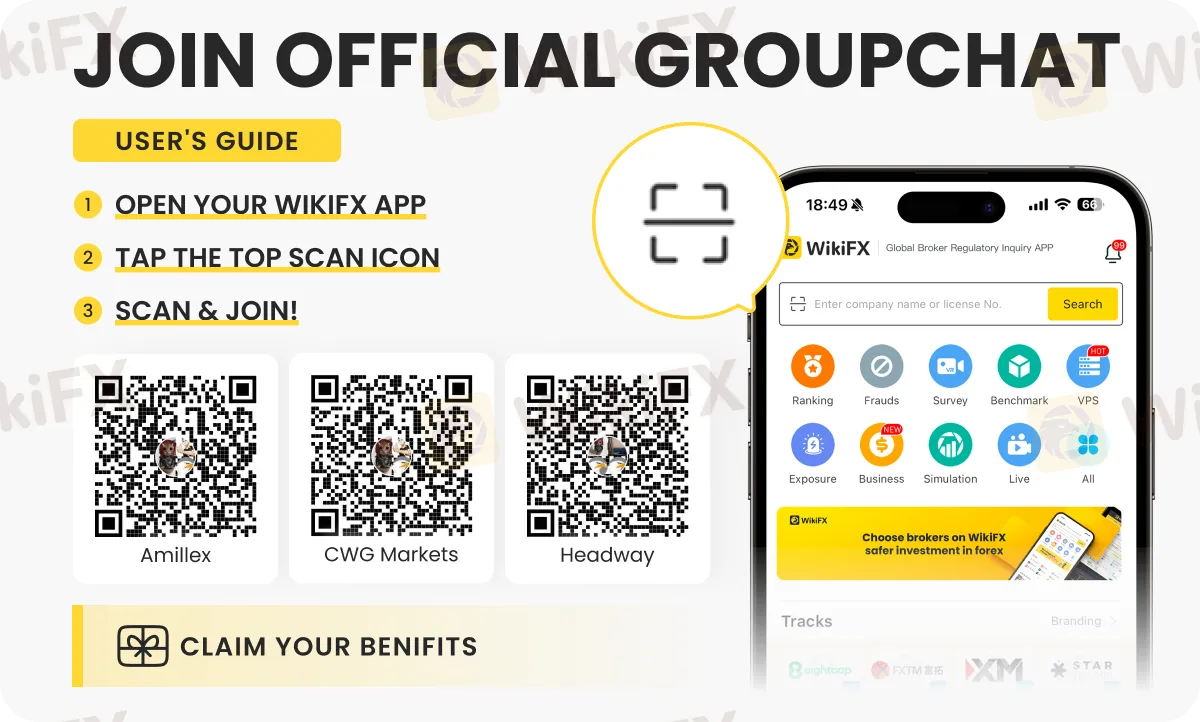

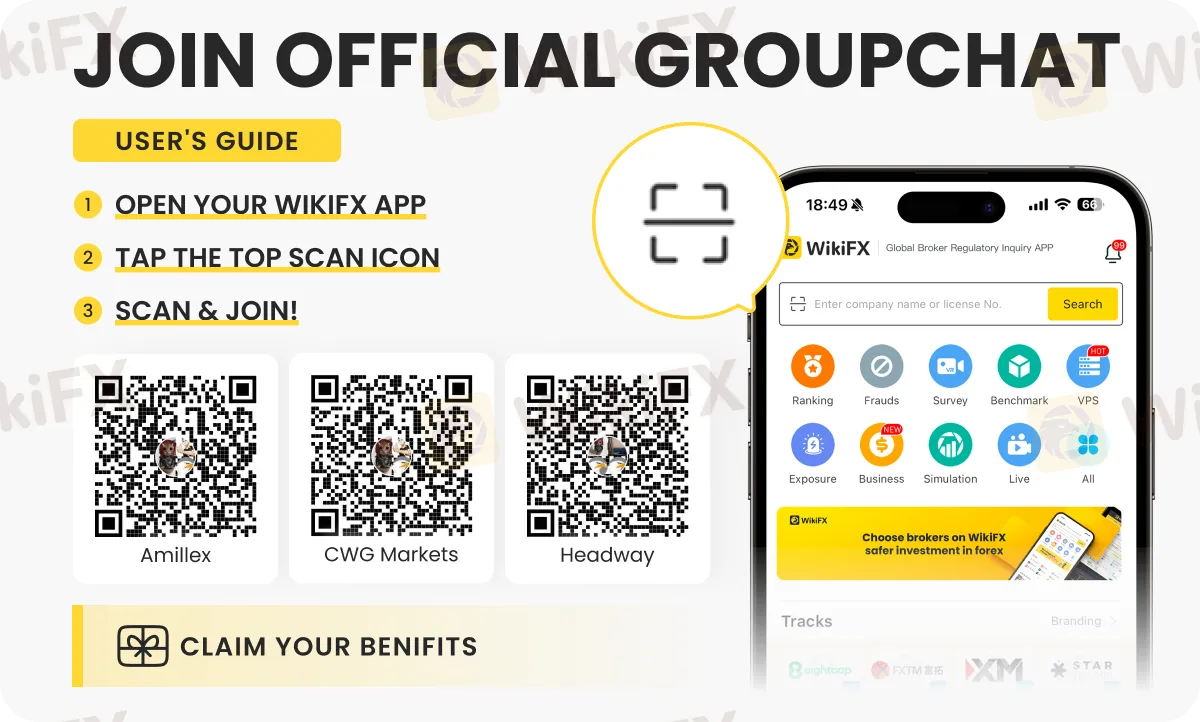

We strongly recommend checking the latest regulatory status and any new warnings for ZarVista on WikiFX to get a real-time, unbiased picture.

Warning Sign 2: Withdrawals

Beyond regulatory theory, the real test of a broker's honesty is how it handles client capital, especially during withdrawals. Looking at user feedback shows a troubling and consistent pattern of withdrawal problems at ZarVista. These first-hand accounts from traders provide direct evidence that supports the “scam” claims and highlights a critical operational failure, whether intentional or not. The large number of complaints about accessing funds is a major sign of a broken or predatory system.

Delayed and Denied Withdrawals

The most common and serious complaint against ZarVista involves clients being unable to withdraw their own funds. These are not isolated incidents but a recurring theme across multiple review platforms.

· Endless “Pending” Status: A frequent report is that withdrawal requests stay stuck in a “pending check” or “processing” status for days, weeks, or even longer, with no resolution in sight.

· Unhelpful Customer Support: When clients ask about these delays, the reported response from customer support is often a repetitive and unhelpful script, such as “the relevant team is processing it,” without providing any concrete timeline or explanation.

· Specific Case Examples: The complaints detail significant funds. One trader reported being unable to withdraw about $9,000. The platform allegedly justified the block by accusing the user of using an Expert Advisor (EA), a claim the user strongly denied. Another user documented a withdrawal request pending for over 12 days, with multiple support tickets going completely unanswered.

Other Alarming User Issues

The withdrawal problems are part of a broader set of alarming issues reported by users, which together paint a picture of a broker that may not be operating in its clients' best interests.

· Profit Cancellation: There are reports of traders having their profits randomly cancelled after making successful trades, effectively removing their gains.

· Account Restrictions: Some users have claimed their accounts were suddenly limited or blocked entirely, particularly after achieving a certain level of profit.

· Customer Service Failures: Beyond withdrawal issues, customer service is often described as unresponsive or evasive when confronted with any critical problem, leaving traders without support.

· Direct Accusations: On public forums, such as Trustpilot, a significant number of frustrated users have moved beyond describing issues and have explicitly labeled ZarVista a “scam” based on their experiences.

Action Step: Check Feedback

These documented experiences form a critical pattern of behavior. Before depositing any funds, it is crucial to investigate whether these issues are ongoing or if new, similar complaints continue to surface.

To gauge the current situation, checking the user review section for ZarVista on WikiFX is a smart step before depositing any funds.

The 'Real' Appearance

To understand why traders might be attracted to a high-risk broker, it's necessary to examine the features it uses to present a legitimate and appealing front. ZarVista offers a suite of modern trading tools, account types, and promotions designed to compete in the crowded brokerage market. However, these features must be evaluated within the context of the severe risks previously identified. A slick interface and attractive leverage mean nothing if your funds are not secure.

Account Types and Leverage

ZarVista divides its offerings into four main account types, catering to different deposit levels. The high leverage of up to 1:500 is a key selling point, but it's a double-edged sword that increases both gains and losses, a particularly dangerous tool when paired with a broker of questionable integrity.

Platforms and Asset Range

The broker provides access to industry-standard trading platforms, which gives it an air of credibility. These include:

· MetaTrader 5 (MT5): The world's most popular platform, known for strong charting and support for automated trading (EAs).

· Proprietary Platforms: ZarVista also offers Social Trading platforms, allowing for copy trading.

The asset range covers over 350 instruments, including forex, metals, indices, and energies. The notable absence of stock CFDs is a limitation, but the overall offering appears comprehensive at first glance.

The Appeal of Bonuses

Aggressive promotional offers are a hallmark of offshore brokers looking to attract new clients quickly. ZarVista has used this strategy with offers like a $50 No Deposit Bonus and a 30% First Deposit Bonus.

It is crucial to understand that these bonuses almost always come with restrictive terms and conditions, such as high trading volume requirements, that can make withdrawing any profits—or even your initial deposit—extremely difficult. They can act as a trap, locking your funds into the platform. Notably, as of early 2025, the no-deposit bonus has been suspended for new applicants, perhaps indicating a shift in strategy or a response to other pressures.

The ZarVista Risk Scorecard

To combine this investigation into a clear, actionable decision, we have developed a risk scorecard. This framework evaluates ZarVista across key pillars of trust, assigning a risk level based on the evidence presented in this report. This goes beyond a simple list of pros and cons to give you a powerful, at-a-glance summary of the dangers.

Evaluating Key Trust Pillars

· Regulatory Oversight: CRITICAL RISK

· Reason: Relies exclusively on weak offshore licenses from Comoros and Mauritius that provide no investor compensation scheme and minimal effective oversight.

· Fund Safety & Withdrawals: CRITICAL RISK

· Reason: Plagued by widespread, consistent, and well-documented user complaints regarding severely delayed, blocked, or denied withdrawals. This is the most significant operational red flag.

· Legal & Corporate Transparency: HIGH RISK

· Reason: The subject of a major financial crime investigation and raid by India's Enforcement Directorate. Additionally, its Mauritius license suffers from a lack of domain transparency.

· Company History & Reputation: HIGH RISK

· Reason: A relatively short history since its founding in 2019, with a reputation already severely damaged by the Indian legal case and an overwhelming number of negative user reviews concerning fund safety.

· Trading Offerings: MEDIUM RISK

· Reason: While the broker offers standard platforms like MT5 and high leverage, these legitimate features are completely overshadowed by the fundamental and critical concerns about the safety of client funds.

Final Conclusion

After a thorough, evidence-based investigation, our conclusion is clear. The search for “ZarVista Scam” is not unfounded; it is a reasonable inquiry driven by legitimate and verifiable red flags. While the broker presents a polished exterior with modern platforms and attractive promotions, its foundations are dangerously weak. The combination of ineffective offshore regulation, a major government investigation, and a consistent pattern of withdrawal failures creates an unacceptable level of risk for any careful investor.

An Unacceptable Risk Level

Choosing a broker is like choosing a bank to hold your savings. While ZarVista offers appealing “perks” like high leverage and bonuses, the vault holding your capital has no reliable lock and is not insured. The evidence strongly suggests that the risk of being unable to retrieve your capital is substantial.

This broker is definitely not suitable for beginners, serious long-term investors, or anyone trading with significant capital. It is only appropriate for those who are fully prepared for the very real possibility of losing their entire investment due to issues beyond trading losses.

Final Step: Research

Given the significant and documented risks associated with ZarVista, conducting your own thorough, independent research is absolutely necessary. Broker profiles and user feedback change constantly, and staying updated is key to protecting yourself.

For a comprehensive and continuously updated safety assessment, including license verification, real-time user feedback, and expert scoring, we strongly advise consulting ZarVista's profile on WikiFX before making any decision. Your capital's safety should always be the number one priority.

Check the latest forex updates and strategies on these special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G - by following the instructions shown below.